Global Legal Process Outsourcing (LPO) Market Size, Share, Statistics Analysis Report By Service Type (Contract Drafting & Management, Compliance Assistance, Litigation Support, eDiscovery, Intellectual Property (IP) Services, Legal Research, Others), By Location Type (Onshore, Offshore), By End-User (Law Firms, Corporate Legal Departments), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 32295

- Number of Pages: 338

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

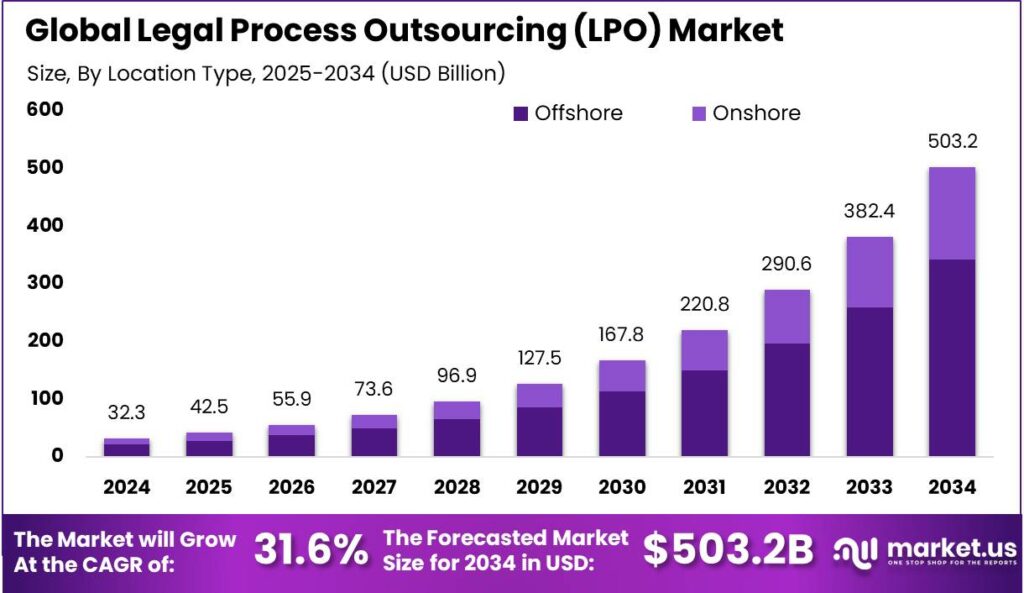

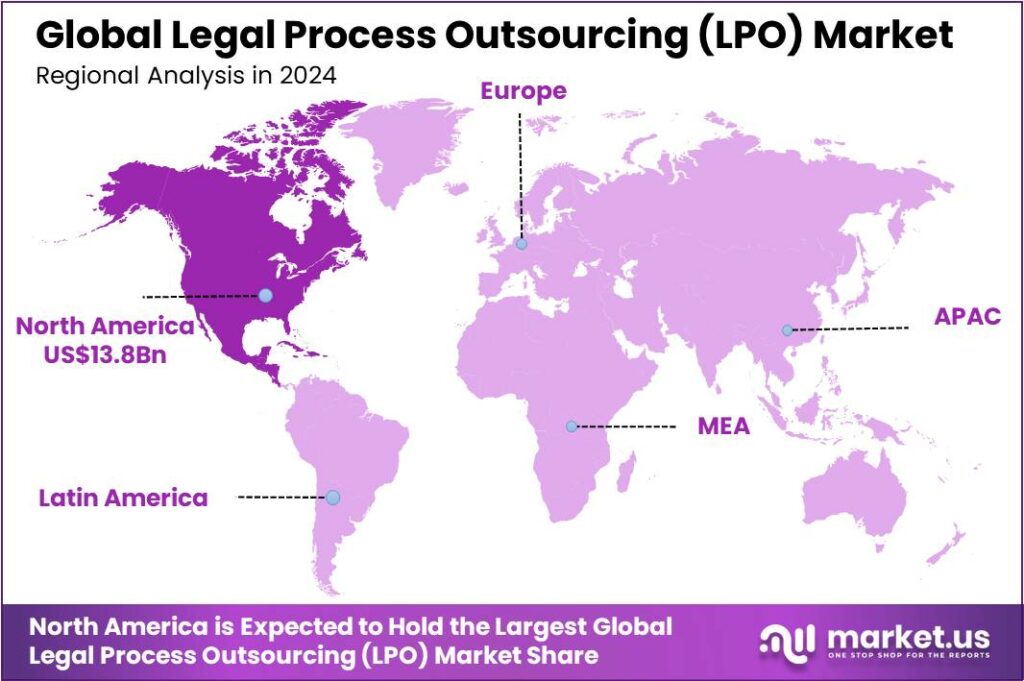

The Global Legal Process Outsourcing (LPO) Market size is expected to be worth around USD 503.2 Billion By 2034, from USD 32.3 Billion in 2024, growing at a CAGR of 31.60% during the forecast period from 2025 to 2034. In 2024, North America held over 43% of the global LPO market, generating USD 13.8 billion in revenue. The U.S. market was valued at USD 13.14 billion, driven by cost-efficient, scalable operations, and is projected to grow at a CAGR of 29.8%.

Legal Process Outsourcing (LPO) refers to the practice where law firms and corporations delegate specific legal tasks to external service providers. These tasks encompass a range of services, including contract drafting, legal research, patent support, compliance assistance, and litigation support. By outsourcing these functions, organizations aim to reduce operational costs, enhance efficiency, and focus on their core competencies.

The demand for LPO services is driven by the increasing complexity of legal work and the need for cost-effective solutions. LPO allows organizations to manage fluctuating workloads by providing specialized expertise and scalable resources. This approach optimizes resource allocation, helping firms respond quickly to client needs, meet deadlines, and handle large volumes of legal work efficiently.

