Global Potato Protein Market Size, Share, And Business Benefits By Product Type (Isolates, Concentrates, Hydrolyzed), By Nature (Organic, Conventional), By Application (Food and Beverages, Animal Feed, Sports Nutrition, Others), By End User (Individual Consumers, Commercial Users), By Distribution Channel (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: January 2025

- Report ID: 137596

- Number of Pages: 309

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Business Benefits of the Potato Protein Market

- By Product Type Analysis

- By Nature Analysis

- By Application Analysis

- By End User Analysis

- By Distribution Channel Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

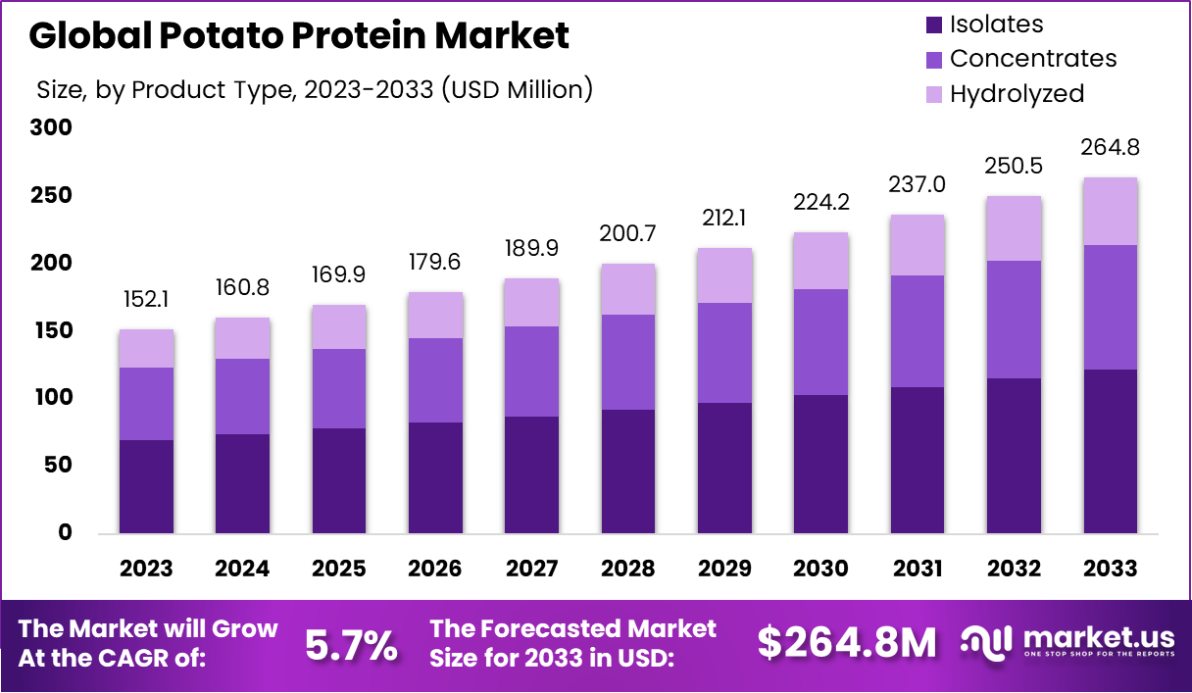

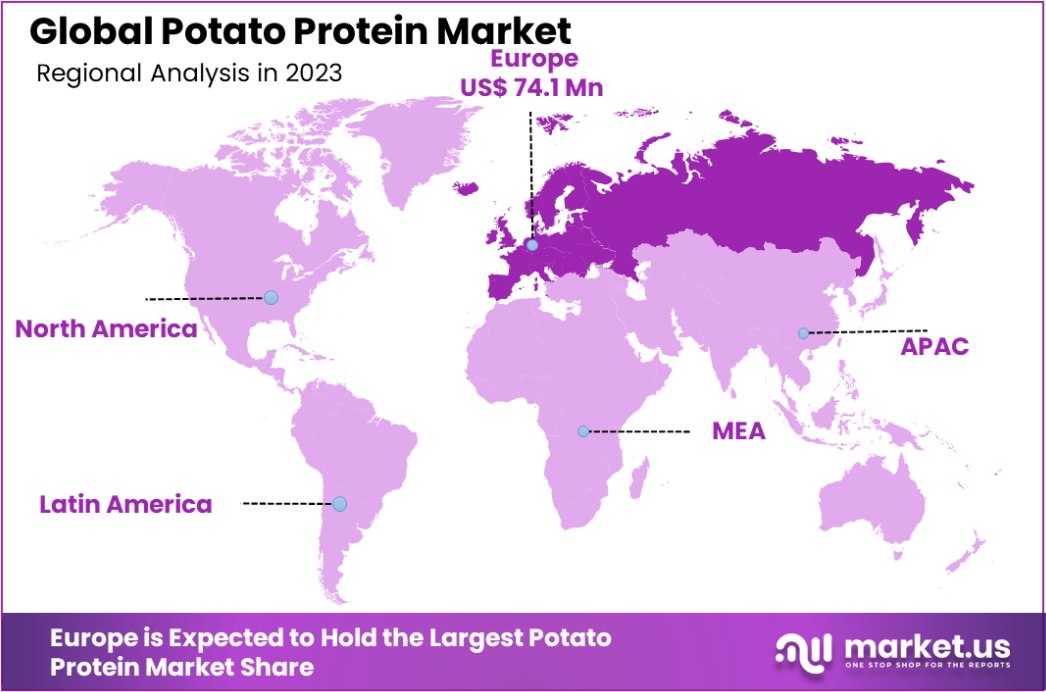

The Global Potato Protein Market is expected to be worth around USD 264.8 Million by 2033, up from USD 152.1 Million in 2023, and grow at a CAGR of 5.7% from 2024 to 2033. Europe holds 48.1% of the potato protein market, valued at USD 74.1 million.

The Potato Protein Market is gaining traction as the demand for plant-based proteins rises. Derived from the starch and fibers of potatoes, this protein has become a key ingredient in food, feed, and nutraceuticals.

The industrial scenario highlights the increasing utilization of potato protein in animal feed, particularly for swine and aquaculture, owing to its high digestibility and amino acid profile. Globally, food manufacturers are integrating potato protein into bakery, snack, and meat substitute products, responding to consumer preferences for sustainable and allergen-free protein sources.

Driving factors include the rising trend toward vegan diets and the need for clean-label ingredients. Potato protein’s functional benefits, such as water binding and emulsification, further enhance its applications. Government initiatives supporting plant-based innovations are positively influencing production scales and export opportunities.

