Global Aseptic Packaging Market By Material (Plastic, Metal, Glass, Paper and Paperboard, Others), By Product (Cartons, Bottles and Cans, Bags and Pouches, Prefilled Syringes, Vials and Ampoules, Others), By Application (Beverages, Food, Pharmaceutical, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 134095

- Number of Pages: 250

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

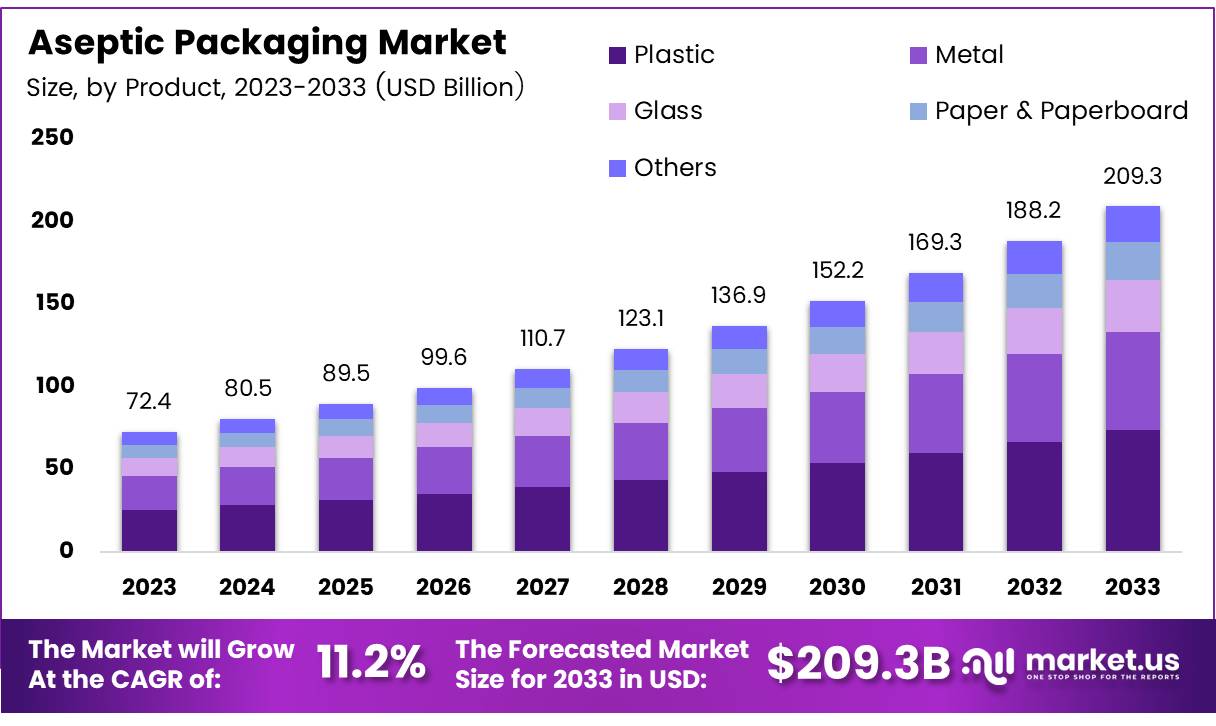

The Global Aseptic Packaging Market size is expected to be worth around USD 209.3 Billion by 2033, from USD 72.4 Billion in 2023, growing at a CAGR of 11.2% during the forecast period from 2024 to 2033.

Aseptic packaging refers to a method of packaging that ensures products, typically food and beverages, are sterilized and then sealed in a sterile container to maintain freshness and prevent contamination. This technology allows the product to remain safe and preserved for extended periods without the need for refrigeration.

Aseptic packaging is widely used for items such as dairy products, juices, soups, and sauces, offering both convenience and safety. The aseptic packaging market is driven by increasing consumer demand for longer shelf-life products and the need for more sustainable packaging solutions.

The aseptic packaging market is expanding rapidly, driven by its ability to extend product shelf life, reduce the need for preservatives, and simplify transportation. As consumers prioritize convenience and safety in food and beverage packaging, demand for aseptic solutions is rising worldwide.

Additionally, the market is benefiting from a growing focus on sustainability, as aseptic packaging often utilizes recyclable materials like paperboard, supporting a circular economy. In the coming years, the market is expected to continue growing steadily, fueled by increasing demand for packaged food, beverages, and dairy products, along with ongoing advancements in packaging technologies.

