Inhalable Drugs Market By Product Type (Aerosol, Dry powder formulation, Spray, and Other Product Types), By Indication (Respiratory diseases and Non-respiratory diseases) By Distribution Channel (Hospital pharmacy, Retail pharmacy, Online pharmacy), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: May 2024

- Report ID: 120260

- Number of Pages: 290

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

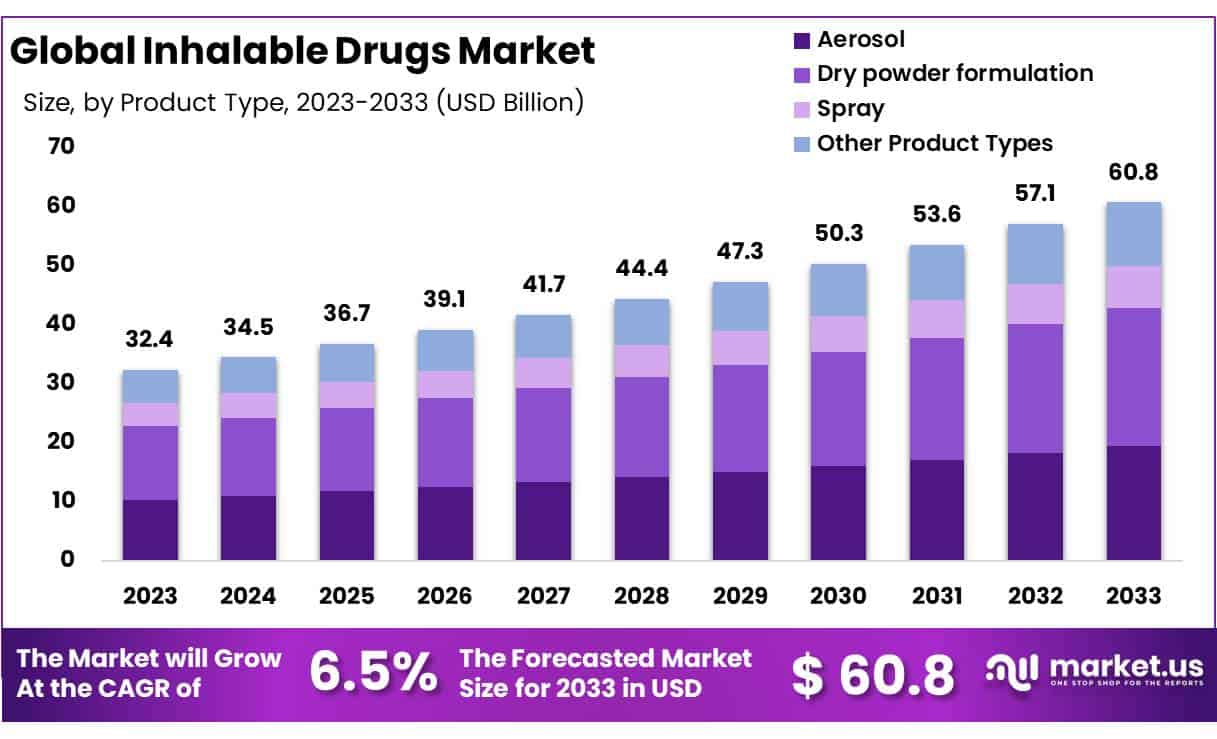

Global Inhalable Drugs Market size is expected to be worth around USD 32.4 billion by 2023 from USD 60.8 billion in 2033, growing at a CAGR of 6.5% during the forecast period 2024 to 2033.

The market for inhalable drugs is growing with more individuals being diagnosed with respiratory diseases including asthma and chronic obstructive pulmonary disease (COPD) globally. The need for convenient and efficient treatment alternatives is being driven by these circumstances. Metered-dose inhalers (MDIs), dry powder inhalers (DPIs), and nebulizers are examples of inhalers that are widely used because they provide immediate symptom alleviation by administering medicine directly to the lungs.

