Alternate Marine Power Market Size, Share, And Business Benefits By Ship Type (Container Ship, Cruiser Ship, Roll-on/Roll-off Ship, Defense Ship, Others), By Voltage (Low Voltage, Medium Voltage, High Voltage), By Power Requirements (Up to 2MW, 2MW-5MW, Above 5MW), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: December 2024

- Report ID: 136139

- Number of Pages: 302

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

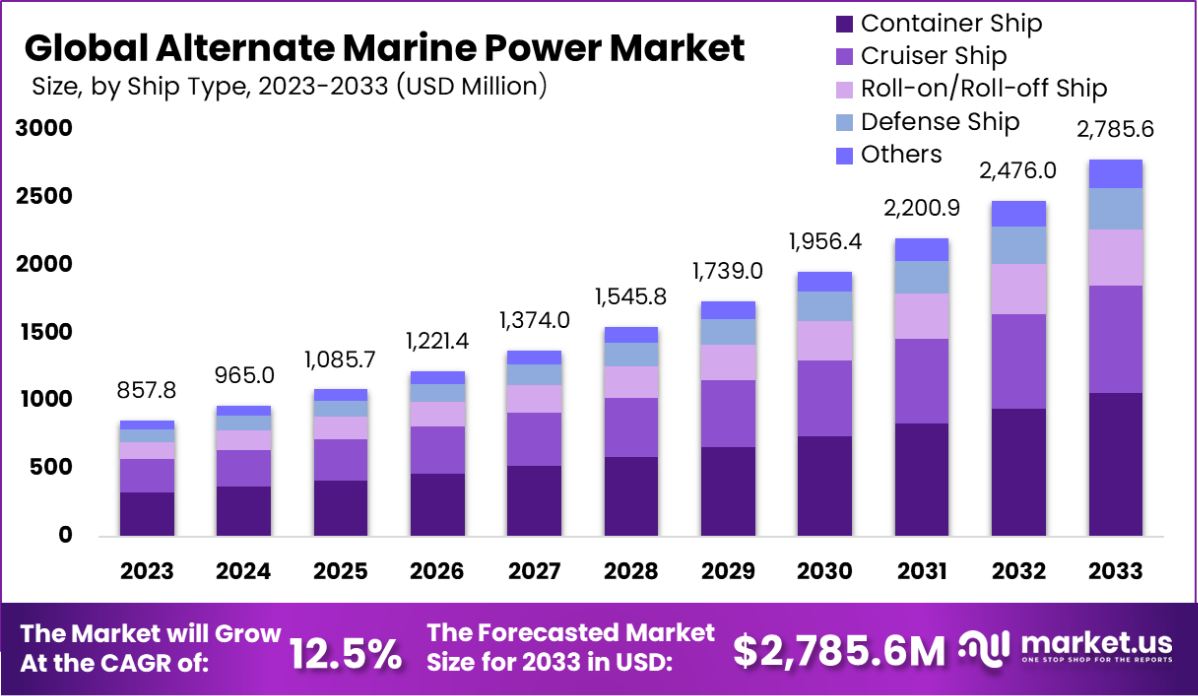

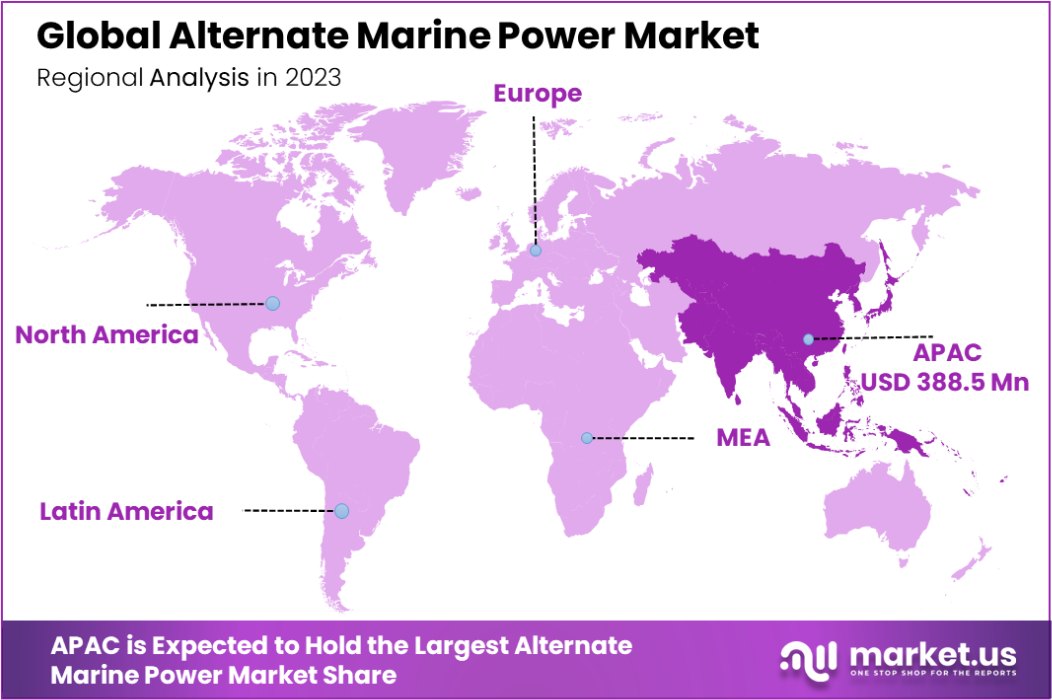

The Global Alternate Marine Power Market is expected to be worth around USD 2,785.6 Million by 2033, up from USD 857.8 Million in 2023, and grow at a CAGR of 12.5% from 2024 to 2033. In 2023, Asia-Pacific held 48.6% of the Alternate Marine Power Market, totaling USD 388.5 million.

Alternate Marine Power (AMP), also known as cold ironing or shore power, is a method that allows ships to shut down their diesel engines and connect to a shore-based electrical power supply while docked. This process significantly reduces air pollution by cutting down on emissions from ship engines, which is especially beneficial in port cities with stringent environmental regulations.

The Alternate Marine Power market is growing as regulations to reduce maritime emissions become stricter globally. This market encompasses the technology, equipment, and services involved in providing and managing electrical power to ships from land-based sources when they are in port.

