Global Potassium Soap Insecticides Market By Formulation Type (Liquid Concentrate, Ready-to-Use Spray), By Pest Type (Aphids, Whiteflies, Thrips, Mites, Others), By Crop Type (Fruits and Vegetables, Small Trees and Shrubs, Ornamental Trees, Oilseeds, Herbs And Spices, Others), By Application (Horticulture, Indoor Gardening, Outdoor Gardening, Field Crops, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155795

- Number of Pages: 277

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

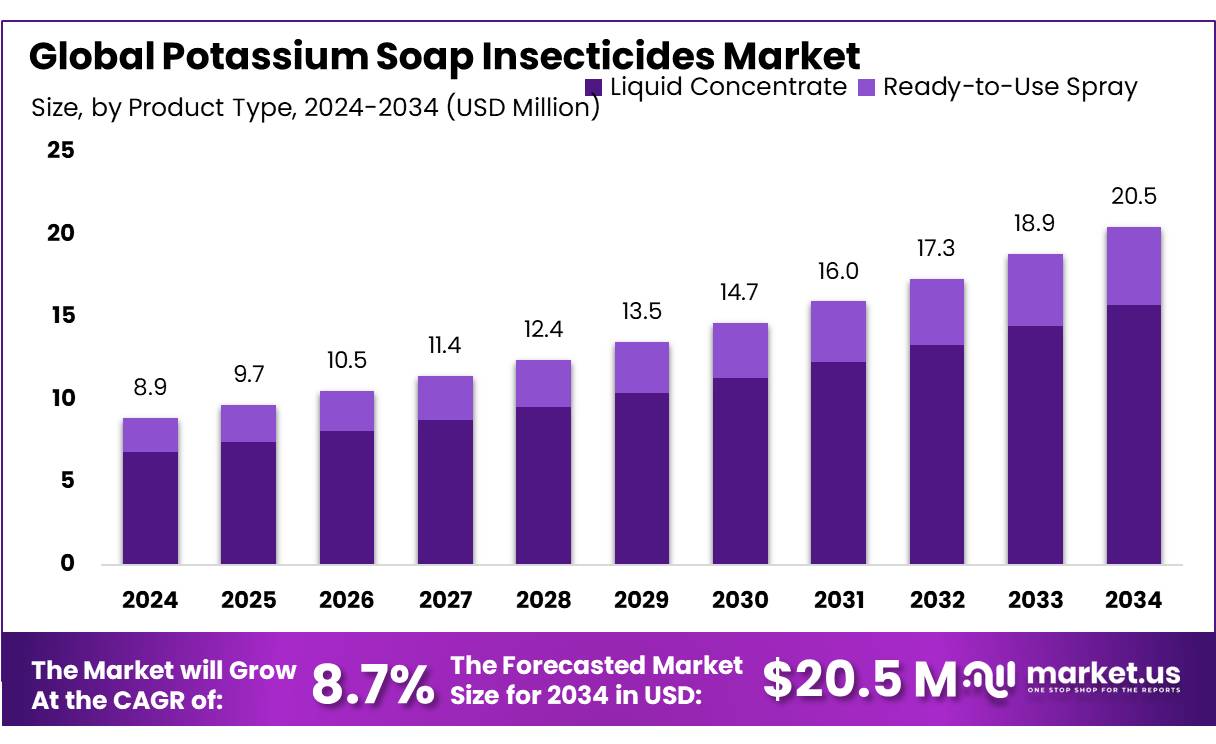

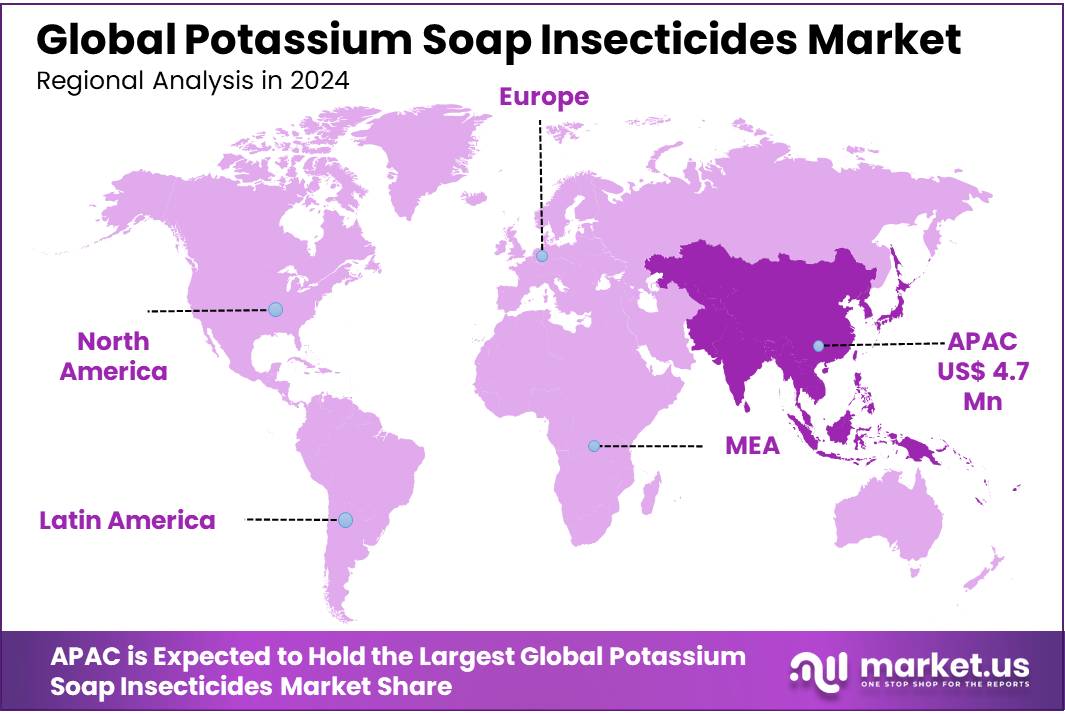

The Global Potassium Soap Insecticides Market size is expected to be worth around USD 20.5 Million by 2034, from USD 8.9 Million in 2024, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034. In 2024, Asia Pacific held a dominant market position, capturing more than a 53.6% share, holding USD 4.7 Million revenue.

Potassium soap insecticides have emerged as a sustainable and eco-friendly alternative to conventional chemical pesticides, gaining traction in global agricultural practices. These insecticides are derived from natural fatty acids and potassium salts, effectively targeting soft-bodied pests such as aphids, whiteflies, and spider mites. Their biodegradability and minimal environmental impact align with the growing consumer demand for organic and pesticide-free produce.

Driving factors for this growth include increasing global population and rising demand for sustainable, residue‑free crop protection solutions. Governments and regulators are increasingly promoting biopesticides and integrated pest management. The U.S. Environmental Protection Agency (EPA) has found that soap salts degrade rapidly in soil, pose minimal risks to birds and fish, and are considered safe with respect to endangered species, though they remain highly toxic to aquatic invertebrates. In addition, insecticidal soaps—especially those listing “potassium salts of fatty acids” as active ingredients—are permitted for use under U.S. organic certification.

