Global Plus Size Clothing Market Report By Product Type (Casual Wear, Formal Wear, Evening Wear, Inner Wear, Ethnic Wear, Sportswear), By Gender (Women, Men, Unisex), By Age Group), By Size Range, By Price Range, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 132154

- Number of Pages: 222

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

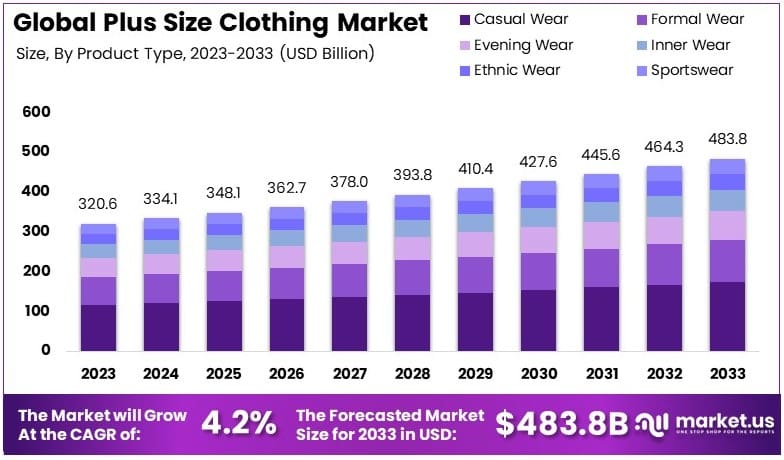

The Global Plus Size Clothing Market size is expected to be worth around USD 483.8 Billion by 2033, from USD 320.6 Billion in 2023, growing at a CAGR of 4.2% during the forecast period from 2024 to 2033.

Plus size clothing refers to apparel designed specifically for individuals with larger body measurements, typically beginning from size 14 and above. It includes a variety of styles, from casual to formal wear, with cuts, fits, and fabrics tailored to provide comfort and a flattering look for plus-size individuals.

The Plus Size Clothing Market encompasses the industry dedicated to designing, manufacturing, and selling clothing in extended sizes. This market caters to a broad demographic seeking fashionable and inclusive apparel options.

The Plus Size Clothing Market reflects a dynamic and evolving segment in the fashion industry, driven by growing demand and shifting consumer expectations. In the United States, approximately 67% of women wear a size 14 or larger, highlighting a substantial market for inclusive apparel.

The plus-size clothing market offers strong growth opportunities, particularly in segments emphasizing diversity and inclusivity. Social media trends, especially around body positivity, are instrumental in driving this demand.

As of November 2022, the hashtags #BodyPositive and #BodyPositivity had accumulated 17.8 million and 9.8 million posts, respectively, on Instagram. This reflects widespread engagement with the concept. Furthermore, a study by Microsoft Advertising found that 70% of Gen Z consumers trust brands that showcase diversity in advertising, underscoring the importance of inclusive marketing.

Despite positive developments, there remain gaps between consumer demand and retail offerings. While 85% of retailers show search results for plus-size clothing, only 43% of items are genuinely plus-size, according to a recent study by Fast Simon. This discrepancy shows a saturation point where demand outpaces available options, suggesting significant untapped potential.

The competitive landscape within the plus-size clothing market is intense, with both established brands and new entrants vying for market share. Market saturation, however, remains moderate, as demand is yet to be fully met.

As more brands introduce extended size ranges, competitive pressures will likely increase. With brands like Nike, Adidas, and formal wear designers extending sizing options, consumers now enjoy more choices, yet gaps in style diversity and quality remain.

Key Takeaways

- The Global Plus Size Clothing Market was valued at USD 320.6 Billion in 2023 and is expected to reach USD 483.8 Billion by 2033, with a CAGR of 4.2% during the forecast period.

- In 2023, Casual Wear leads the product type segment with 35.9%, driven by high demand for comfort-focused and versatile fashion styles.