The primary growth driver for the Alternate Marine Power market is the increasing implementation of environmental regulations by governments and international bodies like the International Maritime Organization (IMO). These regulations compel port authorities and shipping companies to adopt cleaner technologies, thus boosting the demand for AMP solutions.

Demand for Alternate Marine Power is driven by the maritime industry’s need to comply with international pollution control standards, reduce smart greenhouse gas emissions, and improve air quality in and around port areas. As more ports worldwide install AMP facilities, the adoption rate among shipping companies is expected to rise.

The expansion of AMP presents significant opportunities for technology providers, infrastructure developers, and regulatory bodies to innovate and collaborate. There is potential for substantial growth in retrofitting older ships and designing new ones with built-in AMP capabilities, as well as expanding the infrastructure of ports equipped with shore power systems. This aligns with the broader shift towards sustainable and green shipping practices globally.

The Alternate Marine Power Market is poised for significant growth, bolstered by substantial governmental and institutional investments aimed at enhancing sustainable energy solutions in maritime operations. Recent funding initiatives underscore the commitment to reducing emissions and promoting zero-emission technologies in marine environments.

Notably, the U.S. Department of Energy’s Water Power Technologies Office has allocated over $1.7 million towards advancing marine energy projects. This funding is aimed at supporting R&D efforts across 12 marine energy initiatives that explore innovative technologies in wave and ocean thermal energies.