In India, the government promotes organic and natural farming through multiple schemes, even though these do not cite potassium soap specifically, the emphasis on biopesticides and organic inputs benefits their adoption. The National Mission on Natural Farming, launched in August 2025 with a budget of ₹2,481 crore (~US $300 million), aims to promote sustainable practices across 750,000 hectares and benefit 10 million farmers.

The Mission Organic Value Chain Development for North Eastern Region (MOVCD‑NER) supports organic value chains across eight states, covering 50,000 hectares and engaging 50,000 farmers, with subsidies offering up to 75% for FPOs and 50% for private investors for infrastructure. Additionally, under the Paramparagat Krishi Vikas Yojana (PKVY), launched in 2015, the government provides INR 20,000 per acre over three years to farmers forming organic clusters, aiming to convert 500,000 acres by 2018.

Together, these policy frameworks and subsidy schemes incentivize the adoption of biopesticides like potassium soap in organic and sustainable agriculture. The BioAgri Revolution, as documented by the Indian Agricultural Research Institute, underscores that while chemical fertilizer consumption (N, P₂O₅, K₂O) rose to 139.8 kg/ha in 2023, bio‑input adoption—including biopesticides—is growing rapidly at around 14% CAGR, compared to just 2% for chemicals

Key Takeaways

- Potassium Soap Insecticides Market size is expected to be worth around USD 20.5 Billion by 2034, from USD 8.9 Billion in 2024, growing at a CAGR of 8.7%.

- Liquid Concentrate held a dominant market position, capturing more than a 76.9% share.

- aphids clearly topped the list of pests treated with potassium soap insecticides, holding more than a 35.8% share.

