General Surgical Devices Market By Product Type (Disposable Surgical Supplies (Surgical Non-woven, Examination & Surgical Gloves, General Surgery Procedural Kits, Needles and Syringes, Venous Access Catheters), Open Surgery Instrument (Retractor, Dilator, Catheters), Energy-based & Powered Instrument (Powered Staplers, Drill System), Minimally Invasive Surgery Instruments (Laparoscope, Organ Retractor), Medical Robotics & Computer Assisted Surgery Devices, and Adhesion Prevention Products), By Application (Orthopedic Surgery, Cardiology, Wound Care, Ophthalmology, Audiology, and Others), By End-user (Hospitals & Clinics, Ambulatory Surgical Centers, and Specialty Clinics), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142006

- Number of Pages: 348

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

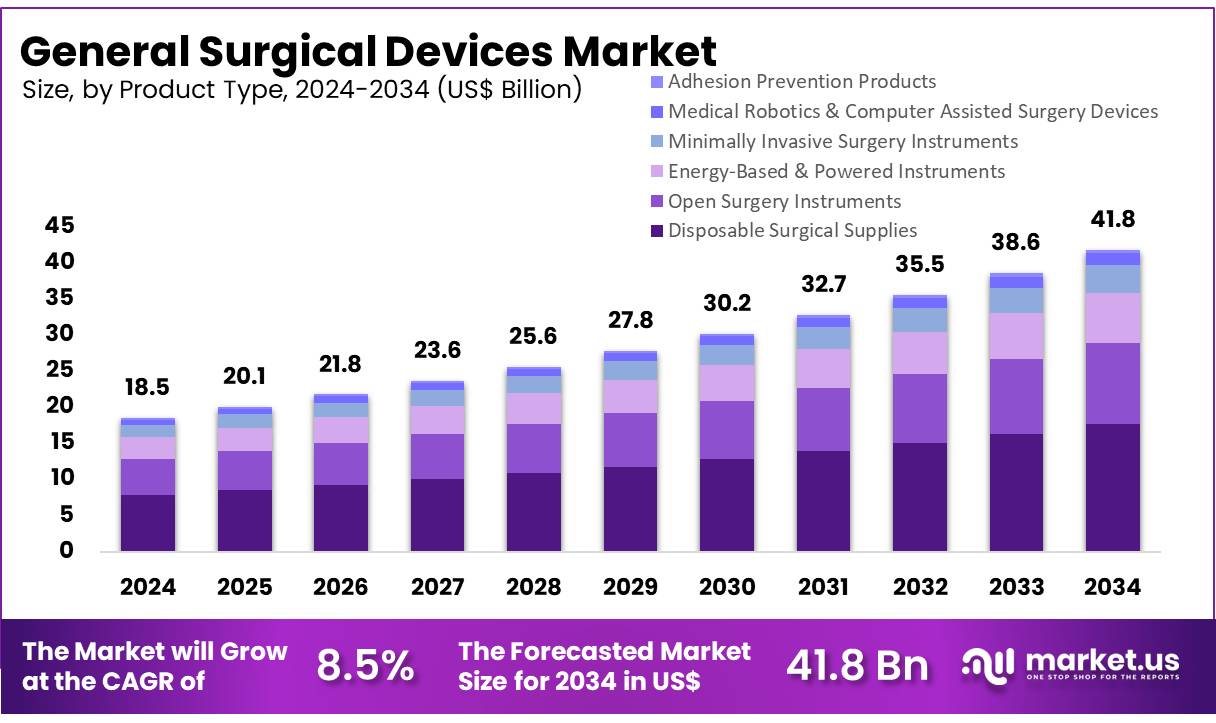

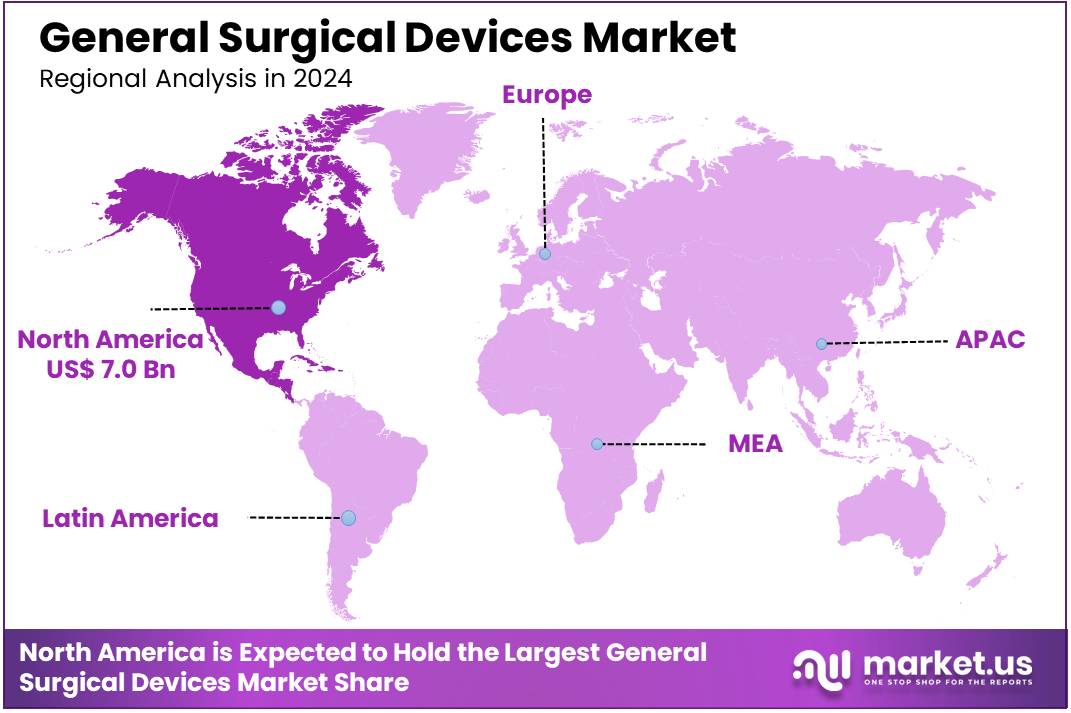

Global General Surgical Devices Market size is expected to be worth around US$ 41.8 billion by 2034 from US$ 18.5 billion in 2024, growing at a CAGR of 8.5% during the forecast period 2025 to 2034. In 2023, North America led the market, achieving over 38.1% share with a revenue of US$ 7.0 Million.

Growing demand for advanced surgical interventions is propelling the general surgical devices market. Key drivers include the increasing prevalence of chronic diseases, technological advancements, and a rising aging population. The demand for surgical devices like robotic systems reflects the rise in minimally invasive procedures, which require such devices for precision and support. Opportunities abound with the integration of augmented reality (AR) and virtual reality (VR) into surgical practices, enhancing visualization and precision.

The FDA has authorized 69 medical devices incorporating AR and VR technologies, underscoring this trend. Recent developments highlight the market’s dynamic nature; for instance, Intuitive Surgical reported an 18% increase in procedures performed with its da Vinci robotic systems in the third quarter of 2024, indicating robust adoption of robotic-assisted surgeries.

Applications of general surgical devices span various domains, including cardiovascular, orthopedic, neurosurgery, and minimally invasive procedures, addressing diverse medical needs. As healthcare continues to evolve, the general surgical devices market is poised for sustained growth, driven by innovation and the imperative to improve patient outcomes.

Key Takeaways

- In 2023, the market for general surgical devices generated a revenue of US$ 18.5 billion, with a CAGR of 8.5%, and is expected to reach US$ 41.8 billion by the year 2033.