Technological advancements play a pivotal role in the evolution of the LPO market. The integration of artificial intelligence (AI) and machine learning in legal processes has enhanced the accuracy and speed of tasks such as document review and legal research. These technologies not only improve efficiency but also reduce the likelihood of human error, making them attractive to legal service providers and clients alike.

Investments in the LPO sector are on the rise, with firms recognizing the potential for high returns and operational benefits. The scalability of LPO services allows businesses to adjust their legal support needs based on demand, providing flexibility and cost savings. Moreover, outsourcing legal processes enables organizations to tap into a global talent pool, ensuring access to diverse legal expertise.

The regulatory environment surrounding LPO is becoming increasingly stringent, with a focus on data security and compliance. Service providers must adhere to various international standards and regulations to ensure the confidentiality and integrity of legal information. This emphasis on compliance underscores the importance of selecting reputable LPO partners with robust security measures in place.

Key Takeaways

- The Global Legal Process Outsourcing (LPO) Market is expected to be worth USD 503.2 Billion by 2034, up from USD 32.3 Billion in 2024, growing at a CAGR of 31.60% during the forecast period from 2025 to 2034.

- In 2024, the Contract Drafting & Management segment held a dominant market position, capturing more than a 22% share in the global Legal Process Outsourcing (LPO) market.

- The Offshore segment held a dominant market position in 2024, capturing more than 68% share in the global Legal Process Outsourcing (LPO) market, mainly due to its significant cost advantage and access to a wide talent pool.

