Global Procalcitonin (PCT) Assay Market By Product Type (Test Kits, Consumables, and Analyzer & Instruments), By Sample (Serum, Cell Culture Medium, Plasma, and Others), By End-user (Hospital, Specialty Clinics, Diagnostics Laboratories, and Academic & Research Institute), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169061

- Number of Pages: 233

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

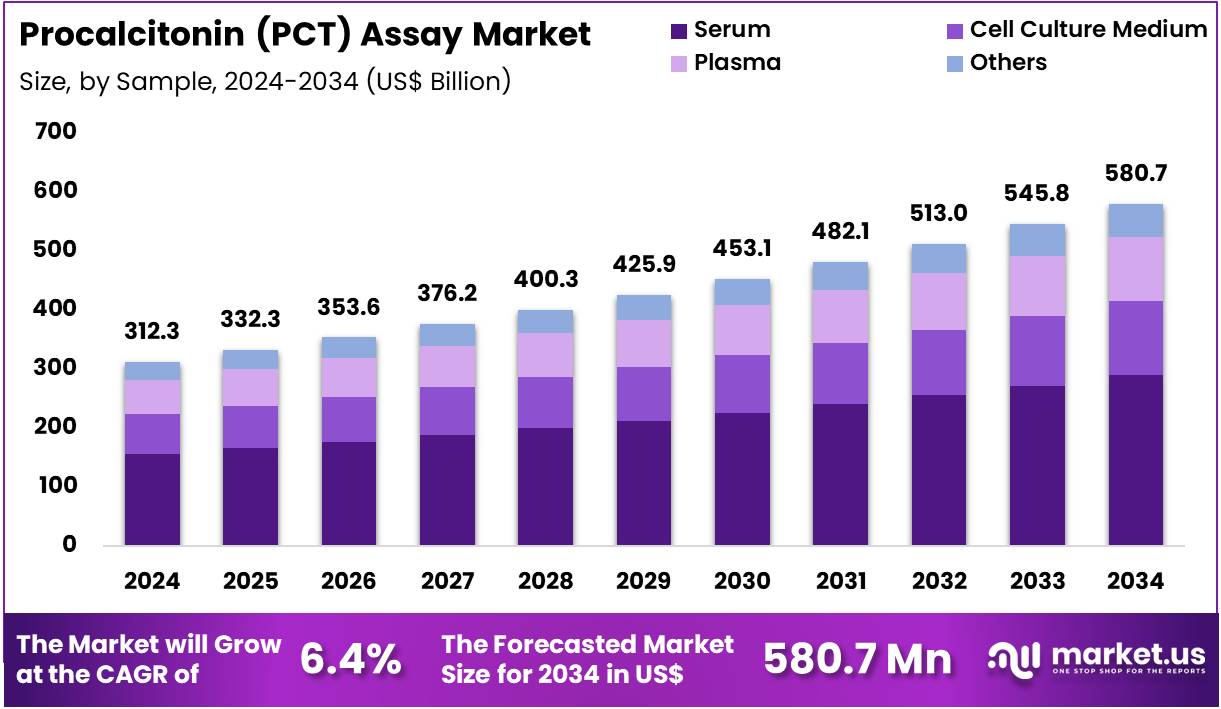

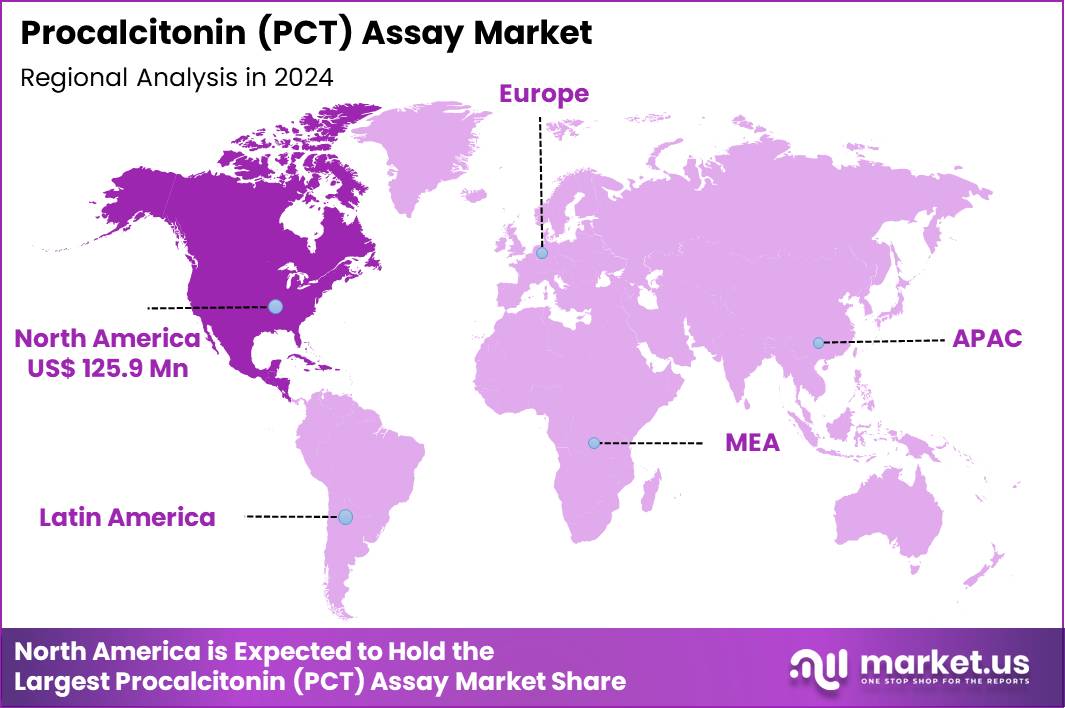

Global Procalcitonin (PCT) Assay Market size is expected to be worth around US$ 580.7 Million by 2034 from US$ 312.3 Million in 2024, growing at a CAGR of 6.4% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 40.3% share with a revenue of US$ 125.9 Million.

Increasing prevalence of sepsis and bacterial infections propels the Procalcitonin (PCT) Assay market, as clinicians prioritize biomarkers that enable swift differentiation between bacterial and viral etiologies to optimize antibiotic stewardship. Diagnostic manufacturers advance chemiluminescent and enzyme-linked assays that deliver quantitative results within hours, supporting evidence-based therapy initiation.

These assays guide lower respiratory tract infection management by confirming bacterial pneumonia in emergency settings, assess sepsis severity in intensive care through serial PCT monitoring, evaluate antibiotic de-escalation in febrile neutropenia cases, and stratify risk in post-surgical wound infections. Emerging opportunities include multiplex panels that integrate PCT with other cytokines for comprehensive inflammatory profiling.

Recent trial data from the Pro-Can study (NCT04203524), shared on March 17, 2025, demonstrate PCT’s potential to safely direct antimicrobial decisions in critically ill cancer patients, an underserved cohort. This evidence expands PCT’s applicability in immunocompromised populations and broadens the clinical footprint of assays in oncology critical care.

Growing adoption of point-of-care testing accelerates the Procalcitonin (PCT) Assay market, as emergency departments seek rapid, bedside quantification to expedite decisions amid rising infectious disease burdens. Biotechnology firms develop portable immunochromatographic strips and microfluidic devices that maintain laboratory-grade sensitivity without centralized infrastructure.

Applications encompass community-acquired pneumonia triage to avoid unnecessary hospitalizations, neonatal sepsis screening via cord blood analysis, urinary tract infection confirmation in elderly patients, and ventilator-associated pneumonia evaluation in prolonged ICU stays. Portable formats create avenues for decentralized diagnostics in ambulatory clinics and disaster response scenarios. Healthcare networks increasingly incorporate PCT thresholds into electronic protocols for real-time alerts on therapy adjustments. This momentum fosters collaborations between assay developers and telehealth providers to enhance remote infectious disease oversight.