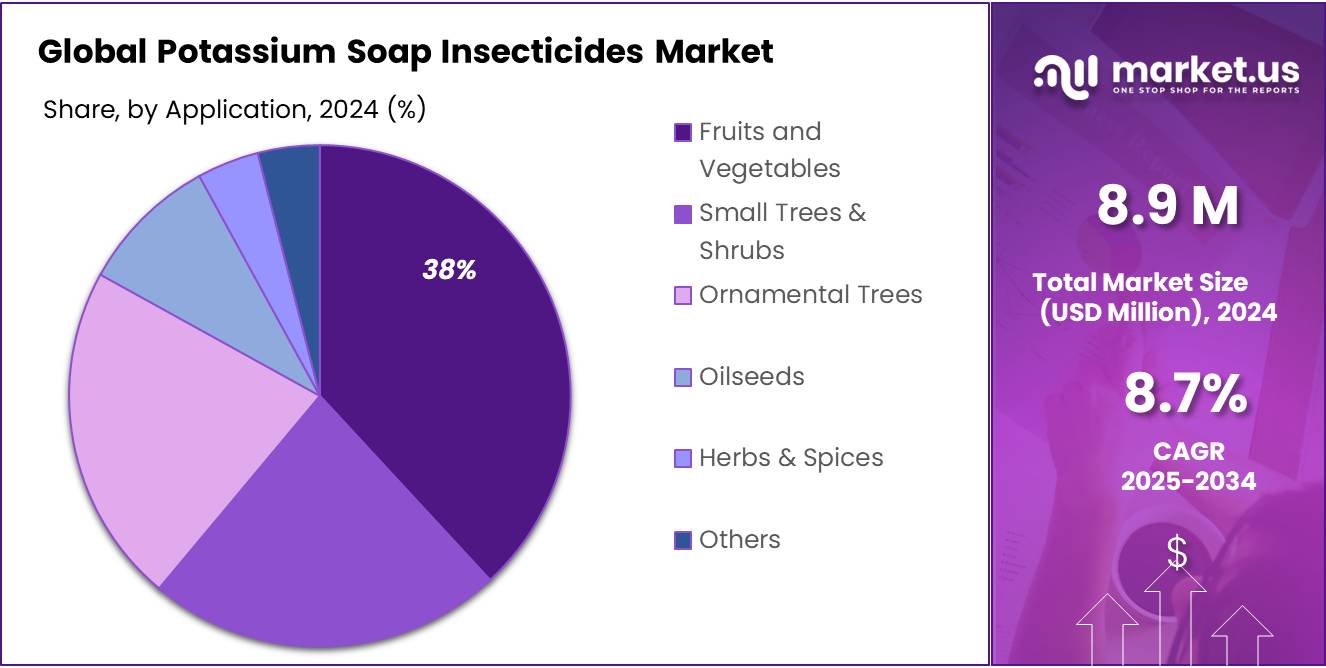

- fruits and vegetables emerged as the top crop types treated with potassium soap insecticides, capturing more than a 38.2% share.

- horticulture clearly led the pack in applications of potassium soap insecticides, accounting for more than a 39.4% share.

- Asia Pacific region emerged as the powerhouse for potassium soap insecticides, driving more than 53.6% of the global market and generating around USD 4.7 million.

By Formulation Type Analysis

In 2024, Liquid Concentrate held a dominant market position, capturing more than a 76.9% share.

In 2024, the liquid concentrate segment clearly stood out. Farmers and gardeners leaned toward this form because it’s easy to dilute and spray—no measuring out powders or worrying about clumping. Users simply mix it with water and use what they need. Because of its flexibility and uniform application, it became the go‑to format, driving its commanding 76.9 %+ share of the market.

Over the months into 2025, that dominance continued. The convenience factor hasn’t waned—everything about liquid concentrate, from storage in compact containers to precise coverage over plant foliage, keeps it ahead. Growers prefer being able to tailor concentration levels for different crops and pests, and liquid forms let them do that efficiently. That adaptability ensures the segment remains top dog in the formulation mix.

By Pest Type Analysis

Aphids take the lead with over 35.8% thanks to their prevalence in many crops.

In 2024, aphids clearly topped the list of pests treated with potassium soap insecticides, holding more than a 35.8% share of usage. Growers favored this approach because aphids—tiny, fast‑reproducing sap‑sucking insects—are a common threat across fruits, vegetables, and ornamentals. Potassium soap sprays work by breaking down their waxy exoskeletons, causing dehydration and death, which makes them a handy and effective option.

