Global Maternity Innerwear Market Size, Share, Growth Analysis By Product Type (Maternity Bras, Maternity Briefs, Maternity Shapewear, Camisoles and Tank Tops, Postpartum Support Wear), By Material Type, By Distribution Channel, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 101627

- Number of Pages: 390

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Maternity Innerwear Market Key Takeaways

- Maternity Innerwear Business Environment Analysis

- Product Type Analysis

- Material Type Analysis

- Distribution Channel Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Emerging Trends

- Regional Analysis

- Competitive Landscape

- Recent Developments

- Report Scope

Report Overview

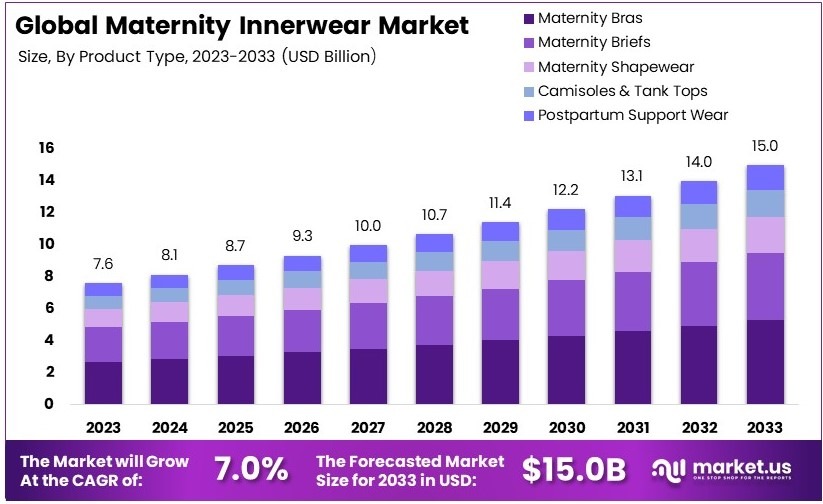

The Global Maternity Innerwear Market size is expected to be worth around USD 15.0 Billion by 2033, from USD 7.6 Billion in 2023, growing at a CAGR of 7.0% during the forecast period from 2024 to 2033.

Maternity innerwear refers to specialized undergarments designed for pregnant women. These products provide comfort, support, and accommodate the changing body during pregnancy. They include items like maternity bras, briefs, shapewear, camisoles, and postpartum support wear. Made from soft, stretchy materials, they ensure ease and flexibility.

The Maternity Innerwear Market encompasses the global industry involved in the production, distribution, and sale of maternity undergarments. It includes various product types, material innovations, and distribution channels.

The maternity innerwear market capitalizes on the consistent global birth rates, offering substantial growth opportunities. According to Our World in Data, 134 million babies were born globally in 2023, underscoring a significant, sustained demand for pregnancy products tailored to the needs of expectant mothers.

In addition to comfort, the quality of the fabric is a critical consideration. According to a survey conducted by Mylo, an overwhelming 96.3% of women emphasized the importance of fabric quality when selecting maternity wear, with nearly half (48.3%) rating its importance as a perfect 10.

Furthermore, the influence of social media on consumer preferences is notable in the maternity innerwear market. The hashtag #maternity has featured in over 7 million Instagram posts, reflecting high consumer engagement and a robust platform for marketing and consumer interaction.

This level of engagement indicates a competitive market landscape where brands actively leverage online communities to enhance their visibility and connect with their target audience.

The importance of thermal comfort during pregnancy cannot be overlooked. A detailed study involving 1,055 pregnant women in Xi’an, China, assessed their thermal sensations and the need for appropriate clothing insulation in hospital settings. This research underscores the necessity for maternity innerwear that adapts to changing body temperatures and comfort needs throughout pregnancy.

Maternity Innerwear Market Key Takeaways

- The Maternity Innerwear Market was valued at USD 7.6 Billion in 2023, and is expected to reach USD 15.0 Billion by 2033, with a CAGR of 7.0%.

- In 2023, Maternity Briefs dominate the product type segment with 33.4% due to essential comfort and support for expectant mothers.

- In 2023, Cotton leads the material type segment with 40%, valued for its breathability and softness.

