Dental Anesthesia Market By Product Type (Lidocaine, Prilocaine, Mepivacaine, Articaine, Bupivacaine 0.5% with epinephrine1:200,000, and Others), By Mode of Administration (Mandibular, Maxillary, and Others), By End-user (Hospitals, Dental Clinics, and Other), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 103970

- Number of Pages: 326

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Global Dental Anesthesia Market Size is expected to be worth around US$ 3.2 Billion by 2033, from US$ 1.9 Billion in 2023, growing at a CAGR of 5.3% during the forecast period from 2024 to 2033.

Increasing demand for minimally invasive dental procedures and patient comfort drives growth in the dental anesthesia market. Advancements in anesthesia technology offer targeted and efficient pain management solutions, reducing patient anxiety and enhancing procedural precision. In April 2022, Milestone Scientific, in collaboration with Keystone Dental Group, introduced the STA Single Tooth Anesthesia System, offering precise anesthesia delivery for single-tooth procedures.

This innovation exemplifies the market trend toward patient-specific solutions that improve the dental experience. Additionally, rising dental aesthetics and restorative treatments amplify the need for reliable anesthesia options, encouraging innovation in localized and topical anesthetic products.

Supporting these developments, Zimbis partnered with Southern Anesthesia & Surgical, Inc. in November 2021, initiating an integrated order system that streamlines inventory management for dental professionals. This solution simplifies the ordering process, ensuring a steady supply of anesthesia products for dental practices.

Increasing awareness of pain management in pediatric and geriatric dentistry further drives demand for specialized anesthetic options tailored to these age groups. Opportunities also arise from growing investments in digital dentistry, fostering the integration of anesthesia systems with advanced dental equipment. The convergence of these factors positions the dental anesthesia market for sustainable growth, driven by innovations in patient-centered care and efficient practice management.

Key Takeaways

- In 2023, the market for dental anesthesia generated a revenue of US$ 1.9 billion, with a CAGR of 5.3%, and is expected to reach US$ 3.2 billion by the year 2033.

- The product type segment is divided into lidocaine, prilocaine, mepivacaine, articaine, bupivacaine 0.5% with epinephrine1:200,000, and others, with lidocaine taking the lead in 2023 with a market share of 38.3%.

- Considering mode of administration, the market is divided into mandibular, maxillary, and others. Among these, maxillary held a significant share of 54.6%.

