Global Digital Finance Market Size, Share, Growth Analysis Report By Type (Infrastructure, Payment & Settlement, Financing, Investment Management, Insurance, Others), By Application (Internet Payment, Mobile Payment, Online Banking Service, Outsourcing of Financial Services, Others), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: November 2024

- Report ID: 132640

- Number of Pages: 275

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

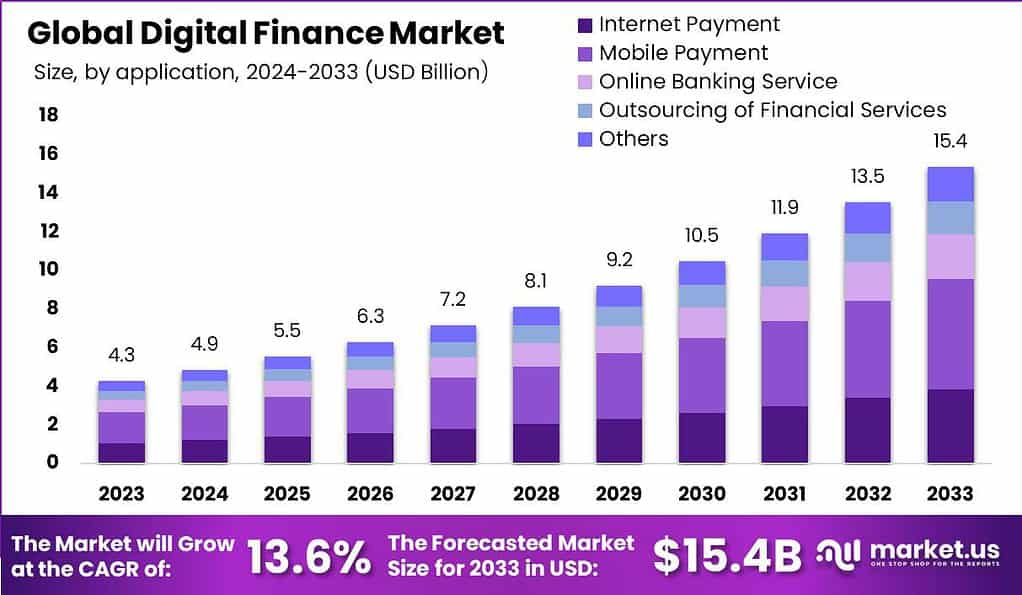

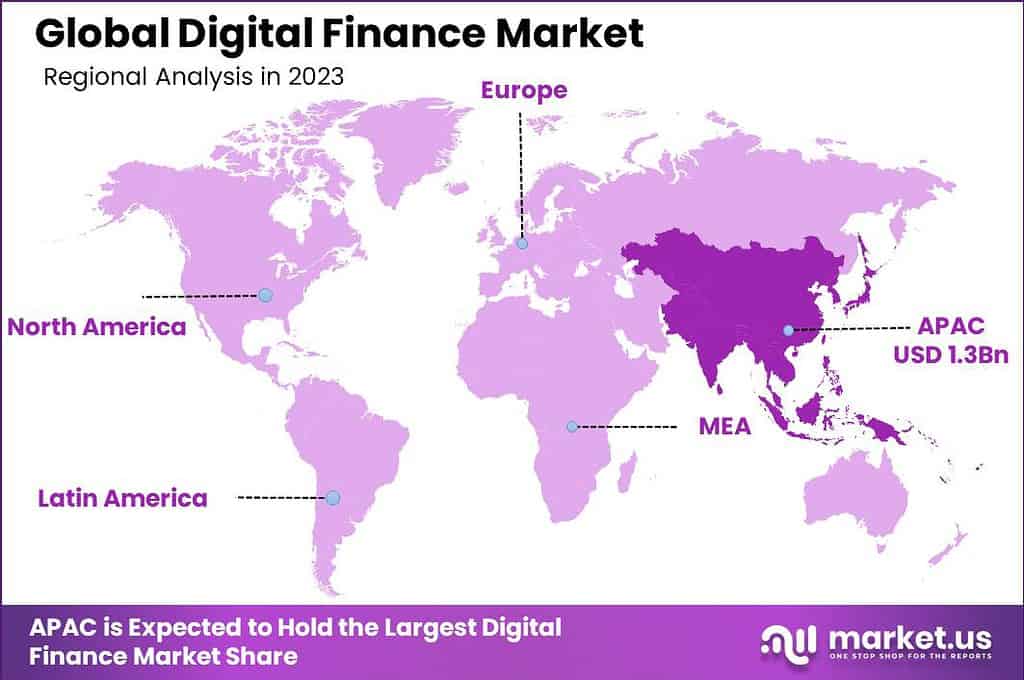

The Global Digital Finance Market size is expected to be worth around USD 15.4 Billion By 2033, from USD 4.3 Billion in 2023, growing at a CAGR of 13.60% during the forecast period from 2024 to 2033. In 2023, the Asia-Pacific region held a dominant position in the Digital Finance Market, capturing over 30% of the market share and generating USD 1.3 billion in revenues.

Digital finance refers to the adoption of advanced technological systems to enhance the delivery of financial services. This includes the integration of technologies such as artificial intelligence, mobile applications, cloud computing, and blockchain into everyday financial services, transforming traditional financial activities like banking, payments, and investment management.

The digital finance market encompasses a broad range of financial services delivered through digital channels, enabling transactions that are faster, more cost-effective, and accessible to a wider audience than traditional financial services. Services under this market include mobile payments, online banking, peer-to-peer lending, robo-advisors for investment management, and cryptocurrencies like Bitcoin.

With the extensive use of mobile devices and internet services, digital finance is crucial for fostering financial inclusion, especially in underserved regions where traditional banking infrastructures are limited. These technologies facilitate a broader reach of financial services, increasing accessibility for users and improving the efficiency and security of financial operations.

Additionally, the regulatory environment is evolving to support fintech innovations while ensuring security and fairness, which boosts market confidence. Another significant driver is the advancement in technology, particularly in areas like AI and blockchain, which enhances the efficiency, security, and functionality of digital financial services.