Additionally, the EPA’s Clean Ports Program is another catalyst for market expansion, providing a substantial $2.8 billion for the adoption of zero-emission port equipment and infrastructure. This initiative is part of a broader strategy to mitigate mobile source emissions at U.S. ports, emphasizing the transition towards cleaner operational practices.

Complementarily, the Climate and Air Quality Planning Competition offers an additional $150 million, specifically earmarked for planning activities that promote zero-emissions operations at U.S. ports.

The technical potential for marine energies further illustrates the market’s capacity for transformation and growth. According to data from the National Renewable Energy Laboratory, wave energy alone presents a technical resource potential of approximately 1,400 TWh/yr within the U.S. Exclusive Economic Zone, which could power an estimated 130 million homes.

Similarly, ocean thermal energy holds a potential of 540 TWh/yr, capable of powering around 51 million homes. These figures not only highlight the substantial energy capacities of marine sources but also align with increasing policy-driven initiatives to leverage these resources, framing a robust outlook for the Alternate Marine Power Market.

This confluence of policy support, technical potential, and investment in R&D positions the market on a trajectory toward accelerated growth and innovation, contributing to broader energy sustainability goals.

Key Takeaways

- The Global Alternate Marine Power Market is expected to be worth around USD 2,785.6 Million by 2033, up from USD 857.8 Million in 2023, and grow at a CAGR of 12.5% from 2024 to 2033.

- Container ships lead with 38.2% in adopting Alternate Marine Power, reducing emissions significantly.

- Medium voltage systems dominate at 49.2%, facilitating efficient power transfer to large vessels.

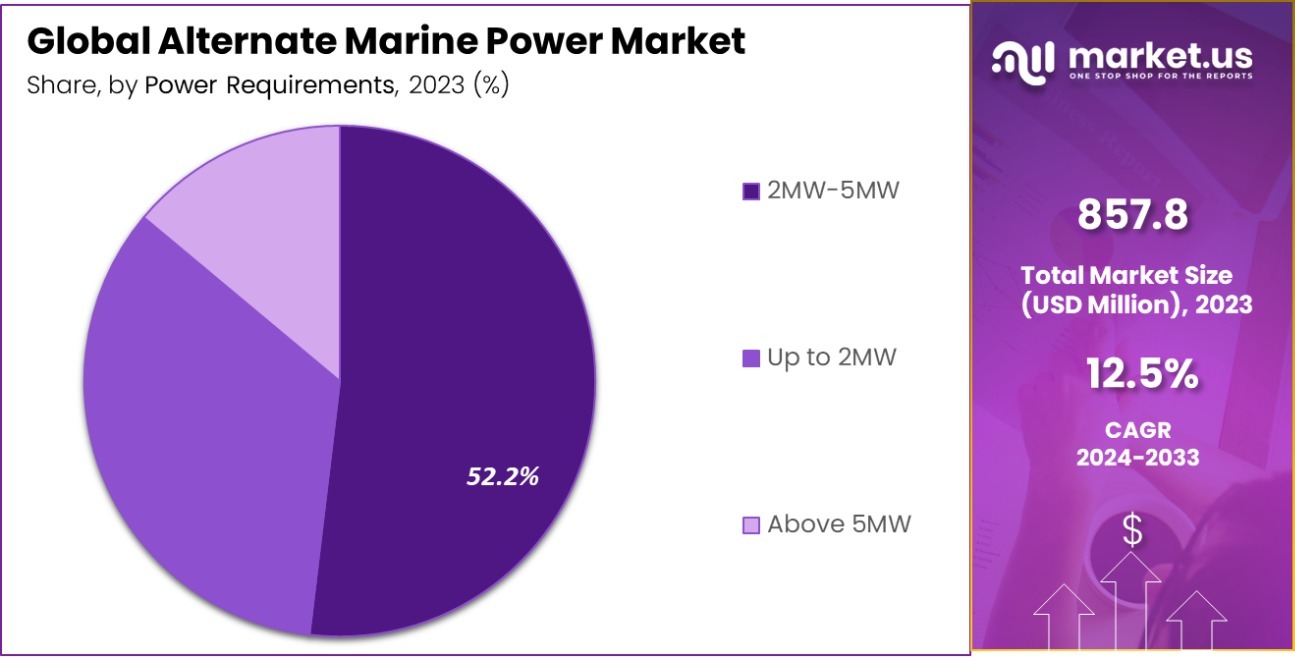

- The 2MW-5MW range captures 52.2% of the market, ideal for substantial ship operations.

