Global Prefilled Syringes Market By Type (Disposable Prefilled Syringes and Reusable Prefilled Syringes) By Material Type (Glass and Plastic) By Application Outlook (Anaphylaxis, Rheumatoid Arthritis, Diabetes and Other Applications) By Distribution Channel (Hospitals, Mail Order Pharmacies and Ambulatory Surgery Centers) , By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: Nov 2023

- Report ID: 45833

- Number of Pages: 267

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

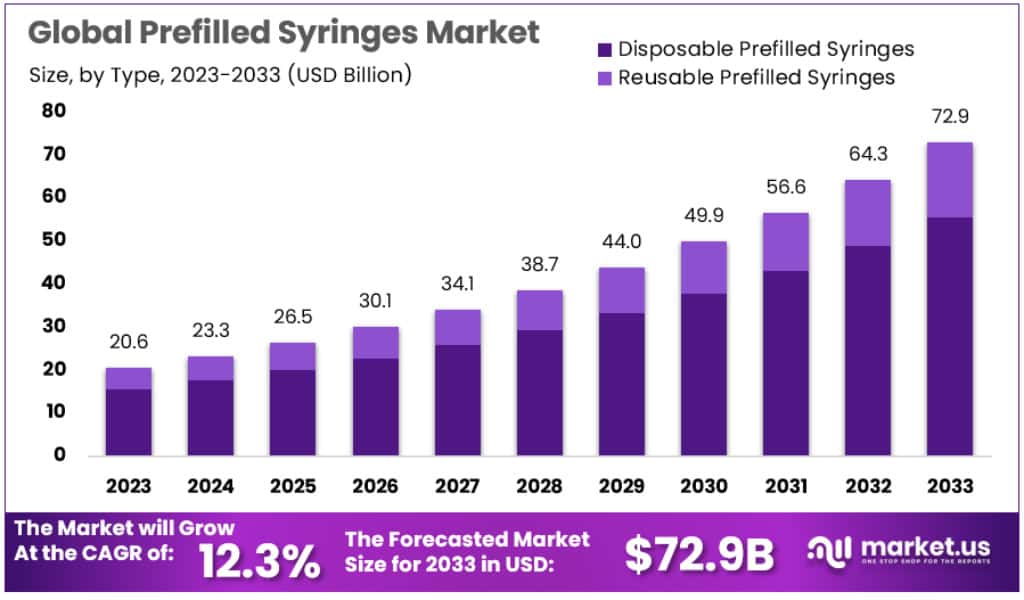

The Global Prefilled Syringes Market size is expected to be worth around USD 72.9 Billion by 2033, from USD 20.6 Billion in 2023, growing at a CAGR of 12.3% during the forecast period from 2023 to 2033.

A pre-filled syringe is a type of syringe that already has medicine in it and comes with a needle attached. Which makes it easier to give an injection without having to measure the medicine first. Prefilled syringes are gaining popularity in the healthcare industry due to their ease of use, reduced risk of errors, and other advantages.

Key Takeaways

- In 2023, the prefilled syringes market was valued at USD 20.6 Billion.

- The market is projected to grow at a CAGR of 12.3% from 2023 to 2033.

- The prefilled syringes Market is expected to be worth approximately USD 72.9 Billion by 2033.

- Disposable prefilled syringes held a dominant market position in 2023, with over 76% market share.

- Reusable prefilled syringes, although having a smaller market share, offer cost-effective options due to their ability to be used multiple times.

- Diabetes applications accounted for more than 51.9% of the market share in 2023.

- Anaphylaxis applications, although smaller in share, are significant for immediate response in severe allergic reactions.

