Global Riboflavin Market Size, Share, And Business Benefits By Form (Powder, Liquid), By Application (Food and Beverages, Dietary Supplements, Pharmaceuticals, Animal Feed, Personal Care, Others), By Region, and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 162085

- Number of Pages: 243

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

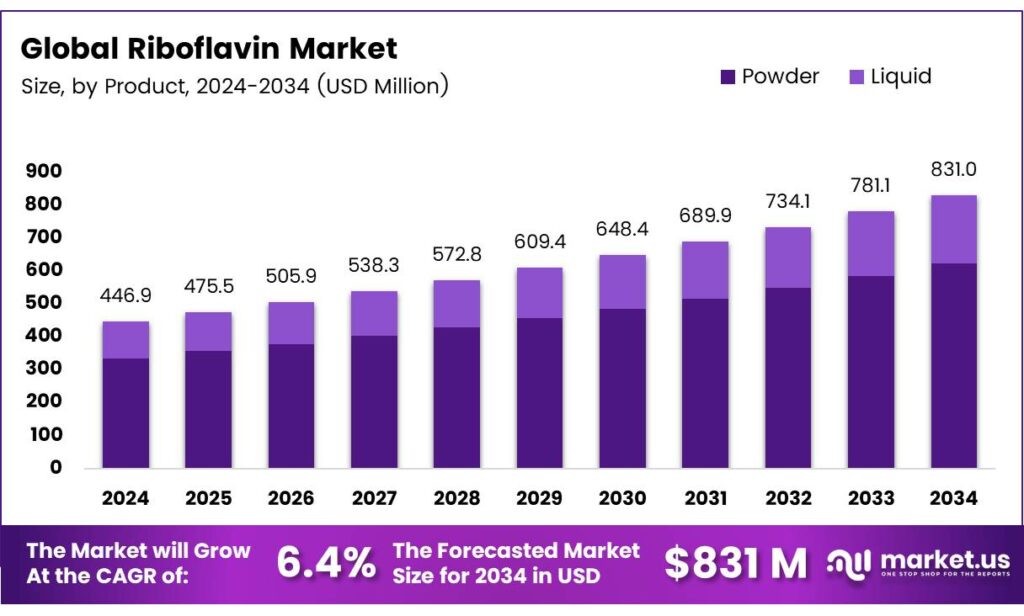

The Global Riboflavin Market size is expected to be worth around USD 831.0 Million by 2034, from USD 446.9 Million in 2024, growing at a CAGR of 6.4% during the forecast period from 2025 to 2034.

Riboflavin, or vitamin B2, is a water-soluble B vitamin essential for body growth, red blood cell production, and energy release from carbohydrates, proteins, and fats. It dissolves in water, with excess excreted through urine, requiring regular intake to maintain a small bodily reserve. Severe deficiency can disrupt FAD and FMN levels, affecting other B vitamin metabolism. A balanced diet with varied foods ensures adequate riboflavin intake.

- Dietary Reference Intakes (DRIs) for riboflavin, set by the National Academies, include Recommended Dietary Allowances (RDAs) and Adequate Intakes (AIs) based on age and sex. Infants need 0.3–0.4 mg/day (AI), children 0.5–0.9 mg/day (RDA), and adults 1.0–1.3 mg/day (RDA). Pregnant women require 1.4 mg/day, and lactating women need 1.6 mg/day. These values guide nutrient planning for healthy individuals.

Riboflavin supports eye health, helping conditions like cataracts, glaucoma, and keratoconus when applied as drops to strengthen the cornea. It also lowers homocysteine levels, reducing the risk of heart disease and stroke by 25%. Only 15% of riboflavin is absorbed, with the rest excreted. Carbohydrates convert to ATP, fueling bodily energy production.

Riboflavin deficiency is rare in the USA due to fortified cereals and multivitamins. A healthy diet rich in fruits and vegetables prevents deficiency, supported by interprofessional healthcare teams. Primary care providers, dietitians, pharmacists, and nurses collaborate to educate patients on dietary sources. This team approach optimizes patient outcomes through tailored guidance.

Pharmacists recommend supplemental dosing, while dietitians monitor riboflavin-rich food intake. Nurses track therapeutic progress during follow-ups, charting changes for clinicians. Routine vitamin supplementation for all is not advised; individualized plans are more effective. Interprofessional communication ensures comprehensive care and better health outcomes.

Key Takeaways

- The Global Riboflavin Market is projected to grow from USD 446.9 million in 2024 to USD 831.0 million by 2034, at a CAGR of 6.4%.

- Powder form dominated the riboflavin market in 2024, holding a 74.9% share due to its stability and versatility in pharmaceuticals and food.

