Generative AI In Utilities Market By Type (Electricity Generation, Transmission & Distribution, And Customer Engagement & Energy Efficiency), By Application (Create Personalized Customer Experiences, Improve Asset Management, And Others), By Deployment(On-Premises, Cloud-Based), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2024-2033

- Published date: March 2024

- Report ID: 117126

- Number of Pages: 377

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

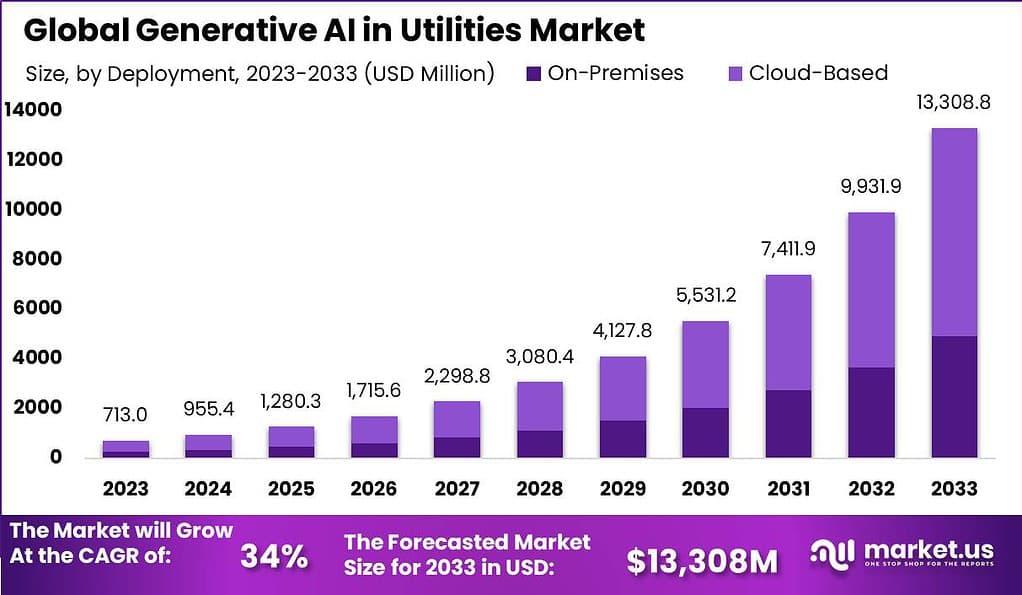

The Global Generative AI In Utilities Market size is expected to be worth around USD 13,308 Million by 2033, from USD 713 Billion in 2023, growing at a CAGR of 34% during the forecast period from 2024 to 2033.

Generative AI, a technology that combines deep learning and generative modeling, is making its presence felt in the utilities sector. Generative AI in utilities refers to the application of this technology to enhance various aspects of utility operations, including energy generation, distribution, and management. It offers utilities the ability to generate realistic scenarios, optimize operations, and improve decision-making processes.

Generative AI brings several benefits to the utilities sector. One key advantage is its ability to generate synthetic data, which can be used to augment existing datasets. This synthetic data generation helps overcome limitations related to data scarcity and allows utilities to train models that can better predict energy demand, optimize distribution networks, and identify potential issues or failures.

The generative AI in utilities market is witnessing growth as utilities recognize its potential in transforming their operations. Companies specializing in generative AI technologies are developing innovative solutions tailored to the unique challenges and requirements of the utilities sector. From large-scale power generation plants to smart grids and renewable energy systems, generative AI is being integrated into various utility infrastructure components.

However, challenges persist in the adoption of generative AI in utilities. One major challenge is the availability of high-quality and representative data. Utilities need diverse and accurate data to train generative AI models effectively. Data privacy and security also remain critical concerns when dealing with sensitive utility data.

Furthermore, ensuring the interpretability and explainability of generative AI models is crucial. Utilities need to understand the decision-making process of these models to gain trust and confidence in their outputs. Transparent and explainable AI solutions will help utilities overcome regulatory and public acceptance hurdles.