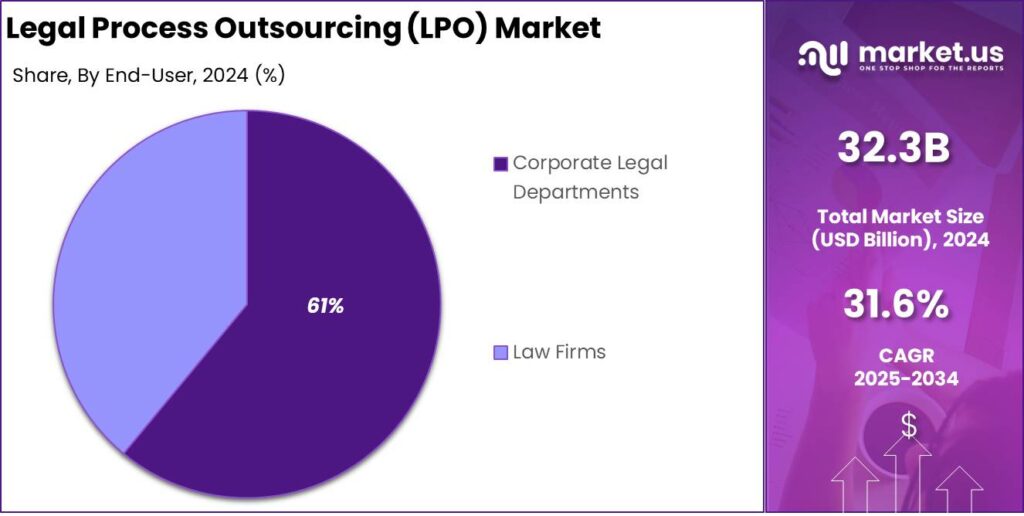

- In 2024, the Corporate Legal Departments segment held a dominant market position, capturing more than 61% share of the global Legal Process Outsourcing (LPO) market.

- North America held a dominant market position in 2024 in the global Legal Process Outsourcing (LPO) market, capturing more than 43% share and generating USD 13.8 billion in revenue.

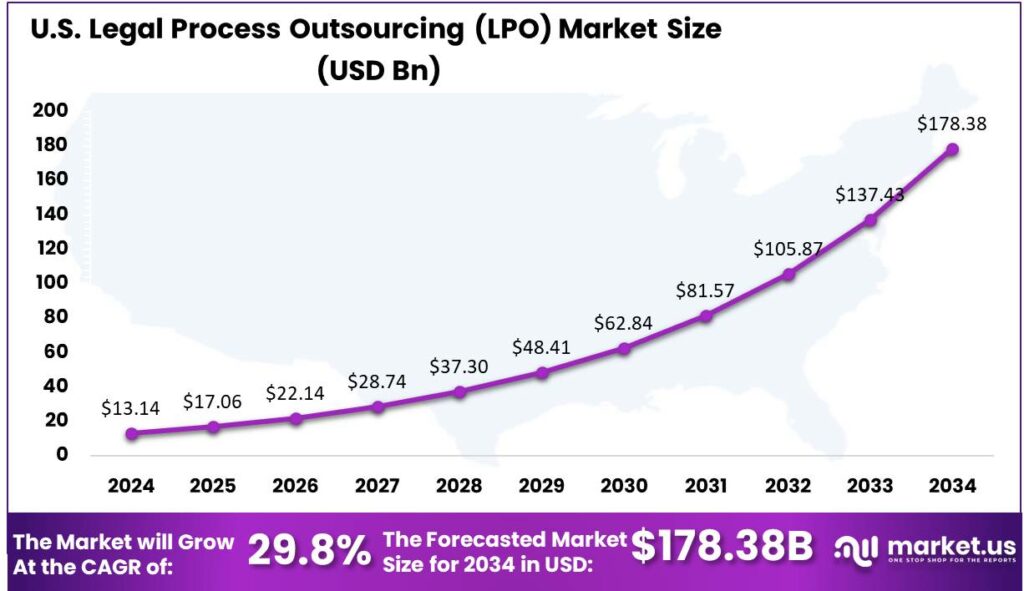

- In 2024, the U.S. Legal Process Outsourcing (LPO) market was valued at USD 13.14 billion, driven by the shift toward cost-efficient, scalable operations, and it is projected to grow at a CAGR of 29.8%.

