Pharmaceutical Packaging Equipment Market By Product Type (Filling Machines, Form, Fill and Seal Machines, Cartoning Machines, and Others), By Technology (Manual, Semi-Automatic, and Automatic), By Formulation (Liquid, Solid, Semisolid, and Others), By End-user (Pharmaceutical Companies and Contract Manufacturing Companies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145137

- Number of Pages: 255

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

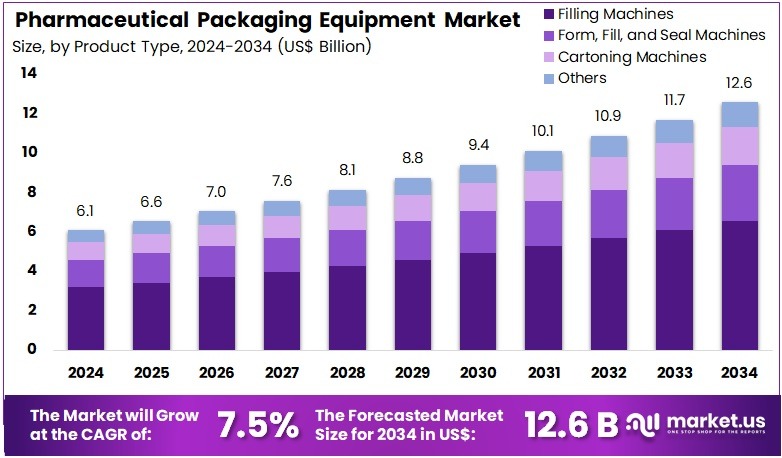

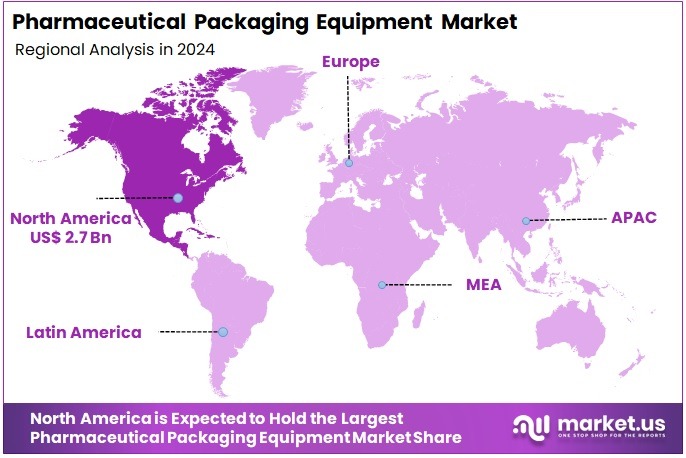

The Pharmaceutical Packaging Equipment Market Size is expected to be worth around US$ 12.6 billion by 2034 from US$ 6.1 billion in 2024, growing at a CAGR of 7.5% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 43.6% share and holds US$ 2.7 Billion market value for the year.

Increasing demand for efficient and secure packaging solutions is driving growth in the pharmaceutical packaging equipment market. The need for packaging systems that ensure product safety, enhance efficiency, and comply with stringent regulations has led to the development of advanced packaging technologies. Pharmaceutical companies are focusing on automation and smart packaging systems to meet production demands and reduce operational costs.

Rising concerns regarding counterfeit drugs and the growing preference for patient-friendly packaging also drive innovations in the market. In February 2021, ProMach acquired Serpa Packaging Solutions, expanding its cartoning and end-of-line packaging capabilities for pharmaceutical and consumer goods markets.

This acquisition strengthens ProMach’s position in automated packaging systems and highlights the increasing focus on improving packaging efficiency and security. Companies are also exploring sustainable packaging options to align with eco-friendly initiatives and reduce environmental impact. As a result, the pharmaceutical packaging equipment market continues to experience advancements in automation, innovation, and sustainability to meet evolving industry needs.

Key Takeaways

- In 2024, the market for pharmaceutical packaging equipment generated a revenue of US$ 6.1 billion, with a CAGR of 7.5%, and is expected to reach US$ 12.6 billion by the year 2034.

- The product type segment is divided into filling machines, form, fill and seal machines, cartoning machines, and others, with filling machines taking the lead in 2024 with a market share of 52.3%.

- Considering technology, the market is divided into manual, semi-automatic, and automatic. Among these, automatic held a significant share of 61.8%.

