Global IT Services Outsourcing Market by Service Type (Application Development Services, Infrastructure Services, Cybersecurity Services, IT Consulting Services, Other Service Types), by Outsourcing Type (Onshore Outsourcing, Nearshore Outsourcing, Offshore Outsourcing), by Industry Vertical (BFSI, Retail, Healthcare, Manufacturing, Telecommunications, Government and Public Sector, Other Industry Verticals), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2025

- Report ID: 138192

- Number of Pages: 363

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways:

- U.S. IT Services Outsourcing Market Size

- Service Type Segment Analysis

- Outsourcing Type Segment Analysis

- Industry Vertical Segment Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunities

- Challenging Factors

- Growth Factors

- Latest Trends

- Key Regions and Countries

- Key Players Analysis

- Top Key Players in the Market

- Recent Developments

- Report Scope

Report Overview

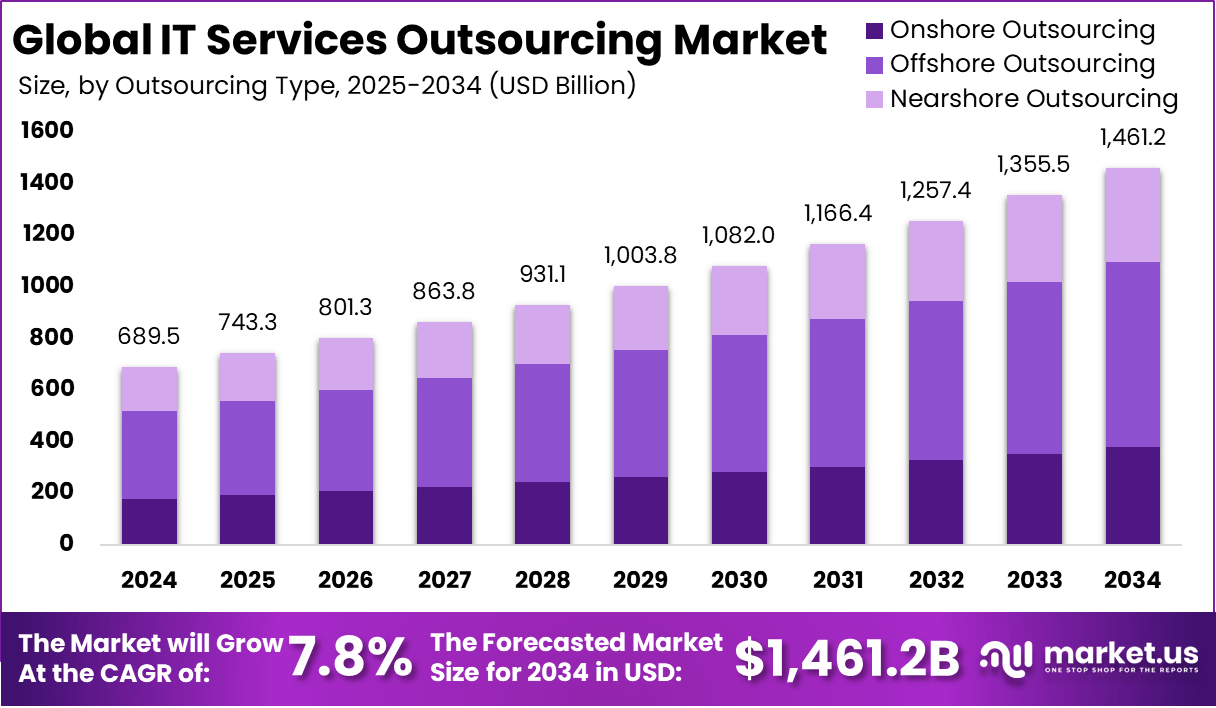

The Global IT Services Outsourcing Market size is expected to be worth around USD 1,461.2 million by 2034, from USD 689.5 million in 2024, growing at a CAGR of 7.8% during the forecast period from 2024 to 2033.

