Global Inulin Market Size, Share, And Business Benefits By Source (Chicory Inulin, Jerusalem Artichoke Inulin, Agave Inulin), By Nature (Organic, Conventional), By Function Type (Bifdus Promoting Agent, Fiber Enhancer, Sugar Alternative, Fat Alternative or Replacer, Others), By Form (Liquid, Powder), By Application (Food and Beverages, Dietary Supplements, Animal Feed Additive, Others), By Sales Channel (Direct Sales, Indirect Sales), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: January 2025

- Report ID: 137480

- Number of Pages: 276

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Business Benefits of Inulin Market

- By Source Analysis

- By Nature Analysis

- By Function Type Analysis

- By Form Analysis

- By Application Analysis

- By Sales Channel Analysis

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

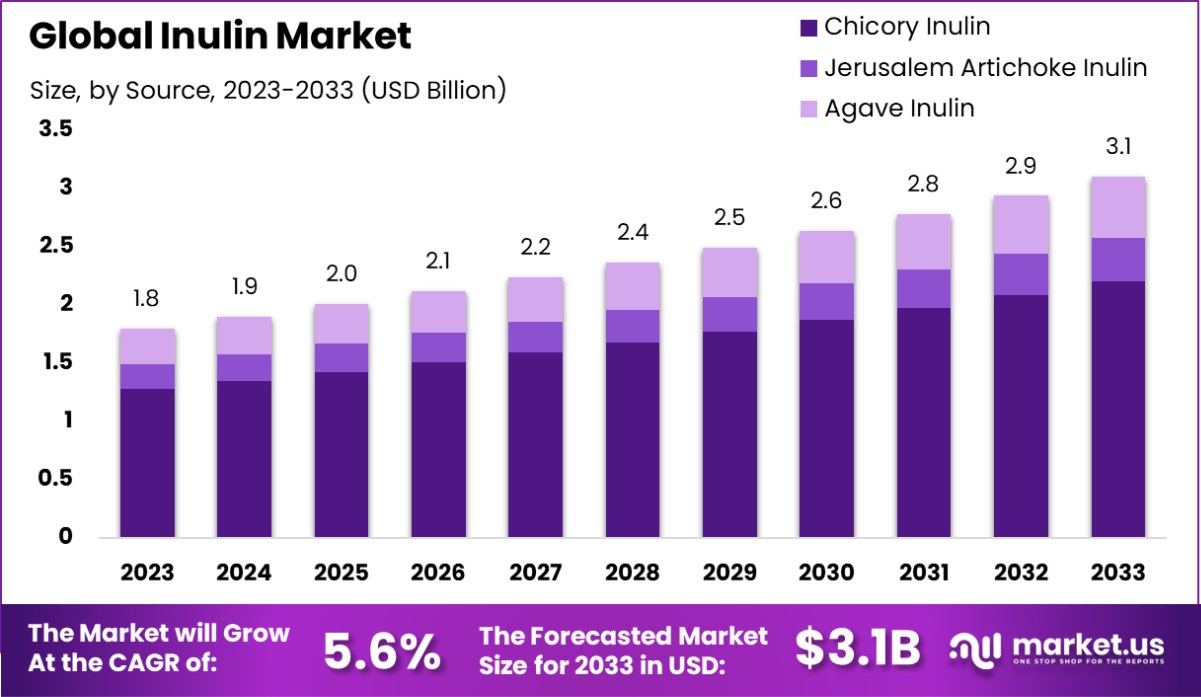

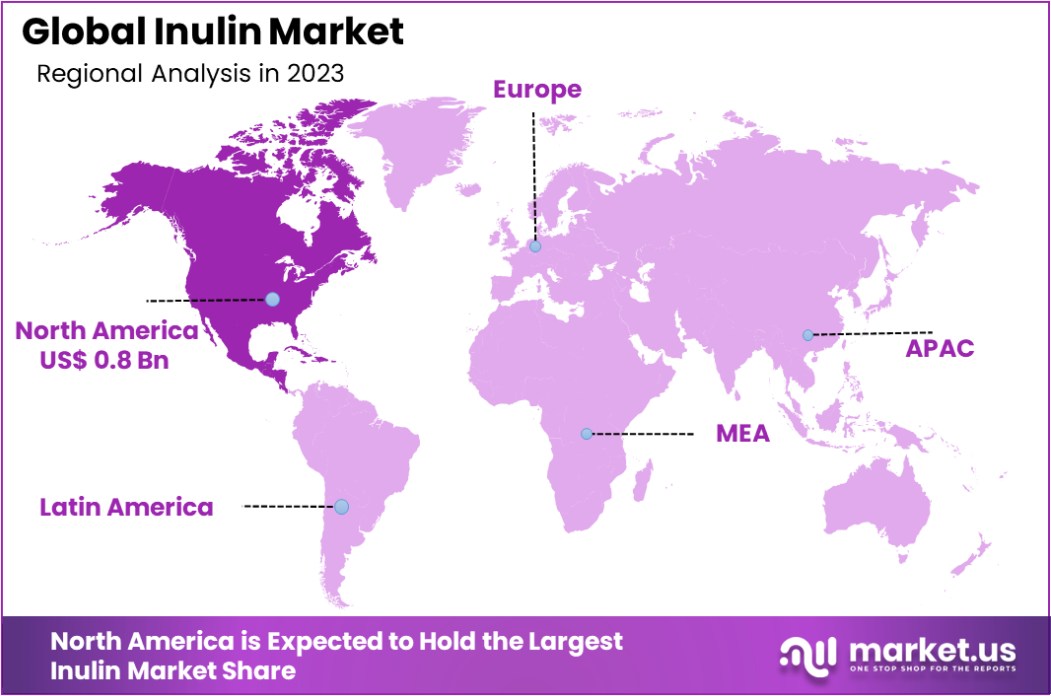

The Global Inulin Market is expected to be worth around USD 3.1 Billion by 2033, up from USD 1.8 Billion in 2023, and grow at a CAGR of 5.6% from 2024 to 2033. In 2023, North America’s inulin market reached USD 0.8 billion, 47.1% share.

Inulin, a naturally occurring polysaccharide, is predominantly sourced from chicory roots and serves as a dietary fiber with prebiotic properties. Its applications span the food and beverage industry, pharmaceuticals, and dietary supplements.

The inulin market is experiencing significant growth, driven by increasing consumer awareness of the health benefits associated with dietary fibers. The Food Safety and Standards Authority of India (FSSAI) has established regulations for health supplements and nutraceuticals, including inulin, to ensure product safety and quality.

