Global Companion Animal Drugs Market Scope By Product (Drugs-Antibiotics, Anti-inflammatory, Anti-infective, Cardiovascular drugs, Gastrointestinal drugs, Anthelmintics, Anti-parasitic, Sedatives, Others; Medicated Feed Additives-Vitamins, Carbohydrates, Proteins, Amino acids, Minerals, Fats & oils, Others; Vaccines- Modified live vaccines, Killed inactivated vaccines, Attenuated vaccines, Recombinant vaccines, Toxoid vaccines, Others) By Route Of Administration (Oral, Injection, Topical, Others) By Animal Type (Cats, Dogs, Horses, Birds, Rabbits, Others) By Distribution Channel (Retail Pharmacy, Veterinary Hospital Pharmacy, Online Pharmacy) Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143242

- Number of Pages: 332

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

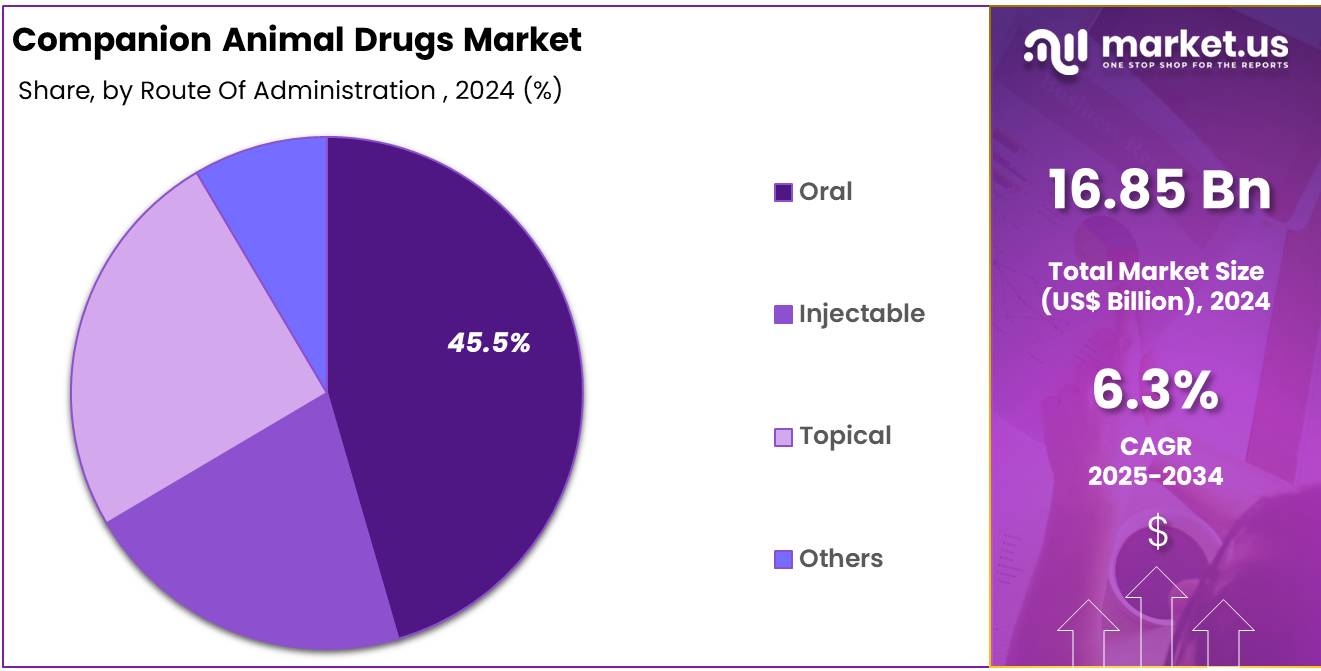

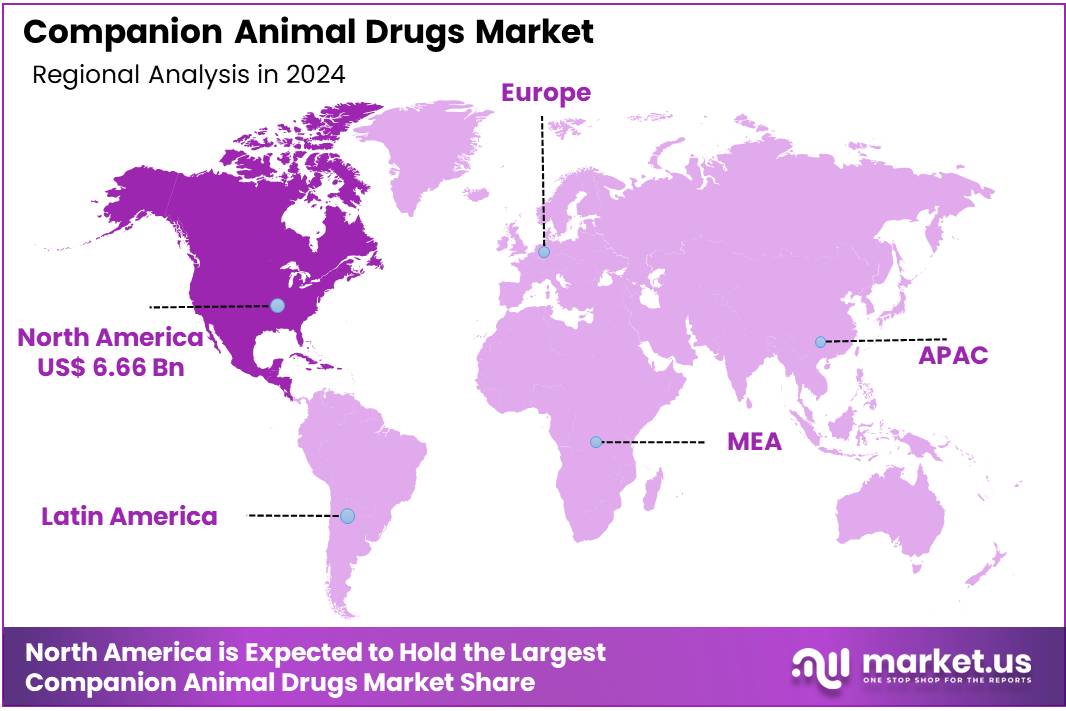

Global Companion Animal Drugs Market size is expected to be worth around US$ 31.04 Billion by 2034 from US$ 16.85 Billion in 2024, growing at a CAGR of 6.3% during the forecast period from 2025 to 2034. In 2023, North America led the market, achieving over 39.50% share with a revenue of US$ 6.66 Billion.

Companion animal drugs are essential for preventing, diagnosing, and treating illnesses and injuries in pets, farm animals, and wildlife. These medications play a vital role in ensuring animal welfare, supporting livestock productivity, and mitigating the spread of zoonotic diseases that can impact both animals and humans.

The key market drivers include the strengthening bond between pet owners and their animal companions, increasing awareness among companion animal owners, and rising expectations for high-quality veterinary care. The global market for companion animal drugs is evolving with a focus on enhancing owner compliance and improving treatment efficacy. Regulatory-compliant manufacturers adhere to stringent quality standards to ensure the safety and effectiveness of their products.

