Global Generative AI In Construction Market By Type (Residential Construction, Commercial Construction, Industrial Construction, And Others), By Technology (Machine Learning, Natural Language Processing, And Others), By Application (Design And Planning, Construction Optimization, Others), By Region And Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, And Forecast 2023-2032

- Published date: Nov. 2024

- Report ID: 116585

- Number of Pages: 212

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

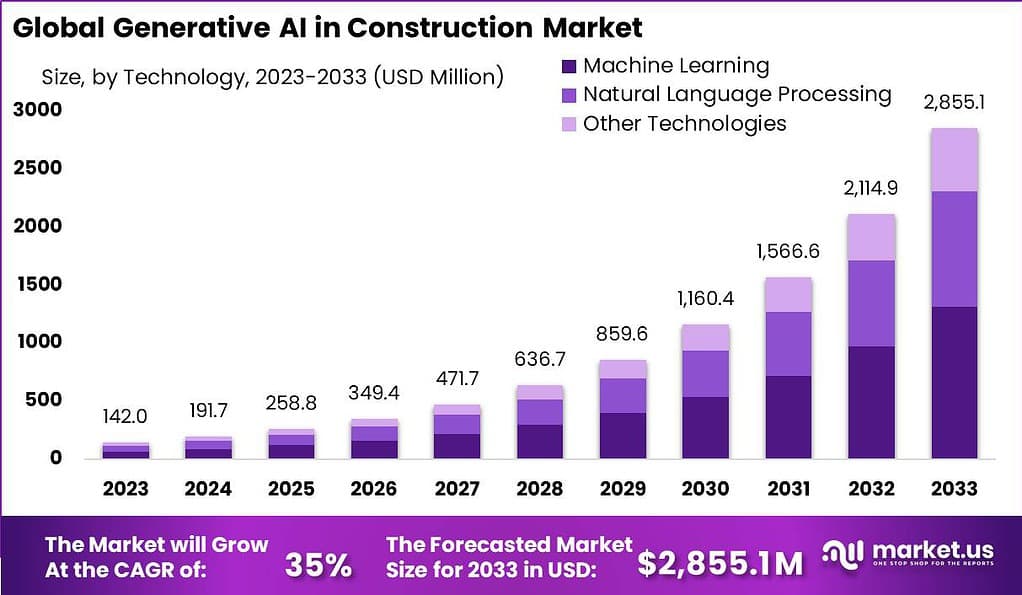

The Global Generative AI in Construction Market size is expected to be worth around USD 2,855.1 Million by 2033, from USD 142 Million in 2023, growing at a CAGR of 35% during the forecast period from 2024 to 2033.

Generative AI in construction refers to the application of AI technologies that generate design alternatives and solutions based on input parameters. This technology is increasingly being integrated into various phases of construction projects, from initial design to project management, helping to optimize processes and enhance efficiency. Generative AI aids in creating multiple design iterations quickly, allowing for rapid exploration of options and optimizing designs based on specific criteria such as cost, materials, and environmental impact.

The generative AI in construction market is experiencing rapid growth, with projections indicating a significant increase in market size over the next decade. This growth is driven by the technology’s ability to enhance efficiency, reduce costs, and support the creation of innovative, sustainable construction solutions. North America currently leads the market, with substantial investments and adoption rates in generative AI technologies across various construction sectors, including commercial and residential building.

The major driving factors for the adoption of generative AI in construction include the need for enhanced operational efficiency and cost reduction. By automating complex and labor-intensive tasks such as design and scheduling, generative AI reduces the time and manpower required, leading to lower overall project costs and shorter project timelines. Additionally, the push towards sustainable construction practices drives the adoption of AI, as it enables more efficient use of resources and reduces waste.

The demand for generative AI in construction is rising, driven by the industry’s need to increase efficiency and quality while reducing costs and environmental impact. Opportunities are particularly prominent in sustainable construction practices where AI can help in designing energy-efficient buildings and optimizing material usage. The integration of AI allows firms to expand into new markets by adapting designs to diverse environmental conditions and local regulations, making projects more feasible and profitable.