The aseptic packaging market is expected to witness robust growth in the coming years, with the increasing demand for convenience foods and beverages being a major driver. As more consumers seek out products with longer shelf life and minimal preservatives, the adoption of aseptic packaging solutions is gaining traction across the food and beverage sector.

Additionally, technological advancements in sterilization techniques, such as high-pressure processing (HPP) and ultra-high temperature (UHT) processing, are creating new opportunities for market players to develop innovative packaging solutions that enhance the overall product experience.

The growth of the aseptic packaging market is being strongly driven by increasing government investments in recycling and sustainability initiatives. One of the key commitments of the Circular Economy is to enhance the collection and recycling of beverage cartons, aiming for a 90% collection rate and at least a 70% recycling rate by 2030.

This aligns with the broader regulatory trend focusing on sustainability and circularity. As demand for eco-friendly packaging rises, aseptic packaging manufacturers face pressure to innovate while meeting these stricter environmental standards.

In Europe, over 80% of paper and board packaging materials are already recycled, reflecting a significant push toward sustainable packaging solutions. Additionally, the push to decarbonize the packaging value chain means that aseptic packaging solutions that meet these environmental targets will likely see strong demand.

For example, in 2021, 78.5% of steel packaging was successfully recycled, highlighting the increasing focus on recyclable and sustainable packaging options, as noted by Metal Packaging Europe.

Moreover, global trade in packaging materials, such as glass, continues to rise. In 2022, CZAPP reported the export of approximately 41.4 million tonnes of glass, emphasizing the growing demand for packaging that is not only safe and efficient but also environmentally friendly.

Key Takeaways

- The global Aseptic Packaging Market is projected to reach USD 209.3 billion by 2033, growing at a CAGR of 11.2%.

- Plastic dominated the By Material segment in 2023, holding a 46.8% market share due to its cost-effectiveness and versatility.

- Cartons led the By Product segment in 2023, driven by their quality preservation and sustainability in food and beverage packaging.

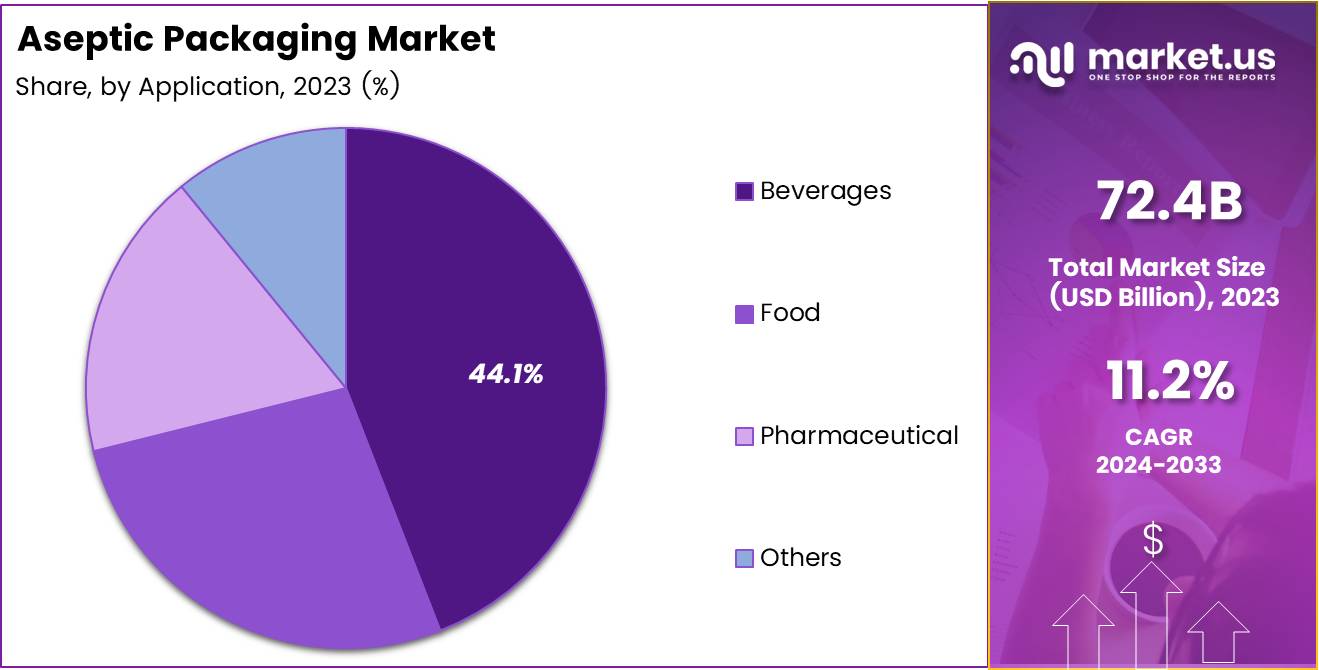

- Beverages accounted for 44.1% of the market share in 2023, with rising demand for long-shelf-life, ready-to-drink products.

