KRAS Inhibitor Market By Cancer Type (Lung Cancer, Colorectal Cancer, Pancreatic Cancer, and Others), By End-user (Hospitals, Clinic Laboratories, Cancer Research Institutes, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133937

- Number of Pages: 362

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

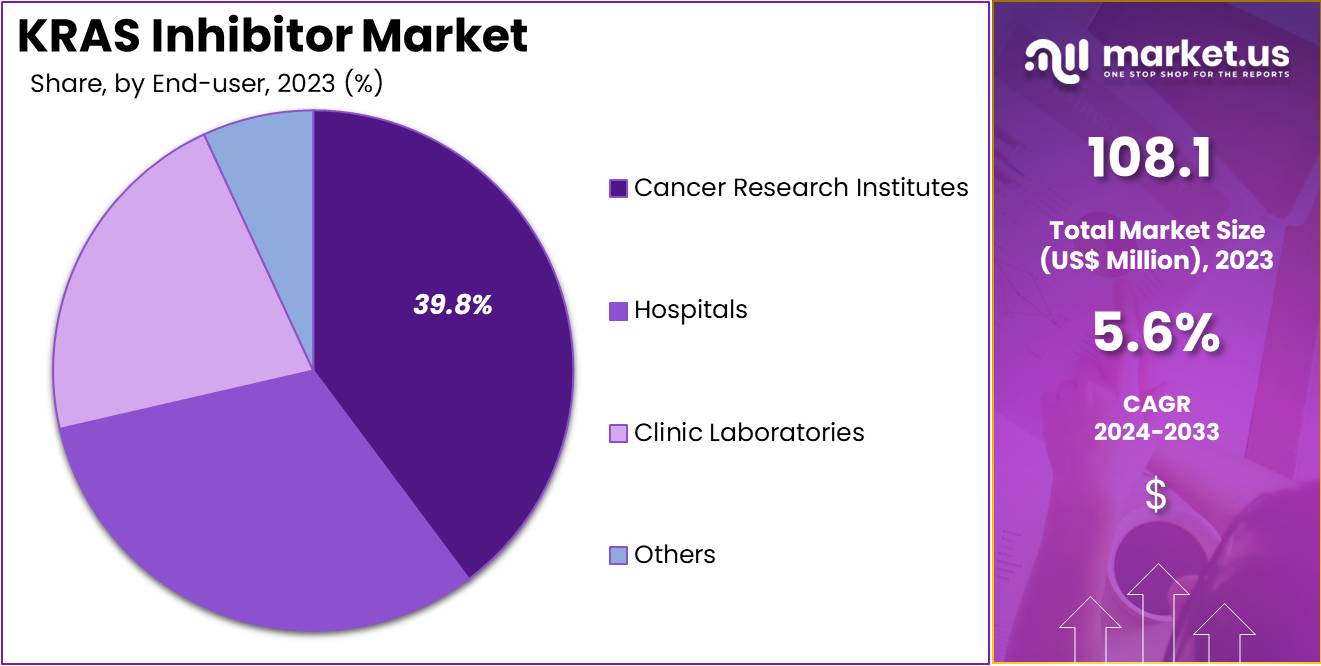

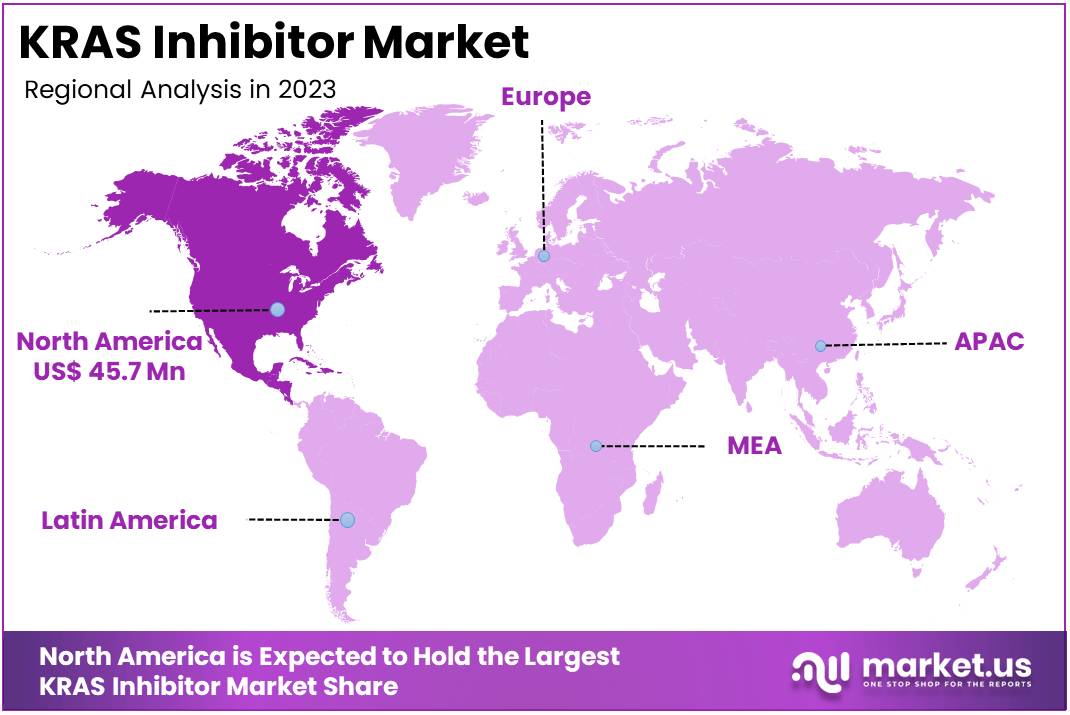

The Global KRAS Inhibitor Market Size is expected to be worth around US$ 186.4 Million by 2033, from US$ 108.1 Million in 2023, growing at a CAGR of 5.6% during the forecast period from 2024 to 2033. North America maintained a leading market position, accounting for over 42.3% of the market share, with a total value of US$ 45.7 million.

Rising interest in targeted cancer therapies is driving the growth of the KRAS inhibitor market. KRAS mutations are common drivers of several aggressive cancers, including non-small cell lung cancer, pancreatic cancer, and colorectal cancer.

The growing understanding of the molecular mechanisms behind KRAS-driven tumors has spurred the development of inhibitors that specifically target the KRAS protein, offering new treatment possibilities for patients with previously limited options. In February 2023, Nested Therapeutics announced the nomination of its first development candidate, a novel KRAS inhibitor targeting the RAS/MAPK pathway. This candidate holds potential as a first-in-class treatment, providing a promising therapeutic option for cancers driven by KRAS mutations.

