Global Device as a Service Market By Component (Hardware, Software, and Services), By Enterprise Size (Small & Medium Enterprise and Large Enterprise), By Device Type (Desktop, Laptop, Notebook, & Tablet, and Others), By End-Use Industry (IT & Telecommunications, BFSI, Healthcare & Life Science, Education, Government & Public Sector, Other End-Use Industries), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct. 2024

- Report ID: 73168

- Number of Pages: 397

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Device as a Service Statistics

- Component Analysis

- Device Type Analysis

- Enterprise Size Analysis

- End-Use Industry Analysis

- Kеу Маrkеt Ѕеgmеntѕ

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Top Use Cases

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

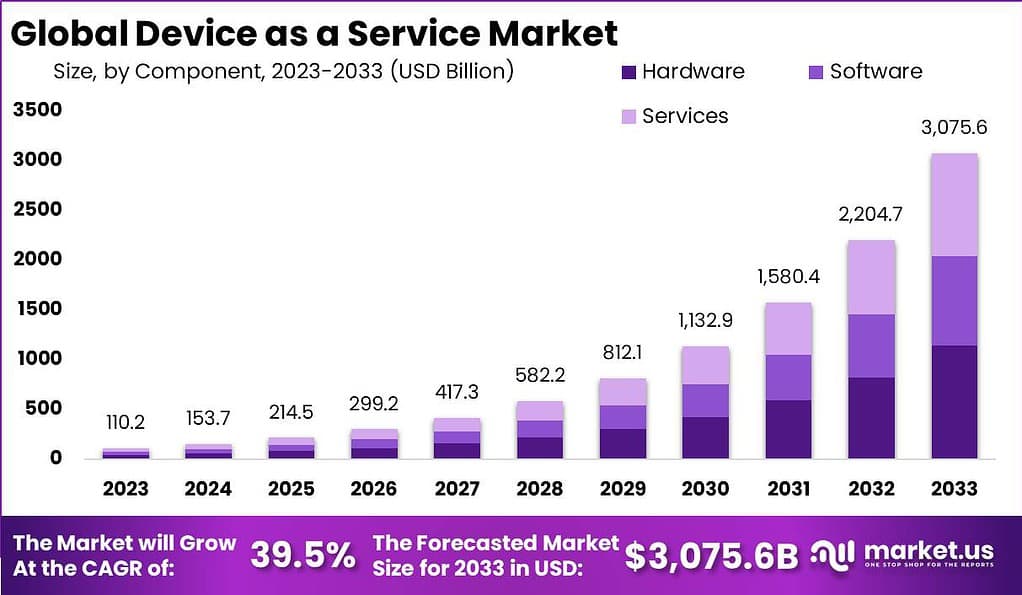

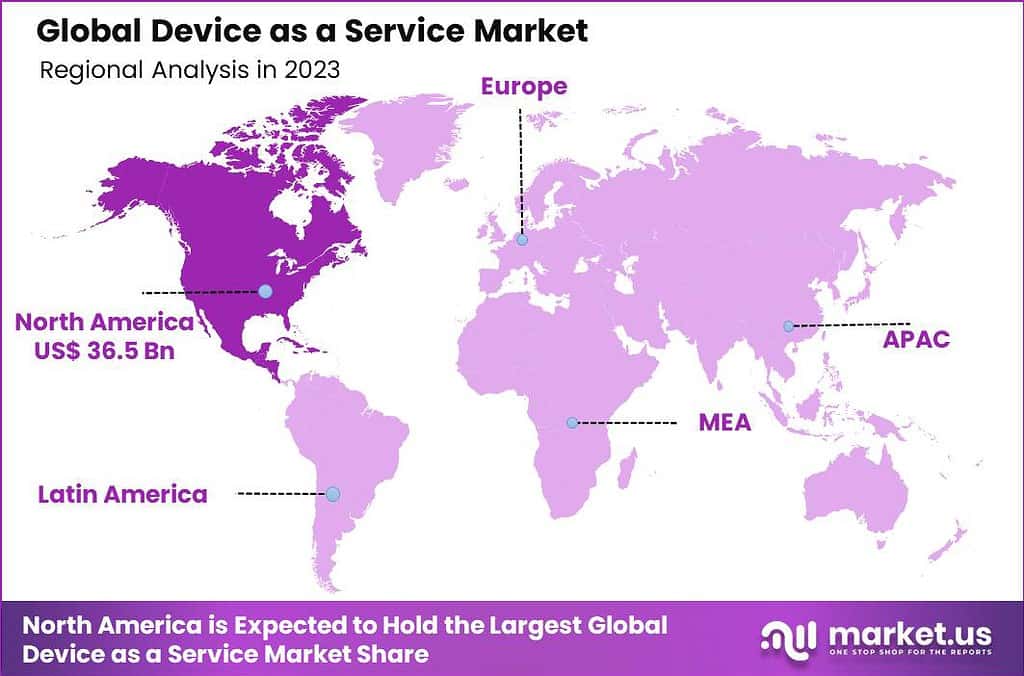

The Global Device as a Service Market size is expected to be worth around USD 3,075.6 Billion by 2033, from USD 110.2 Billion in 2023, growing at a CAGR of 39.5% during the forecast period from 2024 to 2033. In 2023, North America held a dominant market position, capturing more than a 33.2% share, holding USD 36.5 Billion revenue.

Device as a Service (DaaS) is a subscription-based model where businesses get hardware, software, and device management services for a monthly fee per user. This approach helps companies avoid large upfront investments in IT equipment. DaaS providers handle everything from device setup and maintenance to security and software updates, allowing businesses to scale their hardware needs according to changes in their workforce.

The DaaS market is growing as more businesses recognize the value of outsourcing their device procurement and management to improve flexibility and reduce costs. The market is expanding as companies from small startups to large corporations adopt DaaS to handle their IT needs more efficiently. This trend is driven by the increasing demand for scalable solutions that support remote work environments and the need to reduce capital expenditures on IT infrastructure.

