Global Generative AI In Manufacturing Market Size, Share By Application (Product Design, Prototyping, And Other), By Deployment (On-Premises And On The Cloud), By Industry Vertical (Automotive, Aerospace, And Other ), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends And Forecast 2023-2032

- Published date: March 2024

- Report ID: 116793

- Number of Pages: 349

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

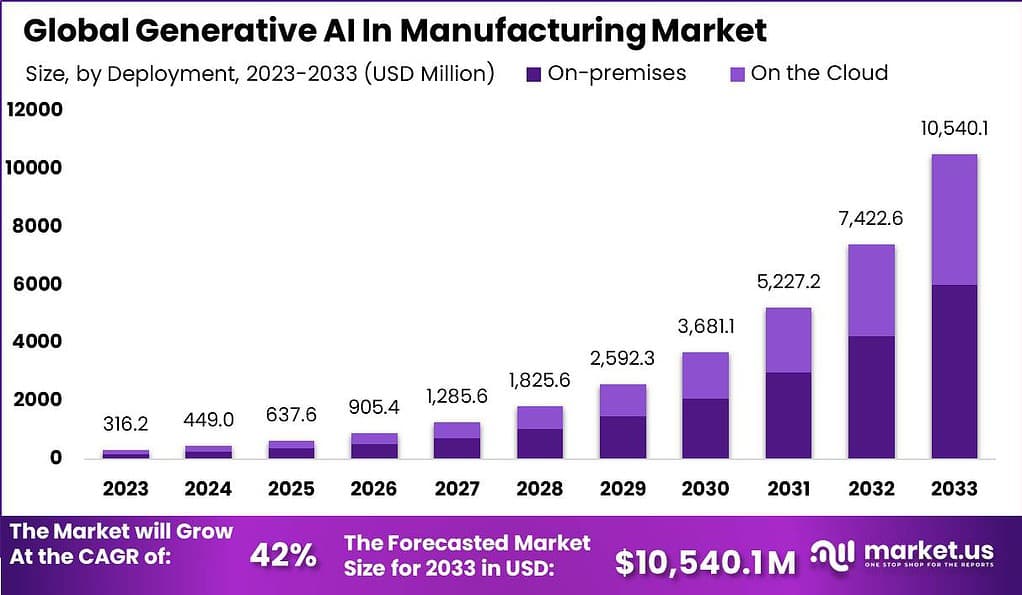

The Global Generative AI In Manufacturing Market size is expected to be worth around USD 10,540.1 Million by 2033, from USD 316.2 Million in 2023, growing at a CAGR of 42% during the forecast period from 2024 to 2033.

Generative AI is utilized in manufacturing to streamline and improve various operations. For instance, in product design, generative AI algorithms can analyze design parameters and constraints to generate multiple design options. This enables designers to explore a wide range of possibilities and identify innovative solutions that may not have been considered otherwise. By automating the design process, generative AI helps reduce development time and enhances the efficiency of design iterations.

The generative AI in manufacturing market is experiencing significant growth as more companies recognize its potential to enhance productivity and drive innovation. The market is driven by factors such as the increasing adoption of automation and digitalization in manufacturing, the need for faster and more efficient product development cycles, and the growing demand for personalized and customized products.

The use of generative AI for predictive maintenance in manufacturing, as reported by Deloitte, is anticipated to decrease unexpected downtime by as much as 30% by the year 2024. This significant reduction in downtime not only enhances productivity but also contributes to substantial cost savings for manufacturing companies.

Furthermore, a survey conducted by Capgemini reveals an optimistic projection that by 2024, over 25% of manufacturing facilities globally will employ generative AI to optimize energy consumption. This advancement is expected to lead to more efficient use of energy resources, reducing waste and contributing to environmental sustainability efforts.

Key Takeaways

- The Generative AI in Manufacturing Market is anticipated to reach a substantial value of USD 10,540.1 million by 2033, reflecting a robust Compound Annual Growth Rate (CAGR) of 42% during the forecast period from 2024 to 2033.