Current trends indicate a rising demand for natural and plant-based ingredients, positioning inulin as a preferred choice for manufacturers aiming to enhance the nutritional profile of their products. The versatility of inulin in improving texture and taste, along with its low caloric value, further contributes to its popularity.

Future growth opportunities for the inulin market are promising, with projections suggesting continued expansion. The increasing prevalence of lifestyle-related health issues is expected to drive demand for functional foods and ingredients like inulin.

The Inulin Market is poised for significant growth, underpinned by evolving consumer preferences for functional ingredients and expanding applications in pharmaceuticals, food, and dietary supplements. A key driver is the integration of inulin into healthcare plans, such as the Part D Senior Savings Model.

According to the Content Management System, this model included inulin as a covered medication in 2022, benefiting over 17 million enrollees across 2,159 prescription drug plans. Additionally, supplemental benefits were extended to more than 800,000 enrollees actively using insulin, demonstrating insulin’s critical role in healthcare frameworks.

On the agricultural side, a notable decline in the cost of raw materials like white corn, which saw a 28% price drop from February 2023 to February 2024 in Jalisco, Mexico, could indirectly influence production costs and pricing strategies for inulin manufacturers. These trends highlight robust market potential, driven by cost efficiency, policy support, and consumer-driven demand for health-enhancing products.

