Global Popcorn Market Size, Share, And Business Benefits By Type (Ready-to-Eat Popcorn, Microwave Popcorn), By Shape (Butterfly, Mushroom), By End-use (Households, Commercial), By Distribution Channel (Supermarket and Hypermarket, Convenience Stores, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: January 2025

- Report ID: 137396

- Number of Pages: 289

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

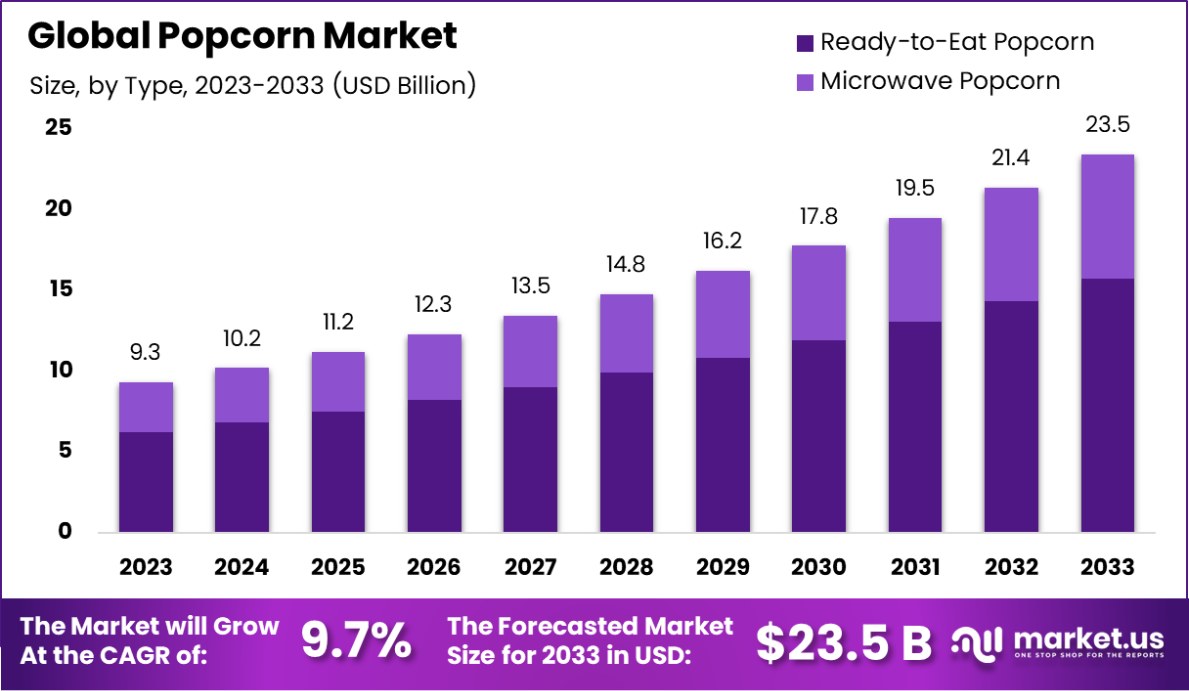

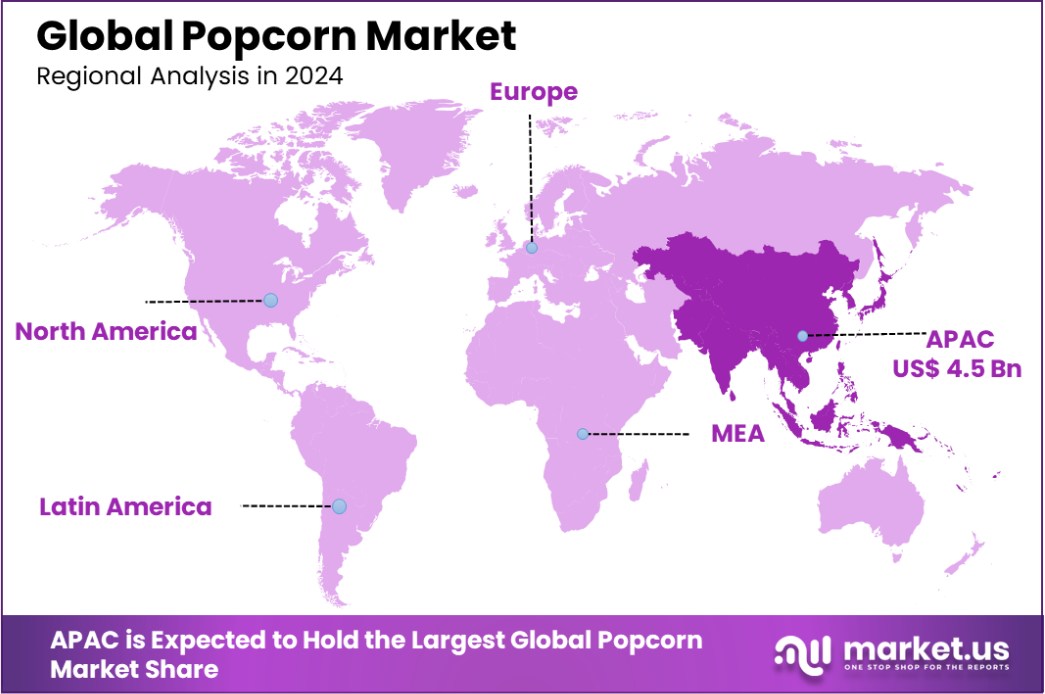

The Global Popcorn Market is expected to be worth around USD 23.5 Billion by 2033, up from USD 9.3 Billion in 2023, and grow at a CAGR of 9.7% from 2024 to 2033. In Asia-Pacific, the popcorn market captures 48.2%, valuing USD 4.5 billion.

The popcorn market has experienced significant growth in recent years, driven by increasing consumer demand for convenient and healthy snack options. Popcorn, a variety of corn kernels that expands and puffs up when heated, has become a staple in households and public venues such as movie theaters.

In the United States, the Popcorn Board, operating under the Agricultural Marketing Service (AMS) of the USDA, plays a pivotal role in maintaining and expanding existing and new markets for popcorn and its products. The Board collects assessments from processors handling over 4 million pounds of popcorn annually, utilizing these funds for promotion, consumer information, and market-related research.

In India, the Khadi and Village Industries Commission (KVIC) has recognized the potential of popcorn manufacturing as a viable small-scale industry. KVIC provides detailed project profiles for setting up popcorn-making units, highlighting the benefits and market potential of popcorn production. These profiles outline the necessary machinery, raw materials, and financial projections, emphasizing the growing demand for popcorn nationwide.