The FDA’s approval of combination therapies, such as Tukysa (tucatinib) with trastuzumab in January 2023, demonstrates the increasing focus on combination approaches in treating complex cancer types like HER2-positive colorectal cancer. These approvals underscore the growing importance of precision medicine in oncology, highlighting opportunities for KRAS inhibitors to complement existing therapies.

Recent trends show heightened investment in research aimed at overcoming challenges associated with KRAS mutations, with pharmaceutical companies focusing on developing next-generation inhibitors that improve efficacy and minimize resistance. The expanding pipeline of KRAS-targeted treatments and the integration of biomarker testing into clinical practice further open up significant opportunities for market growth. As research progresses, the KRAS inhibitor market is poised for continued innovation, driven by advancements in both molecular biology and drug development strategies.

Key Takeaways

- In 2023, the market for KRAS inhibitor generated a revenue of US$ 108.1 million, with a CAGR of 5.6%, and is expected to reach US$ 186.4 million by the year 2033.

- The cancer type segment is divided into lung cancer, colorectal cancer, pancreatic cancer, and others, with lung cancer taking the lead in 2023 with a market share of 42.3%.

- Considering end-user, the market is divided into hospitals, clinic laboratories, cancer research institutes, and others. Among these, cancer research institutes held a significant share of 39.8%.