- In 2023, Asia-Pacific dominated the Alternate Marine Power Market, holding 48.6% and USD 388.5 million.

Business Benefits of Alternate Marine Power

Alternate Marine Power (AMP) offers several business benefits for the shipping and port industries. Firstly, it significantly reduces fuel costs by allowing ships to turn off their diesel engines and connect to an electrical grid while docked.

This switch can lead to substantial savings, especially considering the high consumption rates of marine fuels. Additionally, AMP contributes to lower maintenance costs for ships. Running ship engines less frequently reduces wear and tear, thus extending the lifespan of the machinery and decreasing the frequency of costly repairs.

Moreover, using shore-side electricity helps shipping companies comply with increasingly stringent emission regulations. By reducing the emissions of pollutants and greenhouse gases, companies avoid potential fines and penalties associated with non-compliance. This also enhances their reputation as environmentally responsible operators, potentially attracting more business from eco-conscious customers.

Finally, ports equipped with AMP technology can attract more traffic by offering this value-added service, distinguishing themselves from competitors and potentially increasing port fees and revenue.

By Ship Type Analysis

The container ship segment dominates the Alternate Marine Power Market, holding a substantial 38.2% share.

In 2023, Container Ship held a dominant market position in the “By Ship Type” segment of the Alternate Marine Power Market, with a 38.2% share. This segment has seen significant growth due to stringent environmental regulations and the maritime industry’s push towards reducing greenhouse gas emissions.

Following Container Ships in market share were Cruiser Ships, which accounted for 29.5% of the market. These ships have increasingly adopted alternate marine power technologies to enhance their sustainability credentials and appeal to environmentally conscious consumers.

Roll-on/Roll-off Ships also made a substantial impact, representing 21.8% of the market. These vessels have incorporated alternative power sources to not only comply with international maritime pollution standards but also to reduce operational costs associated with traditional fuels. Lastly, Defense Ships accounted for the smallest share at 10.5%.

Despite this, there is a growing interest from naval forces worldwide to integrate more sustainable technologies into their fleets, driven by both environmental concerns and the long-term economic benefits of reduced fuel dependency.

Together, these segments underscore the diverse adoption and investment in alternate marine power solutions across different ship types, reflecting broader shifts in the industry towards more sustainable marine operations.

By Voltage Analysis

Medium voltage systems lead in the Alternate Marine Power Market, accounting for 49.2% of the market share.

In 2023, Medium Voltage held a dominant market position in the “By Voltage” segment of the Alternate Marine Power Market, with a 49.2% share. This category’s prominence is largely attributed to its widespread adoption in container and cruiser ships, which require robust power systems for longer and more energy-intensive voyages.

Medium Voltage systems are preferred due to their efficiency in power transmission and ability to reduce energy loss over distances, which is essential in large-scale marine operations.

Following closely, Low Voltage systems accounted for 32.6% of the market. These systems are particularly favored in smaller vessels and short-sea shipping, where complex high-voltage equipment is unnecessary, and cost-efficiency is a priority. Low Voltage systems are easier to install and maintain, making them suitable for smaller ship operators focusing on cost-effective operations.

High Voltage systems captured 18.2% of the market, primarily used in specialized vessels such as icebreakers and large roll-on/roll-off ships, where high power output is crucial for heavy-duty tasks and extreme conditions.

Although they occupy a smaller market share, the demand for high-voltage systems is expected to grow as ships increase in size and operational complexity, requiring more powerful and efficient energy systems to meet global shipping demands.