The increasing health consciousness among consumers has led to a preference for low-calorie, high-fiber snacks, positioning popcorn as an ideal choice. Additionally, the convenience of ready-to-eat and microwaveable popcorn products has further boosted market demand. Manufacturers are capitalizing on this trend by introducing a variety of flavors and organic options to cater to diverse consumer preferences.

Technological advancements in popcorn production, such as improved popping methods and flavoring techniques, have enhanced product quality and shelf life, contributing to market growth. Furthermore, the expansion of retail channels, including supermarkets, hypermarkets, and online platforms, has increased product accessibility, driving sales globally.

Future growth opportunities in the popcorn market are promising, with emerging markets in Asia and Africa presenting significant potential due to changing lifestyles and increasing disposable incomes. The development of innovative and healthier product variants, such as gluten-free and non-GMO popcorn, is expected to attract a broader consumer base.

The global popcorn market continues to showcase robust growth, driven by evolving consumer preferences for convenient and healthier snack options. Indiana’s 2023 popcorn production highlights significant advancements, with a 9% increase in output reaching 4.68 million cwt.

Notably, the state planted 91,000 acres, up 6,000 acres from the previous year, achieving an average yield of 52.0 cwt per acre—1 cwt/acre higher than in 2022. However, the average price declined to $20.30 per cwt from $25.00 in 2022, reflecting market dynamics. Despite this, Indiana’s popcorn crop value stood at $95 million.

Nationally, Americans consume approximately 14 billion quarts annually, indicating strong demand. Meanwhile, Nebraska produced an impressive 333 million pounds in 2022, solidifying its position in this competitive market.