There is a growing demand in the Digital Finance Market driven by the consumer’s increasing preference for accessing financial services on the go. Younger demographics, in particular, favor digital-first solutions for managing their finances, from everyday transactions to complex investment strategies. This demand is accelerated by the global increase in smartphone penetration and improvements in internet infrastructure.

The market is ripe with opportunities, particularly in developing regions where traditional banking infrastructure is limited. Fintech companies are finding fertile ground for growth by offering low-cost, scalable solutions that address the needs of a diverse customer base. Also, partnerships between traditional banks and tech companies are helping to push the boundaries of what digital financial services can offer.

Based on Data from PaymentsJournal, the Middle East has become a leader in instant payments, recording 855 million transactions in 2023, a remarkable 33% year-over-year increase. This surge is fueled by robust government initiatives aimed at enhancing digital payment infrastructures. With these advancements, the instant payments market in the region is projected to reach an impressive $3 billion by 2028, highlighting the growing adoption of seamless, real-time payment systems.

Consumer experience in digital finance is also showing steady improvement. The overall score increased from 41 to 48 out of 100, reflecting progress in service infrastructure and consumer protection. However, challenges such as financial resilience and inclusivity still need to be addressed, pointing to significant opportunities for further innovation and expansion in the sector.

The Global Artificial Intelligence Market is on a trajectory of phenomenal growth. According to Market.us, its size is expected to soar to USD 3,527.8 billion by 2033, up from USD 250.1 billion in 2023, with a CAGR of 30.3% during the forecast period. This highlights the increasing integration of AI technologies across industries, driven by demand for automation, advanced analytics, and personalized consumer experiences.

In financial services, CRM systems are proving to be a game-changer. For every dollar spent, financial institutions report an average ROI of $8.71, and 47% of users cite improved customer satisfaction due to effective CRM solutions. Additionally, sales teams leveraging CRM technologies spend approximately 18% of their time using these tools, enabling better customer engagement and retention strategies.