By Power Requirements Analysis

In the Alternate Marine Power Market, systems between 2MW and 5MW are most prevalent, representing 52.2%.

In 2023, the 2MW-5MW category held a dominant market position in the “By Power Requirements” segment of the Alternate Marine Power Market, with a 52.2% share. This range is particularly popular among medium to large vessels, such as container ships and cruisers, which require significant but not excessive power to operate sustainably and efficiently.

The preference for 2MW-5MW systems stems from their ability to balance power output with fuel efficiency, making them ideal for operators aiming to meet strict environmental regulations while maintaining operational capacity.

The “Up to 2MW” category accounted for 28.5% of the market, favored by smaller vessels and short-haul operators. These systems are sufficient for powering essential onboard operations without the complexities and costs associated with larger systems, appealing to small to medium-ship operators focusing on regional trade routes.

Lastly, systems “Above 5MW” captured 19.3% of the market. These are essential for the largest ships that demand high power for extended periods, such as defense ships and some specialized cargo vessels.

While they represent a smaller portion of the market, the demand for Above 5MW systems is likely to grow as shipping operations expand and as larger, more powerful vessels require more robust power solutions to ensure global maritime connectivity and security.

Key Market Segments

By Ship Type

- Container Ship

- Cruiser Ship

- Roll-on/Roll-off Ship

- Defense Ship

- Others

By Voltage

- Low Voltage

- Medium Voltage

- High Voltage

By Power Requirements

- Up to 2MW

- 2MW-5MW

- Above 5MW

Driving Factors

Stringent Global Environmental Regulations Increase Demand

Regulatory bodies worldwide are enforcing stricter environmental regulations to combat marine pollution and reduce greenhouse gas emissions. This regulatory pressure compels ship operators to adopt alternate marine power solutions, such as electric or hybrid systems, to meet compliance standards and avoid hefty fines.

As governments continue to tighten these regulations, the demand for cleaner marine technologies is projected to rise, encouraging further innovation and investment in the alternate marine power sector.

Rising Fuel Costs Propel Shift to Alternative Power

The escalating cost of traditional marine fuels is a significant driver for the alternate marine power market. As fuel prices remain volatile and often high, the economic incentive to switch to more predictable and often cheaper alternative energy sources becomes stronger.

This shift not only helps operators reduce operational costs but also enhances energy security by decreasing dependency on oil and gas, making the adoption of alternate power systems increasingly attractive.

Technological Advancements in Marine Power Systems

Advancements in technology are critical in driving the adoption of alternative marine power systems. Improvements in battery technology, energy efficiency, and power system integration enable ships to operate more effectively using electric and hybrid power solutions.

As these technologies continue to mature and become more cost-effective, they provide a feasible option for ship operators looking to modernize their fleets and benefit from increased operational efficiency and reduced environmental impact.

Restraining Factors

High Initial Investment Costs Limit Market Adoption

The significant initial costs associated with implementing alternate marine power systems pose a major barrier to their widespread adoption. Upgrading ships to utilize modern power technologies, such as hybrid or fully electric systems, requires substantial capital investment.

This financial barrier is particularly challenging for smaller operators and those in developing regions, who may find the cost prohibitive despite the long-term savings and environmental benefits.

Infrastructure Deficiencies in Charging and Fuel Facilities

A lack of adequate infrastructure for charging and refueling poses another significant hurdle. Many ports and maritime facilities are not yet equipped to support alternative power sources, such as electricity or hydrogen.

This deficiency restricts the operational range of alternatively powered vessels, limiting their usability and discouraging broader adoption among the maritime community. Developing this infrastructure is essential but involves complex logistics and considerable investment.

Technological Compatibility and Integration Challenges

Integrating new power systems into existing maritime operations presents technological and compatibility challenges. Many older vessels are not designed to accommodate alternate power systems without substantial modifications.

