Pregnancy Products Market By Product Type (Stretch Mark Minimizers, Toning & Body Firming Gel, Pregnancy Test Kits, Restructuring Gel, and Others), By Application (Urinary Incontinence, Orthopaedic Care, Breast Cancer Care, Pelvic Pain, and Pregnancy & Postpartum Care), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133506

- Number of Pages: 330

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

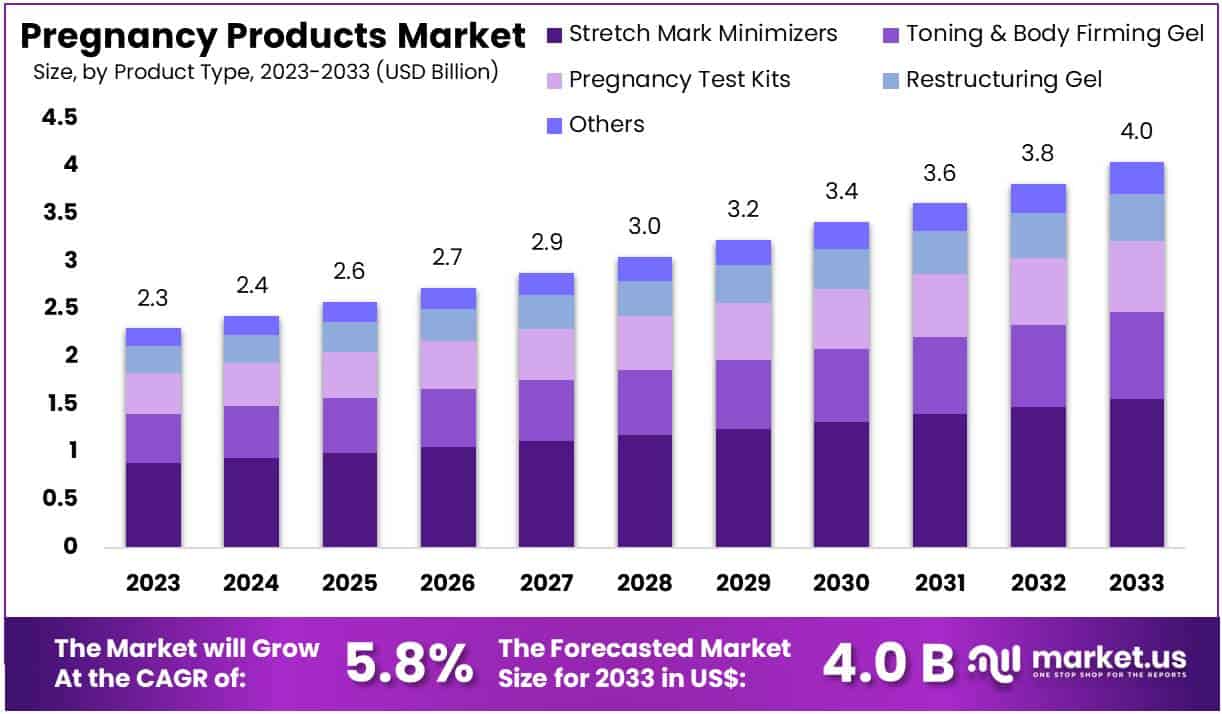

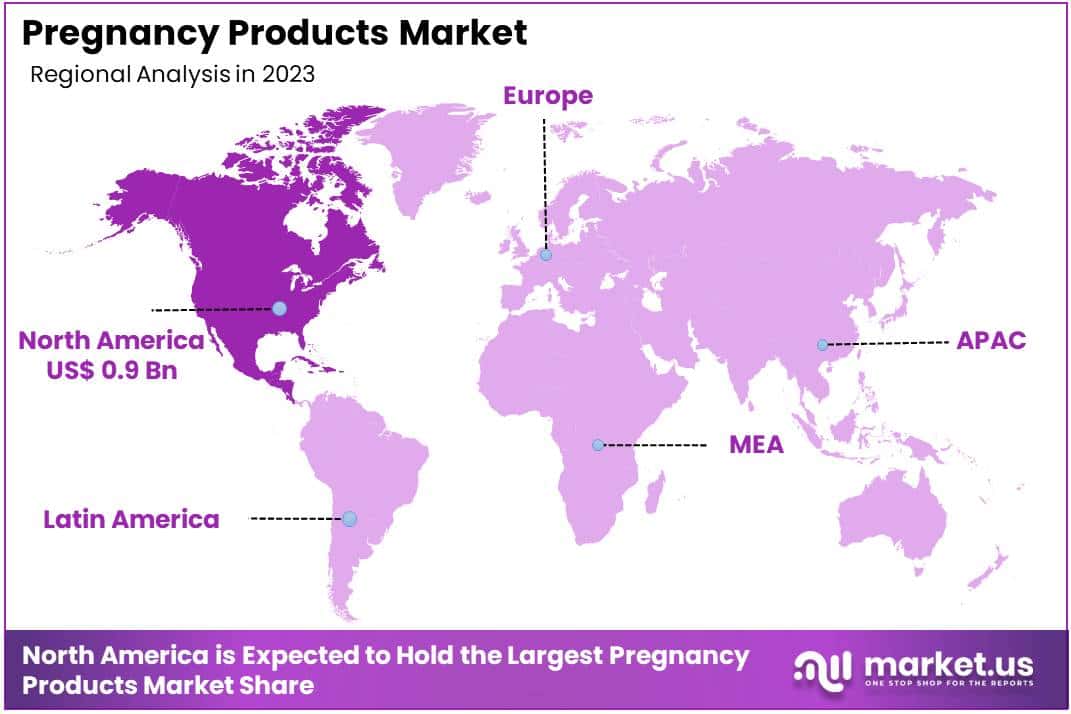

The Global Pregnancy Products Market size is expected to be worth around US$ 4 Billion by 2033, from US$ 2.3 Billion in 2023, growing at a CAGR of 5.8% during the forecast period from 2024 to 2033. North America achieved the highest market share, accounting for 39.6% of the total.

Growing awareness of maternal health drives the pregnancy products market, as expectant mothers seek solutions to ensure comfort and well-being throughout pregnancy. Pregnancy products, including skincare, nutritional supplements, maternity wear, and support belts, address various needs, from managing physical discomfort to maintaining skin health.

In May 2023, the Breast Cancer Research Foundation reported that breast cancer affects one in 3,000 pregnant women, emphasizing the importance of pregnancy-safe skincare products such as moisturizers and creams that alleviate symptoms and improve skin health.

In March 2024, ReadyToBeMom.com and FOGSI launched a multimedia pregnancy education platform featuring live podcasts by doctors, streamed on social media and Big FM, to provide essential pregnancy information. Recent trends reveal a growing focus on natural and organic ingredients in skincare and nutritional products, aligning with consumer preferences for safe, chemical-free options.

Opportunities in the market emerge from the increasing demand for customized and tech-enabled pregnancy solutions, including wearable devices that monitor fetal health and maternity apps offering personalized guidance. The rising adoption of holistic wellness practices during pregnancy, such as prenatal yoga and meditation, also fuels demand for related products and services.

Key Takeaways

- In 2023, the market for pregnancy products generated a revenue of US$ 2.3 billion, with a CAGR of 5.8%, and is expected to reach US$ 4.0 billion by the year 2033.

- The product type segment is divided into stretch mark minimizers, toning & body firming gel, pregnancy test kits, restructuring gel, and others, with stretch mark minimizers taking the lead in 2023 with a market share of 38.7%.