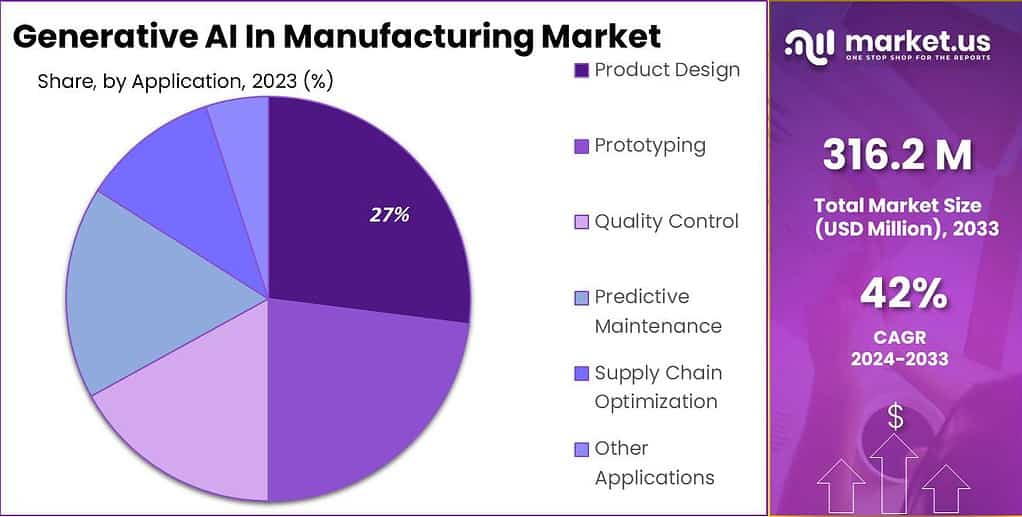

- Leading the market in 2022, the product design segment facilitated rapid design generation, reduced time-to-market, and enhanced product innovation, capturing over a 27.4% market share.

- By 2024, the adoption of generative AI for predictive maintenance is expected to decrease unexpected downtime by up to 30%, contributing significantly to productivity and cost savings.

- On-Premises Solutions: Held over a 56% market share in 2022 due to heightened control and security, especially favored by industries with sensitive data requirements like proprietary designs and data governance protocols.

- Automotive Sector: Dominated the market in 2022 with over a 33.5% share, leveraging generative AI to drive innovation, efficiency, and sustainability in vehicle design, production, and supply chain management.

- North America: Emerged as the market leader, capturing more than a 47.6% share in 2022, propelled by robust technological infrastructure, significant investments in research and development (R&D), and a favorable regulatory environment supporting AI integration.

- By 2024, it’s expected that more than 40% of manufacturing companies will have embraced generative AI solutions for tasks such as product design and process optimization.

- By the end of 2024, over 60% of new industrial robots are anticipated to include generative AI features, allowing for greater flexibility and adaptability.

- The market size for generative AI is forecasted to reach about USD 255.8 Billion by 2033, up from USD 13.5 Billion in 2023, with a Compound Annual Growth Rate (CAGR) of 34.2% from 2024 to 2033.

- Currently, 44% of organizations are testing generative AI, and 10% have fully implemented it into their operations.

- The AI in Manufacturing market is projected to grow to about USD 156.1 Billion by 2033, starting from USD 3.8 Billion in 2023, with a growth rate (CAGR) of 45% during the forecast period from 2024 to 2033.

- By 2024, it is anticipated that over 60% of new product introductions in the manufacturing sector will utilize generative AI for the creation of designs and concepts.

- The application of generative AI for predictive maintenance in manufacturing is expected to lower maintenance expenses by up to 25% by 2024.

- By the end of 2024, it is estimated that more than 50% of new manufacturing execution systems (MES) will integrate generative AI capabilities for real-time optimization.

Deployment Analysis

In 2022, the Product Design segment held a dominant market position within the Generative AI in Manufacturing Market, capturing more than a 27.4% share. This substantial market share can be attributed to the segment’s pivotal role in accelerating the design phase, reducing time to market, and enhancing product innovation.

Generative AI has revolutionized product design by enabling the rapid generation of multiple design alternatives based on specified criteria and constraints, significantly streamlining the design process. This technology facilitates the exploration of complex design spaces, allowing manufacturers to optimize products for performance, aesthetics, and cost-efficiency simultaneously.

