Global Mustard Market Size, Share, And Business Benefits By Form (Seed, Powder, Oil, Paste, Others), By Type (Black Mustard, White Mustard), By Application (Food and beverages, Personal care, Therapeutics, Others), By End User (Households, Industries), By Distribution Channel (Online Retailing, Hypermarkets and Supermarkets, Convenience Store and Grocery Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: February 2025

- Report ID: 137434

- Number of Pages: 246

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Business Benefits of the Mustard Market

- By Form Analysis

- By Type Analysis

- By Application Analysis

- By End User Analysis

- By Distribution Channel Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

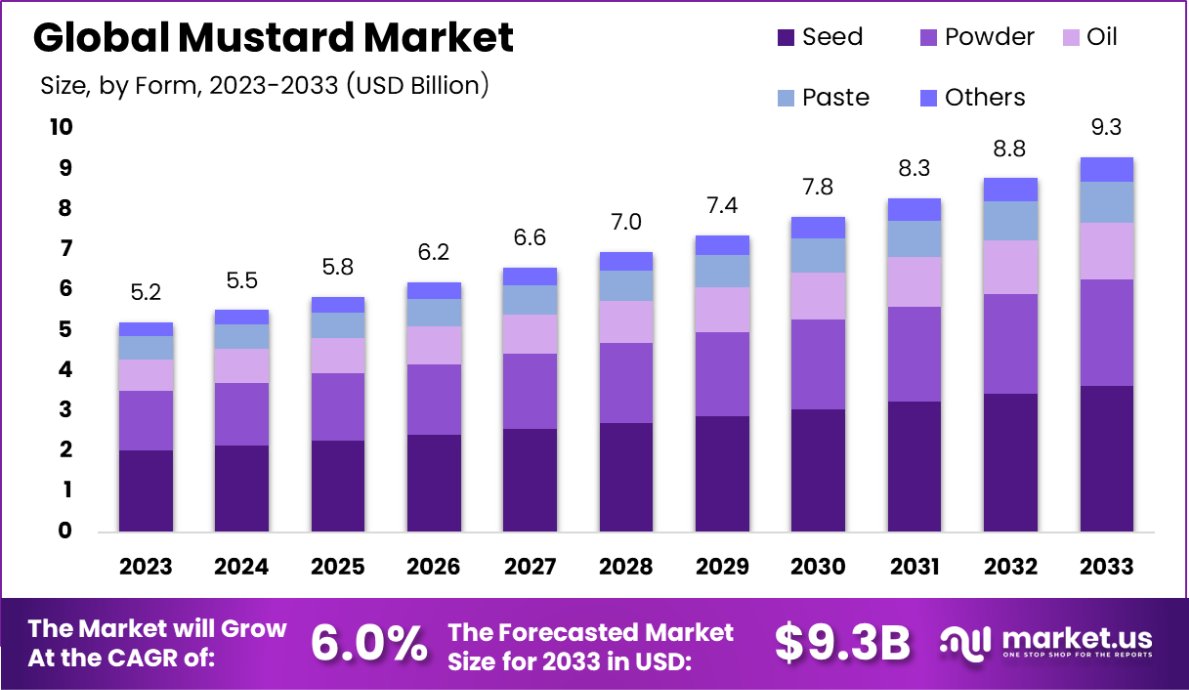

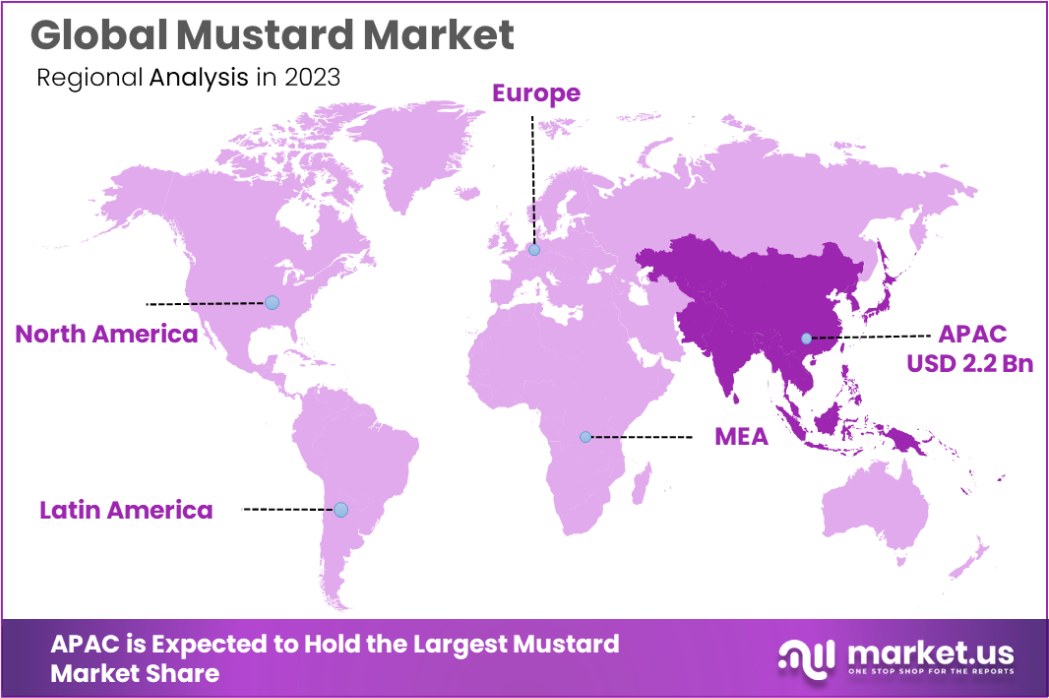

The Global Mustard Market is expected to be worth around USD 9.3 Billion by 2033, up from USD 5.2 Billion in 2023, and grow at a CAGR of 6.0% from 2024 to 2033. The Asia-Pacific mustard market holds 51.2%, valued at USD 2.2 Bn.

The mustard market in India has experienced significant growth in recent years, solidifying its position as a crucial segment within the country’s agricultural sector. As a leading oilseed crop, mustard contributes approximately 36% to India’s total edible oil production, underscoring its importance in meeting domestic oil demands.

Several factors have driven this expansion. Government initiatives, such as the Special Mustard Programme initiated during the Rabi season of 2020-21, have played a pivotal role. This program led to a 40% increase in mustard production, from 9.12 million tonnes in 2019-20 to 12.82 million tonnes in 2022-23, and an 11% rise in productivity, from 1,331 kg/ha to 1,447 kg/ha.

Despite these advancements, challenges persist. Fluctuating market prices have been a concern for mustard farmers, with prices occasionally falling below the Minimum Support Price (MSP), impacting profitability.

