General Anesthesia Drugs Market By Drug (Sevoflurane, Dexmedetomidine, Propofol, Remifentanil, and Others), By Route of Administration (Intravenous and Inhaled), By Application (Heart Surgeries, Knee & Hip Replacements, General Surgery, Cancer, and Others), By End-user (Hospitals, Ambulatory Surgical Centers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 144042

- Number of Pages: 397

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

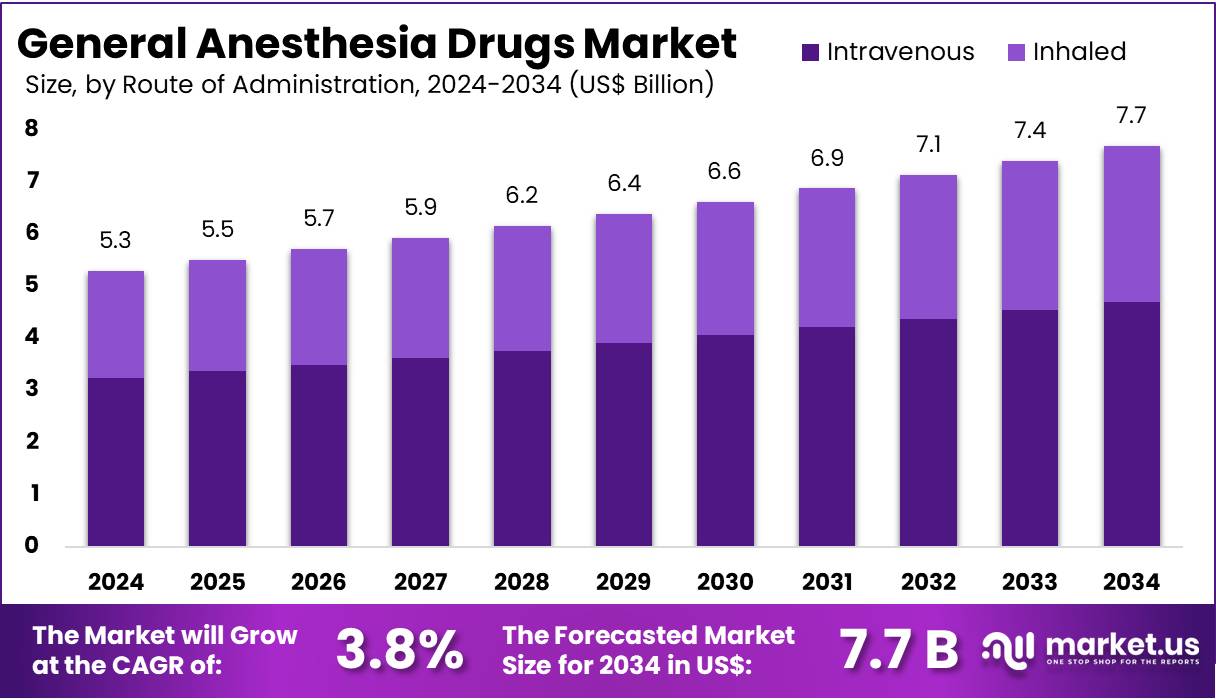

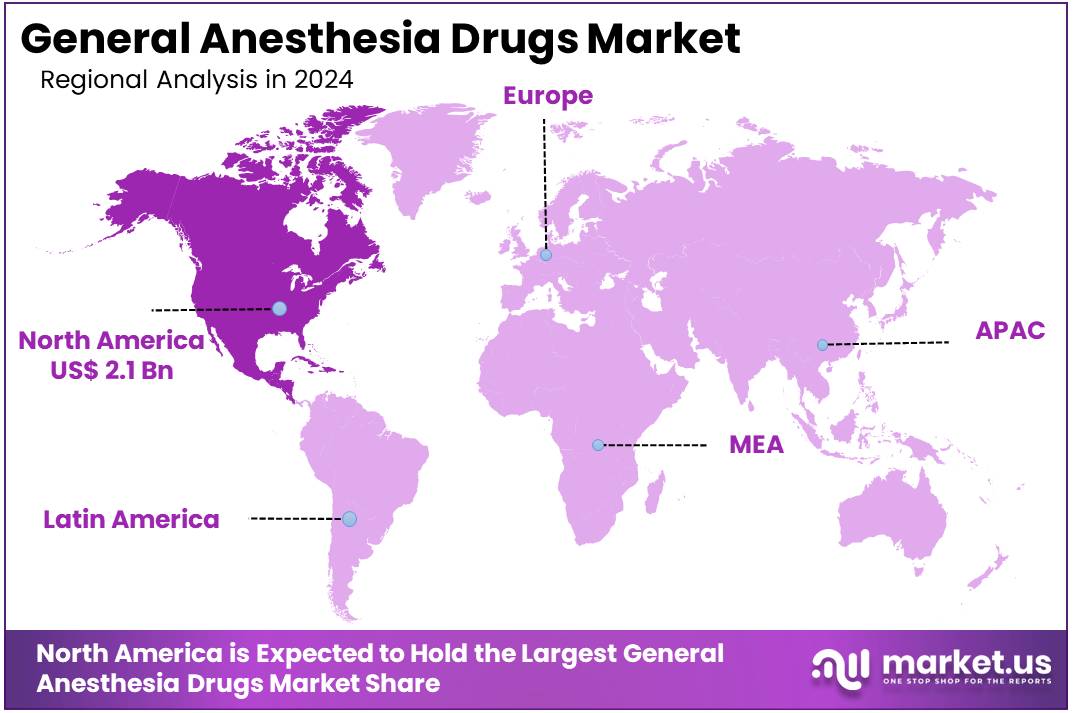

The General Anesthesia Drugs Market Size is expected to be worth around US$ 7.7 billion by 2034 from US$ 5.3 billion in 2024, growing at a CAGR of 3.8% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 38.7% share and holds US$ 2.1 Billion market value for the year.

Increasing demand for surgical procedures and the growing number of outpatient surgeries drive the growth of the general anesthesia drugs market. Rising awareness about patient comfort and safety during surgeries further boosts the adoption of these drugs, as they provide essential pain management during and post-surgical procedures. Advancements in drug formulations, including the introduction of more targeted and efficient drugs, offer opportunities for market expansion.

General anesthesia drugs play a critical role in a variety of surgical applications, including orthopedic, cardiovascular, and cosmetic surgeries, contributing to improved patient outcomes. In April 2024, Baxter introduced its Ropivacaine Hydrochloride Injection, USP, which offers a convenient, ready-to-use infusion bag for pain relief during and after surgeries.

This new product addresses the need for efficient pain management solutions and provides healthcare providers with a reliable alternative to conventional pain relief methods. The continued development of innovative anesthetic agents presents significant opportunities for growth in the general anesthesia drugs market.

Key Takeaways

- In 2024, the market for general anesthesia drugs generated a revenue of US$ 5.3 billion, with a CAGR of 3.8%, and is expected to reach US$ 7.7 billion by the year 2034.

- The drug segment is divided into sevoflurane, dexmedetomidine, propofol, remifentanil, and others, with propofol taking the lead in 2024 with a market share of 48.5%.

- Considering route of administration, the market is divided into intravenous and inhaled. Among these, intravenous held a significant share of 61.2%.

- Furthermore, concerning the application segment, the market is segregated into heart surgeries, knee & hip replacements, general surgery, cancer, and others. The heart surgeries sector stands out as the dominant player, holding the largest revenue share of 37.7% in the general anesthesia drugs market.

