Global Pasta And Noodles Market By Type (Pasta, Noodles), By Category (Dried, Fresh/Instant, Canned or Frozen), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, Others) , By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2025-2034

- Published date: April 2025

- Report ID: 146690

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

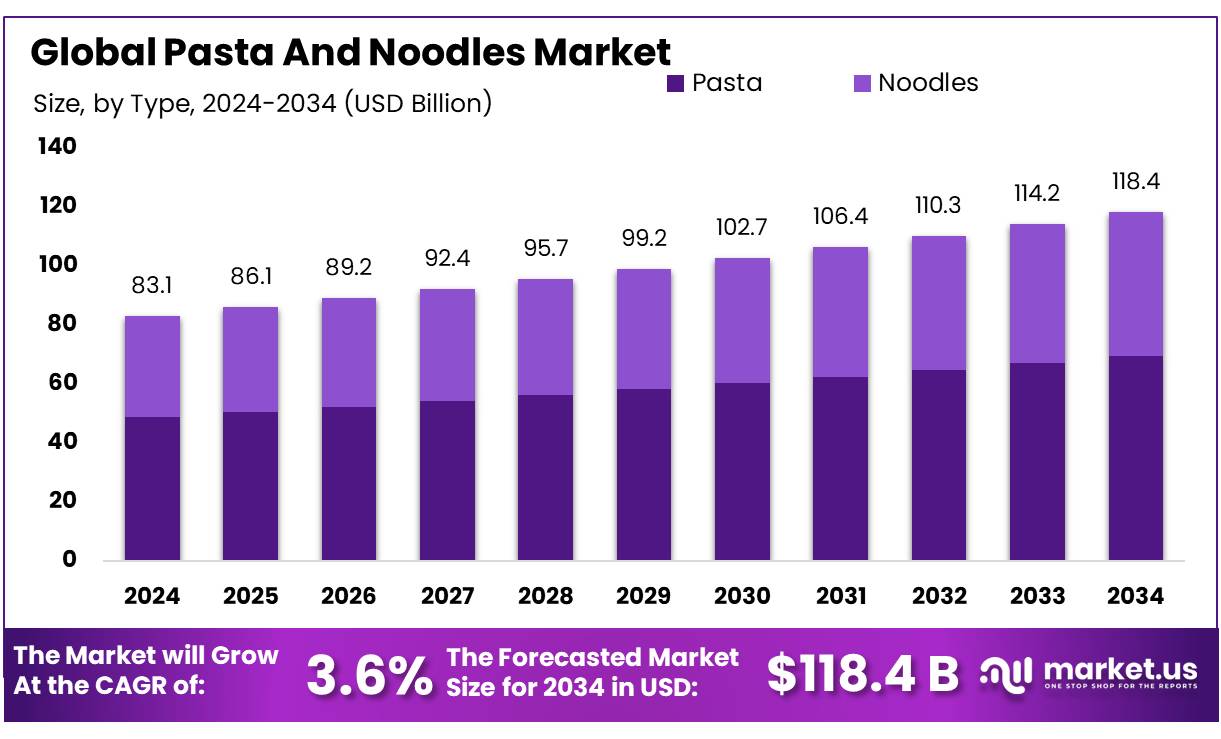

The Global Pasta And Noodles Market size is expected to be worth around USD 118.4 Bn by 2034, from USD 83.1 Bn in 2024, growing at a CAGR of 3.6% during the forecast period from 2025 to 2034.

The pasta and noodles market comprises a diverse range of products enjoyed worldwide, serving as staple foods in many cultures. With a history dating back to ancient civilizations, these food items have evolved into a significant segment of the global food industry. Pasta, traditionally made from durum wheat, water, and sometimes eggs, is known for its versatility and nutritional benefits. Noodles, often made from a variety of grains, including rice and wheat, cater to a wide array of dietary preferences and culinary traditions.

As of 2024, the global pasta and noodles market is valued at approximately USD 61 billion, demonstrating a steady growth trajectory. The market’s expansion is facilitated by increased consumption in both developed and emerging regions, supported by the convenience and comfort-food factor of these products.

According to data from the Food and Agriculture Organization (FAO), global wheat production, crucial for pasta and noodle manufacturing, reached nearly 770 million tonnes in 2024, ensuring a stable supply chain for the industry.

Convenience the busy lifestyles of modern consumers make convenience foods more appealing. Ready-to-eat and easy-to-prepare pasta and noodle products are increasingly popular, with sales rising by about 5% annually in urban areas worldwide.

