Global Healthcare Packaging Market Analysis By Material Type (Glass, Plastic, Metal, Paper and Paperboard), By Product (Bottles and Containers, Vials and Ampoules, Cartridges and Syringes, Pouches and Bags, Blister Packs, Others), By Application (Medical Tools & Equipment, Medical Devices, In-Vitro Diagnostic Product, Drugs, Oral, Injectable, Dermal/Topical, Inhalable, Others), By Packaging (Primary Packaging, Secondary Packaging) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132497

- Number of Pages: 320

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

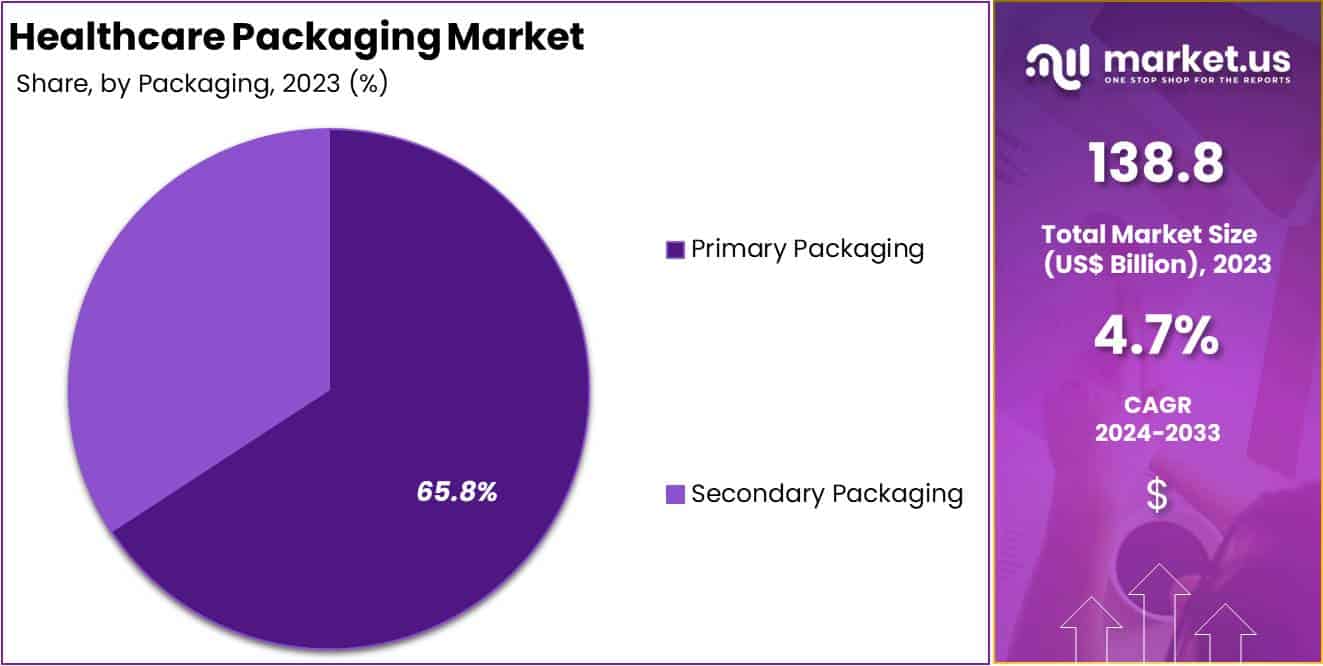

The Global Healthcare Packaging Market size is expected to be worth around US$ 219.2 Billion by 2033, from US$ 138.8 Billion in 2023, growing at a CAGR of 4.7% during the forecast period from 2024 to 2033.

Healthcare packaging plays a crucial role in safeguarding medical products, from pharmaceuticals to medical devices, ensuring they maintain their integrity from production to patient. This specialized packaging adheres to strict regulatory standards to prevent contamination and preserve the efficacy of the contents. The U.S. healthcare sector’s expenditure, which reached $4.5 trillion in 2022 alone, underscores the substantial demand influencing the packaging needs across various healthcare settings, including hospitals and pharmacies.