The growth of the DaaS market is fueled by several factors. Firstly, it reduces the IT burden, allowing companies to shift resources from managing hardware to focusing on strategic initiatives. Secondly, it offers financial flexibility by reducing upfront costs and providing predictable monthly expenses. This is particularly appealing to startups and small businesses that may have limited initial capital.

Additionally, the need for advanced, regularly updated technology across various sectors drives the demand for DaaS, as it ensures employees have the best tools at their disposal without the company needing to continually invest in new hardware

The demand in the DaaS market is largely fueled by the increasing need for flexibility in device management and the widespread adoption of remote and hybrid work models. As businesses continue to adapt to dynamic work environments, the need for solutions that can provide updated technology and support without the hassle of in-house management continues to grow.

Opportunities in the DaaS market are significant, especially in sectors like education, healthcare, and industries with large mobile workforces. There is also potential for growth in offering customized solutions tailored to specific industry needs, providing more than just hardware but also specialized software and security solutions as part of the DaaS package.

Key Takeaways

- The DaaS market is projected to expand from USD 110.2 Billion in 2023 to USD 3,075.6 Billion by 2033, demonstrating a staggering CAGR of 39.5%. This growth underscores the increasing demand for flexible, scalable technology solutions in business environments.

- The Hardware component led the market in 2023, holding over 37.3% share, driven by the surge in demand for cutting-edge hardware devices across diverse sectors.

- The Desktop device type was the market leader, capturing more than 41.1% share, favored for its processing power and security features essential in enterprise settings.