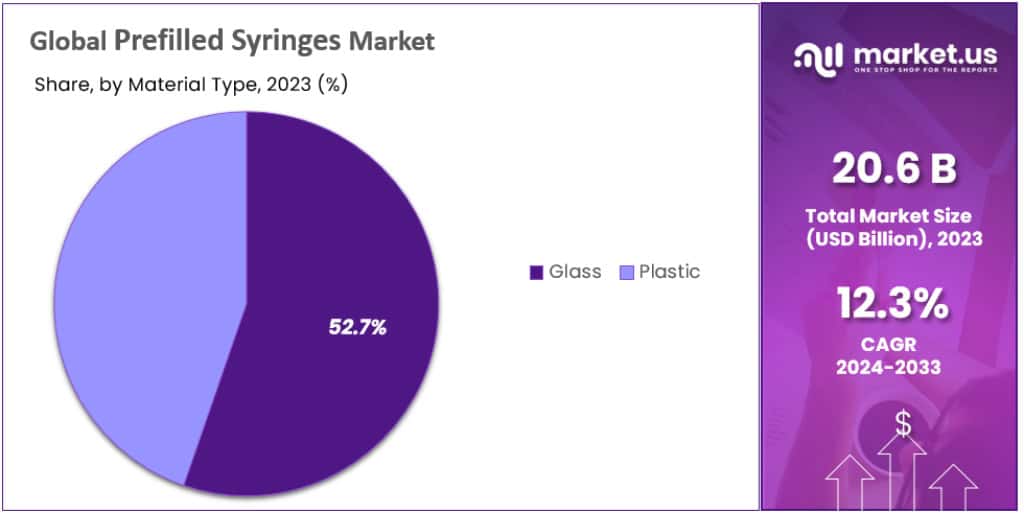

- Glass prefilled syringes held a leading market share of more than 52.7% in 2023 due to their stability and chemical resistance.

- Hospitals held the largest share in the distribution of prefilled syringes, at over 48.9% in 2023.

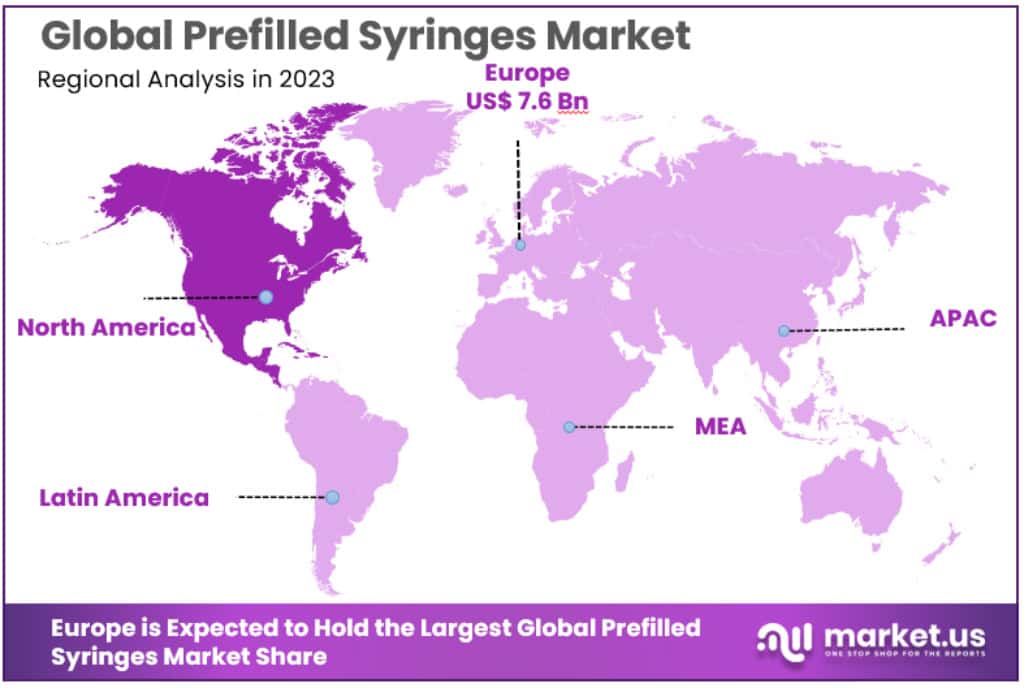

- Europe leads the prefilled syringes market with a 37.1% share and a market value of USD 7.6 billion in 2023.

Type Analysis

In 2023, disposable prefilled syringes held a dominant market position, capturing more than a 76% share. This segment’s strength is driven by their convenience and safety. Disposable prefilled syringes are used once and then thrown away, reducing the risk of infections and eliminating the need for cleaning and sterilization. Their popularity is also boosted by their wide use in vaccination programs and chronic disease management.

On the other hand, reusable prefilled syringes, although holding a smaller market share, present notable advantages. These syringes can be used multiple times with proper sterilization, making them a cost-effective option for some healthcare settings and patients managing long-term conditions. However, the requirement for cleaning and the potential risk of contamination if not properly sterilized limit their widespread adoption compared to disposable ones.

Application Outlook Analysis

In 2023, diabetes held a dominant market position in the prefilled syringes segment, capturing more than a 51.9% share. This is largely because prefilled syringes are a key tool for insulin administration, crucial for diabetes management. Their ease of use, accuracy in dosing, and convenience make them highly preferred among diabetic patients, particularly those requiring regular insulin injections.