Technological advancements in the sector are centered around the integration of machine learning and natural language processing (NLP) with existing construction management software. These technologies enhance predictive analytics, risk management, and real-time decision-making capabilities. Additionally, the use of augmented and virtual reality (AR/VR) in conjunction with AI is transforming traditional construction methods by improving design visualization and project planning accuracy.

The statistic from Peak’s Decision Intelligence Maturity Index revealing that in 2022, 92% of construction companies reported using or intending to use AI underscores the significant impact of artificial intelligence on the construction industry. This high percentage reflects a widespread recognition within the sector of the transformative potential of AI technologies to enhance various aspects of construction operations, from design and planning to execution and management.

Recent research by OpenAI has highlighted the significant impact of generative AI on the workforce, with findings suggesting that 80% of the US workforce could see up to 10% of their tasks being automated by this technology. In a practical application of generative AI, a leading construction firm collaborated with Attri to revolutionize material selection and procurement processes.

This partnership resulted in a 45% reduction in the time required for materials selection, a 35% reduction in costs, and a notable decrease in environmental impact, including a 35% reduction in construction waste. Over the past 10 months, there has been a noticeable uptick in the investment in generative AI by 50% of surveyed organizations, indicating growing interest and confidence in this technology. Specifically, in the construction sector, the adoption of generative AI for architectural design and building information modeling (BIM) saw a 27% increase in 2023 over the previous year.

Key Takeaways

- The Generative AI in Construction Market is estimated to reach USD 2,855.1 Million by 2033, exhibiting a robust 35% Compound Annual Growth Rate (CAGR) during the forecast period from 2024 to 2033.

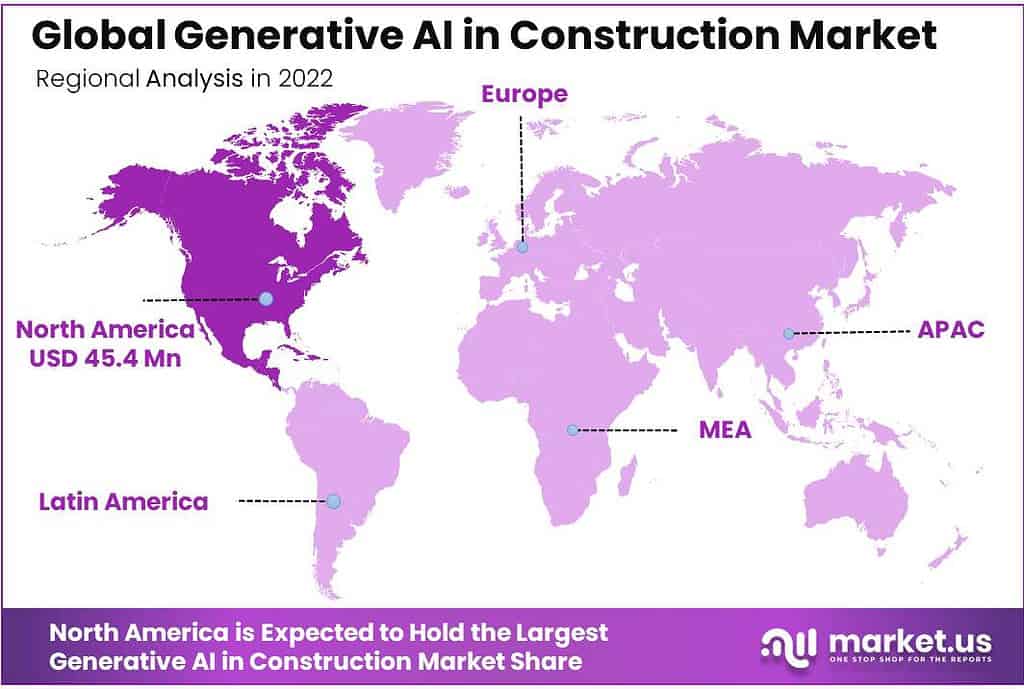

- In 2022, North America held a dominant market position in the generative AI in construction sector, capturing a significant market share.

- Construction companies using generative AI for project planning and scheduling saw a 20% reduction in project delays and cost overruns in 2023.