As we moved into 2025, that strong preference didn’t fade. Farmers and gardeners continued relying on potassium soap to manage aphid infestations—it’s safe, easy to mix, and gentle on the environment. Because aphids often build up resistance to harsher chemicals, the mild yet efficient approach of soaps remained attractive. That ongoing trust in the product helps secure its leading position in the pest‑type mix.

By Crop Type Analysis

Fruits & vegetables lead the way with over 38.2% of usage, thanks to their delicate nature and heavy pest pressure.

In 2024, fruits and vegetables emerged as the top crop types treated with potassium soap insecticides, capturing more than a 38.2% share. This makes perfect sense—these crops are especially susceptible to soft-bodied insects like aphids, whiteflies, and mites, which thrive in the moist, lush environments of orchards and vegetable gardens. Potassium soap’s ability to gently but effectively control such pests—without leaving harmful residues—makes it a natural fit for growers managing delicate produce.

Moving into 2025, that dominance remains strong. Farmers and home gardeners continue to favor potassium soap for fruits and vegetables because it’s easy to dilute, safe on tender plant tissues, and aligns well with organic standards. They can spray it directly on produce without worrying about chemical residues, making it safe for immediate harvests and environmentally safer for beneficial insects nearby.

By Application Analysis

Horticulture shines brightest with over 39.4% of usage, thanks to its precise care needs and year-round demand.

In 2024, horticulture clearly led the pack in applications of potassium soap insecticides, accounting for more than a 39.4% share. Gardeners, landscapers, and greenhouse operators valued this treatment because it’s gentle on delicate flowering plants, ornamentals, and nursery stock while still getting rid of common pests. Its ability to control soft-bodied insects without harsh chemicals made it especially appealing for environments where aesthetic quality and plant health are top priorities.

Heading into 2025, horticulture’s lead remains strong. The soap’s flexibility—simple dilution, easy spray application, and minimal residue—continues to make it a favorite for professionals and hobbyists alike. Whether it’s kept in a small urban greenhouse or used across expansive ornamental gardens, potassium soap provides effective protection without compromising the vibrant appearance growers strive for.

Key Market Segments

By Formulation Type

- Liquid Concentrate

- Ready-to-Use Spray

By Pest Type

- Aphids

- Whiteflies

- Thrips

- Mites

- Others

By Crop Type

- Fruits and Vegetables

- Small Trees & Shrubs

- Ornamental Trees

- Oilseeds

- Herbs & Spices

- Others

By Application

- Horticulture

- Indoor Gardening

- Outdoor Gardening

- Field Crops

- Others

Emerging Trends

Organic agriculture’s explosive growth is setting the pace for potassium soap insecticides

According to a collaborative report by FiBL and IFOAM—two leading institutions in organic agriculture—the global area under organic management swelled by 2.5 million hectares in 2023, bringing the total to nearly 99 million hectares, a 2.6% increase from the previous year. That’s not a tiny blip—it’s a significant expansion, with countries like Latin America adding 1 million hectares, and Africa seeing a phenomenal 24% year-over-year growth, reaching 3.4 million hectares.

That expansion matters because organic farmers need pest control tools that meet strict compliance criteria. Potassium soap fits the bill—it’s biodegradable, leaves little to no residues, and is generally accepted in organic frameworks worldwide. As more farmland turns organic, soap-based solutions move from niche to necessity. It’s a growth vector that’s rooted in real, tangible change in how the world grows its food.

In addition to land-use growth, the consumer side mirrors this trend. In the U.S., certified organic product sales reached $71.6 billion in 2024, growing at 5.2%, more than double the overall marketplace’s 2.5% growth rate. This surge underlines that consumer demand for organic produce is solid—and rising. For growers, that creates both an incentive and a responsibility to use pest control that matches consumer expectations. Potassium soap, being organic-compliant and safe, benefits directly from this shift.

On the governmental and institutional front, policies are aligning, too. Schemes like the USDA’s Organic Transition Initiative (part of the National Organic Program) support farmers in transitioning to organic practices, helping them access certifications, training, and market support. Such policies help shift more producers toward organic systems—and with that comes a need for trusted inputs like potassium soap.