Anaphylaxis applications, while holding a smaller share, are also significant. Prefilled syringes for anaphylaxis typically contain epinephrine, essential for immediate response in severe allergic reactions. Their ready-to-use nature ensures rapid administration, which is critical in emergency situations.

The use of prefilled syringes for rheumatoid arthritis is also noteworthy. These syringes allow for self-administration of medication, offering patients with arthritis a more manageable and less painful way to receive their treatments regularly.

Other applications of prefilled syringes, which include various medical treatments and vaccinations, also contribute to the market but are more fragmented in nature.

Material Type Analysis

Glass prefilled syringes held a dominant market position, capturing more than a 52.7% share in 2023. Their leading status is largely due to their high stability and lower reaction rate with medications. Glass syringes offer excellent chemical resistance, ensuring that the medication remains pure and effective. They are also preferred for their clarity and durability, making them a reliable choice for a wide range of medical applications.

Plastic prefilled syringes, while occupying a smaller portion of the market, are gaining traction due to their flexibility and break-resistance. They are lighter and less fragile compared to glass, which makes them more convenient for transport and handling. Additionally, advancements in plastic materials have improved their compatibility with various medications, boosting their appeal in certain healthcare scenarios.

Distribution Channel Analysis

Hospitals held a dominant market position in the distribution of prefilled syringes, capturing more than a 48.9% share in 2023. This is largely because hospitals are primary centers for various treatments where prefilled syringes are extensively used. Their need for efficient, safe, and quick medication delivery makes prefilled syringes a preferred choice. This high demand in hospital settings is driven by both inpatient and outpatient care needs.

Mail order pharmacies, although having a smaller share, play a crucial role in the distribution of prefilled syringes. They are particularly important for patients managing chronic conditions at home, like diabetes or rheumatoid arthritis. These pharmacies offer convenience by delivering necessary medical supplies directly to patients’ homes, which is essential for those requiring regular medication.

Ambulatory surgery centers also contribute to the distribution of prefilled syringes. These centers, known for outpatient surgical care, utilize prefilled syringes for their efficiency and ease of use, which is vital in fast-paced surgical environments.

Key Market Segments

Type

- Disposable Prefilled Syringes

- Reusable Prefilled Syringes

Material Type

- Glass

- Plastic

Application Outlook

- Anaphylaxis

- Rheumatoid Arthritis

- Diabetes

- Other Applications

Distribution Channel

- Hospitals

- Mail Order Pharmacies

- Ambulatory Surgery Centers

Driver

Growing Number of Chronic Diseases

Prefilled syringes are mostly used for chronic diseases like heart problems, diabetes, and autoimmune diseases where patients need to give themselves medicine regularly. The rise in these long-term and lifestyle-related diseases worldwide is a big reason for the growing market for prefilled syringes. They are also becoming more popular because they are easy and safe for patients to use themselves.

- About 436 million people globally had diabetes in 2019, expected to increase to 700 million by 2045.

- In 2018, there were 18 million cancer cases globally, with lung, breast, and colorectal cancers being the most common.

- In 2017, 24 million people in the US had autoimmune diseases, and 8 million had auto-antibodies, which can lead to these diseases.

Restraint

Need for Safer Syringes

Prefilled syringes are safer than drawing medicine from vials, but they can still cause needle stick injuries if they don’t have safety features. About 500,000 injuries happen in the US and 1,000,000 in Europe each year because of this. There’s a need for more syringes with built-in safety features, but they are costly and hard to make. The healthcare industry is working on reducing these injuries, which could lead to more safe prefilled syringes being made.

Opportunity

Better Healthcare in Emerging Markets

Many countries, especially in Africa and South Asia, don’t have enough healthcare services. About 400 million people lack essential healthcare worldwide. However, healthcare spending is increasing globally, from 8% to almost 10% of GDP, or about $8 trillion a year. This is expected to triple by 2040. This growth means there’s a big chance for more use of prefilled syringes in these growing healthcare markets.

Latest Trends

More Use of Biologics and Biosimilars

There’s a shift from chemical drugs to biologics and biosimilars, which are better for targeted treatments and have fewer drug interactions. More and more of these drugs are being packaged in prefilled syringes. For example, 33 biosimilars were approved by the FDA as of January 2022, and most patients prefer biosimilar drugs in prefilled pens over syringes.