Cultural Influence global popularity of ethnic cuisines, such as Italian and Asian, continues to promote the growth of the pasta and noodles sector. This is particularly evident in North America and Europe, where ethnic food consumption has seen an average increase of 7% per year.

Plant-Based and Alternative Ingredients Rising vegetarianism and flexitarian diets provide a fertile ground for pasta and noodle variants made from alternative, plant-based ingredients. This segment is expected to grow at a CAGR of 6% over the next five years.

Key Takeaways

- Pasta And Noodles Market size is expected to be worth around USD 118.4 Bn by 2034, from USD 83.1 Bn in 2024, growing at a CAGR of 3.6%.

- Pasta held a dominant market position, capturing more than a 58.7% share of the overall Pasta and Noodles Market.

- Dried pasta and noodles maintained a dominant market position, capturing more than a 52.3% share of the overall Pasta and Noodles Market.

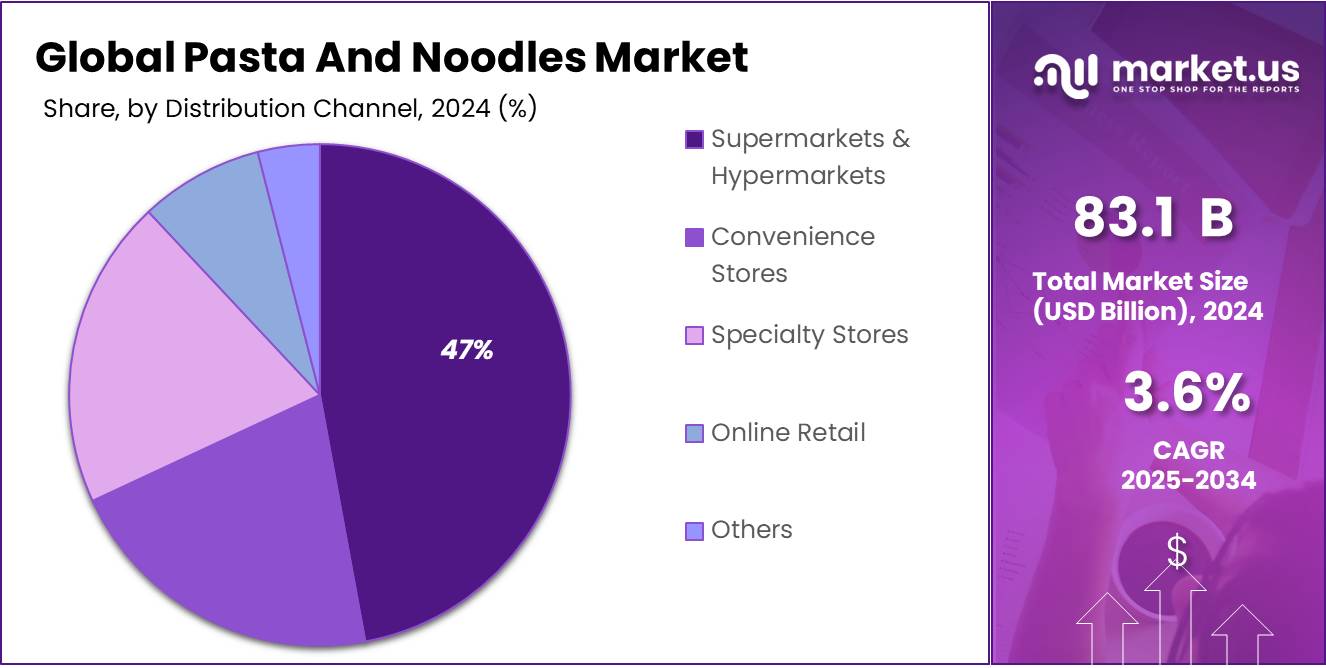

- Hypermarkets & Supermarkets held a dominant market position in the distribution of pasta and noodles, capturing more than a 47.2% share.