Key Takeaways

- The Global Inulin Market is expected to be worth around USD 3.1 Billion by 2033, up from USD 1.8 Billion in 2023, and grow at a CAGR of 5.6% from 2024 to 2033.

- The Inulin market is predominantly driven by chicory inulin, accounting for 71.2% of the share.

- Conventional inulin leads the market with a significant 69.1% share, reflecting widespread consumer preference.

- Serving as a bifidus-promoting agent, inulin dominates with a 48.1% market share by function type.

- Powdered inulin represents a remarkable 78.6% share, showcasing its popularity in diverse formulations and industries.

- The food and beverages sector holds the highest application share at 59.1%, driving consistent growth.

- Indirect sales channels dominate the market with a 67.1% share, underlining their importance in distribution networks globally.

- In 2023, North America’s inulin market captured 47.1%, valued at USD 0.8 billion.

Business Benefits of Inulin Market

Inulin, a natural polysaccharide found predominantly in the roots of plants, has significant business benefits underscored by various governmental health bodies. According to the U.S. Department of Agriculture, inulin is recognized for its prebiotic properties, enhancing gastrointestinal health by promoting beneficial bacteria growth.

This attribute aligns with increasing consumer demand for functional foods that support digestive health, opening expansive market opportunities for food and beverage manufacturers.

The U.S. Food and Drug Administration’s recognition of inulin as Generally Recognized as Safe (GRAS) underscores its safety for consumption, facilitating its adoption across a myriad of products, including dairy, bakery, and dietary supplements. This regulatory assurance helps businesses in these sectors innovate their product lines with health-centric claims, potentially boosting market acceptance and consumer trust.

Furthermore, inulin’s role in sugar reduction and fiber enrichment is pertinent as public health policies increasingly focus on reducing sugar intake and boosting dietary fiber, which is highlighted in reports from health departments.

This positions inulin as a strategic ingredient in reformulating products to meet these guidelines, thereby appealing to health-conscious consumers and aligning with governmental nutritional recommendations.

Overall, the integration of inulin into various consumer products not only meets emerging health trends but also aligns with governmental dietary recommendations, enhancing its market viability and offering substantial business opportunities in the health-focused food sector.

By Source Analysis

Chicory inulin dominates the market, accounting for a 71.2% share.

In 2023, Chicory Inulin held a dominant market position in the “By Source” segment of the Inulin Market, capturing a 71.2% share. The prominence of Chicory Inulin can be attributed to its widespread availability and established use in various food and beverage applications, owing to its superior prebiotic properties and natural sweetness.

Following Chicory, Jerusalem Artichoke Inulin accounted for 18.6% of the market. This segment benefits from its appeal to consumers seeking alternative sources of inulin that offer similar health benefits, including improved digestive health and enhanced mineral absorption.

Agave Inulin, with a smaller market share of 10.2%, is recognized for its mild flavor and health attributes, making it an attractive option for product formulations aiming to appeal to health-conscious consumers without altering taste profiles.

Together, these sources are integral to the market’s growth, driven by rising consumer awareness of dietary health and the increasing prevalence of functional foods in global diets. The varied applications and inherent benefits of each type further diversify the market landscape, influencing consumer choices and competitive strategies within the industry.

By Nature Analysis

Conventional inulin holds a significant 69.1% of the total market.

In 2023, Conventional inulin held a dominant market position in the “By Nature” segment of the Inulin Market, with a 69.1% share. This segment’s strong performance is driven by the widespread availability and cost-effectiveness of conventional inulin compared to its organic counterpart.

Conventional inulin is primarily favored by manufacturers for its scalability and ease of integration into a variety of food and beverage products, ranging from baked goods to dairy alternatives. This has facilitated broader consumer access to inulin-enriched products, supporting market growth.

