Global High-Performance Fibers Market By Type (Carbon Fiber, Aramid Fiber, Glass Fiber, Polybenzimidazole (PBI), Polybenzoxazole (PBO), High Strength Polyethylene, Others), By Category (Virgin, Recycled), By End-use (Aerospace and Defense, Automotive and Transportation, Sporting Goods, Building and Construction, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 147274

- Number of Pages: 319

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

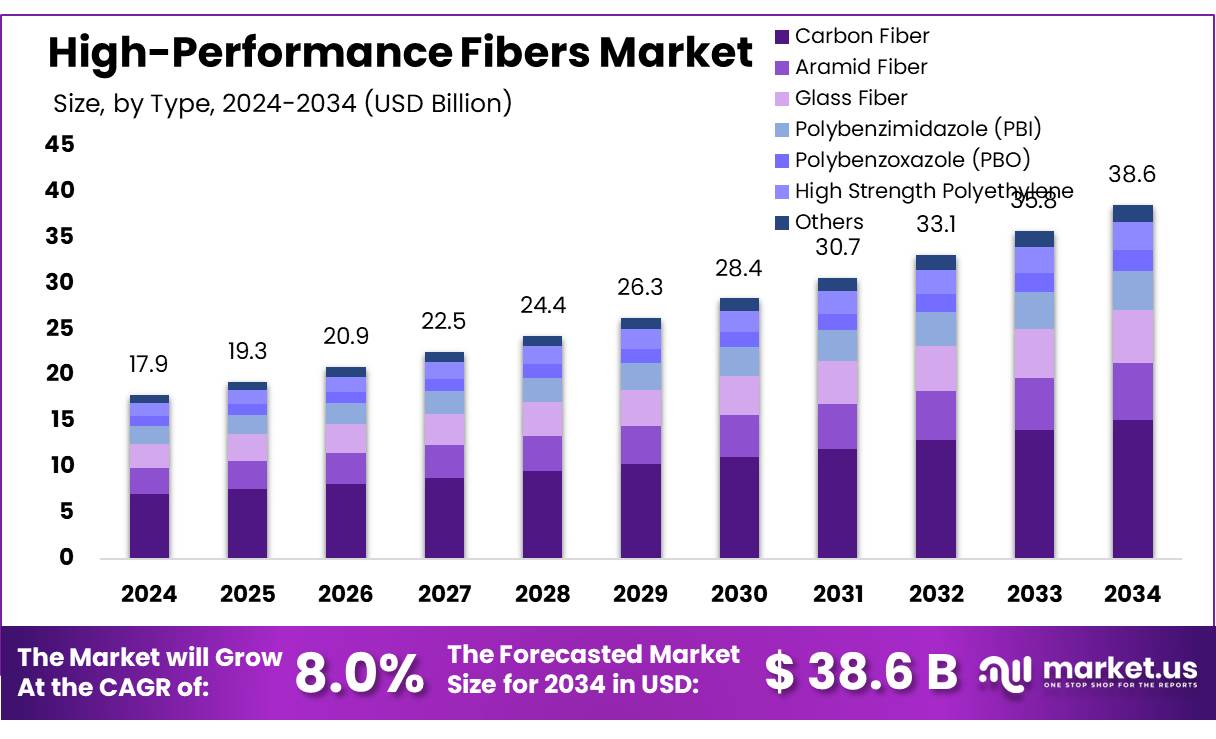

The Global High-Performance Fibers Market size is expected to be worth around USD 38.6 Billion by 2034, from USD 17.9 Billion in 2024, growing at a CAGR of 8.0% during the forecast period from 2025 to 2034.

High-performance fibers are advanced synthetic fibers that exhibit superior properties such as exceptional strength, stiffness, heat resistance, and chemical stability. These fibers surpass the capabilities of conventional commodity fibers, enabling their use in demanding applications across various industries.

They are extensively utilized in sectors including aerospace, national defense, automotive, renewable energy, rail transportation, and sports equipment, where lightweight materials with high mechanical performance are critical.