Additionally, climate variations, such as rising temperatures during sowing seasons, have led some farmers to shift from mustard to other crops less affected by heat, potentially influencing future production levels.

Looking ahead, the mustard market presents substantial growth opportunities. The government’s focus on agroecological crop planning aims to divert land from surplus commodities like rice and wheat to deficit commodities such as oilseeds and pulses, enhancing mustard production.

Furthermore, the development of value-added mustard-based products, including yellow mustard condiments and honey mustard, offers potential for micro-level processing enterprises, contributing to rural employment and income diversification.

The mustard market is experiencing significant growth, driven by increasing demand for its applications in the food, pharmaceutical, and cosmetics industries. India, a key player in mustard production, witnessed an increase in rapeseed-mustard harvested area to 9.3 million hectares in 2023, according to the USDA Foreign Agricultural Service.

This expansion reflects favorable agronomic conditions and government support for oilseed cultivation. Additionally, the USDA’s Specialty Crop Block Grant Program allocated over $544,000 to Illinois for fiscal year 2023 to support specialty crops, including mustard, enhancing domestic market development and production efficiency.

Montana, a major contributor to the U.S. mustard market, benefits from $3 million in annual funding through the National Agricultural Statistics Service for specialty crops, demonstrating strong federal backing for cultivation and innovation.

Key Takeaways

- The Global Mustard Market is expected to be worth around USD 9.3 Billion by 2033, up from USD 5.2 Billion in 2023, and grow at a CAGR of 6.0% from 2024 to 2033.

