Global Sequencing Market By Product (Consumables, Instruments, and Services), By Application (Oncology, Clinical Diagnostics, Agrigenomics, Forensics, and Others), By End-User (Pharmaceutical & Biotechnology Companies, Academic & Government Research Institutes, Hospitals & Clinics, and Others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 147178

- Number of Pages: 326

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

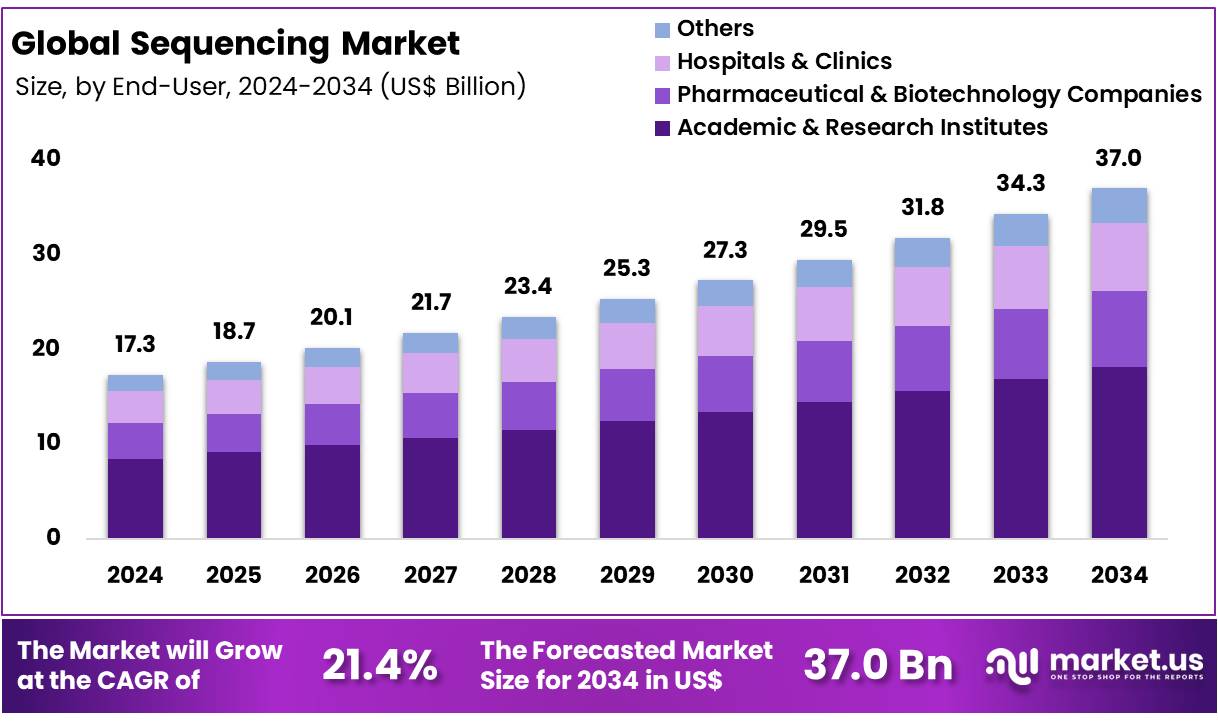

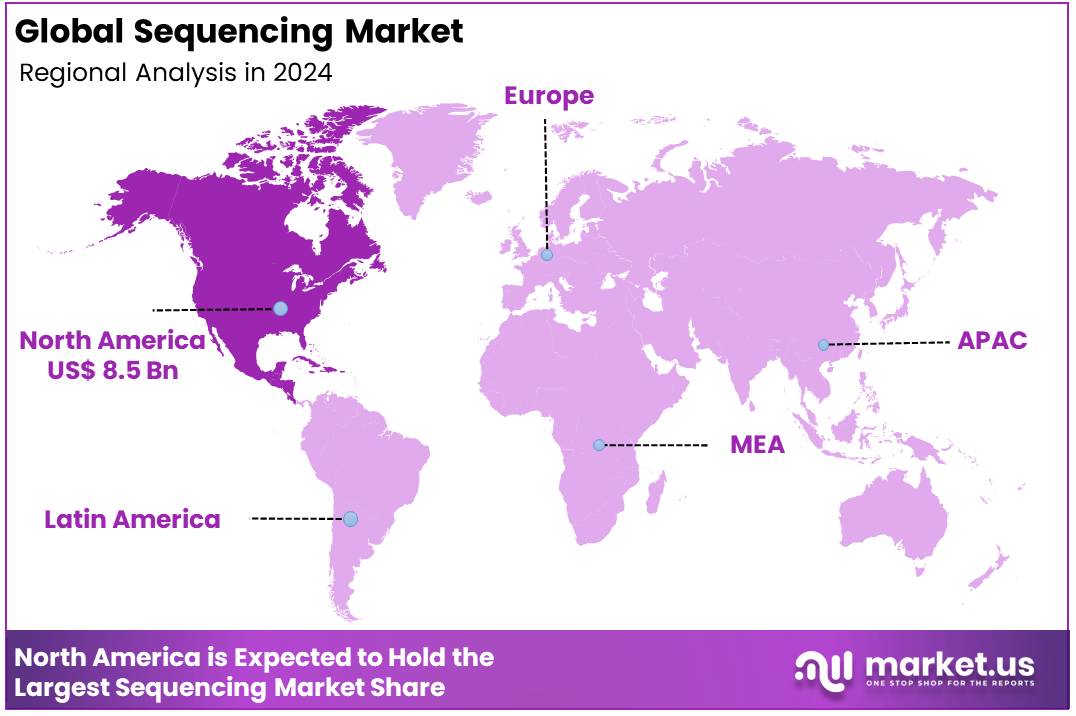

Global Sequencing Market was valued at US$ 17.3 Billion in 2024 and is expected to grow at a CAGR of 21.4% from 2024 to 2034. In 2024, North America led the market, achieving over 49.3% share with a revenue of US$ 8.5 billion.

The sequencing market is driven by several dynamic factors, including technological advancements, growing demand for personalized medicine, and the increasing adoption of genomic research. The development of next-generation sequencing (NGS) technologies has revolutionized the market, providing high-throughput, cost-effective, and accurate sequencing capabilities.

This has led to a significant reduction in sequencing costs, enabling more widespread use across healthcare, research, and agriculture sectors. As genomic data becomes central to understanding disease mechanisms, personalized treatment strategies, and drug development, the demand for sequencing services continues to surge.

Additionally, the integration of bioinformatics and AI technologies with sequencing platforms is enhancing data interpretation and accelerating the discovery of novel biomarkers and therapeutic targets. Moreover, the growing emphasis on early disease diagnosis, especially in oncology, and the rising adoption of genomic-based therapies are fuelling market growth.

The increasing availability of government and private funding for genomics research, along with expanding collaborations between biotechnology companies and academic institutions, is further propelling market innovation. However, challenges such as data privacy concerns, the need for skilled professionals, and the complexity of genomic data analysis pose barriers to market growth.

Despite this, the sequencing market is poised for continued expansion as advancements in sequencing technologies, rising healthcare demands, and increasing genetic research drive the sector forward, with significant opportunities emerging in personalized medicine, diagnostics, and agriculture.

Key Takeaways

- The global sequencing market was valued at USD 17.3 billion in 2024 and is anticipated to register substantial growth of USD 37.0 billion by 2034, with 21.4% CAGR.