The healthcare packaging market is significantly shaped by global trade regulations and sustainability initiatives. According to a 2018 directive from the European Union, at least 65% of all packaging waste must be recycled by 2025, focusing on plastics. This policy is part of the Circular Economy Action Plan under the European Green Deal, aiming to minimize resource depletion by promoting recycling and reuse. In the U.S., trade tensions with China have impacted the import costs and supply chain dynamics for medical packaging materials, highlighting the need for standardized global trade practices to streamline operations and encourage sector innovation.

Stringent regulations by authorities like the U.S. Food and Drug Administration (FDA) ensure the safety of these packaging materials. The FDA’s framework, supported by initiatives like the Medical Device User Fee Amendments (MDUFA), mandates rigorous safety and efficacy evaluations for packaging materials. Companies must pay user fees that contribute to the FDA’s premarket review processes, ensuring that only materials meeting high safety standards are utilized in healthcare settings.

Sustainability is increasingly pivotal in healthcare packaging, with the industry moving towards more environmentally friendly practices. The European Union’s Packaging and Packaging Waste Directive (PPWD) targets a recycling rate of 65% by 2025, with plans to increase this by 5% by 2030. Companies are innovating with materials such as Tyvek® by DuPont and the all-HDPE StreamTwo® pouch by PAXXUS, which reduce energy consumption during production by about 50%, illustrating significant advancements towards sustainability in healthcare packaging.

The sector is also experiencing a surge in mergers, acquisitions, and partnerships, driven by the need for compliance with rigorous safety standards and the integration of advanced technologies. In 2023 alone, the healthcare packaging market reported 65 transactions, a notable increase from 53 the previous year. These strategic moves are supported by substantial private equity investments, which have injected over $750 billion into the sector over the last decade, aiming to enhance service offerings, achieve economies of scale, and expand geographic reach. This trend underscores a dynamic shift towards consolidating resources and expertise to better meet the evolving demands of the healthcare industry.

Key Takeaways

- The Healthcare Packaging Market is projected to grow from US$ 138.8 billion in 2023 to US$ 219.2 billion by 2033, at a 4.7% CAGR.

- Plastics dominate the material segment, holding a 48.7% market share in 2023, favored for their durability and cost-effectiveness.

- Medical Devices lead the applications in healthcare packaging, comprising 32.7% of the market, driven by advances in medical technology.

- Primary Packaging is pivotal, securing over 65.8% of the market share in 2023, essential for protecting and containing healthcare products.

