Global Lecithin Market Size, Share, And Business Benefits By Source (Soy, Sunflower, Rapeseed, Others), By Nature (GMO, Non-GMO, By Product, Unrefined Lecithin, Refined Lecithin, Chemically Modified Lecithin, Others), By Form (Leithin Powder, Lecithin Granules, Liquid Lecithin), By Function (Emulsifiers, Dispersing Agents, Surfactants, Others), By End Use (Convenience Foods, Bakery, Confectionary, Pharmaceuticals and Personal Care, Personal Care and Cosmetics, Animal Feed, Industrial, Other), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: January 2025

- Report ID: 137548

- Number of Pages: 229

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Business Benefits of Lecithin Market

- By Source Analysis

- By Nature Analysis

- By Product Analysis

- By Form Analysis

- By Function Analysis

- By End-Use Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

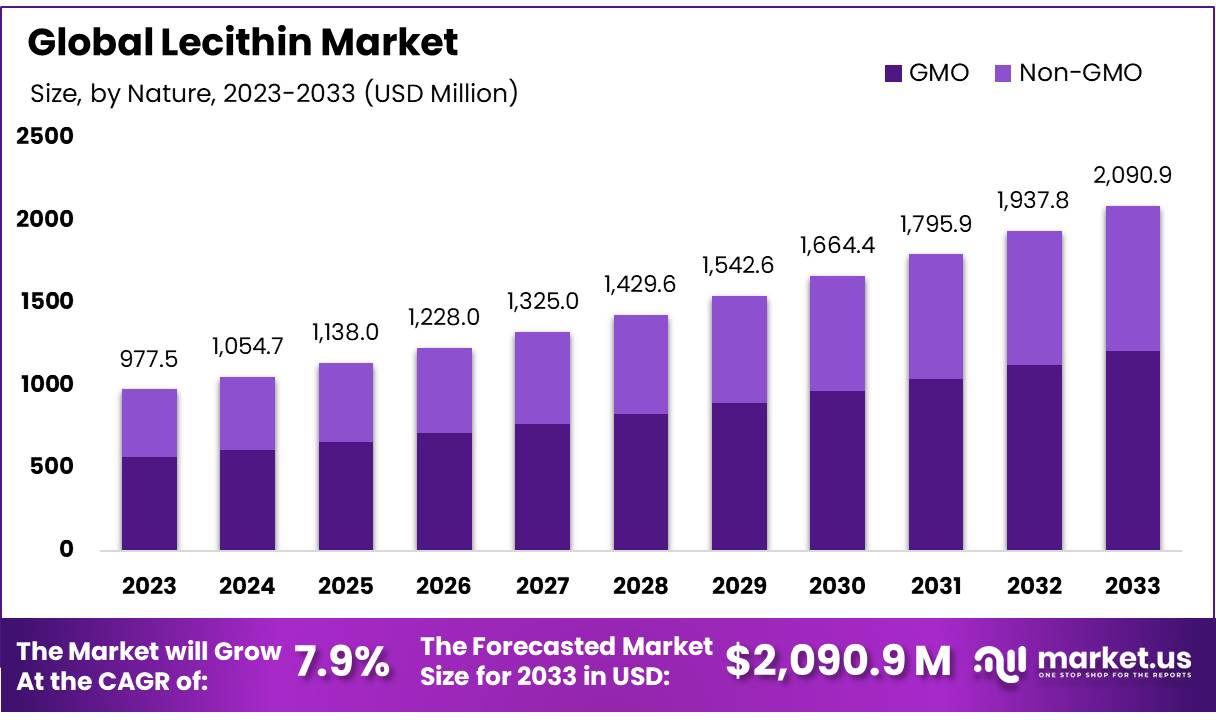

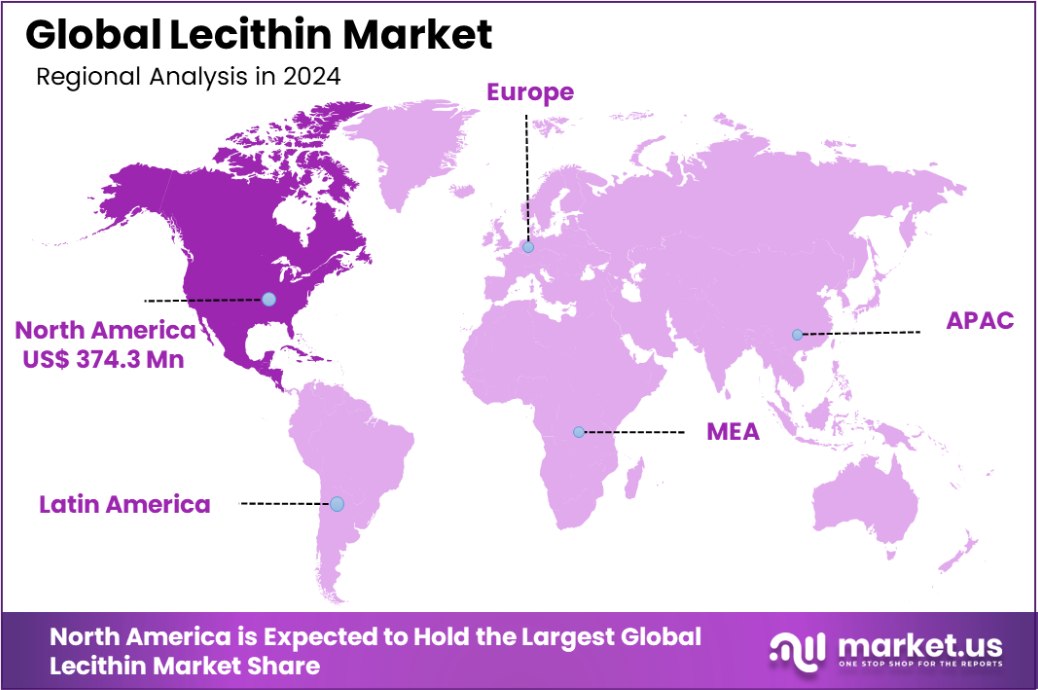

The Global Lecithin Market is expected to be worth around USD 2,090.9 Million by 2033, up from USD 977.5 Million in 2023, and grow at a CAGR of 7.9% from 2024 to 2033. North America holds 38.4% of the Lecithin Market at USD 374.3 million.

The Lecithin market is poised for transformative growth, driven by innovative production methods and emerging applications in diverse industries. Adopting alternative sources like rice and dairy, beyond the traditional soybean base, reflects an ongoing shift towards more versatile and cost-effective production techniques.

This is critical as variations in the phospholipid and fatty acid composition between traditional and alternative sources do not significantly impact the functional efficacy of lecithin products. Quality metrics such as acetone insoluble matter, acid value, peroxide value, and hydrophilic-lipophilic balance are pivotal for maintaining high standards in lecithin production.