- The mustard market by form shows seeds dominating at 39.3% of overall sales globally.

- Black mustard leads the market by type, capturing 63.3% of total mustard consumption worldwide.

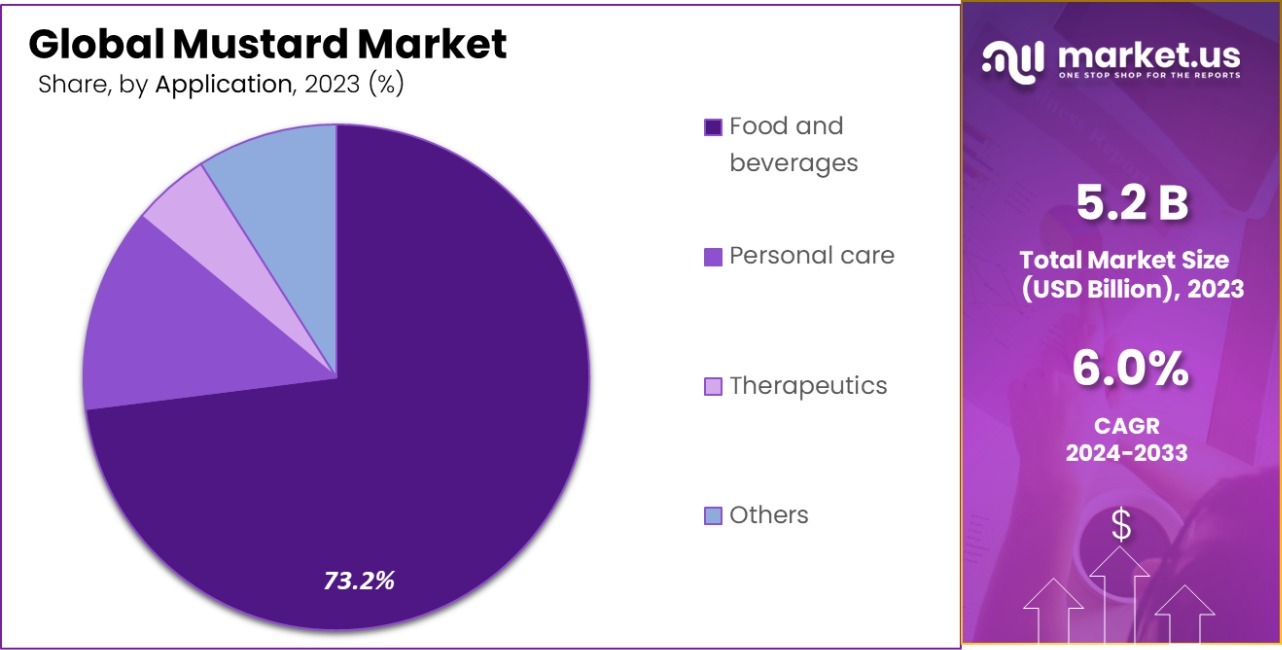

- The food and beverages sector dominates the mustard market, accounting for 73.2% of the demand.

- Households are the primary end-users in the mustard market, representing 69.2% of total consumption.

- Hypermarkets and supermarkets are the leading distribution channels in the mustard market, contributing 43.2%.

- The Asia-Pacific mustard market holds a 51.2% share, valued at USD 2.2 billion.

Business Benefits of the Mustard Market

The mustard market presents significant business benefits, supported by government data highlighting its economic and agricultural importance. Mustard, a vital oilseed crop, plays a critical role in the agricultural sector, particularly in countries like India and Canada.

According to government agricultural reports, mustard is a high-yield, low-input crop, making it a sustainable choice for farmers. Its ability to grow in diverse climates and soils ensures widespread cultivation, thereby contributing to rural employment and income stability.

Government initiatives, such as subsidies on mustard seed procurement and support for research on high-yield and disease-resistant varieties, bolster productivity and profitability. For instance, India’s Ministry of Agriculture data underscores the contribution of mustard to oilseed production, accounting for a significant share of domestic edible oil supply, thereby reducing reliance on imports.

