Global Liquid Air Energy Storage Market Size, Share Analysis Report By Capacity (5-15 MW, 16-50 MW, 50-100 MW, 100 MW+) By Application (Power Generation, Power Transmission and Grid Support, Renewable Energy Integration, LNG Terminals, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160495

- Number of Pages: 377

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

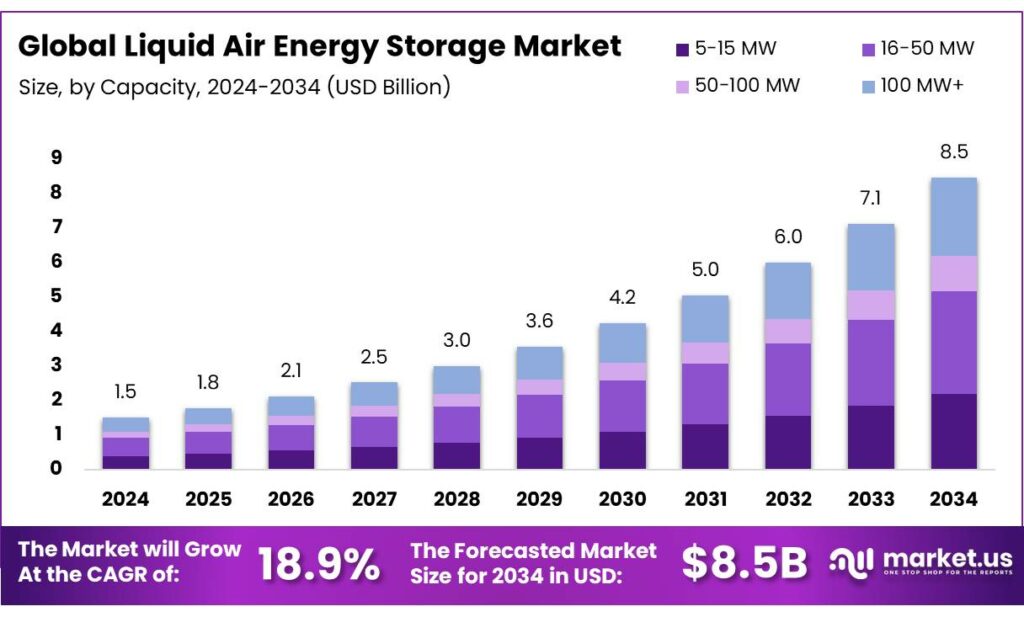

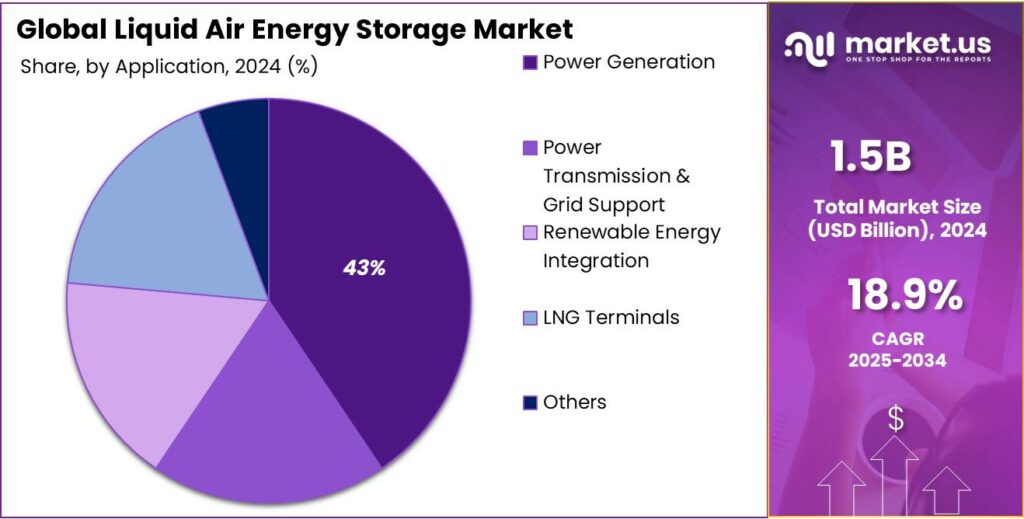

The Global Liquid Air Energy Storage Market size is expected to be worth around USD 8.5 Billion by 2034, from USD 1.5 Billion in 2024, growing at a CAGR of 18.9% during the forecast period from 2025 to 2034.In 2024 Asia-Pacific held a dominant market position, capturing more than a 43.2% share, holding USD 1.6 Billion in revenue.

