Veterinary Antibiotics Market By Animal Type (Cattle, Pigs, Sheep & Goats, Poultry, and Others), By Drug Class (Tetracyclines, Penicillins, Sulfonamides, Macrolides, Trimethoprim, Polymyxins, Aminoglycosides, Fluoroquinolones, and Other), By Dosage Form (Powders, Solutions, Injections, and Others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 141536

- Number of Pages: 346

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

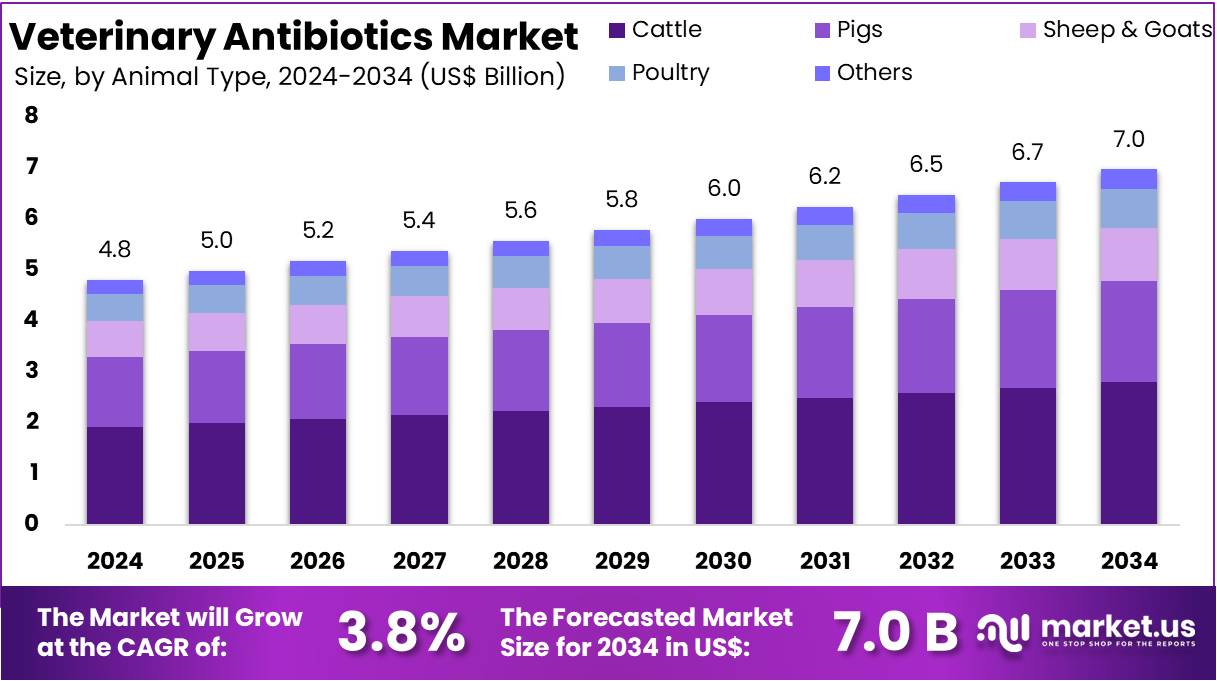

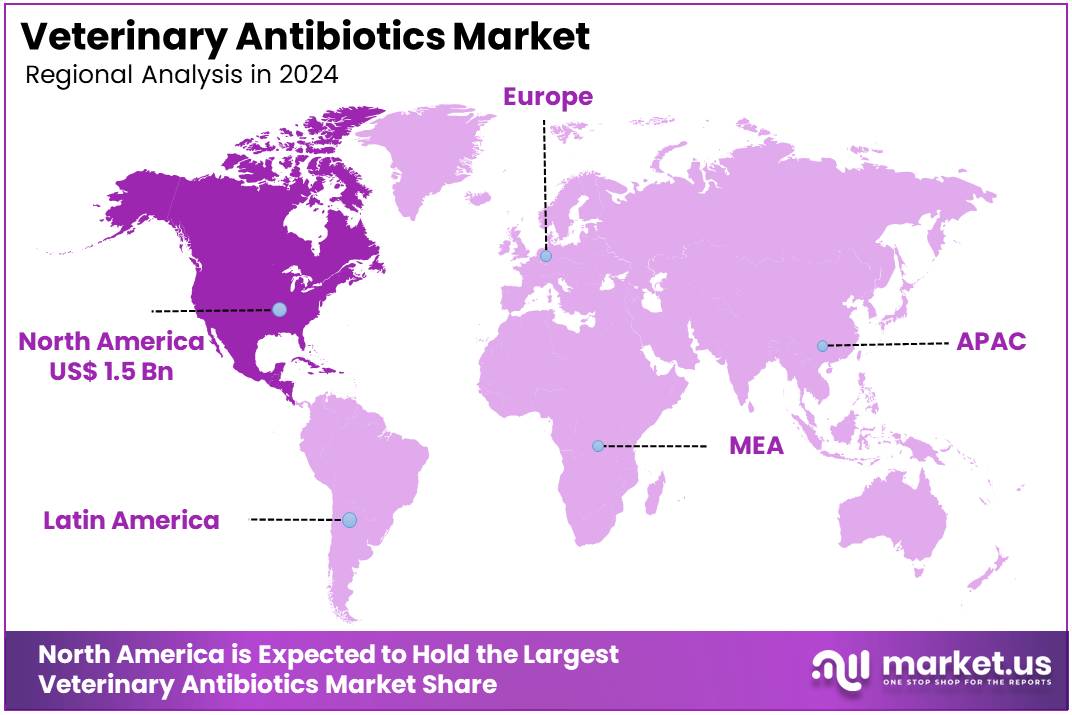

The Global Veterinary Antibiotics Market Size is expected to be worth around US$ 7 Billion by 2034, from US$ 4.8 Billion in 2024, growing at a CAGR of 3.8% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 33.2% share and holds US$ 1.5 Billion market value for the year.

The veterinary antibiotics market is shaped by several dynamic factors that drive its growth and challenges. The increasing demand for animal protein, particularly in developing countries, is a major growth driver, as livestock farming expands to meet the nutritional needs of a growing global population. As a result, there is a higher need for antibiotics to prevent and treat infections in animals, ensuring better productivity and meat quality.

However, the rise of antimicrobial resistance (AMR) has raised concerns, prompting stricter regulations and reducing the overuse of antibiotics in animal agriculture. Governments and regulatory bodies are implementing policies to regulate antibiotic use and promote alternatives like vaccines and probiotics.

Additionally, the growing awareness of animal health and welfare is pushing veterinarians and farmers to adopt more effective and sustainable antibiotic practices. The market is also being influenced by advancements in antibiotic formulations and delivery methods, as well as rising investments in veterinary healthcare research.