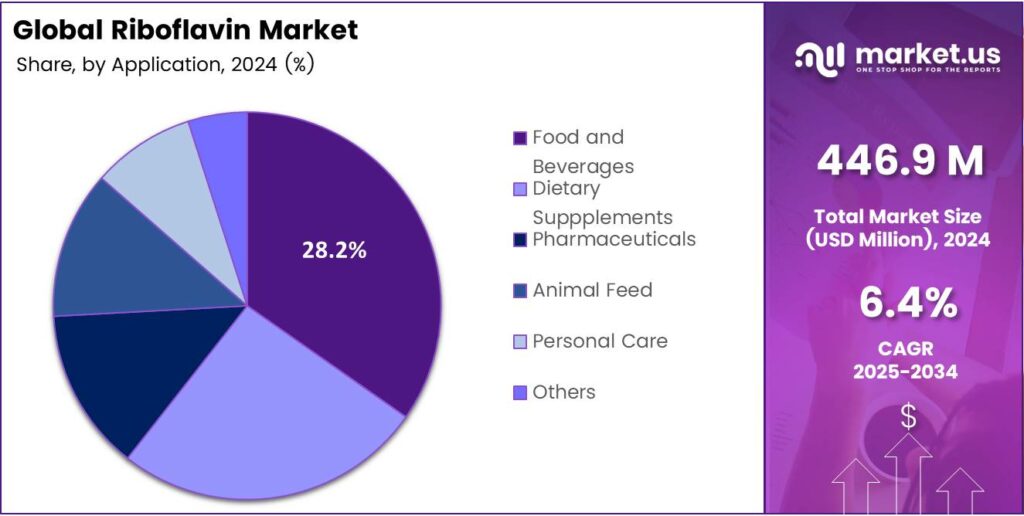

- The food and beverages segment led the market in 2024 with a 28.2% share, driven by riboflavin’s use in fortified foods and energy drinks.

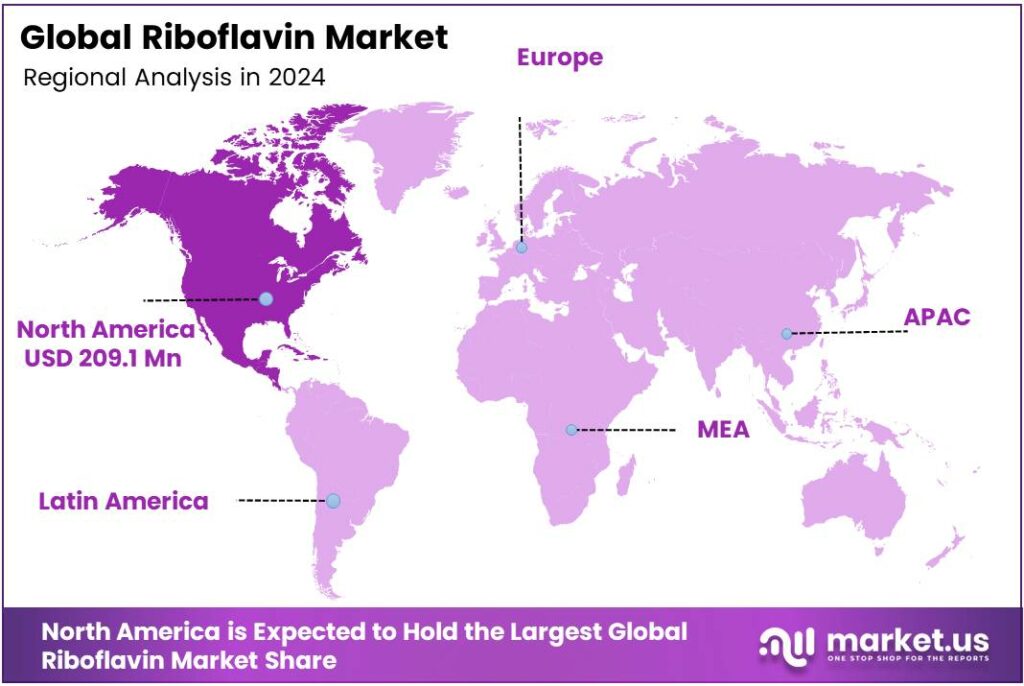

- North America held a 46.8% share of the riboflavin market in 2024, valued at USD 209.1 million.

By Form

Powder Form Leads with 74.9% Market Share

In 2024, Powder held a dominant market position in the By Form segment of the Riboflavin Market, capturing more than a 74.9% share. This leadership was driven by its widespread use in pharmaceutical formulations, dietary supplements, and food fortification due to its stability, long shelf life, and ease of blending with other ingredients.

Powdered riboflavin is favored by food manufacturers for its uniform dispersion in beverages, cereals, and bakery products. This trend is expected to continue as the demand for fortified foods and nutraceutical products increases globally. The form’s superior storage characteristics and cost efficiency further support its dominance, maintaining Powder’s strong foothold in the riboflavin market across multiple industries.