Despite the challenges, the generative AI in utilities market offers significant opportunities. With the increasing integration of renewable energy sources, the need for efficient energy management and optimization becomes paramount. Generative AI can play a pivotal role in optimizing energy systems, improving grid stability, and facilitating the transition to a sustainable and decentralized energy landscape.

Moreover, as utilities embrace digital transformation and smart grid technologies, generative AI can provide valuable insights and predictive capabilities. It can help utilities anticipate demand fluctuations, optimize energy storage, and enable efficient energy trading in peer-to-peer energy markets.

Key Takeaways

- The Generative AI in Utilities Market is estimated to reach a staggering USD 13,308 Million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of 34% during the forecast period.

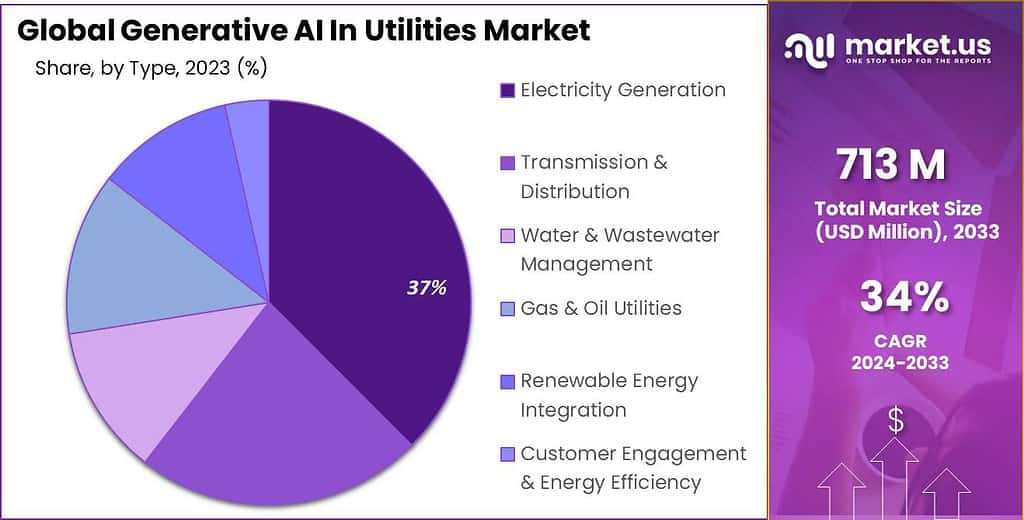

- In 2022, the Electricity Generation segment held a dominant position in the market, capturing over 37.5% share. This segment’s significance lies in its role in optimizing electricity generation processes, enhancing predictive maintenance, and facilitating renewable energy integration.

- The “Create Personalized Customer Experiences” segment held a dominant market position, capturing over 42% share in 2022. This segment’s growth is driven by consumer demand for tailored services and interactions, with utilities leveraging generative AI to offer customized energy solutions and enhance customer satisfaction.

- In 2022, the On-Premises deployment segment held a dominant position, capturing over 37% share. On-premises solutions offer utilities control over IT environments, addressing data security and privacy concerns effectively.

- North America held a dominant market position in 2022, capturing over 45% share. The region benefits from advanced technological infrastructure, a proactive approach to digital transformation, and significant investments in research and development.

- Artificial Intelligence Market is on a remarkable growth trajectory, with expectations to soar from USD 177 Billion in 2023 to USD 2,745 billion by 2032. This represents a Compound Annual Growth Rate (CAGR) of 36.8% from 2024 to 2033.

- In the last 10 months, more than 50% of over 1,400 organizations surveyed have ramped up their investment in Generative AI, highlighting the burgeoning interest in this technology.

- Currently, 44% of organizations are in the pilot phase of generative AI deployment, while 10% have fully integrated these solutions into their operations.

