Pharmaceutical Grade Washer Market By Product Type (Cabinet Washers, Ultrasonic Washers, Tunnel Washers, CIP/SIP Systems, and Others), By Mode of Operation (Automated, Semi-automated, and Manual), By Application (Cleaning Medical Vials/Ampoules/Syringes, Cleaning Laboratory Glassware & Equipment, and Others), By End-user (Pharmaceutical Companies, Research & Development Laboratories, Biotechnology Companies, and Contract Research Organizations (CROs)), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133693

- Number of Pages: 316

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- Mode of Operation Analysis

- Application Analysis

- End-user Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Trends

- Regional Analysis

- Key Players Analysis

- Top Key Players in the Pharmaceutical Grade Washer Market

- Recent Developments

- Report Scope

Report Overview

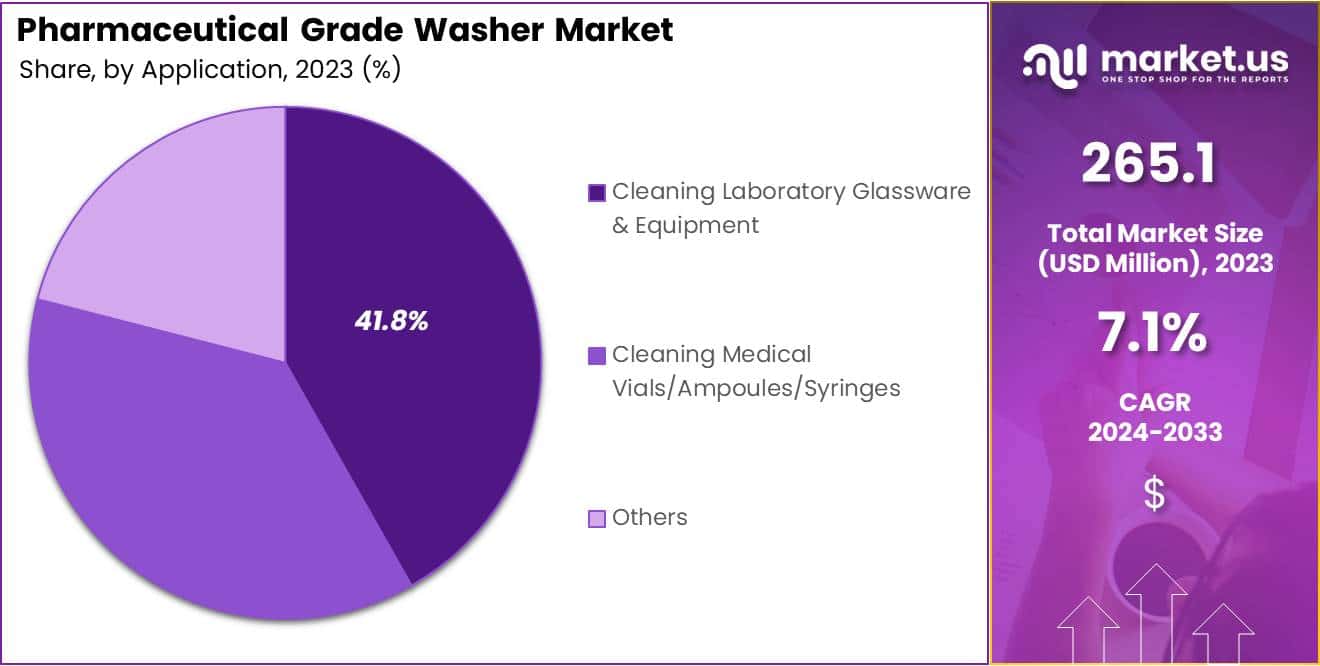

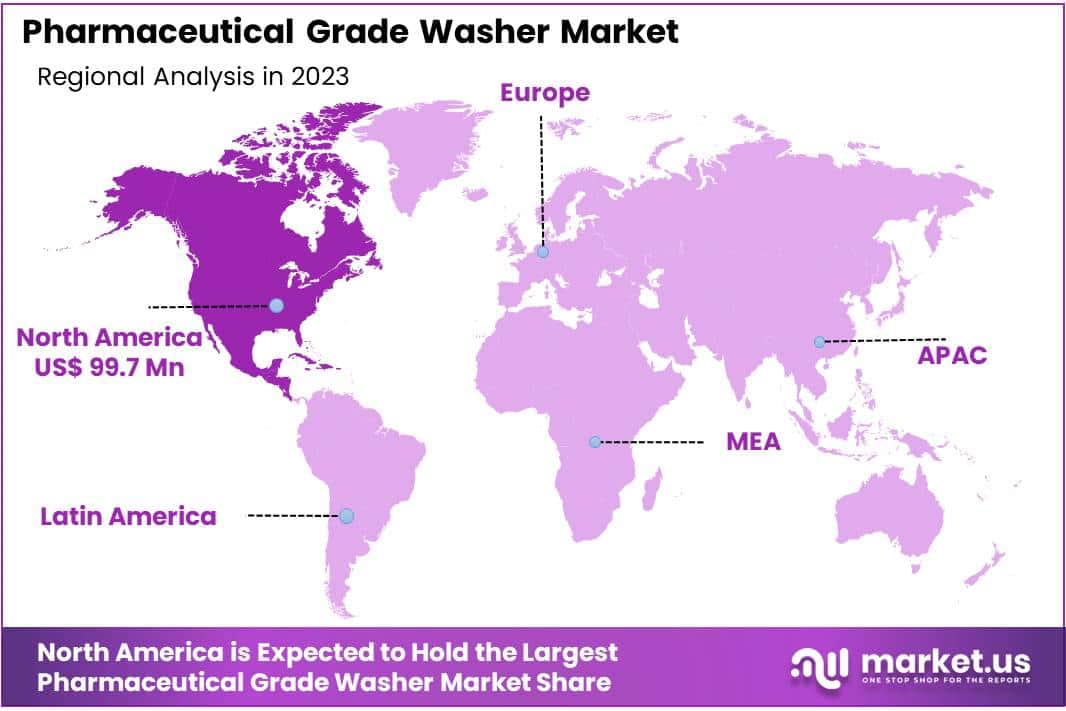

The Global Pharmaceutical Grade Washer Market Size is expected to be worth around US$ 526.4 Million by 2033, from US$ 265.1 Million in 2023, growing at a CAGR of 7.1% during the forecast period from 2024 to 2033. North America dominated the market, securing a 37.6% share and achieving a market value of US$ 99.7 million for the year.

Rising concerns about healthcare-associated infections (HAIs) and the growing need for stringent infection control in medical environments are driving the demand for pharmaceutical grade washers. These washers, specifically designed to clean and disinfect pharmaceutical and medical equipment to the highest standards, play a critical role in ensuring patient safety and maintaining sterile environments.

In 2021, the American Rescue Plan Act committed US$ 2.1 billion to bolster infection prevention in state health departments. Of this, US$ 385 million was earmarked specifically for tackling healthcare-associated infections and antimicrobial resistance. This substantial investment underscores the ongoing commitment to enhancing public health infrastructure and addressing these critical issues.