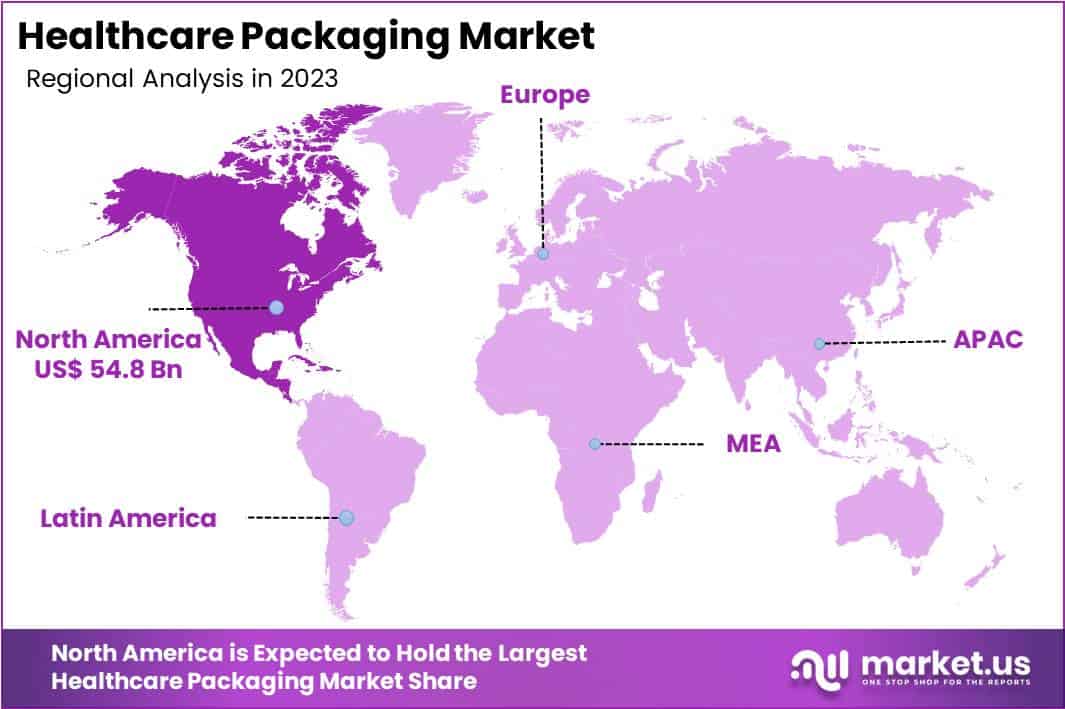

- In 2023, North America dominated the market, securing over 39.5% of the share with a market value of USD 54.8 billion.

Material Type Analysis

In 2023, the Plastic segment held a dominant market position in the Material Type Segment of the Healthcare Packaging Market, capturing more than a 48.7% share. This prominence is largely due to plastic’s versatility and cost-effectiveness. Plastic packaging offers exceptional barrier properties, durability, and lightness, which are essential for ensuring the safety and integrity of healthcare products. These benefits make it an ideal choice for a wide range of applications, from pharmaceuticals to medical devices.

Furthermore, advancements in recyclable and biodegradable plastics are enhancing its appeal amid growing environmental concerns. Healthcare providers increasingly prefer plastic packaging because it can be sterilized and tailored to meet stringent hygiene standards. This adaptability extends to various forms of packaging solutions, including bottles, vials, trays, and pouches, each supporting the safe distribution of sensitive healthcare products.

As regulations on packaging safety and sustainability tighten, the role of plastic in healthcare packaging is expected to evolve. Manufacturers are focusing on innovative solutions like smarter packaging designs and improved materials that comply with regulatory standards while maintaining cost efficiency and product protection. This ongoing innovation underscores the plastic segment’s substantial impact on the healthcare packaging market’s future dynamics.

Product Analysis

The healthcare packaging market is segmented by various products, each tailored to meet stringent industry standards. Bottles and containers hold a significant share, valued for storing liquid medications and supplements. Meanwhile, vials and ampoules are indispensable for injectable medications, ensuring sterility and precise dosages. Glass is predominantly used, though plastic is becoming popular due to advancements in material technology.

Another crucial segment includes cartridges and syringes, driven by the increasing demand for biologics and auto-injectors. This sector focuses on innovations that enhance safety and dosing accuracy. The rise in chronic diseases further boosts the market for prefilled syringes. Pouches and bags, known for their flexibility and light weight, are preferred for packaging bulky items like medical kits, benefiting from improved barrier materials.

Blister packs are prominent for unit-dose packaging of pills, enhancing patient compliance with visible dosages and safety features like tamper evidence. The category labeled Others encompasses trays, clamshells, and wraps, often used for medical devices. Each packaging type is specifically designed to ensure maximum protection and convenience, underlining the market’s focus on safety and user-friendliness.

Application Analysis

In 2023, the Medical Devices segment claimed a commanding position in the Healthcare Packaging Market’s Application Segment, holding over 32.7% of the market share. This segment thrives on the back of advancements in medical technologies that require sophisticated packaging. These packages must ensure safety, sterility, and compliance with strict regulations. The growth is driven by the increasing need for reliable packaging solutions for devices like stents, implants, and monitoring equipment.