Key trends reveal growing R&D investments in improving protein extraction techniques to enhance yield and nutritional value. Additionally, markets in North America and Europe are leading consumption, while Asia-Pacific is emerging as a significant growth hub for feed applications.

The Potato Protein Market is poised for robust growth, driven by both supportive government policies and burgeoning global production. In France, the government’s decision to nearly double the support for starch potato cultivation—from €83 per hectare in 2024 to €173 per hectare in 2025-26—signals a strategic push to bolster domestic production capacities.

Globally, the potato market has witnessed a significant uptick, with production soaring to 440 million cwt in 2023, marking a 9% increase from the previous year. This surge is reflected in the market valuation, which climbed to $5.00 billion in 2023, up 3% from 2022.

Despite a slight dip in the average price of potatoes to $12.30 per cwt, down $0.60 from 2022, the volume of potatoes sold to processors from the 2023 crop expanded by 7%, totaling 284 million cwt. This data underlines a growing trend of potato utilization in various forms, including protein extraction, underscoring a broader industry shift towards plant-based ingredients.

The confluence of increased production and governmental support is setting the stage for the potato protein market to meet the escalating demand in plant-based food sectors, presenting a lucrative opportunity for market stakeholders.

Key Takeaways

- The Global Potato Protein Market is expected to be worth around USD 264.8 Million by 2033, up from USD 152.1 Million in 2023, and grow at a CAGR of 5.7% from 2024 to 2033.

- The Potato Protein Market sees isolates leading product types with a significant 46.2% market share.

- Conventional potato protein dominates, capturing 73.1% of the market by nature, preferred for its availability.