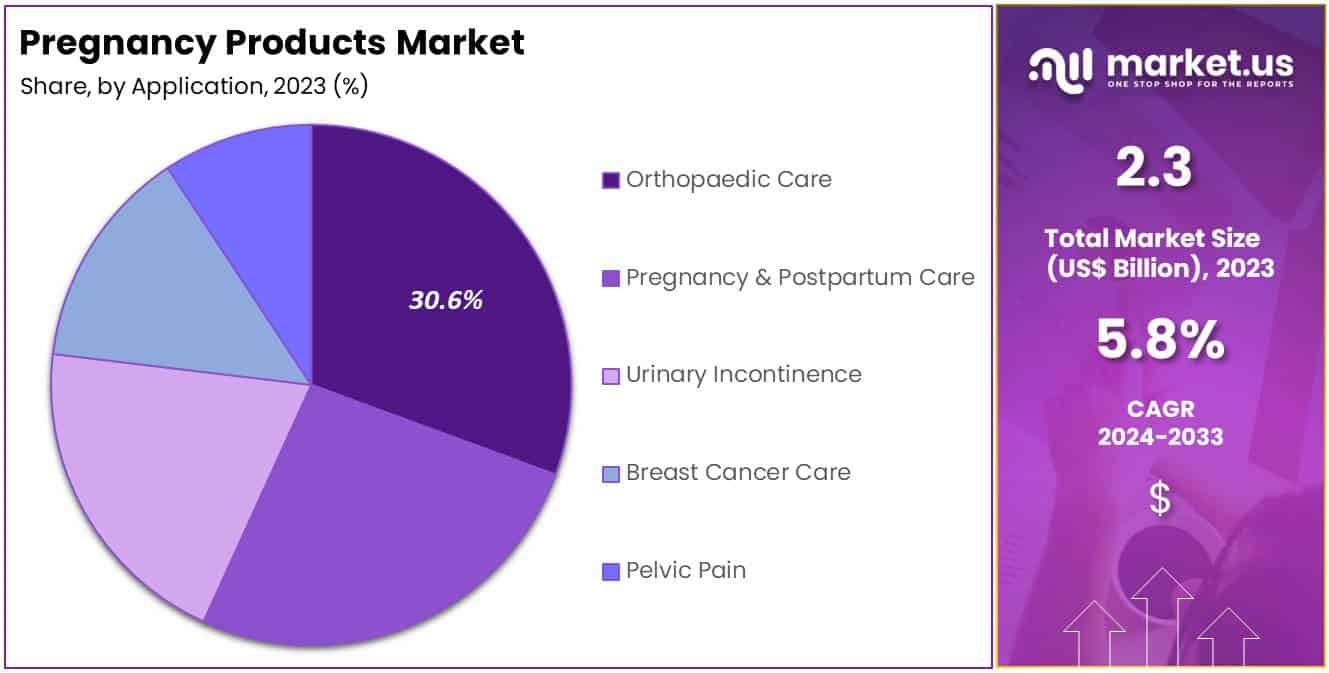

- Considering application, the market is divided into urinary incontinence, orthopaedic care, breast cancer care, pelvic pain, and pregnancy & postpartum care. Among these, orthopaedic care held a significant share of 30.6%.

- Furthermore, concerning the distribution channel segment, the market is segregated into hospital pharmacies, retail pharmacies, and online pharmacies. The hospital pharmaciessector stands out as the dominant player, holding the largest revenue share of 5% in the pregnancy products market.

- North America led the market by securing a market share of 39.6% in 2023.

Product Type Analysis

The stretch mark minimizers segment led in 2023, claiming a market share of 38.7% owing to the rising awareness among expectant mothers about skin care during pregnancy and the desire to reduce the appearance of stretch marks. Increasing demand for products formulated with natural and safe ingredients supports this trend, as consumers prioritize safety during pregnancy.

Furthermore, advancements in dermatological research have led to the development of more effective and fast-acting stretch mark minimizers, enhancing their appeal. The segment is also likely to benefit from aggressive marketing strategies and endorsements by healthcare professionals. As more consumers seek preventative solutions to manage skin changes during pregnancy, the stretch mark minimizers segment is expected to expand significantly.

Application Analysis

The orthopaedic care held a significant share of 30.6% due to the increasing prevalence of pregnancy-related musculoskeletal issues, such as back pain, joint discomfort, and posture-related problems. Expectant mothers frequently seek orthopedic solutions like maternity support belts, compression stockings, and posture-correcting devices to alleviate discomfort.

Rising awareness about the importance of orthopedic care during pregnancy further boosts demand in this segment. Additionally, healthcare providers often recommend such products to prevent long-term complications. Technological advancements in ergonomic design and materials enhance the effectiveness and comfort of these products. As the focus on maternal health intensifies, the orthopaedic care segment is anticipated to see robust growth.

Distribution Channel Analysis

The hospital pharmaciessegment had a tremendous growth rate, with a revenue share of 44.5% owing to the trusted role hospital pharmacies play in providing specialized products for maternal and prenatal care. Patients often rely on hospital pharmacies for high-quality products recommended by healthcare professionals, ensuring safe and effective use.

The availability of a comprehensive range of pregnancy-related products, including stretch mark creams, maternity vitamins, and orthopedic aids, further supports this segment’s growth. Additionally, hospital pharmacies benefit from direct patient access during consultations and routine check-ups, making them a convenient distribution channel.

As healthcare infrastructure continues to expand, particularly in emerging economies, the hospital pharmacies segment is projected to play a crucial role in meeting the rising demand for pregnancy products.