Furthermore, a rise in the creation of generic medications—which are more reasonably priced for patients—occurs when important patents expire. The utilization of combination treatments, which employ many active components to enhance patient results, is another innovative development in the sector. Moreover, the market is expected to expand as a result of the rising prevalence of respiratory conditions such cystic fibrosis, asthma, and chronic obstructive pulmonary disease (COPD).

- According to the Centers for Disease Control and Prevention (CDC) estimate that in 2021, over 25 million Americans—roughly 8.0% of adults and 6.5% of children—had asthma.

Key Takeaways

- In 2023, the market for inhalable drugs generated a revenue of USD 32.4 billion, with a CAGR of 6.5%, and is expected to reach USD 60.8 billion by the year 2033.

- The product type segment is divided into aerosol, dry powder formulation, spray and other product types, with dry powder formulation taking the lead in 2023 with a market share of 38.4%.

- Considering indication, the market is divided into respiratory diseases and non-respiratory disease. Among these, respiratory diseases held the significant share of 62.1%.

- Furthermore, concerning distribution channel segmentation, the hospital pharmacy sector stands out as the dominant player, holding the largest revenue share of 45.2% in the inhalable drugs market.

- North America led the market by securing a market share of 48% in 2023.

By Product Type Analysis

The market is categorized into aerosol, dry powder formulation, spray, and other product types, based on product type, with dry powder formulation leading in 2023, by claiming a market share of 38.4% owing to the ease of use, effectiveness, and patient preference associated with dry powder inhalers (DPIs). DPIs do not require the coordination between actuation and inhalation that metered-dose inhalers (MDIs) demand, making them simpler for patients to use correctly and thus improving the delivery of medication.

Furthermore, dry powder formulations have been favored for their ability to accommodate a wide range of drugs and doses, and their improved stability and storage conditions. Innovations in particle engineering and device design have also enhanced the performance of DPIs, leading to more efficient lung deposition and better therapeutic outcomes.

By Indication Analysis

Considering indications, the market is divided into respiratory diseases and non-respiratory disease. Among these, respiratory diseases held the significant share of 62.1%. Inhalable medications are frequently used to treat non-respiratory conditions including diabetes and Parkinson’s disease as well as chronic respiratory conditions like bronchospasm, COPD, and asthma. Because combination therapy of inhaled corticosteroids (ICS), long-acting muscarinic antagonists (LAMA), and long-acting β2 adrenoceptor antagonists (LABA) is effective in reducing lung inflammation and reducing hospitalization, it is widely used to treat asthma and COPD.

Numerous pharmaceutical companies have created combination treatments as a result of these medications’ efficacy. For example, in September 2020, Innoviva, Inc. and GlaxoSmithKline plc announced that the FDA had authorized a new indication for Trelegy Ellipta, a combination medicine, for the treatment of asthma in patients who were 18 years of age and older. This expanded on the drug’s current license to treat patients with COPD.

By Distribution Channel Analysis

The inhalable drugs market is segmented based on distribution channel into hospital pharmacy, retail pharmacy, and online pharmacy. The dominance of the hospital pharmacy segment, with its largest revenue share of 45.2% in the inhalable drugs market. Hospital pharmacies are often the first point of contact for patients receiving initial diagnoses or undergoing treatment for respiratory conditions, ensuring that these patients have immediate access to prescribed inhalable drugs.

Additionally, the close collaboration between healthcare providers and hospital pharmacies facilitates tailored treatment regimens and patient education, improving adherence to medication and overall treatment outcomes.

Although retail and online pharmacies are becoming increasingly popular due to convenience and often lower costs, hospital pharmacies remain pivotal for managing severe cases and providing specialized drugs that may not be available elsewhere. This segment’s prominence is also bolstered by the trust and reliability perceived in hospital-based settings, where healthcare standards are rigorously maintained.

