Global Oral Thin Films Market By Product (Sublingual Film and Fast Dissolving Dental/Buccal Film), By Disease Indication (Schizophrenia, Migraine, Opioid Dependence, Nausea and Vomiting, and Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 144744

- Number of Pages: 266

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Analysis

- Disease Indication Analysis

- Distribution Channel Analysis

- Key Segments Analysis

- Market Dynamics

- Market Restraints

- Market Opportunities

- Impact of macroeconomic factors / Geopolitical factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

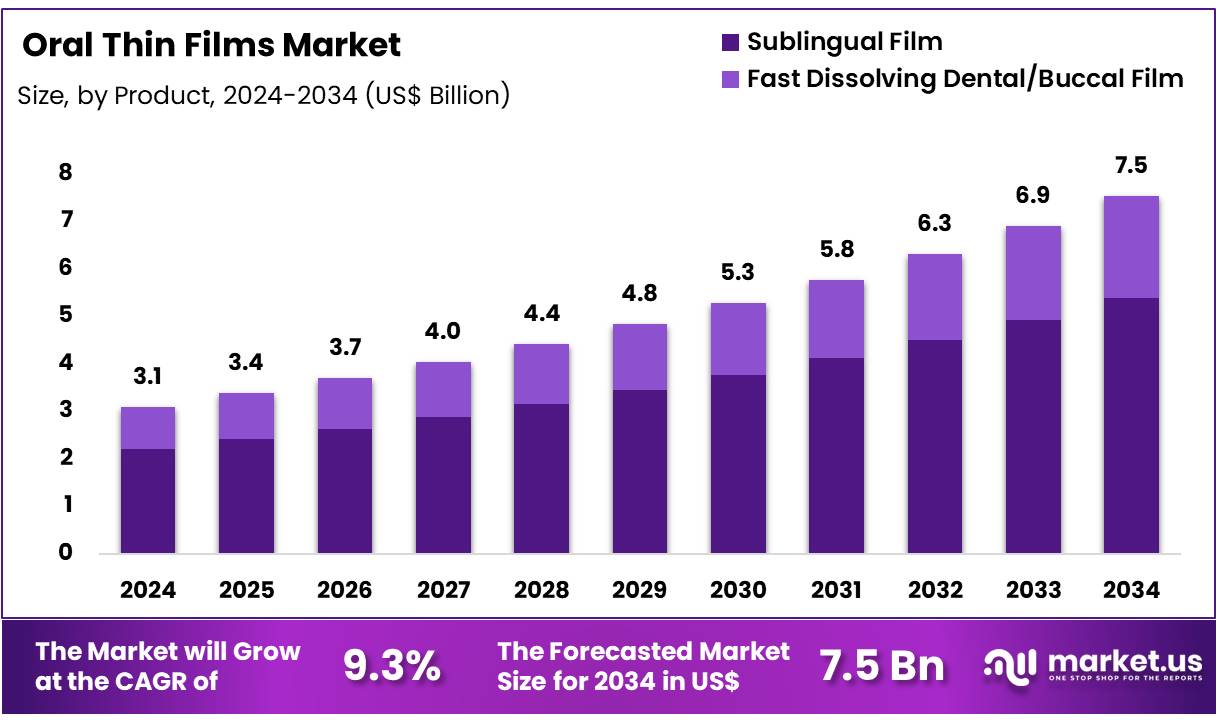

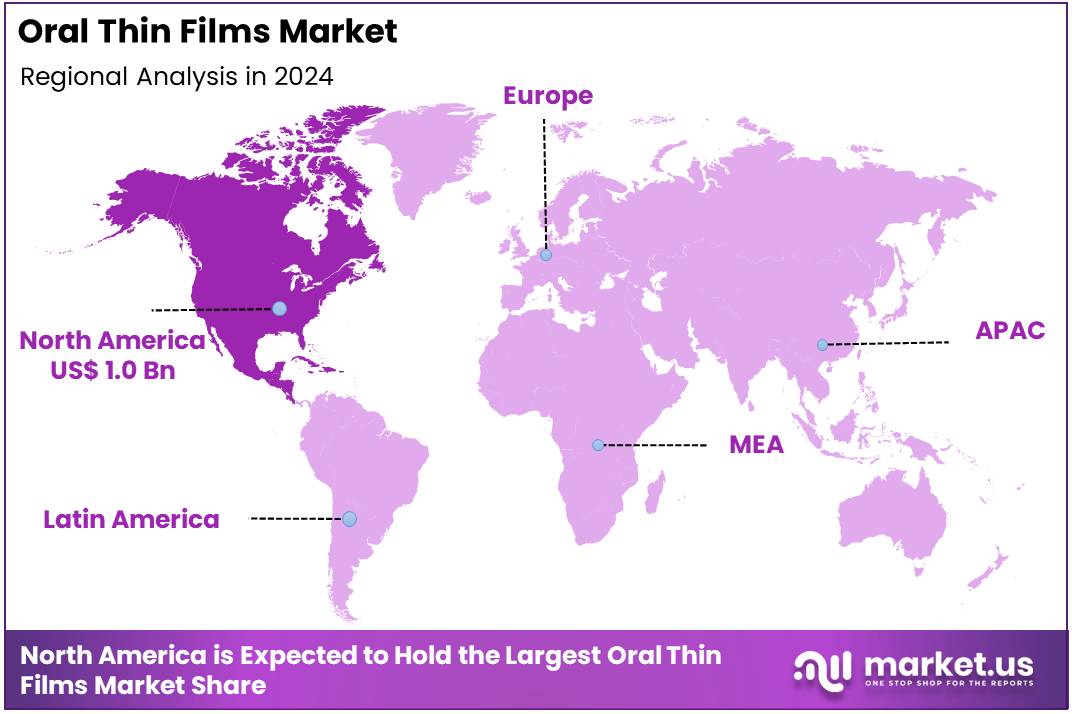

Global Oral Thin Films Market size is expected to be worth around US$ 7.5 Billion by 2034 from US$ 3.1 Billion in 2024, growing at a CAGR of 9.3% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 35.5% share with a revenue of US$ 1.0 Billion.

The global oral thin films market is driven by increasing demand for convenient, fast-acting drug delivery systems, particularly in the healthcare sector. As consumers seek more user-friendly alternatives to traditional tablets and capsules, oral thin films offer an efficient solution due to their ease of administration, rapid dissolution, and improved bioavailability. The rising prevalence of chronic diseases, such as diabetes, cancer, and neurological disorders, is fuelling the demand for advanced drug delivery systems.

Additionally, oral thin films are gaining popularity in the nutraceuticals and cosmetics industries for the delivery of vitamins, supplements, and active ingredients. Technological advancements in film

manufacturing, including the use of novel polymers and biodegradable materials, further enhance product effectiveness and sustainability.

manufacturing, including the use of novel polymers and biodegradable materials, further enhance product effectiveness and sustainability.However, challenges such as regulatory hurdles, the complexity of formulation, and high production costs may impede market growth. Despite this, increasing research and development and expanding applications across various sectors will drive future market expansion.

- In February 2025, Aquestive Therapeutics, Inc., a pharmaceutical company dedicated to advancing medicines that improve patients’ lives through innovative science and delivery technologies, announced multiple presentations showcasing results from the investigational use of Anaphylm epinephrine sublingual film in treating severe allergic reactions, including anaphylaxis.

Key Takeaways

- The global oral thin films market was valued at USD 3.1 billion in 2024 and is anticipated to register substantial growth of USD 7.5 billion by 2034, with a 9.3% CAGR.

- In 2024, the sublingual film segment took the lead in the global market, securing 70.3% of the total revenue share.

- The schizophrenia segment took the lead in the global market, securing 29.4% of the total revenue share.