The leading position of the Product Design segment is further bolstered by its contribution to sustainability and material efficiency. Through the use of generative AI, companies can create designs that require less material and are more energy-efficient, aligning with the growing emphasis on sustainable manufacturing practices.

Moreover, the integration of AI in product design supports the customization trend in the manufacturing sector, where products are increasingly tailored to individual customer preferences. The ability to quickly produce and evaluate designs that cater to specific requirements has made the Product Design segment a critical factor in the competitive differentiation of manufacturers.

Application Analysis

In 2022, the On-Premises segment held a dominant market position within the Generative AI in Manufacturing Market, capturing more than a 56% share. This significant market share is primarily due to the heightened control and security that on-premises deployment offers to manufacturing firms.

Companies in sectors where proprietary designs and sensitive data are paramount tend to prefer on-premises solutions to maintain strict data governance and security protocols. This deployment model ensures that all critical information remains within the physical premises of the organization, mitigating risks associated with data breaches and unauthorized access.

The preference for the On-Premises segment is further reinforced by the need for high-performance computing capabilities close to the site of data generation and application. Manufacturing processes often require real-time analysis and decision-making, where the slightest delay can result in inefficiencies or loss.

On-premises deployment of generative AI tools enables manufacturers to leverage their existing infrastructure to support these intensive computational tasks, ensuring seamless integration with production lines and machinery. This setup is particularly advantageous for complex product designs and prototyping, where immediate feedback and iterations are crucial.

Moreover, the On-Premises segment’s lead in the market can also be attributed to the customization and flexibility it offers. Manufacturing entities can tailor their generative AI solutions to fit specific operational workflows, optimizing processes for maximum efficiency and output. Although the initial investment and maintenance cost for on-premises solutions may be higher compared to cloud alternatives, the long-term benefits of enhanced performance, security, and customization justify the preference for this deployment model.

Industry Vertical Analysis

In 2022, the Automotive segment held a dominant market position within the Generative AI in Manufacturing Market, capturing more than a 33.5% share. This leadership is largely due to the automotive industry’s relentless pursuit of innovation and efficiency in design, production, and supply chain management.

Generative AI has emerged as a key technology in this sector, enabling the rapid development of vehicle components, optimization of manufacturing processes, and enhancement of overall vehicle performance and safety. The technology’s capability to generate and evaluate numerous design alternatives based on set parameters has significantly accelerated the design process, reducing time to market for new vehicle models.

The Automotive segment’s prominence in the Generative AI market is further supported by its application in customizing vehicles to meet diverse consumer preferences and regulatory requirements across different regions. Generative AI facilitates the creation of designs that optimize fuel efficiency, reduce emissions, and improve safety features, aligning with the global shift towards sustainability and eco-friendliness in the automotive industry.

Additionally, the integration of AI in automotive manufacturing processes helps in identifying potential issues early in the design phase, thereby reducing costly recalls and enhancing brand reputation. The use of generative AI in the Automotive segment has paved the way for advancements in autonomous vehicle technology. AI algorithms are crucial in developing complex systems that require minimal human intervention, driving the segment’s growth further.

Key Market Segments

Based on Deployment

- On-premises

- On the Cloud

Based on Application

- Product Design

- Prototyping

- Quality Control

- Predictive Maintenance

- Supply Chain Optimization

- Other Applications

Based on Industry Vertical

- Automotive

- Aerospace

- Electronics

- Consumer Goods

- Other Industry Verticals

Driver

Technological Advancements in AI and Machine Learning

The rapid advancements in artificial intelligence (AI) and machine learning (ML) technologies are major drivers of the Generative AI in Manufacturing Market. These technologies enable the automation of design and manufacturing processes, significantly reducing the time and cost associated with product development.

AI and ML algorithms can analyze vast amounts of data to identify patterns and optimize manufacturing workflows, leading to improved efficiency and productivity. Furthermore, generative AI facilitates the creation of innovative product designs and material compositions, pushing the boundaries of what is possible in manufacturing. This driver is critical for industries seeking to maintain competitive advantages through innovation, efficiency, and reduced time to market for new products.

