Global Malt Sprouts Market Size, Share, And Industry Analysis Report By Source (Barley, Wheat, Rye), By Form (Powder, Whole Sprouts, Pellets, Liquid Extract), By Application (Animal Feed, Ruminant Feed, Poultry Feed, Swine Feed, Pet Food), By End-Use (Feed Industry, Food and Beverage Industry, Pharma and Nutraceutical, Industrial and Biofuel Manufacturers), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 172187

- Number of Pages: 227

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

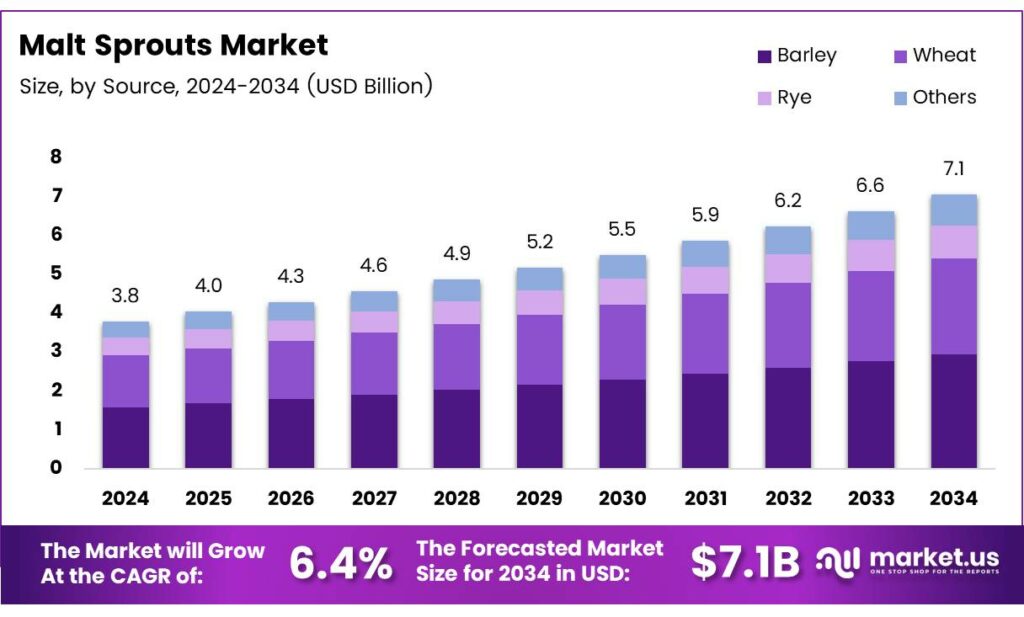

The Global Malt Sprouts Market size is expected to be worth around USD 7.1 billion by 2034, from USD 3.8 billion in 2024, growing at a CAGR of 6.4% during the forecast period from 2025 to 2034.

The Malt Sprouts Market refers to global trade in malt sprout by‑products derived from germinated barley. It encompasses production, processing, supply chain, and consumption in the animal feed sector. Market growth correlates with livestock nutrition demand, cost efficiency, and sustainable feed alternatives across regions, driving investment and adoption trends.

The malt sprout product segment has gained traction as an economical protein and energy source in ruminant diets. Consistent demand from dairy and beef producers who value feed efficiency. Moreover, transition to processed, pelleted malt sprout improves logistics, reduces waste, and enhances customer satisfaction in bulk supply agreements and contract farming models.

- Malt sprout typically contains high nutritional constituents supporting feed applications. Malt sprout pellets have approximately 95% dry matter, with organic matter around 89%, including proteins of 21–25% and carbohydrates at 46%. These attributes drive market demand due to feed value and efficient energy provision for livestock nutrition.

Finally, additional statistical insights highlight the commercial viability of malt sprouts in markets. Dry feed ingredient malt sprout has 94% dry matter content and is priced at about USD 8.75 per kg. It delivers 3.245 Mcal digestible energy per kg dry matter, roughly 3.05 Mcal per 1,000 grams fed, with crude protein at 27.66% and lysine at 1.3% on a dry matter basis.