Business Benefits

Delegating routine legal tasks to external providers enables in-house teams to concentrate on strategic initiatives. This shift in focus enhances the firm’s ability to deliver value-added services and strengthen client relationships.

According to the Virtual Legal Assistant article, automating routine tasks like data entry and document review has boosted productivity by 40% in some firms, freeing in-house legal teams to focus on high-level strategy.

LPO enables organizations to reduce legal expenses by outsourcing tasks to regions with lower labor costs. Outsourcing to countries like India offers major savings, as legal services cost far less than in developed nations, enabling better resource allocation and higher profitability.

LPO providers often operate across different time zones, facilitating round-the-clock work cycles. This continuous workflow accelerates the completion of legal tasks, leading to faster delivery of services to clients. Timely execution enhances client satisfaction and provides a competitive edge in the legal market.

U.S. Market Size

In 2024, the U.S. Legal Process Outsourcing (LPO) market was valued at USD 13.14 billion, reflecting the growing shift of legal departments and law firms toward more cost-efficient and scalable operational models.

Legal outsourcing in the U.S. has gained considerable traction as firms increasingly delegate repetitive, time-consuming tasks such as legal research, contract management, litigation support, and document review to external vendors.

The market is witnessing a significant growth trajectory, projected to expand at a compound annual growth rate (CAGR) of 29.8% over the forecast period. This robust growth can be attributed to multiple driving factors, including the rapid digitization of legal workflows, increased demand for AI-enabled legal analytics, and the globalization of legal service delivery models.

Additionally, advancements in legal technology are transforming the LPO landscape in the United States. Automation tools, e-discovery platforms, and secure cloud-based legal management systems are enabling outsourcing firms to handle complex legal functions more efficiently. This technological integration not only reduces turnaround time but also enhances accuracy and compliance in high-stakes legal processes.

In 2024, North America held a dominant market position in the global Legal Process Outsourcing (LPO) market, capturing more than a 43% share and generating USD 13.8 billion in revenue. This leadership can be primarily attributed to the region’s mature legal infrastructure, high operational costs of traditional law firms, and an increasing inclination toward alternative legal service models.

Organizations are increasingly partnering with LPO providers for services like contract management, intellectual property support, due diligence, and e-discovery. The region is also seeing a surge in technology-driven legal outsourcing, using AI, machine learning, and automation to streamline legal tasks. These innovations reduce turnaround times, improve accuracy, and enhance compliance, making LPO a key strategy in corporate legal workflows.

Another critical aspect contributing to North America’s dominance is its strict regulatory environment and growing compliance burden. Companies in finance, healthcare, and technology face constant pressure to meet legal and regulatory requirements. Outsourcing specialized legal tasks to expert service providers has become a strategic way to ensure compliance and reduce legal risks and costs.

The North American market is also supported by the increasing integration of nearshoring and hybrid outsourcing models, where companies balance onshore control with offshore cost advantages. Countries like Canada and Mexico are emerging as favorable nearshore LPO destinations, offering legal professionals well-versed in North American laws and fluent in English.

Service Type Analysis

In 2024, Contract Drafting & Management segment held a dominant market position, capturing more than a 22% share in the global Legal Process Outsourcing (LPO) market. This leadership can be attributed to the increasing complexity of business transactions and the growing demand for efficient contract governance across sectors such as IT, healthcare, banking, and manufacturing.

As companies operate across multiple jurisdictions, the need for professionally drafted, reviewed, and managed contracts has become essential to mitigate risks, ensure regulatory compliance, and avoid costly legal disputes. Outsourcing these tasks to specialized LPO providers enables legal departments to streamline contract workflows while reducing internal workloads.

A key factor driving this segment’s growth is the adoption of contract lifecycle management (CLM) platforms, which let LPO firms deliver seamless, end-to-end contract services. Combined with legal expertise, these tools enable fast, accurate handling of high contract volumes.