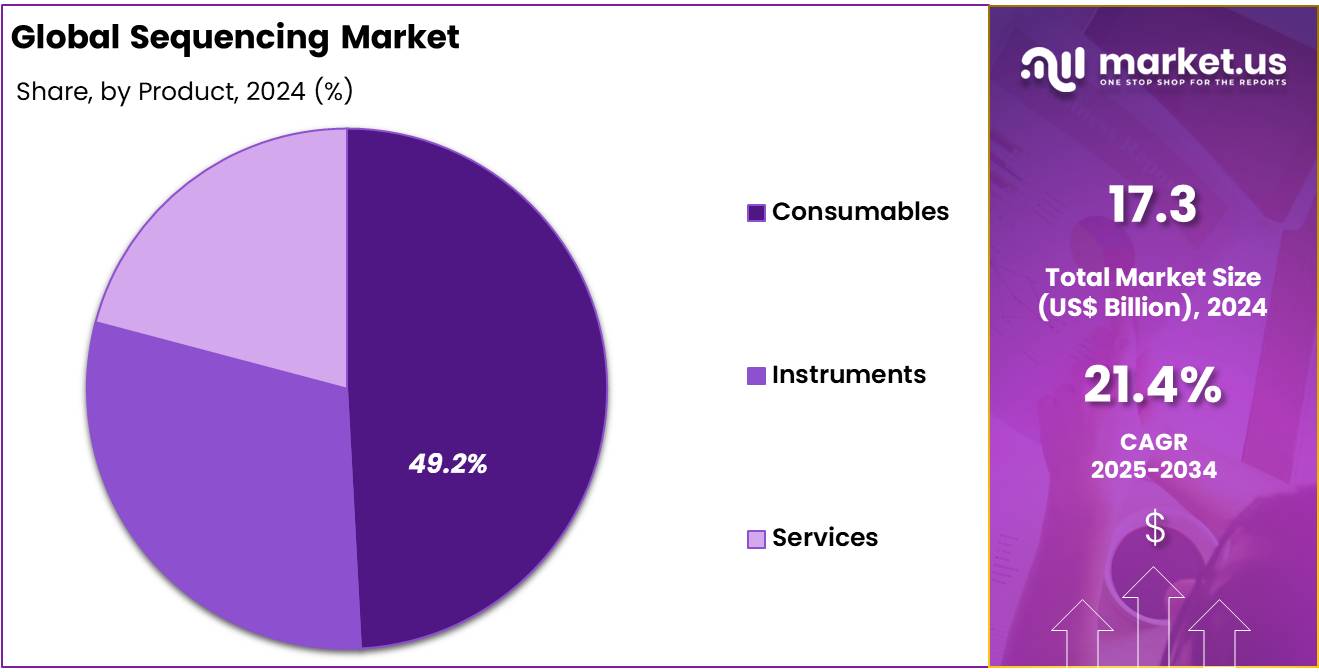

- In 2024, the consumables segment took the lead in the global market, securing 49.2% of the total revenue share.

- The oncology segment took the lead in the global market, securing 37.4% of the total revenue share.

- The biotechnology & pharmaceutical companies segment took the lead in the global market, securing 39.2% of the total revenue share.

- North America maintained its leading position in the global market with a share of over 49.3% of the total revenue.

Product Analysis

Based on product the market is fragmented into consumables, instruments, and services. Amongst these, consumables segment dominated the global sequencing market capturing a significant market share of 49.2% in 2024. Consumables encompass a wide array of essential materials such as reagents, sequencing chips, library preparation kits, and sample preparation tools.

These components are indispensable for the preparation, amplification, and sequencing of DNA and RNA samples, forming the backbone of sequencing operations. The demand for these consumables is driven by the increasing adoption of next-generation sequencing (NGS) technologies, which necessitate high-quality, specialized materials to ensure accurate and reliable results.

The substantial share of consumables in the market is also attributed to the rapid advancements in sequencing technologies, which have led to the development of more sophisticated and efficient consumables. These innovations have enhanced the performance and scalability of sequencing platforms, further propelling the demand for consumables.