Rising integration of automated laboratory platforms invigorates the Procalcitonin (PCT) Assay market, as high-volume facilities leverage robotics to process escalating test demands with minimal variability. Instrument providers embed PCT modules into random-access analyzers that handle diverse sample types from serum to whole blood. These systems support chronic obstructive pulmonary disease exacerbation assessment to guide corticosteroid use, meningitis differentiation in cerebrospinal fluid samples, intra-abdominal infection monitoring post-perforation, and post-transplant graft infection surveillance.

Automation advancements unlock opportunities for high-throughput multiplexing with lactate or C-reactive protein for synergistic sepsis scoring. Clinical laboratories adopt these platforms to streamline workflows and reduce turnaround times during peak seasons. This technological synergy positions PCT assays as indispensable tools in modern antimicrobial resistance combat strategies.

Key Takeaways

- In 2024, the market generated a revenue of US$ 312.3 million, with a CAGR of 6.4%, and is expected to reach US$ 580.7 million by the year 2034.

- The product type segment is divided into test kits, consumables, and analyzer & instruments, with test kits taking the lead in 2024 with a market share of 45.6%.

- Considering sample, the market is divided into serum, cell culture medium, plasma, and others. Among these, serum held a significant share of 49.8%.

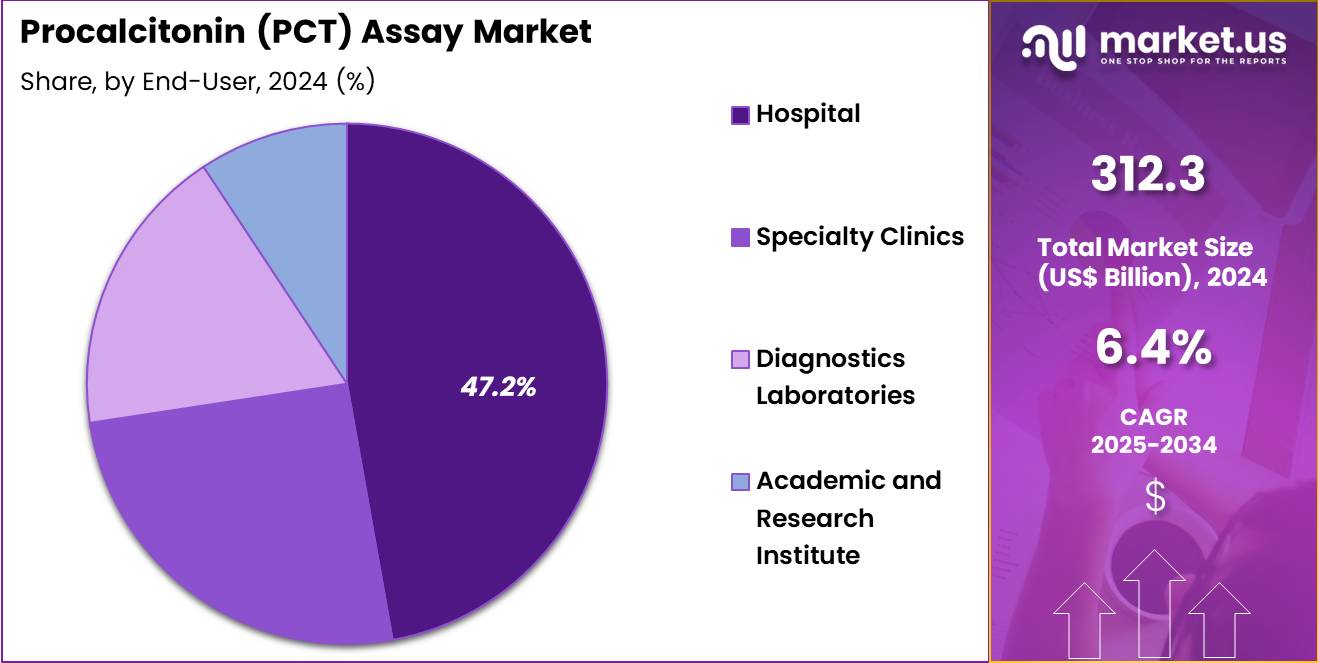

- Furthermore, concerning the end-user segment, the market is segregated into hospital, specialty clinics, diagnostics laboratories, and academic & research institute. The hospital sector stands out as the dominant player, holding the largest revenue share of 47.2% in the market.

- North America led the market by securing a market share of 40.3% in 2024.

Product Type Analysis

Test kits, holding 45.6%, are expected to dominate due to rising demand for rapid, reliable, and scalable PCT assays used in sepsis diagnosis and bacterial infection differentiation. Hospitals prefer test kits that deliver fast results to support early clinical decisions in emergency and ICU settings. Manufacturers introduce high-sensitivity kits optimized for automated analyzers, improving workflow efficiency.

Public-health systems increase adoption as PCT-guided antibiotic stewardship programs gain importance, reducing unnecessary antibiotic use. Point-of-care PCT kits expand testing beyond centralized labs, strengthening accessibility. Diagnostic labs choose standardized test kits to maintain consistency across high sample volumes. Growing prevalence of severe infections increases routine PCT measurement. Improved reagent stability supports wider geographic deployment. These drivers keep test kits anticipated to remain the leading product type.

Sample Analysis

