Assisted Reproductive Technology Market By Type (In-Vitro Fertilization (IVF) (Frozen Non-Donor, Frozen Donor, Fresh Non-Donor, and Fresh Donor) and Artificial Insemination (Intravaginal Insemination (IVI), Intrauterine Insemination (IUI), Intratubal Insemination (ITI), and Intracervical Insemination (ICI))), By End-User (Fertility Clinics & Other Facilities and Hospitals & Other Settings), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 63178

- Number of Pages: 297

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

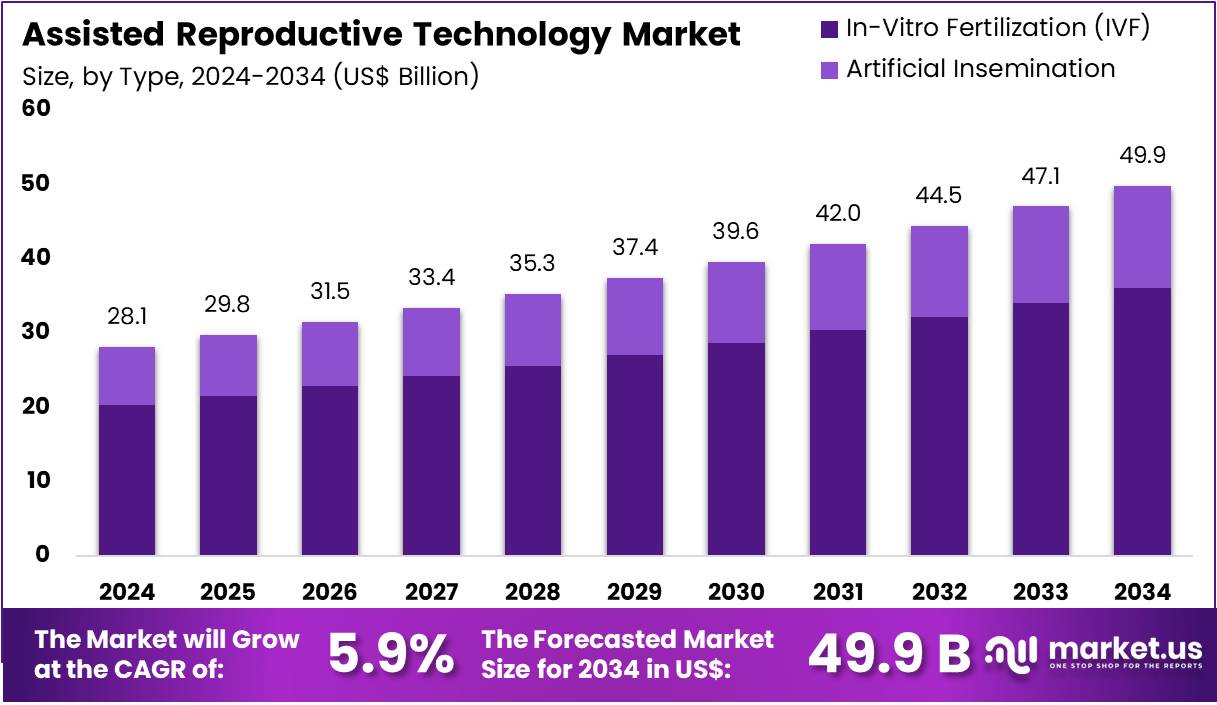

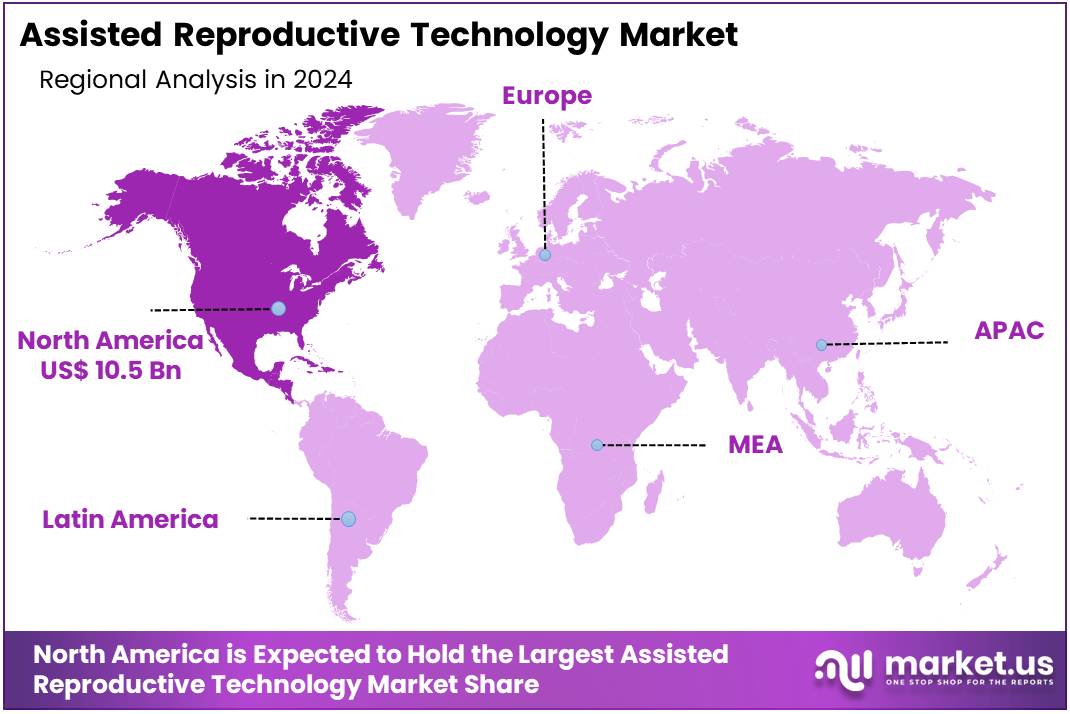

The Global Assisted Reproductive Technology Market Size is expected to be worth around US$ 49.9 Billion by 2034, from US$ 28.1 Billion in 2024, growing at a CAGR of 5.9% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 37.5% share and holds US$ 10.5 Billion market value for the year.

Growing global infertility rates are significantly driving the expansion of the assisted reproductive technology (ART) market. In 2021, approximately 186 million people worldwide were affected by infertility, highlighting a substantial and persistent demand for effective fertility treatments. This prevalent health challenge, coupled with societal shifts towards delayed childbearing and an increasing understanding of reproductive health issues, creates a robust foundation for market growth. The increased maternal age, for instance, leads to a significant rise in infertility, with the share of women unable to conceive jumping from 17% at age 40 to 56% at age 45.