- The product type segment is divided into disposable surgical supplies, open surgery instrument, energy-based & powered instrument, minimally invasive surgery instruments, medical robotics & computer assisted surgery devices, and adhesion prevention products, with disposable surgical supplies taking the lead in 2023 with a market share of 42.4%.

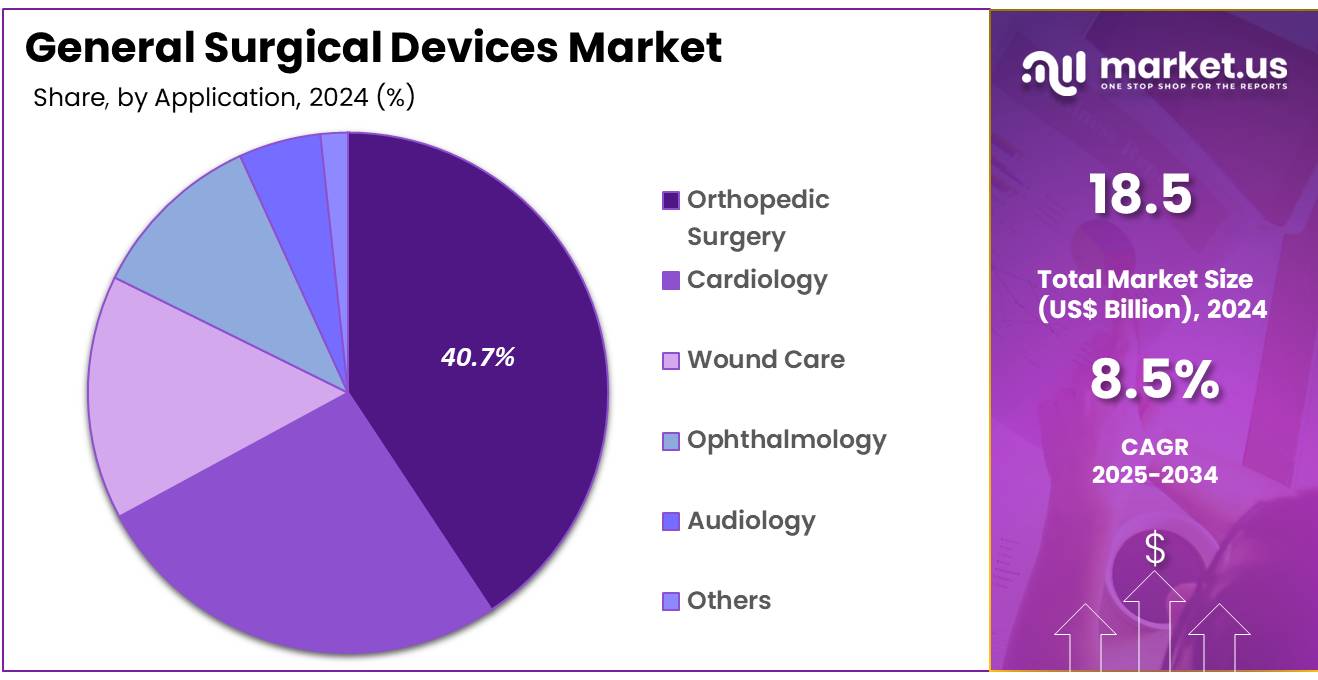

- Considering application, the market is divided into orthopedic surgery, cardiology, wound care, ophthalmology, audiology, and others. Among these, orthopedic surgery held a significant share of 40.7%.

- Furthermore, concerning the end-user segment, the market is segregated into hospitals & clinics, ambulatory surgical centers, and specialty clinics. The hospitals & clinics sector stands out as the dominant player, holding the largest revenue share of 54.5% in the general surgical devices market.

- North America led the market by securing a market share of 38.1% in 2023.

Product Type Analysis

The disposable surgical supplies segment led in 2023, claiming a market share of 42.4% owing to the increasing demand for infection control and patient safety. Disposable supplies, such as gloves, drapes, and gowns, are anticipated to gain prominence as healthcare facilities focus on reducing the risk of cross-contamination and promoting hygiene standards during surgeries.