These metrics are essential for determining the suitability of lecithin in various applications, ranging from food products to pharmaceuticals. The market’s growth is further supported by the regulatory safe status of lecithin, affirming its wide acceptance and integration into health-centric products.

Looking forward, the market’s expansion is anticipated to continue robustly. This growth trajectory is underpinned by lecithin’s critical role in enhancing the structural integrity of cellular membranes, which is vital across medical and nutritional applications.

As the industry evolves, lecithin’s versatility and capacity for customization in viscosity and formulation to meet specific customer requirements will be key drivers. This adaptability makes it ideal for a broad spectrum of industrial applications, ensuring its place as a staple in organic and non-organic product lines.

The Lecithin market is experiencing steady demand growth, driven by its widespread application in food, pharmaceuticals, and cosmetics. However, the market faces challenges, particularly with fluctuations in raw material supply, especially soy lecithin.

The 2023 soybean harvest in India is estimated at 10 to 11 million metric tons, translating to about 54,000 metric tons of non-GMO IP soy lecithin, a decline from 60,000 metric tons in 2022. This reduction can be attributed to various factors, including climate changes and shifting agricultural trends.

Despite these challenges, the lecithin market is expected to expand due to increasing consumer demand for plant-based products. Therefore, manufacturers must focus on sustainable sourcing and efficient production techniques to mitigate supply disruptions.

Key Takeaways

- The Global Lecithin Market is expected to be worth around USD 2,090.9 Million by 2033, up from USD 977.5 Million in 2023, and grow at a CAGR of 7.9% from 2024 to 2033.

- Soy-based lecithin holds a significant share of 49.3% of the lecithin market globally.

- GMO lecithin accounts for 58.3%, reflecting its dominant presence in the lecithin market segment.

- Unrefined lecithin is the leading product in the market, making up 44.2% of the share.