Post-pandemic remote work has highlighted the need for centralized digital contract management. Companies now prioritize outsourcing partners that offer both legal precision and cloud-based access. Contract Drafting & Management has become vital in M&A, vendor deals, service contracts, and data-sharing elevating it from a cost-saving option to a strategic essential.

Location Type Analysis

In 2024, the Offshore segment held a dominant market position, capturing more than a 68% share in the global Legal Process Outsourcing (LPO) market, and this leadership can be primarily attributed to its significant cost advantage and access to a wide talent pool.

Moreover, offshore providers have rapidly adopted advanced legal technologies and infrastructure to deliver high-value services such as contract lifecycle management, litigation support, intellectual property services, and compliance monitoring. These service capabilities are being continuously upgraded to align with global standards, giving offshore vendors a competitive edge.

The offshore segment’s dominance is driven by growing client confidence in data security and process integrity across borders. Stringent privacy standards, such as ISO and GDPR compliance, along with dedicated teams and secure cloud workflows, have shifted offshore LPOs from basic support roles to trusted, full-service legal providers.

The flexibility of offshore LPOs is key for clients needing to scale quickly, whether due to litigation surges or regulatory changes. By offering resource agility without long-term hiring commitments, and continuing investment in legal tech and training, offshore providers remain the top choice for legal outsourcing.

End-User Analysis

In 2024, Corporate Legal Departments segment held a dominant market position, capturing more than a 61% share of the global Legal Process Outsourcing (LPO) market. This dominance is largely due to the increasing pressure on corporations to manage growing legal workloads while simultaneously controlling operational costs.

As regulatory environments become more complex and global operations more interconnected, corporate legal teams are turning to LPO providers for specialized support in areas such as contract management, compliance, litigation support, and intellectual property monitoring. By outsourcing non-core legal functions, these departments are able to focus on strategic advisory roles and higher-value legal decision-making.

Corporate legal departments, unlike traditional law firms, prioritize efficiency, scalability, and cost optimization. Adopting a hybrid service model, they outsource routine tasks to LPO firms, reducing costs and ensuring consistent quality across regions. Industries like banking, tech, pharma, and manufacturing are increasingly investing in outsourcing to stay agile amid evolving regulations.

The growing use of legal tech by corporate clients has reinforced the leadership of this segment. Companies are leveraging AI-driven contract analytics, workflow automation, and cloud-based tools through LPO partners, enhancing transparency, compliance, and audit readiness. As a result, tech-enabled LPOs are evolving into long-term strategic partners rather than just vendors.

Key Market Segments

By Service Type

- Contract Drafting & Management

- Compliance Assistance

- Litigation Support

- eDiscovery

- Intellectual Property (IP) Services

- Legal Research

- Others

By Location Type

- Onshore

- Offshore

By End-User

- Law Firms

- Corporate Legal Departments

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Cost Efficiency and Operational Optimization

The main driver of Legal Process Outsourcing (LPO) growth is its cost efficiency and operational benefits, allowing law firms and legal departments to cut expenses by outsourcing routine tasks like document review, legal research, and contract management.

Outsourcing to lower-cost regions like India and the Philippines significantly reduces legal expenses, allowing firms to invest in strategic initiatives like service expansion and technology, boosting overall competitiveness.

LPO providers bring specialized expertise and advanced technology that enhance efficiency and service quality. This helps organizations streamline legal processes, reduce turnaround times, and deliver consistent, high quality results driving cost savings, client satisfaction, and sustained growth.

Restraint

Data Security and Confidentiality Concerns

A major barrier to adopting Legal Process Outsourcing (LPO) is the concern over data security and confidentiality. Legal processes involve sensitive information, and outsourcing raises fears of data breaches and unauthorized access, especially when outsourcing to offshore locations with varying data protection regulations.

The risk of handling sensitive client information is a major concern in the LPO market, with potential violations of attorney-client privilege and data breaches leading to legal liabilities and reputational damage. To mitigate these risks, LPO providers must implement robust data security measures, including encryption, secure storage, and strict access controls.