On the other hand, Organic inulin accounted for 30.9% of the market. Despite its smaller share, the organic segment is witnessing robust growth, propelled by increasing consumer demand for clean-label products and natural ingredients.

This shift is reflective of a broader trend towards organic and non-GMO food products, particularly among health-conscious consumers who are willing to pay a premium for products perceived as more natural or beneficial to health.

The growth trajectory for organic inulin is expected to remain positive, as consumer preferences continue to evolve towards sustainability and health-oriented dietary choices, presenting opportunities for new product developments and market expansion.

By Function Type Analysis

Bifidus-promoting agents represent 48.1% of the global inulin market.

In 2023, Bifidus Promoting Agent held a dominant market position in the “By Function Type” segment of the Inulin Market, with a 48.1% share. This function type is particularly valued for its prebiotic benefits, which significantly enhance the growth of Bifidobacteria in the gut, thereby improving gut health and immunity.

The increasing consumer awareness about the importance of gut health and the role of dietary fibers in promoting beneficial gut flora has driven the demand for inulin as a Bifidus bifidus-promoting agent.

Following closely, Fiber Enhancer captured 27.3% of the market share. This segment capitalizes on the growing consumer interest in dietary fiber intake for its well-documented benefits in digestion and overall health management.

Sugar Alternative and Fat Alternative or Replacer segments accounted for 15.2% and 9.4% of the market, respectively. The demand for Sugar Alternatives is bolstered by the rising prevalence of diabetes and obesity, driving consumers toward healthier, low-calorie sweetener options.

Similarly, Fat Alternatives or Replacers are gaining traction as consumers seek out lower-calorie options that do not compromise on taste or texture in food products. Each function type’s distinct health benefits play a crucial role in driving the inulin market’s diversification and expansion.