- Lecithin powder, at 39.2%, is the most preferred form in various industrial applications.

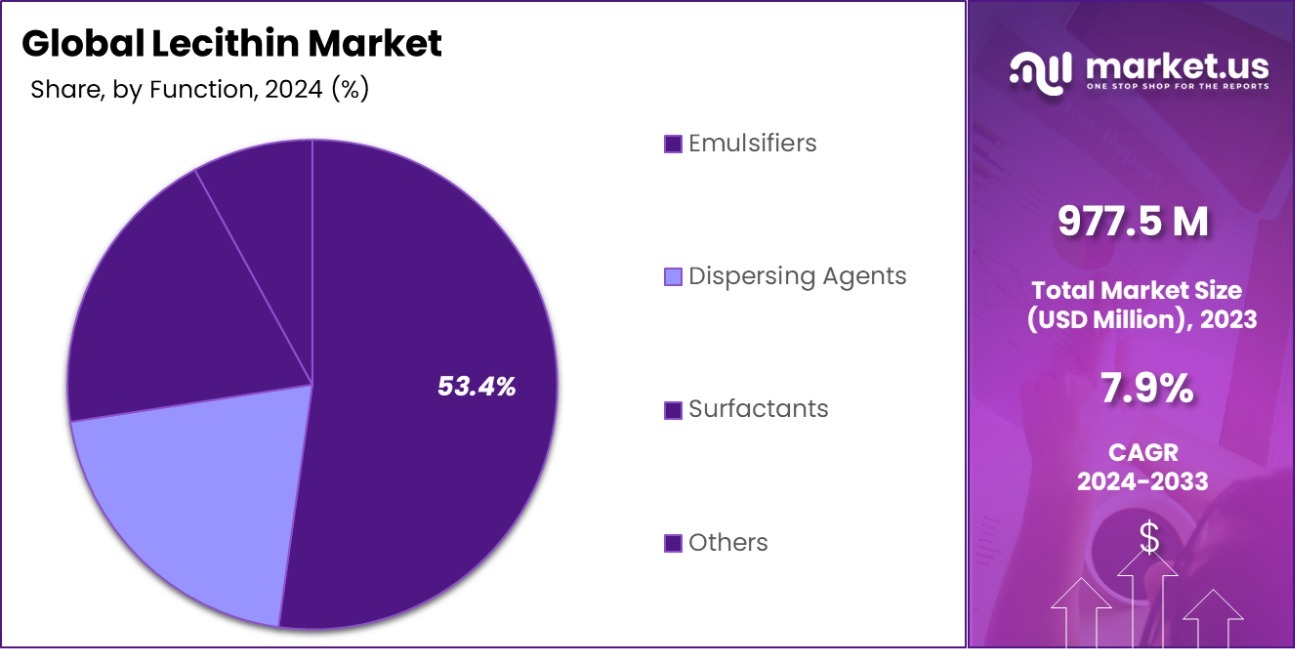

- Emulsifiers are the primary function of lecithin, holding 53.4% of the market’s overall share.

- Convenience foods dominate lecithin’s end-use market, representing 29.1% of the total consumption globally.

- The North American Lecithin Market holds a 38.4% share, valued at USD 374.3 million.

Business Benefits of Lecithin Market

Lecithin, a versatile emulsifier derived from the soybean oil production process, is essential across various industries like food and beverages, pharmaceuticals, and cosmetics. According to the U.S. Department of Agriculture, lecithin effectively blends incompatible ingredients such as oil and water, enhancing the texture and extending the shelf life of products such as mayonnaise, salad dressings, and chocolates. In baking, lecithin improves dough handling and increases the volume of baked goods.

The U.S. Food and Drug Administration points out the importance of lecithin in pharmaceutical formulations, where it aids in the absorption of active pharmaceutical ingredients, improving the delivery and effectiveness of medications. In the cosmetics industry, lecithin acts as a skin conditioning agent, enriching the texture of creams and lotions while promoting skin hydration and repair.

The National Institutes of Health recognizes lecithin’s health benefits, including its role in managing cholesterol levels and protecting liver health, which could drive consumer interest in nutraceutical products. As the market shifts toward natural and effective ingredients to meet consumer health preferences, demand for lecithin is expected to increase, presenting valuable business opportunities in its market.

By Source Analysis

Soy accounts for 49.3% of the Lecithin Market by source.