- North America led the market by securing a market share of 42.3% in 2023.

Cancer Type Analysis

The lung cancer segment led in 2023, claiming a market share of 42.3% owing to the increasing prevalence of lung cancer and the promising potential of KRAS inhibitors in treating this challenging disease. Lung cancer, particularly non-small cell lung cancer (NSCLC), is projected to remain one of the most common and deadly cancer types globally, driving the demand for effective therapies.

KRAS mutations, which are found in a significant portion of NSCLC cases, have long been a therapeutic target. Recent breakthroughs in developing KRAS inhibitors are anticipated to revolutionize treatment for these patients, offering hope for improved survival rates.

As clinical trials demonstrate the efficacy of KRAS inhibitors in overcoming these mutations, the lung cancer segment is likely to see rapid growth in market share. The increasing number of patients diagnosed with lung cancer, coupled with advancements in targeted therapies, is expected to contribute to the segment’s expansion in the coming years.

End-user Analysis

The cancer research institutes held a significant share of 39.8% due to the increasing investment in cancer research and the need for novel therapies. Research institutions are expected to play a critical role in advancing the development of KRAS inhibitors, as they conduct preclinical and clinical studies aimed at understanding the underlying mechanisms of KRAS mutations in various cancers.

With the rising number of cancer research initiatives and the growing focus on precision medicine, research institutes are anticipated to be key drivers of innovation in KRAS-targeted therapies. Furthermore, the collaboration between pharmaceutical companies and academic institutions is likely to accelerate the discovery and clinical application of KRAS inhibitors. As cancer research institutes continue to focus on developing effective therapies for cancers with high unmet needs, such as lung and pancreatic cancer, the segment is expected to see sustained growth.

Key Market Segments

By Cancer Type

- Lung Cancer

- Colorectal Cancer

- Pancreatic Cancer

- Others

By End-user

- Hospitals

- Clinic Laboratories

- Cancer Research Institutes

- Others

Drivers

Increase in Clinical Trials Driving the KRAS Inhibitor Market

The increase in clinical trials is driving the KRAS inhibitor market by accelerating the development and validation of new treatments. In April 2023, Innovent Biologics, Inc. presented the latest findings from its Phase 1 clinical trial for IBI351 (GFH925), a KRASG12C inhibitor, at the American Association for Cancer Research (AACR) Annual Meeting.

These updated results, shared through an oral presentation, highlighted the potential of this compound to treat various cancers. As the number of clinical trials targeting KRAS mutations grows, new data are expected to emerge, driving interest in these inhibitors as part of targeted cancer therapies. The rising investment in clinical research reflects a broader commitment to addressing KRAS-driven cancers, which have historically been difficult to treat.

The positive outcomes from these trials are anticipated to increase investor confidence and accelerate the approval process for KRAS inhibitors. Clinical trials are likely to continue playing a central role in expanding the therapeutic options available for cancer patients, thus fueling the growth of the market for these inhibitors.

Restraints

High Development Costs Restraining the KRAS Inhibitor Market

High development costs are expected to restrain the growth of the KRAS inhibitor market. The development of KRAS inhibitors requires significant financial investment due to the complex nature of drug discovery and the rigorous clinical testing required for approval. These inhibitors must undergo multiple stages of testing, including preclinical trials, Phase 1, Phase 2, and Phase 3 trials, all of which require substantial resources.

The costs associated with clinical trials, regulatory approval, and manufacturing are anticipated to impede the pace at which new KRAS inhibitors enter the market. Additionally, the specialized nature of these therapies and their focus on specific mutations further increase the cost of development. Smaller biotechnology companies, in particular, may face challenges in securing the necessary funding to advance these inhibitors to commercialization.

These high costs could limit access to KRAS inhibitors, particularly in developing countries or for patients without adequate healthcare coverage, thus hampering the broader adoption of these promising treatments.