Additionally, the maritime industry often faces difficulties in standardizing these technologies across different types of vessels and operations. These integration challenges can delay adoption and increase the costs of transitioning to alternative power, further restraining market growth.

Growth Opportunity

Expansion of Eco-Friendly Regulations Boosts Market Potential

As global environmental regulations become more stringent, there is a significant growth opportunity for the alternate marine power market. Governments and international bodies are likely to introduce incentives and subsidies to promote eco-friendly maritime technologies.

This regulatory push will not only enhance market demand but also stimulate innovation in cleaner energy solutions, providing a clear pathway for growth as more shipping companies seek compliance and environmental stewardship.

Emerging Markets Offer New Avenues for Expansion

Emerging markets, with their rapid industrialization and increasing trade activities, present a lucrative opportunity for the expansion of the alternate marine power market. These regions are experiencing a surge in maritime operations and are under pressure to adopt sustainable practices.

The development of maritime infrastructure in these areas, coupled with growing economic capabilities, opens up new avenues for deploying alternate marine power systems, tapping into a previously underexploited customer base.

Technological Innovations Open New Applications

Continuous advancements in technology offer a substantial growth opportunity for alternate marine power systems. Innovations in battery technology, renewable energy integration, and hybrid systems can lead to more efficient and versatile marine power solutions.

These technological improvements make alternative power more attractive and feasible across a broader range of vessels, from small fishing boats to large container ships, thereby expanding the market’s potential reach and applicability

Latest Trends

Increasing Adoption of Hybrid and Electric Propulsion Systems

The trend towards hybrid and electric propulsion systems is rapidly gaining momentum in the alternate marine power market. These systems combine the benefits of both traditional and alternative power sources, offering improved efficiency and reduced emissions.

As technology advances and costs decrease, more ship operators are considering hybrid and electric options as viable alternatives to fully fossil-fuelled engines. This shift is particularly pronounced in sectors like ferries and short-sea shipping, where operational ranges are well-suited to the current capabilities of electric technologies.

Integration of Renewable Energy Sources in Marine Operations

There’s a growing trend towards integrating renewable energy sources, such as smart solar and wind, into marine power systems. Ships are being equipped with solar panels and wind turbines to supplement their main power sources, reducing reliance on fossil fuels and cutting operational costs.

This trend is not only environmentally beneficial but also enhances energy independence for vessels, making it particularly attractive for long-haul shipping operations where fuel costs can accumulate significantly.

Development of Smart and Autonomous Ship Technologies

Smart ship technologies and the push towards autonomous vessels represent a significant trend in the marine industry. These technologies require sophisticated alternate power solutions that can handle complex operations and provide reliable power for extended periods.

The integration of AI and IoT with alternate marine power systems facilitates more efficient energy use and better management of onboard power systems, paving the way for the next generation of smart, autonomous ships that are cleaner and more efficient.

Regional Analysis

In 2023, the Asia-Pacific Alternate Marine Power Market was valued at USD 388.5 million, representing 48.6%.

The Alternate Marine Power Market is witnessing varied levels of adoption and growth across different regions, influenced by local regulations, technological advancements, and economic factors. Asia-Pacific is the dominating region, commanding 48.6% of the market with a valuation of USD 388.5 million. This leadership is largely due to aggressive environmental policies in countries like China and Japan, combined with rapid industrial growth and expanding maritime activities.

Europe follows, driven by stringent EU regulations on maritime emissions which bolster the adoption of alternative marine power systems. European ship operators are actively investing in hybrid and electric propulsion technologies to comply with these regulations, positioning Europe as a key player in the market’s evolution.

North America, while a smaller segment, is progressively catching up, with increased investments in green shipping initiatives and technological innovations in the United States and Canada. Meanwhile, the Middle East & Africa, and Latin America are emerging markets in this sector.