In 2023, Soy held a dominant market position in the By Source segment of the Lecithin Market, with a 49.3% share. Soy lecithin has been widely adopted due to its cost-effectiveness, versatile applications, and abundant availability. It is used in food processing, cosmetics, pharmaceuticals, and animal feed, contributing significantly to its market dominance.

Soy lecithin’s superior emulsifying and stabilizing properties make it a preferred choice in various formulations, especially in the food industry, where it is used in products like baked goods, margarine, chocolates, and salad dressings. The increasing consumer demand for processed food, coupled with the rising awareness of the health benefits associated with soy, is expected to sustain its stronghold in the market in the coming years.

Sunflower lecithin has also experienced significant growth, securing a substantial share in the By Source segment of the Lecithin Market in 2023. Sunflower lecithin is preferred for its non-GMO status and higher levels of polyunsaturated fats compared to other sources.

The growing trend of clean-label and allergen-free food products is driving the demand for sunflower lecithin in various sectors, including food and beverages, personal care, and pharmaceuticals. Its hypoallergenic nature further supports its rise in popularity among consumers who seek natural alternatives.

Rapeseed lecithin, while holding a smaller market share, continues to witness growth due to its efficient extraction process and nutritional benefits. It is used in a wide array of food products and has applications in the production of biodiesel as well.

By Nature Analysis

GMO Lecithin dominates with 58.3% in the market by nature.

In 2023, GMO held a dominant market position in the By Nature segment of the Lecithin Market, with a 58.3% share. GMO lecithin is primarily derived from genetically modified crops such as soybeans, which have been optimized for higher yields and cost-effective production. This segment’s market dominance is attributed to the scalability and affordability of GMO lecithin, making it a popular choice for large-scale industrial applications.

GMO lecithin is extensively used in the food and beverage industry, particularly in the production of processed foods, confectioneries, and emulsifiers, as it provides excellent functionality at a competitive price point. Its widespread availability and lower production costs continue to drive its dominance in the lecithin market, particularly in regions where cost efficiency remains a primary concern.

Non-GMO lecithin, while holding a smaller share in comparison, has gained considerable traction due to growing consumer demand for natural and sustainable ingredients. This segment is driven by a shift toward clean-label products, with increasing awareness around genetically modified organisms (GMOs) and their potential long-term health effects.

Non-GMO lecithin is increasingly favored in the premium product segments, especially in organic foods, nutraceuticals, and cosmetics, where consumers are more likely to pay a premium for products made from non-GMO sources. Its market share is expected to continue expanding as consumer preferences for natural and non-GMO options rise globally.

By Product Analysis

Unrefined Lecithin holds a 44.2% share in the product category.

In 2023, Unrefined Lecithin held a dominant market position in the By Product segment of the Lecithin Market, with a 44.2% share. Unrefined lecithin is minimally processed, retaining more of its natural components, including phospholipids, fatty acids, and essential oils. This makes it particularly popular in health-conscious markets, as it is perceived as a more natural and nutritious option compared to refined lecithin.

Unrefined lecithin is widely used in food products such as bakery goods, snacks, and confectioneries, where it acts as an emulsifier, stabilizer, and flavor enhancer. Its growing popularity in the organic and clean-label product sectors is driving its market share growth, as consumers increasingly demand less processed ingredients in their food products.

Refined Lecithin, while accounting for a smaller share in comparison to unrefined lecithin, continues to hold a significant position in the Lecithin Market. Refined lecithin undergoes extensive processing to remove impurities, resulting in a product with higher purity levels.

This makes it an ideal choice for industries requiring a higher standard of lecithin, including pharmaceuticals, cosmetics, and high-end food formulations. The refined form of lecithin is known for its consistency, making it a preferred option in industrial applications where precise performance is critical.

Chemically Modified Lecithin, representing a niche segment, is used in specialized applications such as surface treatment, plastics, and coatings. The modification process improves its functionality, especially in non-food sectors. Despite its smaller market share, it is expected to see gradual growth as industries explore more advanced applications for modified lecithin.

By Form Analysis

Lecithin powder is preferred, with a 39.2% market share by form.

In 2023, Lecithin Powder held a dominant market position in the By Form segment of the Lecithin Market, with a 39.2% share. Lecithin powder is widely recognized for its ease of use, long shelf life, and versatility, which makes it particularly appealing in both food and industrial applications. It is frequently used as an emulsifier, stabilizer, and dispersing agent in various products, including bakery goods, confectionery, and nutritional supplements.