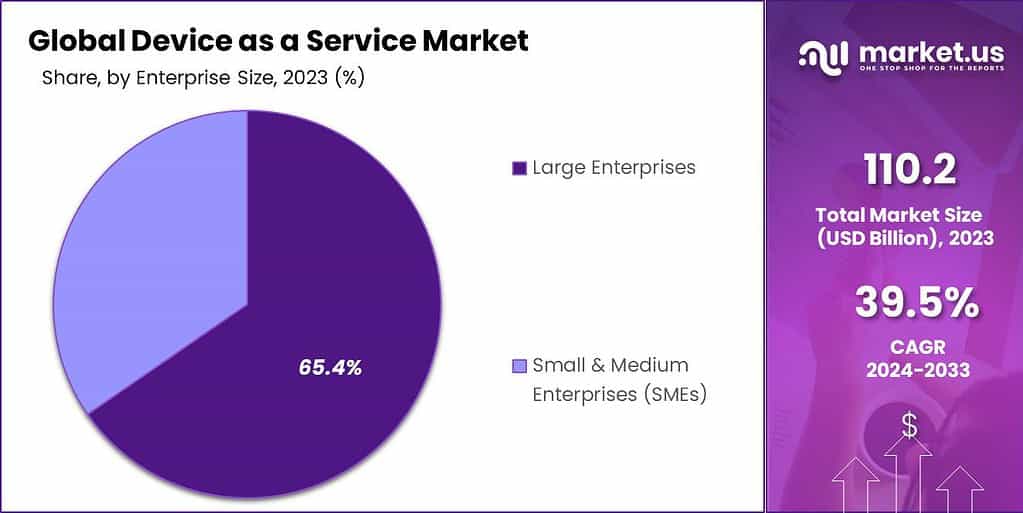

- Large Enterprises dominated the enterprise size segment, accounting for over 65.4% of the market, benefiting from DaaS’s scalability and comprehensive solutions.

- The IT & Telecommunications industry emerged as the leading end-use sector with a 21.5% share, necessitating continuous technology updates to maintain operational efficiency.

- North America emerged as a dominant force, holding a 33.2% market share in 2023. This dominance is attributed to the region’s quick adoption of innovative business models and a strong technological infrastructure.

Device as a Service Statistics

- 16% of medium-sized business employees and 12% of small business employees believe their companies are adopting new technologies.

- The Device as a Service (DaaS) market is expected to reach $10.7 billion by 2023, reflecting significant growth potential.

- Accenture leads the DaaS market with a 23% market share, showcasing its dominant influence.

- Acer Inc. and Apple Inc. each hold 9% of the DaaS market share.

- Cisco and Cognizant are key players, each with an 8% share in the market.

- Computacenter contributes 7% to the market, demonstrating strong presence.

- Dell Technologies and Intel Corporation each command a 6% share.

- Lenovo holds a 5% market share, indicating robust participation.

- Hewlett-Packard has a market share of 3%, highlighting its involvement.

- The European market is significant, with a 28.6% share in the DaaS industry.

- The Asia-Pacific region is a major player, holding 23.8% of the market share.

- South America’s market share stands at 9.9%, illustrating regional engagement.

- The Middle East and Africa region accounts for 8.6% of the market.

- Only 0.30% of businesses with fewer than nine employees currently utilize DaaS; however, 19% plan to adopt it.

- Among businesses with 10-19 employees, 6% use DaaS currently, with 17% planning to implement it.

- For companies with 20-49 employees, 7% already utilize DaaS, with another 17% planning adoption.

- In larger organizations with 50-99 employees, 8% are current users, while 19% are considering future adoption.

Component Analysis

In 2023, the Hardware segment held a dominant market position in the Device as a Service (DaaS) market, capturing more than a 37.3% share. This substantial market share can be attributed to the escalating demand for state-of-the-art hardware devices across various sectors, including corporate environments, education, and healthcare.

Enterprises are increasingly adopting DaaS models to mitigate the high capital expenditure associated with the upfront purchase of hardware devices. By integrating hardware procurement with services and software into a single subscription model, organizations can enjoy the benefits of the latest technologies without the burden of significant initial investments. The flexibility and scalability offered by the DaaS model are particularly appealing, allowing businesses to adjust their hardware inventory in line with their evolving requirements.

The leading position of the Hardware segment is further bolstered by the rapid technological advancements and the continuous need for hardware updates. In the dynamic landscape of information technology, the lifecycle of hardware devices is becoming increasingly shorter, necessitating frequent upgrades to keep pace with technological advancements.