IT service outsourcing refers to the external usage of service providers to deliver IT-based business operations, application services, and infrastructure solutions efficiently. Here the company provides a part of its IT operation outside the internal structure to reduce the cost and control the operations. These operations could be application development, software, and infrastructure support as well as maintenance, data center management, and others.

The market for IT service outsourcing is growing aggressively due to the increasing need to optimize business processes and reduce operational costs. Moreover, outsourcing provides businesses access to a huge talent pool with specific capabilities in technological operations, thus making it a viable solution, particularly for small and medium-sized businesses.

It would also allow the businesses to focus on their core operations as the IT-based processes are looked after by third-party suppliers. The rapid evolution of technologies including cloud computing, Artificial Intelligence, the Internet of Things, and others are transforming the market by providing huge opportunities for businesses to grow. Additionally, the growing demand for managed services and subscription-based models is also contributing to this growth.

Key Takeaways:

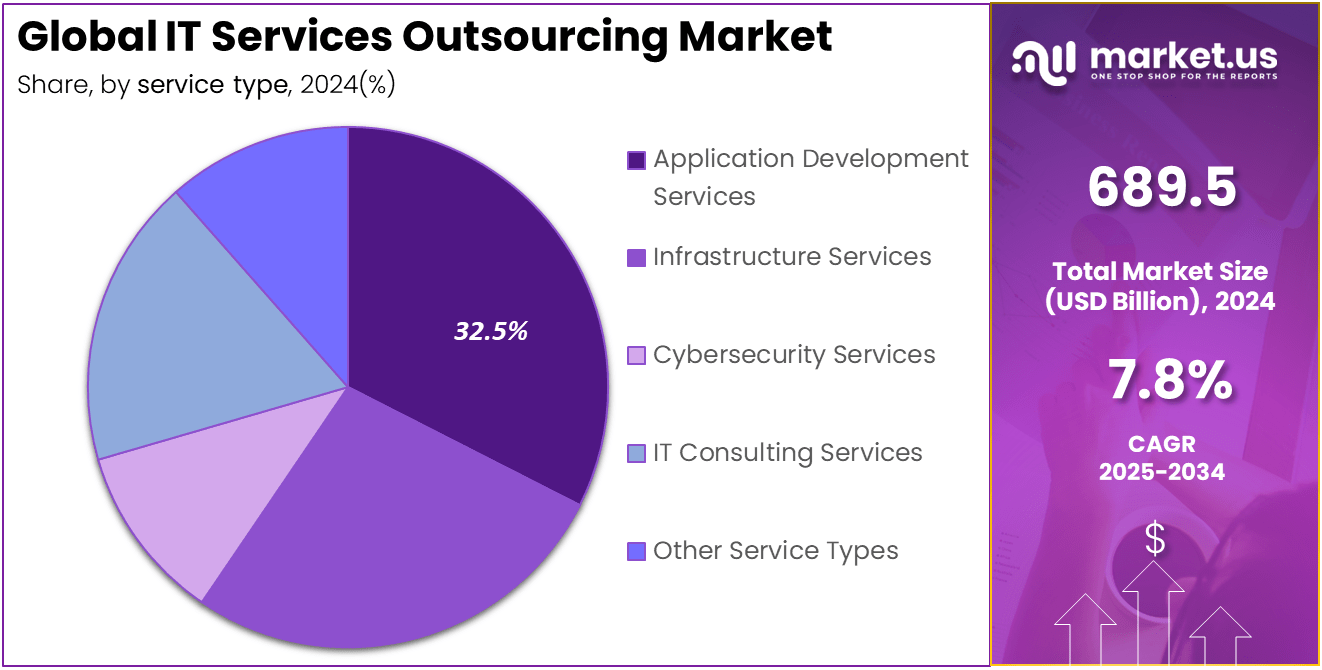

- In 2024, the Application Development Services segment held a dominant market position, capturing more than a 32.5% share of the Global IT Services Outsourcing Market.