Opportunities within the ART market are burgeoning due to continuous technological advancements and innovations. Enhanced genetic screening techniques, such as preimplantation genetic testing (PGT), are improving success rates; for women under 35, IVF with PGT can achieve clinical pregnancy rates often exceeding 40-50% per embryo transfer. Furthermore, progress in cryopreservation techniques for gametes and embryos, specifically vitrification, boasts post-thawing survival rates of approximately 90% for eggs and embryos, and approximately 70-80% of thawed eggs are successfully fertilized, significantly increasing the chances of pregnancy. These advancements collectively expand the applicability and efficacy of ART procedures.

Recent trends underscore a commitment to personalized medicine and enhanced patient experience within the ART landscape. The integration of artificial intelligence (AI) is proving transformative, allowing for more precise embryo selection, optimized treatment protocols, and improved prediction of IVF success rates, with some studies indicating AI can enhance creative productivity by 25% and increase value by 50% in related fields.

In November 2024, SpOvum launched its cutting-edge AI-driven platform, SpOvum ARTGPT, specifically designed to revolutionize patient interactions within the ART field by providing innovative solutions for an improved patient experience, ranging from initial consultations to post-treatment support. These developments are making ART more accessible, efficient, and tailored to individual patient needs across various applications like in vitro fertilization (IVF), intracytoplasmic sperm injection (ICSI), and fertility preservation.

Key Takeaways

- In 2024, the market for assisted reproductive technology generated a revenue of US$ 28.1 billion, with a CAGR of 5.9%, and is expected to reach US$ 49.9 billion by the year 2034.

- The type segment is divided into in-vitro fertilization (IVF) and artificial insemination, with in-vitro fertilization (IVF) taking the lead in 2023 with a market share of 72.5%.