The DaaS model addresses this challenge effectively by ensuring that clients have access to the most current hardware, thereby enhancing operational efficiency and productivity. Furthermore, the comprehensive nature of DaaS agreements, which often include maintenance, support, and eventual device replacement, adds significant value for customers.

Device Type Analysis

In 2023, the Desktop segment held a dominant market position in the Device as a Service (DaaS) market, capturing more than a 41.1% share. This prominence is largely due to the enduring preference for desktops in various enterprise environments where stationary workstations are prevalent.

Desktops offer superior processing power, larger storage capacities, and enhanced security features compared to their portable counterparts, making them indispensable in sectors that demand robust computing capabilities.

Moreover, the adaptability of desktops to integrate with a wide range of peripherals and enterprise systems further cements their leading position. The cost-effectiveness of desktops in a DaaS model, where businesses can access the latest technology without the hefty upfront costs, also contributes to their significant market share.

The Desktop segment benefits from the increasing trend of businesses upgrading their IT infrastructure to accommodate evolving work demands, particularly in data-intensive industries like finance, design, and software development. In these sectors, the reliability, performance, and security offered by desktops are unmatched.

Additionally, the DaaS model enhances the appeal of desktops by offering businesses scalable solutions that include maintenance, support, and regular updates, ensuring that organizations can maintain a competitive edge with the latest technology.

Enterprise Size Analysis

In 2023, the Large Enterprises segment held a dominant market position in the Device as a Service (DaaS) market, capturing more than a 65.4% share. This significant market share is primarily due to the large-scale operational and technological needs of these enterprises, which align well with the comprehensive solutions offered by DaaS models.

Large enterprises, with their complex IT infrastructure and diverse technology requirements, find great value in DaaS offerings, as these services provide a scalable and flexible solution to managing a vast array of devices. Moreover, the ability to bundle hardware, software, and services into a single, predictable monthly payment allows these organizations to optimize their IT budgets and redirect capital expenditure towards other strategic investments.

The appeal of DaaS for large enterprises also stems from the enhanced operational efficiency and simplified device management it offers. With IT environments that are often spread across multiple locations and include thousands of devices, large enterprises benefit from the centralized management and support provided by DaaS providers. This not only ensures uniformity and compliance across the organization’s technological assets but also significantly reduces the burden on internal IT teams.

Furthermore, DaaS models incorporate the latest security measures, crucial for large enterprises facing increasing cyber threats. By ensuring devices are always up to date with the latest security software and hardware configurations, DaaS helps mitigate the risk of data breaches and cyber-attacks, thereby providing a secure and efficient IT operation.

End-Use Industry Analysis

In 2023, the IT & Telecommunications segment held a dominant market position in the Device as a Service (DaaS) market, capturing more than a 21.5% share. This leadership position can be attributed to the intrinsic nature of the IT and telecommunications industry, which requires continuous updates and access to the latest technology to support its operations and services.

The DaaS model, offering flexible and scalable access to the latest hardware, software, and support services through a subscription-based payment model, perfectly aligns with the dynamic needs of this sector. Additionally, the constant evolution in telecommunications necessitates frequent upgrades to hardware and software, making the DaaS model particularly appealing as it ensures businesses can keep pace with technological advancements without incurring prohibitive costs.

The IT & Telecommunications sector’s reliance on high-performance and reliable technology infrastructure further underscores the importance of the DaaS model. In an era where downtime or technological obsolescence can lead to significant losses, the ability to swiftly adapt and upgrade technology resources is invaluable.

DaaS providers cater to this need by offering end-to-end management of devices, including regular updates, maintenance, and eventual replacement, thus ensuring that the IT and telecommunications services remain uninterrupted and competitive. Furthermore, the sector’s emphasis on security and compliance is well-served by the DaaS model, which can offer the latest security features and software updates to protect against cyber threats.