The powdered form’s ability to blend seamlessly with other ingredients has contributed to its popularity in the food processing industry. Additionally, its stable properties under different storage conditions further enhance its market attractiveness.

The growing demand for powdered supplements, such as those used in sports nutrition and weight management, has bolstered the segment’s dominance, with consumer preferences increasingly leaning toward convenient, easy-to-use products.

Lecithin Granules, while holding a smaller share compared to lecithin powder, continues to be a key player in the lecithin market. Granules offer an advantage in certain food formulations due to their slow solubility and ease of handling.

They are widely used in dietary supplements, pharmaceuticals, and animal feed, where precise dosage and controlled release are required. The granulated form’s popularity is driven by its ability to preserve the functional properties of lecithin over extended periods, particularly in dry formulations.

Liquid Lecithin, representing another significant segment, is favored for its immediate dispersibility and ease of mixing into various formulations, making it an essential component in the food and beverage sector. It is especially popular in manufacturing emulsions, sauces, and dressings, where its liquid nature enables seamless blending.

By Function Analysis

Emulsifiers lead with 53.4% of the Lecithin Market by function.

In 2023, Emulsifiers held a dominant market position in the By Function segment of the Lecithin Market, with a 53.4% share. Emulsifiers are the primary function of lecithin, responsible for promoting the mixing of water and oil, which would otherwise remain separate. This unique capability makes lecithin a key ingredient in a wide range of industries, including food, pharmaceuticals, and cosmetics.

The food industry is the largest consumer of lecithin as an emulsifier, where it is used in products such as margarine, chocolate, dressings, and sauces. As consumers continue to demand more processed and convenient food products, the need for emulsifiers, particularly those made from lecithin, is expected to grow. Lecithin’s natural and clean-label status further strengthens its position, making it the preferred emulsifying agent in organic and non-GMO formulations.

Dispersing Agents, while holding a smaller share compared to emulsifiers, is a vital function of lecithin in several applications. Dispersing agents improve the distribution of particles in liquid formulations, ensuring uniformity in products like paints, coatings, and pharmaceuticals. In the food sector, lecithin as a dispersing agent is used in the production of beverages, especially powdered drink mixes, where it helps to prevent clumping and improve solubility.

Surfactants, another important function of lecithin, are used primarily in personal care and cleaning products. Surfactants reduce surface tension, improving the spreadability and effectiveness of cleaning agents and cosmetics. Lecithin-based surfactants are valued for their mildness and skin compatibility, making them a preferred choice in personal care products like shampoos, lotions, and soaps.

By End-Use Analysis

Convenience foods represent 29.1% of Lecithin Market’s end-use applications.

In 2023, Convenience Foods held a dominant market position in the By End Use segment of the Lecithin Market, with a 29.1% share. Lecithin is widely used in convenience foods for its emulsifying, stabilizing, and texturizing properties. It is essential in products like ready-to-eat meals, sauces, dressings, and snacks, where it improves texture and enhances shelf life.

As the demand for on-the-go and processed foods continues to rise globally, lecithin’s role in enhancing the quality and consistency of these products is expected to increase. Additionally, the growing consumer preference for healthier convenience food options, such as those with clean-label ingredients, is driving the shift towards lecithin derived from non-GMO and natural sources.

Bakery products are another significant end-use segment for lecithin, leveraging its ability to improve dough consistency, extend shelf life, and enhance texture. Lecithin is extensively used in bread, cakes, cookies, and other baked goods, contributing to better product quality and moisture retention.

Confectionery products also rely heavily on lecithin, with its ability to ensure smooth textures and prevent crystallization in chocolate, candy, and fillings. As the confectionery market expands, lecithin’s role in improving product stability and texture will continue to be significant.

Pharmaceuticals and Personal Care products use lecithin for its emulsifying and solubilizing capabilities. Lecithin’s presence in formulations for creams, lotions, and oral medications supports product efficacy and texture.

Personal Care and Cosmetics benefit from lecithin for its gentle properties in moisturizers, shampoos, and skin-care products. It is favored for its skin-friendly nature and its ability to provide a smooth, non-greasy finish to cosmetic products.

Animal Feed applications use lecithin as a supplement to improve the digestibility and nutritional value of feed. As global animal husbandry practices evolve, the demand for high-quality feed additives like lecithin is increasing.