High-quality veterinary medicines from reputable sources provide efficient treatment solutions and contribute to maintaining the overall health and well-being of companion animals. The product portfolio in this market spans a wide range of medications, including antibiotics, antiparasitics, vaccines, pain relievers, hormonal treatments, behavioral drugs, and nutritional supplements.

The growth of the companion animal drugs market is driven by increasing pet ownership, advancements in veterinary medicine, heightened awareness of pet health, and the rising adoption of pet insurance. However, the industry faces key challenges, such as antimicrobial resistance, drug residues in animal products, and complex regulatory frameworks.

Despite these challenges, the market presents significant opportunities in the areas of natural and holistic medications, sustainable veterinary practices, and precision medicine. These innovations are reshaping the industry, making it a dynamic and rapidly evolving sector crucial for ensuring pet health and enhancing owner satisfaction.

Additionally, the European Commission hosted a half-day event on June 20, 2022, to highlight the achievements of veterinary medicines legislation and its pivotal role in the EU’s fight against antimicrobial resistance. This initiative aligns with the Farm to Fork Strategy, which aims to reduce EU sales of antimicrobials for animal farming and aquaculture by 50% by 2030.

Key Takeaways

- Market Size: Companion Animal Drugs Market size is expected to be worth around US$ 31.04 Billion by 2034 from US$ 16.85 Billion in 2024.

- Market Share: The market growing at a CAGR of 6.3% during the forecast period from 2025 to 2034.