The Malt Sprouts is strengthened by rising livestock populations and the intensifying need for balanced ruminant diets. Feed formulators increasingly integrate malt sprout to achieve fiber requirements and cost control. Furthermore, advancements in pelleting technologies support transportation and storage optimization, which positively influences pricing stability and market penetration.

Key Takeaways

- The Global Malt Sprouts Market was valued at USD 3.8 billion in 2024 and is projected to reach USD 7.1 billion by 2034, at a CAGR of 6.4% during the forecast period from 2025 to 2034.

- Barley dominates the source segment with a 48.5% market share due to its superior nutritional profile and availability.

- Powder form leads the form segment with a 39.7% share, driven by ease of mixing and extended shelf life.

- Animal Feed is the largest application segment, holding a 38.3% share, primarily for enhancing livestock nutrition.

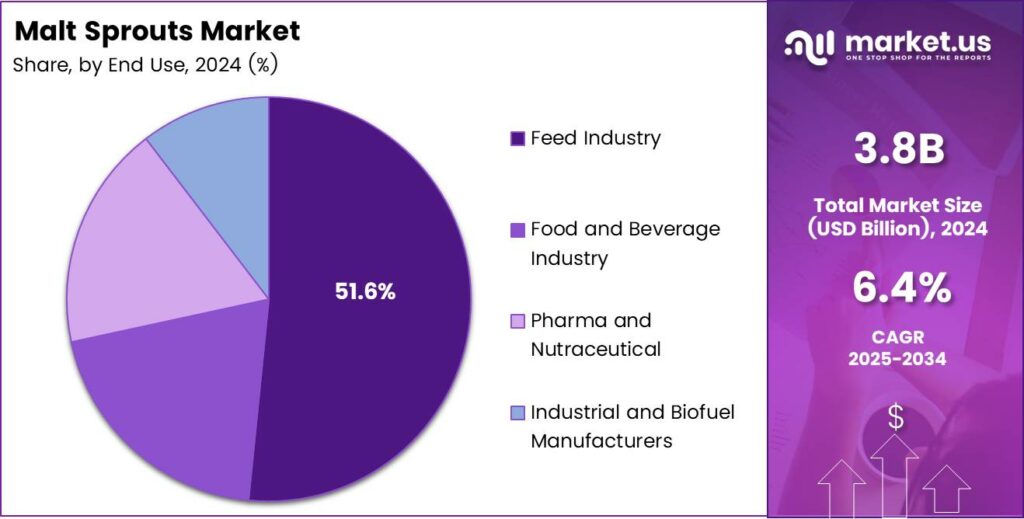

- The Feed Industry commands the top end-use segment with a 51.6% market share.