- In 2023, the use of Generative AI for site logistics optimization and resource allocation in construction projects grew by 18%, leading to improved efficiency and productivity on job sites.

- By the conclusion of 2024, more than 50% of leading construction firms will have integrated Generative AI solutions across multiple facets of their operations, encompassing design, planning, execution, and maintenance.

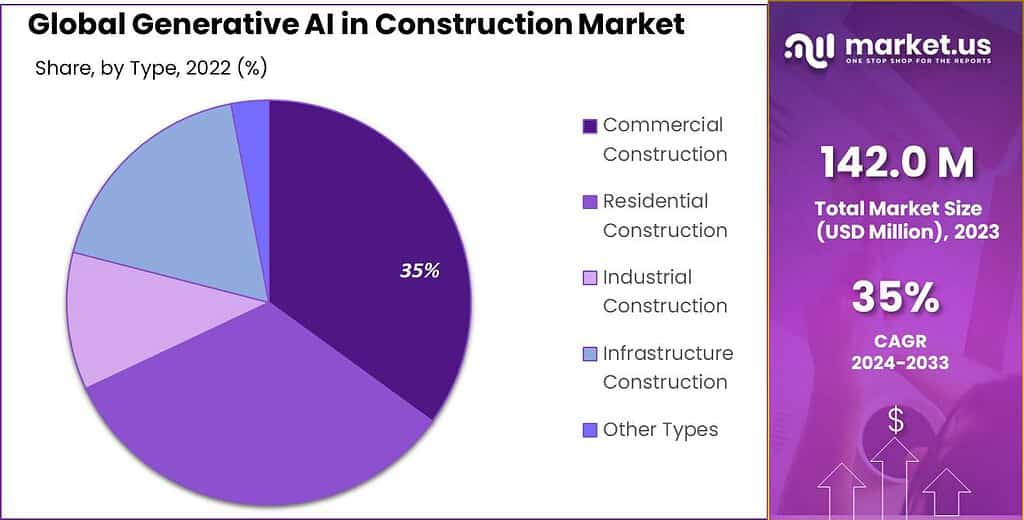

Based on Type Analysis

In 2022, the Commercial Construction segment held a dominant position in the Generative AI in Construction market, capturing a significant share. This leadership can be attributed to the increasing adoption of AI technologies in the development of commercial projects, including office buildings, retail centers, and hospitality facilities.

The drive towards sustainability and efficiency in commercial construction has further accelerated the integration of generative AI tools. These tools enhance design optimization, project planning, and resource management, leading to reduced costs and shorter project timelines. Commercial Construction’s leading role in the Generative AI in Construction market is also bolstered by substantial investments in infrastructure development and smart city projects across the globe.

As urbanization continues to rise, there is a growing demand for innovative construction solutions that can address the complex requirements of commercial spaces. Generative AI aids in meeting these demands by providing advanced analytics, predictive modeling, and automated design processes, which contribute to the creation of safer, more efficient, and aesthetically pleasing commercial structures.

Based on Technology Analysis

In 2022, the Machine Learning segment held a dominant market position in the Generative AI in Construction market, capturing a significant share. This prominence is primarily due to machine learning’s ability to analyze vast datasets and learn from them, which significantly enhances decision-making, risk management, and operational efficiencies in construction projects.

Machine learning algorithms are instrumental in predictive analytics, enabling construction managers to foresee potential issues and mitigate risks before they escalate. Furthermore, these algorithms optimize resource allocation and project scheduling, leading to cost reductions and improved project timelines.

The leadership of the Machine Learning segment is also reinforced by its application in real-time monitoring and maintenance of construction sites. By utilizing machine learning algorithms, construction firms can monitor the structural health of buildings, predict equipment failures, and ensure the safety of the construction environment. This proactive approach to maintenance not only extends the lifespan of constructed facilities but also significantly reduces downtime and repair costs.

Based on Application Analysis

In 2022, the Design and Planning segment held a dominant market position within the generative AI in construction market, capturing a significant share of the market. This leadership can be attributed to the increasing demand for efficient and error-minimizing tools in the early stages of construction projects.