- Approximately 40% of utility and energy companies have allocated a dedicated team and budget for exploring generative AI capabilities. Conversely, 41% of these entities adopt a cautious “watch and wait” stance. Despite varied approaches, an overwhelming 95% of companies in this sector have engaged in discussions about the potential of generative AI within the past year.

- A significant 54% of executives see generative AI as a pivotal tool in the advancement and management of green energy projects, underscoring its importance in achieving sustainability goals.

- The utility sector anticipates a 45% increase in the adoption of generative AI technologies in 2023, driven largely by the demand for enhanced operational efficiency and superior asset management practices.

- The specific segment of water utilities is poised for a 35% growth in generative AI adoption in 2024. This growth is primarily motivated by the need for innovative solutions in predictive maintenance and leak detection.

Based on Type Analysis

In 2022, the Electricity Generation segment held a dominant position in the Generative AI in Utilities market, capturing more than a 37.5% share. This leading status can be attributed to the increasing demand for sustainable and efficient power generation methods, spurred by global initiatives toward green energy and reduction of carbon footprints.

Generative AI plays a crucial role in optimizing electricity generation processes, enhancing predictive maintenance, and forecasting energy production and demand. The integration of AI technologies enables the development of smart grids and renewable energy sources, such as wind and solar power, to be more efficient and reliable. As a result, the sector is witnessing substantial investments from stakeholders aiming to leverage AI for improved operational efficiencies and to meet the rising global energy demand.

The significance of the Electricity Generation segment is further underscored by the rapid advancements in AI algorithms and machine learning models that facilitate real-time data analysis and decision-making. These technologies allow for the continuous monitoring and adjustment of energy production, leading to significant reductions in waste and operational costs.

Moreover, generative AI contributes to the enhancement of energy storage solutions, crucial for managing the intermittency of renewable energy sources. With a growing emphasis on sustainability and energy independence, the Electricity Generation segment is poised for further expansion. The adoption of generative AI technologies in this segment not only supports the transition towards more sustainable energy sources but also ensures a more efficient and resilient electricity supply chain, thereby solidifying its leading position in the market.

Based on Application Analysis

In 2022, the “Create Personalized Customer Experiences” segment held a dominant market position in the Generative AI in Utilities market, capturing more than a 42% share. This prominence is primarily due to the escalating consumer demand for tailored services and interactions in the utility sector.

Utilities companies are increasingly leveraging generative AI to analyze customer data and behavior patterns, enabling them to offer customized energy solutions, personalized billing, and tailored energy-saving tips. This shift towards personalized customer engagement strategies not only enhances customer satisfaction but also fosters loyalty and encourages sustainable energy usage practices.

The ability of generative AI to process vast datasets and predict customer preferences with high accuracy is a key driver behind the segment’s growth, making it a cornerstone for utilities aiming to differentiate themselves in a competitive market.

The leading status of the “Create Personalized Customer Experiences” segment is further cemented by the digital transformation trends sweeping across the utilities industry. As companies strive to become more customer-centric, the integration of AI technologies offers a direct pathway to achieving this objective.

Generative AI enables utilities to develop dynamic and interactive platforms that can provide customers with real-time insights into their energy consumption and generate personalized recommendations for improving energy efficiency. This approach not only empowers consumers but also plays a critical role in the broader context of energy conservation and demand management.

Based on Deployment Analysis

In 2022, the On-Premises deployment segment of the Generative AI in Utilities market held a dominant position, capturing more than a 37% share of the market.

This significant market share can be attributed to several critical factors that underscore the segment’s leading position. Firstly, on-premises solutions offer a high degree of control over IT environments, which is paramount for utilities companies dealing with sensitive data and stringent regulatory compliance requirements. Such control ensures that data security and privacy concerns are addressed effectively, making on-premises deployment a preferred choice for many organizations within this sector.

Furthermore, the on-premises model provides utilities companies with the ability to tailor and customize their AI solutions to fit specific operational needs and constraints, thus enhancing operational efficiency and performance. This customization capability, combined with the direct control over system maintenance and upgrades, allows for better integration with existing legacy systems, which is a common characteristic of the utilities industry. The initial cost and complexity of setting up an on-premises infrastructure are often offset by the long-term benefits of enhanced security, customization, and integration capabilities.