Common types of high-performance fibers include carbon fibers, aramid fibers, ultra-high molecular weight polyethylene (UHMWPE), basalt fibers, polyphenylene sulfide, polyimide, and poly(p-phenylene benzobisoxazole) fibers. The exceptional characteristics of these fibers such as high tensile strength, thermal resistance, and chemical durability contribute to enhanced performance, weight reduction, and improved protection and reliability of sophisticated equipment.

Globally, the high-performance fiber market is experiencing steady growth, driven by increasing demand for lightweight, durable materials in advanced engineering applications, defense, and renewable energy sectors, which continue to fuel innovation and expansion in this field.

Key Takeaways

- The global high-performance fibers market was valued at US$ 17.9 billion in 2024.

- The global high-performance fibers market is projected to grow at a CAGR of 8.0% and is estimated to reach US$ 38.6 billion by 2034.

- Among types, carbon fibers accounted for the majority of the market share at 39.20%.

- By category, virgin accounted for the largest market share of 87.3%.

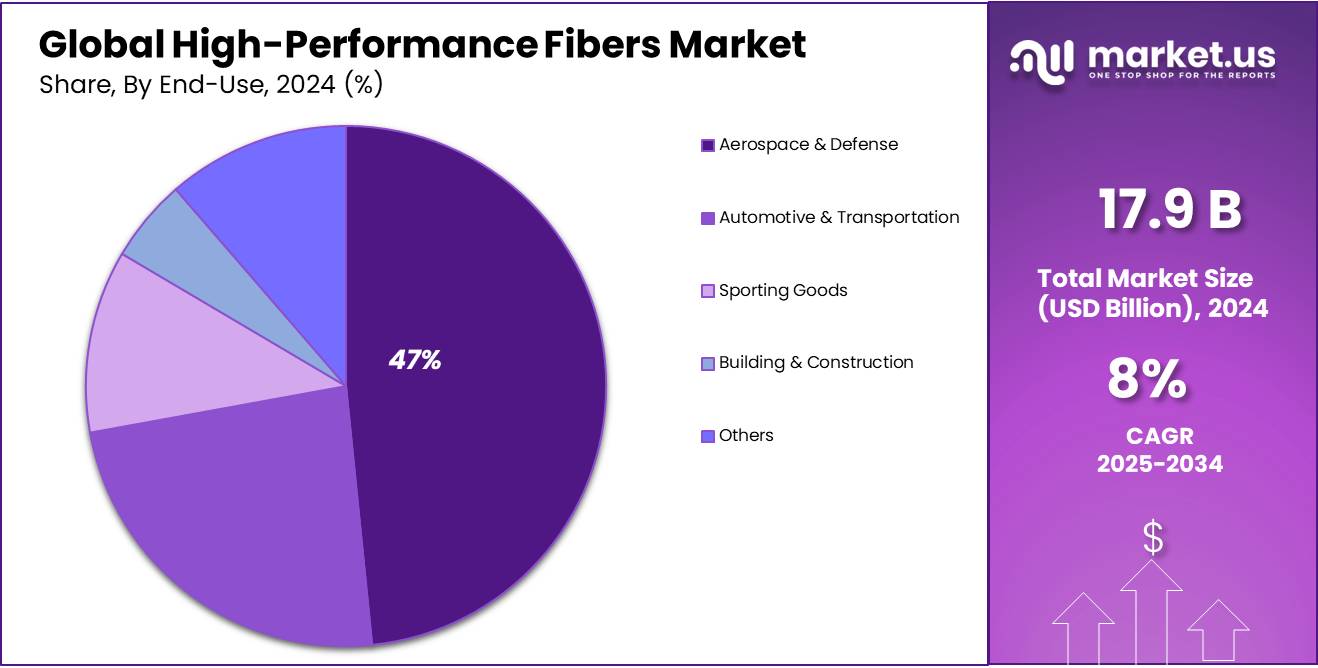

- By end-use, aerospace & defense accounted for the majority of the market share at 46.9%.