Key Market Segments

By Product Type

- Stretch Mark Minimizers

- Toning & Body Firming Gel

- Pregnancy Test Kits

- Restructuring Gel

- Others

By Application

- Urinary Incontinence

- Orthopaedic Care

- Breast Cancer Care

- Pelvic Pain

- Pregnancy & Postpartum Care

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Drivers

Increasing Adoption of Caesarean Delivery

The rising adoption of caesarean deliveries significantly drives the demand for pregnancy products as more women seek post-operative care and recovery solutions. Caesarean deliveries often require specialized products, such as scar creams, postpartum support belts, and nursing essentials, to aid recovery and ensure comfort. According to a report from the Centers for Disease Control and Prevention published in April 2024, the caesarean delivery rate in the United States increased from 32.1% in 2022 to 32.4% in 2023.

This growth reflects an ongoing trend toward surgical births, which frequently necessitate targeted postpartum care. As more healthcare providers recommend tailored products to aid in recovery, the market for pregnancy-related products is anticipated to expand. This trend also aligns with growing consumer awareness about the importance of postnatal care. Consequently, the increased prevalence of surgical deliveries is likely to bolster demand for innovative pregnancy products that address the unique needs of caesarean mothers.

Restraints

Rising Lack of Awareness

Rising lack of awareness about the availability and benefits of pregnancy products restrains the market, particularly in developing regions. Many expectant mothers remain unaware of essential products that could improve their comfort and well-being during and after pregnancy. This limited awareness stems from insufficient education, inadequate healthcare guidance, and cultural factors that prioritize traditional methods over modern solutions.

The absence of targeted marketing strategies and outreach initiatives further hampers product adoption, especially among first-time mothers who might not recognize their specific needs. Healthcare providers and retailers play a critical role in bridging this gap, but inconsistent recommendations often leave women without clear guidance.

This lack of information can prevent women from seeking products that alleviate pregnancy-related discomforts or aid in postpartum recovery. Consequently, the lack of awareness is anticipated to impede market growth by limiting product penetration and reducing demand.

Opportunities

Rising Prevalence of Urinary Tract Infections (UTIs)

The growing prevalence of urinary tract infections (UTIs) during pregnancy presents a significant opportunity for the pregnancy products market as women increasingly seek preventive and supportive care. UTIs commonly affect expectant mothers due to hormonal changes and pressure on the urinary tract, necessitating specialized care products to ensure comfort and hygiene.

According to a July 2023 study in the International Journal of Gynecology & Obstetrics, 35-67% of women experience urinary incontinence during pregnancy, while 15-45% continue to face it postpartum. This widespread prevalence highlights the demand for incontinence care solutions designed specifically for pregnant and postpartum women.

These products, including absorbent pads, antimicrobial wipes, and comfortable undergarments, help women manage their condition while maintaining their daily routines. As awareness of pregnancy-related UTIs and their management grows, the demand for targeted care solutions is expected to rise, creating growth opportunities for manufacturers. This trend aligns with a broader focus on improving maternal health and hygiene.

Impact of Macroeconomic / Geopolitical Factors

Economic factors play a crucial role in shaping the pregnancy products market. In developed regions, economic growth boosts consumer purchasing power, leading to increased expenditure on maternity care products. Conversely, economic downturns and inflation in emerging markets reduce disposable income, which may decrease demand for non-essential pregnancy-related items.

Geopolitical tensions and trade restrictions pose significant challenges by disrupting global supply chains. This disruption results in delays and elevated costs for both manufacturers and consumers. Additionally, varying regulatory landscapes across regions complicate compliance, impacting product availability and market entry strategies.

On a positive note, increasing awareness of maternal health and supportive government policies in various countries bolster the adoption of pregnancy care products. The expansion of healthcare infrastructure and a greater emphasis on prenatal care create opportunities for market growth. This environment encourages innovation and investment in the sector, promising developments for the future.

Trends

Impact of High Incidence of Miscarriages

High miscarriage rates have heightened awareness among women regarding the importance of prenatal care, leading to increased demand for pregnancy products. An estimated 23 million miscarriages occur annually worldwide, underscoring the need for effective maternal health solutions. This trend has prompted healthcare providers and expectant mothers to prioritize products that support healthy pregnancies, such as prenatal vitamins, nutritional supplements, and monitoring devices.

Manufacturers are responding by developing innovative products aimed at reducing miscarriage risks and promoting maternal well-being. Growing emphasis on early detection and prevention of pregnancy complications is anticipated to drive the adoption of specialized maternity care items. As awareness of maternal health issues continues to rise, the pregnancy products market is likely to experience sustained growth, with a focus on enhancing the safety and health of both mothers and their unborn children.

