Cephalosporin Drugs Market By Generation (First, Second, Third, Fourth, and Fifth), By Routes of Administration (Oral and Injection), By Application (Skin Infection, Urinary Tract Infection, Sexually Transmitted Infection, Respiratory Tract, and Ear Infection), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143741

- Number of Pages: 256

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

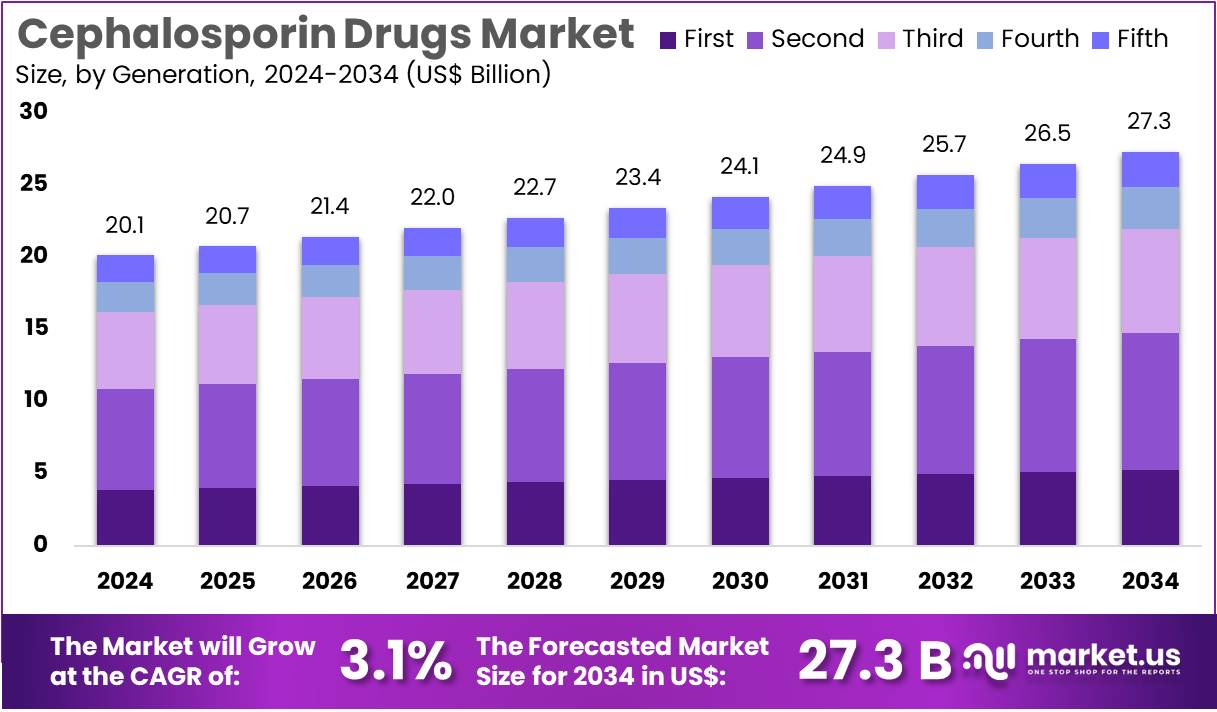

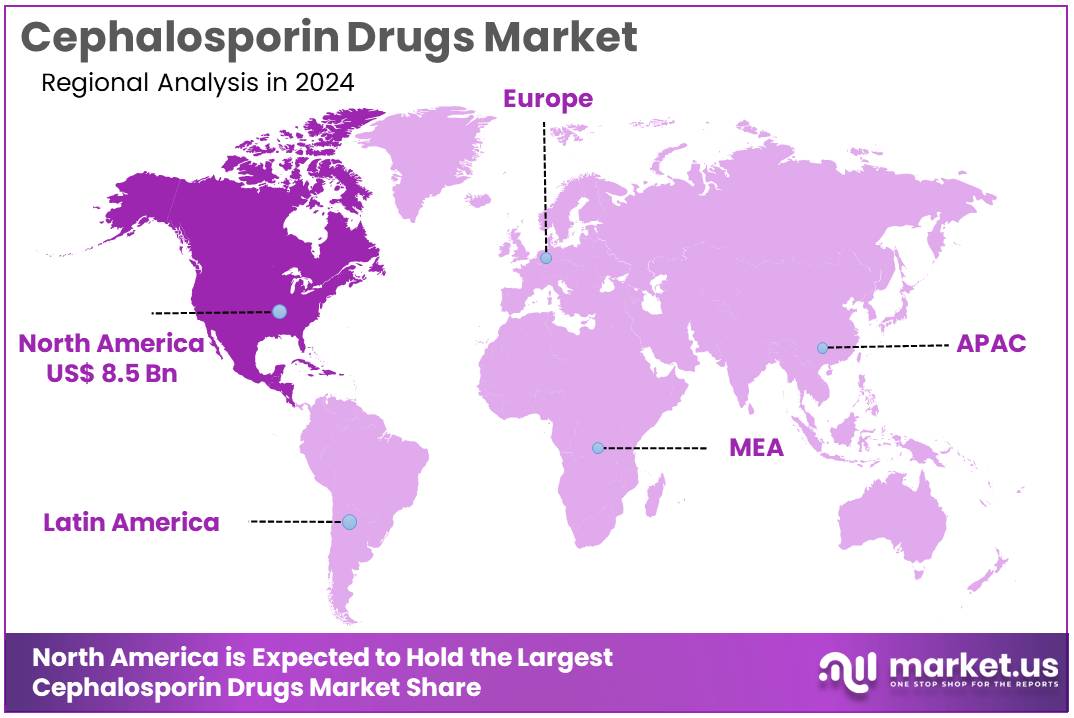

The Global Cephalosporin Drugs Market Size is expected to be worth around US$ 27.3 Billion by 2034, from US$ 20.1 Billion in 2024, growing at a CAGR of 3.1% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 42.5% share and holds US$ 8.5 Billion market value for the year.

Increasing antibiotic resistance and the rising prevalence of bacterial infections drive the growth of the cephalosporin drugs market. These drugs are widely used in treating a variety of bacterial infections, including pneumonia, urinary tract infections, and skin infections. The expanding application of cephalosporins in hospital settings, especially in surgical prophylaxis, is also contributing to market growth.

Innovations in cephalosporin formulations, such as extended-spectrum cephalosporins, offer broader activity against resistant strains of bacteria. In April 2024, Basilea Pharmaceutical International Ltd. announced that its drug Zevtera (ceftobiprole medocaril sodium for injection) received approval from the US Food and Drug Administration (FDA) for treating serious bacterial infections in both adults and pediatric patients.

This approval highlights the growing trend toward the development of advanced cephalosporin drugs to address the need for more effective treatments. Opportunities in the market also arise from the increasing use of cephalosporins in outpatient settings and the development of combination therapies to enhance their efficacy against multi-drug-resistant organisms.

Key Takeaways

- In 2023, the market for Cephalosporin Drugs generated a revenue of US$ 20.1 billion, with a CAGR of 3.1%, and is expected to reach US$ 27.3 billion by the year 2033.

- The generation segment is divided into first, second, third, fourth, and fifth, with second taking the lead in 2023 with a market share of 34.7%.

- Considering routes of administration, the market is divided into oral and injection. Among these, oral held a significant share of 62.3%.