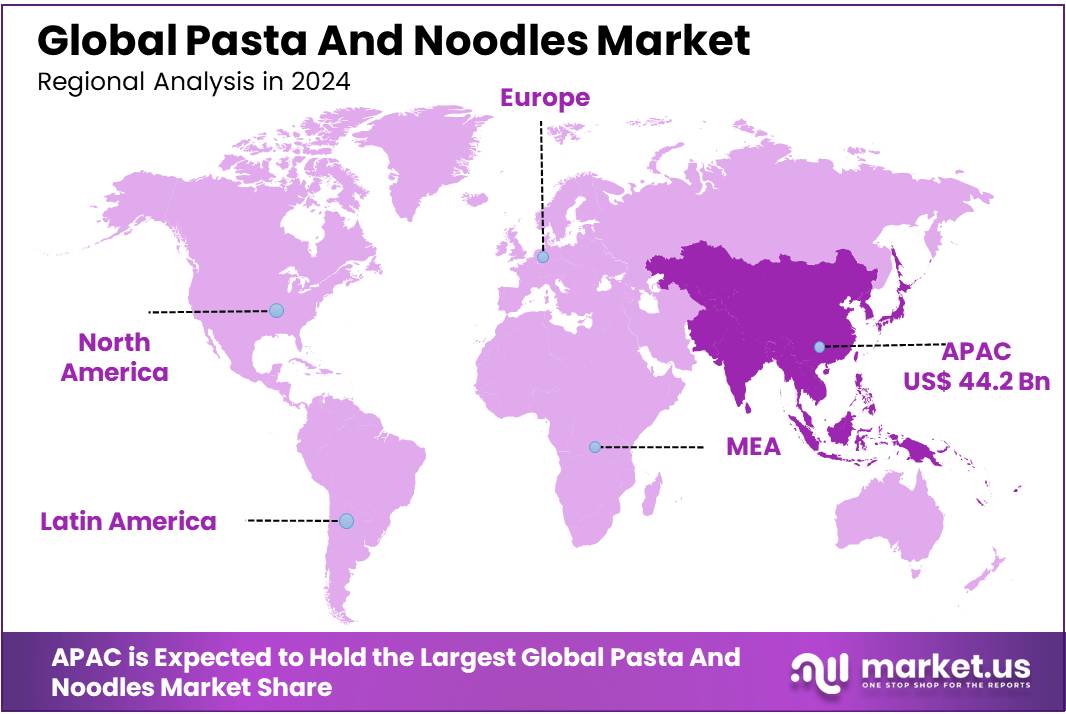

- Asia-Pacific (APAC) region held a commanding position in the global pasta and noodles market, capturing an impressive 53.2% market share, with a valuation of USD 44.2 billion.

By Type

Pasta Commands Market with 58.7% Share Due to Its Global Popularity and Versatility

In 2024, Pasta held a dominant market position, capturing more than a 58.7% share of the overall Pasta and Noodles Market. This substantial market share underscores pasta’s entrenched popularity across various global markets, appealing widely due to its versatility in numerous culinary traditions and its role as a staple in comfort food cuisine.

The significant presence of pasta in households and restaurants alike is reflective of its fundamental role in both everyday dining and gourmet culinary practices. The enduring appeal of pasta is further bolstered by its convenience, affordability, and the increasing availability of diverse pasta types tailored to meet a broader spectrum of dietary preferences, including whole grain, gluten-free, and high-protein options. This segment’s robust performance is indicative of consumers’ ongoing appreciation for pasta’s adaptability to various sauces and ingredients, making it a perennial favorite in diverse culinary settings.

By Category

Dried Pasta and Noodles Lead with 52.3% Market Share Due to Long Shelf Life and Convenience

In 2024, Dried pasta and noodles maintained a dominant market position, capturing more than a 52.3% share of the overall Pasta and Noodles Market. This segment benefits significantly from the long shelf life and ease of storage that dried pasta and noodles offer, making them ideal for stockpiling and usage in a variety of culinary settings. The convenience factor, coupled with their quick preparation time, makes dried pasta and noodles a preferred choice for busy households and food service providers alike.

Additionally, the affordability of dried pasta and noodles contributes to their widespread popularity in both developed and emerging markets, where consumers appreciate the blend of convenience, cost-effectiveness, and versatility these products bring to the dining table. This segment’s strong performance highlights its integral role in meeting the global demand for easy-to-prepare, nutritious meal options.

By Distribution Channel

Supermarkets & Hypermarkets Lead with 47.2% Share in Pasta and Noodles Sales

In 2024, Hypermarkets & Supermarkets held a dominant market position in the distribution of pasta and noodles, capturing more than a 47.2% share. This substantial market share is attributed to the extensive reach and accessibility of these retail giants, which offer a wide variety of pasta and noodles under one roof. The convenience of one-stop shopping appeals to consumers who value the ability to purchase all their grocery needs, including a diverse array of pasta and noodles, in a single visit.

Additionally, supermarkets and hypermarkets often provide competitive pricing and frequent promotions on these products, enhancing their attractiveness to budget-conscious shoppers. The strategic placement of pasta and noodles in prominent sections and the availability of both local and international brands contribute to the high sales volume witnessed in these outlets. This distribution channel’s prominence underscores its role in shaping purchasing patterns and consumer preferences in the pasta and noodles market.