Application Analysis

The market is fragmented by application into oncology, clinical diagnostics, agrigenomics, forensics, and others. Oncology dominated the global sequencing market capturing a significant market share of 36.2% in 2024. This dominance is driven by the increasing prevalence of cancer worldwide and the growing emphasis on precision oncology, which leverages genomic information to tailor treatments to individual patients. Next-generation sequencing (NGS) technologies enable comprehensive analysis of genetic alterations in tumors, facilitating the identification of actionable mutations and the development of targeted therapies.

Moreover, NGS-based screening methods, such as liquid biopsies, offer non-invasive options for early cancer detection, further expanding the role of sequencing in oncology. The integration of sequencing into oncology has also spurred advancements in companion diagnostics, enabling clinicians to match patients with the most effective therapies based on their genetic profiles. As a result, the oncology segment continues to drive innovation and investment in the sequencing market, positioning it as a cornerstone of modern cancer care.

End-User Analysis

The market is fragmented by end-user into pharmaceutical & biotechnology companies, academic & government research institutes, hospitals & clinics, and others. Pharmaceutical & biotechnology companies dominated the global sequencing market capturing a significant market share of 39.2% in 2024. This dominance is primarily driven by substantial investments in research and development (R&D), which are pivotal for advancing drug discovery and personalized medicine initiatives.

The integration of next-generation sequencing (NGS) technologies enables these companies to identify genetic variations associated with diseases, facilitating the development of targeted therapies and biomarkers. Furthermore, the decreasing costs of sequencing technologies have made them more accessible, encouraging widespread adoption in pharmaceutical research.

The growing prevalence of chronic and genetic diseases has further intensified the demand for genomic insights, propelling pharmaceutical and biotechnology firms to leverage sequencing data for innovative therapeutic solutions.

Additionally, collaborations between these companies and academic institutions have accelerated the translation of genomic research into clinical applications, reinforcing their central role in the sequencing market. As the industry continues to evolve, the strategic utilization of sequencing technologies by pharmaceutical and biotechnology companies is expected to remain a critical factor in driving market growth and innovation.

Key Segments Analysis

By Product

- Consumables

- Instruments

- Services

By Application

- Oncology

- Clinical Diagnostics

- Agrigenomics

- Forensics

- Others

By End-User

- Academic & Research Institutes

- Pharmaceutical & Biotechnology Companies

- Hospitals & Clinics

- Others

Dynamics

Rapid Advancements in Next-Generation Sequencing (NGS) Technologies

The rapid advancements in next-generation sequencing (NGS) technologies. These innovations have drastically reduced the cost and time associated with sequencing, making it more accessible for a broader range of applications across research, clinical diagnostics, and personalized medicine. NGS technologies, such as Illumina and PacBio, offer high throughput, accuracy, and scalability, allowing for the sequencing of entire genomes quickly and affordably.

This reduction in sequencing costs has spurred greater adoption in diverse fields such as oncology, rare disease diagnosis, and genomic research, accelerating the demand for sequencing services and consumables. Furthermore, the integration of advanced data analysis tools powered by artificial intelligence and machine learning is enhancing the ability to interpret complex genomic data, expanding the utility of sequencing technologies in clinical settings. This technological progress not only drives market growth but also opens up new opportunities in drug discovery and the development of targeted therapies.

Restraints

Complexity and High Cost of Data Analysis

The interpretation of the vast amount of data generated remains a challenging task. Sequencing produces huge volumes of raw genetic data that require sophisticated bioinformatics tools and highly trained professionals to analyze. The complexity of genomic data, coupled with the need for specialized software and computational infrastructure, presents a barrier to the widespread adoption of sequencing, especially in smaller healthcare facilities or regions with limited resources.

Additionally, the lack of standardization in data analysis methods and the potential for misinterpretation can hinder the effective use of sequencing data in clinical settings, slowing down its integration into routine healthcare practices.