Liquid Air Energy Storage (LAES) is an emerging technology that offers a promising solution for large-scale, long-duration energy storage, addressing the challenges posed by the intermittent nature of renewable energy sources like wind and solar power. LAES systems operate by compressing and cooling ambient air to cryogenic temperatures, liquefying it for storage, and then converting it back to electricity when needed through expansion and heating processes. This method provides a high energy density and is not constrained by geographical limitations, making it suitable for integration into various energy grids.

The industrial landscape for LAES is evolving, with significant developments in both the United Kingdom and the United States. In the UK, the government has introduced a cap-and-floor scheme for Long Duration Energy Storage, setting a minimum duration requirement of eight hours for projects to qualify for support. Highview Power, a leader in LAES technology, has secured a £165 million investment from the UK Infrastructure Bank to construct the first commercial-scale LAES plant in the UK, further demonstrating the government’s commitment to this technology.

In the United States, the Department of Energy announced $15 million in funding for 12 projects across 11 states to advance next-generation, high-energy storage solutions, including LAES, as part of efforts to electrify domestic aircraft, railroads, and ships. Additionally, the U.S. Department of Energy’s Long Duration Storage Shot initiative aims to achieve a 90% cost reduction for technologies providing 10+ hours of energy storage by 2030, highlighting the federal focus on enhancing the economic viability of LAES

The future growth opportunities for LAES are substantial. The UK government estimates that deploying 20 GW of LDES could save the electricity system £24 billion between 2030 and 2050, reducing household energy bills as additional cheap renewable energy reduces reliance on more expensive natural gas. Similarly, a study by the Massachusetts Institute of Technology and the Norwegian University of Science and Technology suggests that LAES could be a cost-effective long-term energy storage solution, providing a reliable method for storing and releasing electricity as needed.

Key Takeaways

- Liquid Air Energy Storage Market size is expected to be worth around USD 8.5 Billion by 2034, from USD 1.5 Billion in 2024, growing at a CAGR of 18.9%.

- 16–50 MW capacity segment held a dominant market position, capturing more than a 34.8% share of the global liquid air energy storage (LAES) market.

- power generation application segment of the Liquid Air Energy Storage (LAES) market held a dominant position, capturing more than a 34.7% share.