The growing emphasis on minimizing hospital-acquired infections (HAIs) is likely to fuel the adoption of disposable products in surgical settings. Additionally, the rise in surgical procedures worldwide, combined with a preference for single-use items for safety and convenience, is expected to drive the demand for disposable surgical supplies.

As healthcare systems worldwide continue to prioritize infection prevention, the disposable surgical supplies market is projected to expand further, particularly in the wake of global health concerns like the COVID-19 pandemic.

Application Analysis

The orthopedic surgery held a significant share of 40.7%. The rise in the global aging population and the increasing incidence of musculoskeletal disorders, such as arthritis and osteoporosis, are likely to contribute to the growing demand for orthopedic surgeries. Additionally, advancements in orthopedic surgical technologies, such as minimally invasive procedures, robotics, and improved surgical instruments, are expected to enhance the efficiency and outcomes of surgeries, driving the segment’s growth.

The increasing preference for joint replacement surgeries, especially hip and knee replacements, is projected to further propel this segment. As the population continues to age and the demand for orthopedic solutions rises, the orthopedic surgery segment is expected to see continued expansion in the coming years.

End-user Analysis

The hospitals & clinics segment had a tremendous growth rate, with a revenue share of 54.5% owing to the increasing number of surgeries performed in these settings. Hospitals and clinics are likely to dominate the market as they provide a wide range of surgical procedures, from routine to highly specialized surgeries. The expansion of healthcare infrastructure, particularly in emerging markets, is expected to drive the demand for general surgical devices in these settings.

The rising prevalence of chronic diseases that require surgical interventions, such as cancer and cardiovascular diseases, is anticipated to further support this segment’s growth. Additionally, the growing adoption of advanced surgical technologies and a focus on improving patient outcomes are projected to contribute to the expansion of this segment. Hospitals and clinics are expected to continue investing in cutting-edge surgical devices, driving the overall market’s growth.

Key Market Segments

Product Type

- Disposable Surgical Supplies

- Surgical Non-woven

-

- Examination & Surgical Gloves

- General Surgery Procedural Kits

- Needles and Syringes

- Venous Access Catheters

- Open Surgery Instrument

- Retractor

- Dilator

- Catheters

- Energy-based & Powered Instrument

- Powered Staplers

- Drill System

- Minimally Invasive Surgery Instruments

- Laparoscope

- Organ Retractor

- Medical Robotics & Computer Assisted Surgery Devices

- Adhesion Prevention Products

Application

- Orthopedic Surgery

- Cardiology

- Wound Care

- Ophthalmology

- Audiology

- Others

End-user

- Hospitals & Clinics

- Ambulatory Surgical Centers

- Specialty Clinics

Drivers

Increasing Demand for Minimally Invasive Surgical Procedures Driving the Market

The general surgical devices market is experiencing significant growth due to the rising demand for minimally invasive surgical procedures. Patients and healthcare providers prefer these techniques because they offer benefits such as reduced postoperative pain, shorter hospital stays, and quicker recovery times. This shift towards less invasive methods has led to a surge in the adoption of advanced surgical instruments and robotic systems.

For instance, in the third quarter of 2024, Intuitive Surgical reported an 18% increase in procedures performed using their da Vinci robotic systems compared to the same period the previous year. This uptick reflects the growing acceptance and utilization of robotic-assisted surgeries in clinical practice.

The trend is further supported by continuous technological advancements, making these procedures more accessible and effective. As a result, the market for general surgical devices is expanding to meet the evolving needs of modern surgical practices.

Restraints

Regulatory and Pricing Challenges Hampering the Market

While the global demand for surgical devices is on the rise, companies face significant challenges in emerging markets due to stringent regulatory environments and pricing pressures. For example, in 2024, Smith & Nephew experienced a downturn in their revenue projections, primarily attributed to China’s volume-based procurement program. This initiative aims to reduce healthcare costs by awarding large contracts to low-cost bidders, leading to decreased profit margins for medical device manufacturers.