- By product type, the market is segmented into drugs, Medicated Feed Additives and vaccines. Drugs are further classified into antibiotic, ant-inflammatory, anti-infective, cardiovascular drugs, gastrointestinal drugs, sedative, anti-parasitic, vaccine- modified vaccine, killed Inactivated vaccine, attenuated, recombinant, toxoid vaccine, others. Medicated feed additive accounted for major sharte of 48.9% in 2024.

- By route of administration, the market is divided into oral, injectable, topical, others, oral segment dominated the market largest share in 2024 with 45.5%.

- By Animals Type, dogs, cat, rabbit, horse, birds, others, with dogs segment dominating the total revenue share in 2023 with 33.6% market share.

- Based on distribution channel, the Veterinary Hospital Pharmacy dominated the market with 45.3% market share.

- North America, region dominated the market with a market share of 39.50% in 2024.

Product Type Analysis

Medicated feed additives hold a significant position in the companion animal drugs market with 48.9% market share due to their essential role in disease prevention, treatment, and overall animal health management. These additives provide a reliable and efficient method of drug administration by ensuring consistent and accurate dosing through animal feed. This approach is particularly effective in managing chronic conditions and preventing disease outbreaks, thereby enhancing overall animal well-being.

Additionally, medicated feed additives promote growth and productivity, making them especially beneficial for young and growing animals. Their ease of administration improves compliance with treatment regimens, reducing stress for both animals and pet owners.

Furthermore, they offer a cost-effective alternative by minimizing the need for separate treatments and frequent veterinary visits, making pet healthcare more accessible. These factors collectively reinforce the importance and market prominence of medicated feed additives in the companion animal drugs industry.

In line with industry developments, Phibro Animal Health Corporation recently acquired Zoetis’ medicated feed additive portfolio, along with select water-soluble products in October 2024. This strategic acquisition is expected to enhance Phibro’s profitability, improve EBITDA margins, and positively impact its Adjusted Earnings Per Share (EPS). The deal includes six manufacturing sites across the U.S., Italy, and China, along with the integration of a workforce of over 300 employees.

Route of Administration Analysis

The oral route is the preferred method of drug administration in the companion animal drugs market due to its numerous advantages. In 2023, the oral segment accounted for the largest share of the market with 45.5%. The oral route offers ease of administration, making it a convenient and less stressful option for both pets and owners.

Medications in this category are available in various formulations, including tablets, capsules, liquids, and chewable treats, ensuring consistent and accurate dosing—a critical factor for effective treatment. Many oral medications are also flavored or palatable, increasing acceptance among pets.

Additionally, oral administration is safer and less invasive than injectable methods, reducing the risk of complications or adverse reactions at the injection site. The ability to administer medications at home without frequent veterinary visits further improves compliance and treatment outcomes. The flexibility and variety of oral drug formulations contribute significantly to the widespread adoption of this administration method in companion animal healthcare.

Animal Type Analysis

The dog segment dominated the companion animal drugs market in 2023, accounting for more than 33.6% of total market revenue. Dogs continue to hold a leading position in this market due to several key factors. As one of the most popular pets globally, a large proportion of households own at least one dog, driving high demand for veterinary care and medications.

Additionally, the growing trend of pet humanization has led to increased spending on dog healthcare, as owners treat their pets as integral family members. Dogs are susceptible to various health conditions, including infectious diseases, chronic illnesses, and behavioral disorders, further fueling demand for specialized medications.

Advancements in veterinary medicine, such as targeted therapies, advanced diagnostics, and precision medicine, have expanded treatment options, reinforcing the market’s growth. Moreover, the rising adoption of pet insurance has made advanced veterinary treatments more accessible and affordable, further driving demand for high-quality pet care.

For instance, in 2023, 56% of Americans reported owning a dog, highlighting significant growth in pet ownership. Due to their susceptibility to age-related diseases, genetic disorders, injuries, and infections, dogs require frequent veterinary attention. In 2023, the American Veterinary Medical Association (AVMA) reported an ongoing outbreak of respiratory illness among dogs in multiple U.S. states, with researchers actively investigating potential causes and treatments.

Additionally, in December 2023, biotech company Loyal received positive feedback from the FDA for its drug LOY-001, developed to extend the lifespan of large dog breeds. This veterinarian-administered, cost-effective treatment is expected to become available through the FDA’s conditional approval process, marking a significant innovation in canine healthcare.