Medical tools and equipment also significantly impact the market, requiring durable packaging that protects against contamination and maintains tool integrity under various conditions. Similarly, in-vitro diagnostic products need packaging that preserves the chemical integrity and reliability of diagnostic kits and reagents, which are sensitive to environmental factors. This necessity for specialized packaging solutions supports the market’s expansion and innovation in protecting sensitive medical products.

The drugs segment is subdivided by the method of administration, including oral, injectable, dermal/topical, and inhalable drugs, each requiring specific packaging solutions. Oral medications typically use blister packs and bottles to ensure safety and extend shelf life. Packaging for injectable drugs focuses on maintaining sterility with secure vials and syringes. Meanwhile, dermal and topical medications leverage pumps and multi-layered tubes to prevent contamination and facilitate ease of use, with inhalable drugs needing moisture-resistant and dose-accurate packaging.

Packaging Analysis

In 2023, the Primary Packaging segment captured a dominant market share of over 65.8% within the Healthcare Packaging Market. This segment includes essential packaging types like blisters, vials, ampoules, and syringes. These are crucial for direct containment and protection of healthcare products. Their importance is heightened by stringent regulations that require robust packaging to maintain the effectiveness and safety of pharmaceuticals during transit and storage.

Secondary Packaging serves as another vital component by providing additional protection and bundling primary packages. It consists of boxes, cartons, and wrappers, which are instrumental in logistical efficiency and product information dissemination. Despite holding a smaller market share compared to Primary Packaging, its role is critical in handling, shipping, and displaying products effectively.

These packaging segments are central to ensuring product safety, extending shelf life, and meeting strict health regulations. Innovations continue to evolve in these areas, with a focus on sustainability and patient convenience. The trend is moving towards environmentally friendly materials and designs that enhance user experience, reflecting global shifts in consumer and regulatory demands.

Key Market Segments

By Material Type

- Glass

- Plastic

- Metal

- Paper and Paperboard

By Product

- Bottles and Containers

- Vials and Ampoules

- Cartridges and Syringes

- Pouches and Bags

- Blister Packs

- Others

By Application

- Medical Tools & Equipment

- Medical Devices

- In-Vitro Diagnostic Product

- Drugs

- Oral

- Injectable

- Dermal/Topical

- Inhalable

- Others

By Packaging

- Primary Packaging

- Secondary Packaging

Drivers

Increasing Demand for Sterile Packaging Solutions

The global healthcare packaging market is experiencing significant growth, primarily driven by the increasing demand for sterile packaging solutions. As the healthcare sector expands, the necessity for effective packaging that upholds the sterility and integrity of medical products is becoming more crucial. Products such as syringes, vials, and other pharmaceutical compounds need secure packaging to maintain their effectiveness and safety.

This demand for sterile packaging is further boosted by a global increase in health awareness. Consumers and healthcare providers are more aware of the importance of sterilization in preventing contamination and ensuring the safety of medical treatments. This awareness underlines the critical role of advanced packaging solutions in the healthcare industry.

Moreover, stringent regulatory mandates are reinforcing the need for sterile packaging. These regulations are designed to prevent contamination and safeguard patient safety by requiring that all packaging used in the healthcare industry meets high sterility standards. The compliance with these regulations is essential for healthcare providers and manufacturers to maintain trust and ensure patient safety.

Restraints

Strict Regulatory Standards

In the healthcare packaging market, stringent regulatory standards significantly restrain growth. These regulations demand rigorous safety and quality checks, leading to increased complexity and costs in packaging solutions. Each packaging layer must prevent contamination and maintain product integrity without reacting negatively with the contents, elevating production expenses and extending time to market.

Labeling requirements add another layer of complexity. Labels must clearly communicate medication usage, ingredients, and storage instructions to prevent misuse and ensure consumer safety. This meticulous attention to detail in labeling is mandated to enhance patient safety, further complicating compliance efforts for manufacturers.

These regulatory challenges not only heighten operational costs but also delay product launches. Manufacturers are compelled to allocate more resources and time to ensure compliance, impacting the speed at which new products can reach the market. This extensive validation process ultimately affects overall market growth, as companies struggle to navigate the intricate regulatory landscape.