In Industrial applications, lecithin is utilized in paints, coatings, and lubricants. Its role as a dispersing agent and emulsifier in industrial processes supports its continued use in these sectors.

Key Market Segments

By Source

- Soy

- Sunflower

- Rapeseed

- Others

By Nature

- GMO

- Non-GMO

By Product

- Unrefined Lecithin

- Refined Lecithin

- Chemically Modified Lecithin

- Others

By Form

- Leithin Powder

- Lecithin Granules

- Liquid Lecithin

By Function

- Emulsifiers

- Dispersing Agents

- Surfactants

- Others

By End Use

- Convenience Foods

- Bakery

- Confectionary

- Pharmaceuticals and Personal Care

- Personal Care and Cosmetics

- Animal Feed

- Industrial

- Other

Driving Factors

Increasing Demand from the Food Industry

The Lecithin Market is significantly driven by its rising use in the food industry. Lecithin acts as a natural emulsifier that helps mix ingredients like oil and water, which usually don’t combine well. This property is essential for producing many food products such as chocolates, baking goods, and dressings.

As consumers continue to seek better-textured and stable food products, the demand for lecithin is expected to rise. This trend is particularly strong as manufacturers focus on cleaner labels and more natural ingredients in response to health-conscious consumer preferences.

Growth in Health and Wellness Awareness

Another key factor propelling the Lecithin Market is the growing awareness of health and wellness among consumers globally. Lecithin is known for its health benefits, including its role in improving cholesterol levels, skin health, and neurological functions.

As people become more conscious of what they consume and its impact on their health, the demand for supplements and foods containing beneficial ingredients like lecithin increases. This health trend is pushing manufacturers to incorporate lecithin into a variety of products, boosting its market growth.

Expansion of Cosmetics and Personal Care Industry

The expansion of the cosmetics and personal care industry significantly influences the Lecithin Market. Lecithin is used in various skincare and haircare products due to its moisturizing properties and ability to help with the absorption of other ingredients.

As the global market for beauty and personal care products grows, driven by increasing consumer spending and interest in organic products, the demand for natural ingredients like lecithin is also rising. This trend is expected to continue, supporting the growth of the lecithin market in the cosmetics sector.

Restraining Factors

Fluctuations in Raw Material Supply and Prices

One major challenge facing the Lecithin Market is the fluctuation in the availability and cost of raw materials. Lecithin is primarily derived from soybeans, sunflower, and other oilseeds, whose prices and supply can vary due to weather conditions, farming practices, and global market trends.

These inconsistencies can lead to unpredictable costs for lecithin producers, making budgeting and pricing strategies more complex. As a result, such volatility can restrain market growth by causing production delays and increasing product prices, which may deter consumers.

Stringent Regulatory and Quality Standards

The lecithin market is also restrained by stringent regulatory and quality standards across different regions. Lecithin used in food and pharmaceutical products must comply with strict safety and quality regulations set by authorities like the FDA in the United States and the EMA in Europe.

Meeting these standards can be challenging and costly for manufacturers, particularly for those in countries with less developed regulatory frameworks. This can limit market entry for new players and reduce the overall growth pace of the lecithin market as companies might be hesitant to expand into regions with rigorous compliance requirements.

Rising Competition from Synthetic Alternatives

Another factor that restrains the growth of the Lecithin Market is the increasing availability of synthetic emulsifiers that compete directly with lecithin. These synthetic alternatives are often cheaper and available more consistently than natural lecithin.

Additionally, they can be engineered to meet the specific needs of manufacturers, offering performance characteristics that natural lecithin might not provide. This competition from synthetic substitutes can limit the demand for natural lecithin, particularly in cost-sensitive markets where manufacturers may opt for less expensive ingredients to maintain profit margins.

Growth Opportunity

Expansion into Emerging Markets

The Lecithin Market holds significant growth potential in emerging markets. Countries in Asia, Africa, and South America are experiencing rapid economic growth, increasing urbanization, and rising health awareness, which boost the demand for processed foods, nutritional supplements, and personal care products containing lecithin.

As these regions develop, there is a growing middle class with disposable income to spend on higher-quality products. This represents a considerable opportunity for lecithin producers to tap into new and expanding markets, potentially increasing their global market share and revenue.