The processing of mustard into oil, meals, and condiments creates value-added opportunities, fostering small and medium enterprises (SMEs). Additionally, mustard’s by-products, such as mustard cake, are a rich source of protein for livestock feed, further enhancing its utility.

In alignment with sustainable agriculture goals, mustard cultivation aids in soil conservation and crop diversification. Thus, the mustard market not only strengthens economic resilience but also aligns with environmental sustainability objectives.

By Form Analysis

The mustard market is driven by seed form, holding a 39.3% market share.

In 2023, Seed held a dominant market position in the By Form segment of the Mustard Market, commanding a 39.3% share. This segment’s strength is underscored by the diverse applications of mustard seeds in culinary uses and as a base for various condiments and spices.

Following closely, Powder secured a 29.5% market share, favored for its convenience and versatility in both household and commercial kitchens. Oil, known for its health benefits and culinary versatility, captured 21.2% of the market.

Its demand is further driven by the growing consumer interest in natural and organic cooking ingredients. Lastly, Paste, which is essential for its ready-to-use property, held a 10% market share. This form is particularly popular in quick-service restaurants and among home cooks for its ease of use and flavor enhancement capabilities.

Each form of mustard plays a unique role in the culinary landscape, influencing buying patterns and consumer preferences across various demographics and geographies.

By Type Analysis

Black mustard dominates, with 63.3% of the total mustard market type share.

In 2023, Black Mustard held a dominant market position in the By Type segment of the Mustard Market, with a substantial 63.3% share. Renowned for its robust flavor and versatility in culinary applications, Black Mustard has been a favorite among chefs and home cooks alike, contributing significantly to its market prevalence.

This type of mustard is particularly favored for its use in Indian and other South Asian cuisines, where it is a staple ingredient in a variety of dishes, enhancing flavors with its pungent and spicy characteristics.

On the other hand, White Mustard accounted for the remaining 36.7% of the market. This variant is milder compared to Black Mustard and is commonly used in the preparation of Western mustards and condiments.

White Mustard seeds are often preferred for their subtle heat and are frequently utilized in the production of milder mustards, which are popular in European and North American markets. Its applications in sauces, dressings, and marinades contribute to its steady demand within these regions.

Together, these two types of mustard cater to a diverse range of culinary traditions and preferences, reflecting a global appreciation for their distinctive flavors and applications in both traditional and contemporary cuisine.

By Application Analysis

The food and beverage sector leads, making up 73.2% of mustard applications.

In 2023, Food and Beverages held a dominant market position in the By Application segment of the Mustard Market, with a commanding 73.2% share. This sector’s prominence is driven by the extensive use of mustard in various culinary processes, including as a condiment, seasoning, and flavor enhancer in cuisines worldwide. The adaptability of mustard to complement a broad spectrum of dishes contributes to its substantial footprint in this segment.

Personal Care, encompassing the use of mustard oil and extracts in products like hair oils, soaps, and lotions, captured 16.5% of the market. The antioxidant properties and high vitamin E content in mustard make it a beneficial ingredient in the personal care industry, appealing to consumers seeking natural and organic product options.

Therapeutics, which includes mustard applications in traditional medicines and modern health treatments, held a 10.3% market share. Mustard is known for its therapeutic qualities, such as relief from muscle pain, congestion, and inflammation, making it valuable in the pharmaceutical and alternative medicine sectors.

Overall, the diverse applications of mustard across these segments highlight its integral role not only in culinary arts but also in personal wellness and health industries.

By End User Analysis

Households are the primary end-users, contributing 69.2% to mustard market demand.

In 2023, Households held a dominant market position in the By End User segment of the Mustard Market, with a substantial 69.2% share. This segment’s strong performance is largely attributed to the widespread use of mustard in home cooking, where it serves as a fundamental ingredient in dressings, marinades, and condiments.

The versatility and accessibility of mustard, available in various forms such as seeds, powder, and pastes, have made it a pantry staple in residential kitchens globally, driving its high consumption rate among households.