By Application

Food and Beverages Leads with 28.2% Market Share

In 2024, Food and Beverages held a dominant market position in the By Application segment of the Riboflavin Market, capturing more than a 28.2% share. The segment’s leadership stemmed from the growing use of riboflavin as a vital nutrient in fortified foods, dairy products, and energy drinks. Its role in enhancing metabolic activity and improving nutritional value has made it an essential additive in packaged food and beverage manufacturing.

This dominance is projected to strengthen further as consumer demand rises for vitamin-enriched products promoting energy and wellness. The increasing focus on preventive health and functional nutrition continues to make the Food and Beverages segment a key growth driver in the global riboflavin market.

Key Market Segments

By Form

- Powder

- Liquid

By Application

- Food and Beverages

- Dietary Supplements

- Pharmaceuticals

- Animal Feed

- Personal Care

- Others

Emerging Trends

Fortification and labeling are putting riboflavin in everyday foods

A clear trend in the riboflavin space is the steady push to add vitamin B2 to staple foods and beverages, guided by stronger fortification policies and clearer nutrition labels. More than 143 countries mandate fortification of at least one staple food, creating consistent demand for B-vitamins such as riboflavin in flour, oils, and other bases.

The public-health need is real. The WHO estimates that over 2 billion people are deficient in key vitamins and minerals, and multiple deficiencies often coexist, making low-dose, wide-reach fortification a practical tool. By embedding riboflavin into staples, programs can chip away at hidden hunger without requiring big behavior changes.

- Regulators also anchor daily targets. In the United States, the FDA Daily Value (DV) for riboflavin is 1.3 mg on Nutrition Facts panels, while EFSA sets a Population Reference Intake (PRI) of 1.6 mg/day for adults in the EU. These benchmarks guide recipe design for fortified foods and beverages and support consistent communication of riboflavin content across markets.

Drivers

Rising Global Micronutrient Deficiency Fuels Riboflavin Demand

One of the major factors driving growth in the riboflavin market is the widespread global gap in micronutrient intake, which is prompting food manufacturers, governments, and health agencies to place riboflavin (vitamin B2) higher up in their fortification and nutrition strategies. A recent study found that about 55% of the global population is not consuming enough riboflavin.

This reality creates a strong pull for riboflavin use both in fortified foods and supplements because companies and regulators see a clear need for ensuring populations get more consistent, reliable intake. Why this matters: riboflavin plays a key role in energy metabolism, the maintenance of healthy skin and eyes, and in converting other B-vitamins into their active forms.

Therefore, the fact that over half the world may be under-consuming it elevates riboflavin from a nice-to-have nutrient to a necessary public health component. Governments often respond by supporting fortification programmes or labelling demands, and the food industry follows suit to meet both consumer expectations and regulatory requirements.

Restraints

Technical and cost hurdles hold back riboflavin fortification

Despite the strong case for using riboflavin (vitamin B2) in food fortification, several real-world barriers are slowing its full potential. One major challenge comes down to the technical and cost burdens associated with adding riboflavin into staple foods at scale. According to the Food and Agriculture Organization/World Health Organization Food Fortification Handbook, iron, zinc, and riboflavin are the micronutrients most commonly affected by upper-level quality constraints for cereals such as flour.

Moreover, for many low- and middle-income countries where fortification is most needed, production is often decentralised and regulatory oversight is weaker. The FAO/WHO annex notes that in such settings, achieving the necessary results within a reasonable time frame is limited by the fact that, in many cases, it requires substantial modification of traditional practices.

Cost is another key restraint. As the FAO/WHO document explains, initial equipment purchases, equipment maintenance, increased staff needs, and quality control measures all raise expenses for food producers. Mills supplying fortified flour might need to invest in mixing equipment, monitoring systems for vitamin levels, and extra packaging to protect riboflavin from light or oxidation.

Opportunity

Expanding Need for Fortification Amplifies Riboflavin Use

A key growth driver for the riboflavin (vitamin B2) market is the broadening global push for food fortification aimed at closing widespread nutrition gaps. Recent data show that more than 4 billion people worldwide do not consume enough riboflavin, folate, vitamin C, and other key micronutrients.

This significant shortfall has prompted governments, health agencies, and food producers to scale up fortification programs, directly boosting demand for riboflavin as a fortificant. The World Health Organization (WHO) has repeatedly endorsed large-scale food fortification, adding vitamins and minerals to widely consumed foods like flour, rice, and oil as one of the most cost-effective interventions for reducing micronutrient deficiencies.

Consumer interest in better nutrition is rising. As people become more aware of hidden hunger, enough calories but not enough nutrients, the demand for foods enriched with B-vitamins has grown. Food companies are responding by adding riboflavin into cereals, beverages, snacks, and dairy products to appeal to health-conscious consumers and to comply with labeling regulations that demand disclosure of vitamin content.