Restraint

High Implementation Costs and Complexity

A significant restraint facing the Generative AI in Manufacturing Market is the high cost and complexity of implementation. Integrating generative AI into existing manufacturing systems requires substantial initial investment in technology, infrastructure, and skilled personnel.

The complexity of AI algorithms and the need for specialized knowledge to manage and maintain AI systems can pose challenges for manufacturers, especially small and medium-sized enterprises (SMEs) with limited resources. Additionally, the ongoing costs associated with updating AI models and systems can be prohibitive for companies looking to adopt generative AI technologies, potentially slowing down market growth.

Opportunity

Increasing Demand for Customized and Sustainable Manufacturing

The growing demand for customized and sustainable manufacturing presents a significant opportunity for the Generative AI in Manufacturing Market. Consumers increasingly seek products tailored to their specific needs and preferences, driving manufacturers to adopt flexible and efficient production methods. Generative AI can streamline the customization process by quickly generating designs that meet individual customer requirements.

Moreover, AI-driven optimization of materials and manufacturing processes can lead to more sustainable production practices, reducing waste and energy consumption. This trend towards customization and sustainability opens up new markets and applications for generative AI, providing manufacturers with opportunities to differentiate themselves and capture value in a competitive landscape.

Challenge

Data Privacy and Security Concerns

One of the main challenges in the Generative AI in Manufacturing Market is addressing data privacy and security concerns. Manufacturing companies often deal with sensitive information, including proprietary designs and confidential customer data. The integration of generative AI systems, which require access to large datasets for training and operation, raises concerns about data breaches and the unauthorized use of intellectual property.

Ensuring the security of AI systems against cyber threats and maintaining data privacy in compliance with regulatory requirements is challenging, especially as cyberattacks become more sophisticated. This challenge necessitates significant investment in cybersecurity measures, potentially deterring some manufacturers from adopting generative AI solutions.

Regional Analysis

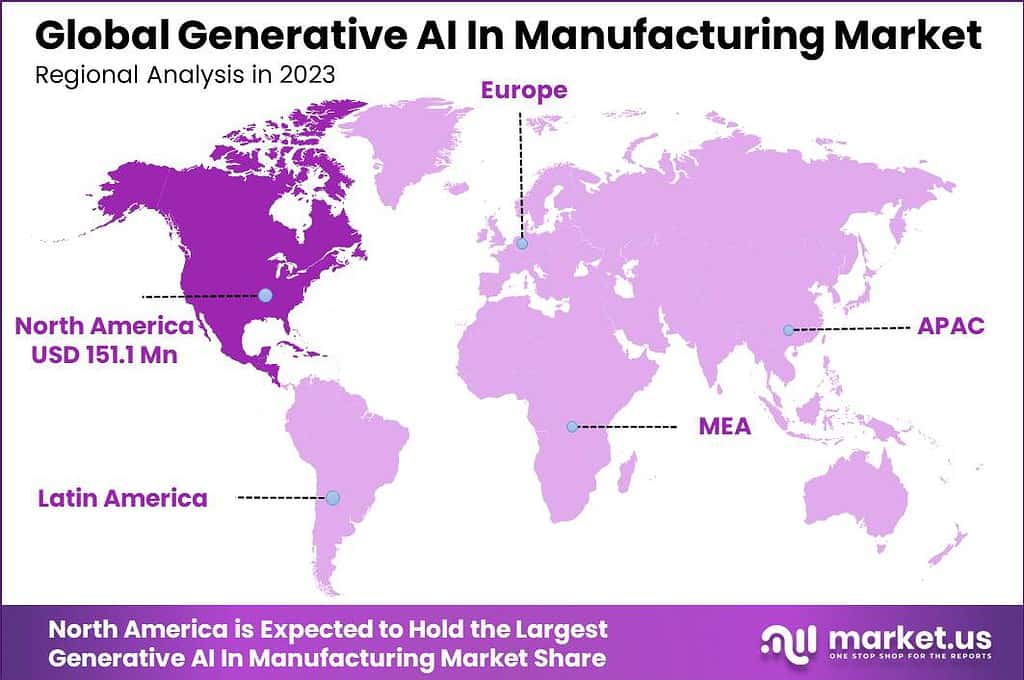

In 2022, North America held a dominant market position in the Generative AI in Manufacturing Market, capturing more than a 47.6% share. This leading stance can be primarily attributed to the region’s robust technological infrastructure and the presence of key market players who are pioneers in AI and machine learning technologies.