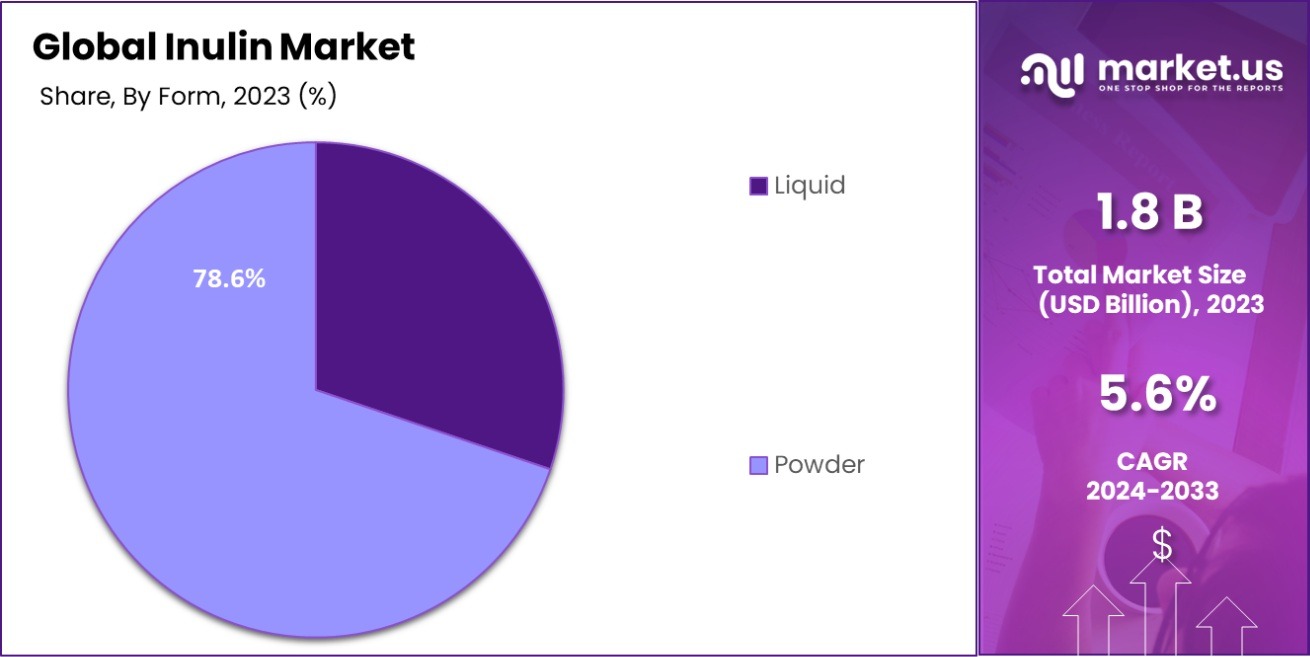

By Form Analysis

Powdered inulin leads comprise 78.6% of the market demand.

In 2023, Powder form held a dominant market position in the “By Form” segment of the Inulin Market, capturing a substantial 78.6% share. The powder form of inulin is highly preferred due to its ease of use, stability, and versatility in a wide range of applications, from dietary supplements to food and beverage formulations.

Its powdered nature allows for seamless integration into dry mixes, bakery products, and health powders, making it a favored choice among manufacturers for its operational convenience and consumer appeal.

Conversely, the Liquid form accounted for 21.4% of the market share. While smaller in comparison, the liquid form is gaining attention for its application in beverage products where it serves as a fiber supplement or a textural enhancer. The ease of incorporation in drinks, dairy products, and smoothies offers significant potential for growth, particularly in the functional beverages sector.

As consumers increasingly seek convenient, health-oriented solutions that do not require preparation, the demand for liquid inulin is expected to rise, driven by trends toward healthier lifestyles and improved dietary habits. The distinct properties of each form play a key role in addressing diverse consumer needs and expanding the inulin market’s reach.

By Application Analysis

Food and beverage industries utilize 59.1% of inulin globally.

In 2023, Food and Beverages held a dominant market position in the “By Application” segment of the Inulin Market, with a 59.1% share. This sector’s leadership is largely attributed to the widespread incorporation of inulin in products such as baked goods, dairy, and confectioneries, where it is used to improve texture, taste, and health benefits.

The increasing consumer demand for healthier food options that support digestive health and weight management has significantly boosted the use of inulin in this segment.

Dietary Supplements followed, capturing 25.4% of the market. Inulin is highly valued in this segment for its prebiotic properties, which enhance gastrointestinal health and overall wellness, appealing to health-conscious consumers looking for targeted nutritional support.

Animal Feed Additives accounted for the remaining 15.5% of the market. The use of inulin in animal nutrition is growing as research continues to reveal its benefits for animal gut health and feed efficiency. This segment is expected to expand as the agricultural sector increasingly adopts functional ingredients to enhance livestock health and productivity.

By Sales Channel Analysis

Indirect sales contribute a strong 67.1% to inulin distribution.

In 2023, Indirect Sales held a dominant market position in the “By Sales Channel” segment of the Inulin Market, with a 67.1% share. This channel’s strength is primarily due to the extensive networks of distributors and resellers that facilitate the widespread availability of insulin across various markets and sectors.

Indirect sales channels, including online retailers and third-party distributors, have proven effective in reaching a broad customer base, from large-scale manufacturers to individual consumers seeking health supplements. This method of sales is particularly effective in regions where direct market penetration is challenging due to logistical or regulatory barriers.

On the other hand, Direct Sales accounted for 32.9% of the market. This channel involves sales directly from manufacturers to end-users or through company-owned stores and websites. Direct sales are favored by some segments of the market for their ability to offer lower prices and more controlled distribution, particularly appealing to professional buyers and large food producers who prefer bulk purchasing directly from the source.

The effectiveness of each sales channel is shaped by its ability to meet consumer needs and adapt to changing market dynamics, thereby influencing the overall distribution and accessibility of insulin products in the global market.