Regional Analysis

North America is leading the Pregnancy Products Market

North America dominated the market with the highest revenue share of 39.6% owing to increased awareness of maternal health and enhanced support services. The White House Blueprint for Addressing the Maternal Health Crisis reported that over 2,000 facilities were recognized as “Birthing Friendly,” committing to improved maternity care quality.

Additionally, the launch of the National Maternal Mental Health Hotline provided immediate support, resources, and referrals for behavioral health issues during pregnancy and childbirth. These initiatives have heightened consumer awareness and demand for products that support maternal well-being. The proliferation of prenatal vitamins, maternity wear, and nursing accessories reflects this trend.

Furthermore, the integration of technology into pregnancy products, such as wearable devices monitoring fetal health, has attracted tech-savvy consumers seeking comprehensive prenatal care solutions. The combination of policy support, increased healthcare services, and consumer interest in maternal health has collectively propelled the market’s expansion.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to improvements in healthcare infrastructure and increased focus on maternal and child health. In February 2024, the State Council of the People’s Republic of China reported the establishment of over 18,000 medical consortia in 2023, aimed at enhancing community healthcare accessibility.

Additionally, China’s National Health Commission announced the creation of 3,491 critical maternal and obstetric care centers nationwide, focusing on the treatment of critical maternal and neonatal cases. These developments are anticipated to increase the demand for pregnancy-related products, including prenatal supplements, maternity apparel, and infant care items. Rising disposable incomes and growing health consciousness among expectant mothers are likely to further drive market expansion.

The adoption of e-commerce platforms in the region is expected to facilitate access to a wider range of pregnancy products, catering to diverse consumer preferences. Collaborations between international brands and local manufacturers are projected to introduce innovative products tailored to the specific needs of the Asia Pacific market, supporting its growth trajectory.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the pregnancy products market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning. Key players in the pregnancy products market focus on diversifying their offerings to include items that cater to various stages of maternity, such as skincare, nutritional supplements, and support wear.

Many invest in research to develop innovative, safe, and organic solutions that meet the growing demand for natural products. Strategic partnerships with healthcare providers and retail chains help expand distribution channels and improve product accessibility. Companies also target digital platforms, leveraging e-commerce and social media to reach a wider audience. Educational campaigns emphasizing maternal health and wellness further drive consumer engagement and brand loyalty.

Top Key Players in the Pregnancy Products Market

- Novena Maternity

- Noodle & Boo.

- Mama Mio U.S. Inc.

- Lansinoh Laboratories

- Expanscience Laboratories, Inc.

- T. Browne Drug Co., Inc.

- Clarins Group

Recent Developments

- In August 2023: Lansinoh Laboratories launched the Lansinoh Wearable Pump, designed to empower breastfeeding mothers by offering a hands-free, portable pumping solution. This innovation caters to the increasing demand for convenient, on-the-go breastfeeding products, contributing to the growth of the pregnancy products market as modern mothers seek solutions that align with their active lifestyles.

- In September 2022: Mama Mio U.S. Inc. introduced Pink Tummy Rub Butter in collaboration with CoppaFeel, aiming to raise awareness about breast cancer. The product is formulated to improve skin elasticity and moisture while protecting against stretch marks, addressing key concerns during pregnancy. This launch not only expands Mama Mio’s product offerings but also reinforces the market trend toward multifunctional pregnancy products that promote both skin health and awareness of broader health issues.

Report Scope

Report Features Description Market Value (2023) US$ 2.3 billion Forecast Revenue (2033) US$ 4.0 billion CAGR (2024-2033) 5.8% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Stretch Mark Minimizers, Toning & Body Firming Gel, Pregnancy Test Kits, Restructuring Gel, and Others), By Application (Urinary Incontinence, Orthopaedic Care, Breast Cancer Care, Pelvic Pain, and Pregnancy & Postpartum Care), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Novena Maternity, Noodle & Boo., Mama Mio U.S. Inc., Lansinoh Laboratories, Expanscience Laboratories, Inc., E.T. Browne Drug Co., Inc., and Clarins Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Novena Maternity

- Noodle & Boo.

- Mama Mio U.S. Inc.

- Lansinoh Laboratories

- Expanscience Laboratories, Inc.

- T. Browne Drug Co., Inc.

- Clarins Group