The leading position of the on-premises segment is also supported by its suitability for utilities that operate in regions with unreliable internet connectivity or where cloud services might not be as readily available or economically feasible. Despite the growing trend towards cloud-based solutions, the preference for on-premises deployments in certain segments of the utilities market highlights the continued importance of bespoke, secure, and highly integrated AI solutions that can operate effectively within the unique constraints of the utilities sector.

Key Market Segments

Based on Type

- Electricity Generation

- Transmission & Distribution

- Water & Wastewater Management

- Gas & Oil Utilities

- Renewable Energy Integration

- Customer Engagement & Energy Efficiency

Based on Application

- Create Personalized Customer Experiences

- Improve Asset Management

- Develop New Products & Services

- Improve Safety

- Other Applications

Based on Deployment

- On-Premises

- Cloud-Based

Driver

Increased Operational Efficiency and Cost Savings

One of the primary drivers behind the adoption of Generative AI in the utilities market is the significant increase in operational efficiency and cost savings it offers. Generative AI technologies enable utilities to optimize their operations through predictive maintenance, energy demand forecasting, and automation of routine tasks.

By predicting equipment failures before they occur, utilities can reduce downtime and extend the lifespan of their assets, thereby lowering maintenance costs. Additionally, AI-driven demand forecasting improves energy distribution efficiency, reducing waste and operational costs. This enhanced operational efficiency not only leads to substantial cost savings but also enables utilities to provide more reliable and affordable services to consumers, strengthening their competitive position in the market.

Restraint

Data Security and Privacy Concerns

One of the major restraints facing the Generative AI in utilities market is the concern over data security and privacy. Utilities companies manage vast amounts of sensitive information, including customer data and critical infrastructure details. The integration of Generative AI systems, which require access to and processing of this data, raises significant security and privacy challenges.

There is a risk of cyber attacks, data breaches, and unauthorized access to sensitive information, which can have severe consequences, including financial losses, damage to reputation, and regulatory penalties. These concerns can hinder the adoption of AI technologies as utilities must ensure robust security measures are in place to protect their data and comply with stringent data protection regulations, which can be resource-intensive and technically challenging.

Opportunity

Integration with Renewable Energy Resources

The increasing integration of renewable energy resources presents a significant opportunity for the application of Generative AI in the utilities sector. As the energy mix becomes more diverse and decentralized, utilities face the challenge of managing variable and intermittent renewable energy sources, such as wind and solar power.

Generative AI can play a crucial role in optimizing energy production, distribution, and storage in this complex environment. By accurately forecasting renewable energy generation and demand, AI algorithms can enable utilities to balance supply and demand in real-time, enhance grid stability, and increase the penetration of renewable energy in the energy mix. This not only supports the transition to a more sustainable energy system but also opens up new business models and revenue streams for utilities in the renewable energy space.

Challenge

Skills Gap and Workforce Readiness

A significant challenge in the adoption of Generative AI within the utilities sector is the skills gap and workforce readiness. The implementation and effective use of AI technologies require specialized knowledge in data science, machine learning, and AI algorithm development, along with an understanding of the utilities’ operational context. However, there is a noticeable shortage of skilled professionals in this area, and existing staff may lack the necessary expertise to leverage AI technologies fully.

This skills gap poses a barrier to the successful integration of AI into utilities’ operations and necessitates significant investment in training and development programs. Furthermore, there is also a need to foster a culture of innovation and digital transformation within utilities, which can be resistant to change, to fully realize the benefits of Generative AI technologies

Emerging Trends

The utilities industry is witnessing a pivotal shift towards integrating generative AI across various domains, aiming to enhance efficiency, sustainability, and customer engagement. One of the key trends includes the application of AI for personalized customer interactions, where utilities leverage data analytics to tailor communications and services to individual preferences, significantly improving customer satisfaction and loyalty. Furthermore, advancements in AI are enabling more accurate forecasting and management of renewable energy resources, which is critical for integrating sustainable energy sources into the grid efficiently.