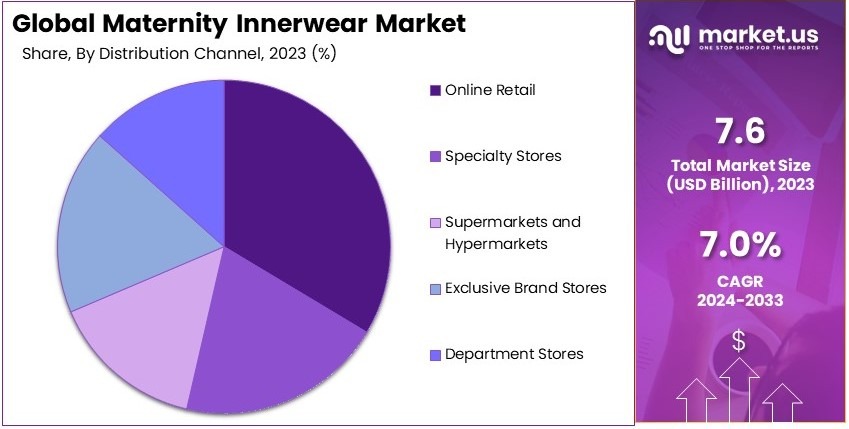

- In 2023, Online Retail is the top distribution channel, catering to the convenience needs of maternity consumers.

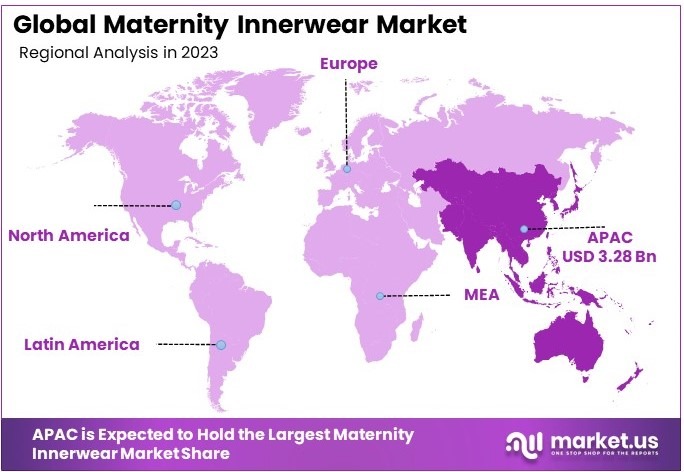

- In 2023, Asia Pacific holds 43.2%, highlighting its growing market and demand for maternity innerwear.

Maternity Innerwear Business Environment Analysis

The maternity innerwear market is somewhat saturated, with numerous brands aiming to meet the specific needs of expectant mothers. To stand out, companies are focusing on innovation and quality to retain consumer interest.

The primary consumers of maternity innerwear are individuals aged 25 to 44, making up about 55% of the market. This age group seeks products that combine comfort with style, illustrating a mature, discerning demographic. Moreover, the market exhibits a fairly balanced gender distribution, with males accounting for around 60% of consumers, broadening the target demographic.

In product differentiation, brands are increasingly focusing on unique selling propositions like ergonomic designs and organic materials. This strategy not only attracts health-conscious consumers but also aligns with growing environmental concerns, enhancing brand loyalty and consumer satisfaction.

Value chain analysis reveals that efficiency in production and distribution is vital. Brands that streamline these processes can reduce costs and improve product accessibility, thereby gaining a competitive edge in the crowded market.

Furthermore, there are significant investment opportunities in developing innovative fabrics and integrating smart technology into maternity wear. Such advancements could significantly improve the comfort and functionality of the products, attracting a larger consumer base.

As for export and import dynamics, the maternity innerwear market benefits from global trade, with many brands expanding their reach through online platforms. This has enabled easier access to diverse markets, increasing the global footprint of leading brands.

Adjacent markets, such as baby personal care products and general maternity wear, offer additional growth avenues. Companies that explore these related markets can leverage cross-selling strategies to enhance overall sales, capitalizing on the comprehensive needs of their consumer base.

Product Type Analysis

Maternity Briefs dominate with 33.4% due to their essential comfort and support features.