- Asia Pacific is estimated as the largest market for high-performance fibers with a share of 46.2% of the market share.

By Type

Carbon Fiber Dominated High Performace Fiber Market Share with 39.2%

The high-performance fibers market is segmented based on type into Carbon fiber, aramid fiber, glass fiber, Polybenzimidazole (PBI), Polybenzoxazole (PBO), high-strength polyethylene, and others. In 2024, the carbon fiber segment held a significant revenue share of 39.2%. Due to its exceptional strength-to-weight ratio, excellent fatigue resistance, and increasing adoption across industries such as aerospace, automotive, sports equipment, and renewable energy.

Its ability to enhance fuel efficiency, reduce emissions, and improve overall product performance drives strong demand. Additionally, ongoing advancements in carbon fiber manufacturing technologies have led to cost reductions, enabling broader applications in both high-end and mainstream markets.

By Category

Virgin High Performace Fiber Holding the 87.3% Market Share As of 2024

Based on category, the market is further divided into virgin, and recycled. The predominance of the Virgin, commanding a substantial 87.3% market share in 2024. Due to their superior mechanical properties, consistent quality, and reliability that virgin fibers offer compared to recycled alternatives. Industries such as aerospace, defense, and automotive demand high-performance materials with stringent specifications, which virgin fibers can consistently meet.

Additionally, recycled fibers often face challenges related to variability in performance, contamination, and processing difficulties, limiting their adoption in critical applications. As a result, virgin fibers remain the preferred choice for manufacturers seeking optimal strength, durability, and performance.

By End-use

Aerospace and Defence Major Industries Leads Market With 46.9% Share in 2024.

Among end-use, the high-performance fiber market is classified into aerospace & defense, automotive & transportation, sporting goods, building & construction, and others. In 2024, aerospace & defense held a dominant position with a 46.9% share. Driven by the sector’s stringent requirements for materials that offer exceptional strength-to-weight ratios, high durability, and resistance to extreme temperatures and harsh environments.

High-performance fibers such as carbon fiber and aramid fiber are extensively used in aircraft structures, missile components, and protective gear, enabling improved fuel efficiency, enhanced safety, and superior performance. The continuous advancement in aerospace technologies and increasing defense budgets globally further contribute to the strong demand for these fibers in the industry.

Key Market Segments

By Type

- Carbon Fiber

- Ultra-high Modulus

- High Modulus

- Intermediate Modulus

- Low Modulus

- High Tenacity

- Aramid Fiber

- Para-aramid

- Meta-aramid

- Glass Fiber

- Polybenzimidazole (PBI)

- Polybenzoxazole (PBO)

- High Strength Polyethylene

- Others

By Category

- Virgin

- Recycled

By End-use

- Aerospace & Defense

- Automotive & Transportation

- Sporting Goods

- Building & Construction

- Others

Drivers

Growing Adoption of Lightweight Materials in High-Tech Industries

The growing adoption of lightweight materials in high-tech industries is emerging as a significant driver of growth in the global high-performance fiber market. Industries such as aerospace, automotive, renewable energy, and advanced defense manufacturing are increasingly turning to high-performance fibers—including carbon fiber, aramid (Kevlar), and high-strength polyethylene—due to their superior strength-to-weight ratios compared to traditional materials like steel and aluminum. These fibers enable substantial weight reductions in structural and interior components while maintaining or enhancing mechanical performance, which is critical for improving energy efficiency, extending operational range, and lowering emissions.

- According to reports published by the U.S. Department of Energy a 10% reduction in vehicle weight can result in a 6%-8% fuel economy improvement.

- In addition replacing traditional steel components with lightweight materials such as high-performance carbon fiber, and composites can directly reduce the weight of a vehicle’s body and chassis by up to 50 percent and therefore reduce a vehicle’s fuel consumption.