Key Market Segments

By Type

- Pasta

- Noodles

By Category

- Dried

- Fresh/Instant

- Canned or Frozen

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Others

Drivers

Convenience and Time-Saving Attributes Drive Pasta and Noodles Market Growth

One of the primary driving factors for the growth of the pasta and noodles market is the increasing consumer demand for convenience foods. As modern lifestyles become busier, with more individuals balancing demanding work schedules and personal commitments, the need for quick and easy meal solutions has significantly risen. Pasta and noodles cater perfectly to this requirement due to their short cooking times and versatility in various dishes.

The Food and Agriculture Organization (FAO) highlights that the global consumption of convenience foods, including pasta and noodles, is on an upward trajectory, particularly in urban areas where time is a premium commodity. According to their reports, pasta and noodle products are among the top convenience foods consumed globally because they require minimal preparation time and can be easily integrated into diverse nutritional diets.

Additionally, government initiatives have played a crucial role in supporting the pasta and noodles market. For example, the United States Department of Agriculture (USDA) has implemented guidelines that promote whole grains, which has spurred the development and marketing of whole-grain pasta and noodles. These products appeal to health-conscious consumers looking for convenient yet healthy meal options, aligning with governmental dietary recommendations.

Restraints

Health Concerns Over Carbohydrate Intake Hinder Pasta and Noodles Market Growth

A significant restraining factor impacting the growth of the pasta and noodles market is the increasing health concerns associated with high carbohydrate intake. As global awareness of dietary health increases, many consumers are shifting towards low-carb and gluten-free diets, which poses challenges to the traditional pasta and noodles sector. This trend is particularly pronounced among populations in Western countries, where obesity and diabetes are major health issues.

Organizations such as the World Health Organization (WHO) have published guidelines recommending reduced consumption of high-carb foods to prevent lifestyle diseases. These guidelines have encouraged a portion of the population to opt for alternatives to traditional wheat-based pasta and noodles, seeking out products that are aligned with ketogenic, paleo, or other low-carb diets.

Government initiatives also reflect this shift; for example, the U.S. Department of Health and Human Services promotes dietary guidelines that suggest moderating carbohydrate intake by choosing whole grains and reducing processed grain consumption. Such policies indirectly affect the pasta and noodles market by endorsing dietary patterns that limit the consumption of traditional pasta and noodle products.

Opportunity

Plant-Based and Gluten-Free Variants Present Major Growth Opportunities in Pasta and Noodles Market

A significant growth opportunity within the pasta and noodles market lies in the rising demand for plant-based and gluten-free alternatives. This trend is driven by a growing consumer base that adheres to vegan diets, has gluten intolerances, or simply seeks healthier dietary options. The increasing awareness of environmental and health issues associated with traditional animal-based or wheat products is steering consumers towards plant-based and gluten-free pasta and noodles.

Data from the Food and Agriculture Organization (FAO) indicates that there is a rising trend in the consumption of plant-based foods globally, with a notable shift in consumer preferences impacting the food industry’s production patterns. The FAO has been actively promoting agricultural biodiversity, which supports the production of a variety of crops like legumes and quinoa, used in making alternative pasta and noodle products. These initiatives help ensure that there are sustainable and diverse agricultural inputs available for these innovative food products.

Governmental health bodies across various countries are also supporting this shift through nutritional guidelines that recommend increasing the intake of plant-based foods. For instance, the Dietary Guidelines for Americans encourage the incorporation of more plant-based meals into everyday diets, recognizing their benefits for health and chronic disease prevention.

Trends

Ethical and Sustainable Production Drives New Trends in Pasta and Noodles Market

A pivotal trend gaining momentum in the pasta and noodles market is the focus on ethical and sustainable production practices. Consumers are increasingly seeking products that not only meet health and dietary needs but also align with environmental and ethical standards. This shift is driven by a broader consumer awareness of the environmental impact of food production and a growing demand for transparency in sourcing and manufacturing processes.

According to the Food and Agriculture Organization (FAO), sustainable agricultural practices are crucial for ensuring the long-term viability of food production systems. The FAO’s initiatives to promote sustainable crop production have significant implications for the pasta and noodles industry, particularly in the cultivation of wheat and other grains essential for pasta production. These initiatives encourage practices that minimize water usage, reduce chemical inputs, and lower carbon footprints, aligning with consumer expectations for sustainability.