Key Market Segments

By Source

- Chicory Inulin

- Jerusalem Artichoke Inulin

- Agave Inulin

By Nature

- Organic

- Conventional

By Function Type

- Bifdus Promoting Agent

- Fiber Enhancer

- Sugar Alternative

- Fat Alternative or Replacer

- Others

By Form

- Liquid

- Powder

By Application

- Food and Beverages

- Dietary Supplements

- Animal Feed Additive

- Others

By Sales Channel

- Direct Sales

- Indirect Sales

Driving Factors

Growing Consumer Awareness of Digestive Health Benefits

The increasing consumer knowledge about the crucial role of digestive health in overall wellness is a significant driver for the inulin market. As people become more health conscious, the demand for food products that contribute to gut health, like those containing inulin, continues to rise.

This trend is further bolstered by the growing body of scientific research supporting the benefits of a healthy microbiome, which has led consumers to seek out functional foods and supplements that contain prebiotics such as inulin.

Rise in Demand for Clean-Label and Natural Products

There is a clear shift towards clean-label and natural products across global markets, as consumers increasingly prefer ingredients that are perceived as natural and free from artificial additives. Inulin, being a naturally occurring fiber found in various plants, fits well into this category.

Its appeal is enhanced by its dual functionality as both a healthful additive and a food ingredient that can improve texture and replace fats and sugars, making it highly attractive in the clean-label space.

Increasing Prevalence of Lifestyle Diseases

The rise in lifestyle diseases such as obesity, diabetes, and cardiovascular issues has led to a greater focus on dietary changes as a preventive measure. Inulin’s role in promoting satiety, reducing calorie intake, and managing blood sugar levels makes it a key ingredient in dietary plans aimed at combating these conditions.

As more consumers adopt healthier eating habits to manage or prevent health issues, the demand for functional ingredients like inulin that support these goals continues to grow.

Restraining Factors

High Costs of Inulin Production and Extraction

The extraction and production of inulin, particularly from sources like chicory root, can be costly and resource-intensive. These high costs are due in part to the need for specialized equipment and processes to extract inulin efficiently and maintain its beneficial properties.

The economic barrier is significant enough to restrain the market’s growth, as it limits the ability of manufacturers to produce inulin at a competitive price, ultimately affecting its widespread adoption and integration into more affordable consumer products.

Limited Consumer Awareness in Emerging Markets

While inulin is gaining popularity in developed markets, its awareness and acceptance are still limited in many emerging markets. This lack of awareness can be attributed to insufficient health literacy and slower uptake of new dietary trends compared to more developed regions.

Without adequate consumer education on the benefits of inulin, its market penetration and growth potential in these regions remain restrained, as consumers are less likely to seek out or invest in products containing unfamiliar ingredients.

Regulatory Challenges and Labeling Restrictions

Inulin must comply with various regulatory standards that can vary significantly from one country to another, creating a complex landscape for manufacturers to navigate. These regulations often pertain to how inulin can be marketed, such as claims about its health benefits, which are tightly controlled.

Additionally, inconsistencies in dietary fiber definitions across jurisdictions can further complicate labeling and marketing efforts. These regulatory hurdles can delay product launches, limit marketing claims, and restrain the broader adoption of insulin in the global market.

Growth Opportunity

Expansion into Plant-Based and Vegan Product Lines

The global surge in vegan and plant-based diets presents a significant growth opportunity for the inulin market. Inulin’s natural origin and health benefits make it an ideal ingredient for vegan food products, enhancing texture and adding fiber without compromising taste.

Manufacturers can capitalize on this trend by incorporating inulin into new plant-based products, thereby broadening their consumer base and tapping into the rapidly growing segment of health-conscious, plant-focused consumers looking for dietary diversity.

Technological Advancements in Extraction and Processing

Investing in technology to improve the extraction and processing of inulin can lead to lower production costs and higher output efficiency. This growth opportunity involves developing more sustainable and cost-effective methods to extract inulin, making it more accessible and appealing to manufacturers.