In the maternity innerwear market, product type segmentation provides insights into the specific needs and preferences of expectant mothers. The Maternity Briefs sub-segment claims a significant market share of 33.4%.

This reflects the high demand for products that offer optimal comfort and support without compromising on ease of wear. These briefs are designed to accommodate growing bellies, provide support, and maintain comfort, making them an essential choice for pregnant women.

Maternity Bras also play a critical role in the market. They are engineered to support increased breast size during pregnancy and postpartum, incorporating features like extra support and adjustable sizing.

Maternity Shapewear helps in supporting the lower back and abdominal area, offering varying levels of support that are crucial as the pregnancy progresses.

Camisoles and Tank Tops are favored for their versatility and ease of wear, often featuring built-in bras and adjustable straps for a comfortable fit throughout pregnancy.

Postpartum Support Wear is increasingly popular for providing essential support to help women recover post-delivery, aiding in the reduction of physical stress and enhancing the body’s return to its pre-pregnancy state.

Material Type Analysis

Cotton leads with 40% due to its breathability and softness, essential for sensitive skin during pregnancy.

Material types in maternity innerwear are crucial for ensuring comfort, functionality, and safety. Cotton, leading with a 40% market share, is highly preferred due to its natural breathability, softness, and hypoallergenic properties, making it ideal for sensitive skin during pregnancy.

Bamboo Fiber is appreciated for its eco-friendly qualities and exceptional softness, and it offers moisture-wicking properties which are beneficial during maternity.

Spandex/Elastane is essential for adding stretchability to maternity innerwear, allowing pieces to grow with the pregnant belly while providing necessary support.

Nylon is valued for its durability and ability to hold shape, often used in blends to enhance the functionality of maternity wear.

Modal, along with other Sustainable and Organic Materials, is becoming more popular as consumers increasingly seek eco-friendly and sustainable options in their intimate apparel, reflecting broader consumer trends towards environmental consciousness.

Distribution Channel Analysis

Online Retail dominates due to its convenience and the breadth of options available.

The distribution channel landscape for maternity innerwear sees Online Retail taking a dominant stance. The convenience of online shopping, coupled with the ability to explore a wide array of products, compare prices, and read consumer reviews without the need to travel physically, makes it a preferred choice for expectant mothers.

Specialty Stores are crucial for providing expert advice and personalized service, often offering fittings and a curated selection of high-quality products.

Supermarkets and Hypermarkets cater to the need for convenience by allowing consumers to shop for maternity innerwear alongside their regular grocery purchases.

Exclusive Brand Stores offer brand-centric shopping experiences with the benefit of loyalty programs and personalized services, which can be particularly appealing for repeat purchases.

Department Stores combine the advantages of diverse brand offerings under one roof, providing accessibility and convenience, yet like exclusive brand stores, they face challenges from the rising preference for online shopping.

Each segment within the maternity innerwear market is driven by distinct factors, such as comfort, functionality, and the personalization of shopping experiences, all of which play pivotal roles in influencing consumer preferences and market dynamics.

Key Market Segments

By Product Type

- Maternity Bras

- Maternity Briefs

- Maternity Shapewear

- Camisoles and Tank Tops

- Postpartum Support Wear

By Material Type

- Cotton

- Bamboo Fiber

- Spandex/Elastane

- Nylon

- Modal

- Sustainable and Organic Materials

By Distribution Channel

- Online Retail

- Specialty Stores

- Supermarkets and Hypermarkets

- Exclusive Brand Stores

- Department Stores

Driving Factors

Increasing Health Awareness and Technological Innovation Drive Market Growth

The Maternity Innerwear Market is growing rapidly due to increasing birth rates and heightened awareness of maternal health. More women are prioritizing comfort and support during pregnancy, driving demand for specialized innerwear.

Additionally, advancements in fabric technology have led to the creation of materials that offer better breathability, flexibility, and support, enhancing the overall comfort for expectant mothers. Furthermore, the rising influence of social media plays a crucial role in market growth.

Influencers and parenting communities share their positive experiences with maternity innerwear, boosting consumer confidence and interest. These factors collectively create a strong foundation for the market, as they address both the functional and emotional needs of pregnant women.

The integration of innovative fabrics not only improves product performance but also attracts a broader audience seeking quality and comfort. Moreover, social media amplifies brand visibility and engagement, making it easier for companies to reach and connect with their target market.