These regions are experiencing gradual growth due to rising awareness and slowly tightening environmental standards, which are expected to increase the uptake of alternate marine power systems in the coming years. Overall, Asia-Pacific’s lead sets a significant benchmark in the global push toward sustainable maritime operations.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global Alternate Marine Power Market saw significant contributions from a diverse array of key companies, each bringing unique technologies and innovations to the forefront of the maritime industry.

ABB has been a frontrunner, offering comprehensive electric, digital, and connected solutions that cater to the growing demand for sustainable marine operations. Their focus on integrating renewable energy sources and enhancing ship automation has positioned them as a leader in the market.

Siemens also plays a pivotal role, particularly with their advanced electric propulsion systems and power management technologies. Their solutions are designed to optimize energy consumption and reduce emissions, which is crucial for ship operators looking to comply with international environmental regulations.

Wabtec Corporation, traditionally known for its expertise in the rail sector, has expanded its technological offerings to marine applications, focusing on energy-efficient solutions that align with global sustainability goals. Their development of hybrid power systems and energy storage solutions has been well-received in the market.

Danfoss and Power Systems Inc. are notable for their robust and efficient power conversion and management systems. Danfoss, with its innovative drive solutions, and Power Systems Inc., through its tailored power distribution architectures, support critical operations on board and help reduce the environmental impact of marine vessels.

Cavotec SA and VINCI Energies SA are making strides with their automated mooring and shore power systems, respectively, which significantly enhance port operations and reduce turnaround times. These technologies not only support the seamless integration of alternative power into existing maritime infrastructures but also promote operational efficiency and safety.

MacGregor and Nidec ASI focus on cargo handling and energy solutions that are integral to the performance and sustainability of marine operations. Their efforts to innovate in these areas have proven essential for enhancing the competitiveness of alternate marine power technologies in the market.

Overall, each key player contributes uniquely to advancing the Alternate Marine Power Market, driving the industry toward more sustainable and efficient marine operations globally. Their continued innovation and adaptation to market needs will be crucial in shaping the future of maritime energy use.

Top Key Players in the Market

- ABB

- Power Systems Inc.

- Danfoss

- Ratio Electric B.V.

- Pillar Group

- ESL Power System Inc.

- Shore Power Technologies

- Wabtec Corporation

- MacGregor

- PowerCon A/S

- Siemens

- Cavvotec SA

- VINCI Energies SA

- Power Con

- Nidec ASI

Recent Developments

- In 2023, ABB launched the innovative ABB Dynafin™ electric propulsion system, enhancing ship efficiency by reducing energy consumption by up to 22%. Additionally, ABB is powering Samskip’s hydrogen-fueled vessels, showcasing hydrogen as a sustainable marine fuel, supporting the industry’s decarbonization goal

- In 2023, Power Systems Inc. expanded its fitness-oriented innovations to the alternate marine power market, enhancing its product efficiency and adaptability across diverse industrial applications.

Report Scope

Report Features Description Market Value (2023) USD 857.8 Million Forecast Revenue (2033) USD 2,785.6 Million CAGR (2024-2033) 12.5% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Ship Type (Container Ship, Cruiser Ship, Roll-on/Roll-off Ship, Defense Ship, Others), By Voltage (Low Voltage, Medium Voltage, High Voltage), By Power Requirements (Up to 2MW, 2MW-5MW, Above 5MW) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ABB, Power Systems Inc., Danfoss, Ratio Electric B.V., Pillar Group, ESL Power System Inc., Shore Power Technologies, Wabtec Corporation, MacGregor, PowerCon A/S, Siemens, Cavvotec SA, VINCI Energies SA, Power Con, Nidec ASI Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Alternate Marine Power MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample

Alternate Marine Power MarketPublished date: December 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB

- Power Systems Inc.

- Danfoss

- Ratio Electric B.V.

- Pillar Group

- ESL Power System Inc.

- Shore Power Technologies

- Wabtec Corporation

- MacGregor

- PowerCon A/S

- Siemens

- Cavvotec SA

- VINCI Energies SA

- Power Con

- Nidec ASI