Key Takeaways

Type Analysis

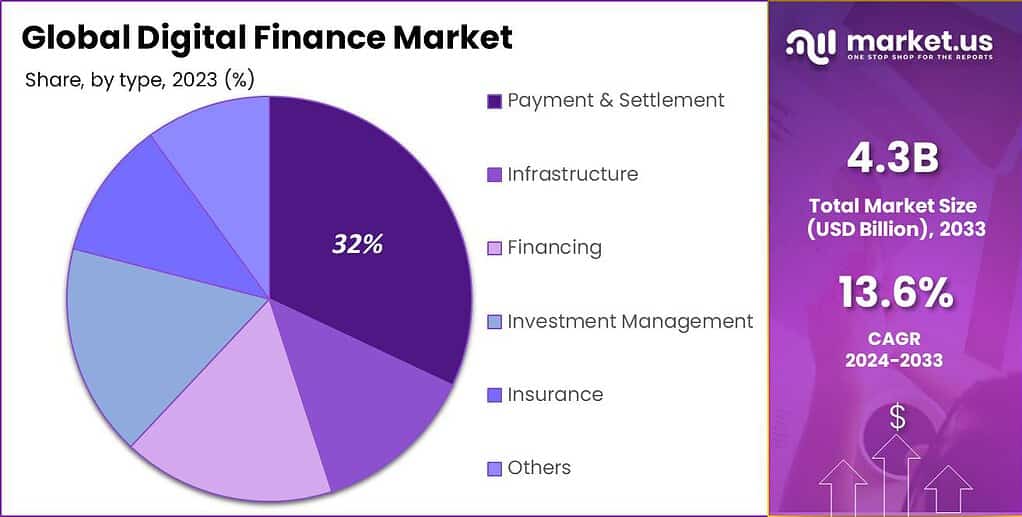

In 2023, the Payment & Settlement segment held a dominant market position in the Digital Finance Market, capturing more than a 32% share. This segment leads primarily because it directly caters to the widespread consumer and business need for efficient transaction mechanisms.

The rise in e-commerce, increased international trade, and the general push towards cashless societies have significantly fueled the demand for reliable and swift payment solutions. Payment & Settlement technologies have become integral to daily commerce, underpinned by innovations that enhance transaction security and speed.

Digital wallets, real-time payment platforms, and peer-to-peer payment apps are examples of solutions that have seen high adoption rates. These tools offer consumers and businesses more flexibility and accessibility than traditional banking methods, contributing to their popularity and dominance in the digital finance landscape.

The growth of the Payment & Settlement segment is also bolstered by supportive regulatory changes worldwide, which encourage digital payment adoption while ensuring strong consumer protection. Moreover, the ongoing enhancements in mobile technology and internet infrastructure globally enable more users to access these digital financial services, thus sustaining the segment’s leading position.

Application Analysis

In 2023, the Mobile Payment segment held a dominant position in the digital finance market, capturing more than a 37% share. This leading stance is primarily due to the widespread adoption of smartphones and the increasing consumer preference for quick and convenient transaction methods.

Mobile payments offer a seamless integration into daily activities, allowing users to make purchases, transfer money, and manage finances directly from their mobile devices, which enhances their appeal over more traditional methods.

The surge in mobile payment usage is also fueled by the enhancement of security measures, such as biometric authentication and end-to-end encryption, which have significantly increased consumer trust. Additionally, financial technology companies are continuously innovating mobile payment solutions to include features like instant notifications, loyalty rewards, and budget tracking, which further attract users.

Governments and financial bodies are also supporting this shift through regulatory reforms and initiatives aimed at promoting digital finance, thereby securing the leading position of mobile payments in the digital finance market. This trend is expected to continue growing as technology advances and as the market further adapts to meet the demands of modern consumers.

Key Market Segments

By Type

- Infrastructure

- Payment & Settlement

- Financing

- Investment Management

- Insurance

- Others

By Application

- Internet Payment

- Mobile Payment

- Online Banking Service

- Outsourcing of Financial Services

- Others

Driver

Increasing Adoption of Digital Payment Systems

The rapid growth of digital payment systems globally serves as a strong driver for the digital finance market. The proliferation of smartphones and internet connectivity has significantly altered the way individuals and businesses conduct financial transactions.

