Global Medical Consumables Market By Product Type (Disposable Medical Gloves, IV Kits, Medical Gauze & Tapes, Disposable Syringes, Sharps Disposable Containers, and Catheters), By End-user (Hospitals, Homecare, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145202

- Number of Pages: 271

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

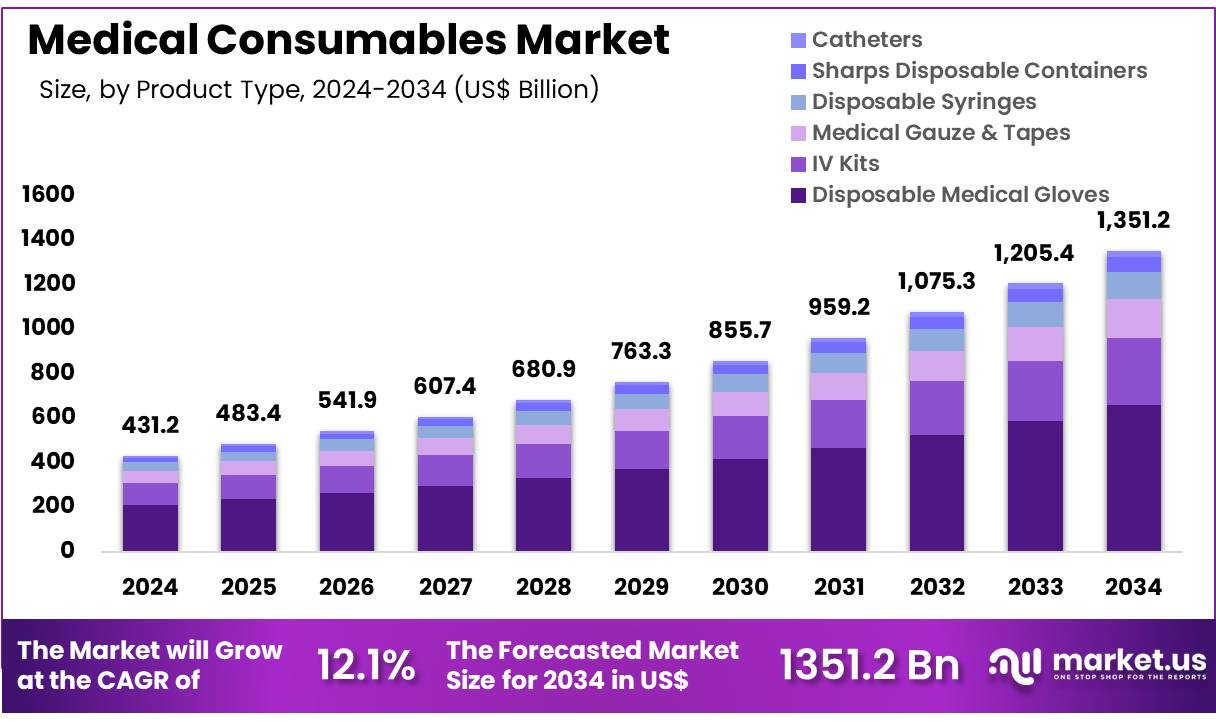

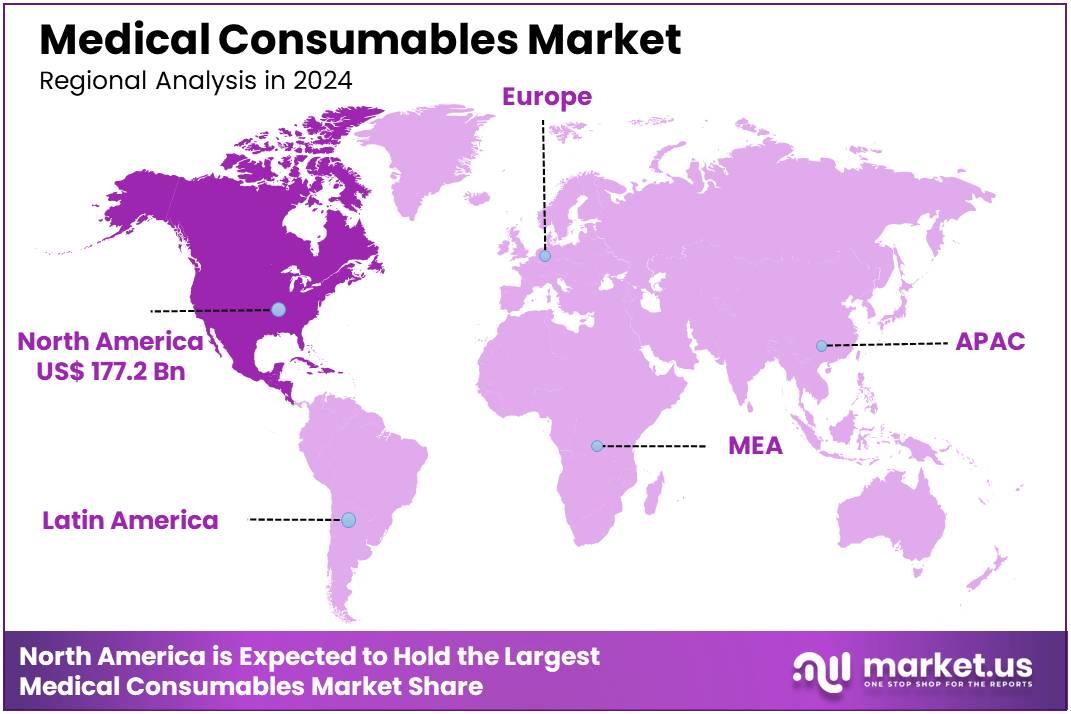

Global Medical Consumables Market size is expected to be worth around US$ 1351.2 Billion by 2034 from US$ 431.2 Billion in 2024, growing at a CAGR of 12.1% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 41.1% share with a revenue of US$ 177.2 Billion.

Increasing demand for high-quality, cost-effective healthcare solutions is driving the growth of the medical consumables market. These products, including surgical instruments, diagnostic supplies, wound care items, and disposable gloves, play a critical role in daily medical procedures, ensuring patient safety and supporting efficient healthcare delivery. As the global population ages and the prevalence of chronic diseases rises, the need for disposable medical consumables has grown significantly.

In May 2024, the Union Pharma Secretary announced that India’s exports of medical consumables and disposables reached US$1.6 billion during the 2022–2023 fiscal year, surpassing imports, which stood at US$1.1 billion. This highlights a 33% drop in imports and a 16% rise in exports, showcasing India’s increasing importance in the global market for medical products.

Technological advancements in medical consumables, such as the development of smart disposables with integrated sensors, are also opening new opportunities in patient monitoring and personalized care. These trends point to a future where medical consumables play an even more integral role in improving healthcare delivery and efficiency worldwide.

Key Takeaways

- In 2024, the market for medical consumables generated a revenue of US$ 431.2 Billion, with a CAGR of 12.1%, and is expected to reach US$ 1351.2 Billion by the year 2033.

- The product type segment is divided into disposable medical gloves, IV kits, medical gauze & tapes, disposable syringes, sharps disposable containers, and catheters, with disposable medical gloves taking the lead in 2024 with a market share of 48.7%.