Compliance with international standards like GDPR and obtaining relevant certifications can enhance client trust. However, concerns about data security and confidentiality continue to hinder widespread LPO adoption.

Opportunity

Expansion into Emerging Markets

The expansion of Legal Process Outsourcing (LPO) into emerging markets like Asia-Pacific, Latin America, and Africa presents significant growth opportunities. Driven by economic development and globalization, these regions offer a skilled legal workforce, cost advantages, and favorable regulatory environments, making them ideal for LPO investments.

Emerging markets in Asia-Pacific, Latin America, and Africa are expected to drive growth in the LPO sector as multinational companies expand into these regions. This presents opportunities for LPO providers to offer tailored services while leveraging advanced technologies like AI and machine learning to improve efficiency. Innovations such as predictive analytics and automated document review can help meet client needs and provide a competitive advantage.

Challenge

Maintaining Quality Control and Accountability

Maintaining quality control and accountability is a key challenge in the Legal Process Outsourcing (LPO) industry. As tasks are outsourced, ensuring consistent quality and adherence to standards is crucial. Differences in legal systems, culture, and communication can lead to discrepancies in service delivery, potentially impacting legal outcomes.

Challenges in Legal Process Outsourcing (LPO) include data security risks, quality control issues, communication barriers, and dependency on external providers. To address these, it’s crucial to establish quality assurance mechanisms like clear service agreements, regular evaluations, and training for LPO staff. Strong collaboration, open communication, standardized processes, and technology platforms can help ensure accountability, real-time monitoring, and effective legal service delivery.

Key Growth Factors

- Cost Efficiency and Resource Optimization: Law firms and corporations are increasingly turning to LPO to manage rising legal expenses. Outsourcing tasks like document review and legal research to countries with lower labor costs helps organizations cut operational expenses.

- Access to Specialized Legal Expertise: LPO providers offer access to legal experts in areas like IP, compliance, and contract law, helping organizations manage complex tasks effectively and achieve high-quality outcomes without extensive in-house training or recruitment.

- Technological Advancements in Legal Services: The integration of AI and machine learning has transformed legal processes, with LPO firms using these technologies to improve accuracy and efficiency in tasks like e-discovery and legal analytics, delivering faster and more reliable services to clients.

- Scalability and Flexibility in Legal Operations: LPO offers organizations the ability to scale legal services up or down based on demand. This flexibility helps firms manage fluctuating workloads, adapting quickly without the need for permanent staffing changes.

- Global Expansion and Round-the-Clock Support: With LPO providers operating across various time zones, organizations benefit from 24/7 legal support. This global reach ensures continuous progress on legal matters, improving turnaround times and client satisfaction.

Emerging Trends

Legal Process Outsourcing (LPO) is undergoing significant transformation, driven by technological advancements and evolving client expectations. One prominent trend is the integration of automation and artificial intelligence (AI) into LPO services. These technologies streamline repetitive tasks, enhance accuracy, and expedite legal processes, thereby improving overall efficiency .

Another notable development is the heightened focus on compliance. With increasing concerns about data privacy and protection, LPO providers are emphasizing adherence to data protection regulations and industry standards. This ensures that legal processes meet regulatory requirements and safeguard sensitive information .

The emergence of niche services within LPO is also gaining traction. Specialized providers are offering services tailored to specific areas of law, such as intellectual property, environmental law, and regulatory compliance. These niche services cater to the unique needs of specialized legal practices, providing expert knowledge in specific legal fields .

Key Player Analysis

UnitedLex Corporation is a global leader in the LPO market and is known for its deep legal knowledge combined with advanced technology. UnitedLex provides end-to-end legal services, including litigation support, contract management, and data privacy solutions. By leveraging AI and analytics, it reduces legal costs and enhances compliance and efficiency for clients.