Serum, holding 49.8%, is anticipated to remain the dominant sample type because it offers higher stability and accuracy for PCT quantification. Clinicians rely on serum-based testing to assess bacterial infection severity and guide treatment adjustments. Laboratories prefer serum samples due to minimal interference and strong compatibility with chemiluminescence and immunoassay platforms. Serum PCT levels provide reliable differentiation between sepsis and non-bacterial inflammation, supporting widespread use.

Emergency departments conduct routine serum-based PCT tests for early sepsis detection. Research institutions analyze serum samples to study PCT kinetics in diverse patient populations. Automated analyzers process serum efficiently, enabling rapid turnaround times. Growing ICU admissions boost serum-based PCT demand. Clinical guidelines encourage serum PCT assessment for antibiotic decision support. These factors keep serum projected to remain the most influential sample segment.

End-User Analysis

Hospitals, holding 47.2%, are expected to dominate end-user adoption as they manage the highest number of severe infection and sepsis cases. Clinicians depend on PCT testing to guide immediate treatment decisions, especially in critical care units. Hospitals integrate advanced analyzers that deliver rapid PCT quantification, improving patient management. Rising bacterial infection rates increase routine PCT testing across emergency departments and inpatient wards.

Antibiotic stewardship programs rely on PCT values to optimize therapy duration, strengthening hospital demand. ICU teams use serial PCT measurements to monitor treatment response. Hospitals invest in point-of-care devices to improve bedside testing efficiency. Large patient volumes support bulk procurement of test kits and consumables. Training programs improve clinician familiarity with PCT interpretation. These factors keep hospitals anticipated to remain the leading end-user segment in the procalcitonin assay market.

Key Market Segments

By Product Type

- Test Kits

- Consumables

- Analyzer & Instruments

By Sample

- Serum

- Cell Culture Medium

- Plasma

- Others

By End‑user

- Hospital

- Specialty Clinics

- Diagnostics Laboratories

- Academic & Research Institute

Drivers

Rising Incidence of Sepsis is Driving the Market

The increasing incidence of sepsis globally has positioned it as a core driver for the procalcitonin assay market, given the biomarker’s critical role in distinguishing bacterial infections from viral or non-infectious inflammation. Procalcitonin levels rise rapidly in response to bacterial stimuli, enabling clinicians to initiate targeted antibiotic therapy and avoid unnecessary broad-spectrum use. Healthcare facilities are integrating PCT assays into sepsis bundles, as recommended by international guidelines, to improve patient outcomes and reduce mortality. Diagnostic laboratories are adopting automated immunoassay platforms to handle surging test volumes, ensuring rapid results within hours of admission.