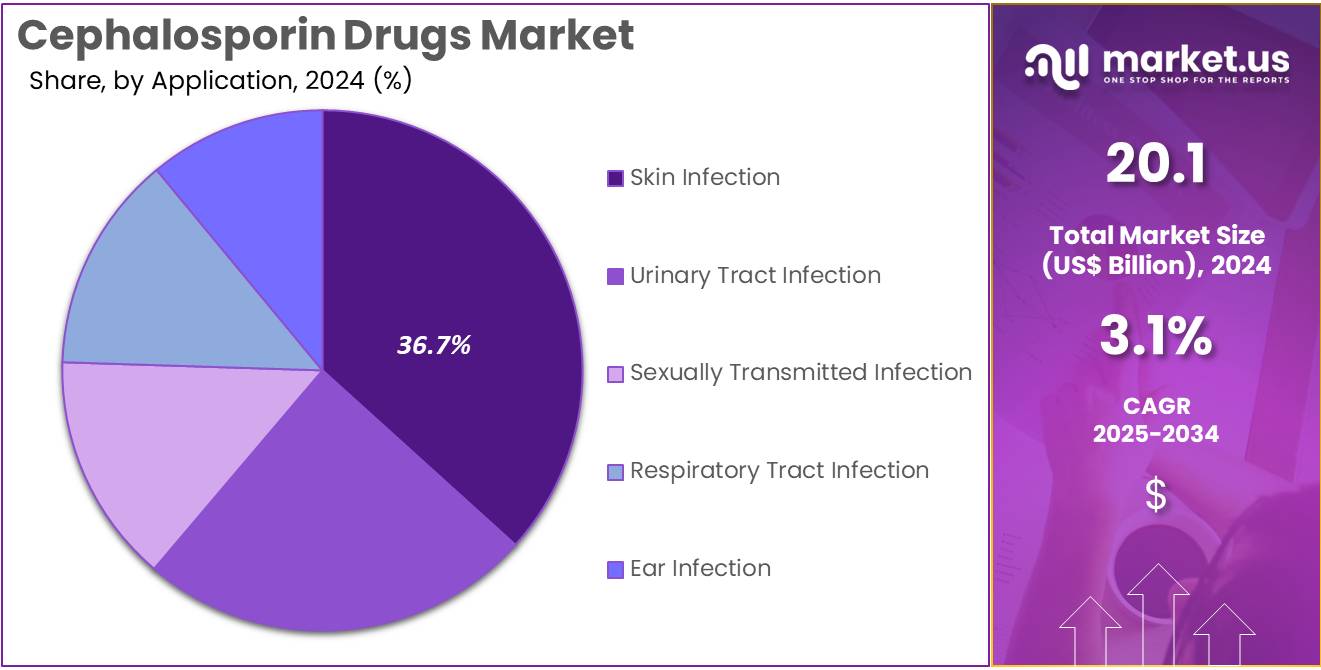

- Furthermore, concerning the application segment, the skin infection sector stands out as the dominant player, holding the largest revenue share of 36.7% in the Cephalosporin Drugs market.

- North America led the market by securing a market share of 42.5% in 2023.

Generation Analysis

The second segment led in 2023, claiming a market share of 34.7% owing to its broad-spectrum activity against both Gram-positive and Gram-negative bacteria. Second-generation cephalosporins are projected to be increasingly used in the treatment of infections like respiratory tract infections, skin infections, and urinary tract infections.

The rise in antibiotic resistance is likely to drive the demand for these drugs, as second-generation cephalosporins have been shown to be effective against a wider range of pathogens compared to earlier-generation drugs. The growing prevalence of hospital-acquired infections and the need for reliable, potent antibiotics in both inpatient and outpatient settings are anticipated to contribute to the continued growth of this segment in the market.

Routes of Administration Analysis

The oral held a significant share of 62.3% due to the increasing demand for convenient, patient-friendly treatments for bacterial infections. Oral cephalosporins offer a convenient option for both acute and chronic conditions, allowing patients to manage their treatment at home and avoid the need for injections.

The rising prevalence of conditions such as respiratory and skin infections, coupled with the increasing focus on outpatient care, is expected to drive the demand for oral cephalosporins. Furthermore, the growing preference for oral antibiotics, due to ease of administration and lower healthcare costs compared to injectable forms, is likely to fuel the growth of the oral segment. As more cephalosporin drugs become available in oral formulations, the segment is projected to expand further.

Application Analysis

The skin infection segment had a tremendous growth rate, with a revenue share of 36.7% as the incidence of skin infections continues to rise globally. Skin infections, such as cellulitis, impetigo, and wound infections, are commonly treated with cephalosporins due to their broad-spectrum activity and effectiveness against common pathogens like Streptococcus and Staphylococcus species.

The growing number of patients with chronic conditions such as diabetes, which increases the risk of skin infections, is likely to drive demand for cephalosporin treatments. Additionally, the increasing occurrence of skin infections in both community and healthcare settings, along with the growing awareness of the importance of timely antibiotic treatment, is expected to contribute to the segment’s expansion. As healthcare providers seek more effective antibiotics for skin infections, the demand for cephalosporin drugs in this application is anticipated to rise.

Key Market Segments

By Generation

- First

- Second

- Third

- Fourth

- Fifth

By Routes of Administration

- Oral

- Injection

By Application

- Skin Infection

- Urinary Tract Infection

- Sexually Transmitted Infection

- Respiratory Tract

- Ear Infection

Drivers

Increasing Antibiotic Resistance is Driving the Market

The rising prevalence of antibiotic-resistant bacterial infections is a significant driver for the cephalosporin drugs market. According to the World Health Organization, antibiotic resistance is one of the top 10 global public health threats, with an estimated 1.27 million deaths directly attributed to resistant infections in 2019. This trend has continued into 2022-2024, with governments and healthcare organizations prioritizing the development and use of advanced antibiotics, including newer generations of cephalosporins.