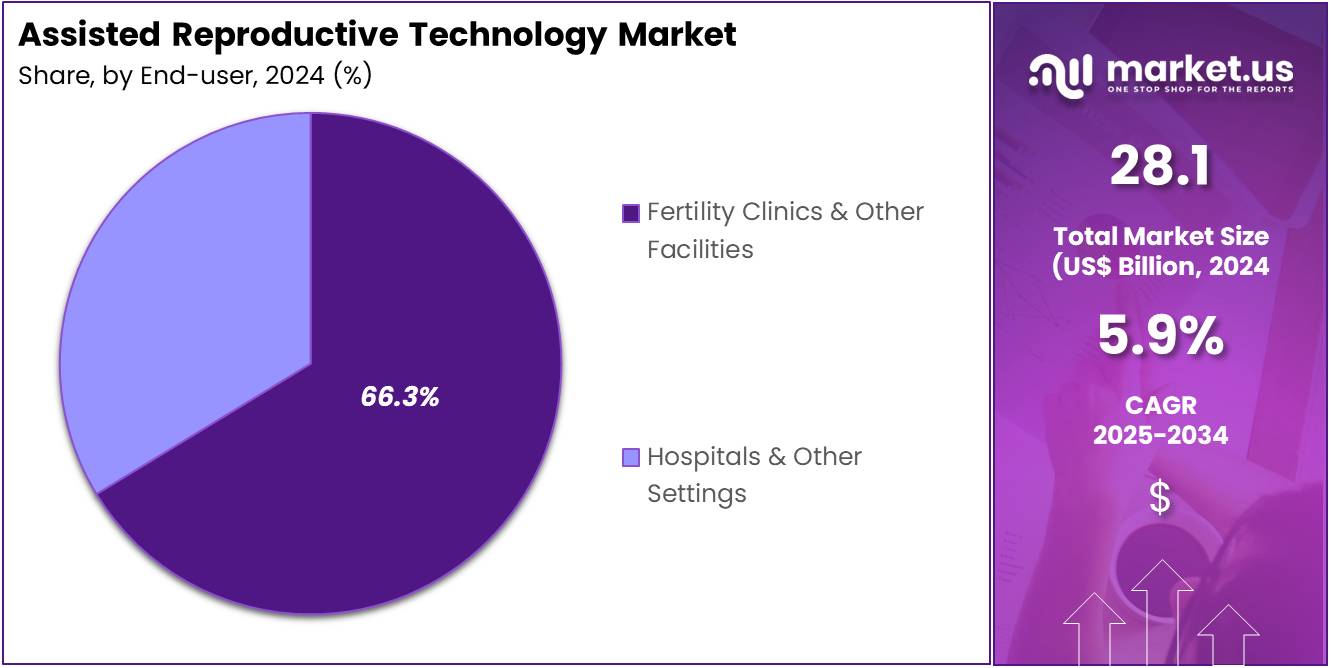

- Considering end-user, the market is divided into fertility clinics & other facilities and hospitals & other settings. Among these, fertility clinics & other facilities held a significant share of 66.3%.

- North America led the market by securing a market share of 37.5% in 2023.

Type Analysis

In-Vitro Fertilization (IVF) accounts for 72.5% of the market share in the assisted reproductive technology (ART) sector. The growth of this segment is expected to continue as IVF remains one of the most effective solutions for infertility treatment, particularly for individuals with blocked fallopian tubes, male factor infertility, or unexplained infertility. The increasing global prevalence of infertility, combined with delayed pregnancies due to lifestyle and societal factors, is driving the demand for IVF treatments.

As IVF success rates improve through advancements in techniques like genetic screening and embryo freezing, more patients are likely to opt for IVF as a preferred method of assisted reproduction. Furthermore, the increasing affordability and accessibility of IVF, especially in emerging markets, are anticipated to expand the market. As reproductive health becomes a greater priority worldwide, IVF is expected to remain a dominant choice in ART treatments, ensuring continued market growth.

End-User Analysis

Fertility clinics & other facilities represent the largest end-user segment in the assisted reproductive technology market, holding 66.3% of the market share. The demand for fertility clinics is expected to grow as they specialize in offering personalized ART treatments, including IVF, artificial insemination, and egg/sperm donation, catering to the specific needs of patients. The increasing availability of specialized care, combined with shorter wait times and focused expertise, makes fertility clinics a go-to choice for individuals seeking assisted reproduction services.