Distribution Type

Veterinary hospitals held the largest market share 45.3% in 2023, establishing themselves as the primary distribution channel for companion animal drugs. Their dominance is driven by several key factors that contribute to their essential role in animal healthcare. These facilities provide a comprehensive range of medical services, including diagnostics, surgical procedures, and emergency care, all of which require a diverse selection of medications. Equipped with state-of-the-art medical infrastructure, veterinary hospitals utilize advanced diagnostic tools, surgical equipment, and cutting-edge treatment options, ensuring high-quality veterinary care.

Additionally, these hospitals employ skilled veterinary professionals, including veterinarians, veterinary technicians, and pharmacists, who are trained to administer and manage medications effectively. The presence of in-house pharmacies further enhances their role in the market by ensuring immediate access to essential medications, thereby improving treatment efficiency and convenience for pet owners. Veterinary hospitals also function as referral centers for complex medical cases, increasing demand for specialized drugs and therapies.

A notable industry initiative was announced in February 2024, when Vets Pets, a cooperative network of veterinary hospitals in North Carolina, launched a pharmacy initiative aimed at enhancing client service and patient care. Led by a team of young pharmacists, this program focuses on improving pharmacy operations across their network of over 100 veterinarians, further strengthening the role of veterinary hospitals in the companion animal healthcare market.

Key Market Segments

Product Type

- Drugs

- Antibiotics

- Anti-inflammatory

- Anti-infective

- Cardiovascular drugs

- Gastrointestinal drugs

- Anthelmintics

- Anti-parasitic

- Sedatives

- Others

- Medicated Feed Additive

- Vitamins

- Carbohydrates

- Proteins

- Amino acids

- Minerals

- Fats & oils

- Others

- Vaccines

- Modified live vaccines

- Killed inactivated vaccines

- Attenuated vaccines

- Recombinant vaccines

- Toxoid vaccines

- Others

Route Of Administration

- Oral

- Injectable

- Topical

- Others

Animal Type

- Cats

- Dogs

- Horses

- Birds

- Rabbits

- Others

Distribution Channel

- Retail Pharmacy

- Veterinary Hospital Pharmacy

- Online Pharmacy

Drivers

Increasing pet ownership

The rise in pet ownership has significantly impacted various aspects of society, the economy, and individual well-being. Pets provide companionship, alleviate stress, and enhance mental health by offering unconditional love and support. This growing trend has led to substantial economic growth in the pet care industry, encompassing veterinary services, pet food, grooming, and accessories, thereby generating employment opportunities and stimulating local economies.The increase in pet ownership has also heightened demand for veterinary services and medications, underscoring the importance of companion animals in households worldwide. Moreover, higher pet ownership encourages responsible animal care and welfare, ensuring that more pets receive proper nutrition, healthcare, and attention.

Pets can enhance physical health by promoting exercise and outdoor activities, resulting in healthier lifestyles for their owners. Therefore, the rise in pet ownership positively impacts society, the economy, and individual well-being.

For instance, pet ownership in the U.S. has increased significantly over the past three decades. As of 2024, 66% of U.S. households (86.9 billion homes) own a pet, up from 56% in 1988. Notably, 97% of pet owners consider their pets to be part of their family. This trend reflects the deepening bond between humans and their companion animals, highlighting the integral role pets play in enhancing quality of life.

Restraints

Risk of complication associated with Drugs

Companion animals, particularly dogs and cats, face significant risks from accidental ingestion of various substances, including human and veterinary medications, recreational and illicit drugs, and common household toxins. These encompass over-the-counter and prescription medicines such as acetaminophen and ibuprofen, recreational drugs like cannabis and cocaine, and everyday items like certain plants and foods. To ensure pet safety, it is crucial to store medications securely, adhere strictly to veterinarian instructions, and remain vigilant about potential hazards.

Immediate veterinary attention is essential if accidental ingestion occurs. Veterinary medications, while essential for treating various conditions in pets, also pose risks if not administered correctly. Overdoses, incorrect dosages, or interactions with other medications can lead to adverse reactions. Additionally, some pets may have allergies or sensitivities to specific drugs, resulting in unexpected side effects.

Pet owners must meticulously follow veterinarian instructions, monitor their pets for any unusual behavior or symptoms, and keep all medications out of reach to prevent accidental ingestion. Regular check-ups and open communication with the veterinarian can help ensure that pets receive safe and effective treatment.