- In 2024, the Offshore Outsourcing segment held a dominant market position, capturing more than a 49.1% share of the Global IT Services Outsourcing Market.

- In 2024, the BFSI segment held a dominant market position, capturing more than a 24% share of the Global IT Services Outsourcing Market.

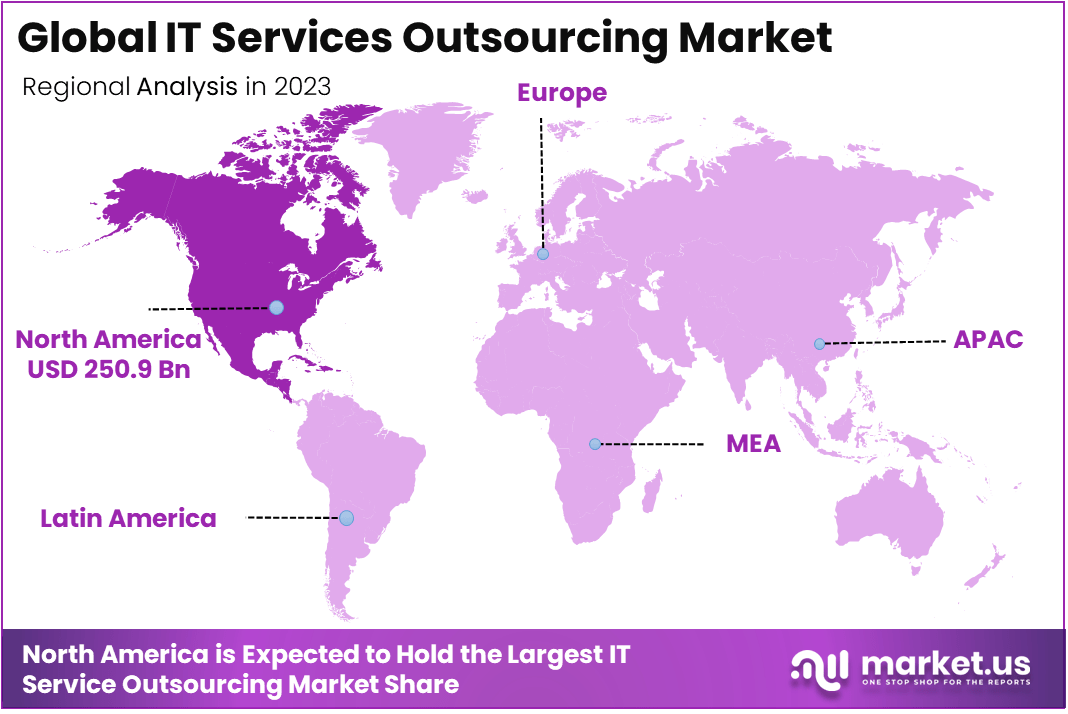

- In 2023, North America held a dominant market position in the global IT Services Outsourcing Market, capturing more than a 36.4% share.