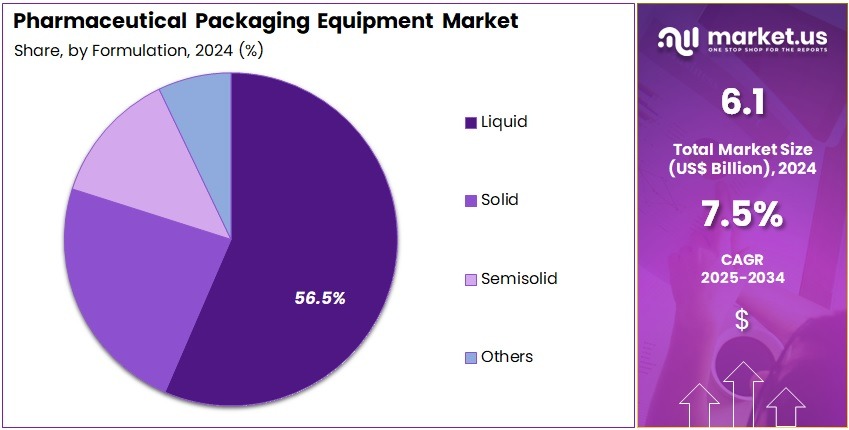

- Furthermore, concerning the formulation segment, the market is segregated into liquid, solid, semisolid, and others. The liquid sector stands out as the dominant player, holding the largest revenue share of 56.5% in the pharmaceutical packaging equipment market.

- The end-user segment is segregated into pharmaceutical companies and contract manufacturing companies, with the pharmaceutical companies segment leading the market, holding a revenue share of 62.5%.

- North America led the market by securing a market share of 43.6% in 2024.

Product Type Analysis

The filling machines segment led in 2024, claiming a market share of 52.3% as the demand for pharmaceutical products, especially in liquid and injectable forms, increases. The growth of the global pharmaceutical industry, particularly in emerging markets, is likely to drive demand for efficient and high-capacity filling machines.

Additionally, technological advancements in filling machines, such as higher precision, speed, and flexibility, are expected to make them more attractive to manufacturers. Regulatory requirements for precise dosing and contamination control are anticipated to fuel the demand for sophisticated filling equipment, driving growth in this segment.

Technology Analysis

The automatic held a significant share of 61.8% due to increasing demand for efficiency, speed, and consistency in pharmaceutical production. Automatic systems eliminate human error, reduce labor costs, and enhance the precision of the packaging process.

With pharmaceutical companies scaling up production and emphasizing product safety, automatic systems are expected to be preferred over manual or semi-automatic alternatives. Automation also allows for better integration into the overall production line, providing manufacturers with greater flexibility and cost savings, which is likely to drive the growth of this segment.

Formulation Analysis

The liquid segment had a tremendous growth rate, with a revenue share of 56.5% as the production of liquid pharmaceuticals, such as vaccines, biologics, and oral liquids, continues to rise. Liquid formulations require specialized packaging to maintain stability, sterility, and ease of use for patients.

The increasing prevalence of chronic diseases and the growing demand for injectable medications and biologics are expected to drive the growth of liquid pharmaceutical products. Advances in liquid packaging technology, such as sterile filling and advanced sealing systems, are projected to make liquid formulation packaging more efficient, contributing to the expansion of this segment.

End-User Analysis

The pharmaceutical companies segment grew at a substantial rate, generating a revenue portion of 62.5% due to the increasing demand for packaged pharmaceutical products across the globe. Pharmaceutical companies, especially those focusing on mass production of medications, are expected to continue investing in high-quality packaging systems to meet regulatory standards, ensure product integrity, and improve supply chain efficiency.

The growth of specialized pharmaceutical companies producing biologics, vaccines, and other high-value medications is anticipated to further drive demand for advanced packaging solutions. As the industry becomes more globalized, pharmaceutical companies are expected to adopt more automated and cost-effective packaging solutions to enhance their competitiveness in the market.