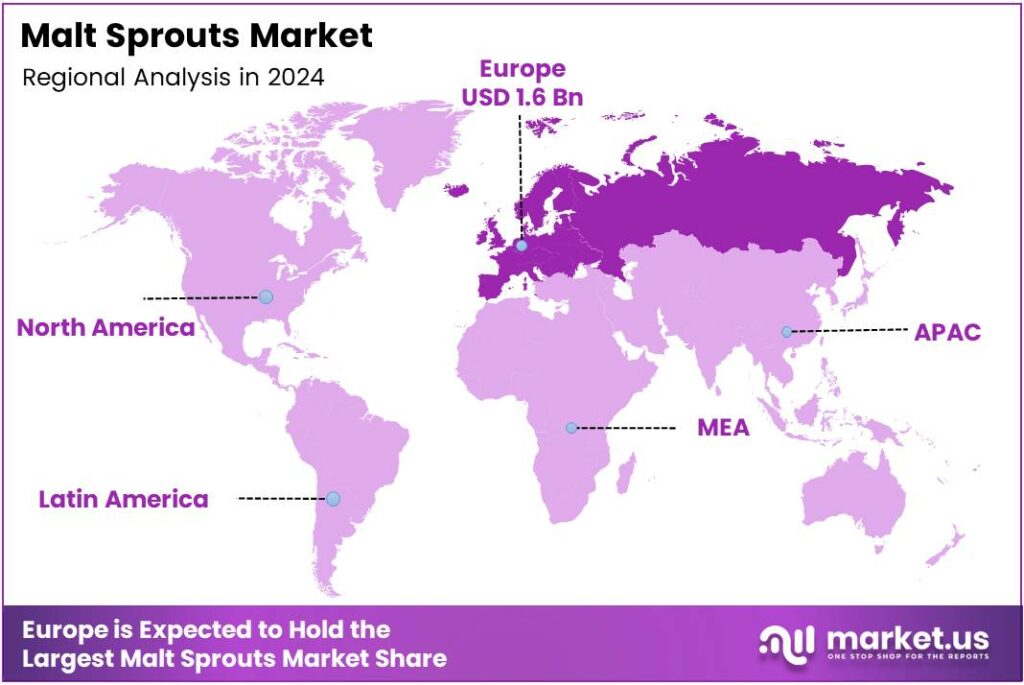

- Europe leads regionally with a 43.8% share, valued at USD 1.6 billion in 2024.

By Source Analysis

Barley dominates with 48.5% due to its superior nutritional profile and abundant availability in brewing byproducts.

Barley remains the leading source in the malt sprouts market, capturing a 48.5% share. Its high fiber content and digestibility make it ideal for animal nutrition. Moreover, barley sprouts are cost-effective, derived from beer production waste. This sustainability drives demand, especially in feed formulations. Consequently, manufacturers prefer barley for its reliability and economic benefits.

Wheat serves as a versatile alternative source for malt sprouts. It offers balanced nutrients like proteins and vitamins, suitable for diverse applications. Additionally, wheat sprouts enhance soil health in agricultural rotations. However, its market presence lags behind barley due to seasonal availability issues. Thus, it appeals to niche users seeking variety.

Rye contributes uniquely to the malt sprouts segment with its robust flavor and resilience in harsh climates. It provides essential amino acids beneficial for livestock. Furthermore, rye sprouts support organic farming practices. Yet, limited cultivation restricts its adoption. Therefore, it targets specialized markets like premium pet foods.

By Form Analysis

Powder dominates with 39.7% due to its ease of mixing and extended shelf life.

Powder form leads the malt sprouts market, holding a 39.7% share. Its fine texture facilitates uniform incorporation into feeds and foods. Moreover, powder minimizes waste during processing. This convenience boosts efficiency for industrial users. As a result, it dominates in high-volume production environments.

Whole sprouts provide a natural, unprocessed option in the market. They retain maximum nutrients like enzymes and fibers. Additionally, they appeal to organic consumers seeking authenticity. However, handling challenges limits widespread use. Thus, they suit small-scale or specialty applications.

Pellets offer compacted convenience for storage and transport in malt sprouts. They ensure consistent dosing in animal diets. Furthermore, pellets reduce dust and improve palatability. Yet, production costs can deter adoption. Therefore, they target efficient feed mills and exporters.

By Application Analysis

Animal Feed dominates with 38.3% due to its essential role in enhancing livestock nutrition and digestion.

Animal feed represents the primary application, securing a 38.3% share in malt sprouts. Its rich beta-glucan content aids gut health in animals. Moreover, it serves as a cost-effective protein source. This drives usage across farming sectors. Consequently, it bolsters overall market growth.

Ruminant feed utilizes malt sprouts for improved rumen fermentation. It supplies fermentable fibers that boost milk yield in cattle. Additionally, it enhances weight gain efficiently. However, specific blending is required. Thus, it supports the dairy and beef industries sustainably.

Poultry feed incorporates malt sprouts to promote feather growth and immunity. Its vitamins reduce stress in birds. Furthermore, it improves egg quality naturally. Yet, portion control is key. Therefore, it fits intensive poultry operations well.

Swine feed benefits from malt sprouts’ energy-boosting properties. It aids digestion and reduces feed costs. In addition, it minimizes antibiotic needs. Despite formulation adjustments, it has grown popular. Hence, it enhances hog production profitability.

By End Use Analysis

The Feed Industry dominates with 51.6% due to its heavy reliance on nutritious byproducts for animal husbandry.

The Feed Industry commands the largest end use, with a 51.6% share in malt sprouts. It values the high-fiber content for balanced rations. Moreover, it reduces production costs effectively. This integration supports global livestock demands. As a result, it leads to market dynamics.