In May 2024, the European Centre for Disease Prevention and Control (ECDC) disclosed that around 4.3 million patients annually contract infections in EU/EEA hospitals. This statistic highlights the persistent challenge of healthcare-associated infections within hospital settings, emphasizing the urgent need for effective infection control measures.

The pharmaceutical grade washer market is also benefiting from advancements in technology, such as automated cleaning systems and environmentally friendly disinfectants, which improve cleaning efficiency and reduce operational costs. Manufacturers are increasingly focusing on developing washers with enhanced capabilities, including precise temperature control, cycle monitoring, and the ability to clean complex devices like surgical instruments and diagnostic equipment.

The growing demand for aseptic environments in pharmaceuticals, biotechnology, and healthcare sectors presents substantial opportunities for market growth. Additionally, rising awareness about infection prevention in hospitals and clinics is driving the adoption of pharmaceutical grade washers, positioning them as essential tools for maintaining hygiene and preventing the spread of infections.

Key Takeaways

- In 2023, the market for Pharmaceutical Grade Washer generated a revenue of US$ 265.1 million, with a CAGR of 7.1%, and is expected to reach US$ 526.4 million by the year 2033.

- The product type segment is divided into cabinet washers, ultrasonic washers, tunnel washers, CIP/SIP systems, and others, with cabinet washerstaking the lead in 2023 with a market share of 35.7%.

- Considering mode of operation, the market is divided into automated, semi-automated, and manual. Among these, automatedheld a significant share of 47.4%.

- Furthermore, concerning the application segment, the cleaning laboratory glassware & equipmentsector stands out as the dominant player, holding the largest revenue share of 41.8% in the Pharmaceutical Grade Washer market.