Key Takeaways

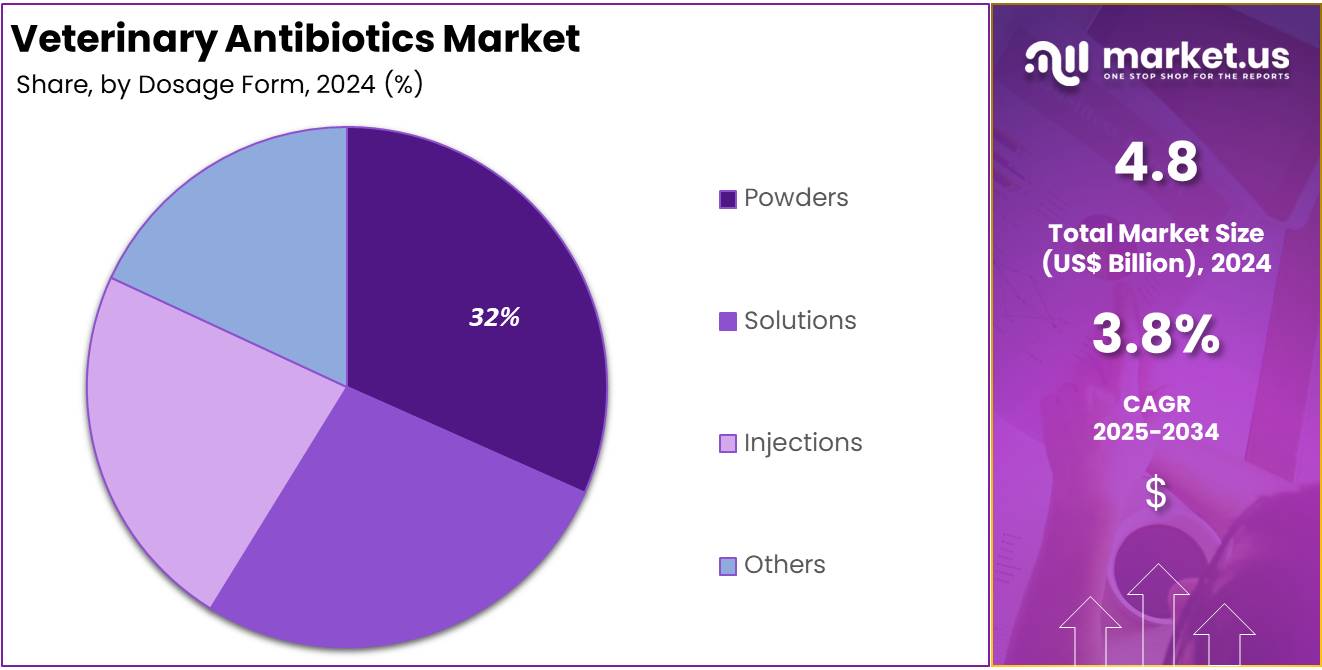

- The veterinary antibiotics market was valued at USD 4.8 billion in 2024 and is anticipated to register substantial growth of USD 7.0 billion by 2034, with 3.8% CAGR.

- In 2024, the cattle segment took the lead in the global market, securing 40.1% of the total revenue share.

- The tetracyclines segment took the lead in the global market, securing 29.3% of the total revenue share.

- The powders segment took the lead in the global market, securing 31.5% of the total revenue share.

- North America took the lead in the global market, securing 33.2% of the total revenue share.

Animal Type Analysis

Based on animal type the market is fragmented into cattle, pigs, sheep & goats, poultry, and others. Amongst these, cattle segment dominated the veterinary antibiotics market capturing a significant market share of 40.1% in 2024. The cattle segment dominates the veterinary antibiotics market due to the large-scale demand for antibiotics in livestock farming, particularly in dairy and beef production. Cattle farming, which plays a pivotal role in global meat and milk production, requires antibiotics to prevent and treat bacterial infections that can impact animal health, productivity, and food safety.

The high economic value of cattle, coupled with the need to maintain herd health and ensure optimal milk yield and meat quality, drives the demand for veterinary antibiotics. Additionally, cattle are more prone to diseases like mastitis, pneumonia, and digestive infections, which further fuels the need for antibiotics in their management. The significant investments in cattle farming infrastructure and the adoption of modern farming practices also contribute to the growth of this segment.

Drug Class Analysis

The market is fragmented by usage into tetracyclines, penicillins, sulfonamides, macrolides, trimethoprim, polymyxins, aminoglycosides, fluoroquinolones, and other. Tetracyclines dominated the veterinary antibiotics market capturing a significant market share of 29.3% in 2024 driven by the increasing demand for animal protein and the rising awareness of animal health. As livestock farming expands globally to meet the nutritional needs of a growing population, antibiotics are essential for preventing and treating infections in animals, ensuring better productivity and food safety.