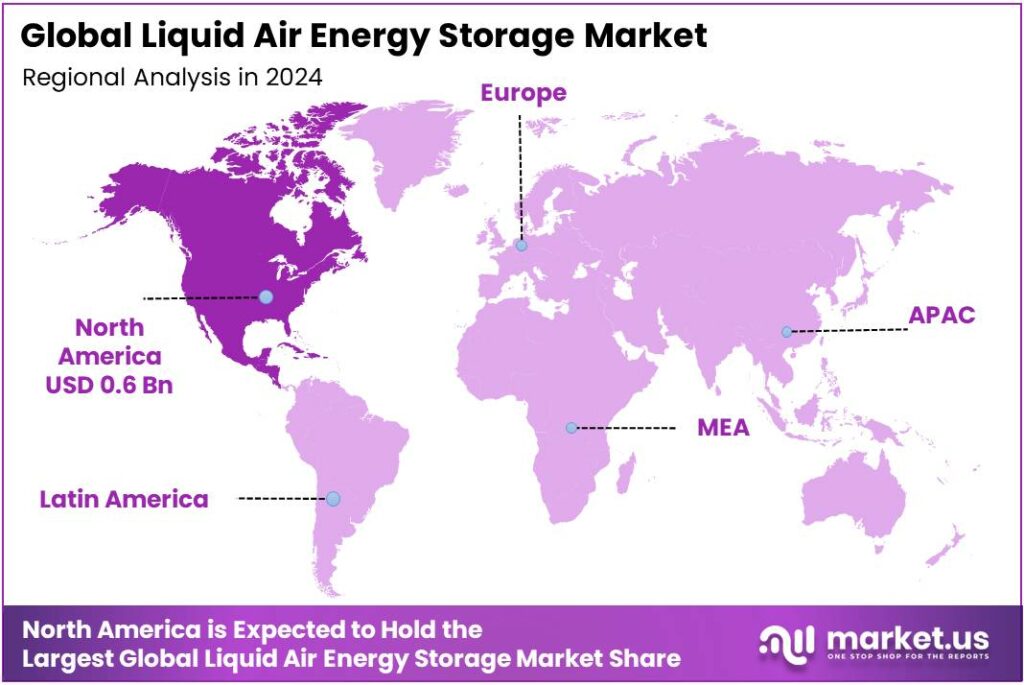

- North America emerged as the dominant region in the Liquid Air Energy Storage (LAES) market, capturing a substantial 43.8% share, valued at approximately USD 600 million.

By Capacity Analysis

16–50 MW Capacity Segment Leads Liquid Air Energy Storage Market

In 2024, the 16–50 MW capacity segment held a dominant market position, capturing more than a 34.8% share of the global liquid air energy storage (LAES) market. This segment’s prominence is attributed to its suitability for large-scale renewable energy integration and utility applications, ensuring grid stability and meeting substantial energy storage needs efficiently. The 16–50 MW range offers a balanced capacity that aligns well with both industrial and commercial energy demands, making it a preferred choice for many projects.

The growth trajectory of the 16–50 MW segment is supported by several key developments. For instance, in June 2024, Highview Power secured a £300 million investment for the construction of a 50 MW LAES plant in Carrington, Greater Manchester. This facility is expected to provide 300 MWh of storage capacity, marking a significant advancement in the deployment of LAES technology. Such projects underscore the increasing confidence in the 16–50 MW capacity range to meet the energy storage requirements of modern grids.

By Application Analysis

Power Generation Application Dominates Liquid Air Energy Storage Market

In 2024, the power generation application segment of the Liquid Air Energy Storage (LAES) market held a dominant position, capturing more than a 34.7% share. This dominance is attributed to the increasing demand for reliable and scalable energy storage solutions to support grid stability and integrate renewable energy sources. LAES systems, with their ability to store and dispatch electricity over extended periods, are well-suited for power generation applications, especially in regions with high penetration of intermittent renewable energy sources like wind and solar.

The growth of the power generation segment is further supported by significant investments and projects worldwide. For instance, in 2024, Highview Power secured a £300 million investment for the construction of a 50 MW LAES plant in Carrington, Greater Manchester. This facility is expected to provide 300 MWh of storage capacity, demonstrating the scalability and feasibility of LAES technology for large-scale power generation applications.

Key Market Segments

By Capacity

- 5-15 MW

- 16-50 MW

- 50-100 MW

- 100 MW+

By Application

- Power Generation

- Power Transmission & Grid Support

- Renewable Energy Integration

- LNG Terminals

- Others

Emerging Trends

Integration of Liquid Air Energy Storage with Renewable Energy Grids

A significant and promising trend in the development of Liquid Air Energy Storage (LAES) is its integration with renewable energy grids, particularly in regions with high penetration of wind and solar power. This integration addresses the challenge of intermittency associated with renewable energy sources by providing a reliable and scalable solution for energy storage.

In the United Kingdom, the government has introduced a “cap and floor” revenue mechanism to support the development of long-duration energy storage technologies, including LAES. This policy aims to provide financial stability for investors and accelerate the deployment of large-scale energy storage solutions.