- In 2023, the Women segment dominates the gender category, holding 45.8% market share, due to growing demand for diverse and inclusive fashion options.

- In 2023, the 25–34 years age group leads the market, driven by a preference for trend-focused, contemporary styles and strong purchasing power.

- In 2023, XXL sizes dominate the size range segment, as they offer inclusivity and versatile fits that appeal to a broad range of consumers.

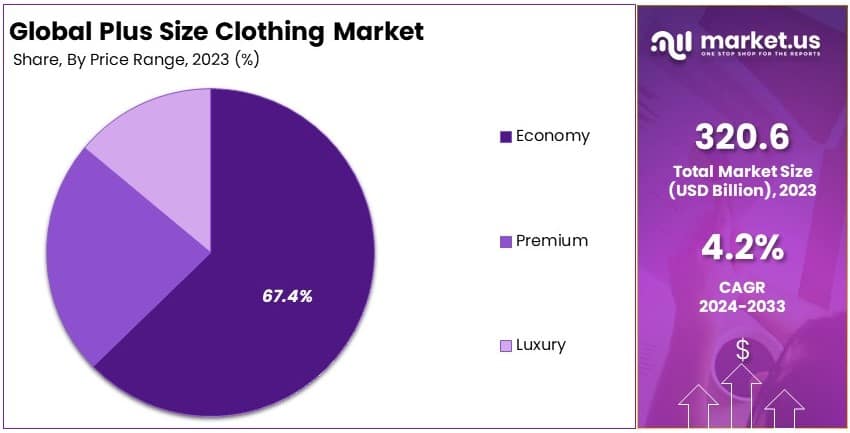

- In 2023, the Economy price range leads with 67.4%, reflecting the need for affordable, quality clothing that meets the budgetary needs of diverse consumers.

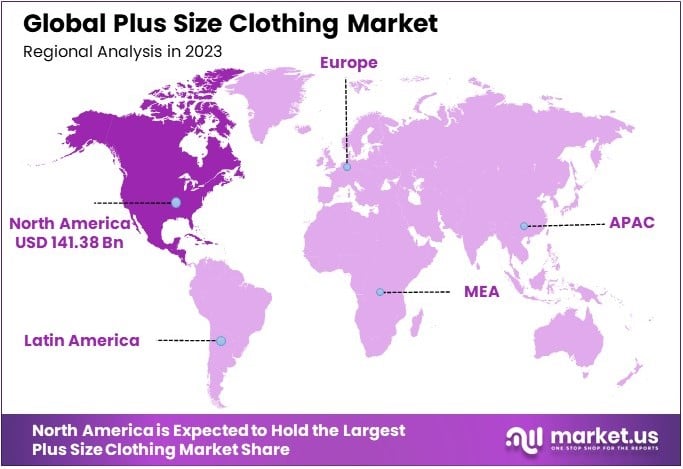

- In 2023, North America leads the plus-size clothing market with 44.1% share, driven by strong consumer demand for inclusivity and significant brand investment in diverse size ranges.

Product Type Analysis

Casual Wear dominates with 35.9% due to high demand for comfort-focused fashion in flexible settings.

The Plus Size Clothing Market by product type is led by the Casual Wear sub-segment, which holds a dominant share of 35.9%. Casual wear’s popularity in the plus-size market can be attributed to the shift toward comfort-focused fashion and the increasing casualization of everyday attire.

Casual wear offers the flexibility that many consumers prioritize, with designs that range from relaxed fits to athleisure, suitable for both home and informal outings. Additionally, casual wear brands frequently introduce size-inclusive collections, recognizing the high demand for these products among plus-size consumers.

Formal Wear in the plus-size segment holds significant potential as workplaces return to in-person settings. Although formal wear does not command as large a share as casual wear, the demand is growing due to the need for professional attire that combines both style and comfort for the plus-size demographic.