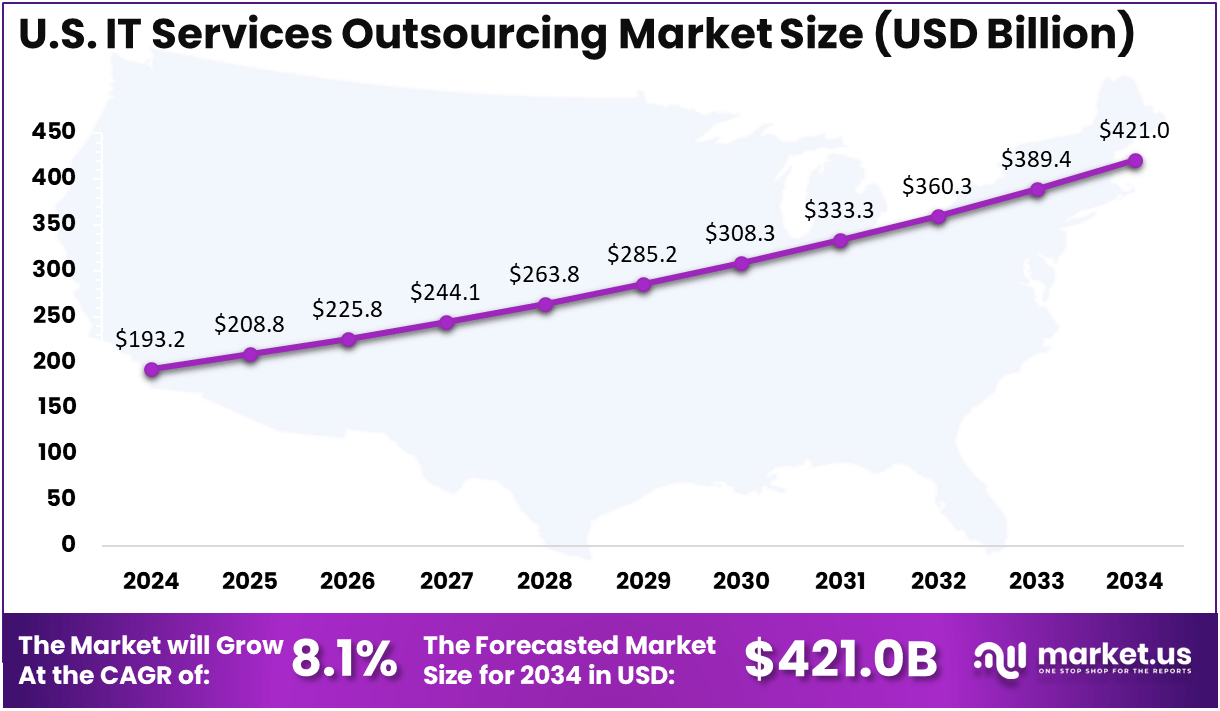

- The US IT Services Outsourcing Market was valued at USD 193.2 million in 2024, with a robust CAGR of 1%.

- According to the International Monetary Fund (IMF) survey, 95% of the banks in Hong Kong were planning to outsource technology-related processes to service providers and over 100 Authorized Institutions that provide banking, asset and wealth management, private equity business, and securities services have outsourced their business processes to service providers

- According to IAOP, more than 150,000 professionals are involved in the $6 trillion global outsourcing industry.

U.S. IT Services Outsourcing Market Size

The US IT Services Outsourcing Market was valued at USD 193.2 million in 2024, with a robust CAGR of 8.1%. This is attributed to the presence of advanced IT infrastructure in the U.S., making it easier for companies to outsource their IT services. The region also has a presence of numerous companies that provide a wide range of services.

Moreover, there is a high demand for specialized services in industries like finance, healthcare, and manufacturing to enhance its operations in the US region. With the development of different tech giants, access to third-party IT suppliers has become easier in the U.S. region.

In 2023, North America held a dominant market position in the global IT Services Outsourcing Market, capturing more than a 36.4% share. This is majorly due to the strong economic base of the North American region, creating a high demand for outsourcing. Additionally, the presence of a large pool of highly skilled IT professionals in North America has also enabled businesses to opt for outsourcing their IT services.

Furthermore, North America is highly investing in research and development of the IT sector, thus fostering innovation and keeping North American firms at the forefront. For instance, according to whitehouse.gov, the U.S. federal government allocated $75 billion for IT research and development spending.

Service Type Segment Analysis

In 2024, the Application Development Services segment held a dominant market position, capturing more than a 32.5% share of the Global IT Services Outsourcing Market. This could be attributed to the growing demand for custom software solutions across industries such as education, healthcare, and BFSI. Businesses are looking to increase their customer experience with the ongoing digital transformations in business processing. This leads to the outsourcing of application development services by businesses.

Moreover, this segment has allowed businesses to access a broad and diversified source of software development expertise at a lower cost, resulting in higher efficiency and cost savings. Businesses are also capable of adopting new technologies in application development such as blockchain and AI with the help of outsourcing. For instance, Altoros is an IT outsourcing company that provides mobile app development services for businesses including Sony, Siemens, and others.