Key Takeaways

- The Global Popcorn Market is expected to be worth around USD 23.5 Billion by 2033, up from USD 9.3 Billion in 2023, and grow at a CAGR of 9.7% from 2024 to 2033.

- Ready-to-Eat (RTE) popcorn dominates the market, capturing 67.4% of total revenue share.

- Butterfly-shaped popcorn leads with 73.4%, reflecting consumer preference for its light, airy texture.

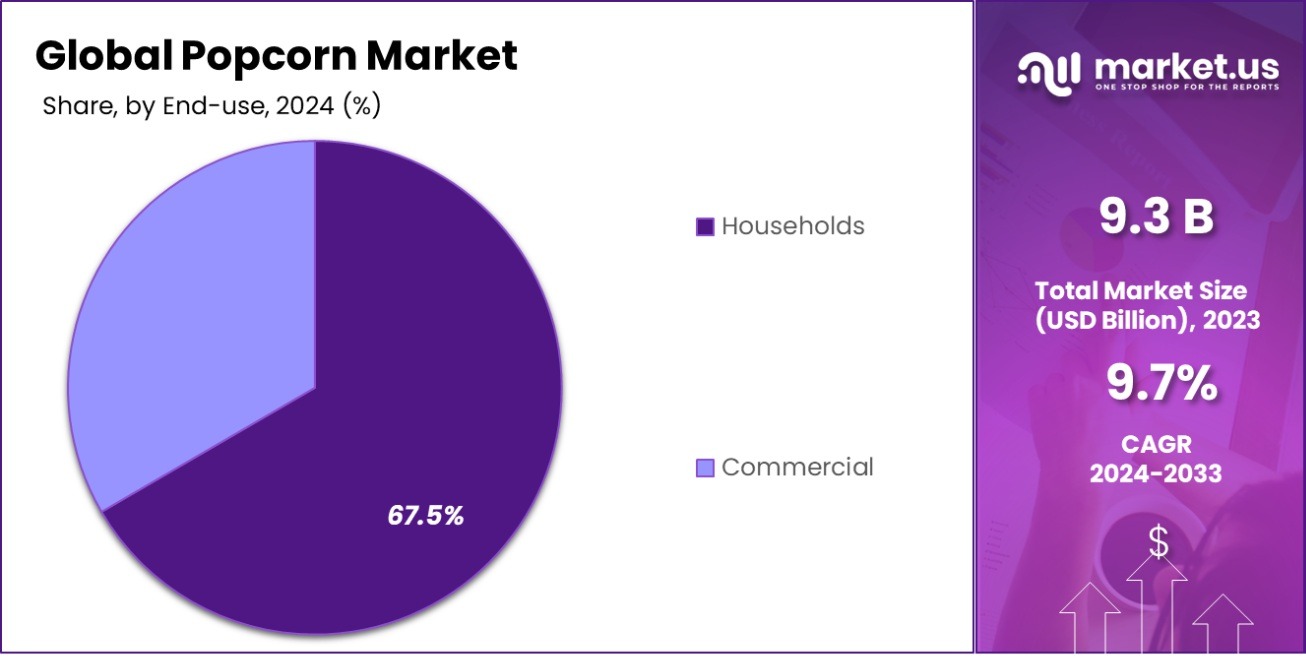

- Household consumption represents 67.5%, driven by growing demand for convenient, at-home snack options.

- Supermarkets and hypermarkets account for 44.3%, emphasizing their role in accessible product availability.

- The Asia-Pacific popcorn market holds a 48.2% share, valued at USD 4.5 billion.

Business Benefits of Popcorn Market

Popcorn, a popular snack enjoyed worldwide, offers several business benefits, particularly when examining data provided by government sources such as agricultural output statistics and economic impact studies.

Firstly, popcorn is a cost-effective crop for farmers, largely because it yields a high volume per acre and requires less initial investment compared to other crops. Government agriculture reports often highlight its low water and fertilizer needs, which contribute to its sustainable nature and lower production costs.