Evening Wear also plays a role in market growth, with consumers seeking fashionable options for social events and special occasions. Evening wear brands are increasingly incorporating inclusive sizing, which attracts plus-size consumers looking for statement pieces that are both elegant and comfortable.

Inner Wear, although often overlooked, is essential in the plus-size market. It focuses on providing supportive and stylish options that cater to comfort and fit mainly for maternity innerwear. Ethnic Wear appeals to culturally diverse consumers, offering traditional styles in plus sizes. While Sportswear caters to the rising focus on fitness and active lifestyles, a segment gaining traction as more plus-size consumers pursue health and wellness goals.

Gender Analysis

Women dominate with 45.8% due to growing demand for diverse, inclusive fashion options.

In the Plus Size Clothing Market, Women dominate the gender segment, holding 45.8% of the market share. This dominance is driven by the significant demand for diverse and inclusive clothing options among female consumers.

The growing awareness of body positivity has propelled brands to focus on inclusive designs, with campaigns highlighting fashion for all body types. This increased representation has further boosted women’s participation in the plus-size clothing market.

Brands are investing in extensive plus-size women’s collections, driven by social media influence and consumer advocacy for broader size ranges. Consequently, the women’s plus-size segment continues to expand as consumer expectations for inclusivity increase.

The Men’s plus-size market is steadily growing, with brands recognizing the demand for a wider range of sizes for male consumers. The focus for men is often on casual and sportswear, with brands working to ensure that these styles meet the specific fit and comfort requirements of plus-size men.

Unisex clothing is emerging as a notable segment, appealing to consumers seeking versatile clothing that transcends traditional gender categories. This segment’s flexibility allows brands to cater to a broader audience, contributing to steady market growth.

Age Group Analysis

25–34 years group leads due to demand for trend-focused and contemporary styles.

The 25–34 years age group is prominent in the Plus Size Clothing Market. This demographic actively engages with trends, seeking fashionable and contemporary plus-size options that meet lifestyle and style needs. With higher purchasing power than younger age groups, these consumers are influential in driving demand across various plus-size categories, particularly in casual and formal wear.

Social media platforms, where this age group frequently interacts, are essential for brands to showcase size-inclusive collections and influence purchasing decisions. The inclination toward body positivity and self-expression within this age range further supports the expansion of plus-size fashion offerings.

In particular, the 25–34 segment’s demand for trend-driven clothing keeps brands competitive in catering to current fashion needs.

The 18–24 years demographic is also contributing to growth, with a preference for trendy, affordable clothing that aligns with youthful and expressive styles. For 35–44 years, the focus is on durable and versatile clothing that combines comfort with practicality. Meanwhile, consumers 45 and above prioritize fit and comfort, with demand for quality pieces that align with mature style preferences.

Size Range Analysis

XXL sizes dominate due to inclusivity and demand for versatile fit.

Within the Plus Size Clothing Market, XXL sizes are increasingly popular, as this size often caters to the widest range of plus-size consumers. This inclusivity has led brands to prioritize XXL sizing, ensuring products meet the fit and comfort requirements across various style preferences.

The XXL range also resonates with consumers who prefer comfortable, slightly oversized clothing, whether in casual, formal, or activewear.

Additionally, the XL size range serves as a bridge between standard and plus-size options. This range is crucial in meeting the needs of consumers who may be transitioning from regular to plus sizes, or who simply prefer a roomier fit in their clothing.

The XXXL range represents a key segment for brands aiming to meet the needs of consumers who require additional room and comfort. As inclusivity in fashion becomes more prioritized, brands are expanding their XXXL offerings to cater to a wider customer base.

This range is particularly important in categories such as innerwear and sportswear, where fit and comfort play crucial roles. The XXXL segment appeals to consumers seeking durable and functional clothing that maintains style and offers a comfortable fit.

At the upper end, 4XL and Above caters to a more specific yet essential segment in the plus-size market. This range plays a significant role in meeting the needs of those requiring extended sizes and represents an important step toward size inclusivity. While traditionally underserved, the demand for 4XL and above has increased as more consumers seek fashion that acknowledges and celebrates body diversity.