Industries, including food processing and catering services, accounted for the remaining 30.8% of the market share. In this sector, mustard is utilized for its flavor-enhancing properties in the production of processed foods, ready-to-eat meals, and bulk culinary preparations.

Industrial usage underscores mustard’s role in commercial food services and manufacturing, where it is valued both as a primary ingredient and as a component in complex food products.

The distinct consumer patterns within these segments reflect mustard’s dual role as both a domestic culinary essential and a key industrial ingredient, underscoring its pervasive influence across different end-user applications.

By Distribution Channel Analysis

Hypermarkets and supermarkets are the main distribution channels, accounting for 43.2% share.

In 2023, Hypermarkets and Supermarkets held a dominant market position in the By Distribution Channel segment of the Mustard Market, with a 43.2% share. These outlets are pivotal in the distribution of mustard, offering a wide variety of product types and brands under one roof, which caters to the diverse preferences of consumers.

The convenience of finding multiple grocery items alongside mustard products enhances shopper experiences and drives sales volumes in these large retail spaces.

Online Retailing captured a 29.6% market share, reflecting a growing consumer preference for the convenience of home shopping and delivery. This channel has seen a significant rise due to advancements in e-commerce technology and changing consumer behaviors, particularly among tech-savvy shoppers who value the ease of comparing prices and products online.

Convenience Stores and Grocery Stores accounted for 27.2% of the market. These outlets are essential for quick and immediate purchases and are typically located in accessible areas, making them a popular choice for consumers needing to pick up mustard along with other daily essentials. The proximity and accessibility of these stores make them a critical component in the distribution landscape of mustard products.

Together, these distribution channels highlight the varied consumer purchasing patterns and the importance of channel diversification in reaching different market segments.

Key Market Segments

By Form

- Seed

- Powder

- Oil

- Paste

- Others

By Type

- Black Mustard

- White Mustard

By Application

- Food and beverages

- Personal care

- Therapeutics

- Others

By End User

- Households

- Industries

By Distribution Channel

- Online Retailing

- Hypermarkets and Supermarkets

- Convenience Store and Grocery Stores

- Others

Driving Factors

Growing Consumer Preference for Organic and Natural Products

The mustard market is experiencing substantial growth driven by the increasing consumer preference for organic and natural products. As health consciousness rises, more consumers are shifting away from artificial and processed condiments, favoring organic mustard varieties that offer enhanced flavor without chemical additives.

This trend is supported by a broader movement towards organic foods, influencing product development and marketing strategies across the condiment industry. Manufacturers are responding by expanding their organic product lines, which is expected to propel market growth further.

Expansion of Culinary Applications Beyond Traditional Uses

Mustard, traditionally used as a simple condiment, is finding new life in various culinary applications, significantly driving market demand. Chefs and home cooks are increasingly incorporating different types of mustard into sauces, marinades, rubs, and even beverages, exploring its potential beyond the usual pairings.

This culinary innovation is making mustard a versatile ingredient in kitchens worldwide, thus broadening its consumer base and increasing its market penetration. The versatility of mustard, from spicy to sweet profiles, makes it appealing to a wide range of tastes and dishes.

Increase in Fast Food Consumption Globally

The global surge in fast food consumption is another crucial driver for the mustard market. Mustard is a key ingredient in many fast food items such as burgers, hot dogs, and sandwiches. As fast food chains expand globally, the demand for mustard continues to grow in both emerging and established markets.

This factor is particularly influential in regions where Western eating habits are becoming more prevalent, leading to an increased demand for condiments like mustard to complement these food choices.

Restraining Factors

Fluctuations in Raw Material Prices Affecting Production Costs

The mustard market is susceptible to significant fluctuations in raw material prices, particularly mustard seeds. These fluctuations can greatly affect production costs, making it challenging for manufacturers to maintain consistent pricing and profit margins.

Seasonal variations, climatic conditions, and changes in agricultural policies in key producing countries can all contribute to price volatility. This unpredictability can deter new entrants in the market and strain existing producers, potentially leading to a reduction in market growth momentum.

Stringent Regulatory Standards Limiting Market Entry

Strict food safety and quality regulations can pose considerable barriers to entry into the mustard market. These regulations vary by country and can be particularly stringent regarding additives, preservatives, and labeling requirements.