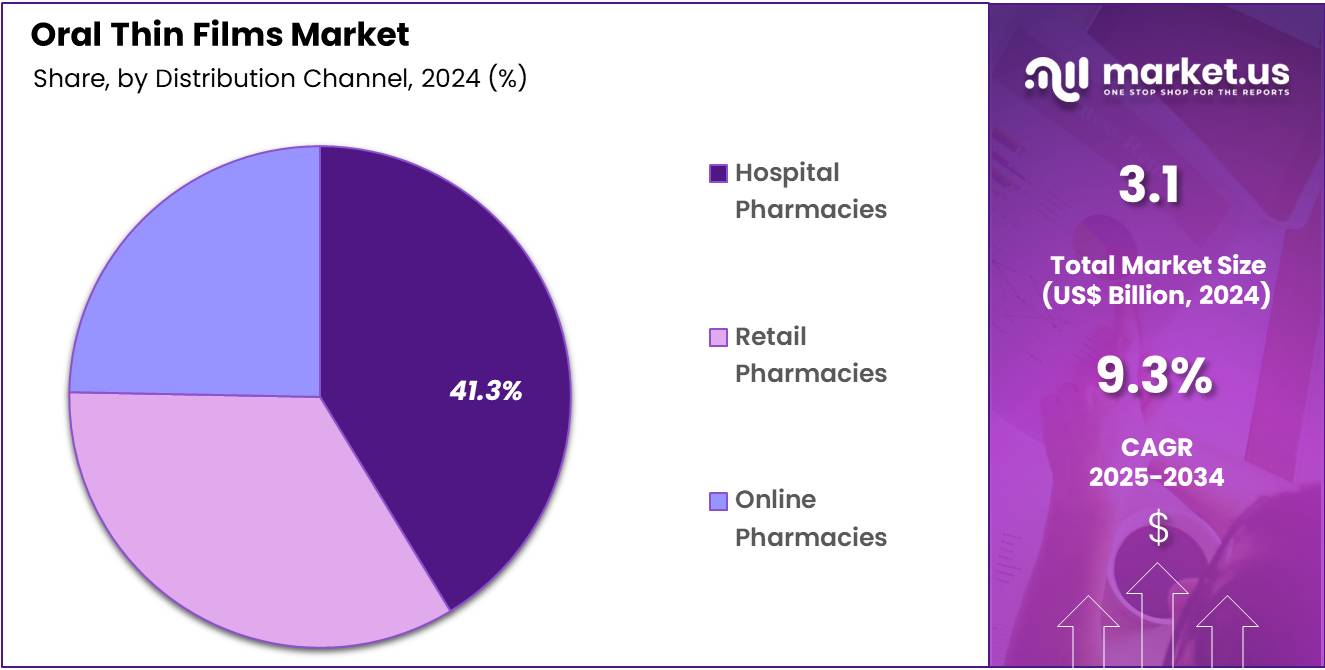

- The hospital pharmacies segment took the lead in the global market, securing 41.3% of the total revenue share.

- North America maintained its leading position in the global market with a share of over 35.5% of the total revenue.

Product Analysis

Based on product the market is fragmented into sublingual film and fast dissolving dental/buccal film. Amongst these, the sublingual film segment dominated the global oral thin films market capturing a significant market share of 70.3% in 2024. Sublingual films offer rapid absorption of active ingredients through the mucous membranes under the tongue, allowing for faster onset of action compared to conventional oral tablets or capsules.

This is particularly beneficial for drugs requiring quick therapeutic effects, such as those used in pain management, nausea relief, and emergency treatments like angina or seizure disorders. The sublingual route bypasses the digestive system, enhancing bioavailability and minimizing first-pass metabolism in the liver.

Additionally, sublingual films are highly portable, discreet, and convenient for patients, making them an attractive alternative to traditional dosage forms. The increasing demand for non-invasive drug delivery methods, along with the growing prevalence of chronic conditions that require quick symptom relief, has propelled the growth of the sublingual film segment in the oral thin films market.

Disease Indication Analysis

The market is fragmented by disease indication into schizophrenia, migraine, opioid dependence, nausea and vomiting, and others. The schizophrenia segment dominated the global oral thin films market capturing a significant market share of 29.4% in 2024. The schizophrenia segment has dominated the global oral thin films market due to the growing need for effective, fast-acting treatments for managing the condition.