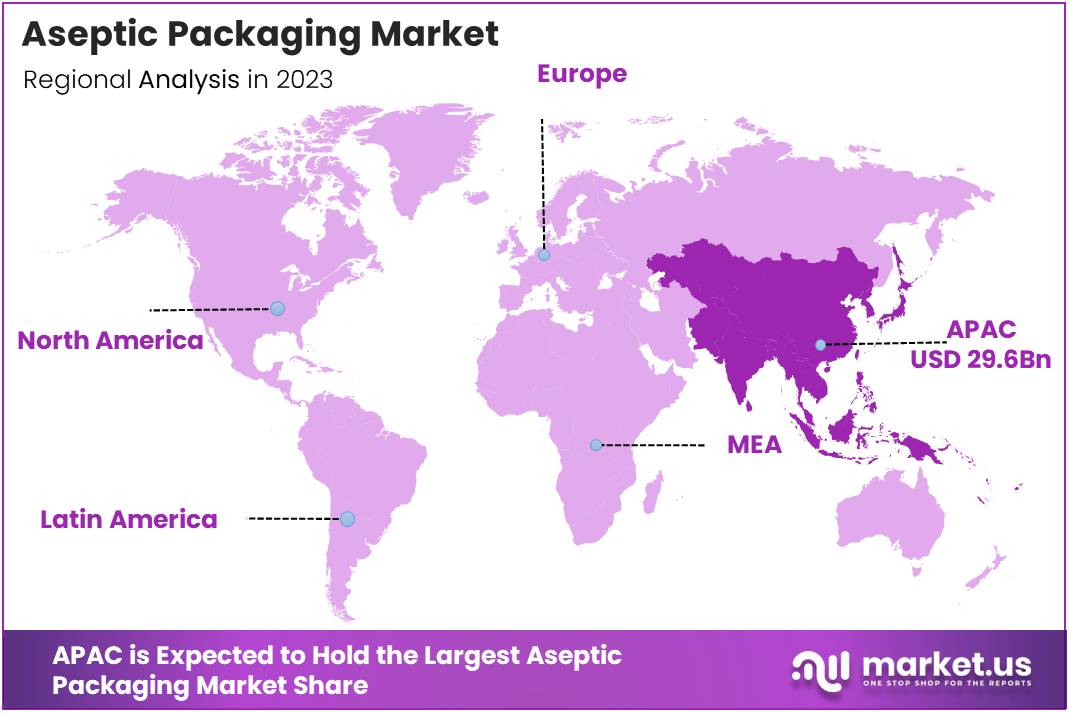

- Asia Pacific is the leading region in the global Aseptic Packaging Market, holding 41.6% of the market with a value of approximately USD 29.6 billion.

Material Analysis

Plastic Led the Aseptic Packaging Market with 46.8% Share in 2023

In 2023, plastic held a dominant market position in the By Material Analysis segment of the Aseptic Packaging Market, with a 46.8% share.

The material’s widespread use can be attributed to its cost-effectiveness, lightweight nature, and versatile applications across various industries, particularly in the packaging of beverages, dairy products, and food items. Plastic’s ability to preserve product quality, while also providing ease of handling and transportation, has solidified its leadership in the aseptic packaging segment.

Metal followed as the second most popular material, valued for its strength, durability, and excellent barrier properties. It is commonly used for products requiring longer shelf lives, such as liquid foods and beverages.

Glass and paper & paperboard, while contributing significantly to the market, serve niche segments, with glass offering premium appeal for select beverages and paper & paperboard gaining attention for their eco-friendly image in sustainable packaging solutions.

Other materials, including bioplastics and composite films, are slowly gaining traction, driven by growing consumer demand for environmentally conscious packaging. These materials continue to represent a smaller, but progressively expanding portion of the market as the industry adapts to sustainability trends.