Additionally, high-performance fibers are being utilized in both commercial and defense applications, from air taxis and aircraft fuselage components to rockets, missiles, fighter jets, and naval vessels. Their lightweight yet durable characteristics support the sector’s push toward fuel efficiency and decarbonization, aligning with broader sustainability goals. Similarly, the automotive industry is undergoing a major transformation driven by the shift toward electric vehicles (EVs), where reducing vehicle weight is essential to compensate for the added mass of batteries and electric powertrains. The integration of lightweight composites into chassis, body panels, and interior parts not only enhances performance but also enables manufacturers to incorporate advanced safety, emission control, and digital systems without increasing total vehicle weight.

- According to the U.S. Department of Energy (DOE), lightweight materials such as carbon fiber composites can reduce vehicle weight by up to 30%, leading to a 20-25% improvement in fuel efficiency, which is critical for electric vehicle (EV) performance and range enhancement.

- The U.S. Federal Aviation Administration (FAA) reports state that modern commercial aircraft use approximately 50% composite materials by weight, including carbon fiber reinforced polymers, to achieve weight reduction and enhanced fuel efficiency.

Furthermore, the expansion of smart manufacturing technologies and increased R&D investments are facilitating wider adoption of high-performance fibers in previously cost-sensitive segments. The shift from luxury and high-performance vehicles to more mainstream automotive applications highlights the scalability of lightweight materials. As urbanization intensifies and mobility demands evolve, high-performance fibers are playing a pivotal role in the development of efficient, sustainable, and next-generation transport solutions. This trend is expected to accelerate further as regulatory pressures for carbon reduction and energy efficiency continue to rise globally, making high-performance fibers indispensable in the ongoing industrial shift toward lightweight, high-strength, and multifunctional material solutions.

- The International Energy Agency (IEA) also emphasizes that the adoption of lightweight composites is essential for decarbonizing the transport sector, projecting that lightweight materials could reduce global CO2 emissions by up to 1 gigaton annually by 2040.

Restraints

Competition From Alternative Material

The global high-performance fiber market is experiencing growth constraints due to rising competition from alternative materials such as steel, iron, high-performance thermoplastics, and aluminum and magnesium alloys. These substitutes often deliver comparable performance characteristics such as strength, durability, and heat resistance at more competitive price points. In addition, consumer and industry preferences in sectors such as construction, automotive, and aerospace are being influenced, particularly where cost-efficiency is a critical factor.

Additionally, advancements in material science and manufacturing processes have significantly improved the lightweight properties, impact resistance, and aesthetic appeal of these alternatives. High-performance thermoplastics and aluminum alloys, for instance, are increasingly favored in architectural applications due to their sleek appearance and resilience, while steel and iron maintain strong positions due to their structural versatility and affordability. As these competing materials continue to narrow the performance gap, they present a tangible restraint on the widespread adoption of high-performance fibers, particularly in cost-sensitive and mainstream applications.

Opportunity

Next-Gen Sports Equipment & Wearables

The emergence of next-generation sports equipment and wearable technology is creating significant growth opportunities for the global high-performance fiber market. As industries increasingly prioritize performance, sustainability, and innovation, high-performance fibers especially carbon fiber composites, aramid fibers, and ultra-high molecular weight polyethylene are becoming essential materials in both advanced athletic gear and wearable electronics.

Furthermore, high-performance fibers are revolutionizing product design by enabling the development of lighter, stronger, and more ergonomically optimized gear. Carbon fiber’s superior strength-to-weight ratio and durability make it ideal for applications such as tennis rackets, golf clubs, bicycle frames, hockey sticks, skis, snowboards, and water sports equipment. These materials enhance athlete performance by improving power transmission, control, and durability while reducing fatigue. As recreational and professional sports markets grow, driven by increased health awareness and competitive trends, the demand for such high-performance materials continues to rise.