With mobile wallets, online banking, and peer-to-peer (P2P) payment platforms becoming mainstream, traditional cash-based systems are being replaced. The convenience and speed offered by digital transactions have resonated well with consumers, especially in regions where cash handling has logistical challenges or risks.

Governments and central banks across the globe are also playing a pivotal role in driving the adoption of digital finance by implementing policies and incentives that encourage the use of digital transactions. Many countries have introduced initiatives aimed at enhancing financial inclusion through digital channels, providing unbanked populations with greater access to financial services.

Restraint

Cybersecurity Concerns and Data Breaches

As financial transactions increasingly shift to online and digital platforms, the risk of cyber-attacks has grown. Hackers and cybercriminals continuously devise sophisticated methods to exploit vulnerabilities in systems, compromising sensitive customer data and financial assets.

Many consumers remain wary about adopting digital financial services due to fears of identity theft, fraud, and unauthorized access to their accounts. Financial institutions and fintech companies must invest heavily in advanced security measures, such as encryption technologies, multi-factor authentication, and real-time fraud detection, to protect customer data and maintain trust. However, implementing such security measures can be costly and challenging, especially for smaller financial firms.

Opportunity

Expansion of Financial Inclusion

Digital finance presents a tremendous opportunity for expanding financial inclusion globally. A significant portion of the world’s population remains unbanked or underbanked, particularly in developing and emerging markets.

Traditional banking services often fail to reach these populations due to geographical constraints, limited infrastructure, and high costs. Digital finance, through mobile banking, e-wallets, etc., bridges this gap by providing easy access to financial services without the need for brick-and-mortar bank branches.

Fintech companies have demonstrated that it is possible to offer low-cost, accessible, and user-friendly digital financial services, enabling people from all walks of life to participate in the economy. Governments and international organizations have recognized the potential of digital finance to drive economic growth and poverty alleviation by empowering individuals and small businesses with financial tools.

Challenge

Regulatory and Compliance Complexities

Financial services are highly regulated, with stringent requirements imposed on institutions to ensure the security, transparency, and fairness of transactions. As digital finance evolves and new business models emerge, regulatory bodies face the challenge of keeping pace with technological advancements while protecting consumer interests and financial stability.

Regulatory fragmentation across countries and regions further complicates compliance efforts for global digital finance providers. Each jurisdiction may have different laws, licensing requirements, data privacy standards, and anti-money laundering (AML) rules, making it challenging for companies to operate seamlessly across borders. This complexity can lead to increased compliance costs, operational inefficiencies, and delays in launching new services or entering new markets.

Emerging Trends

The financial landscape is undergoing a significant transformation, driven by several key trends. One prominent development is the rise of decentralized finance (DeFi), which leverages blockchain technology to offer financial services without traditional intermediaries.

The adoption of cloud computing is also reshaping the financial sector. By enabling scalable and flexible operations, cloud technology allows financial institutions to efficiently manage data and deploy services. This shift not only reduces operational costs but also accelerates the development of innovative financial products.

Additionally, the concept of Open Finance is gaining traction. Building upon Open Banking principles, Open Finance extends data sharing to a broader range of financial products, including investments and insurance. This approach empowers consumers with greater control over their financial data, fostering a more competitive and customer-centric financial ecosystem.

Business Benefits

Embracing digital finance offers numerous advantages for businesses. One significant benefit is enhanced operational efficiency. By automating routine financial tasks, companies can reduce manual errors and allocate resources more effectively, leading to cost savings and improved productivity.

Digital finance also facilitates better decision-making through real-time data analytics. Access to up-to-date financial information enables businesses to make informed choices, adapt to market changes swiftly, and identify growth opportunities. Also, adopting digital finance practices can open new revenue streams. Innovative financial products and services can attract a broader customer base and generate additional income.

Moreover, digital finance enhances customer experiences by offering personalized and convenient services. For example, mobile banking applications allow customers to manage their finances on the go, increasing satisfaction and loyalty. Personalized financial products tailored to individual needs can also attract and retain customers.

Regional Analysis

In 2023, Asia-Pacific held a dominant market position in the Digital Finance Market, capturing more than a 30% share with revenues reaching USD 1.3 billion. This region leads primarily due to the rapid digital transformation across its major economies, including China, India, and Southeast Asia.