Regulatory bodies endorse PCT for risk stratification in emergency departments, aligning with efforts to curb antimicrobial resistance. Collaborative surveillance networks facilitate data collection on PCT-guided protocols, informing resource allocation in high-burden regions. The economic impact of sepsis, including prolonged intensive care stays, justifies expanded investments in assay availability. Professional societies advocate for serial PCT monitoring to guide de-escalation, embedding the test in standard care pathways.

This driver spurs advancements in point-of-care formats, broadening accessibility in resource-limited settings. Educational programs for emergency physicians emphasize PCT’s prognostic value, enhancing clinical decision-making. The World Health Organization estimates that sepsis affects 49 million people annually, causing nearly 11 million deaths worldwide as of 2024. These statistics underscore the urgent need for efficient diagnostic tools like PCT assays to mitigate this public health crisis.

Restraints

High Cost of PCT Assays is Restraining the Market

The elevated cost of procalcitonin assays compared to conventional inflammatory markers continues to serve as a primary restraint, limiting routine adoption in budget-constrained healthcare systems. Advanced immunoassay kits require specialized equipment and reagents, inflating per-test expenses that strain public health budgets in low- and middle-income countries. This financial barrier discourages widespread screening, confining PCT use to intensive care units rather than primary care settings. Reimbursement inconsistencies across payers further complicate affordability, with many jurisdictions prioritizing cost-effective alternatives like C-reactive protein tests.

Manufacturers face pressures to reduce pricing without compromising sensitivity, yet economies of scale remain elusive in fragmented markets. The restraint exacerbates diagnostic delays, as facilities opt for less precise but cheaper options, potentially worsening sepsis outcomes. Policy initiatives for subsidized testing aim to address gaps, but implementation varies regionally due to fiscal priorities. These costs also hinder research into novel PCT variants, slowing innovation pipelines.

International aid programs provide limited relief, insufficient for sustained demand. Mitigation strategies, including generic kit development, are emerging but face validation hurdles. The high cost of procalcitonin antibody-based diagnostic tests poses a notable challenge, as highlighted in industry analyses for 2024. Such economic factors illustrate the accessibility issues impeding broader market penetration.

Opportunities

Procalcitonin-Guided Antibiotic Stewardship Programs are Creating Growth Opportunities

The proliferation of procalcitonin-guided antibiotic stewardship programs in hospitals presents substantial growth opportunities for the assay market, as these initiatives rely on serial PCT measurements to optimize therapy duration and reduce resistance risks. By using PCT cutoffs to de-escalate antibiotics, programs demonstrate reduced treatment lengths without compromising safety, appealing to value-based care models. Opportunities arise in customizing assays for integration with electronic health records, enabling automated alerts for stewardship teams.

Regulatory incentives for stewardship-linked diagnostics expedite approvals, fostering collaborations between assay developers and infection control experts. This alignment supports expansion into outpatient settings, where PCT informs ambulatory management of lower respiratory infections. Economic evaluations highlight savings from averted adverse events, incentivizing payer coverage for routine testing. Global health organizations prioritize these programs in low-resource contexts, spurring demand for affordable, portable kits.

The resultant ecosystem diversifies revenue through bundled services, including training and data analytics. Emerging applications in pediatric sepsis further broaden applicability, tailoring protocols for vulnerable populations. Sustained clinical trials will generate evidence for guideline updates, solidifying PCT’s stewardship role. Numerous randomized controlled trials from 2022-2024 have confirmed that procalcitonin-guided algorithms reduce antibiotic exposure by 25-50% in sepsis patients. This evidence base exemplifies the transformative potential for market expansion in stewardship-focused diagnostics.