- For instance, Highview Power, a leading provider of LAES technology, has secured a £165 million investment from the UK Infrastructure Bank to construct the first commercial-scale LAES plant in Carrington, Manchester. This project is expected to have a storage capacity of 300 MWh and an output power of 50 MW for six hours, demonstrating the potential of LAES in supporting renewable energy integration

Similarly, in the United States, the Department of Energy has launched the “Long Duration Storage Shot” initiative, aiming to reduce the cost of long-duration energy storage technologies by 90% by 2030. This initiative is part of the broader Energy Storage Grand Challenge, which seeks to accelerate the development and deployment of energy storage technologies. The focus on long-duration storage solutions like LAES is crucial for enhancing grid reliability and facilitating the transition to a clean energy future

These government-backed initiatives are pivotal in de-risking investments in LAES technologies, thereby attracting private sector participation and accelerating the commercialization of LAES systems. The financial support and policy incentives not only make LAES projects more economically viable but also signal a commitment to integrating sustainable and scalable energy storage solutions into national energy strategies.

Drivers

Government Support and Policy Incentives

One of the most significant driving factors propelling the adoption of Liquid Air Energy Storage (LAES) is the robust support from governments worldwide, particularly through funding initiatives and policy frameworks aimed at advancing clean energy technologies.

In the United Kingdom, the government has introduced a “cap and floor” scheme to bolster investment in long-duration energy storage (LDES) technologies, including LAES. This scheme offers a minimum revenue guarantee and a maximum revenue cap, providing financial stability for investors and encouraging the development of LDES projects. For instance, Highview Power’s 300 MWh LAES facility in Carrington, Manchester, is set to receive support under this scheme, with the UK Infrastructure Bank backing the project with a £165 million investment.

Across the Atlantic, the United States has also recognized the importance of long-duration energy storage in achieving a reliable and resilient clean energy grid. The U.S. Department of Energy (DOE) has launched the “Long Duration Storage Shot” initiative, aiming to reduce the cost of long-duration energy storage technologies by 90% by 2030. This initiative is part of the broader Energy Storage Grand Challenge, which seeks to accelerate the development and deployment of energy storage technologies.

These government-backed initiatives are pivotal in de-risking investments in LAES technologies, thereby attracting private sector participation and accelerating the commercialization of LAES systems. The financial support and policy incentives not only make LAES projects more economically viable but also signal a commitment to integrating sustainable and scalable energy storage solutions into national energy strategies.

Restraints

High Initial Capital Costs

One of the most significant barriers to the widespread adoption of Liquid Air Energy Storage (LAES) is the high initial capital investment required for its deployment. The construction of LAES facilities necessitates substantial investments in advanced cryogenic equipment, including compressors, expanders, heat exchangers, and storage tanks.

Additionally, integrating LAES systems with existing power infrastructure involves considerable expenses related to retrofitting and upgrading grid components to accommodate the storage technology. These high capital costs can be prohibitive for many potential stakeholders, including utility companies, industrial users, and renewable energy developers, especially when compared to other energy storage technologies such as lithium-ion batteries, which have seen significant cost reductions in recent years.

To mitigate this challenge, ongoing efforts are needed to drive down the costs of key components and improve the efficiency of LAES systems. Advancements in materials science, manufacturing processes, and system integration can contribute to cost reductions. Additionally, economies of scale achieved through the widespread adoption and larger-scale deployments of LAES can help lower per-unit costs. Financial incentives, subsidies, and supportive government policies can also play a crucial role in offsetting the high initial capital costs and encouraging investment in LAES technology.

The financial risk associated with such large investments can deter companies from adopting LAES, particularly in markets where the economic case for long-duration storage is not yet fully established. The high upfront costs can lead to longer payback periods and lower returns on investment, making it challenging to achieve competitive pricing in the energy storage market. While LAES offers advantages in terms of scalability and duration, the higher initial costs can impact the overall cost-effectiveness of projects, hindering their widespread adoption.