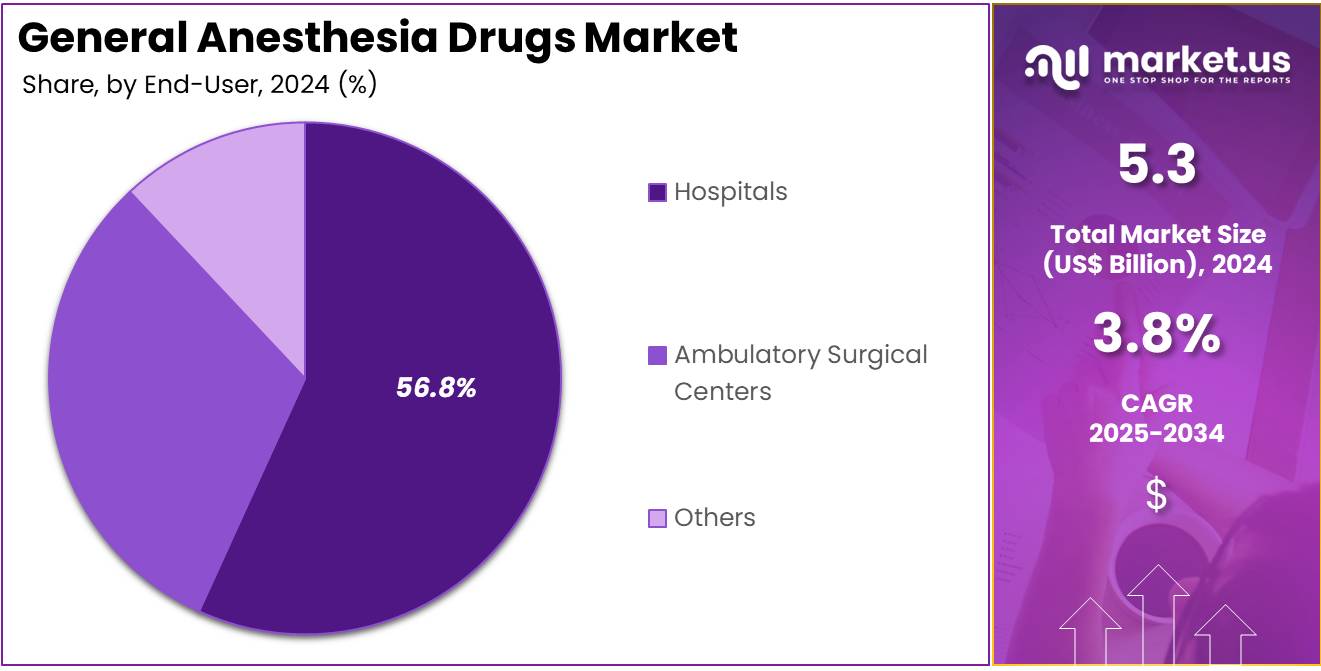

- The end-user segment is segregated into hospitals, ambulatory surgical centers, and others, with the hospitals segment leading the market, holding a revenue share of 56.8%.

- North America led the market by securing a market share of 38.7% in 2024.

Drug Analysis

The propofol segment led in 2024, claiming a market share of 48.5% owing to its widespread use as an intravenous anesthetic agent. Propofol is anticipated to remain the drug of choice for induction and maintenance of general anesthesia due to its rapid onset and short duration of action, which allows for quicker recovery times in patients.

The increasing demand for outpatient procedures, where faster recovery is crucial, is likely to drive the adoption of propofol. Additionally, its proven safety profile and lower incidence of side effects compared to other anesthetics are projected to contribute to the continued growth of this segment. As hospitals and surgical centers prioritize efficiency and patient recovery, propofol’s usage in general anesthesia is expected to increase.

Route of Administration Analysis

The intravenous held a significant share of 61.2% due to the growing preference for intravenous anesthetics over inhaled agents. Intravenous anesthesia offers several advantages, including a faster onset of action and better control over the depth of anesthesia, which is expected to drive its adoption in surgeries that require rapid induction and quicker recovery.

As the medical community increasingly seeks more efficient and effective ways to manage anesthesia during procedures, intravenous drugs like propofol and dexmedetomidine are likely to gain further traction. The shift towards outpatient surgeries and shorter recovery times is anticipated to further contribute to the growth of the intravenous segment, making it a preferred choice in modern anesthetic practices.

Application Analysis

The heart surgeries segment had a tremendous growth rate, with a revenue share of 37.7% as the number of heart surgeries continues to rise globally. General anesthesia plays a critical role in heart surgeries, such as coronary artery bypass grafting (CABG) and valve replacement, due to the need for complete muscle relaxation and stable hemodynamics during the procedure.

The growing prevalence of cardiovascular diseases, combined with the advancements in cardiac surgical techniques, is likely to drive the demand for general anesthesia drugs tailored to heart surgeries. As more patients undergo heart surgeries to treat coronary artery disease and other heart conditions, the use of general anesthesia drugs during these procedures is anticipated to increase, contributing to the growth of this segment.

End-User Analysis

The hospitals segment grew at a substantial rate, generating a revenue portion of 56.8% due to the continued dominance of hospitals as the primary setting for complex surgeries that require general anesthesia. Hospitals are expected to remain the largest consumers of general anesthesia drugs as they handle a wide variety of surgical procedures, from major surgeries to emergency interventions, requiring safe and effective anesthesia management.

The rising volume of surgeries performed in hospitals, along with the increasing preference for minimally invasive and outpatient procedures, is likely to drive the demand for general anesthesia drugs. Additionally, hospitals’ focus on improving patient safety, reducing recovery times, and enhancing surgical outcomes is expected to further fuel the adoption of these drugs in hospital settings, contributing to the market’s overall growth.