Impact of Macroeconomic / Geopolitical Factors

Economic turbulence and soaring reagent costs push hospital networks to limit procalcitonin assay orders, favoring cheaper alternatives in non-critical sepsis cases. Intensifying antimicrobial stewardship programs and ICU protocol upgrades, however, lock in steady adoption as clinicians rely on PCT levels to guide antibiotic decisions. Geopolitical bottlenecks in Red Sea transit lanes stall peptide shipments from Middle Eastern synthesis plants, lengthening restocking cycles and inflating prices for assay producers. These delays, nevertheless, ignite fresh EU-India sourcing corridors and backup fermentation capacity that smooth future supply flows.

Current U.S. 25% Section 301 tariffs on Chinese-sourced immunoassay calibrators, tightened in early 2025, raise procurement bills for American microbiology labs and squeeze reimbursement margins. Labs pivot smoothly by onboarding USMCA-qualified vendors and securing duty-relief certifications that keep testing affordable. Taken together, these forces refine cost discipline while reinforcing clinical value. The procalcitonin assay arena moves ahead with clear momentum, transforming today’s hurdles into stronger, more responsive diagnostics that save lives in sepsis care every day.

Latest Trends

FDA Clearance for VIDAS BRAHMS PCT Assay Expansion is a Recent Trend

The U.S. Food and Drug Administration’s expansion of indications for established procalcitonin assays has marked a significant trend in 2024, enhancing their utility in guiding antibiotic decisions for respiratory infections and sepsis. This regulatory advancement validates serial PCT monitoring to assess progression and mortality risk, streamlining integration into critical care workflows. The trend emphasizes automated platforms with turnaround times under 20 minutes, aligning with demands for rapid sepsis triage.

Developers are prioritizing multiplex formats combining PCT with other cytokines for comprehensive inflammation profiling. Regulatory focus on real-world evidence accelerates similar expansions, promoting competitive innovations in sensitivity thresholds. Adoption in emergency departments surges, where expanded labels support de-escalation protocols amid rising resistance concerns. This evolution intersects with digital dashboards for trend analysis, facilitating remote stewardship consultations. Competitive responses include adaptations for point-of-care use in non-hospital settings.

Broader ramifications encompass applications in post-surgical monitoring, adapting assays for prophylactic decisions. The trend fosters international harmonization, easing approvals in Europe and Asia. In September 2022, the U.S. Food and Drug Administration cleared a broader clinical use for the VIDAS BRAHMS PCT assay, allowing it to support decisions on when to start or stop antibiotics in patients with lower respiratory tract infections and sepsis.

This regulatory expansion continues to influence the market through 2024 by reinforcing the role of procalcitonin as a cornerstone biomarker for antimicrobial stewardship. Wider authorization increases physician confidence, elevates test utilization in emergency and critical care settings, and directly drives demand for PCT assays as hospitals prioritize precise, biomarker-guided antibiotic management.

Regional Analysis

North America is leading the Procalcitonin (PCT) Assay Market

North America accounted for 40.3% of the overall market in 2024, and the region experienced strong growth as hospitals expanded early-sepsis detection protocols and integrated PCT-guided antibiotic stewardship into emergency and critical-care units. Clinicians increased reliance on rapid PCT assays to distinguish bacterial from non-bacterial infections, which improved treatment decisions and reduced unnecessary antibiotic use.

Diagnostic laboratories upgraded automated immunoassay platforms to handle rising test volumes linked to respiratory and bloodstream infection management. Awareness initiatives across healthcare networks strengthened clinician adoption of biomarker-driven sepsis pathways. The CDC reported 1.7 million sepsis cases treated in U.S. hospitals in 2023 (CDC – Sepsis Program Data), and this high clinical burden directly reinforced stronger uptake of PCT-based diagnostics. Pharmaceutical–academic collaborations advanced host-response biomarker research, driving further method standardization. These developments collectively supported significant regional market expansion in 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to record substantial growth during the forecast period as healthcare providers intensify early-sepsis screening and enhance emergency-care diagnostic capabilities. Hospitals invest in high-throughput analyzers to deliver rapid biomarker evaluations for critically ill patients. Clinical networks encourage biomarker-supported antibiotic management to reduce resistance across densely populated countries.