Opportunity

Government-Backed Long-Duration Energy Storage Projects

In the United Kingdom, the government has introduced a “cap and floor” scheme to support LDES technologies, including LAES. This scheme offers a guaranteed minimum revenue (the “floor”) and a maximum revenue cap, providing financial stability for investors and encouraging the development of LDES projects. For instance, Highview Power’s 300 MWh LAES facility in Carrington, Manchester, is set to receive support under this scheme, with the UK Infrastructure Bank backing the project with a £165 million investment

Similarly, in the United States, the Department of Energy has launched the “Long Duration Storage Shot” initiative, aiming to reduce the cost of long-duration energy storage technologies by 90% by 2030. This initiative is part of the broader Energy Storage Grand Challenge, which seeks to accelerate the development and deployment of energy storage technologies

These government-backed initiatives are pivotal in de-risking investments in LAES technologies, thereby attracting private sector participation and accelerating the commercialization of LAES systems. The financial support and policy incentives not only make LAES projects more economically viable but also signal a commitment to integrating sustainable and scalable energy storage solutions into national energy strategies.

Regional Insights

North America Leads Liquid Air Energy Storage Market with 43.8% Share

In 2024, North America emerged as the dominant region in the Liquid Air Energy Storage (LAES) market, capturing a substantial 43.8% share, valued at approximately USD 600 million. This leadership is primarily driven by robust federal and state-level policies promoting clean energy technologies, substantial investments in long-duration storage solutions, and a strong commitment to grid modernization.

The United States, in particular, has been at the forefront of LAES development. Federal initiatives such as the Bipartisan Infrastructure Law and the Inflation Reduction Act have allocated significant funding for energy storage projects, including those utilizing non-lithium technologies like LAES. For instance, the U.S. Department of Energy’s Office of Clean Energy Demonstrations has made available up to USD 100 million to pilot projects requiring 10-hour-plus discharge durations using non-lithium technologies.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Cryostar specializes in cryogenic equipment and solutions, offering products such as cryogenic pumps, compressors, and expanders that are integral to LAES systems. With over 50 years of experience in the gas and cryogenics industry, Cryostar provides critical components that enable the efficient storage and release of energy in LAES applications. The company’s innovations contribute to the advancement of long-duration energy storage technologies, supporting the global shift towards cleaner energy alternatives.

Advanced Energy Industries, Inc. is a provider of power conversion and control systems, offering solutions that are applicable in various energy storage technologies, including LAES. The company’s expertise in power electronics and thermal management supports the optimization of energy storage systems, enhancing their performance and reliability. Advanced Energy’s contributions are pivotal in advancing the efficiency and scalability of LAES technologies, facilitating their integration into modern energy grids.

Highview Enterprises Ltd is a pioneer in the development of LAES technologies, focusing on creating scalable and efficient energy storage solutions. The company has been involved in several large-scale LAES projects, demonstrating the viability of this technology in providing long-duration energy storage. Highview’s innovations contribute to the advancement of LAES, supporting the integration of renewable energy sources into the grid and enhancing energy security.

Top Key Players Outlook

- L’AIR LIQUIDE S.A.

- Cryostar Company

- Advanced Energy Industries, Inc.

- Highview Enterprises Ltd

- Linde plc

- Sumitomo Heavy Industries, Ltd

- SFW

- Everllence

- Highview Power

Recent Industry Developments

In 2024, AEIS reported a revenue of $1.508 billion for the twelve months ending June 30, 2024, reflecting an 18.4%.

In June 2024, the company secured a £300 million investment from the UK Infrastructure Bank, Centrica, and other investors, enabling the construction of a 50 MW / 300 MWh LAES facility in Carrington, Greater Manchester.

Report Scope

Report Features Description Market Value (2024) USD 1.5 Bn Forecast Revenue (2034) USD 8.5 Bn CAGR (2025-2034) 18.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Capacity (5-15 MW, 16-50 MW, 50-100 MW, 100 MW+) By Application (Power Generation, Power Transmission and Grid Support, Renewable Energy Integration, LNG Terminals, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape L’AIR LIQUIDE S.A., Cryostar Company, Advanced Energy Industries, Inc., Highview Enterprises Ltd, Linde plc, Sumitomo Heavy Industries, Ltd, SFW, Everllence, Highview Power Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Liquid Air Energy Storage MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Liquid Air Energy Storage MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- L’AIR LIQUIDE S.A.

- Cryostar Company

- Advanced Energy Industries, Inc.

- Highview Enterprises Ltd

- Linde plc

- Sumitomo Heavy Industries, Ltd

- SFW

- Everllence

- Highview Power