Moreover, fertility clinics are expected to continue benefiting from advancements in reproductive technologies, such as egg freezing and preimplantation genetic testing, which improve success rates and patient outcomes. As the global acceptance of ART grows and infertility treatments become more widely accessible, fertility clinics are likely to remain at the forefront of the market, ensuring continued expansion. Additionally, the rising number of clinics offering comprehensive services, from diagnosis to post-treatment care, is anticipated to further drive this segment’s growth.

Key Market Segments

By Type

- In-Vitro Fertilization (IVF)

- Frozen Non-Donor

- Frozen Donor

- Fresh Non-Donor

- Fresh Donor

- Artificial Insemination

- Intravaginal Insemination (IVI)

- Intrauterine Insemination (IUI)

- Intratubal Insemination (ITI)

- Intracervical Insemination (ICI)

By End-User

- Fertility Clinics & Other Facilities

- Hospitals & Other Settings

Drivers

Rising Infertility Rates are driving the market

The increasing global prevalence of infertility is a primary driver for the assisted reproductive technology (ART) market. Lifestyle changes, environmental factors, and delayed parenthood contribute significantly to this trend, compelling more individuals and couples to seek fertility treatments. The World Health Organization (WHO) reported in 2023 that approximately 1 in 6 people globally are affected by infertility, impacting both men and women. This widespread issue creates a consistent and growing demand for ART procedures like in vitro fertilization (IVF), intracytoplasmic sperm injection (ICSI), and others.

Furthermore, a demographic shift towards delaying childbirth, particularly in developed nations, contributes to higher infertility rates. For instance, in the United States, the average age of first-time mothers has steadily increased, with those giving birth in 2022 averaging older than 29 years, up from 1970. This delay often leads to a decline in natural fertility, increasing the need for reproductive interventions. As awareness of ART solutions grows and societal acceptance improves, more individuals are opting for these treatments to build their families, fueling the market’s expansion.

Restraints

High Cost of ART Procedures is restraining the market

The substantial cost associated with assisted reproductive technology procedures acts as a significant restraint on market growth, particularly in regions with limited or no public funding and insurance coverage. A single cycle of IVF can range significantly depending on the country and clinic, with additional procedures like genetic testing or cryopreservation further escalating expenses.

In India, for example, the average IVF cost in 2024 ranged from Rs 90,000 to Rs 1,50,000, with additional procedures like ICSI potentially adding up to Rs 1,50,000 per cycle. Many patients require multiple cycles to achieve a successful pregnancy, multiplying the financial burden. This high out-of-pocket expenditure makes ART inaccessible for a large segment of the population, even in countries with a high prevalence of infertility. The absence of comprehensive insurance coverage for these treatments in many parts of the world forces patients to bear the full cost, creating a significant barrier to entry and limiting the overall market penetration of advanced reproductive services.

Opportunities

Advancements in Fertility Preservation are creating growth opportunities

The ongoing advancements and increasing adoption of fertility preservation techniques are creating significant growth opportunities within the assisted reproductive technology market. These techniques, such as egg freezing (oocyte cryopreservation) and sperm freezing (sperm cryopreservation), allow individuals to preserve their reproductive potential for future use, often before medical treatments like cancer therapy or for social reasons like delaying parenthood.

Demand for egg freezing, specifically, is soaring, showing nearly a 40% year-over-year increase in cycles from 2022 to 2023. This reflects changing priorities, including career focus and further education, leading women to delay childbearing. For individuals facing medical conditions that could impair fertility, such as cancer patients, fertility preservation offers a crucial option to ensure future family-building possibilities.

The American Society of Clinical Oncology (ASCO) updated its guidelines in March 2025, emphasizing the importance of discussing fertility preservation with cancer patients at diagnosis. As awareness about these options grows and techniques become more refined and successful, more individuals are opting for fertility preservation, expanding the scope and revenue potential of the broader ART market.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the assisted reproductive technology market. Economic downturns directly impact disposable income, which is crucial for individuals considering expensive ART procedures that often lack comprehensive insurance coverage. In such periods, elective medical procedures, including fertility treatments, may see a decline as consumers prioritize essential spending.