Secondly, popcorn’s popularity drives consistent demand, creating stable market opportunities. Government economic analyses indicate that popcorn enjoys a robust presence in both domestic and international markets, facilitating opportunities for export, which can significantly benefit national economies. Additionally, popcorn’s versatility in flavoring and packaging allows businesses to tap into diverse consumer preferences, further expanding market reach.

Lastly, government health data underscores popcorn’s appeal as a healthier snacking option, low in calories and high in fiber, attracting health-conscious consumers. This aspect is often highlighted in nutritional guidelines issued by health departments, promoting popcorn as a preferred snack choice, which supports market growth and consumer acceptance.

By Type Analysis

The Ready-to-Eat (RTE) segment dominates the popcorn market, capturing 67.4%.

In 2023, Ready-to-Eat (RTE) Popcorn held a dominant position in the By Type segment of the Popcorn Market, accounting for a substantial 67.4% market share. The rising preference for convenience foods, particularly among urban consumers, has been a key driver for the growth of this segment.

RTE Popcorn’s appeal lies in its immediate consumability, premium flavor options, and increasing availability across retail channels, including supermarkets, convenience stores, and e-commerce platforms. Additionally, the growing trend of healthier snacking options has led manufacturers to introduce RTE variants with reduced sodium, no artificial additives, and gourmet flavor profiles, further bolstering demand.

In contrast, Microwave Popcorn accounted for the remaining 32.6% market share in 2023. While this segment has faced competition from RTE Popcorn, it remains popular among budget-conscious consumers and those who enjoy freshly popped corn at home.

Microwave Popcorn’s versatility in offering customizable flavors and portion control has helped maintain its relevance, particularly in developing markets. Innovations such as packaging improvements, reduced preparation times, and healthier formulations are expected to drive steady growth in this segment.

By Shape Analysis

Butterfly-shaped popcorn leads the market with a substantial 73.4% share.

In 2023, Butterfly Popcorn held a dominant position in the By Shape segment of the Popcorn Market, commanding a significant 73.4% market share. Its light, fluffy texture and irregular shape make it a preferred choice for various applications, particularly in movie theaters, ready-to-eat snacks, and home consumption.

The versatility of butterfly popcorn, combined with its ability to hold seasonings and flavors well, has been a key factor driving its widespread adoption. Additionally, its cost-effectiveness in large-scale production makes it the go-to choice for manufacturers catering to high-volume demand in retail and commercial settings.

On the other hand, Mushroom popcorn accounted for 26.6% of the market share in 2023. This shape is particularly popular in the production of caramel and coated popcorn varieties due to its dense, compact structure, which minimizes breakage and ensures even coating. Mushroom popcorn’s higher yield and durability during processing make it the preferred choice for gourmet popcorn producers targeting premium markets.

The By Shape segmentation highlights a clear functional differentiation, with butterfly popcorn dominating mainstream demand while mushroom popcorn caters to niche, value-added segments. Continuous innovation in flavoring and production techniques is expected to influence growth trajectories across both categories.

By End-Use Analysis

Households significantly drive popcorn consumption, representing a notable 67.5% share.

In 2023, Households held a dominant position in the By End-Use segment of the Popcorn Market, accounting for a substantial 67.5% market share. The growing trend of at-home entertainment, including streaming services and small gatherings, has significantly boosted the demand for popcorn among households.

Consumers value the convenience, affordability, and versatility of popcorn as a snack, driving its popularity across both ready-to-eat (RTE) and microwave formats. Additionally, the rising preference for healthier snacking options has led to the proliferation of low-calorie, organic, and gourmet popcorn variants, further contributing to household demand.

Meanwhile, the Commercial segment represented 32.5% of the market share in 2023. This segment includes movie theaters, amusement parks, stadiums, and other entertainment venues where popcorn remains a staple snack.

Although commercial demand experienced fluctuations due to temporary closures and restrictions in previous years, recovery in the entertainment and hospitality sectors has reignited growth. Moreover, innovations in popcorn preparation and flavor customization at commercial establishments are enhancing the consumer experience and driving demand.

The By End-Use segmentation reflects a strong consumer preference for at-home snacking, with steady growth in commercial use as the entertainment and leisure industries continue to recover and expand.

By Distribution Channel Analysis

Supermarkets and hypermarkets account for 44.3% of popcorn sales worldwide.