The company’s third-quarter revenue growth was limited to 4%, reaching US$1.4 billion, with a notable decline in sales within emerging markets by 1.2%. These regulatory and pricing hurdles can deter market entry and expansion, limiting the availability of advanced surgical devices in regions where they are critically needed. Consequently, companies must navigate complex regulatory landscapes and adapt their pricing strategies to maintain competitiveness in these markets.

Opportunities

Integration of Artificial Intelligence in Surgical Robotics Creating Growth Opportunities

The integration of artificial intelligence (AI) into surgical robotics presents a significant opportunity for the general surgical devices market. AI enhances the precision and efficiency of surgical procedures, leading to improved patient outcomes. In 2024, medical robotics startup Mendaera raised US$73 million in a Series B funding round to develop robotic systems that utilize AI and ultrasound technologies. These systems aim to assist clinicians in performing needle-based medical procedures with greater accuracy.

The substantial investment in such technologies indicates a strong belief in the potential of AI-driven surgical solutions. As hardware costs decrease and AI algorithms become more sophisticated, the adoption of AI-enhanced surgical devices is expected to rise. This progression offers healthcare providers advanced tools to perform complex surgeries more effectively, thereby expanding the market for general surgical devices.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the surgical devices industry. Economic growth in developed regions often leads to increased healthcare spending, enabling hospitals to invest in advanced surgical technologies. Conversely, economic downturns can result in budget constraints, limiting the acquisition of new equipment.

Geopolitical tensions and trade policies also play a crucial role; for instance, newly enacted US tariffs on Chinese products have led companies like GE HealthCare to anticipate additional costs, potentially affecting profit margins. Despite a 15% decline in sales in China in 2024, GE HealthCare experienced a 5% increase in sales in the US and Canada, demonstrating resilience in certain markets.

Supply chain disruptions due to geopolitical conflicts can lead to equipment shortages, impacting surgical procedures. However, companies are adapting by diversifying supply chains and focusing on innovation to meet global demand. Overall, while challenges persist, the industry continues to find opportunities for growth amid a complex macroeconomic and geopolitical landscape.

Latest Trends

Surge in Adoption of Robotic-Assisted Surgeries Driving the Market

A notable trend in the general surgical devices market is the increased adoption of robotic-assisted surgeries. This approach offers surgeons enhanced precision, flexibility, and control during operations. In the third quarter of 2024, Intuitive Surgical reported an 18% rise in procedures performed with their da Vinci robotic systems compared to the same quarter in the previous year. This growth is indicative of the broader acceptance of robotic systems in surgical practices worldwide.

The company’s revenue from instruments and accessories also saw an 18% increase, highlighting the sustained demand for robotic-assisted surgical tools. As technology continues to advance, making robotic systems more accessible and user-friendly, it is anticipated that this trend will persist, further propelling the growth of the general surgical devices market.

Regional Analysis

North America is leading the General Surgical Devices Market

North America dominated the market with the highest revenue share of 38.1% owing to a combination of factors such as increased demand for minimally invasive procedures and the rising prevalence of chronic diseases that require surgical intervention. Technological advancements in surgical tools, such as robotics, and enhanced precision in procedures have contributed to better patient outcomes and faster recovery times. The expanding healthcare infrastructure and rising healthcare expenditure also played a key role in supporting market expansion.

The growth of outpatient surgical centers and the adoption of same-day discharge procedures have further stimulated the demand for high-quality, cost-effective surgical devices. In August 2024, Johnson & Johnson introduced an advanced chest fixation system designed to improve stability after major thoracic and cardiac procedures.