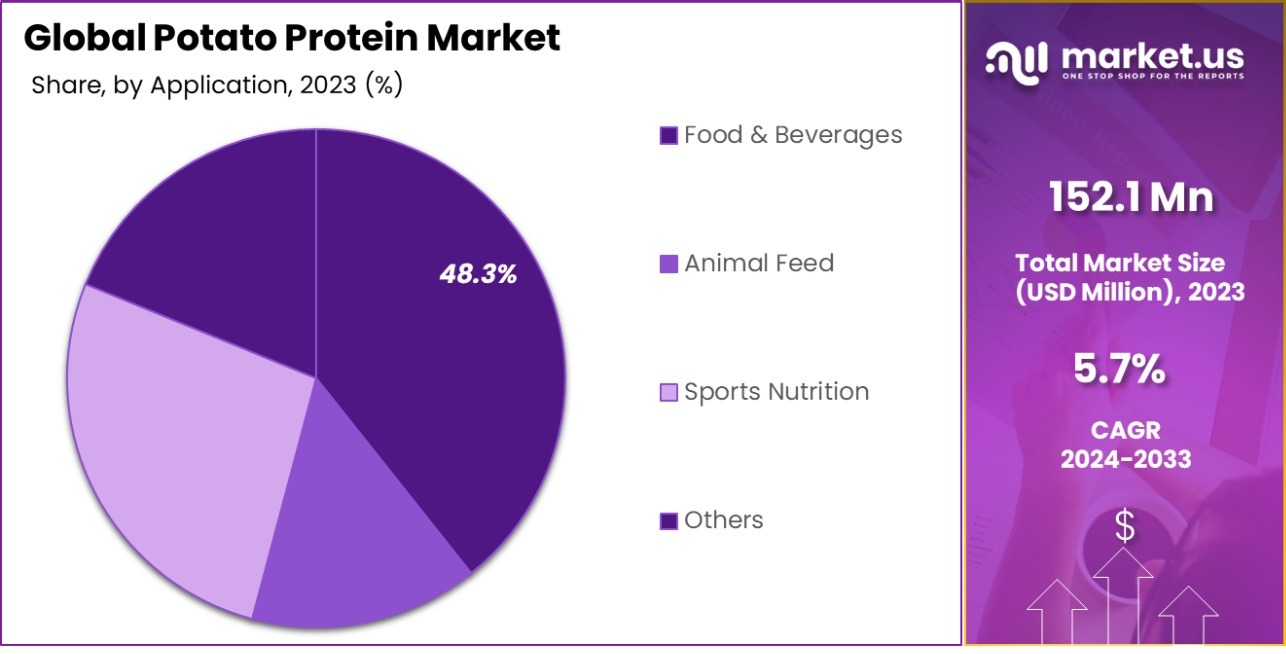

- In applications, food and beverages incorporate potato protein most, holding a 48.3% slice of the market.

- Commercial users are the primary end users, utilizing 66.1% of potato protein in various industries.

- The majority of potato protein sales occur offline, with physical stores commanding a 68.1% market share.

- Europe holds a 48.1% share in the potato protein market, USD 74.1 million.

Business Benefits of the Potato Protein Market

The potato protein market offers significant business opportunities due to its alignment with consumer preferences and global regulatory trends. Governments worldwide are emphasizing sustainable agricultural practices and promoting plant-based proteins as part of dietary guidelines to reduce environmental impact and address food security concerns.

Potato protein, derived as a byproduct of potato starch extraction, provides a high-value use for agricultural outputs, minimizing waste and supporting circular economy principles. The protein’s high amino acid content and functional properties make it ideal for various applications in food, beverages, and animal feed. It serves as an alternative to traditional protein sources, catering to the rising demand for allergen-free and plant-based solutions.

Regulatory bodies, such as the European Union and the U.S. Department of Agriculture (USDA), recognize potato protein as a sustainable and safe ingredient, further encouraging its adoption. Governments are also funding research into plant-based proteins, enhancing innovation in extraction technologies and product applications.

The market contributes to rural economies by creating new revenue streams for farmers and processors. Its scalability and compatibility with existing agricultural systems ensure economic viability. With sustainability and health-conscious trends gaining momentum, the potato protein market holds strong potential for businesses to achieve both economic and environmental goals.

By Product Type Analysis

Isolates dominate the potato protein market, holding a 46.2% share.

In 2023, Isolates held a dominant market position in the By Product Type segment of the Potato Protein Market, with a 46.2% share. This category benefits from its high purity and extensive application in nutritional supplements and dairy alternatives, where consumers demand allergen-free and easily digestible protein sources.

Concentrates captured 33.1% of the market. They are favored for their balanced protein content and cost-effectiveness, making them popular in animal feed applications. This segment is expected to grow as the demand for sustainable and plant-based feed ingredients increases.