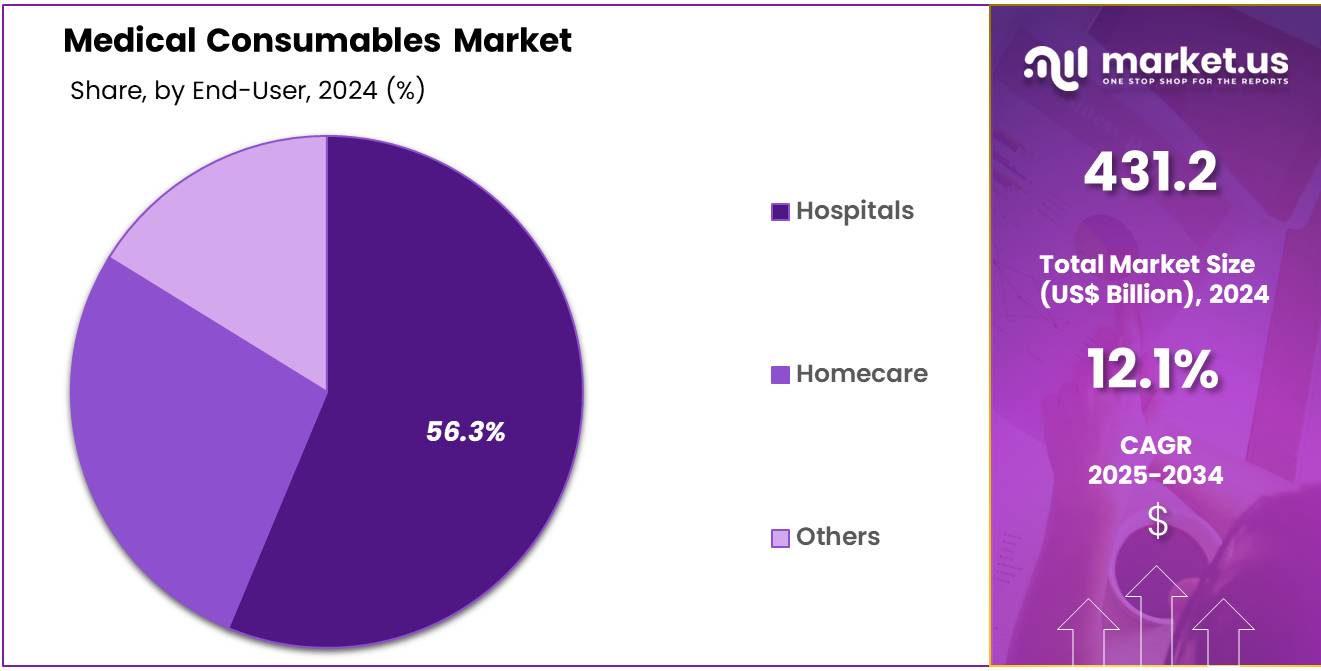

- Considering end-user, the market is divided into hospitals, homecare, and others. Among these, hospitals held a significant share of 56.3%.

- North America led the market by securing a market share of 41.1% in 2024.

Product Type Analysis

The disposable medical gloves segment led in 2024, claiming a market share of 48.7% owing to increasing demand for infection control and safety in healthcare settings. Disposable gloves are essential for preventing cross-contamination during medical procedures, and their widespread use is expected to expand in hospitals, clinics, and outpatient care settings.

The global emphasis on hygiene and patient safety, heightened by the COVID-19 pandemic, is anticipated to further drive the adoption of disposable gloves. Additionally, as healthcare providers and medical professionals continue to prioritize protection from infectious diseases, the demand for high-quality, durable, and comfortable disposable gloves is likely to increase, contributing to the segment’s growth.

End-User Analysis

The hospitals held a significant share of 56.3% as hospitals remain the primary consumers of essential consumable products. The rising number of surgeries, diagnostic procedures, and medical treatments is likely to drive the demand for consumables such as gloves, syringes, and gauze. With an increasing patient population, driven by the aging global demographic and the rise in chronic diseases, hospitals will require a constant supply of consumables to meet operational needs.

Moreover, hospitals‘ growing focus on improving patient care quality, reducing the risk of infections, and complying with healthcare regulations is expected to further fuel the demand for medical consumables, making hospitals a key end-user segment in the market.