Key segments of the market include cattle, poultry, and swine, with cattle being the dominant segment due to its crucial role in meat and dairy production. However, the market faces challenges from the growing concern over antimicrobial resistance (AMR), which has led to tighter regulations on antibiotic use in agriculture. Governments and health organizations are pushing for more sustainable alternatives, such as vaccines, probiotics, and improved farm management practices, to reduce reliance on antibiotics.

Dosage Form Analysis

The market is fragmented by dosage form into powders, solutions, injections, and others. Powders dominated the veterinary antibiotics market capturing a significant market share of 31.5% in 2024. Powders dominate the veterinary antibiotics market due to their convenience, cost-effectiveness, and ease of administration, especially in large-scale livestock operations. Antibiotic powders are often mixed with animal feed or drinking water, making them an efficient delivery method for treating a wide range of infections in animals, including cattle, poultry, and swine.

This formulation is particularly favoured in large herds or flocks where individual dosing is impractical. The ability to provide consistent dosages through feed ensures better disease control and improved animal health outcomes. Furthermore, powder formulations have a longer shelf life and are easier to store compared to liquid or injectable antibiotics, making them a preferred choice for farmers and veterinarians.

Key Segments Analysis

By Animal Type

- Cattle

- Pigs

- Sheep & Goats

- Poultry

- Others

By Drug Class

- Tetracyclines

- Penicillins

- Sulfonamides

- Macrolides

- Trimethoprim

- Polymyxins

- Aminoglycosides

- Fluoroquinolones

- Other

By Dosage Form

- Powders

- Solutions

- Injections

- Others

Drivers

Increasing Incidence of Livestock Diseases

The rising incidence of livestock diseases is a major driver of growth in the veterinary antibiotics market. Increasing outbreaks of bacterial infections, respiratory diseases, and gastrointestinal disorders in animals are prompting higher demand for effective antibiotic treatments to ensure animal health and food safety. Factors such as intensive farming practices, rising global meat consumption, and expanding livestock populations contribute to the growing prevalence of diseases, necessitating the widespread use of antibiotics.