Use Cases

Generative AI’s use cases within the utilities sector are vast and varied. From automating routine tasks to reducing carbon footprints and predictive maintenance, the technology is setting new benchmarks for operational efficiency and sustainability. For instance, AI-driven chatbots, like Ontario Power Generation’s ChatOPG, streamline internal communications and information dissemination. In sustainability efforts, companies like Con Edison leverage AI to optimize energy consumption and reduce emissions, underscoring the technology’s role in facilitating eco-friendly practices.

Growth Factors

The growth of generative AI in utilities is underpinned by several factors, including the push for decarbonization, the need for grid modernization, and the increasing demand for personalized customer services. The integration of generative AI is being further accelerated by significant investments and policy support, such as the Inflation Reduction Act in the United States, which provides substantial funding and tax credits for clean energy initiatives and technology adoption. Moreover, as generative AI technologies continue to mature, their potential to enhance operational efficiencies, reliability, and customer engagement in utilities becomes increasingly evident.

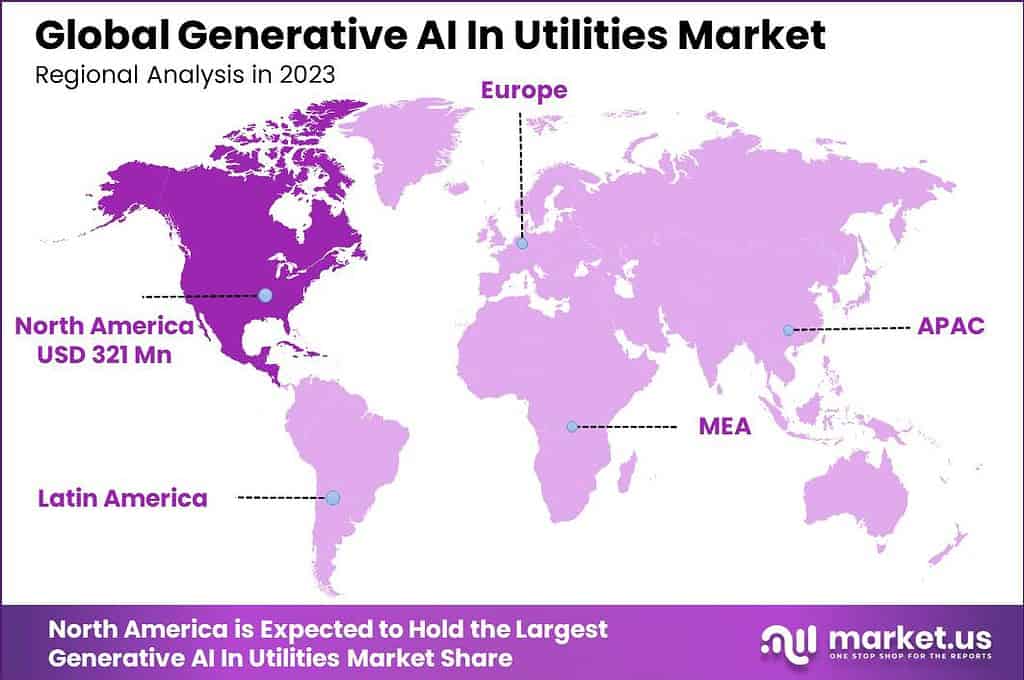

Regional Analysis

In 2022, North America held a dominant market position in the Generative AI in Utilities sector, capturing more than a 45% share. The demand for Generative AI In Utilities in North America was valued at USD 321 Million in 2023 and is anticipated to grow significantly in the forecast period.

This leading position can be attributed to several key factors that underscore the region’s pioneering role in integrating AI technologies within the utilities sector. First and foremost, North America benefits from a highly developed technological infrastructure and a robust innovation ecosystem, supported by significant investments in research and development from both the public and private sectors.