Conversely, robust economic growth fosters increased healthcare spending, both by individuals and potentially through government or employer-sponsored benefits, facilitating greater access to fertility services. For instance, national health expenditures in the US are projected to have grown by 8.2% in 2024, reflecting a continued rebound in healthcare utilization.

Geopolitical instabilities, such as trade conflicts or regional disputes, can disrupt the global supply chain for critical ART equipment, reagents, and pharmaceuticals. These disruptions lead to increased costs, delays in product availability, and potential shortages of essential components, affecting treatment accessibility and pricing. However, these challenges also spur innovation and drive efforts towards diversifying supply chains and fostering localized production, ultimately enhancing the resilience of the reproductive healthcare sector in the long run.

Current US tariffs on imported medical devices and pharmaceutical components directly impact the assisted reproductive technology market. These tariffs raise the cost of essential equipment, laboratory consumables, and specialized media used in fertility clinics, as many of these products are sourced globally. As a result, clinics might face higher operational expenses, which they often pass on to patients through increased treatment costs, making ART less affordable.

For example, while specific tariffs on ART products are not always explicitly stated, the broader impact of tariffs on the medical device industry is clear; for instance, the American Hospital Association reported that the United States imported over $75 billion in medical devices and supplies in 2024, with new tariffs in April 2025 potentially adding significant costs to these imports. This economic pressure on supply chains can delay the adoption of new technologies and limit the expansion of services.

However, these tariffs also encourage domestic manufacturing and investment in local production capabilities. This could lead to a more resilient and self-sufficient US ART supply chain, potentially fostering innovation and creating new job opportunities within the country’s reproductive healthcare sector in the long term.

Latest Trends

Integration of Preimplantation Genetic Testing (PGT) is a recent trend

A prominent recent trend in the assisted reproductive technology market is the increasing integration of Preimplantation Genetic Testing (PGT) into IVF cycles. PGT allows for the genetic screening of embryos before implantation, identifying chromosomal abnormalities (PGT-A) or specific genetic disorders (PGT-M, PGT-SR). This helps improve pregnancy success rates by selecting healthier embryos and reducing the risk of transmitting genetic diseases to offspring.

The demand for PGT is growing due to the increasing incidence of single-gene and chromosomal disorders, coupled with greater awareness among prospective parents. In 2024, the preimplantation genetic diagnosis (PGD) segment, a component of PGT-M, contributed 77.14% of the market share within the overall preimplantation genetic testing market, driven by rising awareness among healthcare professionals and consumers about testing for specific gene mutations.

The launch of new tests based on next-generation sequencing (NGS) for PGT-A by companies like Thermo Fisher Scientific in July 2023, and Eurofins Genoma’s niPGT-A solution in September 2022, highlights the technological advancements in this area. This trend offers a more personalized approach to fertility treatment, minimizing the emotional and financial burden of failed IVF cycles and the birth of children with genetic conditions.

Regional Analysis

North America is leading the Assisted Reproductive Technology Market

The assisted reproductive technology (ART) market in North America, which accounts for 37.5% of the global market share, witnessed significant growth in 2024, propelled by rising infertility rates, increasing awareness and acceptance of fertility treatments, and favorable healthcare infrastructure. Data from the Society for Assisted Reproductive Technology (SART) shows a consistent upward trend in ART cycles and live births. In 2023, the total number of IVF cycles performed at 371 reporting SART member clinics in the United States increased to 432,641, up from 389,993 cycles in 2022. These cycles resulted in 95,860 babies born in 2023, an increase from 91,771 in 2022, accounting for 2.6% of all births in the United States. This indicates a growing reliance on ART to achieve pregnancies.

The decline in the overall U.S. fertility rate, which reached a historic low in 2023, also contributes to the increased demand for fertility services as individuals and couples seek alternative paths to parenthood. Furthermore, improved access to advanced healthcare facilities and the expanding coverage of fertility treatments by employers, as seen with large companies offering benefits for egg freezing and other services, further bolstered market expansion in the region.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

The assisted reproductive technology market in Asia Pacific is anticipated to demonstrate robust growth during the forecast period, driven by escalating infertility rates, increasing disposable incomes, and the expansion of fertility clinics. The estimated lifetime prevalence of infertility is highest in the Western Pacific Region, indicating a substantial patient pool requiring fertility interventions. Governments across the region are increasingly recognizing the importance of addressing infertility, with some countries implementing supportive policies and funding programs to improve access to fertility treatments.