Enhanced processing technologies could also open up new applications for inulin, such as in pharmaceuticals and cosmetics, expanding its market beyond food and beverages.

Strategic Partnerships with Health and Wellness Brands

Forming strategic partnerships with companies in the health and wellness sector can provide new channels for insulin distribution and marketing. By aligning with brands that focus on dietary supplements, functional foods, and natural products, inulin manufacturers can leverage these partnerships to enhance product visibility and credibility among health-focused consumers.

These collaborations can help Inulin reach a wider audience, particularly in markets where health and wellness are becoming increasingly prioritized.

Latest Trends

Incorporation of Inulin in Functional Beverages

One of the latest trends in the inulin market is its incorporation into functional beverages. As consumers increasingly seek convenient, health-boosting drink options, inulin is being added to a variety of beverages such as smoothies, health drinks, and dairy alternatives.

Its soluble fiber content not only enhances the nutritional profile but also improves the texture and mouthfeel of beverages. This trend capitalizes on the growing demand for functional foods that support digestion and overall health, making inulin a popular choice for beverage manufacturers looking to differentiate their products.

Enhanced Focus on Prebiotic and Gut Health Products

There is a heightened consumer interest in products that support gut health, positioning inulin as a key ingredient due to its prebiotic properties. This trend is driving the development of new food products that prominently feature prebiotics as a health benefit.

Manufacturers are now marketing inulin not just as a fiber supplement but as an essential component for maintaining a healthy microbiome, appealing directly to health-conscious consumers who are knowledgeable about the importance of gut health in overall wellness.

Increasing Use of Inulin as a Sugar Replacement

Amid rising concerns about sugar intake and its health impacts, inulin is increasingly being used as a natural sugar replacement in foods and beverages. This trend is driven by inulin’s ability to provide a sweet taste while also adding fiber and reducing the overall calorie content of products.

The versatility of inulin allows it to be used in a wide range of applications, from baked goods to confectionery, where it enhances texture and bulk without the added sugar. This positions insulin favorably among consumers looking to reduce sugar without sacrificing taste or texture.

Regional Analysis

In 2023, North America’s inulin market held a 47.1% share, valued at USD 0.8 billion.

In the global inulin market, regional dynamics vary significantly, reflecting diverse consumer preferences and dietary trends. North America is the dominating region, holding 47.1% of the market with a valuation of USD 0.8 billion. This is largely attributed to heightened consumer awareness about health and wellness, coupled with a robust presence of food and beverage manufacturers incorporating functional ingredients like inulin.

Europe follows closely, driven by a strong focus on dietary health and stringent food labeling regulations that promote transparency. The region benefits from a well-established food processing industry and a surge in demand for prebiotic ingredients, which are increasingly used in dairy products and health supplements.

Asia Pacific presents a rapidly growing market, spurred by increasing urbanization, rising disposable incomes, and greater health consciousness among consumers. This region shows significant potential due to its large population and growing preference for functional foods.

Meanwhile, the Middle East & Africa and Latin America are emerging markets with expanding opportunities. These regions are experiencing gradual increases in consumer awareness and health-related lifestyle changes, driving demand for dietary fibers such as inulin. Although these markets are currently smaller, they offer potential for substantial growth as regional health trends continue to evolve.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global inulin market saw significant contributions from key players, each employing distinct strategies to capture and expand their market share. Notable among them are Archer Daniels Midland Co., BENEO GmbH, and Cargill Incorporated, which led the market through strategic innovation and expansion initiatives.

Archer Daniels Midland Co. focused on enhancing its production capabilities and launching new products tailored to the evolving needs of health-conscious consumers. This approach helped ADM cater to the rising demand for functional foods and dietary supplements that promote digestive health.

BENEO GmbH capitalized on its expertise in the functional ingredients sector by investing in research and development. This strategy not only reinforced its position in the European market but also allowed it to make significant inroads into emerging markets in Asia Pacific and Latin America, where demand for dietary fibers is on the rise.