Hydrolyzed potato protein, accounting for 20.7% of the market, is highly appreciated for its functional properties, including flavor enhancement and texture improvement in food and beverage products. This segment’s growth is driven by expanding applications in sports nutrition and specialty diets.

By Nature Analysis

Conventional potato proteins are preferred, with a 73.1% market share.

In 2023, Conventional held a dominant market position in the By Nature segment of the Potato Protein Market, with a 73.1% share. This dominance is largely due to its widespread availability and cost-effectiveness compared to organic alternatives. Conventional potato protein continues to be preferred by large-scale manufacturers for its consistent quality and supply stability.

Organic potato protein accounted for 26.9% of the market. This segment is gaining traction as consumer demand for non-GMO and organically produced ingredients increases. Organic potato protein is particularly popular in premium health food products, and its market share is expected to grow as organic farming practices spread and consumer health consciousness rises.

By Application Analysis

Food and beverage lead applications comprise 48.3% of the market.

In 2023, Food and Beverages held a dominant market position in the By Application segment of the Potato Protein Market, with a 48.3% share. This sector benefits from the versatile use of potato protein in products such as baked goods, meat alternatives, and dairy replacements, where it serves as an essential hypoallergenic protein source.

Animal Feed captured 31.2% of the market. Potato protein is increasingly valued in this segment for its high digestibility and amino acid profile, making it an excellent ingredient for young and adult animals alike. This segment is expected to expand as the industry continues to seek sustainable and nutritious feed options.

Sports Nutrition accounted for 20.5% of the market. This segment leverages potato protein’s high biological value and rapid absorption characteristics, making it ideal for recovery drinks and protein supplements targeted at athletes and fitness enthusiasts. Demand in this niche is growing as awareness of plant-based performance enhancers increases.

By End User Analysis

Commercial users are the major end-users, with a 66.1% share.

In 2023, Commercial Users held a dominant market position in the end-user segment of the Potato Protein Market, with a 66.1% share. This segment includes food manufacturers and service providers who utilize potato protein to enhance nutritional content and improve texture in various food products, capitalizing on its functional benefits in large-scale food production.

Individual Consumers accounted for 33.9% of the market. This group primarily purchases potato protein for personal use, often in dietary supplements and plant-based food alternatives. The growth in this segment is driven by increasing health awareness and dietary preferences towards vegan and gluten-free products among consumers.

By Distribution Channel Analysis

Offline channels prevail, distributing 68.1% of potato protein products.

In 2023, Offline held a dominant market position in the By Distribution Channel segment of the Potato Protein Market, with a 68.1% share. This channel includes supermarkets, health food stores, and direct distributor purchases, which remain preferred for their immediate product access and ability to offer consumer assurance through physical product evaluation.

Online distribution accounted for 31.9% of the market. This segment is growing as consumers increasingly value the convenience of home delivery and the availability of a wide range of products. The trend toward online shopping is bolstered by improvements in e-commerce technology and the expanding reach of digital marketing strategies.

Key Market Segments

By Product Type

- Isolates

- Concentrates

- Hydrolyzed

By Nature

- Organic

- Conventional

By Application

- Food and Beverages

- Animal Feed

- Sports Nutrition

- Others

By End User

- Individual Consumers

- Commercial Users

By Distribution Channel

- Online

- Offline

Driving Factors

Rising Popularity of Plant-Based Diets Boosts Demand

The global market for potato protein is primarily driven by the increasing adoption of vegan and plant-based diets. As consumers become more health conscious and aware of the environmental impacts of animal farming, they are turning to plant-based alternatives for protein sources.

Potato protein, known for its high-quality protein content and allergen-free properties, is gaining favor among manufacturers looking to cater to this growing demographic, thereby stimulating market growth.

Expanding Applications in the Food and Beverage Industry

Potato protein’s versatility is a major catalyst for its market expansion. This plant-based protein is being increasingly utilized across various food and beverage segments, including dairy alternatives, meat substitutes, and bakery products.

Its ability to enhance texture and nutritional content makes it a preferred choice for product formulations. This adaptability is leading food manufacturers to innovate and expand their product lines with potato protein, further propelling the market.

Consumer Demand for Allergen-Free Protein Options

There is a noticeable shift towards allergen-free food products among consumers, particularly those with dietary restrictions or allergies. Potato protein, being naturally free from common allergens like gluten, soy, and dairy, meets this need effectively.