Compliance requires significant investment in quality control and production processes, which can be prohibitive for smaller or newer companies. This regulatory environment can stifle innovation and limit the variety of mustard products available in the market, ultimately restraining market expansion.

Increasing Competition from Substitute Products

The mustard market faces stiff competition from a variety of substitute products, such as mayonnaise, ketchup, and other condiments, which can fulfill similar culinary roles. Consumers may opt for these alternatives based on price, taste preference, or availability, impacting mustard sales.

As manufacturers of these substitutes innovate and expand their product lines, the competition intensifies, potentially limiting the growth of the mustard market. This is especially true in regions where mustard is not a traditional condiment, making market penetration more challenging.

Growth Opportunity

Expanding Global Reach through E-Commerce Platforms

The proliferation of e-commerce offers a significant growth opportunity for the mustard market. By leveraging online sales channels, mustard brands can expand their reach beyond traditional geographic limitations, accessing a global customer base.

This approach not only enhances brand visibility but also caters to the increasing consumer demand for convenience and variety. Online platforms also enable smaller mustard producers to compete on a larger scale, promoting diversity in product offerings and driving market growth through increased consumer access.

Innovative Product Flavors Attracting New Customers

There is a growing opportunity to attract new segments of consumers by diversifying product flavors. The mustard market can benefit from experimenting with innovative blends that incorporate exotic and unusual ingredients, appealing to a broader palate.

This strategy can particularly attract younger consumers who are eager to try new flavor profiles. Seasonal releases, limited edition flavors, and collaborations with other food brands can further enhance consumer interest and market expansion, potentially setting trends within the condiments industry.

Health-Focused Mustard Varieties Expanding Consumer Base

Health and wellness trends present a substantial opportunity for growth in the mustard market. Developing mustard varieties with added health benefits, such as reduced sodium, no added sugars, or fortified with vitamins, can meet the demands of health-conscious consumers.

Additionally, highlighting mustard’s natural health benefits, like being low in calories and high in antioxidants, can attract a health-focused audience. Catering to dietary needs such as gluten-free or vegan can also widen the market’s consumer base and drive growth.

Latest Trends

Artisanal and Craft Mustard Varieties Gaining Popularity

The rise of artisanal and craft mustard varieties is a notable trend, reflecting consumers’ growing preference for unique, high-quality products. These mustards often feature local ingredients, traditional manufacturing methods, and innovative flavors that differentiate them from mass-produced options.

The trend towards artisanal products is driven by consumers seeking authenticity and transparency in food sourcing, supporting small businesses, and enjoying a gourmet experience. This movement has encouraged both new entrants and established brands to offer premium products, enhancing market growth.

Integration of Ethnic Flavors into Mustard Products

As global cuisine becomes more popular, mustard manufacturers are incorporating ethnic flavors into their products, catering to adventurous consumers looking to explore new tastes. This trend includes the introduction of mustards that feature spices and ingredients typical of various international cuisines, such as Indian, Mexican, or Middle Eastern.

These flavored mustards are not only used as condiments but also as key ingredients in cooking, offering versatility and a fusion of flavors that appeal to a diverse consumer base.

Sustainability and Eco-Friendly Practices in Production

Sustainability is a growing focus in the mustard market, with an increasing number of consumers demanding environmentally friendly practices throughout the production chain. This trend involves the adoption of sustainable farming techniques for mustard seeds, the reduction of waste and energy consumption in manufacturing, and the use of recyclable or biodegradable packaging.

Brands that commit to these practices are likely to attract environmentally conscious consumers, further driving market growth while promoting a positive brand image and consumer loyalty.

Regional Analysis

The Asia-Pacific region dominates the mustard market with a 51.2% share, valued at USD 2.2 billion.

North America is characterized by a stable demand for mustard, driven by traditional consumption of fast foods and increasing interest in organic and artisanal varieties. The U.S. and Canada are key markets, with consumers showing a preference for innovative flavors and healthier options.