Opportunities

Growth in Biologics and Advanced Medicines

The healthcare packaging market is set for growth with the expansion of the biologics sector, including advanced therapies like vaccines and blood components. These products need specialized packaging to maintain their effectiveness and stability during storage and transport. Innovations such as blow-fill-seal (BFS) technologies are crucial as they ensure sterility with minimal human contact, ideal for sensitive biologics.

Smart packaging technologies, including QR codes and NFC, are enhancing pharmaceutical safety and traceability. These technologies meet stringent regulatory demands and increase patient safety by enabling real-time tracking and product authentication. The integration of such intelligent systems is expected to drive further advancements in the packaging industry, particularly for biologics that require high standards of safety and stability. Sustainability also plays a pivotal role in the evolution of healthcare packaging. As the industry adopts more sustainable practices, it aligns with global environmental goals.

Trends

Sustainability in Packaging

The healthcare packaging market is experiencing a significant shift towards sustainable and eco-friendly solutions. This trend is driven by increasing environmental concerns from both consumers and regulatory bodies. As a result, pharmaceutical and medical device companies are integrating sustainable practices into their packaging designs. These practices emphasize the use of recyclable materials and innovations aimed at reducing the environmental footprint of packaging while still adhering to required protective standards.

One notable change in the sector is the reduction in packaging sizes, which contributes to decreased waste and material use. Companies are actively pursuing packaging solutions that not only meet stringent safety regulations but also minimize their ecological impact. This approach supports broader sustainability goals and responds to consumer demand for environmentally responsible products.

Innovations in packaging design are also prominent, focusing on enhancing recyclability and reducing environmental degradation. These advancements are crucial as they help maintain the integrity and safety of packaged products. By adopting such eco-friendly strategies, the healthcare packaging industry is setting a precedence for sustainability, aligning with global efforts to mitigate environmental damage and promoting a shift towards greener alternatives.

Regional Analysis

In 2023, North America held a dominant market position, capturing more than a 39.5% share and holds USD 54.8 billion market value for the year. This prominence is bolstered by advanced technological innovations, especially in smart packaging solutions. These advancements are crucial in maintaining product safety and extending the shelf life of medical products, which are essential in sensitive healthcare operations.

Stringent regulations in the region, enforced by bodies such as the U.S. Food and Drug Administration (FDA), mandate high standards for packaging. These standards ensure that healthcare products are packaged to preserve integrity throughout their lifecycle. Compliance with these regulations supports the high quality and safety of healthcare packaging, reinforcing North America’s leading position in the market.

The market is further supported by substantial healthcare spending in the United States and Canada, where there is significant investment not only in healthcare services but also in pharmaceuticals and medical devices. Each of these sectors demands specialized packaging solutions to ensure product safety and efficacy during storage and transport.

Finally, the presence of major healthcare and pharmaceutical corporations in North America drives demand for innovative packaging solutions. These companies continually seek advanced packaging technologies to enhance the security and manageability of their products. This demand catalyzes ongoing growth and innovation within the regional market, securing its status as a leader in healthcare packaging.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the Healthcare Packaging Market, Amcor plc and Gerresheimer AG are prominent for their specialized solutions. Amcor is noted for its flexible, sustainable packaging options, vital for ensuring the safety and integrity of medical products. Meanwhile, Gerresheimer stands out with its precision in glass and plastic packaging solutions that maintain medication potency.

DS Smith Plc and Huhtamäki Oyj contribute innovative packaging that improves healthcare supply chain efficiency. DS Smith focuses on risk reduction and product protection, while Huhtamäki excels in extending the shelf life of healthcare products through durable packaging designs.

Berry Global Inc. and Sonoco Products Company offer a broad range of packaging materials and custom solutions. Berry Global meets critical sterilization needs with its diverse product lineup, while Sonoco’s thermoformed plastic and molded fiber packaging solutions are tailored to protect and present healthcare products effectively. These companies collectively ensure the safe and efficient delivery of healthcare products globally. Together, these companies, along with other key players, drive advancements and meet evolving needs in healthcare packaging.