Price Range Analysis

Economy range dominates with 67.4% due to affordability and accessibility.

The Economy price range is dominant, with a substantial 67.4% share in the Plus Size Clothing Market. This category’s popularity reflects the demand for affordable, quality clothing among plus-size consumers. Economic uncertainty has increased the need for budget-friendly options, leading brands to focus on offering fashionable and accessible clothing in this range.

Economy brands cater to casual and essential clothing styles, ensuring accessibility for a broad consumer base. Furthermore, the economy segment appeals to younger consumers who seek affordable, trendy items, as well as budget-conscious shoppers of all ages.

The Premium price range is aimed at consumers willing to invest in quality and design. Although this segment holds a smaller share compared to economy, it has a dedicated customer base that values style and durability. Premium plus-size clothing often features higher-quality fabrics and designs tailored to provide a comfortable and flattering fit.

On the higher end, the Luxury price range targets a niche market of plus-size consumers who prioritize exclusivity and high-end fashion. Luxury plus-size options are often crafted from premium materials and are carefully designed to meet the specific needs of this demographic.

Key Market Segments

By Product Type

- Casual Wear

- Formal Wear

- Evening Wear

- Inner Wear

- Ethnic Wear

- Sportswear

By Gender

- Women

- Men

- Unisex

By Age Group

- 18–24 years

- 25–34 years

- 35–44 years

- 45 and above

By Size Range

- XL

- XXL

- XXXL

- 4XL and Above

By Price Range

- Luxury

- Premium

- Economy

Drivers

Rising Body Positivity Movement Drives Market Growth

The body positivity movement is a strong driver of the plus-size clothing market’s growth. This cultural shift has promoted inclusivity, with consumers increasingly seeking a wider range of sizes. Consequently, brands have responded by expanding their offerings, catering to diverse body shapes and preferences.

Social media, in particular, has played a crucial role by giving influencers a platform to promote size inclusivity and raise awareness, further normalizing plus-size fashion. Alongside this trend, greater acceptance of body diversity has encouraged companies to broaden their product lines, appealing to a more extensive consumer base.

In addition, inclusive marketing strategies have gained priority, with brands designing campaigns that resonate deeply with the plus-size audience. Together, these efforts enhance brand reputation and attract a broader customer segment, fueling overall market expansion.

Restraints

Limited Product Variety Restrains Market Growth

A lack of product variety is a significant restraint in the plus-size clothing market. Many brands offer limited styles and designs, which restricts choices for consumers and can ultimately curb market growth.

Furthermore, production costs for plus-size clothing tend to be higher, creating additional financial limitations for companies hesitant to invest in this segment. Complicating matters, sustainable options for plus-size clothing remain limited, as eco-friendly fabrics are often more costly for larger sizes.

Adding to these challenges, limited retail space for plus-size collections reduces accessibility, making it difficult for customers to find suitable options. As a result, the scarcity of high-quality plus-size products in physical stores limits the market’s potential to expand.

Opportunity

Expansion of E-commerce Provides Opportunities

The rise of e-commerce has created vast opportunities for the plus-size clothing market. Online retail extends brands’ reach, enabling plus-size consumers to access diverse options without geographical limitations.

E-commerce platforms also allow for a personalized shopping experience, catering to individual preferences and enhancing customer satisfaction. Notably, virtual try-on technologies have emerged as a significant opportunity, allowing customers to visualize products with greater accuracy, which could boost online sales.

Moreover, the global nature of e-commerce allows smaller brands specializing in plus-size clothing to enter international markets, driving further growth. These developments not only broaden consumer access but also strengthen market penetration for plus-size brands.

Challenges

Sizing Standardization Challenges Market Growth

Sizing inconsistencies present a major challenge in the plus-size clothing market. Many brands lack standardized sizing, leading to significant variations across products, which affects customer satisfaction.