The widespread adoption of smartphones and the internet, combined with a growing young and tech-savvy population, has created a fertile environment for digital financial services to thrive. The surge in e-commerce in the region has been significant catalyst. These startups have innovated at a breakneck pace, offering everything from digital payments to insurance and investment solutions tailored to the local needs and preferences.

The rising middle-class population and increasing literacy in financial services have spurred demand for convenient and secure digital financial solutions. This demographic shift has prompted a surge in fintech startups across the region, innovating in areas from mobile payments to insurance and investment apps, further enriching the digital finance ecosystem.

Moreover, Asia-Pacific’s unique financial landscape, characterized by a large unbanked population, presents vast opportunities for digital finance to bridge the gap where traditional banking has lagged. Financial inclusion initiatives are increasingly leveraging digital technology to provide essential services like microloans and insurance.

With ongoing technological advancements and supportive regulatory frameworks, Asia-Pacific is poised to maintain its leadership position in the Digital Finance Market, driving innovation and access to financial services across the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

In the Digital Finance Market, PayPal Holdings, Inc. stands out as a pivotal player. The company’s ability to adapt to the evolving financial landscape while maintaining robust security measures has solidified its position as a trusted name in digital finance. PayPal continues to innovate, integrating advanced technologies like artificial intelligence to enhance user experience and expand its global reach.

Square, Inc. is another influential force in the Digital Finance Market, particularly known for revolutionizing the way small businesses and individuals manage transactions. Square’s product suite includes point-of-sale systems, payment processing services, and financial planning tools, all designed to make financial operations seamless and accessible.

Ant Group Co., Ltd., an affiliate of the Chinese Alibaba Group, is a dominant player in Asia’s digital finance scene. The company’s flagship service, Alipay, is one of the world’s largest mobile and online payment platforms. Ant Group has successfully leveraged China’s vast consumer base and tech-centric culture to offer diverse services, including wealth management, insurance, and loan services.

Top Key Players in the Market

- PayPal Holdings, Inc.

- Square, Inc

- Ant Group Co., Ltd.

- Stripe, Inc.

- Adyen N.V.

- Robinhood Markets, Inc.

- Revolut Ltd

- TransferWise Ltd

- Klarna Bank AB

- SoFi Technologies, Inc.

- Adyen

- Mastercard

- Visa

- Tencent

- Google Pay

- Apple Pay

- Other Key Players

Recent Developments

- August 2023: Deutsche Börse announced the acquisition of Luxembourg-based distributed ledger technology company FundsDLT, expanding its capabilities in blockchain technology.

- December 2023: IDFC First Bank launched a UPI-based digital RuPay credit card, enhancing its digital payment offerings.

- June 2024: Apple announced plans to add new features to Apple Pay and Apple Wallet, including financing options and support for Windows and Chrome users, aiming to enhance user experience and expand accessibility.

Report Scope

Report Features Description Market Value (2023) USD 4.3 Bn Forecast Revenue (2033) USD 15.4 Bn CAGR (2024-2033) 13.6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Infrastructure, Payment & Settlement, Financing, Investment Management, Insurance, Others), By Application (Internet Payment, Mobile Payment, Online Banking Service, Outsourcing of Financial Services, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape PayPal Holdings, Inc., Square, Inc, Ant Group Co., Ltd., Stripe, Inc., Adyen N.V., Robinhood Markets, Inc., Revolut Ltd, TransferWise Ltd, Klarna Bank AB, SoFi Technologies, Inc., Adyen, Mastercard, Visa, Tencent, Google Pay, Apple Pay , Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Digital Finance MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample

Digital Finance MarketPublished date: November 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- PayPal Holdings, Inc.

- Square, Inc

- Ant Group Co., Ltd.

- Stripe, Inc.

- Adyen N.V.

- Robinhood Markets, Inc.

- Revolut Ltd

- TransferWise Ltd

- Klarna Bank AB

- SoFi Technologies, Inc.

- Adyen

- Mastercard

- Visa

- Tencent

- Google Pay

- Apple Pay

- Other Key Players