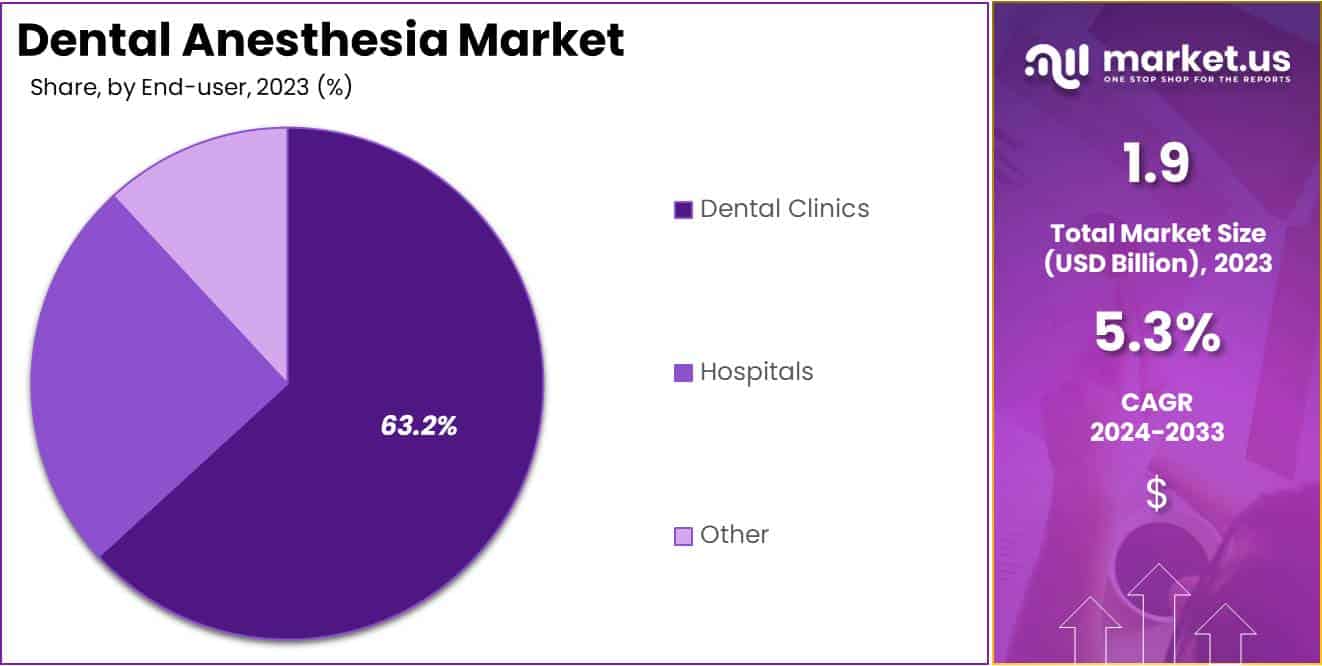

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, dental clinics, and other. The dental clinics sector stands out as the dominant player, holding the largest revenue share of 63.2% in the dental anesthesia market.

- North America led the market by securing a market share of 39.4% in 2023.

Product Type Analysis

The lidocaine segment led in 2023, claiming a market share of 38.3% owing to its efficacy and reliability as a local anesthetic. As one of the most commonly used anesthetics, lidocaine provides rapid onset and effective numbing for various dental procedures, which makes it highly preferred by dental professionals. Increasing demand for minimally invasive dental treatments, such as cavity fillings and root canal therapy, propels lidocaine’s market expansion.

Moreover, its safety profile and relatively low cost make it accessible for widespread use, especially in outpatient settings. The rising prevalence of oral health issues, coupled with an aging population, contributes to an increased number of dental procedures, further boosting lidocaine demand. Advances in formulations, including lidocaine gels and topical patches, enhance its usability and convenience, which is likely to support sustained growth.

Additionally, government initiatives aimed at improving oral healthcare infrastructure in emerging markets create further opportunities for lidocaine adoption, positioning the segment for robust expansion.

Mode of Administration Analysis

The maxillary held a significant share of 54.6% due to advancements in administration techniques and rising demand for specific maxillary procedures. Maxillary anesthesia, often used in procedures involving the upper jaw and teeth, offers a precise and effective method for managing pain during dental treatments.

With the increase in cosmetic dentistry, such as veneers and implants, the need for maxillary anesthesia grows significantly. The introduction of advanced administration methods, like computer-assisted anesthesia systems, enhances control and reduces discomfort, making it more appealing to both patients and practitioners.

An increase in dental conditions specific to the maxillary region, including sinus-related complications, also supports demand for this mode of administration. Additionally, the growing prevalence of pediatric and geriatric patients requiring non-invasive maxillary treatments is likely to further bolster this segment’s growth. Overall, these dynamics drive the anticipated expansion of maxillary anesthesia within the dental sector.

End-user Analysis

The dental clinics segment had a tremendous growth rate, with a revenue share of 63.2% owing to the increasing preference for specialized and accessible dental care. Rising awareness regarding the importance of oral health leads to higher patient volumes in dental clinics, fueling demand for dental anesthesia services.

Dental clinics, which often provide quicker and more affordable services than hospitals, cater to routine procedures such as extractions, fillings, and root canals, necessitating consistent anesthesia use. Technological advancements in anesthesia administration, such as needle-free and computer-controlled systems, improve patient comfort, making clinics an attractive option for patients. Additionally, the trend towards outpatient and ambulatory care favors dental clinics, further supporting the segment’s growth.

As government policies emphasize expanding dental care access, particularly in underserved regions, dental clinics play a pivotal role, which is anticipated to increase their share in the anesthesia market. Consequently, the convergence of these factors is likely to drive sustained growth in the dental clinics segment.