In addition, a shortage of fit and comfort in available plus-size options further complicates the shopping experience, making it challenging for consumers to find well-fitting items. Compounding this issue, there is a limited pool of designers with expertise in plus-size fashion, which impacts product quality and limits market appeal.

Moreover, a general lack of understanding of plus-size consumer preferences among retailers restricts this segment’s growth potential. These combined challenges hinder the market’s ability to build consumer trust and satisfaction effectively.

Growth Factors

Increased Awareness of Health Is Growth Factor

Growing awareness around health and wellness has emerged as a critical growth factor in the plus-size clothing market. Many plus-size consumers are focusing more on fitness, which has led to a rising demand for activewear in larger sizes.

This trend has encouraged brands to design products that combine comfort with functionality, meeting the preferences of health-conscious consumers. Additionally, the popularity of athleisure allows consumers to find versatile options suitable for both fitness and casual wear.

Inclusive fitness campaigns highlighting body diversity further motivate brands to expand their activewear lines to cater to all body types. These health-oriented trends contribute significantly to the growth and sustained demand in the plus-size clothing market.

Emerging Trends

Social Media Influence Is Latest Trending Factor

Social media influence has become a prominent trend in the plus-size clothing market. Many brands leverage these platforms to reach a wider audience, with influencers and brand ambassadors actively promoting size inclusivity and highlighting plus-size collections.

Simultaneously, interactive social media campaigns boost engagement and increase brand visibility, driving consumer interest in plus-size fashion. Another trend is the rise of online communities, where consumers share style tips and recommendations, fostering brand loyalty.

Additionally, brands utilize social media analytics to gain insights into consumer behavior, allowing them to tailor offerings more closely to plus-size customers’ needs. This trend is anticipated to continue shaping market dynamics, strengthening growth in the plus-size clothing segment.

Regional Analysis

North America Dominates with 44.1% Market Share

North America leads the plus-size clothing market, commanding 44.1% of the global share, valued at USD 141.38 billion. This dominance is primarily driven by increasing consumer demand for inclusive fashion and widespread awareness of body positivity.

Major retailers are capitalizing on this demand, expanding size ranges and launching targeted campaigns. Additionally, North American brands are responsive to consumer needs for diversity, emphasizing size inclusivity across product lines. E-commerce advancements further support growth, allowing brands to reach a wider audience and cater to specific plus-size preferences.

The North American market benefits from high consumer purchasing power and a strong retail infrastructure. Body positivity movements are highly influential here, driving consumer demand for size-inclusive options.

Regional Outlook

- Europe: Europe has a strong market for plus-size clothing, driven by increasing body positivity awareness and a trend toward size inclusivity. Brands here focus on fashion-forward options that cater to diverse styles.

- Asia Pacific: In Asia Pacific, demand for plus-size clothing is growing due to rising disposable income and shifting attitudes toward body image. Fashion trends here are increasingly inclusive, though cultural differences impact style preferences.

- Middle East & Africa: Plus-size fashion in the Middle East and Africa is gradually expanding. Cultural acceptance of diverse body sizes is evolving, with a focus on modest fashion. E-commerce is essential in reaching consumers, as physical retail options for plus-size clothing are limited.

- Latin America: Latin America’s plus-size market is on the rise, supported by increasing body positivity movements. However, economic factors limit consumer spending. Brands focus on affordable and casual wear, resonating with local preferences.

Key Regions and Countries covered іn the rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Plus Size Clothing Market is shaped by a few major players that lead in accessibility, brand recognition, and product range. Key companies, including Lane Bryant Brands Opco LLC, H&M Hennes & Mauritz AB, Ralph Lauren Corporation, and Torrid LLC, hold a significant market presence due to their targeted strategies and strong brand loyalty.

Lane Bryant stands out as a pioneer in plus-size fashion, focusing exclusively on clothing for plus-size women. Consequently, its wide selection—from casual to formal wear—has built a loyal customer base and a solid reputation. The brand’s commitment to fit, comfort, and style positions it as a trusted choice within the market.