Kеу Маrkеt Ѕеgmеntѕ

By Component

- Hardware

- Software

- Services

By Enterprise Size

- Small & Medium Enterprise

- Large Enterprise

By Device Type

- Desktop

- Laptop, Notebook, & Tablet

- Smartphone & Peripheral

By End-Use Industry

- IT & Telecommunications

- BFSI

- Healthcare & Life Science

- Education

- Government & Public Sector

- Other End-Use Industries

Driver

Accelerated Embrace of the Subscription-Based Services Model

The accelerated embrace of the subscription-based services model has emerged as a significant driver for the Device as a Service (DaaS) market. This model’s attractiveness lies in its ability to offer businesses operational flexibility, financial predictability, and access to the latest technologies without hefty upfront investments.

Companies increasingly prefer the subscription model because it allows them to scale their IT infrastructure up or down based on current needs, transforming a significant capital expenditure into a manageable operational cost.

Moreover, the subscription model aligns with the shift towards digital transformation and cloud services, where businesses seek to leverage technology to enhance efficiency and competitiveness. This growing preference for subscription-based services has propelled the DaaS market forward, making technology adoption more accessible and adaptable for businesses across various industries.

Restraint

Limited Awareness of Device as a Service Benefits

One of the primary restraints facing the Device as a Service (DaaS) market is the limited awareness of its benefits among potential users. Despite its advantages, including cost savings, scalability, and access to the latest technology, many businesses are still unfamiliar with the DaaS model and its potential impact on their operations.

This lack of understanding can lead to hesitation in adopting DaaS solutions, as organizations may not fully grasp how DaaS can address their specific needs or how it differs from traditional hardware purchasing and leasing models. Efforts to educate the market and demonstrate the value proposition of DaaS, such as through case studies, detailed ROI analyses, and targeted marketing campaigns, are essential to overcoming this barrier and encouraging broader adoption.

Opportunity

Rise of Wearable-as-a-Service (WaaS) Paradigm

The rise of the Wearable-as-a-Service (WaaS) paradigm presents a burgeoning opportunity within the broader Device as a Service (DaaS) market. As wearables, such as smartwatches, fitness trackers, and health monitoring devices, become increasingly integrated into both personal and professional lives, the demand for flexible, subscription-based models for these devices grows.

WaaS offers organizations the ability to deploy wearable technology to employees on a large scale without the significant upfront costs, facilitating enhanced productivity, health and safety monitoring, and data collection. This model also allows for rapid updating and replacement of wearables to keep pace with technological advancements. The expansion into WaaS opens new avenues for DaaS providers to innovate and cater to niche markets, underscoring the versatility and potential of subscription-based technology services.

Challenge

Addressing Security and Data Protection Risks in Device as a Service

Addressing security and data protection risks presents a significant challenge in the Device as a Service (DaaS) model. As DaaS involves third-party providers managing devices that access and store sensitive information, ensuring the security and integrity of data becomes paramount. The increasing sophistication of cyber threats and the complexities of complying with various data protection regulations add layers of difficulty to providing secure DaaS solutions.

Providers must implement robust security measures, including regular software updates, advanced encryption techniques, and comprehensive compliance protocols, to protect client data effectively. Additionally, educating clients about best practices in device usage and security is crucial to mitigate risks. Overcoming these challenges is essential for building trust and encouraging the adoption of DaaS solutions, highlighting the need for constant vigilance and innovation in cybersecurity measures within the DaaS ecosystem.

Growth Factors

- Subscription-Based Model Demand: An increasing preference for subscription models over traditional capital expenditure models is fueling growth, enabling organizations to access the latest technology with lower upfront costs and more predictable operating expenses.

- Cloud Services Adoption in Developing Countries: The prevalence of cloud services, especially in emerging economies, is significantly boosting the adoption of DaaS. This trend is driven by the model’s ability to ensure timely upgrades and maintenance of software and hardware, reducing the IT burden and avoiding technological obsolescence.

- Flexibility and Scalability: DaaS provides organizations the capability to scale their hardware and service needs based on operational requirements, which is essential for handling fluctuating workloads and supporting remote or hybrid work environments.

- Rising Demand in IT and Telecommunications: The IT and telecommunications sectors are prominent adopters of DaaS due to their heavy reliance on IT hardware and the critical need for security, reliability, and performance. The sectors’ ongoing need for software updates and related services also contributes to the robust demand for DaaS solutions.