Europe remains a significant market, with countries like France, Germany, and the UK leading in both production and consumption. The region’s deep culinary traditions around mustard, particularly Dijon mustard in France, support a strong market presence. Europe is also seeing growth in demand for organic and non-GMO mustard varieties.

Asia-Pacific is the dominating region in the mustard market, accounting for 51.2% of the global share and generating revenues of USD 2.2 billion. This region’s growth is propelled by expanding fast food markets, particularly in China and India, along with a growing interest in Western cuisines. The versatility of mustard in local Asian dishes also contributes to its increased consumption.

Middle East & Africa and Latin America are emerging markets with potential for growth due to urbanization and the increasing popularity of fast foods. These regions are experiencing a gradual introduction to more diverse condiment options, including mustard, which was previously less common.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global mustard market in 2023 is highly competitive, driven by established players and emerging companies innovating in product offerings and regional expansions. Prominent brands like French, H.J. Heinz Company, and The Kraft Heinz Company dominate the market with their extensive distribution networks and strong brand equity.

These companies have capitalized on the rising demand for condiments by launching healthier and innovative mustard varieties, catering to shifting consumer preferences toward organic and gluten-free options.

Regional leaders such as Colman’s of Norwich in Europe continue to leverage their legacy status and traditional recipes to maintain a loyal consumer base, while newer entrants like Mustard and Co. and Backwoods Mustard Company are tapping into the artisanal and craft mustard trend, appealing to niche markets seeking unique, premium offerings.

Global food conglomerates like Cargill, Conagra Brands Inc., and Unilever are focusing on leveraging economies of scale and enhancing their mustard product portfolios to penetrate emerging markets such as Asia-Pacific and the Middle East. Smaller companies like Sun Impex and Bertman Foods Co. are carving out market niches by providing tailored flavors and high-quality ingredients.

The market landscape also reflects increased competition in sustainability, as companies across the spectrum adopt eco-friendly production methods and packaging solutions to meet growing environmental concerns. These key players are poised to shape the mustard market’s trajectory, balancing tradition with innovation while addressing global consumer trends.

Top Key Players in the Market

- Backwoods Mustard Company

- Bertman Foods Co.

- Boar’s Head Brand

- Cargill

- Colman’s of Norwich

- Conagra Brands Inc.

- French’s

- H.J. Heinz Company

- McCormick & Company, Inc.

- Mustard and Co.

- Sun Impex

- The Kraft Heinz Company

- Unilever

- Woeber Mustard Manufacturing Company

Recent Developments

- In 2024, Bertman Foods Co. company released seasonal recipe eBooks, including their Holiday Recipe eBook in December, Summer Recipe eBook in June, and Spring Recipe eBook in March, showcasing their products’ versatility.

- In 2024, Boar’s Head Brand, renowned for premium deli products, offered mustard varieties like Delicatessen Style and Lower Sodium Mustard. Also, they expanded mustard sales by 10%, driven by innovative recipes blending traditional flavors with healthier options.

Report Scope

Report Features Description Market Value (2023) USD 5.2 Billion Forecast Revenue (2033) USD 9.3 Billion CAGR (2024-2033) 6.0% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Seed, Powder, Oil, Paste, Others), By Type (Black Mustard, White Mustard), By Application (Food and beverages, Personal care, Therapeutics, Others), By End User (Households, Industries), By Distribution Channel (Online Retailing, Hypermarkets and Supermarkets, Convenience Store and Grocery Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Backwoods Mustard Company, Bertman Foods Co., Boar’s Head Brand, Cargill, Colman’s of Norwich, Conagra Brands Inc., French’s, H.J. Heinz Company, McCormick & Company, Inc., Mustard and Co., Sun Impex, The Kraft Heinz Company, Unilever, Woeber Mustard Manufacturing Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Backwoods Mustard Company

- Bertman Foods Co.

- Boar's Head Brand

- Cargill

- Colman's of Norwich

- Conagra Brands Inc.

- French’s

- H.J. Heinz Company

- McCormick & Company, Inc.

- Mustard and Co.

- Sun Impex

- The Kraft Heinz Company

- Unilever

- Woeber Mustard Manufacturing Company