Restraining Factors

High Competition and Cultural Barriers Restrain Market Growth

Despite its potential, the Maternity Innerwear Market faces several challenges that limit its growth. High competition among brands makes it difficult for new entrants to establish a foothold, often leading to price wars and reduced profit margins.

Additionally, price sensitivity among consumers can deter purchases, especially when multiple brands offer similar products at varying price points. Limited product range is another significant restraint, as consumers seek diverse options that cater to different body types and preferences.

When brands fail to provide a wide selection, it can result in lower customer satisfaction and loyalty. Moreover, cultural stigma around maternity apparel in certain regions poses a barrier to market expansion.

In some cultures, pregnancy-related clothing may be viewed as unnecessary or excessive, reducing the demand for specialized innerwear. These factors collectively hinder the market by introducing financial pressures, limiting consumer choices, and creating social obstacles that brands must navigate.

Growth Opportunities

Expansion and Sustainability Provide Opportunities

The Maternity Innerwear Market is brimming with growth opportunities through expansion and sustainable practices. Expanding into emerging markets presents a significant avenue for growth, as rising disposable incomes and increasing birth rates in these regions drive demand for quality maternity products.

Additionally, the development of sustainable materials aligns with the growing consumer preference for eco-friendly and ethically produced apparel. Brands that invest in sustainable fabrics and manufacturing processes can attract environmentally conscious consumers and differentiate themselves in a crowded market.

Personalized and customized products offer another promising opportunity, allowing brands to cater to individual preferences and enhance customer satisfaction. Tailoring innerwear to fit specific needs and styles can foster brand loyalty and repeat business.

Collaborations with healthcare providers also present a unique growth path, as partnerships with hospitals and clinics can promote maternity innerwear as a recommended choice for expectant mothers. These collaborations can enhance credibility and reach, driving sales and market presence.

Emerging Trends

Integration of Wearable Technology Is Latest Trending Factor

The integration of wearable technology has become the latest trending factor in the Maternity Innerwear Market. Smart fabrics embedded with sensors can monitor vital signs such as heart rate and body temperature, providing valuable health insights for expectant mothers. This technological advancement enhances the functionality of maternity innerwear, making it not only comfortable but also beneficial for maternal health.

Additionally, the rise of online retail platforms has transformed how consumers shop for maternity products. E-commerce offers convenience, a wide range of choices, and the ability to compare products easily, attracting more customers to purchase online.

Increased demand for multi-functional designs is another significant trend, as women seek versatile innerwear that can adapt to their changing bodies throughout pregnancy. Moreover, the popularity of inclusive sizing ensures that maternity innerwear caters to a diverse range of body types, promoting body positivity and accessibility.

Regional Analysis

Asia Pacific Dominates with 43.2% Market Share

Asia Pacific leads the Maternity Innerwear Market with a 43.2% share, totaling USD 3.28 billion. This dominance is driven by high birth rates, increasing female workforce participation, and growing awareness of maternal health. The region benefits from a booming e-commerce sector that makes it easy for consumers to access a wide range of maternity innerwear.

The market dynamics in Asia Pacific are influenced by cultural diversity and a significant shift towards nuclear families, which increases demand for specialized maternity products. Additionally, local manufacturers provide affordable and varied options, meeting the needs of diverse economic groups across this vast region.

The future of Asia Pacific in the Maternity Innerwear Market appears strong as awareness and accessibility continue to rise. Enhanced distribution channels and continued economic growth in major countries like China and India are expected to further boost the market, maintaining the region’s leading position globally.

Regional Mentions:

- North America: North America’s maternity innerwear market is fueled by advanced healthcare facilities and high consumer spending. The region focuses on premium products, with a significant trend towards organic and hypoallergenic materials.

- Europe: Europe shows a strong preference for luxury and high-quality maternity innerwear, supported by established fashion brands. The market here benefits from a high level of awareness regarding maternity health and comfort.

- Middle East & Africa: The maternity innerwear market in the Middle East and Africa is growing due to urbanization and increasing health awareness. The market is gradually adopting Western trends, with more retailers offering maternity-specific products.