In response to these trends, manufacturers in the pasta and noodles market are increasingly adopting sustainable practices, such as using organic ingredients, reducing packaging waste, and ensuring fair trade sourcing. For instance, several leading pasta brands have committed to 100% organic wheat sourcing and have implemented measures to reduce energy consumption in their production processes.

Regional Analysis

In 2024, the Asia-Pacific (APAC) region held a commanding position in the global pasta and noodles market, capturing an impressive 53.2% market share, with a valuation of USD 44.2 billion. This dominance is largely attributable to the deep-rooted cultural significance of noodles in the dietary habits of many APAC countries. Noodles are not just a staple food but also play a pivotal role in various traditional dishes across the region, from ramen in Japan to pho in Vietnam and pad thai in Thailand.

The vast population base, combined with rapid urbanization and increasing disposable incomes, has fueled the demand for both traditional and innovative pasta and noodle products. As urban consumers in APAC lead increasingly busy lifestyles, there is a growing preference for convenient and quick meal solutions, which pasta and noodles readily provide. This has spurred significant growth in the ready-to-eat and instant noodles segments.

Governments in the APAC region have also supported the industry by promoting food safety and quality standards, which enhance consumer confidence in these products. Regulatory frameworks have been strengthened to ensure the quality of food products, including pasta and noodles, which has positively impacted the market dynamics.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Nestlé S.A. stands as a prominent player in the global pasta and noodles market, leveraging its extensive distribution network and strong brand portfolio. The company focuses on innovation and quality, offering a variety of pasta and noodle products that cater to diverse consumer preferences and dietary needs. Nestlé’s strategic initiatives include enhancing its product offerings with health-oriented options like whole grain and gluten-free pasta, aiming to meet the nutritional demands of its global customer base.

The Barilla Group, renowned for its pasta, leads with a commitment to quality and sustainability. Barilla’s range includes traditional wheat pasta alongside newer, healthier alternatives like legume-based and gluten-free options, reflecting consumer trends towards health-conscious eating. The company emphasizes sustainable production practices and actively promotes the Mediterranean diet’s benefits, positioning itself as a leader in nutritional food solutions.

Nissin Foods, famous for inventing instant noodles, continues to innovate within the quick-service food segment. The company has expanded its product lineup to include a variety of flavors and healthier options, such as reduced-sodium and whole grain noodles, catering to evolving consumer tastes and health trends. Nissin’s strong presence in Asia and growing international reach underline its key role in the pasta and noodles market.

Top Key Players in the Market

- Nestlé S.A.

- Barilla Group

- Nissin Foods

- Unilever

- Del Monte Foods

- Campbell Soup Company

- Conagra Brands, Inc.

- Ebro Foods SA

- TreeHouse Foods Inc

- General Mills, Inc.

- Bambino Agro Industries Ltd

- Jinmailang Foods Co., Ltd

- ITC Limited

- Acecook Vietnam Co., Ltd.

- Other Key Players

Recent Developments

Nestlé has introduced a range of fortified pasta and noodles that cater to health-conscious consumers. These innovations align with global health trends and have helped solidify Nestlé’s position in the market. The company’s strategic focus on product diversification, including the introduction of gluten-free and high-protein pasta variants, has enabled it to tap into new consumer segments and maintain a competitive edge.

Nissin’s strategic focus on adapting to dietary trends while maintaining the essence of instant gratification has helped it strengthen its market presence globally, making it a go-to brand for consumers seeking both quick meals and nutritious options.

Report Scope

Report Features Description Market Value (2024) USD 83.1 Bn Forecast Revenue (2034) USD 118.4 Bn CAGR (2025-2034) 3.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Pasta, Noodles), By Category (Dried, Fresh/Instant, Canned or Frozen), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Nestlé S.A., Barilla Group, Nissin Foods, Unilever , Del Monte Foods , Campbell Soup Company, Conagra Brands, Inc., Ebro Foods SA, TreeHouse Foods Inc, General Mills, Inc., Bambino Agro Industries Ltd, Jinmailang Foods Co., Ltd, ITC Limited, Acecook Vietnam Co., Ltd., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Nestlé S.A.

- Barilla Group

- Nissin Foods

- Unilever

- Del Monte Foods

- Campbell Soup Company

- Conagra Brands, Inc.

- Ebro Foods SA

- TreeHouse Foods Inc

- General Mills, Inc.

- Bambino Agro Industries Ltd

- Jinmailang Foods Co., Ltd

- ITC Limited

- Acecook Vietnam Co., Ltd.

- Other Key Players