Innovations in Food Technology and Applications

There is a considerable opportunity for growth in the Lecithin Market through innovations in food technology and new applications. As food scientists continue to discover the diverse functional benefits of lecithin, including its use as an antioxidant and a preservative, more industries could adopt it in their formulations.

There’s also potential in exploring lecithin’s uses in plant-based and gluten-free products, which are gaining popularity among health-conscious consumers. Innovating and expanding its applications in the food sector could open new avenues for market growth.

Increasing Use in Nutraceuticals and Therapeutic Products

The rising trend of nutraceuticals and therapeutic products offers another growth opportunity for the Lecithin Market. Lecithin is valued for its health benefits, such as improving cognitive functions and supporting cardiovascular health.

With the global increase in focus on mental health and chronic diseases, there is a growing consumer inclination towards dietary supplements that include natural ingredients like lecithin. Capitalizing on this trend by developing and marketing lecithin-based health products can attract health-conscious consumers and boost market growth.

Latest Trends

Rising Demand for Non-GMO and Organic Lecithin Products

The trend towards non-GMO and organic products is significantly influencing the Lecithin Market. Consumers are increasingly seeking out products that are free from genetically modified organisms (GMOs) and that are organically produced, driven by concerns over health and environmental impacts.

This shift in consumer preferences is prompting manufacturers to source non-GMO and organic lecithin, particularly from sunflower and other non-soy plants. As a result, companies are adapting their product lines to meet this demand, which is reshaping the market and driving growth in the organic segment.

Growth of Lecithin in Infant Formula and Pharmaceuticals

Lecithin’s role in infant formula and pharmaceuticals is a growing trend that offers substantial market potential. In infant formula, lecithin is used to enhance fat absorption and mimic natural milk, which is crucial for the development of infants.

In the pharmaceutical industry, lecithin serves as an emulsifier and a drug delivery agent, improving the bioavailability of active pharmaceutical ingredients. The increasing application of lecithin in these sectors highlights its functional benefits and underscores a growing market segment that could drive future demand.

Increased Use of Lecithin in Cosmetics for Natural Emulsification

There is an emerging trend of using lecithin in the cosmetics industry as a natural emulsifier. As consumers increasingly prefer cosmetics with natural ingredients, manufacturers are incorporating lecithin to create stable and effective products such as creams, lotions, and makeup.

Lecithin not only helps blend ingredients smoothly but also provides additional benefits like skin hydration and absorption enhancement. This increased adoption in cosmetics, coupled with the growing natural beauty product market, signifies a promising trend that could expand lecithin’s market reach and consumer base.

Regional Analysis

In North America, the Lecithin Market holds a 38.4% share, valued at USD 374.3 million.

The Lecithin Market is segmented into several key regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. North America is the dominating region, commanding 38.4% of the market with a value of USD 374.3 million, driven by a well-established food processing industry and growing health awareness among consumers.

In Europe, stringent regulations promoting the use of natural food additives and an increasing preference for clean label products bolster the demand for lecithin. The region’s focus on non-GMO and organic food ingredients further enhances its market growth.

Asia Pacific is witnessing rapid growth due to expanding food and beverage industries in emerging economies like China and India. The rise in disposable incomes and urbanization are key factors propelling the demand for lecithin in this region.

The Middle East & Africa, though smaller in market size, is experiencing growth due to increasing awareness of the nutritional benefits of lecithin. The development of the pharmaceutical and cosmetics sectors in this region also contributes to market expansion.

Latin America shows potential for growth with its rising processed food industry and health-conscious population, particularly in countries such as Brazil and Argentina.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the Lecithin Market has been notably influenced by several key players, each contributing uniquely to the industry’s dynamics. American Lecithin Company, for instance, continues to lead with its innovative product offerings tailored for both food and pharmaceutical sectors, emphasizing non-GMO and organic sources.

Archer Daniels Midland Company (ADM) remains a dominant force, leveraging its vast supply chain to meet increasing demands for lecithin globally, particularly in emerging markets where health consciousness is rising.

Bunge Limited has expanded its footprint by focusing on sustainable and traceable lecithin sources, appealing to a consumer base increasingly concerned with ethical sourcing. Caldic Canada Inc. and Cargill, Inc. have both emphasized their roles in producing specialized lecithin blends, which cater to specific industry needs such as infant formula and dietary supplements, indicating a shift towards high-value, niche markets.