For instance, the US Centers for Disease Control and Prevention reported in 2023 that drug-resistant infections cause over 2.8 million illnesses annually in the US alone. Pharmaceutical companies like Pfizer and Merck have increased their R&D investments in this area, with Pfizer allocating US$ 2.3 billion to antibiotic development in 2022. This focus on combating resistance is propelling market growth.

Restraints

Stringent Regulatory Approvals are Restraining the Market

The stringent regulatory requirements for drug approval are a major restraint in the cephalosporin drugs market. Regulatory bodies like the US Food and Drug Administration and the European Medicines Agency have tightened their approval processes to ensure drug safety and efficacy. In 2023, the FDA approved only 12 new antibacterial drugs, a decline from previous years, due to increased scrutiny.

This has delayed the launch of new cephalosporin drugs, impacting market growth. For example, in 2022, only 3 out of 10 cephalosporin drug candidates successfully passed Phase III clinical trials. The high cost of compliance, which can exceed US$ 1 billion per drug, further discourages smaller pharmaceutical companies from entering the market. These factors collectively hinder the pace of innovation and commercialization.

Opportunities

Emerging Markets are Creating Growth Opportunities

Emerging markets, particularly in Asia-Pacific and Latin America, present significant growth opportunities for the cephalosporin drugs market. According to a 2023 report by the International Federation of Pharmaceutical Manufacturers & Associations, healthcare spending in these regions is expected to grow by 6-8% annually through 2024.

Countries like India and China are witnessing a surge in demand for antibiotics due to increasing healthcare access and rising incidences of infectious diseases. For instance, India’s antibiotic market grew by 9.2% in 2022, driven by government initiatives to improve healthcare infrastructure. Additionally, the Indian government allocated US$ 10 billion to healthcare in its 2023 budget, further boosting the pharmaceutical sector. These factors create a favorable environment for market expansion.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the cephalosporin drugs market. Rising healthcare expenditures and increased government funding in emerging economies are driving market growth. For instance, the US government allocated US$ 1.5 billion to combat antibiotic resistance in 2023, boosting R&D activities.

However, supply chain disruptions caused by geopolitical tensions, such as the Russia-Ukraine conflict, have led to raw material shortages and increased production costs. Inflation and currency fluctuations in 2022-2023 further strained pharmaceutical companies’ profit margins. Despite these challenges, the growing emphasis on global health security and collaborative efforts like the Global Antibiotic Research and Development Partnership are fostering innovation. These positive developments ensure a resilient and expanding market, even amid uncertainties.

Trends

Adoption of Generic Cephalosporins is a Recent Trend

The increasing adoption of generic cephalosporins is a notable trend in the market. According to a 2023 report by the Generic Pharmaceutical Association, generic antibiotics accounted for 75% of the total antibiotic market share in the US in 2022. This trend is driven by cost-effectiveness and the expiration of patents for several branded cephalosporins.

For example, the patent for Pfizer’s Zinforo, a fourth-generation cephalosporin, expired in 2022, leading to the launch of cheaper generic versions. In Europe, generic cephalosporins saw a 12% increase in sales volume in 2023, as reported by the European Generic Medicines Association. This shift towards generics is reshaping the competitive landscape and making these drugs more accessible globally.

Regional Analysis

North America is leading the Cephalosporin Drugs Market

North America dominated the market with the highest revenue share of 42.5% owing to increasing antibiotic resistance, rising prevalence of bacterial infections, and advancements in pharmaceutical research. According to the Centers for Disease Control and Prevention (CDC), antibiotic-resistant infections cause over 2.8 million illnesses and 35,000 deaths annually in the US, underscoring the urgent need for effective antibiotics like cephalosporins.

The US Food and Drug Administration (FDA) approved several new cephalosporin-based formulations during this period, including combination therapies targeting multidrug-resistant pathogens. Additionally, the Canadian Antimicrobial Resistance Surveillance System (CARSS) reported a 12% increase in the use of broad-spectrum antibiotics, including cephalosporins, between 2022 and 2023, reflecting their growing clinical importance.