In 2023, Supermarkets and Hypermarkets held a dominant position in the By Distribution Channel segment of the Popcorn Market, accounting for 44.3% of the market share. These channels offer consumers the advantage of a wide variety of popcorn products, including ready-to-eat, microwaveable, and gourmet options, all in a single location.

Their extensive reach and ability to stock a diverse range of brands and flavors have positioned them as a primary choice for consumers. Additionally, the prevalence of promotional offers, bulk purchasing options, and in-store sampling have further contributed to their dominance in the market.

Convenience Stores followed, capturing 31.7% of the market share in 2023. Their widespread presence and accessibility make them a popular choice for on-the-go purchases and last-minute snack needs. This channel is particularly significant in urban and semi-urban areas, where quick and easy access to snacks is a priority for busy consumers.

Meanwhile, the Online segment accounted for 24.0% of the market share, reflecting the growing preference for e-commerce platforms. The convenience of home delivery, access to niche and premium popcorn brands, and exclusive online discounts are key factors driving growth in this segment.

Key Market Segments

By Type

- Ready-to-Eat Popcorn

- Microwave Popcorn

By Shape

- Butterfly

- Mushroom

By End-use

- Households

- Commercial

By Distribution Channel

- Supermarket and Hypermarket

- Convenience Stores

- Online

- Others

Driving Factors

Increasing Demand for Convenient Snack Options

The popcorn market is significantly driven by the rising demand for convenient and easy-to-prepare snack options. In today’s fast-paced world, consumers are increasingly seeking quick, hassle-free eating solutions that do not require extensive preparation time.

Popcorn fits well within this category due to its ease of preparation and availability. Additionally, the growth of microwave popcorn has further simplified its consumption, making it a go-to snack for movie nights at home, quick office breaks, or as a healthy alternative to traditional snack foods.

Growth in Home Entertainment Consumption

With advancements in technology and the increasing accessibility of streaming platforms, there has been a noticeable shift towards home entertainment. This trend has subsequently boosted the popcorn market, as popcorn is commonly associated with movie viewing.

The convenience of microwave popcorn, in particular, aligns well with the trend of watching movies or binge-watching series from the comfort of one’s home, enhancing the overall experience. The association of popcorn with entertainment activities continues to reinforce its demand across various demographics.

Rising Awareness of Healthier Snacking Options

Health consciousness among consumers is a key driver for the popcorn market. Popcorn is often marketed as a healthier snack alternative to chips and other fried snacks due to its lower calorie content and higher fiber levels.

This appeals to health-conscious consumers looking for snacks that are not only tasty but also beneficial. The availability of organic and non-GMO popcorn variants has further attracted a segment of consumers who are mindful of the nutritional content and quality of their food intake, thereby propelling market growth.

Restraining Factors

Competition from Alternative Snack Products

One of the primary restraining factors for the popcorn market is the intense competition from a wide array of alternative snack products. Consumers have a plethora of choices ranging from chips and chocolates to nuts and fruits, which can divert their attention and spending away from popcorn.

This competition is further heightened by continuous innovations in snack products, such as the introduction of healthier or gourmet options that directly compete with popcorn’s market share, making it challenging for popcorn brands to maintain their relevance and appeal in a crowded market.

Fluctuations in Raw Material Prices

The popcorn market is susceptible to fluctuations in the prices of raw materials, particularly corn, which is the main ingredient in popcorn. Changes in corn prices can be influenced by various factors such as weather conditions, agricultural policies, and economic fluctuations.

These price variances can affect the cost of production for popcorn manufacturers, leading to potential increases in the final product prices for consumers. Such price instabilities can deter budget-conscious consumers and impact the overall sales volume of popcorn.

Health Concerns Over Processed Popcorn Products

Another significant restraint in the popcorn market is the growing consumer awareness and concern over the health impacts of processed foods, including certain types of popcorn. Microwave popcorn, for instance, often contains additives, artificial flavors, and preservatives that health-conscious consumers are increasingly avoiding.