H&M, on the other hand, is notable for its affordable, trendy offerings that extend to plus sizes, aligning with its fast-fashion business model. Moreover, with both a global store network and an extensive online presence, H&M reaches a broad consumer base. This global accessibility, paired with style-forward collections, makes H&M a top choice among plus-size consumers seeking current fashion trends.

Ralph Lauren caters to a premium segment within the plus-size market, offering quality and sophistication. By including plus sizes within its main collections, the brand makes classic, elegant styles accessible to a more diverse audience. Furthermore, Ralph Lauren’s emphasis on quality fabrics and timeless designs attracts consumers who value both fashion and durability.

In summary, these companies drive the Plus Size Clothing Market by promoting inclusive sizing, style diversity, and quality. Together, they reinforce their leading positions and encourage continued market growth.

Top Key Players in the Market

- Lane Bryant Brands Opco LLC

- Ralph Lauren Corporation

- H&M Hennes & Mauritz AB

- Punto Deri San Tic A.Ş.

- Under Armour, Inc.

- PUNTO FA, S.L.

- WHP Global

- Nike, Inc.

- adidas AG

- PUMA SE

- Forever21 Inc.

- ASOS plc

- Capri Holdings Limited

- MANGO

- Torrid LLC

Recent Developments

- FullBeauty Brands and ELOQUII: April 2023 – FullBeauty Brands announced the acquisition of ELOQUII, a leading plus-size fashion retailer, to expand its presence in the U.S. plus-size women’s clothing market, which is growing three times faster than the broader women’s apparel market. More than half of U.S. women aged 18-65 wear size 14 or higher, highlighting a historically underserved demographic.

- AK Retail Holdings and Evans: August 2023 – AK Retail Holdings acquired the plus-size brand Evans from City Chic Collective for £8 million, including its intellectual property and customer base, marking a significant expansion in the plus-size fashion market.

- Myer and Premier Investments: October 2024 – Australian retailer Myer made a $950 million bid to acquire five fashion brands—Just Jeans, JayJays, Portmans, Dotti, and Jacqui-E—from Premier Investments’ apparel division, adding 780 stores to Myer’s portfolio and expanding its market presence.

- Lululemon’s Growth Strategy: April 2022 – Lululemon announced its “Power of Three ×2” growth strategy, aiming to double its 2021 revenue of $6.25 billion to $12.5 billion by 2026, focusing on product innovation, guest experience, and market expansion, including a commitment to size inclusivity in activewear.

Report Scope

Report Features Description Market Value (2023) USD 320.6 Billion Forecast Revenue (2033) USD 483.8 Billion CAGR (2024-2033) 4.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Casual Wear, Formal Wear, Evening Wear, Inner Wear, Ethnic Wear, Sportswear), By Gender (Women, Men, Unisex), By Age Group (18–24 years, 25–34 years, 35–44 years, 45 and above), By Size Range (XL, XXL, XXXL, 4XL and Above), By Price Range (Luxury, Premium, Economy) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Lane Bryant Brands Opco LLC, Ralph Lauren Corporation, H&M Hennes & Mauritz AB, Punto Deri San Tic A.Ş., Under Armour, Inc., PUNTO FA, S.L., WHP Global, Nike, Inc., adidas AG, PUMA SE, Forever21 Inc., ASOS plc, Capri Holdings Limited, MANGO, Torrid LLC Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Lane Bryant Brands Opco LLC

- Ralph Lauren Corporation

- H&M Hennes & Mauritz AB

- Punto Deri San Tic A.Ş.

- Under Armour, Inc.

- PUNTO FA, S.L.

- WHP Global

- Nike, Inc.

- adidas AG

- PUMA SE

- Forever21 Inc.

- ASOS plc

- Capri Holdings Limited

- MANGO

- Torrid LLC