The food and beverage industry employs malt sprouts in brewing and baking enhancements. It adds natural sweetness and nutrients to products. Additionally, it aids fermentation processes. However, regulatory standards apply. Thus, it targets health-oriented consumables.

Pharma and nutraceutical sectors use malt sprouts for supplement formulations. Its bioactive compounds support immune health. Furthermore, it enables capsule or tablet production. Yet, purity testing is essential. Therefore, it grows in wellness markets.

Industrial and biofuel manufacturers convert malt sprouts into ethanol or adhesives. It provides sustainable raw materials. In addition, it minimizes waste in processing. Despite technical challenges, it advances green initiatives. Hence, it fosters eco-friendly innovations.

Key Market Segments

By Source

- Barley

- Wheat

- Rye

- Others

By Form

- Powder

- Whole Sprouts

- Pellets

- Liquid Extract

By Application

- Animal Feed

- Ruminant Feed

- Poultry Feed

- Swine Feed

- Pet Food

- Others

By End-Use

- Feed Industry

- Food and Beverage Industry

- Pharma and Nutraceutical

- Industrial and Biofuel Manufacturers

Emerging Trends

Integration of Circular Economy Principles Shapes the Future of Malt Sprouts

The most prominent trend in the market today is the shift toward a “zero-waste” brewing model. Modern breweries are no longer viewing malt sprouts as waste but as a valuable co-product. This transition is leading to strategic partnerships between beverage giants and agricultural firms to ensure every part of the grain is utilized.

- In the EU alone, we generate over 58 million tonnes of food waste annually, which works out to about 130 kg per person. A significant part of the struggle is that materials like malt sprouts are produced in one location (a brewery or malt house) but often need to be used somewhere else. If they aren’t dried down to a moisture level of about 10% to 12% immediately, they become a safety risk rather than a resource.

The rise of the “clean label” movement is another key trend. Consumers want to know exactly what is in their food—and by extension, what their livestock are eating. Malt sprouts are seen as a transparent, “whole-food” ingredient, fitting perfectly into the trend of natural and non-GMO farming standards.

Drivers

Rising Demand for Cost-Effective Protein Sources Fuels Market Growth

The global malt sprouts market is primarily driven by the increasing need for affordable, high-quality animal feed. As meat consumption rises worldwide, livestock producers are searching for nutrient-dense ingredients that do not break the bank. Malt sprouts, being a protein-rich byproduct of the malting process, perfectly fit this requirement.

- The Food and Agriculture Organization (FAO), barley is the fourth most important cereal crop in the world, with a global production of roughly 132 million tons. With a massive market value of around $25 billion, the sheer scale of barley production ensures that malt sprouts are available in almost every corner of the globe.

Nutritional value is another significant driver. Malt sprouts are naturally high in fiber and contain essential vitamins and minerals. Farmers are increasingly moving away from synthetic additives in favor of these natural alternatives, which support better digestion and overall animal health.

Restraints

High Moisture Content and Logistics Challenges Restrain Market Expansion

One of the biggest hurdles for the malt sprouts market is the high moisture content of the product. Fresh sprouts can spoil quickly if not handled correctly. This limited shelf life makes long-distance transportation difficult and often requires expensive drying or pelleting processes to keep the product stable for sale.

- Since malt sprouts are a byproduct, any fluctuation in barley harvests due to climate change or geopolitical issues directly impacts supply and pricing. Malt sprouts typically contain about 26% to 28% crude protein on a dry matter basis. In the world of animal nutrition, finding an ingredient that offers over 25% protein at a fraction of the cost of soybean meal is like finding a hidden gem.

Competition from established feed ingredients like soybean meal and corn also limits growth. These commodities have massive global supply chains and well-known pricing structures. Malt sprouts often struggle to compete in regions where these traditional crops are heavily subsidized or more readily available.

Growth Factors

Expansion into Premium Pet Food and Sustainable Biotech Offers New Vistas

The surging “pet humanization” trend presents a massive opportunity for the malt sprouts market. Pet owners are now looking for natural, “clean-label” ingredients for their dogs and cats. Because malt sprouts are plant-based and nutrient-rich, they can be marketed as a premium, sustainable fiber source in high-end pet food formulations.