Cargill Incorporated leveraged its global network to increase the accessibility of insulin to various consumer segments. By expanding its distribution channels and forming strategic partnerships, Cargill enhanced its market reach and responded effectively to regional demands, particularly in North America and Europe.

Cosucra Groupe Warcoing SA, another leader, emphasized sustainability in its inulin production, appealing to the growing segment of environmentally conscious consumers. Their approach highlights a commitment to eco-friendly practices while maintaining high-quality product standards.

Together, these companies drive the inulin market forward by focusing on innovation, sustainability, and market expansion strategies. Their efforts are crucial in shaping the competitive landscape and meeting the dietary needs of a diverse global consumer base, positioning inulin as a key ingredient in the pursuit of healthier diets and lifestyles.

Top Key Players in the Market

- Archer Daniels Midland Co.

- BENEO GmbH

- Cargill Incorporated

- Cosucra Groupe Warcoing SA

- Dow DuPont

- Eli Lilly Company

- FMC Corporation

- Green Labs LLC

- Jarrow Formulas

- Koninklijke DSM N.V.

- Novo Nordisk

- PMV Nutrient Products PVT Ltd.

- Qingdao Oriental Tongxiang International Trading Co. Ltd.

- S Cargill Incorporated

- Sensus B.V.

- Steviva Brands, Inc.

- Sudzucker Group

- Tate & Lyle PLC

- Tereos S.A.

- The IIDEA Company

- TIC Gums

- Tierra Group

- TrooFoods Ltd.

Recent Developments

- In 2023, Archer Daniels Midland Co. processed 18.1 million metric tons of corn and 34.9 million metric tons of oilseeds, showcasing their vast operational scale and critical role in global food systems through 330 processing and over 500 procurement facilities worldwide.

- In 2023, BENEO GmbH emphasized the development of sustainable, plant-based food products using Orafti® Inulin, focusing on enhanced nutritional profiles and prebiotic benefits, highlighted at industry events such as Food Ingredients Europe.

Report Scope

Report Features Description Market Value (2023) USD 1.8 Billion Forecast Revenue (2033) USD 3.1 Billion CAGR (2024-2033) 5.6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Source (Chicory Inulin, Jerusalem Artichoke Inulin, Agave Inulin), By Nature (Organic, Conventional), By Function Type (Bifdus Promoting Agent, Fiber Enhancer, Sugar Alternative, Fat Alternative or Replacer, Others), By Form (Liquid, Powder), By Application (Food and Beverages, Dietary Supplements, Animal Feed Additive, Others), By Sales Channel (Direct Sales, Indirect Sales) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Archer Daniels Midland Co., BENEO GmbH, Cargill Incorporated, Cosucra Groupe Warcoing SA, Dow DuPont, Eli Lilly Company, FMC Corporation, Green Labs LLC, Jarrow Formulas, Koninklijke DSM N.V., Novo Nordisk, PMV Nutrient Products PVT Ltd., Qingdao Oriental Tongxiang International Trading Co. Ltd., S Cargill Incorporated, Sensus B.V., Steviva Brands, Inc., Sudzucker Group, Tate & Lyle PLC, Tereos S.A., The IIDEA Company, TIC Gums, Tierra Group, TrooFoods Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Archer Daniels Midland Co.

- BENEO GmbH

- Cargill Incorporated

- Cosucra Groupe Warcoing SA

- Dow DuPont

- Eli Lilly Company

- FMC Corporation

- Green Labs LLC

- Jarrow Formulas

- Koninklijke DSM N.V.

- Novo Nordisk

- PMV Nutrient Products PVT Ltd.

- Qingdao Oriental Tongxiang International Trading Co. Ltd.

- S Cargill Incorporated

- Sensus B.V.

- Steviva Brands, Inc.

- Sudzucker Group

- Tate & Lyle PLC

- Tereos S.A.

- The IIDEA Company

- TIC Gums

- Tierra Group

- TrooFoods Ltd.