North America, particularly the United States, has been at the forefront of technological innovation, supported by significant investments in research and development (R&D) from both the public and private sectors. The region’s strong emphasis on enhancing manufacturing processes through digital transformation has driven the adoption of generative AI solutions across various industries, including automotive, aerospace, and consumer goods.

The demand for Generative AI In Manufacturing in North America was valued at USD 151.1 Million in 2023 and is anticipated to grow significantly in the forecast period. The market dominance of North America is also bolstered by the region’s proactive approach to integrating AI into educational and workforce development programs. This has ensured a steady supply of skilled professionals capable of developing and implementing generative AI technologies.

Additionally, the region’s regulatory environment is relatively favorable towards the adoption of new technologies, further facilitating the growth of generative AI in manufacturing. With a highly competitive manufacturing sector constantly seeking efficiency gains and innovation, North America’s demand for generative AI solutions is expected to remain strong.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Generative AI in Manufacturing Market is characterized by the presence of several key players, each contributing to the technological advancements and market growth through innovation, strategic partnerships, and global expansion. These players operate in various segments of the market, including AI software development, manufacturing solutions, and consulting services.

Top Market Leaders

- SAP SE

- IBM Corporation

- Microsoft Corporation

- Alphabet Inc.

- Siemens AG

- General Electric Company

- Autodesk Inc.

- NVIDIA Corporation

- Cisco Systems Inc.

- Oracle Corporation

- Other Key Players

Recent Developments

- Siemens AG (October 2023): Launched Siemens NX Generative Design software, utilizing generative AI to automate product design processes.

- Autodesk Inc. (July 2023): Announced integration of generative AI into its Fusion 360 platform, allowing for AI-powered generative design workflows.

- NVIDIA Corporation (May 2023): Unveiled its NVIDIA Omniverse Generative AI Toolkit, designed for developers to build custom generative AI applications for manufacturing tasks.

Report Scope

Report Features Description Market Value (2023) USD 316.2 Mn Forecast Revenue (2033) USD 10,540.1 Mn CAGR (2024-2033) 42% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Application (Product Design, Prototyping, And Other), By Deployment (On-Premises And On The Cloud), By Industry Vertical (Automotive, Aerospace, And Other) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape SAP SE, IBM Corporation, Microsoft Corporation, Alphabet Inc., Siemens AG, General Electric Company, Autodesk Inc., NVIDIA Corporation, Cisco Systems Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is generative AI in manufacturing?Generative AI in manufacturing refers to the use of artificial intelligence techniques, particularly generative models such as generative adversarial networks (GANs) or variational autoencoders (VAEs), to create designs, optimize processes, or enhance various aspects of manufacturing operations.

How big is Generative AI In Manufacturing Market?The Global Generative AI In Manufacturing Market size is expected to be worth around USD 10,540.1 Million by 2033, from USD 316.2 Million in 2023, growing at a CAGR of 42% during the forecast period from 2024 to 2033.

Who are the key players in Generative AI In Manufacturing Market?SAP SE, IBM Corporation, Microsoft Corporation, Alphabet Inc., Siemens AG, General Electric Company, Autodesk Inc., NVIDIA Corporation, Cisco Systems Inc. are the major companies operating in the Generative AI In Manufacturing Market.

Which region has the biggest share in Generative AI In Manufacturing Market?In 2022, North America held a dominant market position in the Generative AI in Manufacturing Market, capturing more than a 47.6% share.

What are the key applications of generative AI in manufacturing?Generative AI finds applications across various stages of the manufacturing lifecycle, including product design, process optimization, predictive maintenance, supply chain management, and quality control.

Generative AI In Manufacturing MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Generative AI In Manufacturing MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- SAP SE

- IBM Corporation

- Microsoft Corporation

- Alphabet Inc.

- Siemens AG

- General Electric Company

- Autodesk Inc.

- NVIDIA Corporation

- Cisco Systems Inc.

- Oracle Corporation

- Other Key Players