Product Analysis

Cartons Lead Aseptic Packaging Market in 2023 by Product Analysis

In 2023, cartons held a dominant market position in the By Product Analysis segment of the aseptic packaging market.

Cartons have remained the preferred packaging solution in industries such as food and beverages, where their ability to preserve product quality while offering convenience and sustainability has driven widespread adoption. Cartons provide excellent protection against light, air, and moisture, extending the shelf life of products without the need for refrigeration.

Their widespread use is particularly prominent in packaging dairy products, juices, and soups, which benefit from the structural integrity and cost-effectiveness that cartons offer. Additionally, cartons are recyclable, which supports the growing emphasis on sustainability within the packaging industry.

While bottles & cans, bags & pouches, and other packaging solutions continue to hold notable shares of the market, cartons remain the most widely used and trusted packaging format, primarily due to their versatility and alignment with consumer demands for both performance and environmental responsibility. As the market continues to evolve, cartons are expected to maintain their leading position in the aseptic packaging landscape.

Application Analysis

Beverages Lead the Aseptic Packaging Market by Application, Capturing a 44.1% Share in 2023

In 2023, Beverages held a dominant market position in the By Application Analysis segment of the Aseptic Packaging Market, with a 44.1% share. The increasing demand for convenient, long-shelf-life products, especially in ready-to-drink (RTD) beverages, has significantly contributed to the growth of this segment.

Aseptic packaging offers the advantage of preserving the flavor, color, and nutritional value of beverages without the need for refrigeration, making it a preferred choice for manufacturers. This technology is especially prevalent in the packaging of dairy products, fruit juices, energy drinks, and bottled water.

The Food segment also demonstrated strong performance, accounting for a substantial portion of the market, driven by the need for safe and durable packaging for products such as sauces, soups, and convenience foods. Aseptic packaging solutions help extend the shelf life of food items while maintaining product integrity.

The Pharmaceutical segment, while smaller, has been growing steadily due to the increasing demand for sterilized, tamper-proof packaging for injectable medicines, vaccines, and other medical products. The Others category, encompassing non-food and non-beverage products, also contributed to market growth but remains limited compared to the aforementioned segments.

Overall, the Aseptic Packaging Market continues to expand, with beverages leading the way in terms of application-based demand.

Key Market Segments

By Material

- Plastic

- Metal

- Glass

- Paper and Paperboard

- Others

By Product

- Cartons

- Bottles and Cans

- Bags and Pouches

- Prefilled Syringes

- Vials and Ampoules

- Others

By Application

- Beverages

- Ready-to-drink Beverages

- Dairy Based Beverages

- Food

- Processed Food

- Dairy Food

- Fruits and Vegetables

- Pharmaceutical

- Others

Drivers

Rising Demand for Convenience Foods

The aseptic packaging market is experiencing significant growth, driven by several key factors. One of the primary drivers is the rising demand for convenience foods. As consumers’ lifestyles become increasingly fast-paced, there is a growing preference for ready-to-eat, processed, and packaged food items.

Aseptic packaging meets this need by offering a reliable solution that preserves food quality without requiring refrigeration. This technology helps manufacturers provide products that are easy to store, transport, and consume.

Additionally, the ability to extend the shelf life of perishable goods is a major benefit of aseptic packaging, especially in the food and beverage industry. It ensures that products such as juices, soups, dairy, and sauces can stay fresh for longer periods, which reduces food waste and logistical challenges for manufacturers.

Furthermore, aseptic packaging addresses increasing health and safety concerns by minimizing the risk of contamination and spoilage. With growing consumer awareness of food safety and hygiene, this packaging technology provides a safe, sanitary barrier that prevents harmful microorganisms from entering the product, ensuring that it remains safe for consumption.

These combined factors contribute to the ongoing demand for aseptic packaging solutions across various industries, making it a critical component in the global food and beverage supply chain.

Restraints

Rising Raw Material Costs and Environmental Concerns

One of the key restraints in the aseptic packaging market is the rising cost of raw materials, particularly specialized cartons and plastics. The prices of these materials have been highly volatile, influenced by fluctuations in the global supply chain, raw material shortages, and rising production costs.

This has created significant pressure on manufacturers, who are often unable to fully pass these increased costs onto consumers without risking reduced demand. As a result, manufacturers face narrower profit margins and challenges in maintaining competitive pricing.