Studies indicate that drug intoxications account for a significant portion of animal poisonings. Antibiotics, antiparasitics, and non-steroidal anti-inflammatory drugs (NSAIDs) are among the most frequently reported culprits. In the US, data from the ASPCA’s Animal Poison Control Center (APCC) reveal that approximately 86% of cases involve dogs, while 14% involve cats. Notably, there has been a substantial increase in reports of cannabis poisoning in pets over recent years. For instance, the APCC reported that recreational drugs, including marijuana-based products, made the top toxins list for the first time in 2022, reflecting an uptick in cases.

These statistics underscore the critical need for pet owners to be aware of the potential hazards associated with veterinary drugs, as well as other household substances. Implementing preventive measures, such as secure storage of medications and prompt consultation with veterinary professionals in case of suspected exposure, is essential to safeguard the health and well-being of companion animals.

Opportunities

Pet insurance growth

The pet insurance industry has experienced significant growth, presenting numerous opportunities within the companion animal healthcare sector. According to the North American Pet Health Insurance Association’s (NAPHIA) 2024 State of the Industry Report, the U.S. pet insurance market reached a total premium volume of $3.91 billion in 2023, marking a 21.6% increase from the previous year. The number of insured pets rose to nearly 5.68 billion, reflecting a 17.1% increase compared to 2022.

This upward trend indicates a growing recognition among pet owners of the value of insuring their pets’ health, leading to increased demand for comprehensive veterinary services. The expansion of pet insurance coverage options to include preventive care and wellness programs can cater to a broader range of pet owners, promoting proactive health management.

Integrating advanced technologies, such as telemedicine and AI-driven customer support, can streamline the claims process and enhance the overall customer experience. Furthermore, increased awareness and education about the benefits of pet insurance can drive market growth, while developing customized plans tailored to different breeds and ages can attract more customers.

Global expansion and partnerships with veterinary clinics and pet-related businesses can tap into new markets and increase customer reach. Additionally, offering eco-friendly and ethically responsible insurance options can appeal to socially conscious consumers.

Overall, the growth in companion animal numbers is poised to bring about a dynamic and expansive veterinary care landscape, benefiting both the industry and pet owners alike. These developments underscore the robust expansion of the pet insurance sector and its integral role in advancing companion animal healthcare.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the companion animal drugs market. Economic growth and rising disposable incomes enable pet owners to allocate more resources to veterinary care and medications, thereby driving market expansion. Additionally, increased urbanization and changing lifestyles contribute to higher pet adoption rates, further boosting demand for companion animal pharmaceuticals.

Geopolitical elements, such as trade policies and international regulations, can impact the availability and cost of raw materials and finished products, affecting the supply chain dynamics of the industry. Political stability and government initiatives promoting animal health also play crucial roles in shaping the market landscape. Moreover, global events like pandemics can disrupt supply chains and alter market dynamics, underscoring the necessity for a resilient and adaptable industry.

Latest Trends

Increasing focus on preventive care

The companion animal healthcare market is experiencing a notable shift towards preventive care, fundamentally transforming pet health management. Pet owners are increasingly proactive in maintaining their pets’ well-being, leading to heightened demand for preventive medications and treatments. This shift encompasses regular vaccinations, parasite control, dental care, and nutritional supplements aimed at disease prevention.The market is also witnessing a rise in wellness programs and routine check-ups, facilitating early detection and management of potential health issues. Pharmaceutical companies are responding by developing innovative products that cater to these preventive needs, ensuring pets lead healthier and longer lives. This trend not only benefits pets but also reduces long-term healthcare costs for owners by minimizing the need for extensive treatments.

Reflecting this industry commitment to preventive care, in January 2023, MSD Animal Health inaugurated a state-of-the-art manufacturing facility in Boxmeer, the Netherlands, dedicated to the sterile filling and freeze-drying of companion animal vaccines. This facility enhances MSD’s capacity to meet the growing global demand for innovative vaccines, underscoring the pivotal role of preventive healthcare in veterinary medicine. These developments highlight the increasing emphasis on preventive care within the companion animal healthcare sector, benefiting both animal well-being and the economic aspects of pet ownership.

Regional Analysis

North America

North America has established itself as the dominant player in the companion animal drugs market, accounting for a substantial 39.50% share of the global market. This leadership is attributed to several key factors. The region exhibits high pet ownership rates; as of 2023, approximately 66% of U.S. households, equating to about 86.9 billion homes, own a pet. This cultural inclination towards pet companionship drives significant expenditure on pet healthcare, including medications and preventive care.