Key Market Segments

By Product Type

- Lidocaine

- Prilocaine

- Mepivacaine

- Articaine

- Bupivacaine 0.5% with epinephrine1:200,000

- Others

By Mode of Administration

- Mandibular

- Maxillary

- Others

By End-user

- Hospitals

- Dental Clinics

- Other

Drivers

Growing Prevalence of Dental Ailments

Growing prevalence of dental ailments significantly drives the dental anesthesia market. According to data from the Centers for Disease Control and Prevention (CDC) published in May 2024, approximately 40% of U.S. adults aged 30 and older exhibit mild to severe periodontitis, with one in two men and one in three women affected.

This high incidence of gum disease underscores a strong demand for effective anesthesia solutions in dental procedures, including gum disease treatment, cavity fillings, and extractions. As dental ailments become more widespread, practitioners are expected to adopt advanced anesthesia techniques to ensure patient comfort and procedural efficacy.

Increased awareness regarding dental health also encourages more frequent dental visits, further expanding the market. Consequently, advancements in anesthesia techniques, catering to the specific needs of dental procedures, are anticipated to support market growth in the coming years.

Restraints

High Shortage of Skilled Anesthesiologists

High shortage of skilled anesthesiologists hampers the growth of the dental anesthesia market. Many regions, especially in developing economies, face challenges in accessing trained professionals capable of administering anesthesia safely and effectively during dental procedures. This shortage restricts the ability of dental clinics to expand their services, as the availability of skilled personnel directly impacts patient safety and procedural success.

Limited training programs and high education costs contribute to this workforce gap, further impeding market expansion. Smaller dental facilities, particularly in rural areas, struggle to attract and retain qualified anesthesiologists, which limits their ability to cater to complex cases. Addressing this shortage is essential to overcoming a significant restraint in the dental anesthesia market.

Opportunities

Rising Awareness for Dental Health is Creating Opportunities in the Market

Rising awareness for dental health creates substantial opportunities for the dental anesthesia market. According to the American Dental Association, 58% of people in the U.S. visit a dentist annually, with 15% scheduling appointments due to oral pain. This growing emphasis on oral health translates to increased demand for comfortable and pain-free dental treatments, driving the need for reliable anesthesia solutions.

Public health campaigns and preventive care programs are expected to further boost patient awareness, prompting more regular dental check-ups and a demand for anesthesia in procedures such as cleanings, fillings, and extractions. As patients seek quality care and painless treatment experiences, the adoption of advanced anesthesia techniques is projected to expand, positioning the market for growth aligned with improved dental health awareness.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors influence the dental anesthesia market by shaping demand, supply chains, and investment levels. Economic downturns reduce patients’ discretionary spending on dental procedures, leading to a temporary dip in demand for anesthesia products. Conversely, economic growth drives increased dental procedures, positively impacting the need for anesthesia.

Geopolitical tensions may disrupt global supply chains, causing shortages or delays in anesthetic materials and equipment, which may drive up costs for providers. However, trade agreements and collaborations facilitate cross-border advancements, enhancing access to cutting-edge anesthesia technologies.

Additionally, governmental investments in healthcare often support more accessible dental services, fostering market expansion. Despite potential disruptions, the focus on improving patient comfort and procedural efficiency positions the market for steady growth.

Trends

Innovation as a Driving Trend in the Dental Anesthesia Market

Increasing innovation in anesthesia delivery methods drives substantial growth in the dental market. Companies invest in research to create products that reduce patient discomfort and enhance procedural efficiency. For instance, Pierrel Pharma introduced the Orabloc dental needles in January 2022 in the U.S., featuring ultra-thin walls, a triple-sharpened tip, and a silicone coating to deliver nearly painless injections. Such advancements are expected to heighten the appeal of modern dental procedures, improving patient experiences and outcomes.

The integration of digital tools, like precise dosage systems, is anticipated to enhance safety and reliability. Rising demand for minimally invasive treatments also encourages the development of sophisticated anesthesia options. This trend of constant innovation likely positions the market for long-term growth, meeting the evolving needs of both patients and providers.