Challenge

Cheaper Alternatives Available

Prefilled syringes cost more to make than disposable ones. Patients sometimes prefer other ways to take medicine, like pills or inhalers, because they are easier, cheaper, and less painful. For example, new ways to take insulin without injections are becoming more popular, which could reduce the use of prefilled syringes for diabetes.

Regional Analysis

Europe is at the top of the prefilled syringes market, with a 37.1% share and a market value of USD 7.6 billion in 2023. A lot of people in Europe are using biologics for chronic diseases, and there’s a strong trend of using advanced self-injection methods. This, along with key companies in Europe making these syringes, is boosting the market. For example, in November 2022, the Schreiner Group and SCHOTT Pharma introduced a new syringe with RFID technology, improving how hospitals manage their supplies.

North America follows Europe in the market. The increase in chronic diseases like diabetes and rheumatoid arthritis is pushing up the demand for accurate and long-term drug delivery. New product launches and strong networks of leading companies are also helping the market grow in this region.

The market in the Asia Pacific is growing quickly. This is because more people are getting chronic and lifestyle diseases, and there’s a rising use of prefilled syringes. Also, more people are becoming aware of new types of syringes, and more companies are outsourcing their syringe packaging and filling. This is all helping the market grow fast in this area.

Latin America and the Middle East & Africa are seeing slower growth in this market. This is mainly due to less awareness of new products and slower market development in these regions.

Key Regions and Countries

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Russia

- Spain

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Rest of Asia-Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- MEA

- GCC

- South Africa

- Israel

- Rest of MEA

In 2022, Becton Dickinson and Company (BD), Gerresheimer AG, SCHOTT AG, and West Pharmaceutical Services Inc. were the major players in the global prefilled syringes market. They’re expected to keep leading and make a lot of money in the coming years. Their success comes from strong research and investing in new, cost-effective drug delivery systems.

These companies also focus on teaming up with other important players to grow their global market presence. For example, in May 2022, BD teamed up with Mitsubishi Gas Chemical Company to explore new uses for Mitsubishi’s Oxycapt technology in prefilled syringes.

Specifically, Becton, Dickinson and Company from the US was the top player in 2019, with a 37.2% market share. They lead because they offer a wide range of prefilled syringes, are present in many places, and have a big customer base. They mainly grow by launching new products.

Key Market Players

- Gerresheimer AG

- Becton, Dickinson and Company

- SCHOTT AG

- West Pharmaceutical Services Inc.

- Unilife Corporation

- Nipro Medical Corporation

- Owen Mumford

- Haselmeier AG

- BD and others.

Recent Development

- October 2023: Becton Dickinson (BD) launches a new prefilled syringe platform called BD Intevia. The platform is designed to improve the safety and efficiency of prefilled syringe manufacturing and administration.

- September 2023: West Pharmaceutical Services (West) launches a new prefilled syringe closure called NovaPure. The closure is designed to improve the stability and integrity of prefilled syringes.

- August 2023: SCHOTT Pharmaceutical Packaging launches a new prefilled syringe called OPTIMA. The syringe is designed to be more durable and break-resistant than traditional prefilled syringes.

- July 2023: AptarGroup launches a new prefilled syringe delivery system called Click2Pen. The system is designed to make it easier and more convenient for patients to administer their own injections.

- June 2023: Gerresheimer launches a new prefilled syringe packaging system called SmartPack. The system is designed to protect prefilled syringes from damage and tampering during shipping and storage.

Report Scope

Report Features Description Market Value (2023) USD 72.9 Billion Forecast Revenue (2033) USD 20.6 Billion CAGR (2023-2032) 12.3% Base Year for Estimation 2023 Historic Period 2017-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Disposable Prefilled Syringes and Reusable Prefilled Syringes) By Material Type (Glass and Plastic) By Application Outlook (Anaphylaxis, Rheumatoid Arthritis, Diabetes and Other Applications) By Distribution Channel (Hospitals, Mail Order Pharmacies and Ambulatory Surgery Centers) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Gerresheimer AG, Becton, Dickinson and Company, SCHOTT AG, West Pharmaceutical Services Inc., Unilife Corporation, Nipro Medical Corporation, Owen Mumford, Haselmeier AG and BD and others. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Gerresheimer AG

- Becton, Dickinson and Company

- SCHOTT AG

- West Pharmaceutical Services Inc.

- Unilife Corporation

- Nipro Medical Corporation

- Owen Mumford

- Haselmeier AG

- BD and others.