Drivers

Growing organic farming boosts demand for potassium soap insecticides

In India, for example, the National Mission on Natural Farming (NMNF) received a substantial boost when it was officially launched on August 23, 2025, backed by a budget of ₹2,481 crore. The initiative is designed to cover 750,000 hectares of land and uplift around 10 million farmers by encouraging natural and chemical‑free practices. With such a massive campaign, farmers are being educated, supported, and persuaded to adopt natural pest control methods—including potassium soap—as a key tool in maintaining crop health without relying on synthetic chemicals.

Adding to this momentum, the Indian Institute of Vegetable Research (IIVR) carried out a powerful outreach program under the Ministry of Agriculture’s Viksit Krishi Samkalp Abhiyan in mid‑2025. From May 29 to June 8, expert teams educated over 44,000 farmers across six districts of Uttar Pradesh on topics such as natural farming, integrated pest management, and organic pest control—including safe, water‑based solutions that align with potassium soap use. The breadth of this engagement, involving both scientific teams and local farmers, shows a real push toward replacing conventional pesticides with softer, more environment‑friendly alternatives.

The organic push isn’t limited to just farming outreach. Under the Paramparagat Krishi Vikas Yojana (PKVY), the Indian government provides INR 20,000 per acre over a three‑year period to farmers forming organic clusters—backed by the goal of bringing half a million acres into organic production by 2018. Such financial incentives make switching to organic methods more viable, and soap‑based insecticides often become the natural tool-of-choice, thanks to their safety and simplicity.

These government-led programs are building not only awareness but also trust in natural pest control options—highlighting their safety, affordability, and compliance with organic norms. For farmers and policymakers alike, the idea of protecting crops without harmful residues resonates deeply with sustainable farming values.

Restraints

Limited residual action & application challenges hold back wider use

First, let’s talk about how potassium soap works—and why that’s sometimes a drawback. These soaps only kill pests they directly contact. Once the spray dries on the leaves—or dries on any surface—its insecticidal activity ends. That means growers must thoroughly wet every target insect, which takes care and precision, especially in dense foliage or large-scale fields. After the spray dries, aphids, mites, or whiteflies that arrive later aren’t affected. In practical terms, that means repeated applications—often every 7 to 14 days—are needed for sustained control. It’s simple science, but it makes control a chore in larger or more complex settings.

Another concern—especially for growers managing delicate ornamental crops—is phytotoxicity, or plant damage. Certain plants are sensitive to soap sprays, especially under stress or in hot conditions. Damage can appear as yellow or brown spots, leaf tip burn, or general scorch—and it might not become visible until a couple of days after spraying. Gardeners or professionals working with sensitive species—like Japanese maples, cherries, or bleeding hearts—are often cautious, fearing cosmetic damage that undercuts the crop’s market value or visual appeal.

Wetting every insect and the drying-related loss of action also mean that soap insecticides offer no residual protection. That makes them less practical for commercial farmers who would prefer a broader window of protection from a single application. For them, the cost—both in product and labor—can outweigh the benefits of a milder, organic method.

On the regulatory side, although potassium soap is exempted from residue tolerance requirements and is classified as GRAS (Generally Recognized as Safe) by the U.S. FDA—making it easy to use on food crops even until harvest—this safety status doesn’t offset the operational drawbacks. It’s great for consumer and environmental health, but still doesn’t address the need for efficacy and ease of use in the field.

Opportunity

Spreading organic cultivation opens a bright path for potassium soap insecticides

Organic farmland keeps expanding steadily. By the end of 2023, farms under organic management covered nearly 99 million hectares, which is an increase of 2.5 million hectares in just one year. That’s a tangible sign that organic farming is not just a niche—it’s rapidly scaling. These farmers need pest control tools that align with organic standards, and potassium soap fits that bill perfectly.

In India, the story is similar—or even more compelling. According to data published by the Federal Agricultural Service, India’s organic agricultural sector was valued at USD 2.5 billion in the 2023–24 marketing year. That reflects a strong, growing foundation of organic production that naturally increases demand for compliant pest control like soap-based insecticides.

On the U.S. side, the organic market continues to outpace traditional food markets. In 2024, certified organic product sales reached USD 71.6 billion, growing at 5.2%—more than double the growth rate for the overall marketplace. That signals rising consumer demand, translates into higher volumes of organic production, and again points to a need for compatible pesticide alternatives that meet consumer and regulatory expectations.