Integreon Inc. is another top player, trusted by law firms and corporations worldwide. It offers a wide range of services, such as document review, contract management, and regulatory compliance. The company invests heavily in training and compliance to ensure high standards. With delivery centers across different countries, Integreon offers 24/7 support and customized solutions tailored to client needs.

Clairvolex is known for its strong focus on intellectual property (IP) services, making it a niche leader in the LPO space. Clairvolex offers patent portfolio management, IP strategy, and licensing support, blending legal expertise with tech innovation. Using smart tools and data analytics, it helps clients maximize the value of their patents and trademarks.

Top Key Players in the Market

- UnitedLex Corporation

- Integreon Inc.

- Clairvolex

- Clutch Group

- Cobra Legal Solutions LLC

- CPA Global Ltd.

- Evalueserve

- Exigent

- Infosys Ltd

- Integreon Managed Solutions Inc.

- Legal Advantage LLC

- Lex Outsourcing

- Lexplosion Solutions Pvt. Ltd.

- Lexsphere Pvt. Ltd.

- Mindcrest Inc.

- Pangea3

- QuisLex Inc.

- Other Key Players

Top Opportunities for Players

- Embracing Advanced Technologies: The integration of artificial intelligence (AI) and machine learning (ML) into legal processes is transforming the LPO landscape. These technologies enhance efficiency in tasks like document review and legal research, enabling providers to offer faster and more accurate services.

- Specialization in Niche Legal Services: There is a growing demand for specialized legal services in areas such as intellectual property, regulatory compliance, and environmental law. LPO providers that develop expertise in these niches can cater to specific client needs, offering tailored solutions that add significant value.

- Expansion into Emerging Markets: Emerging economies, particularly in the Asia-Pacific region, present substantial growth opportunities for LPO providers. Expanding legal services in countries like India leverages cost-effective talent pools and meets the growing demand for legal support.

- Development of Flexible Service Models: Clients are increasingly seeking flexible and scalable legal solutions. By offering hybrid models that combine onshore and offshore services, LPO providers can meet diverse client needs, ensuring cost efficiency and compliance with local regulations, ultimately enhancing client satisfaction and loyalty.

- Strengthening Data Security and Compliance: As data privacy regulations become more stringent globally, ensuring robust data security measures is paramount. LPO providers prioritizing compliance with international standards and advanced cybersecurity build trust, positioning themselves as reliable partners in managing sensitive legal information.

Recent Developments

- In March 2024, Epiq, a global leader in technology-driven solutions for the legal and corporate sectors, announced an expanded partnership with Mintz. This collaboration will introduce enhanced business process outsourcing and workplace transformation services, including Records and Information Management (RIM), to all Mintz offices.

Report Scope

Report Features Description Market Value (2024) USD 32.3 Bn Forecast Revenue (2034) USD 503.2 Bn CAGR (2025-2034) 31.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Service Type (Contract Drafting & Management, Compliance Assistance, Litigation Support, eDiscovery, Intellectual Property (IP) Services, Legal Research, Others), By Location Type (Onshore, Offshore), By End-User (Law Firms, Corporate Legal Departments) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape UnitedLex Corporation, Integreon Inc., Clairvolex, Clutch Group, Cobra Legal Solutions LLC, CPA Global Ltd., Evalueserve, Exigent, Infosys Ltd, Integreon Managed Solutions Inc., Legal Advantage LLC, Lex Outsourcing, Lexplosion Solutions Pvt. Ltd., Lexsphere Pvt. Ltd., Mindcrest Inc., Pangea3, QuisLex Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Legal Process Outsourcing (LPO) MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample

Legal Process Outsourcing (LPO) MarketPublished date: May 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Integreon, Inc.

- Clairvolex

- Elevate Legal Services UK Ltd.

- Infosys Limited

- Exigent Group Limited

- Evalueserve

- UnitedLex

- Legal Advantage LLC

- Lex Outsourcing

- Mindcrest Inc.

- Lexplosion Solutions Pvt. Ltd.

- QuisLex, Inc.

- Other Key Players