DuPont de Nemours, Inc. has been at the forefront of integrating lecithin into its broader portfolio of emulsification solutions, driving innovations that enhance product stability and shelf-life.

Clarkson Specialty Lecithins and Foodchem International Corporation have carved niches by focusing on purity and allergen-free products, appealing to a segment of consumers with dietary restrictions.

Emerging players like GIIAVA (India) Pvt Ltd and Lipoid GmbH have significantly impacted the market by focusing on pharmaceutical and cosmetic applications, where lecithin’s natural properties are highly valued for their efficacy and safety.

Wilmar International Limited has capitalized on its vertical integration to ensure consistent quality and supply, making it a reliable partner for global brands.

Top Key Players in the Market

- American Lecithin Company

- Archer Daniels Midland Company

- Bunge Limited

- Caldic Canada Inc

- Cargill, Inc

- Clarkson Specialty Lecithins

- DuPont de Nemours, Inc.

- Foodchem International Corporation

- GIIAVA (India) Pvt Ltd

- Lipoid GmbH

- Global River Food Ingredients

- Guangzhou Hisoya Biological Science And Technology Co. Ltd.

- Haneil Soyatech Pvt Ltd

- Imcopa Food Ingredients B.V.

- Lecico GmbH

- Lipoid GmbH

- NOW Foods

- Orison Chemicals Limited

- Ruchi Soya Industries Ltd.

- Sodrugestvo Group S.A

- Stern-Wywiol Gruppe GmbH & Co. KG

- Sun Nutrafoods

- Wilmar International Limited

Recent Developments

- In 2024, Bunge Limited broadened its lecithin offerings with deoiled soybean lecithin in North America, enhancing food manufacturing processes and supporting uninterrupted production with integrated supply chains.

- In 2024, Archer Daniels Midland Company expanded its non-GMO lecithin production, emphasizing sustainability and traceability in response to global demand for safe, plant-based emulsifiers used in various industries.

- In 2023, American Lecithin Company highlighted their development of PhytoSolve®, a technology that enhances nutrient delivery up to ten times more effectively, using non-GMO, vegan ingredients for diverse markets like nutrition and pharmaceuticals.

Report Scope

Report Features Description Market Value (2023) USD 977.5 Million Forecast Revenue (2033) USD 2,090.9 Million CAGR (2024-2033) 7.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Soy, Sunflower, Rapeseed, Others), By Nature (GMO, Non-GMO, By Product, Unrefined Lecithin, Refined Lecithin, Chemically Modified Lecithin, Others), By Form (Leithin Powder, Lecithin Granules, Liquid Lecithin), By Function (Emulsifiers, Dispersing Agents, Surfactants, Others), By End Use (Convenience Foods, Bakery, Confectionary, Pharmaceuticals and Personal Care, Personal Care and Cosmetics, Animal Feed, Industrial, Other) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape American Lecithin Company, Archer Daniels Midland Company, Bunge Limited, Caldic Canada Inc, Cargill, Inc, Clarkson Specialty Lecithins, DuPont de Nemours, Inc., Foodchem International Corporation, GIIAVA (India) Pvt Ltd, Lipoid GmbH, Global River Food Ingredients, Guangzhou Hisoya Biological Science And Technology Co. Ltd., Haneil Soyatech Pvt Ltd, Imcopa Food Ingredients B.V., Lecico GmbH, Lipoid GmbH, NOW Foods, Orison Chemicals Limited, Ruchi Soya Industries ltd., Sodrugestvo Group S.A, Stern-Wywiol Gruppe GmbH & Co. KG, Sun Nutrafoods, Wilmar International Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- American Lecithin Company

- Archer Daniels Midland Company

- Bunge Limited

- Caldic Canada Inc

- Cargill, Inc

- Clarkson Specialty Lecithins

- DuPont de Nemours, Inc.

- Foodchem International Corporation

- GIIAVA (India) Pvt Ltd

- Lipoid GmbH

- Global River Food Ingredients

- Guangzhou Hisoya Biological Science And Technology Co. Ltd.

- Haneil Soyatech Pvt Ltd

- Imcopa Food Ingredients B.V.

- Lecico GmbH

- Lipoid GmbH

- NOW Foods

- Orison Chemicals Limited

- Ruchi Soya Industries Ltd.

- Sodrugestvo Group S.A

- Stern-Wywiol Gruppe GmbH & Co. KG

- Sun Nutrafoods

- Wilmar International Limited