Outsourcing of Application development services has allowed businesses to scale their business efforts according to their needs, thus providing greater flexibility to respond to market demands. It has also led to an experience dealing with the challenges and risks associated with application development, thus increasing the success rate of the project.

Outsourcing Type Segment Analysis

In 2024, the Offshore Outsourcing segment held a dominant market position, capturing more than a 49.1% share of the Global IT Services Outsourcing Market. this is primarily due to the access to a diverse range of skills and perspectives provided by offshore outsourcing.

Moreover, economic incentives such as tax reductions, subsidies, and favorable regulations offered by various countries have also contributed to the dominance of this segment in the market. for instance, in India, Special Economic Zones (SEZs) provide benefits such as duty-free imports, tax exemptions, and simplified regulations to attract foreign investment

Additionally, offshore outsourcing allows companies to optimize their resources by utilizing the specialized infrastructure and tools that are available in other countries. This could result in higher efficiency and effective outcomes.

Industry Vertical Segment Analysis

In 2024, the BFSI segment held a dominant market position, capturing more than a 24% share of the Global IT Services Outsourcing Market. This could be attributed to the higher reliance of the BFSI industry on technology for its operations, compliance, and customer engagement. For instance, according to financialservices.gov, in India, there were around 1,684 crores of digital transactions made in April 2024.

Moreover, outsourcing IT services has also helped the BFSI segment to modernize its systems with minimal risks and disruptions. The rise in fintech companies has also created a huge opportunity for traditional BFSI institutions to outsource IT services.

BFSI companies are increasingly demanding robust disaster recovery and business continuity plans. Outsourcing IT services has ensured that they have access to cutting-edge solutions and expertise which safeguards their operations against various disruptions.

Key Market Segments

By Service Type

- Application Development Services

- Infrastructure Services

- Cybersecurity Services

- IT Consulting Services

- Other Service Types

By Outsourcing Type

- Onshore Outsourcing

- Nearshore Outsourcing

- Offshore Outsourcing

By Industry Vertical

- BFSI

- Retail

- Healthcare

- Manufacturing

- Telecommunications

- Government and Public Sector

- Other Industry Verticals

Driving Factors

Increasing demand for specialized skills at a lesser cost

The increasing need for access to specialized skills in a minimum amount has driven the IT service outsourcing market. Companies often demand specialized skills for short-term projects or specific tasks. Thus hiring a full-time employee for this could be costly and inefficient, allowing them to opt for outsourcing these services. It allows companies to access the skills on an as-needed basis and at a lesser cost.

Outsourcing also enables companies to scale their workforce according to the availability of resources and project needs. It can also accelerate the project timelines by implementing new technologies and solutions in less time.

Restraining Factors

Data security concerns

Data security concern is a significant restraint for the IT service outsourcing market. Outsourcing the IT services including sharing sensitive and confidential data to the third-party suppliers or service providers. This generates a risk of data breach or access by unauthorized individuals, leading to potential financial and reputational damage.

Any data security incident could lead to damage to the reputation of the providers as well as the company that has outsourced the service. Moreover, the service providers could also become a target of cyberattacks, thus exposing the data of multiple clients publically.

Growth Opportunities

Globalization of companies

Globalization of businesses has presented various opportunities for market growth. With globalization, companies demand a robust IT infrastructure and support to manage their operations across different regions. This creates a demand for IT service outsourcing across the globe.

Globalization also allows companies to tap into a diverse and skilled workforce. It makes entry into the global market easier by providing local knowledge about cultural differences, market dynamics, and regulatory framework. For instance, Apple has partnered with Infosys, and by outsourcing IT services to Infosys, Apple can tap into the cost-effective and highly skilled workforce in India.

Challenging Factors

Lack of quality control

Lack of quality control is a significant challenge for the IT service outsourcing market. There are higher chances of inconsistent service delivery in the outsourcing method. This could lead to subpar performance as well as results, negatively impacting the business reputation.