Key Market Segments

By Product Type

- Aerosol

- Dry powder formulation

- Spray

- Other Product Types

By Indication

- Respiratory diseases

- Non-respiratory disease

By Distribution Channel

- Retail pharmacy

- Hospital pharmacy

- Online pharmacy

Drivers

Increasing Prevalence of Respiratory Diseases

The global increase in respiratory diseases such as asthma, chronic obstructive pulmonary disease (COPD), and other related conditions is a significant driver for the growth of the inhalable drugs market. These ailments are becoming more common due to factors such as air pollution, smoking, and rising allergen levels, which affect millions worldwide. Inhalable drugs are particularly valued for their ability to deliver medication directly to the lungs, providing rapid and efficient relief from the distressing symptoms associated with respiratory issues.

This method of drug delivery not only ensures quick relief but also maximizes the therapeutic effects while minimizing systemic side effects compared to other delivery methods. As a result, as the prevalence of respiratory conditions continues to rise, so too does the demand for these vital medications, pushing pharmaceutical companies to innovate and expand their range of inhalable drug products to meet this growing need.

Restraints

High Cost of Advanced Inhaler Devices

Technological advancements in the inhalable drugs market, such as the development of smart inhalers and more sophisticated drug delivery systems, have undoubtedly enhanced the efficacy and user-friendliness of treatments for respiratory diseases. These innovations often include features like Bluetooth connectivity, dose counters, and adherence trackers, which help patients manage their conditions more effectively.

However, these enhancements come with increased production and development costs, which are frequently passed on to the end-user, making these advanced devices more expensive.

This price increase can be a significant barrier to access in less affluent regions where patients and healthcare systems may not have the financial capacity to afford the latest technology. Consequently, while technological improvements have the potential to revolutionize treatment, they also risk widening the healthcare disparity between different economic demographics, potentially limiting market growth where these advanced products are needed but unaffordable.

Opportunities

Generic and Biosimilar Inhalable Drugs

The expiration of patents for leading inhalable drugs opens significant doors for the entry of generic and biosimilar products into the market. Once a drug patent expires, other manufacturers are legally allowed to produce and sell generic versions, which are chemically identical to their branded counterparts but typically sold at a much lower price.

This shift can substantially reduce the cost barrier for patients needing these medications, making essential treatments more accessible and affordable. Furthermore, the introduction of biosimilars, which are near-identical biologic drugs not chemically synthesized but produced through biological processes, adds another layer of cost-effective treatment options.

These alternatives often enter the market at a price point substantially lower than the original biologics, fostering competition and driving down overall drug prices. For healthcare systems and insurance providers, this can lead to significant cost savings, while for patients, it increases adherence to prescribed treatments by easing the financial burden.

As a result, the post-patent period in the inhalable drugs market not only stimulates competition but also enhances patient access to necessary medications, thereby broadening the market’s reach and impact.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors exert a significant influence on the inhalable drugs market, shaping its growth trajectory and dynamics. Economic conditions, such as GDP growth rates, inflation, and healthcare expenditure, directly impact consumer purchasing power and healthcare budgets, thereby influencing demand for pharmaceutical products, including inhalable drugs. In times of economic downturn, healthcare spending may be constrained, leading to a slowdown in market growth as patients may defer non-essential treatments or opt for cheaper alternatives.

Conversely, robust economic growth and increasing disposable incomes can drive demand for inhalable drugs, particularly in emerging markets where healthcare infrastructure and access to medication are expanding. Geopolitical factors, including trade tensions, regulatory changes, and geopolitical conflicts, also impact the market landscape. Tariffs, trade barriers, and regulatory uncertainties can disrupt supply chains, increase manufacturing costs, and hinder market access for inhalable drug manufacturers.

Latest Trends

Focus on Combination Therapies

The development of combination inhalers is a prominent trend in the inhalable drugs market, driven by the need to enhance treatment efficacy for complex respiratory conditions like asthma and COPD. These inhalers contain more than one active ingredient, typically combining a bronchodilator and a corticosteroid, to target different aspects of the disease simultaneously.

This approach offers several benefits: it simplifies treatment regimens by reducing the number of inhalations a patient needs per day, improves adherence to medication, and can be more effective at controlling symptoms and preventing exacerbations compared to monotherapy.