Regional Analysis

North America leads with a 46.8% share and a USD 209.1 Million market value.

In 2024, North America held a dominant position in the Riboflavin Market, capturing a notable 46.8% share, valued at approximately USD 209.1 million. This leadership is primarily driven by the strong presence of fortified food and dietary supplement industries across the United States and Canada. Rising consumer focus on preventive healthcare, balanced nutrition, and the increasing prevalence of vitamin deficiencies have accelerated the demand for riboflavin-enriched products in the region.

The U.S. Food and Drug Administration (FDA) mandates labeling of essential nutrients, including vitamin B2, which has encouraged manufacturers to enhance fortification in cereals, dairy products, and beverages. The region’s robust nutraceutical and pharmaceutical sectors further strengthen its position, as riboflavin plays a crucial role in energy metabolism and eye health formulations.

Growing trends toward plant-based diets and clean-label products have also boosted the use of riboflavin as a natural additive and supplement ingredient. Government initiatives such as the U.S. Department of Agriculture’s (USDA) nutrition programs and public awareness campaigns promoting micronutrient intake have supported steady market expansion.

North America is projected to maintain its leading stance due to advanced manufacturing capabilities, high per-capita supplement consumption, and continuous product innovation from key players in the region. The strong presence of research-driven companies, along with an increasing shift toward fortified and functional foods, ensures North America remains a cornerstone of global riboflavin market growth in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BASF SE is a dominant force in the riboflavin (Vitamin B2) market. Its strength lies in large-scale, cost-effective production using advanced fermentation technology. BASF offers a diverse portfolio, including feed, food, and pharmaceutical-grade riboflavin, serving a vast global customer base. The company leverages its extensive R&D capabilities and integrated supply chain to maintain a competitive edge, ensuring consistent quality and supply security for its clients worldwide.

Koninklijke DSM NV (now part of Firmenich) is a premier science-based health and nutrition company. A key riboflavin producer, DSM emphasizes high-purity, sustainable production via proprietary biotechnology. Its products are critical in fortified foods, dietary supplements, and animal feed solutions. DSM differentiates itself through strong innovation, focusing on health benefits and regulatory expertise.

N.B. Group Co. Ltd is a significant Chinese producer that has substantially influenced the global riboflavin market dynamics. The company is recognized for its highly competitive cost structure and large-volume manufacturing capacity. Its production primarily serves the animal feed industry, where price sensitivity is high. By offering a cost-effective alternative, It a formidable competitor and a key driver of competitive pricing within the industry.

Top Key Players in the Market

- BASF SE

- Koninklijke DSM NV

- Shanghai Acebright Pharmaceuticals Group Co., Ltd

- Xinfa Pharmaceutical Co. Ltd

- Hubei Guangji Pharmaceutical Co., Ltd

- N.B. Group Co., Ltd

- Shanghai Hegno Pharmaceutical Holding Co., Ltd

- Legend Industries

- Parchem Fine & Specialty Chemicals

- Hebei Shengxue Dacheng Pharmaceutical Co., Ltd

Recent Developments

- In 2024, BASF continues to lead in sustainable riboflavin production through fermentation processes, emphasizing clean-label ingredients for nutraceuticals and animal feed. BASF completed the expansion of its riboflavin fermentation plants, increasing output. This supports growing demand, production allocated to nutraceuticals and animal feed.

- In 2024, DSM maintains dominance in high-purity riboflavin for pharmaceuticals and supplements, with expansions in Asia and emerging research on prebiotic applications. DSM expanded its riboflavin production facility in China, increasing output to meet demand in food, pharma, and feed sectors.

Report Scope

Report Features Description Market Value (2024) USD 446.9 Million Forecast Revenue (2034) USD 831.0 Million CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Powder, Liquid), By Application (Food and Beverages, Dietary Supplements, Pharmaceuticals, Animal Feed, Personal Care, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Koninklijke DSM NV, Shanghai Acebright Pharmaceuticals Group Co. Ltd, Xinfa Pharmaceutical Co. Ltd, Hubei Guangji Pharmaceutical Co. Ltd, N.B. Group Co. Ltd, Shanghai Hegno Pharmaceutical Holding Co., Ltd, Legend Industries, Parchem Fine & Specialty Chemicals, Hebei Shengxue Dacheng Pharmaceutical Co. Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- BASF SE

- Koninklijke DSM NV

- Shanghai Acebright Pharmaceuticals Group Co., Ltd

- Xinfa Pharmaceutical Co. Ltd

- Hubei Guangji Pharmaceutical Co., Ltd

- N.B. Group Co., Ltd

- Shanghai Hegno Pharmaceutical Holding Co., Ltd

- Legend Industries

- Parchem Fine & Specialty Chemicals

- Hebei Shengxue Dacheng Pharmaceutical Co., Ltd