Regional Analysis

North America is leading the Dental Anesthesia Market

North America dominated the market with the highest revenue share of 39.4% owing to rising dental procedure volumes and increasing demand for improved patient comfort during treatments. The growing prevalence of oral health issues, particularly among aging populations, has driven more individuals to seek dental care, which frequently requires anesthesia.

This demand is compounded by the projected shortage of healthcare professionals; according to the Association of American Medical Colleges (AAMC), the United States may need an additional 38,000 to 124,000 physicians by 2034, including approximately 12,500 anesthesiologists. This anticipated shortage has prompted investments in advanced dental anesthesia solutions that simplify administration and improve patient safety.

Furthermore, increased awareness of pain management options and innovations in anesthetic products have made dental procedures more accessible and comfortable, further boosting market demand. Overall, these trends have established a strong foundation for sustained growth in North America’s dental anesthesia market.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to expanding dental networks and rising patient awareness. The growing middle class in countries like India and China is anticipated to drive demand for dental treatments, as more people prioritize oral health and cosmetic dentistry.

Large dental chains, such as Clove Dental, have committed significant investments to expand their reach; for example, in September 2018, Clove Dental allocated INR 171 crore (around $25 million) to grow its franchise network to 600 clinics across India within five years. This expansion strategy reduces overall treatment costs, making dental care more affordable and accessible, which is likely to increase patient volumes.

Additionally, advancements in anesthetic techniques and products tailored to meet local market demands are expected to enhance the overall quality of dental care. These factors collectively position the Asia Pacific region for substantial growth in dental anesthesia over the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the dental anesthesia market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning. Key players in the dental anesthesia market employ several strategies to achieve growth and strengthen market presence.

They focus on developing advanced anesthetic formulations that offer faster onset and longer-lasting effects, enhancing patient comfort. Collaborations with dental associations and educational institutions help promote best practices and increase product adoption among practitioners.

Companies also expand their distribution networks globally, targeting regions with growing demand for dental care. Furthermore, they emphasize compliance with regulatory standards and invest in marketing to build trust and awareness within the healthcare community.

Top Key Players in the Dental Anesthesia Market

- Zeyco

- Septodont

- Primex Pharmaceuticals

- Laboratorios Normon

- Henry Schein, Inc.

- Dentalhitec

- Balanced Pharma

- Aspen Group

- 3M

Recent Developments

- In December 2023: Balanced Pharma received notification from the US Patent & Trademark Office for the issuance of an additional patent covering its anesthesia cartridge containing BPI-001, a local anesthetic specifically for dentistry. This development supports the growth of the dental anesthesia market by reinforcing intellectual property and expanding options for localized dental anesthesia solutions.

- In August 2023: 3M divested certain assets from its dental local anesthetic portfolio, based in Seefeld, Germany, to Pierrel SpA. The sale included established brands like Ubistesin, Xylestesin, and Mepivastesin. This transaction contributes to the growth of the dental anesthesia market by broadening Pierrel SpA’s portfolio and increasing competitive dynamics within the sector.

- In August 2022: Henry Schein, Inc. acquired Midway Dental Supply, a distributor providing dental products to clinics and laboratories across the Midwestern United States. This acquisition is relevant to the dental anesthesia market’s growth by enhancing distribution networks and improving access to anesthesia products for dental practices in this region, supporting market expansion.

Report Scope

Report Features Description Market Value (2023) US$ 1.9 billion Forecast Revenue (2033) US$ 3.2 billion CAGR (2024-2033) 5.3% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Lidocaine, Prilocaine, Mepivacaine, Articaine, Bupivacaine 0.5% with epinephrine1:200,000, and Others), By Mode of Administration (Mandibular, Maxillary, and Others), By End-user (Hospitals, Dental Clinics, and Other) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zeyco, Septodont, Primex Pharmaceuticals, Laboratorios Normon, Henry Schein, Inc., Dentalhitec, Balanced Pharma, Aspen Group, and 3M. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Zeyco

- Septodont

- Primex Pharmaceuticals

- Laboratorios Normon

- Henry Schein, Inc.

- Dentalhitec

- Balanced Pharma

- Aspen Group

- 3M