Key Market Segments

By Product Type

- Filling Machines

- Form, Fill and Seal Machines

- Cartoning Machines

- Others

By Technology

- Manual

- Semi-Automatic

- Automatic

By Formulation

- Liquid

- Solid

- Semisolid

- Others

By End-user

- Pharmaceutical Companies

- Contract Manufacturing Companies

Drivers

Increasing Demand for Automated Packaging Solutions is Driving the Market

The pharmaceutical packaging equipment market is experiencing significant growth due to the increasing adoption of automation in drug manufacturing and packaging. Automated systems improve production efficiency, reduce errors, and ensure compliance with strict regulatory standards, making them essential in the pharmaceutical industry. Major players like Syntegon and IMA Group reported higher revenues in their packaging divisions in 2023, a clear indication of the market’s expansion.

The shift towards high-speed and precision-based packaging, particularly for biologics and injectables, is further accelerating this trend. Regulatory agencies such as the US Food and Drug Administration (FDA) are pushing for advanced track-and-trace technologies to enhance drug safety and prevent counterfeiting. As demand for automated solutions grows, pharmaceutical manufacturers are increasingly investing in high-tech packaging systems to meet the needs of modern drug production and distribution.

Restraints

High Capital Investment is Restraining the Market

The high cost of advanced packaging machinery remains a significant challenge, particularly for small and mid-sized pharmaceutical companies. Many manufacturers consider the initial investment in automated packaging systems a major barrier to entry. For instance, the price of a fully automated blister packaging line can exceed US$500,000, which can be prohibitive for smaller companies with limited budgets.

In addition to the high upfront costs, maintenance and training expenses further add to the financial burden, slowing the adoption of such systems, especially in cost-sensitive markets. In low-income regions, the lack of financial resources makes it even more difficult for pharmaceutical companies to implement automated packaging systems, limiting access to the latest technology. These factors create obstacles to widespread adoption, particularly in emerging markets where the budget for infrastructure is constrained.

Opportunities

Expansion of Biologics and Personalized Medicine is Creating Growth Opportunities

The rise of biologics and personalized therapies is significantly increasing the demand for specialized packaging solutions. These products often require aseptic packaging, lyophilization (freeze-drying), and temperature-controlled systems to ensure stability and effectiveness. Companies like West Pharmaceutical Services and Gerresheimer saw higher revenues in 2023 from the growing demand for high-value biologics packaging.

As the regulatory approvals for biologics continue to rise, the need for upgraded packaging infrastructure becomes more pressing. These therapies often have unique packaging requirements due to their sensitive nature, driving the need for more advanced, customized solutions. The growing focus on personalized medicine further accelerates this trend, creating opportunities for packaging suppliers to innovate and expand their offerings. With the ongoing rise in biologics production, packaging solutions designed to maintain the integrity of these therapies are becoming increasingly crucial to the pharmaceutical industry.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors have a profound impact on the pharmaceutical packaging market. Rising inflation has led to increased production costs for packaging machinery, which has in turn raised prices for both manufacturers and consumers. The US Bureau of Labor Statistics reported a rise in industrial equipment costs in 2023, directly affecting procurement budgets for pharmaceutical companies.

Geopolitical conflicts, such as trade disruptions, have caused shortages of raw materials, particularly aluminum and plastics, essential for packaging production. However, government initiatives like the US CHIPS and Science Act are helping to strengthen domestic manufacturing capabilities and reduce dependence on imports.

Emerging markets are benefiting from increased healthcare investments, with funding directed toward expanding pharmaceutical infrastructure. These macroeconomic and geopolitical challenges have introduced some volatility in supply chains, but technological advancements and the rising demand for smart packaging continue to drive the long-term growth of the market. Despite the short-term difficulties, the future of pharmaceutical packaging looks promising, with continued innovation and adaptation to global demands.

Trends

Sustainability-Focused Packaging is a Recent Trend

Sustainability is a key trend influencing the pharmaceutical packaging market, with many companies adopting eco-friendly packaging solutions to reduce their environmental impact. Firms are increasingly turning to recyclable materials, reducing plastic usage, and seeking alternative packaging designs to meet both consumer and regulatory demands for greener products. Many pharmaceutical companies have set sustainability targets for packaging by 2025, aiming to reduce their carbon footprint.

The demand for recyclable blister packs has surged, and regulatory bodies are enforcing stricter sustainability standards to curb environmental waste. Major suppliers are investing in green packaging alternatives, with some companies reporting growth in sustainable product sales. This trend is reshaping the packaging industry, as companies recognize the long-term benefits of adopting eco-friendly practices, which include cost savings, improved brand image, and compliance with evolving regulations.