Additionally, zoonotic disease risks and economic losses due to reduced productivity further emphasize the need for efficient veterinary antibiotics. Governments and regulatory bodies are implementing stringent policies to control disease outbreaks, encouraging farmers and veterinarians to adopt advanced antibiotic solutions.

Restraints

Growing Concern over Antimicrobial Resistance (AMR)

The excessive and indiscriminate use of antibiotics in livestock has led to the emergence of resistant bacterial strains, posing a serious threat to both animal and human health. Regulatory authorities across the globe, including the FDA and WHO, have implemented stringent guidelines to limit antibiotic use in food-producing animals, restricting market growth. Many countries are promoting antibiotic-free meat production and encouraging alternatives such as probiotics and vaccines, further challenging the demand for veterinary antibiotics.

Additionally, increasing consumer awareness about antibiotic residues in animal-derived products is pushing the food industry toward sustainable and organic farming practices, reducing reliance on antibiotics. These factors, coupled with the risk of bans on certain antibiotics, present significant hurdles for manufacturers and veterinary professionals, impacting the overall growth of the veterinary antibiotics market.

Opportunities

Advancements in Precision Medicine

Advancements in precision medicine are creating significant growth opportunities in the veterinary antibiotics market by enabling more targeted and effective disease management in livestock. Precision medicine leverages genetic profiling, biomarker analysis, and advanced diagnostics to develop tailored antibiotic treatments that enhance efficacy while minimizing resistance risks.

With innovations such as nanoparticle-based drug delivery, customized dosing, and microbiome-based therapies, veterinary antibiotics are becoming more precise in combating specific pathogens. Additionally, artificial intelligence and big data analytics are revolutionizing disease prediction and antibiotic selection, improving treatment outcomes while reducing the overuse of broad-spectrum antibiotics. These advancements are particularly beneficial in intensive farming, where disease outbreaks can severely impact productivity.

Impact of macroeconomic factors / Geopolitical factors

Macroeconomic and geopolitical factors significantly impact the veterinary antibiotics market by influencing production costs, supply chain stability, and market demand. Economic fluctuations, inflation, and currency exchange rates affect the affordability of veterinary antibiotics, especially in developing regions where livestock farming is a crucial economic activity. Trade policies, tariffs, and import-export restrictions imposed due to geopolitical tensions can disrupt the global supply of raw materials and finished products, leading to price volatility and shortages.

Additionally, conflicts and political instability in key agricultural regions may hinder the distribution of veterinary medicines, impacting livestock health management. Stricter regulations on antibiotic use, influenced by global health policies and government initiatives to combat antimicrobial resistance, also shape market dynamics. On the positive side, increased government funding for animal healthcare in response to food security concerns and zoonotic disease risks is driving investments in veterinary antibiotics. Overall, macroeconomic and geopolitical factors play a crucial role in shaping market growth and accessibility.

Trends

The veterinary antibiotics market is experiencing notable trends influenced by regulatory changes, market dynamics, and evolving industry practices. A significant trend is the global reduction in antimicrobial use in animals, driven by efforts to combat antimicrobial resistance. For instance, the World Organization for Animal Health reported a 13% decrease in antimicrobial use over three years.

This decline is partly due to bans on antibiotics for growth promotion, as seen in the European Union since 2006. Market consolidation is also evident, with corporate entities acquiring independent veterinary practices, leading to regulatory scrutiny over pricing and service quality. Furthermore, advancements in precision medicine and targeted therapies are fostering innovation, offering more effective treatment options and contributing to market growth.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 33.2% share and holds US$ 1.5 Billion market value for the year.

North America leads the veterinary antibiotics market due to its strong veterinary healthcare system and strict regulations. The region’s high prevalence of zoonotic diseases drives the need for effective antibiotics to prevent infections. Advanced diagnostic capabilities help detect and treat diseases early, reducing the risk of transmission. Regulatory frameworks, such as the FDA’s oversight of antibiotic use in animals, ensure responsible antibiotic administration. This structured approach supports both public health and the livestock industry, reinforcing North America’s dominance in the veterinary antibiotics market.