Opportunities

Rising R&D Investment and Government Initiative

Rising research and development (R&D) investments and government initiatives have played a pivotal role in advancing the global sequencing market, particularly through initiatives like Genomics England and the UK Biobank. These projects aim to sequence the genomes of large populations to gain deeper insights into the genetic basis of diseases, thereby enhancing the development of personalized medicine. Governments worldwide are recognizing the value of genomic research in addressing public health challenges, with the UK serving as a prominent example.

- In December 2022, the UK government allocated USD 133.08 million in funding to Genomics England, in collaboration with the NHS, to investigate the use of whole genome sequencing for accelerating the diagnosis and treatment of rare genetic diseases in newborns. Such initiatives are expected to significantly impact the pace at which new genetic-based treatments and diagnostics are developed, supporting the growth of the sequencing market.

This government-backed funding not only fosters innovation in genomics but also contributes to creating a framework for more precise and timely medical interventions. Furthermore, the increasing focus on genomic medicine is driving substantial R&D investments from pharmaceutical and biotechnology companies, aiming to harness the potential of sequencing technologies for drug discovery, disease prevention, and tailored treatments. These investments, along with governmental support, are propelling the sequencing market forward, fostering the creation of novel genomic tools and applications that will revolutionize healthcare.

Impact of macroeconomic factors / Geopolitical factors

Macroeconomic and geopolitical factors have a significant impact on the sequencing market, influencing both its growth and challenges. On the macroeconomic front, factors such as economic stability, healthcare budgets, and government spending on research and development (R&D) directly affect the adoption of genomic technologies.

In periods of economic growth, increased funding for healthcare and research initiatives often drives demand for advanced sequencing technologies, as both public and private sectors invest in personalized medicine, rare disease research, and drug development.

Conversely, during economic downturns, healthcare budgets may be tightened, limiting the funding available for genomic research and healthcare programs, which could slow down the adoption of sequencing technologies. Additionally, fluctuations in currency exchange rates can impact the cost of imported sequencing equipment and reagents, affecting global market dynamics, particularly in developing economies that rely heavily on imports for advanced medical technologies.

Geopolitical factors also play a crucial role in shaping the sequencing market. Tensions between countries or regions, trade wars, and political instability can disrupt global supply chains, leading to delays in the production and distribution of sequencing instruments and consumables.

For instance, trade restrictions or tariffs on biomedical materials between countries such as the U.S. and China could hinder the availability of essential components for sequencing platforms, potentially driving up costs. Moreover, geopolitical tensions may limit international collaboration on genomic research, which is essential for advancing sequencing technologies and expanding their applications.

Latest Trends

The sequencing market is undergoing significant transformation, driven by technological innovations, evolving healthcare needs, and expanding applications across various sectors. One of the most prominent trends is the continuous advancement of next-generation sequencing (NGS), which remains the dominant technology in the market due to its high throughput, cost-effectiveness, and accuracy. NGS is increasingly being integrated into both research and clinical diagnostics.

Additionally, third-generation sequencing technologies, such as nanopore sequencing, are gaining momentum because they allow real-time sequencing of single molecules without amplification, offering portability and faster results. Another key trend is the growing integration of artificial intelligence (AI) and machine learning in sequencing workflows. These technologies are improving the accuracy of genomic data analysis, allowing for more efficient interpretation and enabling the identification of disease risks, treatment responses, and personalized therapeutic options.

Regional Analysis

The North America sequencing market is experiencing substantial growth, driven by strong support from research institutions, pharmaceutical companies, and healthcare providers. Genomics has become an integral part of disease research and drug discovery due to the significant impact of genetic expression on human health. The region’s commitment to advancing genomic research is reflected in numerous collaborative efforts aimed at leveraging sequencing technologies for medical innovation.

- A notable example is the January 2022 partnership between Illumina, Inc. and Nashville Biosciences, LLC, a part of Vanderbilt University Medical Center, which focuses on utilizing genomics for drug development and creating a comprehensive clinical genomic resource.

Additionally, the U.S. sequencing market is expected to expand significantly over the forecast period, largely due to the rising incidence of cancer in the country.