Governments are helping that shift too. In North-East India, the Mission Organic Value Chain Development for North Eastern Region (MOVCD‑NER) has been building support for organic agriculture since 2015. The scheme has nurtured 100 organic FPOs/FPCs over 50,000 hectares, with 50,000 farmers involved. It also backs value chain elements like certification, aggregation, and processing infrastructure—most of which align well with the use of permitted inputs like potassium soap

Regional Insights

Asia Pacific commands a strong lead with a 53.60% market share and a value of USD 4.7 million.

In 2024, the Asia Pacific region emerged as the powerhouse for potassium soap insecticides, driving more than 53.6% of the global market and generating around USD 4.7 million in regional revenue. This leadership reflects both the scale of agriculture in the region—home to major food producers like China and India—and rising awareness of sustainable pest control methods. The region’s hard-working smallholder farmers, alongside expanding horticultural and organic sectors, have embraced potassium soap as a cost-effective and gentle way to protect a wide range of crops.

Asia Pacific’s dominance is expected to deepen. Growing urban farming trends, increasing demand for residue-free produce, and supportive government policies—such as subsidies for organic inputs and training programs—are reinforcing its position as the leading region. Supportive data highlight that in 2022, Asia Pacific accounted for over 50.3% of global potassium soap insecticide revenues, underscoring the region’s ongoing influence.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BONIDE is a long-standing name in home and garden care, offering a ready‑to‑use potassium soap insecticidal spray that targets soft‑bodied pests like aphids, mites, and whiteflies. Its Insecticidal Soap RTU blends potassium fatty acids, letting users spray directly—no mixing, perfect for houseplants, vegetables, and flowers. Approved for organic gardening and safe enough for use right up till harvest, it balances ease, accessibility, and eco-friendliness.

Hungarian company Corax Bioner brings a lab‑based edge to the soap insecticide world with its Biosol® Potassium Soap. It’s an emulsion-forming concentrate containing 30% potassium soap, used both as a pesticide and to boost adherence of other treatments. Applied in agriculture, orchards, and nurseries, it can be combined with other foliar products or used on its own at varying concentrations (0.5–2.5%).

Under the Certis brand, the DES‑X Insecticidal Soap Concentrate offers a powerful, contact‑based solution with 47 % potassium salts of fatty acids. OMRI‑listed and compatible with integrated pest management, it works on insects and mites while remaining harmless to beneficials. Users benefit from zero‑day pre‑harvest intervals, residue exemption, and flexible application (field sprays, greenhouse). Perfect for growers managing pest “hot spots” before releasing predators.

Top Key Players Outlook

- BONIDE Products LLC

- Corax Bioner Co.

- Certis USA L.L.C.

- Ecoworm Limited

- Kao Corporation

- OHP, Inc.

- PROMISOL S.A.

- SPAA SRL

- W. Neudorff GmbH

- Victorian Chemical Company Pty Ltd

Recent Industry Developments

In 2024, Ecoworm Limited continued to carve out its niche by offering eco‑friendly potassium soap insecticides that double as natural cleaners. Their “Clean & Guard Potassium Soap Concentrate” (35 fl oz) creates up to 50 L of ready‑to‑use spray—an economical choice for gardeners combating aphids.

In 2024, Certis USA L.L.C. cemented its role in the potassium soap insecticides space through its flagship DES‑X® Insecticidal Soap Concentrate, which contains 47.0% potassium salts of fatty acids.

Report Scope

Report Features Description Market Value (2024) USD 8.9 Bn Forecast Revenue (2034) USD 20.5 Bn CAGR (2025-2034) 8.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Formulation Type (Liquid Concentrate, Ready-to-Use Spray), By Pest Type (Aphids, Whiteflies, Thrips, Mites, Others), By Crop Type (Fruits and Vegetables, Small Trees and Shrubs, Ornamental Trees, Oilseeds, Herbs And Spices, Others), By Application (Horticulture, Indoor Gardening, Outdoor Gardening, Field Crops, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BONIDE Products LLC, Corax Bioner Co., Certis USA L.L.C., Ecoworm Limited, Kao Corporation, OHP, Inc., PROMISOL S.A., SPAA SRL, W. Neudorff GmbH, Victorian Chemical Company Pty Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Potassium Soap Insecticides MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Potassium Soap Insecticides MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BONIDE Products LLC

- Corax Bioner Co.

- Certis USA L.L.C.

- Ecoworm Limited

- Kao Corporation

- OHP, Inc.

- PROMISOL S.A.

- SPAA SRL

- W. Neudorff GmbH

- Victorian Chemical Company Pty Ltd