Zoonotic diseases significantly impact human and animal health. The Centers for Disease Control and Prevention (CDC) reports that over 60% of infectious diseases in humans come from animals. Additionally, 75% of emerging diseases originate from animal sources. These alarming statistics highlight the need for stringent disease control measures. Veterinary antibiotics play a crucial role in reducing the spread of infections. Their widespread use in treating bacterial illnesses ensures healthier livestock and safer food production, preventing potential outbreaks in both humans and animals.

Public health concerns are increasing due to the growing risk of disease transmission. Effective antibiotics are essential to maintain animal health and protect people from zoonotic diseases. Farmers rely on antibiotics to safeguard livestock from bacterial infections, improving productivity and food supply safety. Companion animals, such as cats and dogs, also require antibiotics to treat infections and enhance their well-being. The rising awareness of antibiotic stewardship encourages responsible usage, ensuring antibiotics remain effective while minimizing the risk of antimicrobial resistance.

The demand for veterinary antibiotics is also fueled by North America’s large-scale animal farming industry and rising pet ownership. Livestock farmers use antibiotics to prevent infections and improve meat and dairy production. Similarly, pet owners seek quality healthcare solutions, increasing the use of antibiotics for companion animals. The region’s strong focus on animal welfare and advancements in veterinary medicine support market growth. With continued investments in research and development, the veterinary antibiotics market is expected to expand further in North America.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The veterinary antibiotics market is characterized by a moderately consolidated landscape, with several key players operating on both global and regional scales. Major companies such as Merck & Co., Ceva Santé Animale, Vetoquinol, Zoetis Services LLC, Boehringer Ingelheim International GmbH, Dechra Pharmaceuticals PLC, Elanco Animal Health Incorporated, and Virbac S.A. hold significant market shares, driven by their extensive product portfolios and continuous investment in research and development. These industry leaders are actively engaged in strategic initiatives, including mergers and acquisitions, to expand their market presence and enhance their product offerings.

Top Key Players in the Medical Tubing Market

- Merck & Co. Inc.

- Ceva Santé Animale.

- Vetoquinol

- Zoetis Services LLC

- Boehringer Ingelheim International GmbH

- Dechra Pharmaceuticals PLC

- Elanco Animal Health Incorporated

- Virbac S.A.

- Calier

- Bimeda Inc

- Prodivet pharmaceuticals SA/NV

- Norbrook Laboratories

Recent Developments

- In February 2024: Blacksmith Medicines and Zoetis entered a strategic partnership to create new antibiotics targeting metalloenzymes for animal health. Blacksmith applies its metal-binding pharmacophore technology and computational tools, while Zoetis offers veterinary expertise and a vast pathogen library. This collaboration seeks to develop alternative treatments to reduce dependence on antibiotics essential for human medicine and combat antibiotic resistance.

- In May 2023: Virbac expanded its footprint in Central Europe by acquiring GS Partners, its long-standing distributor in the Czech Republic and Slovakia. This move established Virbac’s 35th subsidiary, enhancing its ability to serve pet and ruminant healthcare needs in the region. The acquisition reinforces Virbac’s commitment to broadening its veterinary solutions and strengthening its market presence.

Report Scope

Report Features Description Market Value (2024) US$ 4.8 billion Forecast Revenue (2034) US$ 7.0 billion CAGR (2025-2034) 3.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Animal Type (Cattle, Pigs, Sheep & Goats, Poultry, and Others), By Drug Class (Tetracyclines, Penicillins, Sulfonamides, Macrolides, Trimethoprim, Polymyxins, Aminoglycosides, Fluoroquinolones, and Other), By Dosage Form (Powders, Solutions, Injections, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Merck & Co., Inc., Ceva Santé Animale., Vetoquinol, Zoetis Services LLC, Boehringer Ingelheim International GmbH, Dechra Pharmaceuticals PLC, Elanco Animal Health Incorporated, Virbac S.A., Calier, Bimeda, Inc, Prodivet pharmaceuticals SA/NV, and Norbrook Laboratories Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Veterinary Antibiotics MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Veterinary Antibiotics MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Merck & Co. Inc.

- Ceva Santé Animale.

- Vetoquinol

- Zoetis Services LLC

- Boehringer Ingelheim International GmbH

- Dechra Pharmaceuticals PLC

- Elanco Animal Health Incorporated

- Virbac S.A.

- Calier

- Bimeda Inc

- Prodivet pharmaceuticals SA/NV

- Norbrook Laboratories