Schizophrenia requires consistent medication for symptom control, and oral thin films offer a convenient, easy-to-administer solution for patients who may have difficulty swallowing tablets or pills. These films ensure rapid absorption of antipsychotic drugs, improving patient compliance and therapeutic outcomes. Moreover, the discreet and portable nature of oral thin films is especially beneficial for individuals who need to manage their condition while maintaining their daily routines.

With the rise in the global prevalence of mental health disorders, including schizophrenia, the demand for innovative drug delivery systems has surged. Oral thin films offer the advantage of bypassing the digestive system, enhancing drug bioavailability and providing faster onset of action, which is crucial in the management of acute episodes in schizophrenia, thus driving market growth in this segment.

- Schizophrenia is a chronic and severe mental disorder affecting approximately 0.3% to 0.7% of the global population, equating to around 21 million individuals worldwide. In the United States, estimates of the prevalence of schizophrenia and related psychotic disorders range between 0.25% and 0.64%.

Distribution Channel Analysis

The market is fragmented by distribution channel into hospital pharmacies, retail pharmacies, and online pharmacies. Hospital pharmacies held a high share in the global oral thin films market capturing a significant market share of 41.3% in 2024. Oral thin films are increasingly being used in hospitals for the delivery of medications in a more efficient, patient-friendly format, especially for those who are unable to swallow traditional pills or capsules due to age, illness, or treatment-related conditions.

The ease of administration, rapid onset of action, and enhanced bioavailability offered by oral thin films make them particularly suitable for managing acute conditions in hospital settings, such as pain, nausea, and neurological disorders.

Furthermore, hospital pharmacies can offer tailored treatment regimens using these films for patients requiring precise dosages or those undergoing intravenous therapy. With a growing focus on improving patient adherence and comfort in hospitals, oral thin films have become an integral part of hospital pharmacy services, contributing to their dominance in the market.

Key Segments Analysis

Product

- Sublingual Film

- Fast Dissolving Dental/Buccal Film

Disease Indication

- Schizophrenia

- Migraine

- Opioid Dependence

- Nausea and Vomiting

- Others

Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Market Dynamics

The Rising Prevalence of Target Diseases

The rising prevalence of target diseases, particularly neurological disorders like Parkinson’s disease, is a key factor driving the growth of the global oral thin films market. Oral thin films are gaining recognition for their effectiveness in managing such conditions due to their ability to deliver medication rapidly and efficiently, with enhanced bioavailability.

These films provide a non-invasive alternative to traditional pills or injections, improving patient adherence and comfort. In the case of Parkinson’s disease, where timely and consistent medication is critical for managing symptoms, oral thin films offer a promising treatment option.

As the prevalence of diseases like Parkinson’s increases, the demand for convenient, effective drug delivery systems like oral thin films is expected to surge, significantly contributing to the market’s growth. Furthermore, the ease of administration and reduced risk of side effects associated with oral thin films makes them a preferred choice for both patients and healthcare providers.

- For instance, Parkinson’s disease affects over 10 million individuals worldwide, with approximately 1 million cases in the United States alone, according to the Parkinson’s Foundation’s 2021 report. This number is expected to rise to 1.2 million by 2030, driven in part by the aging global population.

Market Restraints

Patent Expirations of Major Drugs and Rising Costs of New Drug Development

The global oral thin films (OTF) market faces significant challenges, particularly due to the patent expirations of major drugs, which have led to an influx of generic competitors, reducing market share for original formulations. As patents expire, drug manufacturers must adapt by reformulating existing drugs into OTF formats, a process that is becoming increasingly complex and costly.

Additionally, the rising costs of new drug development, compounded by stringent regulatory requirements, make the creation of novel OTF formulations a financial burden for many companies. The high prices of manufacturing equipment and the substantial R&D expenses involved in ensuring effective drug delivery through oral thin films also deter new entrants into the market.

- As highlighted in a February 2020 article by Contract Pharma, the challenges associated with patent expirations and escalating development costs are creating barriers to market expansion.