Key Market Segments

By Drug

- Sevoflurane

- Dexmedetomidine

- Propofol

- Remifentanil

- Others

By Route of Administration

- Intravenous

- Inhaled

By Application

- Heart Surgeries

- Knee & Hip Replacements

- General Surgery

- Cancer

- Others

By End-user

- Hospitals

- Ambulatory Surgical Centers

- Others

Drivers

Increasing Prevalence Of Surgeries Is Driving The Market

The rising number of surgical procedures worldwide is a key driver for the general anesthesia drugs market. According to the World Health Organization (WHO), an estimated 310 million major surgeries were performed globally in 2023, reflecting a steady increase from previous years. This growth is fueled by aging populations, higher rates of chronic diseases, and advancements in surgical techniques.

For instance, the US witnessed a significant rise in elective surgeries post-COVID-19, with hospitals reporting a 15-20% increase in surgical volumes in 2022. Companies like Pfizer and Baxter International have reported higher demand for anesthetic drugs, with Pfizer’s anesthesia portfolio revenue growing by 8% in 2023. This trend underscores the critical role of anesthesia in modern healthcare.

Restraints

Stringent Regulatory Requirements Are Restraining The Market

The stringent regulatory landscape for drug approval and safety is a major restraint for the anesthesia drugs market. Regulatory bodies like the US Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have tightened guidelines for drug approvals, leading to longer development timelines and higher costs.

In 2023, the FDA issued new safety warnings for certain anesthetic agents, impacting their market availability. For example, Fresenius Kabi faced delays in launching a new anesthetic drug in the US due to additional clinical trial requirements. These regulatory hurdles have slowed market growth, with companies reporting a 10-12% increase in R&D expenditures in 2022-2023 to meet compliance standards.

Opportunities

Growing Demand For Ambulatory Surgical Centers Is Creating Growth Opportunities

The shift toward ambulatory surgical centers (ASCs) presents a significant growth opportunity for the anesthesia drugs market. ASCs are increasingly preferred for their cost-effectiveness and convenience, with the US Centers for Medicare & Medicaid Services (CMS) reporting a 25% increase in ASC-based procedures in 2023. This trend is driving demand for short-acting anesthetic drugs that facilitate quicker patient recovery.

Companies like AbbVie and Hikma Pharmaceuticals are capitalizing on this opportunity by developing specialized formulations for ASCs. AbbVie reported a 12% increase in sales of its anesthesia products tailored for outpatient settings in 2023, highlighting the potential of this segment.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the anesthesia drugs market, creating both challenges and opportunities. Rising healthcare expenditures and increased government funding for surgical infrastructure in emerging economies are driving market growth. For instance, India’s healthcare budget increased by 12% in 2023, boosting access to surgical care.

However, supply chain disruptions caused by geopolitical tensions, such as the Russia-Ukraine conflict, have led to shortages of raw materials, increasing production costs. Inflation and currency fluctuations have further strained pricing strategies, particularly in developing regions.

Despite these challenges, the market benefits from technological advancements and strategic collaborations, ensuring a steady pipeline of innovative anesthetic solutions. The growing emphasis on patient-centric care and safer drug formulations will continue to propel the market forward, fostering resilience and long-term growth.

Trends

Rising Adoption Of Non-Opioid Anesthetics Is A Recent Trend

A notable trend in the anesthesia drugs market is the growing adoption of non-opioid anesthetics, driven by concerns over opioid addiction and side effects. In 2023, the US Department of Health and Human Services (HHS) reported a 30% increase in the use of non-opioid alternatives in surgical settings compared to 2022.

Companies like Merck & Co. and Aspen Pharmacare are investing heavily in developing non-opioid formulations, with Merck’s non-opioid anesthetic portfolio generating US$ 1.2 billion in revenue in 2023. This trend aligns with global efforts to combat the opioid crisis and improve patient safety, making it a pivotal development in the market.

Regional Analysis

North America is leading the General anesthesia drugs Market

North America dominated the market with the highest revenue share of 38.7% owing to several key factors. The increasing number of surgical procedures, particularly in the US, has been a major contributor. According to the Centers for Disease Control and Prevention (CDC), hospital inpatient surgeries in the US rose by approximately 5% between 2022 and 2024. Additionally, the aging population, which is more prone to chronic diseases requiring surgical interventions, has further fueled demand.