For instance, countries like China and India are pivotal to this growth, offering more affordable treatments, which also attracts medical tourism. Technological advancements in reproductive medicine are expected to further propel market expansion. This includes innovations in in vitro fertilization (IVF) techniques, such as time-lapse imaging for embryo selection and advancements in preimplantation genetic testing, which improve success rates and patient outcomes.

The continuous development of new and more efficient procedures, combined with a growing acceptance of fertility treatments within Asian societies, projects a strong growth trajectory for the reproductive technology sector in this dynamic region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the reproductive technology market proactively drive growth through strategic initiatives like vertical integration, encompassing diagnostics, lab testing, genetic screening, cryopreservation, and fertility procedures under a unified umbrella to streamline patient experiences and enhance clinical outcomes. They prioritize personalized fertility pathways, leveraging AI and big data for tailored treatment protocols, predictive modeling, and data-informed embryo selection, improving efficiency and effectiveness.

Furthermore, these companies expand into adjacent services such as egg freezing, fertility preservation for cancer patients, and LGBTQ+ reproductive services, diversifying their offerings. Technological advancements, including next-generation sequencing and time-lapse embryo imaging, significantly improve implantation rates and reduce miscarriage risks. Finally, market leaders actively engage in consolidation, forming networks through private equity investments to capitalize on economies of scale and standardize protocols, further increasing service consistency.

CooperCompanies, Inc. operates through two business units: CooperVision and CooperSurgical. CooperSurgical focuses on women’s health and fertility, providing a diverse portfolio of products and services globally. This includes offerings for office and surgical products, as well as a comprehensive suite of fertility solutions, such as media, genetic testing, and cryopreservation products and services.

CooperSurgical consistently emphasizes innovation, acquiring companies that enhance its product lines and service capabilities within the reproductive health sector. For instance, in December 2021, CooperCompanies completed the acquisition of Generate Life Sciences, significantly expanding its presence in cryo-storage and reproductive tissue services. Their strategic focus remains on supporting medical professionals and patients across the continuum of reproductive health.

Top Key Players in the Assisted Reproductive Technology Market

- Vitrolife AB

- Thermo Fisher Scientific, Inc

- The Cooper Companies, Inc

- Progyny Inc

- Oxford Gene Technology

- Millendo Therapeutics, Inc

- Merck KGaA (EMD Serono, Inc)

- Genera Biomedx

- Conceive Fertility Foundation

- Astorg

Recent Developments

- In March 2025, Astorg, a prominent pan-European private equity firm, unveiled Nexpring Health, a global MedTech company focused on advancing Assisted Reproductive Technology (ART).

- In April 2025, the Conceive Fertility Foundation, in collaboration with the Wyatt Foundation, introduced the 025 IVF Grant Program. This initiative is designed to raise awareness about infertility, alleviate treatment costs for patients with financial constraints, and promote research into more affordable fertility care solutions.

Report Scope

Report Features Description Market Value (2024) US$ 28.1 billion Forecast Revenue (2034) US$ 49.9 billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (In-Vitro Fertilization (IVF) (Frozen Non-Donor, Frozen Donor, Fresh Non-Donor, and Fresh Donor) and Artificial Insemination (Intravaginal Insemination (IVI), Intrauterine Insemination (IUI), Intratubal Insemination (ITI), and Intracervical Insemination (ICI))), By End-User (Fertility Clinics & Other Facilities and Hospitals & Other Settings) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Vitrolife AB, Thermo Fisher Scientific, Inc, The Cooper Companies, Inc, Progyny Inc, Oxford Gene Technology, Millendo Therapeutics, Inc, Merck KGaA (EMD Serono, Inc), Genera Biomedx, Conceive Fertility Foundation, Astorg. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Assisted Reproductive Technology MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Assisted Reproductive Technology MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Vitrolife AB

- Thermo Fisher Scientific, Inc

- The Cooper Companies, Inc

- Progyny Inc

- Oxford Gene Technology

- Millendo Therapeutics, Inc

- Merck KGaA (EMD Serono, Inc)

- Genera Biomedx

- Conceive Fertility Foundation

- Astorg