Moreover, the use of perfluorinated compounds (PFCs) in microwave popcorn bags, linked to health risks, has led to further scrutiny. These health concerns can hinder the growth of the processed popcorn segment, as consumers shift towards fresher and more natural options.

Growth Opportunity

Expansion into Emerging Markets with Growing Middle Class

A significant growth opportunity for the popcorn market lies in expanding into emerging markets where the middle class is growing rapidly. These regions often exhibit increased disposable income and a burgeoning interest in Western-style snacks, making them ripe for introducing popcorn products.

By targeting these areas, companies can tap into new customer bases that are looking for convenient, affordable, and novel snack options. Strategic marketing and localizing flavors to suit regional tastes could further enhance the appeal of popcorn, driving higher consumption rates.

Innovation in Flavors and Healthier Options

There’s a substantial opportunity in the innovation of flavors and the introduction of healthier popcorn variants. As consumers become more health-conscious, they seek snacks that not only satisfy their taste buds but also offer nutritional benefits.

Popcorn manufacturers can capitalize on this trend by creating products that are lower in calories, use natural flavorings, and include beneficial ingredients like added vitamins or protein. Additionally, experimenting with local and exotic flavors can attract a broader audience, helping brands stand out in a competitive market.

Leveraging E-commerce and Subscription Services

The rise of e-commerce platforms presents a lucrative growth opportunity for the popcorn market. By leveraging online sales channels, popcorn brands can reach a wider audience, including those in areas where retail distribution might be limited.

Furthermore, subscription services that deliver gourmet or specialty popcorn right to consumers’ doors offer convenience and encourage repeat purchases. These models not only enhance customer engagement through regular brand interaction but also allow companies to collect valuable consumer data to better tailor their marketing strategies and product offerings.

Latest Trends

Rise of Organic and Non-GMO Popcorn Variants

A leading trend in the popcorn market is the increased availability and consumer preference for organic and non-GMO popcorn. This shift aligns with a broader consumer movement towards eating healthier and more sustainably sourced foods. Organic popcorn is free from synthetic pesticides and fertilizers, while non-GMO popcorn reassures consumers about the natural genetic integrity of their snacks.

These trends are not only influencing consumer buying behaviors but also prompting manufacturers to revise their product lines to include these healthier options, thereby expanding their market reach and consumer base.

Enhanced Focus on Gourmet and Artisanal Products

The popcorn market is witnessing a growing trend towards gourmet and artisanal popcorn products, which offer unique flavors and premium ingredients. These high-end popcorn variants often feature exotic seasonings and combinations such as truffle, caramel sea salt, and spicy jalapeño.

The appeal of gourmet popcorn is linked to consumer desires for luxury and indulgence in everyday products, making it popular for gifts and special occasions. As more consumers are willing to pay a premium for specialty foods, the segment provides significant growth potential for new entrants and existing players alike.

Integration of Popcorn in Diverse Culinary Applications

Another emerging trend is the use of popcorn in a variety of culinary applications beyond just a snack. Chefs and home cooks are creatively incorporating popcorn into dishes like salads, desserts, and even main courses, using it as a crunchy topping or a gluten-free breadcrumb alternative.

This culinary innovation not only revitalizes the image of popcorn but also opens new avenues for its use, potentially increasing its consumption. As popcorn gains status as a versatile ingredient, it could see expanded use in both home kitchens and professional culinary settings.

Regional Analysis

In the Asia-Pacific region, the popcorn market accounts for a 48.2% share, valued at USD 4.5 billion.

The global popcorn market is segmented into key regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. Each region contributes uniquely to the market’s dynamics, influenced by local consumer preferences and economic factors.

North America, historically a robust market for popcorn due to the entrenched snack culture and high movie-going rates, remains a significant player. Here, the U.S. leads with innovative flavors and organic options responding to health trends. Europe follows closely, with a strong preference for gourmet and artisanal popcorn, especially in Western European countries where consumers are increasingly seeking premium, healthy snacks.

Asia-Pacific is the dominating region, holding 48.2% of the market and generating revenues of USD 4.5 billion. This region’s growth is fueled by the expanding middle class in countries like China and India, where Western eating habits are becoming more popular, and snack consumption is on the rise due to increasing urbanization and lifestyle changes.