Additionally, environmental concerns surrounding the use of non-biodegradable materials in aseptic packaging are a growing issue. Despite some progress in developing more eco-friendly alternatives, many packaging solutions used in the industry remain difficult to recycle or are not biodegradable.

The negative environmental impact of packaging waste, particularly in regions with limited recycling infrastructure, is prompting calls for more sustainable packaging solutions. As consumer demand for greener products continues to rise, companies in the aseptic packaging market may face pressure to invest in eco-friendly alternatives, which could increase production costs or require significant changes to existing manufacturing processes.

Growth Factors

Growth Opportunities in Aseptic Packaging Market

The aseptic packaging market is poised for growth driven by multiple emerging opportunities. One key factor is the rising demand in emerging markets, particularly in regions like Asia-Pacific, Latin America, and Africa.

As urbanization increases and disposable incomes rise in these areas, there is a significant shift toward packaged food products, which often require aseptic packaging for extended shelf life and safety.

Additionally, the growing popularity of plant-based foods and beverages is another notable driver. As consumer preferences shift toward dairy alternatives, plant-based drinks, and other perishable goods, aseptic packaging presents an ideal solution to preserve these products without the need for refrigeration.

Lastly, the surge in online grocery shopping and home delivery services, particularly following the COVID-19 pandemic, has led to new demand for packaging solutions that ensure food safety and quality during transit. Aseptic packaging is increasingly being used to meet the logistics challenges of delivering fresh, long-lasting products to consumers.

These trends indicate substantial potential for expansion in both developed and emerging markets, making aseptic packaging a key enabler for businesses looking to capitalize on shifting consumer behaviors and market needs.

Emerging Trends

Growing Demand for Lightweight and Smart Aseptic Packaging Solutions

The aseptic packaging market is currently experiencing several notable trends that are shaping its future. One of the most significant trends is the shift towards lightweight packaging.

As businesses aim to reduce transportation costs and minimize environmental footprints, the demand for lighter, more efficient packaging materials is increasing. This trend is driven by the need for cost savings in logistics and growing consumer preference for sustainable practices.

Alongside this, the adoption of intelligent packaging technologies is also gaining traction. Packaging that integrates sensors, QR codes, and NFC technology is becoming more common, allowing consumers and businesses to track products more effectively, monitor quality, and access real-time information. This technological shift not only enhances traceability but also boosts consumer confidence in product safety and quality.

Additionally, there is a growing emphasis on the customization of packaging designs. As brands look for ways to stand out in crowded markets, they are increasingly seeking tailored aseptic packaging solutions. Custom packaging helps enhance brand identity, appeal to specific consumer groups, and convey product uniqueness.

As these trends continue to evolve, it is evident that aseptic packaging is moving toward solutions that are more efficient, intelligent, and personalized, meeting both functional and marketing needs while also addressing environmental concerns. These developments signal a dynamic shift in the packaging industry, with broader implications for sustainability and consumer experience.

Regional Analysis

Asia Pacific Dominates Aseptic Packaging Market with 41.6% Share, Valued at USD 29.6 Billion

Among the key regions, Asia Pacific stands as the dominant market, accounting for 41.6% of the global share, with a market value of approximately USD 29.6 billion. This region is propelled by the rapid industrial growth in emerging economies such as China and India, along with a high demand for packaged food and beverages.

The expanding middle-class population and increasing disposable income have significantly contributed to the surge in demand for aseptic packaging solutions, particularly for dairy, juice, and ready-to-eat food products.

Regional Mentions:

In North America, the market is expected to exhibit steady growth, bolstered by the strong demand for convenience foods and beverages, as well as innovations in packaging technologies. The North American aseptic packaging market is driven by the U.S., which remains one of the largest consumers of packaged food and beverages.

The region’s stringent food safety regulations and emphasis on sustainability further contribute to the adoption of aseptic packaging solutions. The market is projected to grow at a moderate pace, supported by the rising preference for long shelf-life and cost-effective packaging solutions.

Europe follows closely, with a strong market presence due to the high adoption of advanced packaging technologies in countries like Germany, France, and the U.K. The European market is characterized by a significant shift toward sustainable packaging solutions and a preference for premium and organic products, which have driven demand for aseptic packaging, particularly in the dairy and beverage segments.