Opportunities

Growing Prevalence of Cancer Creating Opportunities for the KRAS Inhibitor Market

The growing prevalence of cancer is creating significant opportunities for the KRAS inhibitor market. According to the American Cancer Society, cancer incidence rates are projected to rise steadily over the next decade, contributing to a higher demand for effective therapies. In June 2022, Erasca, Inc., a clinical-stage precision oncology company, announced plans to initiate a clinical trial evaluating the combination of its KRAS G12C inhibitor with the ERK1/2 inhibitor ERAS-007 for patients with non-small cell lung cancer (NSCLC) and colorectal cancer (CRC).

These cancers are often driven by KRAS G12C mutations, and targeting this specific mutation with precision therapies has the potential to improve patient outcomes. As the number of cancer diagnoses continues to rise, especially among populations with KRAS mutations, the need for targeted therapies like KRAS inhibitors will increase.

The growing number of patients eligible for KRAS-targeted treatments is expected to drive demand for these inhibitors, offering substantial market growth opportunities. The focus on personalized medicine is likely to further enhance the demand for KRAS inhibitors as clinicians seek more effective treatment options for patients with specific genetic profiles.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the KRAS inhibitor market, affecting both the availability and affordability of these advanced cancer treatments. Economic slowdowns can lead to reduced healthcare budgets, which may hinder the uptake of costly treatments like KRAS inhibitors, limiting their accessibility to patients in certain regions. Conversely, periods of economic growth and higher healthcare spending can drive demand for novel cancer therapies.

Geopolitical factors, such as trade restrictions, regulatory changes, and political instability, can disrupt global supply chains, delay drug development timelines, or increase production costs. However, the rising global incidence of cancers associated with the KRAS mutation, combined with increasing investments in cancer research and development, creates a positive outlook.

The continued focus on personalized medicine and innovative therapies further supports market expansion. As new breakthroughs in oncology emerge, the KRAS inhibitor market is poised for growth, driven by both demand and advancements in cancer treatment.

Trends

Rising Collaborations and Partnerships Driving the KRAS Inhibitor Market

Rising collaborations and partnerships are driving significant growth in the KRAS inhibitor market. These strategic alliances enable companies to combine resources and expertise to accelerate the development of targeted therapies for cancers with KRAS mutations. By working together, partners can enhance the speed and efficiency of clinical trials, ultimately bringing innovative cancer treatments to market faster. This trend is particularly notable in the context of personalized cancer therapies aimed at patients with specific KRAS mutations, such as KRAS G12C.

For example, in January 2022, BridgeBio Pharma, Inc. and Amgen Inc. entered a non-exclusive clinical collaboration. The partnership focuses on investigating the combination of BBP-398, a SHP2 inhibitor, and LUMAKRAS (sotorasib), a KRASG12C inhibitor. This collaboration targets advanced solid tumors harboring the KRAS G12C mutation, a major focus area for KRAS inhibitor research. Such partnerships are expected to fast-track the development of new, effective treatments for this patient group.

Similarly, in February 2021, Mirati Therapeutics formed a partnership with the University of Texas MD Anderson Cancer Center. This collaboration aims to expand research on investigational KRAS inhibitors like adagrasib (MRTX849) and MRTX1133. These inhibitors show promise in treating cancers with KRAS mutations, including non-small cell lung cancer. As these partnerships continue to grow, the KRAS inhibitor market is poised for accelerated development, with a greater number of treatment options expected to become available for patients.

Regional Analysis

North America is leading the KRAS Inhibitor Market

North America dominated the market with the highest revenue share of 42.3% owing to breakthroughs in precision oncology and the increasing prevalence of cancers with KRAS mutations. The approval of LUMAKRAS (sotorasib) by the U.S. Food and Drug Administration (FDA) in 2021 marked a pivotal moment in the market.

This small molecule targeting KRAS became the first approved therapy for metastatic non-small cell lung cancer (NSCLC) patients with KRAS G12C mutations, offering a targeted treatment option that significantly improved patient outcomes. The FDA’s approval of LUMAKRAS exemplifies the shift toward personalized cancer therapies, which are tailored to specific genetic profiles.