Key Market Segments

Product Type

- Disposable Medical Gloves

- IV Kits

- Medical Gauze & Tapes

- Disposable Syringes

- Sharps Disposable Containers

- Catheters

End-user

- Hospitals

- Homecare

- Others

Drivers

Rising Demand for Healthcare Services is Driving the Market

The increasing demand for healthcare services, driven by aging populations and the prevalence of chronic diseases, is a major driver for the medical consumables market. Items such as syringes, gloves, and wound care products are essential for daily medical operations, and their demand has surged due to the growing number of hospital admissions and outpatient procedures.

In 2022, the World Health Organization reported that global healthcare spending increased by 6%, with a significant portion allocated to essential medical supplies. Companies like Cardinal Health and Medtronic have noted a steady rise in sales of consumables, particularly in regions with aging demographics, such as North America and Europe. This trend is expected to continue into 2024, as healthcare systems worldwide prioritize patient care and infection prevention.

Restraints

Stringent Regulatory Requirements are Restraining the Market

Stringent regulatory requirements for the production and distribution of medical consumables act as a significant restraint. Regulatory bodies like the US Food and Drug Administration and the European Medicines Agency enforce strict guidelines to ensure product safety and efficacy, which can delay product launches and increase compliance costs.

In 2023, a report highlighted that 30% of small manufacturers faced challenges in meeting these regulations, leading to slower market entry. Companies like Becton, Dickinson and Company have acknowledged these hurdles, investing heavily in regulatory compliance to maintain market presence. While these measures ensure high-quality products, they also create barriers for smaller players, limiting competition and innovation in the market.

Opportunities

Expansion in Emerging Markets is Creating Growth Opportunities

Emerging markets present significant growth opportunities for the medical consumables market. Countries in Asia, Africa, and Latin America are investing heavily in healthcare infrastructure, increasing the demand for essential medical supplies. In 2023, the Indian government announced a 15% increase in healthcare spending, focusing on improving access to medical consumables in rural areas.

Similarly, multinational companies like Johnson & Johnson and 3M have expanded their distribution networks in these regions to capitalize on the growing demand. This expansion is driven by rising healthcare awareness and government initiatives to improve public health, creating a lucrative opportunity for manufacturers and suppliers.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the medical consumables market. Economic growth in emerging markets, such as India and Brazil, has increased healthcare spending, driving demand for essential supplies. However, rising inflation and supply chain disruptions, exacerbated by geopolitical tensions, have led to increased production costs and delayed deliveries.

For instance, the Russia-Ukraine conflict disrupted the supply of raw materials like plastics and resins in 2022, impacting manufacturers globally. On the positive side, government initiatives in North America and Europe, such as increased funding for healthcare infrastructure, have created new opportunities. Despite challenges, the market remains resilient, with technological advancements and strategic collaborations ensuring sustained growth.

Latest Trends

Adoption of Eco-Friendly Products is a Recent Trend

The adoption of eco-friendly and sustainable medical consumables is a prominent trend in the market. With growing environmental concerns, healthcare providers are shifting toward biodegradable and recyclable products, such as gloves and packaging materials. In 2023, companies like Halyard Health and Kimberly-Clark introduced sustainable product lines, reporting a 25% increase in demand within the first year.

This trend aligns with global efforts to reduce medical waste and promote sustainability in healthcare. Manufacturers are increasingly focusing on developing environmentally friendly alternatives, reshaping the market and meeting the evolving preferences of healthcare providers and patients.

Regional Analysis

North America is leading the Medical Consumables Market

North America dominated the market with the highest revenue share of 41.1% owing to increased demand for healthcare services, advancements in medical technology, and the ongoing need for infection control. The US Centers for Disease Control and Prevention (CDC) reported a 10% rise in hospital admissions in 2023, leading to higher consumption of items such as gloves, syringes, and wound care products. The US Food and Drug Administration (FDA) approved over 1,000 new medical devices and consumables in 2023, many of which were designed to improve patient safety and efficiency in clinical settings.