This can give rise a trust issues between the client and the providers, thus leading to loss of business. In severe cases, it could also result in regulatory and compliance issues leading to huge fines and brand damage.

Growth Factors

There are various factors contributing to the growth of the market. the rise of hybrid working models leading to a need for robust IT infrastructure and support. This has driven the demand for outsourcing IT infrastructure.

Moreover, the increasing demand for sustainability and reducing carbon footprints, as well as the growth of smart city initiatives and EdTech has also led to an increasing demand for technology upgradation. This in turn leads to a growing demand for outsourcing IT services.

Latest Trends

The growing trend of integrating Artificial intelligence and automation in IT services is reshaping the market. This has increased the demand for outsourcing new technologies in the current infrastructure.

Moreover, with the rise in cyber threats, there is a growing focus on outsourcing cybersecurity services. Cloud-native and multi-cloud outsourcing services are also gaining popularity in the global market. These trends highlight the evolving landscape of the IT service outsourcing market.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

One of the leading players in the market is IBM Corporation which offers a comprehensive suite of IT service outsourcing solutions that are designed to help businesses modernize their operations, enhance their efficiency, and drive innovations.

Another prominent firm operating in the market is Accenture which offers a range of business process outsourcing services that aim at transforming and optimizing essential business processes.

Top Key Players in the Market

- IBM Corporation

- DXC Technology Company

- Fujitsu

- ScienceSoft USA Corporation

- Wipro

- Accenture

- TATA Consultancy Services Limited

- Infosys Limited

- Capgemini

- Cognizant

- Oracle Corporation

- BMC Software, Inc.

- Other Key Players

Recent Developments

- In April 2024, 80 Level, a global platform with 10 years of experience covering game development, announced its expansion into the outsourcing market. 80 Level Professional Services assist developers in optimizing efficiency and attracting clients for all types of game projects at reasonable costs.

- In February 2024, MGS, a leading end-to-end solutions provider, launched its Global Engineering Services Group, bringing together over 200 toolmakers and 85 engineers across the globe. This will allow MedTech, Diagnostic, and Pharma innovators to build projects across the entire production process.

- In February 2024, Accenture PLC acquired Insight Sourcing, a strategic sourcing and procurement services provider, aimed at enhancing its offerings for private equity firms and various industries, including consumer goods and technology.

Report Scope

Report Features Description Market Value (2024) USD 689.5 million Forecast Revenue (2034) USD 1,461.2 million CAGR (2025-2034) 7.8% Largest Market North America Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (Application Development Services, Infrastructure Services, Cybersecurity Services, IT Consulting Services, Other Service Types), by Outsourcing Type (Onshore Outsourcing, Nearshore Outsourcing, Offshore Outsourcing), by Industry Vertical (BFSI, Retail, Healthcare, Manufacturing, Telecommunications, Government and Public Sector, Other Industry Verticals), Region Regional Analysis North America (US, Canada), Europe (Germany, UK, Spain, Austria, Rest of Europe), Asia-Pacific (China, Japan, South Korea, India, Australia, Thailand, Rest of Asia-Pacific), Latin America (Brazil), Middle East & Africa(South Africa, Saudi Arabia, United Arab Emirates) Competitive Landscape IBM Corporation, DXC Technology Company, Fujitsu, ScienceSoft USA Corporation, Wipro, Accenture, TATA Consultancy Services Limited, Infosys Limited, Capgemini, Cognizant, Oracle Corporation, BMC Software, Inc., Other Key Players Customization Scope We will provide customization for segments and at the region/country level. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  IT Services Outsourcing MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

IT Services Outsourcing MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- IBM Corporation

- DXC Technology Company

- Fujitsu

- ScienceSoft USA Corporation

- Wipro

- Accenture

- TATA Consultancy Services Limited

- Infosys Limited

- Capgemini

- Cognizant

- Oracle Corporation

- BMC Software, Inc.

- Other Key Players