Emerging Trends

- Focus on Cost-Efficiency and Security: Businesses are increasingly attracted to DaaS for its ability to offer cost-efficient access to secured devices, alongside benefits like higher policy compliance and increased user productivity.

- Technological Advancements and IoT Adoption: Continuous technological evolution and the growing adoption of Internet of Things (IoT) devices are propelling the DaaS market. These advancements ensure organizations can stay technologically current without significant capital investments.

- Digital Transformation Acceleration: The COVID-19 pandemic has sped up digital transformation across industries, fostering the adoption of cloud and remote working practices. This shift has benefited the DaaS model, helping businesses streamline operations and enhance productivity.

- Growing Startup Ecosystem: The burgeoning global startup ecosystem is driving the demand for DaaS models, with startups requiring the flexibility and cost-effective IT solutions that DaaS provides.

Top Use Cases

- Remote and Hybrid Work Support: DaaS solutions support remote and hybrid work models by providing scalable access to hardware and services, ensuring employees have the necessary tools irrespective of location.

- IT Infrastructure Modernization: For companies aiming to modernize their IT infrastructure without heavy investments, DaaS offers an attractive option, allowing them to lease hardware with the latest specifications.

- SMEs and Startups: Small and Medium Enterprises (SMEs) and startups particularly benefit from DaaS models due to their cost-effectiveness and scalability, aligning with the operational flexibility these businesses need.

- Educational Institutions and Healthcare: The educational and healthcare sectors are increasingly adopting DaaS solutions, benefiting from the flexibility and ease of access to technology that DaaS offers, facilitating seamless service delivery and operational efficiency.

Regional Analysis

In 2023, North America held a dominant market position in the Device as a Service (DaaS) market, capturing more than a 33.2% share. This leading stance can be largely attributed to the region’s robust technological infrastructure and the rapid adoption of innovative business models by North American companies. The demand for Device as a Service in North America was valued at USD 36.5 billion in 2023 and is anticipated to grow significantly in the forecast period.

The presence of a highly competitive business environment drives organizations to seek out the most efficient and technologically advanced solutions to maintain their competitive edge. DaaS, with its promise of reducing capital expenditure and providing access to the latest technology, fits perfectly into this landscape. Additionally, the region is home to several key DaaS providers, which further facilitates the adoption of DaaS solutions among local businesses due to the ease of access and support.

The growth of the DaaS market in North America is also supported by the region’s strong emphasis on digital transformation across various sectors, including healthcare, education, and government. The shift towards remote work and the need for flexible, scalable technology solutions have only accelerated the demand for DaaS.

Companies are increasingly recognizing the benefits of DaaS in enabling a more agile IT infrastructure that can adapt to changing work environments and business needs. Furthermore, North America’s stringent regulatory framework regarding data security and privacy encourages organizations to adopt DaaS solutions that comply with these regulations, ensuring secure and efficient device management.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The DaaS market is characterized by the presence of several key players, each contributing to the sector’s growth with their innovative solutions and strategic initiatives. These companies are pivotal in shaping the future of DaaS offerings, focusing on expanding their reach, enhancing service capabilities, and meeting the evolving needs of businesses across various industries.

Top Market Leaders

- HP Inc.

- Dell Inc.

- Lenovo Group Limited

- Microsoft Corporation

- IBM Corporation

- Cognizant

- Accenture plc

- Acer Inc.

- Apple Inc.

- Cisco Systems, Inc.

- Intel Corporation

- CDW Corporation

- Other Key Players

Recent Developments

- April 2024 – NTT DATA, a prominent player in digital business and IT services, teamed up with HP to launch a Sustainable Device-as-a-Service solution. This groundbreaking approach weaves sustainability into the full lifecycle of endpoint devices, from acquisition to disposal. By doing so, organizations are equipped to seamlessly incorporate sustainable practices into their daily operations, addressing the growing demand for eco-friendly business solutions.

- January 2024 – Jio Financial Services broke new ground with its innovative rental model for electronics. This flexible, on-demand service allows consumers to access a broad spectrum of devices, including desktops, laptops, and smartphones. This model is set to revolutionize consumer electronics accessibility, offering a more adaptable and economically sensible alternative to outright purchases.