Generative AI, with its capability to generate multiple design iterations quickly, allows architects and engineers to explore a vast array of design options and optimize them based on specific criteria, such as cost, time, materials, and environmental impact. This not only enhances the quality and feasibility of construction projects but also significantly reduces the time and cost associated with the design and planning phase.

The integration of generative AI in Design and Planning has revolutionized the way construction projects are conceptualized, contributing to this segment’s leading position. By employing advanced algorithms to analyze and learn from a plethora of data points, generative AI provides unprecedented insights into project planning. It enables the identification of the most efficient design pathways, considering various constraints and objectives.

Furthermore, the technology’s capacity to simulate and predict potential challenges before the commencement of physical construction has been pivotal in minimizing risks and ensuring smoother project execution. This application of generative AI not only streamlines the design and planning processes but also aligns with the industry’s growing emphasis on sustainability and cost-effectiveness, making it a cornerstone of modern construction practices.

Key Market Segments

Based on Type

- Residential Construction

- Commercial Construction

- Industrial Construction

- Infrastructure Construction

- Other Types

Based on Technology

- Machine Learning

- Natural Language Processing

- Other Technologies

Based on Application

- Design and Planning

- Construction Optimization

- Project Management

- Other Applications

Driver

Enhanced Project Efficiency and Cost Savings

The integration of Generative AI in the construction industry drives substantial improvements in project efficiency and cost management. This technology enables construction companies to automate the design and planning phases, significantly reducing the time and labor traditionally required.

For instance, by using Generative AI, firms can quickly generate multiple design prototypes, optimize resource allocation, and enhance decision-making processes, which in turn minimizes waste and ensures resources are available when needed. This capability not only accelerates project timelines but also helps in sticking to budgets, avoiding costly delays and overruns.

Restraint

High Initial Investment and Integration Challenges

Despite its benefits, the widespread adoption of Generative AI in construction faces significant barriers, primarily due to the high initial costs associated with deploying these technologies. The investment isn’t just financial; it also involves substantial time and effort in training staff and integrating new systems with existing workflows.

Many construction firms, particularly small to medium-sized enterprises, find these initial costs prohibitive. Moreover, the construction industry often relies on established processes and systems, making the integration of new, technologically advanced solutions a complex and disruptive task.

Opportunity

Advancing Sustainable Construction Practices

Generative AI presents a significant opportunity to promote sustainable practices within the construction industry. By optimizing design and resource utilization, this technology can substantially reduce waste and enhance energy efficiency. Generative AI supports the design of buildings and infrastructure that comply with environmental standards and regulations more efficiently.

Furthermore, it enables the use of new materials and innovative construction techniques that could be less harmful to the environment. As global focus intensifies on reducing the environmental impact of construction, Generative AI becomes a crucial tool for companies aiming to enhance their sustainability credentials and comply with regulatory demands.

Challenge

Data Security and Operational Complexity

Data security poses a considerable challenge in the deployment of Generative AI in construction. The technology relies heavily on large sets of data, including sensitive information about projects. Ensuring the integrity and security of this data is paramount, as breaches can lead to significant financial and reputational damage.

Additionally, the operational complexity of implementing AI systems, which requires ongoing maintenance and updates, can be daunting. These systems must be robust enough to handle complex analytical tasks and adaptable to evolving construction practices, which necessitates a continuous investment in technology updates and staff training.

Regional Analysis

In 2022, North America held a dominant market position in the generative AI in construction sector, capturing a significant market share. The demand for Generative AI In Construction in North America was valued at USD 45.4 Million in 2023 and is anticipated to grow significantly in the forecast period.

North America’s construction industry is characterized by its pursuit of efficiency, sustainability, and safety, all of which are enhanced by generative AI applications. These technologies have been pivotal in transforming design and planning processes, optimizing resource allocation, and minimizing waste, thereby driving demand within the region.

In 2022, the United States saw a big amount of money spent on nonresidential construction, which includes buildings not used for living, like offices and schools. This spending reached about ~$888 billion. Out of this, private projects – those funded by businesses or individuals – made up over ~$539 billion. Government projects, on the other hand, added up to around ~$335 billion.