Public-health agencies build capacity for infection-surveillance programs, creating higher demand for rapid biomarker testing. Medical universities expand research in inflammatory biomarkers, increasing the need for reliable quantification tools. The Australia Institute of Health and Welfare reported 18,659 sepsis-related deaths in 2022 (AIHW – Sepsis in Australia 2022), and this burden highlights the importance of early diagnostic intervention. Diagnostic companies increase regional distribution of assay kits and instruments. Together, these factors position the region for strong and consistent growth over the forecast horizon.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players pursue growth by introducing high-sensitivity immunoassays and chemiluminescence platforms that detect elevated PCT levels earlier, thereby capturing increased demand for early infection detection and antibiotic stewardship. They expand into emerging geographies by establishing local manufacturing or partnering with regional distributors to meet rising sepsis incidence and critical-care infrastructure growth.

They embed assay solutions within automated laboratory workflows and integrate cloud-based diagnostics support systems to drive lab adoption and streamline decision-making. They form collaborations with hospital networks and clinical research organisations to validate performance and position assays as standard-of-care in infectious-disease management.

They acquire or license niche reagent or point-of-care technology companies to broaden assay menus and speed portfolio expansion. Thermo Fisher Scientific illustrates this model: the U.S. headquartered company serves life-sciences, clinical research and diagnostic markets, offers extensive instrumentation and reagent portfolios, and leverages its global scale and acquisitions track record to support growth in PCT assay and broader diagnostics markets.

Top Key Players

- bioMérieux SA

- F. Hoffmann‑La Roche Ltd.

- Thermo Fisher Scientific Inc.

- Abbott Laboratories

- Merck KGaA

- EKF Diagnostics Holdings plc

- Hangzhou Kitgen Biotechnology Co., Ltd.

- RayBiotech, Inc.

Recent Developments

- On May 9, 2025, DiaSys Diagnostic Systems GmbH received FDA 510(k) clearance for its Procalcitonin FS Assay, along with the required calibrator and control materials. With this authorization, a new quantitative PCT test becomes available in the United States to support early risk assessment for critically ill patients on their first day in the ICU.

- On July 2, 2025, findings from the ADAPT-Sepsis randomized clinical trial were released, providing strong evidence for the clinical use of PCT. In patients with suspected sepsis, antibiotic treatment guided by PCT levels shortened overall antibiotic exposure by roughly 10% compared to standard practice, without increasing mortality or compromising safety. The results add meaningful support for broader adoption of PCT-based antibiotic-stewardship strategies.

Report Scope

Report Features Description Market Value (2024) US$ 312.3 Million Forecast Revenue (2034) US$ 580.7 Million CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Test Kits, Consumables, and Analyzer & Instruments), By Sample (Serum, Cell Culture Medium, Plasma, and Others), By End-user (Hospital, Specialty Clinics, Diagnostics Laboratories, and Academic & Research Institute) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape bioMérieux SA, F. Hoffmann‑La Roche Ltd., Thermo Fisher Scientific Inc., Abbott Laboratories, Merck KGaA, EKF Diagnostics Holdings plc, Hangzhou Kitgen Biotechnology Co., Ltd., RayBiotech, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Procalcitonin (PCT) Assay MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Procalcitonin (PCT) Assay MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- bioMérieux SA

- F. Hoffmann‑La Roche Ltd.

- Thermo Fisher Scientific Inc.

- Abbott Laboratories

- Merck KGaA

- EKF Diagnostics Holdings plc

- Hangzhou Kitgen Biotechnology Co., Ltd.

- RayBiotech, Inc.