By delivering multiple medications in a single device, combination inhalers ensure more consistent drug delivery and can lead to better overall management of respiratory conditions. This strategy not only improves patient outcomes but also has the potential to reduce healthcare costs associated with hospitalizations and emergency visits due to uncontrolled symptoms.

As a result, pharmaceutical companies continue to invest in the research and development of these multifunctional devices, responding to both the clinical needs of patients and the economic pressures on healthcare systems.

Regional Analysis

North America is leading the Inhalable Drugs Market

North America dominated the market with the highest revenue share of 48% owing to its advanced healthcare infrastructure, high prevalence of respiratory diseases, and robust regulatory environment conducive to pharmaceutical innovation. The region benefits from well-established pharmaceutical companies, research institutions, and healthcare systems that promote the development and adoption of inhalable drugs.

Additionally, factors such as a large patient population, increasing healthcare expenditure, and favorable reimbursement policies contribute to the widespread use of inhalable drugs in North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

APAC is expected to grow with the fastest CAGR owing to the rapid urbanization, increasing healthcare expenditure, and rising awareness about respiratory health issues. Governments in countries like China, India, and Southeast Asian nations are prioritizing investments in healthcare infrastructure and expanding access to affordable healthcare services, which is expected to drive demand for inhalable drugs in the region.

Moreover, the growing prevalence of respiratory diseases in Asia Pacific, attributed to factors such as air pollution and changing lifestyles, presents significant market opportunities for inhalable drug manufacturers.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the inhalable drugs market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning. Currently, over 220 projects related to inhalable medicines are underway globally. For example, Breath Therapeutics’ Boston Program, which concentrates on the development of Cyclosporine A for Inhalation to address Bronchiolitis Obliterans Syndrome, is currently in Phase III clinical trials and is anticipated to be introduced to the market within the forecast period.

Additionally, these companies participate in joint ventures, collaborative development efforts, and pursue mergers and acquisitions to further strengthen their market presence and expand their product portfolios.

Top Key Players

- AstraZeneca Plc.

- Vectura Group Ltd

- GSK plc.

- Mundipharma International.

- Boehringer Ingelheim International GmbH.

- Sanofi

- Theravance Biopharma

- Novartis International AG

- Cipla Inc.

- Viatris Inc.

- Merck & Co., Inc.

- Pfizer Inc.

- Mylan N.V.

- Other Key Players

Recent Developments

- In November 2023, Sanofi, a leading pharmaceutical company, announced that Dupixent has shown promising results in its second positive Phase 3 trial, significantly reducing COPD exacerbations. This outcome has accelerated the company’s submission to the U.S. Food and Drug Administration (FDA), confirming Dupixent’s potential to become the first approved biologic for this serious disease.

- In January 2023, AstraZeneca received FDA approval for Airsupra (albuterol and budesonide) inhalation aerosol, aimed at reducing asthma exacerbation risk in adults aged 18 and older. Developed in partnership with Avillion, Airsupra represents a significant advancement in asthma management.

Report Scope:

Report Features Description Market Value (2023) USD 32.4 billion Forecast Revenue (2033) USD 60.8 billion CAGR (2024-2033) 6.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type – Aerosol, Dry powder formulation, Spray, and Other Product Types; By Indication – Respiratory diseases and Non-respiratory disease; By Distribution Channel – Hospital pharmacy, Retail pharmacy, Online pharmacy Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AstraZeneca Plc., Vectura Group Ltd, GSK plc., Mundipharma International, Boehringer Ingelheim International GmbH, Sanofi, Theravance Biopharma, Novartis International AG, Cipla Inc., Viatris Inc., Merck & Co., Inc., Pfizer Inc., Mylan N.V. and Other Key Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AstraZeneca Plc.

- Vectura Group Ltd

- GSK plc.

- Mundipharma International.

- Boehringer Ingelheim International GmbH.

- Sanofi

- Theravance Biopharma

- Novartis International AG

- Cipla Inc.

- Viatris Inc.

- Merck & Co., Inc.

- Pfizer Inc.

- Mylan N.V.

- Other Key Players