In 2022, the United States allocated a significant portion of its construction budget, totaling ~$910 billion, towards residential construction. This investment was distributed across various segments of the housing market. Single-family homes received the largest share of funding, with approximately ~$442 billion dedicated to their construction.

Multifamily housing, which includes apartments and condominiums, was allocated about ~$105 billion. Additionally, a substantial amount of ~$354 billion was spent on upgrades, indicating a strong focus on renovating and improving existing residential properties. Public housing projects, aimed at providing affordable housing solutions, were supported with approximately ~$9 billion.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The generative AI in construction market is characterized by a dynamic and innovative landscape with several key players contributing to its growth and development. These companies range from established technology giants to specialized startups, each playing a crucial role in advancing the integration of generative AI within the construction industry. Their efforts are focused on developing solutions that enhance design efficiency, construction optimization, and overall project management through the application of artificial intelligence.

Top Market Leaders

- Autodesk Inc.

- Dassault Systemes

- Trimble

- Bentley Systems

- Katerra

- Oracle Corporation

- Aurora Computer Services

- Building System Planning Inc.

- IBM Corporation

- Microsoft Corporation

- Other Market Players

Recent Developments

- In May 2023, Autodesk Inc. made an exciting announcement about the release of the first set of Autodesk Forma capabilities. This move is aimed at making teamwork more seamless for those who design, operate, and build our surroundings.

- Bentley Systems (August 2023): Launched Generative Design capabilities within their OpenBuildings Designer software. This allows architects to explore various design options based on specific parameters.

- IBM (May 2023): Partnered with a construction company to pilot AI-powered project optimization tools, including generative design for material selection.

- In June 2023, Docebo Inc., a company known for its global learning platform that focuses on AI and innovation, announced it had acquired Edugo.AI. This strategic acquisition is driven by two main goals: to enhance the AI skills that are already in use and to introduce new features to Docebo.

Report Scope

Report Features Description Market Value (2023) USD 142.0 Mn Forecast Revenue (2033) USD 2,855.1 Mn CAGR (2023-2033) 35% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2023-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Residential Construction, Commercial Construction, Industrial Construction, And Others), By Technology (Machine Learning, Natural Language Processing, And Others), By Application (Design And Planning, Construction Optimization, Others) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Autodesk Inc., Dassault Systemes, Trimble, Bentley Systems, Katerra, Oracle Corporation, Aurora Computer Services, Building System Planning Inc., IBM Corporation, Microsoft Corporation, Other Market Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Generative AI in the construction industry?Generative AI refers to artificial intelligence systems that can autonomously generate designs, solutions, or simulations based on specified constraints or objectives. In construction, it's utilized for tasks such as design optimization, layout planning, and resource allocation.

How big is Generative AI in Construction Market?The Global Generative AI in Construction Market size is expected to be worth around USD 2,855.1 Million by 2033, from USD 142 Million in 2023, growing at a CAGR of 35% during the forecast period from 2024 to 2033.

Who are the top players operating in the generative AI In construction market?The major players operating in the generative AI In construction market are Autodesk Inc., Dassault Systemes, Trimble, Bentley Systems, Katerra, Oracle Corporation, Aurora Computer Services, Building System Planning Inc., IBM Corporation, Microsoft Corporation, Other Market Players

Which region will lead the global generative AI In construction market?In 2022, North America held a dominant market position in the generative AI in construction sector, capturing a significant market share.

What are the challenges associated with implementing Generative AI in construction?Challenges include data quality and availability, integration with existing design tools and workflows, trust and acceptance among industry professionals, and the need for specialized expertise to configure and interpret AI-generated solutions.

Generative AI in Construction MarketPublished date: Nov. 2024add_shopping_cartBuy Now get_appDownload Sample

Generative AI in Construction MarketPublished date: Nov. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Autodesk Inc.

- Dassault Systemes

- Trimble

- Bentley Systems

- Katerra

- Oracle Corporation

- Aurora Computer Services

- Building System Planning Inc.

- IBM Corporation

- Microsoft Corporation

- Other Market Players