- The end-user segment is segregated into pharmaceutical companies, research & development laboratories, biotechnology companies, and contract research organizations (CROs), with the pharmaceutical companiessegment leading the market, holding a revenue share of 44.6%.

- North America led the market by securing a market share of 37.6% in 2023.

Product Type Analysis

The cabinet washerssegment led in 2023, claiming a market share of 35.7% owing to their widespread use in cleaning equipment in controlled environments. Cabinet washers are anticipated to remain a key product type due to their versatility and effectiveness in washing a range of pharmaceutical equipment, including containers, tools, and small parts.

The rise in demand for pharmaceutical products, coupled with the increasing emphasis on maintaining stringent cleanliness and hygiene standards in manufacturing processes, is likely to propel this segment’s growth.

Additionally, the ability of cabinet washers to efficiently clean large batches of equipment at once, along with their ease of integration into production lines, is expected to contribute to their continued adoption. The growing importance of regulatory compliance and the push for higher-quality pharmaceutical products further supports the market’s expansion for cabinet washers.

Mode of Operation Analysis

The automatedheld a significant share of 47.4% due to the increasing need for efficiency, precision, and compliance in pharmaceutical production. Automated washers are anticipated to become more widely used as pharmaceutical companies seek to reduce human error and improve cleaning consistency in critical processes.

Automation offers significant advantages, including the ability to process large volumes of equipment quickly, without compromising cleanliness or quality standards. As the pharmaceutical industry moves toward more streamlined operations, the demand for automated systems is likely to rise, particularly in large-scale manufacturing facilities.

The growing focus on reducing labor costs and improving throughput while maintaining compliance with industry regulations is expected to further accelerate the adoption of automated washers.

Application Analysis

The cleaning laboratory glassware & equipment segment had a tremendous growth rate, with a revenue share of 41.8% owing to the increasing need for effective cleaning solutions for laboratory instruments. As laboratories handle complex compounds and reagents, the demand for high-precision cleaning systems to ensure accuracy in testing and research is anticipated to rise.

The growing number of pharmaceutical research activities, along with stricter hygiene and contamination control standards, is likely to propel demand for washers specifically designed for cleaning laboratory glassware and equipment. Additionally, the rise in laboratory automation and the increasing complexity of laboratory workflows are expected to drive the need for efficient and reliable cleaning solutions.

The segment is projected to grow as pharmaceutical companies and research labs continue to prioritize operational efficiency and contamination prevention.

End-user Analysis

The pharmaceutical companiessegment grew at a substantial rate, generating a revenue portion of 44.6% due to the increasing demand for high-quality and safe pharmaceutical products. Pharmaceutical companies are expected to be one of the largest end-users of these washers, as they play a critical role in maintaining cleanliness and hygiene standards in manufacturing facilities.

As regulations surrounding pharmaceutical manufacturing become more stringent, companies are anticipated to invest more in advanced cleaning systems to comply with Good Manufacturing Practices (GMP) and other regulatory requirements.

Additionally, the rise in global pharmaceutical production, fueled by an aging population and increasing prevalence of chronic diseases, is likely to drive demand for pharmaceutical grade washers. The need to improve efficiency, reduce production downtime, and ensure product quality is projected to support continued growth in this segment.

Key Market Segments

By Product Type

- Cabinet Washers

- Ultrasonic Washers

- Tunnel Washers

- CIP/SIP Systems

- Others

By Mode of Operation

- Automated

- Semi-automated

- Manual

By Application

- Cleaning Medical Vials/Ampoules/Syringes

- Cleaning Laboratory Glassware & Equipment

- Others

By End-user

- Pharmaceutical Companies

- Research & Development Laboratories

- Biotechnology Companies

- Contract Research Organizations (CROs)

Drivers

Increase in Number of Surgeries Driving the Market

Increasing numbers of surgeries globally are driving the pharmaceutical grade washer market. The global volume of surgical procedures has been rising steadily, contributing to the growing need for high-quality, effective sterilization and cleaning equipment. A study by the National Institutes of Health (NIH) revealed that approximately 310 million surgeries are performed annually, with the U.S. accounting for 40 to 50 million of these procedures.

This high number of surgeries underscores the critical importance of preventing infections during operations, making the demand for reliable pharmaceutical-grade washing systems essential. As healthcare facilities continue to expand and surgical procedures increase, the need for advanced cleaning systems will likely grow.