This environment fosters the development and rapid adoption of advanced technologies, including generative AI, across various industries, with utilities being no exception. Moreover, the region’s utilities sector is characterized by a proactive approach towards digital transformation and sustainability. With the increasing demand for renewable energy sources and the need for efficient energy management, utilities in North America have been quick to adopt AI solutions.

These solutions not only enhance operational efficiencies and reduce costs but also support the integration of renewable energy sources into the grid, aligning with regulatory policies and consumer expectations for sustainable energy consumption. The presence of leading AI technology providers and startups in North America further facilitates the adoption of generative AI by providing utilities with access to cutting-edge technologies and expertise.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Generative AI in Utilities market is characterized by the presence of a diverse range of key players, each contributing to the innovation and adoption of AI technologies across the sector. These players include established technology giants, specialized AI startups, and traditional utility companies that are increasingly investing in digital transformation. A detailed analysis of these key players reveals their strategic roles and contributions to the market dynamics.

Top Market Leaders

- Siemens AG

- General Electric Company

- ABB Ltd.

- Schneider Electric SE

- IBM Corporation

- Microsoft Corporation

- Other Key Players

Recent Developments

-

Siemens AG

- Acquisitions/Mergers: Look for any recent acquisitions by Siemens that aim to bolster its AI capabilities, especially in energy management and smart grid technologies.

- New Product Launches: Updates on Siemens’ launch of AI-driven platforms or tools designed to enhance utility operations, such as predictive maintenance or energy efficiency solutions.

-

General Electric Company

- Acquisitions/Mergers: Information on GE’s strategic acquisitions that expand its digital offerings in the utilities market.

- New Product Launches: Announcements about new AI-powered analytics and monitoring systems by GE for improving grid reliability and renewable energy integration.

-

ABB Ltd.

-

- Acquisitions/Mergers: Any recent moves by ABB to acquire companies with advanced AI technologies applicable to utilities.

- New Product Launches: Updates regarding ABB’s introduction of new AI solutions for smart cities and energy services.

Report Scope

Report Features Description Market Value (2023) USD 713 Mn Forecast Revenue (2033) USD 13,308.8 Mn CAGR (2024-2033) 34% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Electricity Generation, Transmission & Distribution, And Customer Engagement & Energy Efficiency), By Application (Create Personalized Customer Experiences, Improve Asset Management, And Others), By Deployment(On-Premises, Cloud-Based) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Siemens AG, General Electric Company, ABB Ltd., Schneider Electric SE, IBM Corporation, Microsoft Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Generative AI in the utilities market?Generative AI in the utilities market refers to the application of artificial intelligence techniques, particularly generative models, to optimize various aspects of utility operations. These operations can include energy generation, distribution, consumption optimization, predictive maintenance, grid management, and more.

How big is Generative AI In Utilities Market?The Global Generative AI In Utilities Market size is expected to be worth around USD 13,308 Million by 2033, from USD 713 Billion in 2023, growing at a CAGR of 34% during the forecast period from 2024 to 2033.

Who are the key players in Generative AI In Utilities Market?Siemens AG, General Electric Company, ABB Ltd., Schneider Electric SE, IBM Corporation, Microsoft Corporation, Other Key Players are the major companies operating in the Generative AI In Utilities Market.

What challenges does Generative AI face in the utilities market?Challenges associated with Generative AI in the utilities market may include data quality and availability, interpretability of generated outputs, regulatory compliance, cybersecurity concerns, and integration with existing infrastructure and legacy systems.

Which region has the biggest share in Generative AI In Utilities Market?In 2022, North America held a dominant market position in the Generative AI in Utilities sector, capturing more than a 45% share.

Generative AI In Utilities MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Generative AI In Utilities MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Siemens AG

- General Electric Company

- ABB Ltd.

- Schneider Electric SE

- IBM Corporation

- Microsoft Corporation

- Other Key Players