This attribute makes it highly attractive in the formulation of hypoallergenic food products, thereby broadening its appeal and use in the global market, and subsequently driving its growth.

Restraining Factors

High Costs of Production and Processing Challenges

The production and processing of potato protein involve intricate techniques and specialized equipment, leading to higher costs compared to other plant proteins. These increased expenses can be a barrier for new entrants and smaller players in the market, limiting their ability to compete with established companies.

Additionally, the complexity of extracting high-quality potato protein often results in higher final product prices, which could deter budget-conscious consumers and restrict market growth.

Competition from More Established Plant Proteins

Potato protein faces stiff competition from more well-known and widely used plant proteins such as soy, pea, and rice protein. These alternatives often have a stronger market presence and consumer acceptance, as well as more developed supply chains.

The familiarity and versatility of these proteins make them strong competitors, posing a challenge for potato protein to gain a significant market share, especially in regions where soy or pea proteins are already preferred choices.

Limited Awareness and Market Penetration

Despite its benefits, potato protein is not as widely recognized among consumers and industries compared to other protein sources. This lack of awareness can hinder market penetration and growth, as consumers tend to opt for familiar ingredients.

Furthermore, limited marketing efforts to educate potential users about the advantages of potato protein can slow down its adoption rate, particularly in markets that are less open to new food innovations.

Growth Opportunity

Expansion into Emerging Markets with Health-Focused Trends

Emerging markets present a fertile ground for growth in the potato protein sector. As health awareness increases globally, these regions are exploring healthier dietary options. Potato protein, with its allergen-free and high-protein qualities, aligns well with the health-focused trends sweeping these markets.

The opportunity for manufacturers is to introduce and market potato protein as a nutritious alternative to animal proteins, capitalizing on the growing consumer preference for sustainable and healthy food choices in these rapidly developing economies.

Innovations in Food Technology Enhance Product Offerings

Advancements in food technology offer significant opportunities for enhancing potato protein applications in various products. By improving extraction methods and processing technologies, the quality and functionality of potato protein can be greatly enhanced.

This can lead to broader uses in the food industry, including textured proteins, functional food products, and specialized dietary supplements. Companies that invest in these technological innovations are likely to see expanded product lines and increased market acceptance.

Strategic Partnerships with Food and Beverage Giants

Forming strategic partnerships with leading food and beverage companies can serve as a powerful growth lever for potato protein providers. These collaborations can help integrate potato protein into mainstream products and access wider distribution channels.

By partnering with established brands, potato protein manufacturers can leverage the brand strength and market presence of these companies to enhance product visibility and consumer trust, facilitating easier entry into new markets and segments.

Latest Trends

Growing Use of Potato Protein in Sports Nutrition

The trend of using potato protein in sports nutrition is gaining momentum as athletes and fitness enthusiasts seek high-quality plant-based protein sources. Potato protein’s excellent amino acid profile and easy digestibility make it a preferred ingredient in protein shakes, energy bars, and recovery supplements.

With the rise in awareness of plant-based diets among the fitness community, brands are increasingly formulating sports nutrition products using potato protein to cater to this expanding consumer base.

Increasing Focus on Sustainable and Clean-Label Products

Sustainability and clean-label trends are reshaping the food industry, and potato protein aligns perfectly with these preferences. Consumers are increasingly choosing products that are environmentally friendly and free from artificial additives.

Potato protein, being a natural and minimally processed ingredient, fits well into this trend. Its appeal as a clean-label ingredient is driving its adoption in various food categories, including snacks, ready-to-eat meals, and functional foods, where transparency and sustainability are key purchase drivers.

Rising Popularity of Organic and Non-GMO Potato Protein

Organic and non-GMO potato protein products are becoming more sought after as consumers prioritize health and ethical choices. This trend is particularly strong in developed markets, where demand for organic foods is growing.

Manufacturers are introducing organic and non-GMO potato protein to meet the preferences of health-conscious and environmentally aware customers. This shift is not only helping brands differentiate themselves but also attracting a niche market segment that values high-quality, ethical food ingredients.

Regional Analysis

Europe holds a 48.1% share in the potato protein market, valued at USD 74.1 million.

The potato protein market exhibits diverse growth dynamics across regions, with Europe emerging as the dominating region, holding 48.1% of the market share, valued at USD 74.1 million. The high adoption rate of plant-based diets, coupled with the strong presence of food manufacturers, drives the demand for potato protein in the European market.