The Middle East & Africa and Latin America markets, while smaller in comparison, are also witnessing gradual growth. The Middle East’s demand for aseptic packaging is driven by expanding retail sectors and increasing consumption of packaged food and beverages, while Latin America’s market is benefiting from growing urbanization and a rising preference for convenient, ready-to-drink products.

In summary, the Asia Pacific region remains the dominant player in the aseptic packaging market, with its significant market share and robust growth prospects, followed by steady developments in North America and Europe.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In 2023, the global aseptic packaging market is characterized by the strong presence of several key players, each contributing to the growth and innovation of the sector.

Leading companies such as Robert Bosch GmbH, Smurfit Kappa, and Tetra Pak International SA continue to drive market expansion through advanced packaging solutions and technological innovations, particularly in the food and beverage industries.

Bosch’s expertise in packaging machinery, combined with Smurfit Kappa’s strong packaging solutions, positions them as critical players in the evolution of sustainable and efficient aseptic packaging.

Tetra Pak, a market leader, remains a dominant force due to its comprehensive aseptic packaging systems and commitment to sustainability. The company has pioneered the development of carton-based packaging that maintains product integrity without refrigeration, catering to a growing demand for longer shelf-life and eco-friendly packaging options.

Companies like Mondi PLC, Reynolds Group Holdings, and SIG Combibloc Group have also strengthened their positions by expanding their product portfolios and focusing on innovation.

SIG Combibloc, for instance, has made significant strides in the development of high-quality aseptic packaging for dairy and beverages, while Mondi’s integration of smart packaging technologies has garnered attention in the healthcare and food sectors.

Amcor and Becton, Dickinson and Company are notable for their focus on sterilization technology and advanced materials, further enhancing product safety and performance in critical applications such as pharmaceuticals. Elopak AS and Greatview Aseptic Packaging Co. Ltd. are expanding their footprint in emerging markets, capitalizing on the growing need for safe, sustainable, and cost-efficient packaging solutions.

Overall, these key players are leveraging technology, sustainability, and expanding product portfolios to maintain their leadership in the aseptic packaging market.

Top Key Players in the Market

- Robert Bosch GmbH

- Smurfit Kappa

- Mondi PLC

- Reynolds Group Holdings Limited

- Becton, Dickinson and Company

- IMA S.P.A

- SIG Combibloc Group

- DS Smith PLC

- Uflex Limited

- Elopak AS

- CDF Corporation

- Schott AG

- Amcor

- Printpack

- Sealed Air Corporation

- Greatview Aseptic Packaging Co. Ltd

- IPI SRL (Coesia Group)

- Tetra Pak International SA

Recent Developments

- In Oct 2024, UFlex shares rose by 4% after its subsidiary announced a $126 million investment in a new aseptic packaging unit in Egypt.

- In Jan 2022, UFlex announced plans to invest $90 million in expanding its aseptic packaging operations.

- In March 2023, a Swiss company revealed plans to invest ₹525 crore in a new aseptic cartons plant.

- In Jan 2023, SIG made an investment of approximately €100 million (INR 880 crore) to upgrade its aseptic carton packaging production technology.

Report Scope

Report Features Description Market Value (2023) USD 72.4 Billion Forecast Revenue (2033) USD 209.3 Billion CAGR (2024-2033) 11.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Plastic, Metal, Glass, Paper and Paperboard, Others), By Product (Cartons, Bottles and Cans, Bags and Pouches, Prefilled Syringes, Vials and Ampoules, Others), By Application (Beverages, Food, Pharmaceutical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Robert Bosch GmbH, Smurfit Kappa, Mondi PLC, Reynolds Group Holdings Limited, Becton, Dickinson and Company, IMA S.P.A, SIG Combibloc Group, DS Smith PLC, Uflex Limited, Elopak AS, CDF Corporation, Schott AG, Amcor, Printpack, Sealed Air Corporation, Greatview Aseptic Packaging Co. Ltd, IPI SRL (Coesia Group), Tetra Pak International SA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Robert Bosch GmbH

- Smurfit Kappa

- Mondi PLC

- Reynolds Group Holdings Limited

- Becton, Dickinson and Company

- IMA S.P.A

- SIG Combibloc Group

- DS Smith PLC

- Uflex Limited

- Elopak AS

- CDF Corporation

- Schott AG

- Amcor

- Printpack

- Sealed Air Corporation

- Greatview Aseptic Packaging Co. Ltd

- IPI SRL (Coesia Group)

- Tetra Pak International SA