Furthermore, issues such as poor drug absorption for lipid-based formulations and limited consumer awareness about the benefits of oral thin films have further hindered growth. Overcoming these challenges requires specialized expertise, innovative strategies, and robust research to drive sustainable development in the OTF market, ensuring that it continues to meet the growing demand for efficient drug delivery systems.

Market Opportunities

Strategic Alliances and Collaborations

Strategic alliances and collaborations are creating significant growth opportunities for the oral thin films market by enabling companies to leverage each other’s expertise, resources, and market reach.

- For instance, in September 2021, Sunovion Pharmaceuticals Inc., a global biopharmaceutical company, and BIAL, a pharmaceutical business, entered into a strategic deal where Sunovion granted BIAL the exclusive right to commercially license apomorphine, a drug used in the treatment of Parkinson’s disease, in oral thin film form.

Such collaborations allow companies to tap into new markets, accelerate product development, and enhance innovation by combining complementary strengths. These partnerships not only expand the market presence of oral thin film products but also facilitate the development of new formulations that can address unmet medical needs in areas like neurology, pain management, and chronic diseases.

By sharing the financial and operational risks associated with research and development, companies can drive forward the growth of oral thin films, reducing costs and time-to-market. As the demand for more efficient and patient-friendly drug delivery systems rises, these strategic alliances and collaborations play a crucial role in fostering innovation, increasing competition, and ultimately expanding the reach of oral thin films across the global healthcare landscape.

Impact of macroeconomic factors / Geopolitical factors

Macroeconomic and geopolitical factors have a significant impact on the global oral thin films market, influencing both production and demand. Economic downturns or recessions can reduce consumer spending and healthcare budgets, leading to decreased investments in advanced drug delivery systems like oral thin films.

Additionally, inflation and fluctuating raw material costs can raise manufacturing expenses, making it harder for companies to maintain profitability. On the geopolitical front, trade tensions, political instability, and regulatory changes in different regions can disrupt the supply chain and affect the availability of essential raw materials for oral thin film production.

For instance, tariffs on imported materials or medicines could increase the cost of manufacturing, potentially limiting the affordability and accessibility of oral thin films. Moreover, variations in healthcare policies across countries, especially regarding drug approval processes and reimbursement structures, can create uncertainty and delay the market penetration of new oral thin film formulations.

However, in some cases, geopolitical factors such as international partnerships or favorable trade agreements can provide new growth opportunities by facilitating market expansion and cross-border collaborations. Overall, the oral thin films market must navigate these macroeconomic and geopolitical factors to maintain growth and ensure the continued development of innovative drug delivery solutions.

Latest Trends

The oral thin films market is witnessing several emerging trends that are shaping its growth. One of the most notable trends is the increasing demand for patient-friendly drug delivery systems, driven by the growing preference for non-invasive and easy-to-use alternatives to traditional pills and injections. Oral thin films offer rapid dissolution, improved bioavailability, and convenient administration, making them particularly appealing to patients with chronic conditions or those requiring quick symptom relief.

Additionally, there is a growing focus on developing thin films for a wider range of therapeutic applications, including the delivery of treatments for neurological disorders, pain management, and psychiatric conditions like schizophrenia and Parkinson’s disease. Another trend is the rising use of innovative materials and technologies in the development of oral thin films, such as the incorporation of biodegradable polymers and advanced drug encapsulation techniques to enhance the stability and effectiveness of the formulations.

Moreover, the nutraceutical sector is increasingly adopting oral thin films for delivering vitamins, supplements, and other health-enhancing products. The market is also seeing a rise in strategic partnerships and collaborations among pharmaceutical companies to advance research and create new oral thin film products. As awareness about the benefits of oral thin films grows and research continues to evolve, these trends are expected to fuel further market expansion and innovation.

Regional Analysis

North America held the largest market share in the global oral thin films market, driven by a combination of factors such as advanced healthcare infrastructure, high awareness of innovative drug delivery systems, and a large patient population with chronic diseases. The region benefits from the presence of major pharmaceutical companies and research institutions, which are actively involved in the development and commercialization of oral thin films for a wide range of medical conditions, including neurological disorders, pain management, and mental health.