Surgical instruments and medical equipment require stringent sanitation standards, driving demand for highly effective washers that meet these requirements. The rising frequency of surgeries, combined with heightened infection control measures, is expected to further boost the pharmaceutical grade washer market as healthcare providers invest in state-of-the-art cleaning solutions.

Restraints

High Initial Investment Restraining the Market

High initial investment costs are likely to restrain the growth of the pharmaceutical grade washer market. While these washers are crucial for maintaining hygiene and preventing infections, their advanced technology and stringent quality standards often result in a substantial upfront cost. These high capital expenditures are expected to impede market adoption, particularly in smaller healthcare facilities or regions with limited budgets.

Smaller clinics or hospitals, in particular, may find it challenging to allocate funds for such high-cost equipment, leading to delays in acquiring or upgrading their cleaning systems. Additionally, maintenance and operational costs further add to the financial burden, deterring some organizations from investing in these washers.

The capital-intensive nature of these products is anticipated to hamper widespread market penetration, limiting access to advanced cleaning solutions, especially in developing countries where financial resources are often constrained. This restraint may slow the overall growth of the pharmaceutical grade washer market despite increasing demand.

Opportunities

Rise in Innovation Creating Opportunities in the Market

Rising innovation is creating significant opportunities in the pharmaceutical grade washer market. As technological advancements continue, manufacturers are introducing more efficient, cost-effective, and environmentally friendly washing systems to meet the increasing demand for high-quality cleaning solutions. For example, in June 2022, Innova introduced an updated version of its glassware washer and water purification system in Mexico.

This system improves cleaning efficiency and effectiveness, especially for laboratory glassware and medical equipment, providing advanced sanitation solutions for healthcare settings. Innovations such as these are expected to drive market growth by offering improved functionality and ease of use, while also reducing the operational costs associated with traditional systems.

The development of smarter, more energy-efficient washers is anticipated to expand the market by making these solutions more accessible to a broader range of healthcare facilities. As the healthcare industry increasingly prioritizes infection control and operational efficiency, the rise in innovative washing systems will likely play a crucial role in addressing these needs, further driving demand for pharmaceutical grade washers.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly affect the pharmaceutical grade washer market, influencing both demand and supply. Economic recessions can lead to reduced healthcare spending, potentially limiting investments in high-quality medical equipment such as pharmaceutical grade washers. In contrast, periods of economic expansion generally result in higher investments in healthcare infrastructure, driving demand for advanced cleaning and sterilization equipment.

Geopolitical tensions and regulatory changes may create challenges in global supply chains, impacting the availability of essential components and materials required for manufacturing these washers. On the positive side, growing awareness of stringent hygiene and contamination control standards in healthcare and pharmaceutical industries boosts market growth.

Furthermore, increasing investments in healthcare infrastructure, particularly in emerging markets, contribute to the market’s expansion. As the need for high-quality sterilization solutions continues to rise, the pharmaceutical grade washer market is expected to maintain an upward trajectory.

Trends

Rising Partnerships and Collaborations Driving the Pharmaceutical Grade Washer Market

Rising partnerships and collaborations are a recent trend driving the pharmaceutical grade washer market. Companies in the medical equipment and healthcare sectors are increasingly forming strategic alliances to expand their product portfolios and enhance market reach. Such partnerships allow for the sharing of expertise and resources, fostering innovation in sterilization and cleaning technologies.

For example, in December 2022, Olympus expanded its partnership with EndoClot Plus, Inc., to strengthen its presence in Europe, the Middle East, and Africa. This collaboration is part of a broader strategy to increase Olympus’s footprint in medical technologies, including solutions for gastrointestinal procedures.

As these strategic collaborations continue to grow, they are anticipated to accelerate the development of advanced cleaning systems, driving market growth. With continued innovation and global expansion, the pharmaceutical grade washer market is likely to see sustained growth in the coming years.

Regional Analysis

North America is leading the Pharmaceutical Grade Washer Market

North America dominated the market with the highest revenue share of 37.6% owing to the increasing emphasis on infection control and the need for stringent sanitation practices in pharmaceutical and healthcare settings. The growing awareness of healthcare-associated infections (HAIs) has propelled demand for high-quality washing equipment that ensures compliance with regulatory standards.

The U.S. government’s commitment to improving healthcare safety, as reflected in the American Rescue Plan Act of 2021, which allocated US$ 2.1 billion toward infection control programs, has supported the expansion of infection prevention technologies. Of this, US$ 385 million was specifically designated for addressing healthcare-associated infections and antimicrobial resistance.