- Latin America: Latin America’s maternity innerwear market is expanding, with rising health awareness and more women participating in the workforce. Increasing local production and the availability of international brands are boosting market growth in the region.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The Maternity Innerwear Market is supported by several prominent companies that have significantly influenced market trends through innovative product designs, quality materials, and targeted marketing. The top players in this market include Seraphine, Hatch Collection, Hotmilk Lingerie, and Bravado Designs, each offering unique contributions to the sector.

Seraphine excels in providing stylish maternity wear that appeals to fashion-conscious consumers. Known for its high-quality fabrics and versatile designs, Seraphine has become a favorite among expecting mothers looking for comfort without compromising on style. Their marketing strategies often involve celebrity endorsements and strong social media campaigns, enhancing their visibility and appeal.

Hatch Collection focuses on premium maternity wear that promises longevity and adaptability beyond pregnancy. Their products are designed to be used during and after pregnancy, which offers added value to consumers. Hatch Collection has carved out a niche by emphasizing chic, timeless styles and sustainable practices, aligning with the preferences of modern, eco-aware shoppers.

Hotmilk Lingerie specializes in maternity and nursing lingerie that combines functionality with feminine aesthetics. Their focus on providing supportive, comfortable, and attractive lingerie has made them a leader in this segment. Hotmilk’s commitment to empowering pregnant and nursing mothers shines through in their innovative designs and inclusive sizing.

Bravado Designs offers a range of maternity and nursing bras that focus on comfort, support, and ease of use. Their products are engineered to accommodate the changing needs of women through pregnancy and nursing. Bravado Designs is recognized for its clinical research in developing products that support breast health during maternity, which has solidified their reputation as a trusted brand among healthcare professionals and consumers alike.

These companies lead the Maternity Innerwear Market by addressing the specific needs of pregnant and nursing women through innovative, thoughtful designs and strong customer engagement strategies. Their commitment to quality, comfort, and style sets them apart in a competitive marketplace, driving the overall growth and dynamics of the industry.

Major Companies in the Market

- Seraphine

- Marks & Spencer Group Plc

- Hatch Collection

- Hotmilk Lingerie

- Bravado Designs

- Cake Maternity

- Motherhood Maternity

- Ingrid & Isabel

- A Pea in the Pod

- Belabumbum

- Clovia

- Wacoal Holdings Corp.

- Ripe Maternity

- Boob Design

Recent Developments

- Hotmilk Lingerie by Victoria’s Secret: In 2024, Hotmilk Lingerie, renowned for its maternity and nursing lingerie, partnered with Victoria’s Secret to expand its distribution. This collaboration introduces Hotmilk’s empowering maternity and nursing bras to a wider audience via Victoria’s Secret’s extensive retail channels.

- Adore Me’s Acquisition of Belabumbum: In February 2019, Adore Me, a direct-to-consumer lingerie brand, acquired Belabumbum, a maternity and nursing apparel company. This acquisition expanded Adore Me’s product range, catering to new phases of a woman’s life, such as pregnancy and nursing.

Report Scope

Report Features Description Market Value (2023) USD 7.6 Billion Forecast Revenue (2033) USD 15.0 Billion CAGR (2024-2033) 7.0% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Maternity Bras, Maternity Briefs, Maternity Shapewear, Camisoles and Tank Tops, Postpartum Support Wear), By Material Type (Cotton, Bamboo Fiber, Spandex/Elastane, Nylon, Modal, Sustainable and Organic Materials), By Distribution Channel (Online Retail, Specialty Stores, Supermarkets and Hypermarkets, Exclusive Brand Stores, Department Stores) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Seraphine, Hatch Collection, Hotmilk Lingerie, Bravado Designs, Cake Maternity, Motherhood Maternity, Ingrid & Isabel, A Pea in the Pod, Belabumbum, Clovia, Wacoal Holdings Corp., Ripe Maternity, Boob Design Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Seraphine

- Marks & Spencer Group Plc

- Hatch Collection

- Hotmilk Lingerie

- Bravado Designs

- Cake Maternity

- Motherhood Maternity

- Ingrid & Isabel

- A Pea in the Pod

- Belabumbum

- Clovia

- Wacoal Holdings Corp.

- Ripe Maternity

- Boob Design