Market Key Players

- Amcor plc

- Gerresheimer AG.

- DS Smith Plc

- Huhtamäki Oyj

- Berry Global Inc.

- Sonoco Products Company

- Sealed Air Corporation

- Constantia Flexibles Group GmbH

- Winpak Ltd.

- CCL Industries Inc.

- 3M Company

- Dunmore Corporation

- Toray Plastics . Inc.

- WestRock Company

- Mondi Group

- BillerudKorsnäs AB

- Ball Corporation

- Honeywell International

- Klöckner Pentaplast Europe GmbH & Co. KG

- Avery Dennison Corporation.

Recent Developments

- In January 2024: Sealed Air Corporation introduced a new biobased, industrial compostable tray for protein packaging under the CRYOVAC® brand at the International Production & Processing Expo (IPPE) 2024. This innovative tray is designed from food-contact grade resin, certified by the USDA as 54% biobased, derived from renewable wood cellulose. It offers an environmentally friendly alternative to expanded polystyrene (EPS) trays, capable of breaking down into organic material without leaving toxic residue.

- In October 2023: Gerresheimer AG has joined an alliance called the “Alliance for RTU” with Stevanato Group and SCHOTT Pharma. This collaboration focuses on advancing ready-to-use (RTU) vial and cartridge solutions. The alliance aims to improve product quality and efficiency in pharmaceutical manufacturing, which is increasingly crucial for injectable medications. This initiative also looks to standardize and enhance aseptic filling processes across the industry, responding to regulatory demands and market needs.

- In September 2023: Sonoco Products Company finalized the acquisition of the remaining equity interest in RTS Packaging, LLC from WestRock, along with one WestRock paper mill in Chattanooga, Tennessee. The acquisition, valued at $330 million, expands Sonoco’s recycled fiber-based packaging solutions. This acquisition was funded through existing credit facilities and cash on hand, and it is expected to enhance earnings per share. The transaction added 15 operations and approximately 1,100 employees to Sonoco’s portfolio.

Report Scope

Report Features Description Market Value (2023) US$ 138.8 Bn Forecast Revenue (2033) US$ 219.2 Bn CAGR (2024-2033) 4.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Material Type (Glass, Plastic, Metal, Paper and Paperboard), By Product (Bottles and Containers, Vials and Ampoules, Cartridges and Syringes, Pouches and Bags, Blister Packs, Others), By Application (Medical Tools & Equipment, Medical Devices, In-Vitro Diagnostic Product, Drugs, Oral, Injectable, Dermal/Topical, Inhalable, Others), By Packaging (Primary Packaging, Secondary Packaging) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Amcor plc, Gerresheimer AG., DS Smith Plc, Huhtamäki Oyj, Berry Global Inc., Sonoco Products Company, Sealed Air Corporation, Constantia Flexibles Group GmbH, Winpak Ltd., CCL Industries Inc., 3M Company, Dunmore Corporation, Toray Plastics . Inc., WestRock Company, Mondi Group, BillerudKorsnäs AB, Ball Corporation, Honeywell International, Klöckner Pentaplast Europe GmbH & Co. KG, Avery Dennison Corporation, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Healthcare Packaging MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Healthcare Packaging MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Amcor plc

- Gerresheimer AG.

- DS Smith Plc

- Huhtamäki Oyj

- Berry Global Inc.

- Sonoco Products Company

- Sealed Air Corporation

- Constantia Flexibles Group GmbH

- Winpak Ltd.

- CCL Industries Inc.

- 3M Company

- Dunmore Corporation

- Toray Plastics . Inc.

- WestRock Company

- Mondi Group

- BillerudKorsnäs AB

- Ball Corporation

- Honeywell International

- Klöckner Pentaplast Europe GmbH & Co. KG

- Avery Dennison Corporation.