Large food and beverage companies are under pressure to reach net-zero waste goals. By partnering with malt sprout suppliers, these companies can turn a former waste product into a value-added ingredient, appealing to the growing demographic of environmentally conscious shoppers.

The biotechnology sector is also showing interest. Malt sprouts can serve as an excellent, low-cost “culture medium” for growing beneficial bacteria and yeast in labs. This opens up a whole new revenue stream outside of traditional animal agriculture, particularly in the production of probiotics and enzymes.

Regional Analysis

Europe Dominates the Malt Sprouts Market with a Market Share of 43.8%, Valued at USD 1.6 Billion

Europe leads the global Malt Sprouts Market, holding a significant share of 43.8% and valued at USD 1.6 billion. Strong demand from the food, feed, and nutraceutical sectors, along with advanced processing technologies, supports market growth. Increasing awareness about protein-rich and functional food ingredients further strengthens the regional market.

North America is witnessing steady growth in the Malt Sprouts Market due to rising health-conscious consumption and functional food adoption. Innovations in feed applications and sustainable farming practices are driving demand. The U.S., as a key contributor, focuses on enhancing nutritional quality for animal and human consumption.

Asia Pacific is emerging as a high-potential market for Malt Sprouts, driven by expanding livestock and poultry industries. Increasing population and protein demand, along with government support for agricultural development, are key growth factors. Rising adoption of natural feed additives is boosting regional consumption.

The Middle East and Africa region shows gradual market expansion due to increasing awareness of high-quality feed and nutritional supplements. Limited local production encourages import reliance, while urbanization and growing livestock demand stimulate market growth.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The global Malt Sprouts Market in 2024 is witnessing strong contributions from leading players, driving innovation and expanding supply chains.

Axereal Group remains a major player with extensive operations in Europe, leveraging integrated farming and processing capabilities to ensure high-quality malt sprouts for both feed and food applications. Their consistent focus on sustainability enhances their market reputation.

MalteuropGroupe continues to dominate through its diversified product portfolio and global distribution network. By investing in modern malting technologies, the company ensures optimized nutritional value, catering to the growing demand across the animal feed and nutraceutical industries. Their strategic partnerships strengthen market penetration in key regions.

GrainCorp, a major Australian player, drives market growth through large-scale barley sourcing and malt processing facilities. Its focus on quality assurance and operational efficiency positions it as a reliable supplier to both domestic and international markets. GrainCorp’s forward integration into downstream applications supports steady revenue growth.

InVivo Group emphasizes innovation and collaborative approaches with farmers and feed manufacturers. Their research-driven strategies enhance the nutritional profile of malt sprouts, supporting the rising demand in the food and beverage industry. InVivo’s commitment to sustainability and local sourcing further strengthens its market position.

Top Key Players in the Market

- Axereal Group

- Malteurop Groupe

- GrainCorp

- InVivo Group

- Viking Malt

- Others

Recent Developments

- In 2024, Axereal Group, through its Boortmalt division, is a major player in the global malting industry. Boortmalt announced an expansion of its Athy facility in Ireland to increase production capacity and meet rising local demand for malt, with construction starting and completion expected.

- In 2024, Malteurop Groupe, part of VIVESCIA, is actively involved in malting operations with a focus on sustainability and innovation. Malteurop collaborated with HEINEKEN and VIVESCIA on the first large-scale regenerative agriculture barley harvest in Europe, promoting sustainable farming practices.

Report Scope

Report Features Description Market Value (2024) USD 3.8 Billion Forecast Revenue (2034) USD 7.1 Billion CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Barley, Wheat, Rye, Others), By Form (Powder, Whole Sprouts, Pellets, Liquid Extract), By Application (Animal Feed, Ruminant Feed, Poultry Feed, Swine Feed, Pet Food, Others), By End-Use (Feed Industry, Food and Beverage Industry, Pharma and Nutraceutical, Industrial and Biofuel Manufacturers) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Axereal Group, Malteurop Groupe, GrainCorp, InVivo Group, Viking Malt, Others Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Axereal Group

- Malteurop Groupe

- GrainCorp

- InVivo Group

- Viking Malt

- Others