Pharmaceutical companies such as Pfizer and Merck have expanded their production capacities, with Pfizer reporting a 15% increase in cephalosporin sales in 2023 compared to 2022. Government initiatives, such as the US National Action Plan for Combating Antibiotic-Resistant Bacteria, have also fueled market growth by allocating US$ 375 million in funding for antibiotic development and stewardship programs in 2023. These factors, combined with rising healthcare expenditures and increased hospital admissions for infectious diseases, have positioned North America as a leading market for cephalosporin drugs.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing healthcare access, rising infectious disease burdens, and expanding pharmaceutical manufacturing capabilities. The World Health Organization (WHO) reported a 20% increase in antibiotic consumption in low- and middle-income countries in the region between 2022 and 2023, with cephalosporins accounting for a substantial share.

India, one of the largest producers of generic antibiotics, exported cephalosporin formulations worth US$1.2 billion in 2023, according to the Pharmaceuticals Export Promotion Council of India (Pharmexcil). China’s National Health Commission has prioritized the development of advanced antibiotics, with domestic companies like CSPC Pharmaceutical Group reporting a 25% increase in cephalosporin production capacity in 2023. The Australian Government’s Antimicrobial Use and Resistance in Australia (AURA) report highlighted a 10% rise in cephalosporin prescriptions in 2023, reflecting their growing clinical utility.

Additionally, Southeast Asian countries, such as Indonesia and Vietnam, are anticipated to witness increased demand due to rising healthcare investments and government initiatives to combat antimicrobial resistance. The Asia Pacific region’s large population, coupled with improving healthcare infrastructure and rising awareness of antibiotic stewardship, is projected to drive sustained growth in the cephalosporin market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the cephalosporin drugs market focus on expanding their product portfolios, enhancing manufacturing capabilities, and forming strategic alliances to drive growth. They invest in research and development to introduce new generations of cephalosporins with improved efficacy, safety profiles, and broader spectrum activity. Companies also increase market penetration by targeting emerging markets where the demand for antibiotics is rising due to increasing healthcare access.

They strengthen collaborations with healthcare providers, hospitals, and distributors to expand their market presence. Additionally, regulatory approvals and the development of generic alternatives further fuel growth and competition in the market. GlaxoSmithKline (GSK), headquartered in Brentford, United Kingdom, is a leading global healthcare company specializing in pharmaceuticals, vaccines, and consumer health products. The company offers a range of antibiotic medications, including cephalosporins, targeting various bacterial infections.

GSK invests heavily in innovation, focusing on the development of advanced antibiotic therapies to address the growing challenge of antimicrobial resistance. The company has a robust global presence, with a strong emphasis on expanding its reach in emerging markets and strengthening its partnerships with healthcare providers. GSK continues to build on its leadership position by enhancing its portfolio and improving patient outcomes.

Recent Developments

- In April 2024, Lupin, a prominent pharmaceutical company based in Mumbai, received FDA approval for the launch of Mirabegron extended-release tablets (25 mg) in the US market. The medication is designed to treat overactive bladder conditions.

- In April 2024, Lupin introduced a generic version of Oracea (Doxycycline Capsules, 40 mg), following FDA approval. This new generic version is expected to offer a cost-effective alternative for patients requiring treatment for acne and rosacea.

Top Key Players in the Cephalosporin Drugs Market

- Sun Pharmaceutical Industries Limited

- Pfizer Inc

- Novartis International AG

- Lupin Limited

- GlaxoSmithKline plc

- Bristol-Myers Squibb Company

- Abbott Laboratories

Report Scope

Report Features Description Market Value (2024) US$ 20.1 billion Forecast Revenue (2034) US$ 27.3 billion CAGR (2025-2034) 3.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Generation (First, Second, Third, Fourth, and Fifth), By Routes of Administration (Oral and Injection), By Application (Skin Infection, Urinary Tract Infection, Sexually Transmitted Infection, Respiratory Tract, and Ear Infection) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Sun Pharmaceutical Industries Limited, Pfizer Inc, Novartis International AG, Lupin Limited, GlaxoSmithKline plc, Bristol-Myers Squibb Company, and Abbott Laboratories. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cephalosporin Drugs MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Cephalosporin Drugs MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Sun Pharmaceutical Industries Limited

- Pfizer Inc

- Novartis International AG

- Lupin Limited

- GlaxoSmithKline plc

- Bristol-Myers Squibb Company

- Abbott Laboratories