North America follows closely, driven by the increasing preference for allergen-free and sustainable food ingredients in the United States and Canada. The Asia Pacific region is experiencing robust growth, propelled by expanding food processing industries and a rising focus on plant-based protein alternatives, particularly in China, India, and Japan.

Latin America is witnessing steady growth, supported by increasing awareness of healthy lifestyles and expanding applications of potato protein in functional foods. The Middle East & Africa region shows moderate growth potential, with a growing urban population and rising interest in innovative food products.

These regional dynamics highlight Europe as the leading market, while the Asia Pacific and North America exhibit promising growth trajectories, fueled by evolving consumer preferences and expanding food and beverage sectors.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global Potato Protein Market is currently experiencing a dynamic shift, driven by consumer preferences toward plant-based and gluten-free products. Key players such as Agrana Beteiligungs-AG and Avebe are capitalizing on these trends by expanding their product portfolios to include innovative potato protein solutions.

Agrana, known for its starch and sugar production, is increasingly focusing on protein extracts from potatoes, aiming to cater to the rising health-conscious segment.

Avebe is another notable contributor, pioneering in the extraction of high-quality protein from potatoes, primarily used in sports nutrition and meat substitutes. This approach not only meets the dietary requirements of a diverse consumer base but also adheres to sustainable agricultural practices.

Similarly, Cargill, Incorporated is leveraging its extensive infrastructure and R&D capabilities to enhance the efficiency of potato protein extraction, thereby ensuring a consistent supply to meet global demands. Their strategy includes partnerships with local farmers to secure a sustainable potato supply chain, which is critical for maintaining production continuity.

Emsland Group and Ingredion Incorporated are also key competitors in this sector. They are enhancing their processing technologies to improve the functionality of potato proteins in various applications, from baked goods to dairy alternatives. Their efforts are crucial in improving texture and taste, which are vital for consumer acceptance.

Kemin Industries, Inc., and Roquette Frères are focusing on niche markets, developing specialized potato protein isolates that offer unique properties for specific applications, thereby creating a competitive edge in this growing market.

Top Key Players in the Market

- Agrana Beteiligungs-Ag

- AKV Langholt AmbA

- Avebe

- Cargill, Incorporated

- Emsland Group

- Ingredion Incorporated

- Kemin Industries, Inc.

- Kmc Ingredients

- Meelunie B.V.

- Omega Protein Corporation

- Pepees Group

- Ppz Niechlow

- Roquette Frères

- Sudstarke GmbH

- Tate & Lyle

- Tereos Group

Recent Developments

- In 2024, Emsland Group focused on enhancing their potato protein products like Empet®, targeting pet food applications. They continued innovation in meat analogs with products like Emfibre® and Empro®, addressing texture and nutrition in plant-based foods. Their sustainability efforts were integrated across all business practices.

- In 2023, AKV Langholt AmbA expanded its influence in the sector by acquiring a 50% share from Cargill in their joint venture, Cargill-AKV I/S, demonstrating a strategic move to consolidate their operations and potentially expand production capabilities.

Report Scope

Report Features Description Market Value (2023) USD 152.1 Million Forecast Revenue (2033) USD 264.8 Million CAGR (2024-2033) 5.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Isolates, Concentrates, Hydrolyzed), By Nature (Organic, Conventional), By Application (Food and Beverages, Animal Feed, Sports Nutrition, Others), By End User (Individual Consumers, Commercial Users), By Distribution Channel (Online, Offline) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Agrana Beteiligungs-Ag, AKV Langholt AmbA, Avebe, Cargill, Incorporated, Emsland Group, Ingredion Incorporated, Kemin Industries, Inc., Kmc Ingredients, Meelunie B.V., Omega Protein Corporation, Pepees Group, Ppz Niechlow, Roquette Frères, Sudstarke GmbH, Tate & Lyle, Tereos Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Agrana Beteiligungs-Ag

- AKV Langholt AmbA

- Avebe

- Cargill, Incorporated

- Emsland Group

- Ingredion Incorporated

- Kemin Industries, Inc.

- Kmc Ingredients

- Meelunie B.V.

- Omega Protein Corporation

- Pepees Group

- Ppz Niechlow

- Roquette Frères

- Sudstarke GmbH

- Tate & Lyle

- Tereos Group