Additionally, the U.S. Food and Drug Administration (FDA) has approved several oral thin film products, creating a favorable regulatory environment for the market’s growth. The increasing prevalence of conditions like Parkinson’s disease, schizophrenia, and other chronic illnesses in North America further fuels the demand for efficient and convenient drug delivery solutions. Furthermore, the rising trend of personalized medicine and growing patient preference for non-invasive treatment options are boosting the adoption of oral thin films in the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The competitive landscape of the oral thin films market is characterized by the presence of several established pharmaceutical companies and innovative startups focused on the development of advanced drug delivery systems. Key players are leading the market with their wide range of oral thin film products, catering to therapeutic areas like neurology, pain management, and psychiatric disorders. These companies are heavily investing in research and development to enhance the effectiveness and bioavailability of oral thin films, while also exploring new applications in the nutraceutical and cosmetic industries.

Additionally, partnerships, collaborations, and licensing agreements are becoming common strategies to expand market reach and innovate formulations. Smaller players are also emerging with specialized solutions, contributing to increased competition. The market is also witnessing a rise in generic oral thin film products due to the expiration of patents for popular drugs, intensifying competitive pressures. Overall, the competitive landscape is dynamic, with continuous innovation, strategic collaborations, and a focus on patient-centric solutions driving market growth.

Aquestive Therapeutics Inc. is a specialty pharmaceutical company focused on developing and commercializing innovative drug delivery platforms to improve the treatment and quality of life for patients. The company is known for its expertise in oral thin film technology, with its portfolio of products aimed at treating central nervous system disorders, including neurological and psychiatric conditions.

In addition, IntelGenx Corp. is a Canadian-based pharmaceutical company specializing in the development of oral drug delivery systems, including oral thin films. IntelGenx utilizes its proprietary platform technologies to enhance the bioavailability, stability, and patient compliance of drugs, particularly in the areas of oncology, pain management, and central nervous system disorders.

Top Key Players

- Aquestive Therapeutics Inc.

- IntelGenx Corp.

- LTS Lohmann

- Therapie-Systeme AG

- NAL Pharma6.

- ZIM Laboratories Limited

- Sunovion Pharmaceuticals, Inc.

- Cure Pharmaceutical

- L.Pharm

- Viatris

- MonoSol Rx

- Indivior

- ALLERGAN

- IntelGenx

Recent Developments

- In March 2023, BIAL, a century-old innovation-driven biopharmaceutical company focused on neurology, unveiled the launch of KYNMOBI® (apomorphine hydrochloride), the first and only sublingual film approved in Germany. It is designed for the intermittent treatment of OFF episodes in adult patients with Parkinson’s disease who do not achieve sufficient control with oral anti-Parkinson medications.

- In April 2022, BioXcel Therapeutics announced the FDA approval of IGALMI™ (dexmedetomidine) Sublingual Film for the acute treatment of agitation associated with schizophrenia or Bipolar I or II Disorder in adults.

Report Scope

Report Features Description Market Value (2024) US$ 3.1 billion Forecast Revenue (2034) US$ 7.5 billion CAGR (2025-2034) 9.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Sublingual Film and Fast Dissolving Dental/Buccal Film), By Disease Indication (Schizophrenia Migraine, Opioid Dependence, Nausea and Vomiting, and Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Aquestive Therapeutics Inc., IntelGenx Corp., LTS Lohmann, Therapie-Systeme AG, NAL Pharma6., ZIM Laboratories Limited, Sunovion Pharmaceuticals, Inc., Cure Pharmaceutical, C.L.Pharm, Viatris, MonoSol Rx, Indivior, ALLERGAN, and IntelGenx Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Aquestive Therapeutics Inc.

- IntelGenx Corp.

- LTS Lohmann

- Therapie-Systeme AG

- NAL Pharma6.

- ZIM Laboratories Limited

- Sunovion Pharmaceuticals, Inc.

- Cure Pharmaceutical

- L.Pharm

- Viatris

- MonoSol Rx

- Indivior

- ALLERGAN

- IntelGenx