This funding has encouraged the adoption of advanced pharmaceutical grade washers, which are crucial for the sterilization of equipment and facilities in hospitals, clinics, and pharmaceutical manufacturing environments. The ongoing need for cleaner and safer healthcare environments, along with the rise in the number of chronic diseases and hospital visits, has further fueled market growth, ensuring strong demand for these products throughout the region.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to demographic changes and an increasing demand for advanced healthcare infrastructure. Japan, in particular, is anticipated to be a key contributor to this market, as the country experiences a rapidly aging population. According to a 2021 report by the World Economic Forum, nearly 29.8% of Japan’s population was aged 65 or older, with 1 in 10 individuals being 80 years or older.

This demographic shift creates unique healthcare challenges, including the need for enhanced infection control measures and efficient medical equipment sterilization. To address these challenges, there is an expected increase in demand for pharmaceutical grade washers in hospitals, clinics, and long-term care facilities.

As healthcare systems in the region evolve to meet the needs of an aging population, the market for advanced sterilization technologies is projected to expand. Moreover, the growing focus on healthcare quality and patient safety across other countries in the region, such as China and India, will likely further drive the adoption of pharmaceutical grade washers.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the Pharmaceutical Grade Washer market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning. Key players in the pharmaceutical grade washer market adopt strategies such as product innovation, strategic partnerships, and market expansion to foster growth.

Companies focus on developing washers with enhanced cleaning efficiency, higher throughput, and compliance with stringent regulatory standards to meet the needs of the pharmaceutical industry. Collaboration with pharmaceutical manufacturers and equipment suppliers helps broaden distribution channels. Companies also invest in automation and digital technologies to improve operational efficiency and meet the increasing demand for contamination control.

Additionally, geographic expansion into emerging markets with growing pharmaceutical sectors provides significant growth opportunities. One of the key players in the market is STERIS Corporation, a leading provider of cleaning and sterilization solutions for the healthcare and pharmaceutical industries. STERIS offers a range of advanced washers designed to ensure compliance with industry standards and improve safety in pharmaceutical production.

The company’s growth strategy focuses on continuous product innovation, expanding its service offerings, and strengthening its global presence through acquisitions and partnerships. STERIS also invests heavily in research and development to introduce cutting-edge technologies aimed at optimizing cleaning processes and reducing risks in pharmaceutical manufacturing.

Top Key Players in the Pharmaceutical Grade Washer Market

- Tuttnauer

- Skytron, LLC

- SHINVA MEDICAL INSTRUMENT CO., LTD.

- Olympus Corporation

- Map Industries

- Getinge

- ECOLAB

- COLTENE Group

Recent Developments

- April 2024: SHINVA Medical Instrument Co., Ltd. signed a Memorandum of Understanding with South Korea’s Genoray, specializing in imaging systems. This partnership aims to boost SHINVA’s influence in the Chinese healthcare sector by enhancing medical imaging and infection control solutions.

- June 2023: Olympus introduced the ETD Endoscope Washer Disinfector, a cutting-edge system for cleaning and disinfecting endoscopes. It is engineered to comply with stringent safety standards for endoscope reprocessing, ensuring dependable disinfection between uses.

Report Scope

Report Features Description Market Value (2023) US$ 265.1 million Forecast Revenue (2033) US$ 526.4 million CAGR (2024-2033) 7.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Cabinet Washers, Ultrasonic Washers, Tunnel Washers, CIP/SIP Systems, and Others), By Mode of Operation (Automated, Semi-automated, and Manual), By Application (Cleaning Medical Vials/Ampoules/Syringes, Cleaning Laboratory Glassware & Equipment, and Others), By End-user (Pharmaceutical Companies, Research & Development Laboratories, Biotechnology Companies, and Contract Research Organizations (CROs)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Tuttnauer, Skytron, LLC, SHINVA MEDICAL INSTRUMENT CO., LTD., Olympus Corporation, Map Industries, Getinge, ECOLAB, and COLTENE Group. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Pharmaceutical Grade Washer MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Pharmaceutical Grade Washer MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Tuttnauer

- Skytron, LLC

- SHINVA MEDICAL INSTRUMENT CO., LTD.

- Olympus Corporation

- Map Industries

- Getinge

- ECOLAB

- COLTENE Group