This new system, with stronger locking capabilities and quicker fixation times, reflects the market’s trend towards improving surgical outcomes through innovation. Increasing awareness and improved access to healthcare have also driven the adoption of these devices across the region.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the aging population, increasing healthcare access, and a surge in surgical interventions. According to the National Bureau of Statistics of China, individuals aged 60 and above are expected to account for 21.1 percent of the total population in 2024. As the population ages, the demand for surgical procedures, particularly for age-related health issues like cardiovascular and orthopedic surgeries, is projected to increase.

The growing prevalence of chronic diseases and the expansion of healthcare infrastructure in countries like China, India, and Japan are likely to further fuel market growth. Increased government spending on healthcare and investments in advanced medical technologies are anticipated to enhance the availability and quality of surgical devices.

The rise of medical tourism in the region is also expected to drive demand for high-quality surgical interventions, thereby supporting the market. With improved healthcare policies and better reimbursement options, the demand for general surgical devices in Asia Pacific is projected to see significant growth in the coming years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the general surgical devices market focus on expanding their product portfolios with advanced, minimally invasive technologies that improve patient outcomes and reduce recovery times. Companies invest in research and development to enhance device precision, durability, and functionality, addressing a wide range of surgical procedures.

Strategic partnerships with hospitals and surgical centers help improve distribution networks and expand service offerings. Many players also emphasize affordability and regulatory compliance to meet the demands of both developed and emerging markets. Additionally, companies prioritize technological integration, such as robotic surgery systems, to further enhance surgical capabilities.

Medtronic is a leading company in this market, offering a comprehensive range of general surgical instruments, including electrosurgical and hemostasis devices. The company focuses on continuous innovation, such as the development of advanced laparoscopic and robotic systems that improve surgical accuracy. Medtronic’s strong market presence and commitment to enhancing surgical outcomes position it as a key player in the industry.

Top Key Players

- Smith & Nephew

- Ostium

- Olympus Corporation

- Johnson & Johnson

- Integra LifeSciences

- Integer Holdings Corporation

- Conmed Corporation

- Cadence Inc

Recent Developments

- In October 2024, Smith & Nephew collaborated with JointVue to integrate 3D surgical planning technology into its robotic knee replacement system. This partnership aims to refine preoperative planning, optimize patient-specific procedures, and improve overall surgical efficiency.

- In August 2024, a medical technology division of Johnson & Johnson launched a robotic surgical system alongside a navigation platform in partnership with a healthcare robotics firm. Growing public and private investment in healthcare innovation is fostering the development of next-generation surgical devices and driving market expansion.

- In September 2022, Solvay teamed up with Ostium, a French startup, to develop high-performance materials for single-use surgical instruments. This initiative focuses on enhancing precision, durability, and environmental sustainability in disposable medical tools.

Report Scope

Report Features Description Market Value (2024) US$ 18.5 billion Forecast Revenue (2034) US$ 41.8 billion CAGR (2025-2034) 8.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Disposable Surgical Supplies (Surgical Non-woven, Examination & Surgical Gloves, General Surgery Procedural Kits, Needles and Syringes, Venous Access Catheters), Open Surgery Instrument (Retractor, Dilator, Catheters), Energy-based & Powered Instrument (Powered Staplers, Drill System), Minimally Invasive Surgery Instruments (Laparoscope, Organ Retractor), Medical Robotics & Computer Assisted Surgery Devices, and Adhesion Prevention Products), By Application (Orthopedic Surgery, Cardiology, Wound Care, Ophthalmology, Audiology, and Others), By End-user (Hospitals & Clinics, Ambulatory Surgical Centers, and Specialty Clinics) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Smith & Nephew, Ostium, Olympus Corporation, Johnson & Johnson , Integra LifeSciences, Integer Holdings Corporation, Conmed Corporation, Cadence Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  General Surgical Devices MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

General Surgical Devices MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Smith & Nephew

- Ostium

- Olympus Corporation

- Johnson & Johnson

- Integra LifeSciences

- Integer Holdings Corporation

- Conmed Corporation

- Cadence Inc