The Middle East & Africa, though a smaller segment, is experiencing rapid growth in snack consumption due to urbanization and a young population. Latin America also shows potential, particularly in countries like Brazil and Mexico, where there is a growing demand for convenient and on-the-go snack options.

Each region’s unique consumer behavior and economic conditions drive the global popcorn market, with Asia-Pacific leading in both market share and growth potential, indicating a shift in snack preferences and purchasing power.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the competitive landscape of the global popcorn market in 2023, key players are leveraging various strategies to secure their market positions and tap into emerging trends, such as health consciousness and gourmet flavor preferences.

Campbell Soup Company and The Hershey Company have utilized their expansive distribution networks and brand recognition to introduce innovative popcorn products that complement their existing snack lines, focusing on premium and indulgent flavors that appeal to a broad consumer base.

Conagra Brands, Inc. and Pepsico, Inc. continue to dominate the ready-to-eat segment, driven by strong branding and extensive retail presence. Both companies have invested in marketing and product innovation, particularly in low-calorie and organic offerings, aligning with the increasing health awareness among consumers.

Eagle Family Foods Group LLC and Weaver Popcorn, Inc., although smaller in scale compared to giants like Pepsico, have carved out niche markets by offering unique flavor profiles and specializing in non-GMO and organic popcorn, catering to health-conscious consumers looking for transparency in their snack foods.

Hain Celestial, Intersnack Group GmbH & Co. KG, and JOLLY TIME focus on sustainable and health-oriented products. These companies emphasize organic ingredients and environmentally friendly practices, aiming to attract eco-conscious consumers.

Emerging players like Proper Snacks, Propercorn, and Quinn Foods LLC have distinguished themselves with a strong emphasis on clean labels and innovative flavors. They often use creative marketing strategies such as emphasizing artisanal processes and unique ingredient combinations.

Snyder’s-Lance, Inc. leverages its extensive portfolio of snack products to cross-promote and bundle products, enhancing consumer value while boosting sales across its range, including popcorn.

Top Key Players in the Market

- Campbell Soup Company

- Conagra Brands, Inc.

- Eagle Family Foods Group LLC

- Hain Celestial

- Intersnack Group GmbH & Co. KG.

- JOLLY TIME

- Pepsico, Inc.

- Proper Snacks

- Propercorn

- Quinn Foods LLC

- snyder’s-lance, inc.

- The Hershey Company

- Weaver Popcorn, Inc.

Recent Developments

- In 2023, Conagra Brands saw a 21% increase in microwave popcorn sales, with adjusted EPS growth of 17.4% by Q4, despite supplier issues. They showcased innovative snack products at the 2023 Sweets & Snacks Expo, emphasizing strategic partnerships and market adaptability.

- In 2023, Hain Celestial made strategic moves in the popcorn sector by emphasizing healthier, sustainable snack options. Notably, the company launched Garden Veggie™ Snacks’ new Flavor Burst™ Tortilla Chips, a product aligned with Hain Celestial’s commitment to better-for-you foods.

Report Scope

Report Features Description Market Value (2023) USD 9.3 Billion Forecast Revenue (2033) USD 23.5 Billion CAGR (2024-2033) 9.7% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Ready-to-Eat Popcorn, Microwave Popcorn), By Shape (Butterfly, Mushroom), By End-use (Households, Commercial), By Distribution Channel (Supermarket and Hypermarket, Convenience Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Campbell Soup Company, Conagra Brands, Inc., Eagle Family Foods Group LLC, Hain Celestial, Intersnack Group GmbH & Co. KG., JOLLY TIME, Pepsico, Inc., Proper Snacks, Propercorn, Quinn Foods LLC, snyder’s-lance, inc., The Hershey Company, Weaver Popcorn, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Campbell Soup Company

- Conagra Brands, Inc.

- Eagle Family Foods Group LLC

- Hain Celestial

- Intersnack Group GmbH & Co. KG.

- JOLLY TIME

- Pepsico, Inc.

- Proper Snacks

- Propercorn

- Quinn Foods LLC

- snyder's-lance, inc.

- The Hershey Company

- Weaver Popcorn, Inc.