Additionally, the Canadian Institute for Health Information (CIHI) highlighted a 15% increase in surgical procedures in 2022, which directly boosted the demand for surgical drapes, sutures, and other disposable items. The US Department of Health and Human Services (HHS) allocated US$500 million in 2023 to stockpile critical medical supplies, including personal protective equipment (PPE), in response to public health emergencies. These factors, combined with the aging population and the rise in chronic diseases, have significantly contributed to the expansion of the medical consumables market in North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to expanding healthcare infrastructure, rising healthcare expenditure, and increasing awareness of infection prevention. The Indian Ministry of Health and Family Welfare (MoHFW) reported a 20% increase in government spending on healthcare infrastructure in 2023, with a focus on equipping hospitals with essential disposable supplies.

Similarly, the Chinese National Health Commission (NHC) highlighted a 25% rise in the procurement of medical consumables in 2022, particularly for rural healthcare facilities. Japan’s Ministry of Health, Labour, and Welfare (MHLW) allocated US$300 million in 2023 to enhance the availability of PPE and other disposable medical products in response to aging demographics. The Australian Government’s Department of Health invested US$300 million in 2023 to enhance the availability of PPE and other disposable medical products in response to aging demographics.

Additionally, the Australian Government’s Department of Health invested US$200 million in 2022 to improve access to medical supplies in remote areas. These investments, coupled with rapid urbanization, increasing surgical volumes, and a growing emphasis on healthcare quality, are expected to drive significant growth in the medical consumables market across the Asia Pacific region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the medical consumables market focus on product innovation, expanding their product lines, and strengthening their distribution networks to drive growth. They invest in developing high-quality, cost-effective consumables such as syringes, gloves, and wound care products to meet the increasing demand for medical supplies.

Companies also emphasize regulatory compliance and quality assurance to build trust and maintain a competitive edge. Collaborations with healthcare providers, hospitals, and distributors help ensure a steady supply and greater product accessibility. Additionally, targeting emerging markets with growing healthcare infrastructure creates new opportunities for expansion.

Medtronic, headquartered in Dublin, Ireland, is a global leader in medical technology and services. The company offers a wide range of medical consumables, including surgical instruments, wound care products, and diagnostic devices, designed to improve patient outcomes and streamline healthcare procedures.

Medtronic focuses on innovation, ensuring its products are safe, effective, and affordable. Through continuous research and development, along with strategic partnerships, Medtronic continues to expand its market presence, particularly in emerging markets where healthcare access is growing rapidly.

Top Key Players

- Wipro

- Owens and Minor

- Meditech

- GE Healthcare

- Fresenius Medical Care AG & Co. KGaA

- Cardinal Health

- Baxter

- 3M

Recent Developments

- In May 2024, data from Meditech Stackathon 2024 revealed that India’s exports of medical consumables grew by 60%, reaching US$1.6 billion in fiscal year 2022–2023, up from US$1.08 billion in 2019–2020. This significant rise reflects India’s improving manufacturing capabilities, regulatory compliance, and competitiveness in the global healthcare market, fueling the growth of the medical consumables sector.

- In March 2024, Wipro GE Healthcare committed to investing US$960 million (INR 8,000 crores) over five years in R&D and manufacturing. This investment will boost the production of medical consumables, enhance innovation, and help India strengthen its position in the global market. The move is expected to accelerate market growth, benefiting both domestic and international healthcare needs.

Report Scope

Report Features Description Market Value (2024) US$ 431.2 billion Forecast Revenue (2034) US$ 1351.2 billion CAGR (2025-2034) 12.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Disposable Medical Gloves, IV Kits, Medical Gauze & Tapes, Disposable Syringes, Sharps Disposable Containers, and Catheters), By End-user (Hospitals, Homecare, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Wipro, Owens and Minor, Meditech, GE Healthcare, Fresenius Medical Care AG & Co. KGaA, Cardinal Health, Baxter, and 3M. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Medical Consumables MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Medical Consumables MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Wipro

- Owens and Minor

- Meditech

- GE Healthcare

- Fresenius Medical Care AG & Co. KGaA

- Cardinal Health

- Baxter

- 3M