- August 2023 – RingCentral, Inc., known for its cloud-based solutions, introduced a subscription model for hardware phones. Previously, customers had to pay the entire cost upfront to purchase hardware phones. This shift to a subscription model is designed to make it easier and more affordable for businesses to manage their communication tools.

- April 2023 – Insight Enterprises expanded its Device as a Service (DaaS) offerings, introducing new packages that eliminate complex device management and provide immediate cost savings. Through strategic partnerships with industry giants like Dell, Apple, HP, Lenovo, and Microsoft, Insight offers competitive options for acquiring new devices and expertise in hardware and mobile device management.

- March 2023 – Foxway rolled out a new device as a service solution for technology devices, structured as a monthly subscription. This service package covers everything from the initial procurement to the eventual recovery of devices, streamlining technology management for organizations.

- February 2023 – Lenovo launched a series of updates including new ChromeOS and Windows 11 laptops, alongside an enhanced DaaS offering specifically for K-12 schools. These updates, which also included new features for its LanSchool and VRClassroom solutions, aim to simplify device management in educational settings and offer long-term economic benefits.

Report Scope

Report Features Description Market Value (2023) USD 110.2 Bn Forecast Revenue (2033) USD 3075.6 Bn CAGR (2024-2033) 39.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Software, and Services), By Enterprise Size (Small & Medium Enterprise and Large Enterprise), By Device Type (Desktop, Laptop, Notebook, & Tablet, and Others), By End-Use Industry (IT & Telecommunications, BFSI, Healthcare & Life Science, Education, Government & Public Sector, Other End-Use Industries) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape HP Inc., Dell Inc., Lenovo Group Limited, Microsoft Corporation, IBM Corporation, Cognizant, Accenture plc, Acer Inc., Apple Inc., Cisco Systems Inc., Intel Corporation, CDW Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Device as a Service (DaaS), and how does it work?Device as a Service (DaaS) is a subscription-based model where businesses or individuals lease hardware devices such as computers, laptops, tablets, smartphones, or other electronic devices from a service provider. Instead of purchasing the devices outright, customers pay a recurring fee for access to the devices, along with related services such as maintenance, support, and software updates.

How big is Device as a Service Market?The Global Device as a Service Market size is expected to be worth around USD 3,075.6 Billion by 2033, from USD 110.2 Billion in 2023, growing at a CAGR of 39.5% during the forecast period from 2024 to 2033.

Which is the key end-user industry of the device-as-a-service market?In 2023, the IT & Telecommunications segment held a dominant market position in the Device as a Service (DaaS) market.

What factors are driving the growth of the Device as a Service market?The growth of the Device as a Service market is driven by factors such as increasing demand for flexible IT solutions, the shift towards subscription-based business models, the need for cost-effective device management solutions, and the growing complexity of IT environments in businesses of all sizes.

What are some potential challenges or considerations for businesses considering Device as a Service?Challenges or considerations for businesses considering Device as a Service include ensuring compatibility with existing IT infrastructure and workflows, evaluating the total cost of ownership compared to traditional purchasing or leasing, addressing data security and privacy concerns, and selecting a reliable and trustworthy service provider.

Who are the major companies in the device-as-a-service market?HP Inc., Dell Inc., Lenovo Group Limited, Microsoft Corporation, IBM Corporation, Cognizant, Accenture plc, Acer Inc., Apple Inc., Cisco Systems, Inc., Intel Corporation, CDW Corporation, Other Key Players are among the major companies operating in the device-as-a-service market.

Device as a Service MarketPublished date: Oct. 2024add_shopping_cartBuy Now get_appDownload Sample

Device as a Service MarketPublished date: Oct. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- HP Inc.

- Dell Inc.

- Lenovo Group Limited

- Microsoft Corporation

- IBM Corporation

- Cognizant

- Accenture plc

- Acer Inc.

- Apple Inc.

- Cisco Systems, Inc.

- Intel Corporation

- CDW Corporation

- Other Key Players