- According to the American Cancer Society, approximately 611,720 cancer-related deaths and more than 2 million new cancer diagnoses are anticipated in 2024 alone.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

North America leads this expansion, driven by robust healthcare infrastructure, substantial research funding, and increasing demand for precision medicine. Illumina, Inc. dominates the market with a substantial share, offering a comprehensive range of sequencing platforms and consumables. However, the company faces challenges from competitors like Roche, Thermo Fisher Scientific, and emerging players such as MGI Tech, which have introduced innovative technologies and pricing strategies.

For instance, Roche’s recent launch of a new sequencing machine has intensified competition, potentially impacting Illumina’s market position. Additionally, geopolitical tensions, such as China’s ban on imports of Illumina’s sequencing machines in response to U.S. tariffs, have further complicated the competitive landscape. Despite these challenges, Illumina remains a key player, focusing on innovation and strategic acquisitions, such as the purchase of Fluent BioSciences, to enhance its capabilities in single-cell analysis.

Other notable companies in the market include Thermo Fisher Scientific, QIAGEN, and Agilent Technologies, each contributing to the advancement of sequencing technologies and expanding their market presence. The competitive dynamics in the sequencing market are shaped by technological advancements, strategic partnerships, and the evolving regulatory environment, influencing the market share and positioning of key players.

Illumina, Inc. is a global leader in genomics, specializing in next-generation sequencing (NGS) technologies and genomics analysis solutions. Headquartered in San Diego, California, Illumina offers a wide range of products used in various applications such as genetic research, clinical diagnostics, and drug development. In addition, F. Hoffman-La Roche Ltd. is a Swiss multinational healthcare company known for its diagnostics and pharmaceutical divisions.

Roche is a key player in the global sequencing market through its subsidiary, Roche Sequencing Solutions, which focuses on developing and commercializing sequencing technologies. The company offers products for clinical sequencing, targeted sequencing, and genomic research, emphasizing precision medicine and oncology applications.

Top Key Players

- Illumina, Inc.

- F. Hoffman-La Roche Ltd.

- QIAGEN

- Thermo Fisher Scientific, Inc.

- Bio-Rad Laboratories, Inc.

- Oxford Nanopore Technologies

- PierianDx

- Genomatix GmbH

- DNASTAR, Inc.

- Perkin Elmer, Inc.

- Eurofins GATC Biotech GmbH

Recent Developments

- In March 2023, Illumina Inc. introduced the Illumina Complete Long Read technology, marking a major advancement in next-generation sequencing (NGS) by enabling the generation of both long and short reads using the same instrument.

- In July 2023, QIAGEN unveiled the QIAseq Normalizer Kits for research purposes. These kits offer a quick, cost-effective, and efficient method for normalizing various DNA libraries, ensuring high-quality results from NGS runs.

Report Scope

Report Features Description Market Value (2024) US$ 17.3 billion Forecast Revenue (2034) US$ 37.0 billion CAGR (2025-2034) 21.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Consumables, Instruments, and Services), By Application (Oncology, Clinical Diagnostics, Agrigenomics, Forensics, and Others), By End-User (Pharmaceutical & Biotechnology Companies, Academic & Government Research Institutes, Hospitals & Clinics, and Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Illumina, Inc., F. Hoffman-La Roche Ltd., QIAGEN, Thermo Fisher Scientific, Inc., Bio-Rad Laboratories, Inc., Oxford Nanopore Technologies, PierianDx, Genomatix GmbH, DNASTAR, Inc., Perkin Elmer, Inc., and Eurofins GATC Biotech GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Illumina, Inc.

- F. Hoffman-La Roche Ltd.

- QIAGEN

- Thermo Fisher Scientific, Inc.

- Bio-Rad Laboratories, Inc.

- Oxford Nanopore Technologies

- PierianDx

- Genomatix GmbH

- DNASTAR, Inc.

- Perkin Elmer, Inc.

- Eurofins GATC Biotech GmbH