Regional Analysis

North America is leading the Pharmaceutical Packaging Equipment Market

North America dominated the market with the highest revenue share of 43.6% owing to increased drug approvals, vaccine production, and automation in manufacturing. The US Food and Drug Administration (FDA) approved 55 novel drugs in 2023, a 12% increase from the previous year, necessitating advanced packaging solutions for new therapies. The Centers for Disease Control and Prevention (CDC) reported a 9% rise in vaccine production in 2023, accelerating demand for high-speed filling and labeling systems.

Rising chronic diseases also contributed to market growth, with the American Cancer Society projecting over 2 million new cancer cases in 2024, which will require secure packaging for sensitive medications. Additionally, automation adoption surged, with the International Society of Automation (ISA) noting a 15% increase in robotic packaging system installations in US pharmaceutical facilities between 2022 and 2024. These factors collectively spurred significant growth in the pharmaceutical packaging equipment market in North America in 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to government initiatives and increased drug manufacturing. India’s Production Linked Incentive (PLI) scheme allocated US$2 billion to pharmaceutical production in 2023, boosting the need for blister packaging and labeling machines. China’s National Medical Products Administration (NMPA) approved over 12,000 generic drugs in 2023, a 20% rise from 2022, driving investments in bottling and sealing systems.

The World Health Organization (WHO) reported a 30% increase in vaccine production across Southeast Asia in 2023, further accelerating demand for sterile filling equipment. Japan’s Ministry of Health, Labour and Welfare (MHLW) recorded a 10% growth in biologics approvals in 2024, reinforcing the shift toward advanced aseptic packaging technologies. These developments indicate a growing need for innovative packaging solutions across the Asia Pacific region in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the pharmaceutical packaging equipment market focus on innovation, automation, and expanding their product portfolios to drive growth. They invest in developing high-speed, flexible, and scalable packaging systems that can accommodate various drug types and packaging materials. Companies also emphasize regulatory compliance and sustainability, offering eco-friendly and tamper-evident packaging solutions to meet industry standards.

Strategic partnerships with pharmaceutical manufacturers and technology providers help enhance product offerings and improve market reach. Additionally, they target emerging markets with growing pharmaceutical industries to expand their global footprint. Uhlmann Packaging Systems, headquartered in Germany, is a leading provider of pharmaceutical packaging solutions. The company specializes in the development of high-performance, automated packaging lines for tablet and capsule production, focusing on speed, precision, and regulatory compliance.

Uhlmann is known for its innovative technologies, including fully integrated packaging systems that streamline production processes. With a strong global presence, the company continues to expand its market share by offering customized solutions and forming strategic partnerships with pharmaceutical manufacturers worldwide.

Top Key Players in the Pharmaceutical Packaging Equipment Market

- Uhlmann Group

- Romaco Holding

- Robert Bosch

- MULTIVAC Group

- Marchesini Group

- Korber AG

- M.A. Industria Macchine Automatiche S.p.A.

- Coesia

Recent Developments

- In August 2024, I.M.A. Industria Macchine Automatiche S.p.A. acquired Sarong’s packaging machinery and e-packaging divisions, boosting its portfolio in sustainable solutions for the food and pharmaceutical industries. The acquisition enhances I.M.A.’s market competitiveness and ability to meet evolving customer needs.

- In December 2023, MULTIVAC Group opened a US$9 million production facility in India, set to serve India, Sri Lanka, and Bangladesh. The 10,000-square-meter facility, operational by early 2024, aims to improve regional customer service and reduce delivery times.

Report Scope

Report Features Description Market Value (2024) US$ 6.1 billion Forecast Revenue (2034) US$ 12.6 billion CAGR (2025-2034) 7.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Filling Machines, Form, Fill and Seal Machines, Cartoning Machines, and Others), By Technology (Manual, Semi-Automatic, and Automatic), By Formulation (Liquid, Solid, Semisolid, and Others), By End-user (Pharmaceutical Companies and Contract Manufacturing Companies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Uhlmann Group, Romaco Holding, Robert Bosch, MULTIVAC Group, Marchesini Group, Korber AG, I.M.A. Industria Macchine Automatiche S.p.A., and Coesia. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Pharmaceutical Packaging Equipment MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Pharmaceutical Packaging Equipment MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Uhlmann Group

- Romaco Holding

- Robert Bosch

- MULTIVAC Group

- Marchesini Group

- Korber AG

- M.A. Industria Macchine Automatiche S.p.A.

- Coesia