The National Institute on Aging reports that the population aged 65 and older in the US grew by nearly 3% during this period. Technological advancements in drug formulations, such as the development of faster-acting and safer anesthetics, have also played a crucial role. For instance, the US Food and Drug Administration (FDA) approved two new anesthesia drugs in 2023, enhancing treatment options.

Furthermore, the expansion of ambulatory surgical centers, which rely heavily on efficient anesthesia delivery, has boosted market growth. The American Hospital Association highlights a 7% increase in the number of such centers from 2022 to 2024. These factors collectively underscore the robust expansion of the market in North America.

The Asia Pacific Region Is Expected To Experience The Highest CAGR During The Forecast Period

Asia Pacific is expected to grow with the fastest CAGR owing to a combination of healthcare advancements, demographic shifts, and economic developments. Governments across the region have significantly increased their healthcare expenditures, with China leading the way by allocating an additional US$50 billion to healthcare infrastructure in 2023.

This investment has facilitated the expansion of hospital networks and the adoption of advanced medical technologies, including improved anesthesia delivery systems. India has also made notable strides, with the Ministry of Health reporting a US$ 12.5 billion allocation for healthcare infrastructure in 2023. This investment has further expanded surgical facilities, enhancing the capacity for complex procedures.

Medical tourism has played a pivotal role, with countries like Thailand and Malaysia attracting patients seeking affordable and high-quality surgical care. These factors, combined with ongoing advancements in anesthesia drug formulations and delivery methods, are expected to drive robust growth in the Asia Pacific market, positioning the region as a key player in the global healthcare landscape.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the general anesthesia drugs market focus on product innovation, strategic partnerships, and expanding their global reach to drive growth. They invest in developing safer and more effective anesthetic agents, focusing on reducing side effects and improving recovery times for patients. Companies also enhance their market position by offering combination therapies and personalized anesthesia solutions tailored to different types of surgeries.

Strategic collaborations with hospitals, healthcare providers, and research institutions help expand product adoption. Additionally, targeting emerging markets with growing healthcare infrastructure presents significant opportunities for growth. Fresenius Kabi, based in Bad Homburg, Germany, is a global healthcare company specializing in intravenous generics, clinical nutrition, and medical devices. The company offers a wide range of anesthesia drugs, including propofol and sevoflurane, designed to provide safe and effective anesthesia for surgical procedures.

Fresenius Kabi focuses on innovation and quality, ensuring that its anesthetic solutions meet the highest standards of patient safety. With a strong global presence, the company continues to expand its offerings and strengthen its position in the anesthesia market through research and development and strategic partnerships.

Top Key Players in the General anesthesia drugs Market

- Pfizer

- Hikama Pharmaceuticals plc

- Eugia Steriles

- Baxter International

- Braun Melsungen AG

- AstraZeneca

- Amneal Pharmaceuticals

- Abbott Laboratories

Recent Developments

- In September 2024, Eugia Steriles, a subsidiary of Aurobindo Pharma, announced the approval of its Lidocaine Hydrochloride injection by the USFDA. This anesthetic is used to numb tissues during medical procedures such as surgeries, catheter insertions, and other invasive treatments to alleviate patient discomfort.

- In August 2024, the U.S. Food and Drug Administration (FDA) granted clearance to Amneal Pharmaceuticals for its Propofol Injectable Emulsion USP, available in three single-dose vial formulations. This medication is commonly used in clinical environments for both the induction and maintenance of anesthesia in patients undergoing surgical procedures and other medical treatments.

Report Scope

Report Features Description Market Value (2024) US$ 5.3 billion Forecast Revenue (2034) US$ 7.7 billion CAGR (2025-2034) 3.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Drug (Sevoflurane, Dexmedetomidine, Propofol, Remifentanil, and Others), By Route of Administration (Intravenous and Inhaled), By Application (Heart Surgeries, Knee & Hip Replacements, General Surgery, Cancer, and Others), By End-user (Hospitals, Ambulatory Surgical Centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Pfizer, Hikama Pharmaceuticals plc, Eugia Steriles, Baxter International, B. Braun Melsungen AG, AstraZeneca, Amneal Pharmaceuticals, and Abbott Laboratories. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  General Anesthesia Drugs MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

General Anesthesia Drugs MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Pfizer

- Hikama Pharmaceuticals plc

- Eugia Steriles

- Baxter International

- Braun Melsungen AG

- AstraZeneca

- Amneal Pharmaceuticals

- Abbott Laboratories