The region also boasts a sophisticated veterinary infrastructure, encompassing advanced veterinary hospitals, clinics, and specialty pharmacies, which enhance accessibility to companion animal medications. The region’s robust research and development initiatives by pharmaceutical companies have led to a continuous introduction of innovative products, further propelling market growth.

Additionally, the proliferation of pet insurance has made veterinary care more affordable, encouraging pet owners to invest in comprehensive healthcare for their animals. Veterinary education and training programs in the region also ensure high standards of treatment, contributing to the region’s market dominance. These factors—elevated pet ownership rates, advanced veterinary infrastructure, strong regulatory support, and a focus on preventive healthcare—solidify North America’s leading position in the companion animal drugs market.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Leading companies in the companion animal drugs market are increasingly focusing on developing rapid and highly sensitive diagnostic tests to facilitate early detection and prompt treatment of various health conditions in pets. Significant investments are being directed towards research and development to innovate point-of-care solutions and molecular diagnostics, enhancing accessibility, particularly in resource-limited settings.

Collaborations with healthcare organizations and governments are pivotal in expanding global awareness and testing programs. Additionally, geographic expansion into regions with high disease prevalence and increasing healthcare investments is driving market penetration. Many companies are also emphasizing affordability and adherence to international guidelines to ensure widespread adoption and reliability of their products.

In 2023, Boehringer Ingelheim’s Animal Health business achieved net sales totaling €4.7 billion, with its antiparasitic product, NEXGARD®, recording a sales growth of 13.3% (currency-adjusted 17.2%) to €1.2 billion, maintaining its position as the highest-selling product in their Animal Health portfolio.

Top Key Players

- Zoetis Inc.

- Boehringer Ingelheim International GmbH

- Merck & Co., Inc.

- Elanco Animal Health Incorporated

- Ceva Santé Animale

- Virbac

- Vetoquinol S.A.

- Dechra Pharmaceuticals PLC

- Bimeda, Inc.

- Norbrook

- Agrolabo S.p.A.

- Phibro Animal Health Corporation

- Calier

Recent Developments

- In November, 2024, Merck Animal Health announced that the European Commission granted marketing authorization for BRAVECTO® TriUNO, a new formulation of BRAVECTO (fluralaner) designed to combat both internal and external parasites in dogs. This product offers immediate and persistent flea and tick-killing activity for one month, treats infections with gastrointestinal nematodes, and prevents heartworm disease and angiostrongylosis.

- In January, 2022, Elanco Animal Health expanded its pain management portfolio with the FDA approval of Zorbium (buprenorphine transdermal solution), addressing a crucial gap in veterinary practices’ pain management options.

Report Scope

Report Features Description Market Value (2024) US$ 16.85 Billion Forecast Revenue (2034) US$ 31.04 Billion CAGR (2025-2034) 6.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Drugs, Antibiotics, Anti-inflammatory, Anti-infective, Cardiovascular drugs, Gastrointestinal drugs, Anthelmintics, Anti-parasitic, Sedatives, Others, Medicated Feed Additive, Vitamins, Carbohydrates, Proteins, Amino acids, Minerals, Fats & oils, Others, Vaccines, Modified live vaccines, Killed inactivated vaccines, Attenuated vaccines, Recombinant vaccines, Toxoid vaccines, Others, By Route Of Administration (Oral, Injectable, Topical, Others) By Animal Type (Cats, Dogs, Horses, Birds, Rabbits, Others) By Distribution Channel (Retail Pharmacy, Veterinary Hospital Pharmacy, Online Pharmacy) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Zoetis Inc., Boehringer Ingelheim International GmbH, Merck & Co., Inc., Elanco Animal Health Incorporated, Ceva Santé Animale, Virbac, Vetoquinol S.A., Dechra Pharmaceuticals PLC, Bimeda, Inc., Norbrook, Agrolabo S.p.A., Phibro Animal Health Corporation, Calier Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Companion Animal Drugs MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Companion Animal Drugs MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Zoetis Inc.

- Boehringer Ingelheim International GmbH

- Merck & Co., Inc.

- Elanco Animal Health Incorporated

- Ceva Santé Animale

- Virbac

- Vetoquinol S.A.

- Dechra Pharmaceuticals PLC

- Bimeda, Inc.

- Norbrook

- Agrolabo S.p.A.

- Phibro Animal Health Corporation

- Calier