The market has also benefited from growing investments in research and development, as pharmaceutical companies explore additional KRAS mutations and new treatment combinations. Moreover, the increasing adoption of biomarker testing and advancements in companion diagnostics have allowed for more precise identification of eligible patients, further driving the demand for KRAS inhibitors in North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to improvements in healthcare infrastructure and increasing access to advanced cancer therapies. As the region’s healthcare systems evolve, more patients are anticipated to benefit from the availability of targeted therapies, such as KRAS inhibitors.

The growing prevalence of cancer, particularly lung and colorectal cancers, in countries like China, Japan, and India is expected to further drive market demand. In recent years, the region has seen a rise in the adoption of molecular profiling and targeted therapies, which has enhanced the identification of patients with KRAS mutations.

Additionally, pharmaceutical companies are likely to focus on expanding their presence in Asia Pacific, offering innovative treatments to meet the growing need. The region’s rising healthcare expenditure and improved access to precision medicine are projected to contribute significantly to the market’s growth, making it a key area for the expansion of KRAS inhibitors.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The major players in the KRAS inhibitor market are actively engaged in the development and introduction of innovative products, as well as implementing strategic initiatives aimed at enhancing their competitive positioning. Key players in the KRAS inhibitor market adopt strategies such as advancing clinical trials, expanding their drug pipelines, and forming strategic collaborations to accelerate growth.

Companies focus on developing targeted therapies that specifically inhibit KRAS mutations, a key driver of certain cancers, to improve treatment efficacy. Investment in personalized medicine and biomarker-based therapies helps cater to the growing demand for tailored cancer treatments. Partnerships with academic institutions and biotechnology firms enhance research and facilitate faster product development. Additionally, global market expansion and regulatory approvals play crucial roles in bringing these therapies to diverse regions with high unmet medical needs.

One of the key players in the market is Amgen, a global biotechnology company that specializes in innovative therapies for cancer treatment. Amgen is at the forefront of developing KRAS-targeted therapies, with its investigational drug, Lumakras (sotorasib), being one of the first to receive regulatory approval for treating KRAS G12C-mutated non-small cell lung cancer. The company’s growth strategy focuses on leveraging its expertise in oncology, expanding its product offerings through R&D, and forming partnerships with other biopharmaceutical firms to accelerate the development and commercialization of new therapies for cancer patients.

Top Key Players in the KRAS Inhibitor Market

- Novartis

- Mirati Therapeutics

- Jemincare

- Innovent Biologics, Inc.

- Incyte

- Erasca

- BridgeBio Pharma

- Amgen

Recent Developments

- In October 2022: Novartis presented promising Phase Ib results for JDQ443, an experimental selective, covalent KRAS G12C inhibitor, at the AACR Annual Meeting. JDQ443 demonstrated significant anti-tumor activity, high systemic exposure, and a favorable safety profile in patients with KRAS G12C-mutated solid tumors, offering promising data for future clinical development.

- In September 2023: Amgen reported encouraging results from the CodeBreaK 101 clinical trial, specifically from Phase 1b, investigating the combination of LUMAKRAS (sotorasib) with carboplatin and pemetrexed for advanced NSCLC with KRAS G12C mutations. These results, presented at the 2023 World Conference on Lung Cancer, further support the potential of LUMAKRAS as part of combination therapies for NSCLC patients with KRAS G12C mutations.

Report Scope

Report Features Description Market Value (2023) US$ 108.1 million Forecast Revenue (2033) US$ 186.4 million CAGR (2024-2033) 5.6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Cancer Type (Lung Cancer, Colorectal Cancer, Pancreatic Cancer, and Others), By End-user (Hospitals, Clinic Laboratories, Cancer Research Institutes, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Novartis, Mirati Therapeutics, Jemincare, Innovent Biologics, Inc., Incyte, Erasca, BridgeBio Pharma, and Amgen. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Novartis

- Mirati Therapeutics

- Jemincare

- Innovent Biologics, Inc.

- Incyte

- Erasca

- BridgeBio Pharma

- Amgen