Moreover, the integration of functional fibers into wearable technology represents a transformative opportunity for the high-performance fiber industry. These fibers can be engineered to embed sensors, conductors, and other electronic components directly into clothing, enabling multifunctional smart textiles that replace bulkier devices like smartwatches or fitness trackers. High-performance fibers offer the mechanical properties needed for flexibility, durability, conductivity, and strength while maintaining the comfort and wearability of traditional fabrics. This is particularly relevant as consumer electronics move toward more seamless and body-integrated formats.

- According to the Sports & Fitness Industry Association (SFIA), sports participation in the US reached a record high in 2023, with over 236 million Americans participating in at least one sport, fitness, or outdoor activity—fueling demand for advanced sports equipment.

Trends

3D Printing with High-Performance Fibers

The integration of 3D printing with high-performance fibers such as carbon fiber, aramid (Kevlar), and glass fiber is rapidly transforming the global high-performance fiber market. This emerging trend enables the production of lightweight, high-strength, and geometrically complex components, particularly valuable in industries such as aerospace, automotive, defense, and industrial manufacturing.

By embedding high-performance fibers into polymer matrices during the additive manufacturing process, manufacturers can enhance the mechanical, thermal, and structural performance of printed parts, offering significant advantages over traditional materials. These capabilities align with growing industry demands for weight reduction, design flexibility, and sustainability, positioning 3D printing as a key enabler of advanced material adoption.

Moreover, additive manufacturing supports on-demand, digital production models that reduce lead times, minimize waste, and increase customization benefits that are increasingly prioritized in high-performance sectors. While thermoplastic-based printing has dominated the market, the shift toward fiber-reinforced thermoset composites is gaining momentum due to their superior properties. As 3D printing technologies mature and material innovations continue, the adoption of high-performance fibers in additive manufacturing is expected to expand further, driving market growth by opening new applications and improving production efficiency across critical industries.

Geopolitical Impact Analysis

Geopolitical Tensions Are Shifting The High-Performance Fiber Market Toward Regional Self-Reliance, Local Manufacturing, And More Resilient Supply Chains.

The global high-performance fiber market—encompassing key materials such as carbon fiber, aramid fiber, and glass fiber—is increasingly shaped by a volatile geopolitical landscape. Rising geopolitical rivalries, trade protectionism, armed conflicts, and intensifying competition for critical resources are disrupting well-established global supply chains. These pressures are compounded by cybersecurity threats and a higher frequency of climate-induced disruptions, creating significant uncertainty for manufacturers and suppliers operating across borders.

Furthermore, ongoing geopolitical conflicts are disrupting key maritime trade routes, affecting the consistent supply of raw materials and finished high-performance fiber products. In response, several governments are adopting protectionist measures and promoting domestic self-sufficiency in critical sectors. Additionally, some nations’ government implementation of the global minimum tax, with others retreating from multilateral tax frameworks, is contributing to regulatory fragmentation. This impact is creating complex and uneven production and supply chains for the high-performance fiber industry.

These Evolving regulations are significantly impacting the high-performance fiber market. Increasingly stringent environmental and trade regulations, especially in export-focused regions. The EU’s Carbon Border Adjustment Mechanism (CBAM) introduces added compliance costs for carbon-intensive producers. These changes are prompting manufacturers to reassess sourcing, production, and supply chain strategies. The focus is shifting toward cost efficiency and alignment with emerging regulatory requirements.

- The European Union is implementing the Carbon Border Adjustment Mechanism (CBAM), which will impose a carbon tax on certain imported products, including steel, alloy, and potentially high-performance fibers like carbon fiber, starting in 2026. This tax aims to account for the embedded carbon emissions in imported goods, making such imports more expensive unless manufacturers reduce their greenhouse gas emissions.

In reaction to these challenges, countries such as India, China, and the United States are actively scaling up domestic production of high-performance fibers—most notably carbon fiber—to reduce import dependency and limit exposure to foreign environmental levies such as CBAM. These strategic efforts reflect a broader market shift toward regional resilience, supply chain localization, and technological self-reliance.

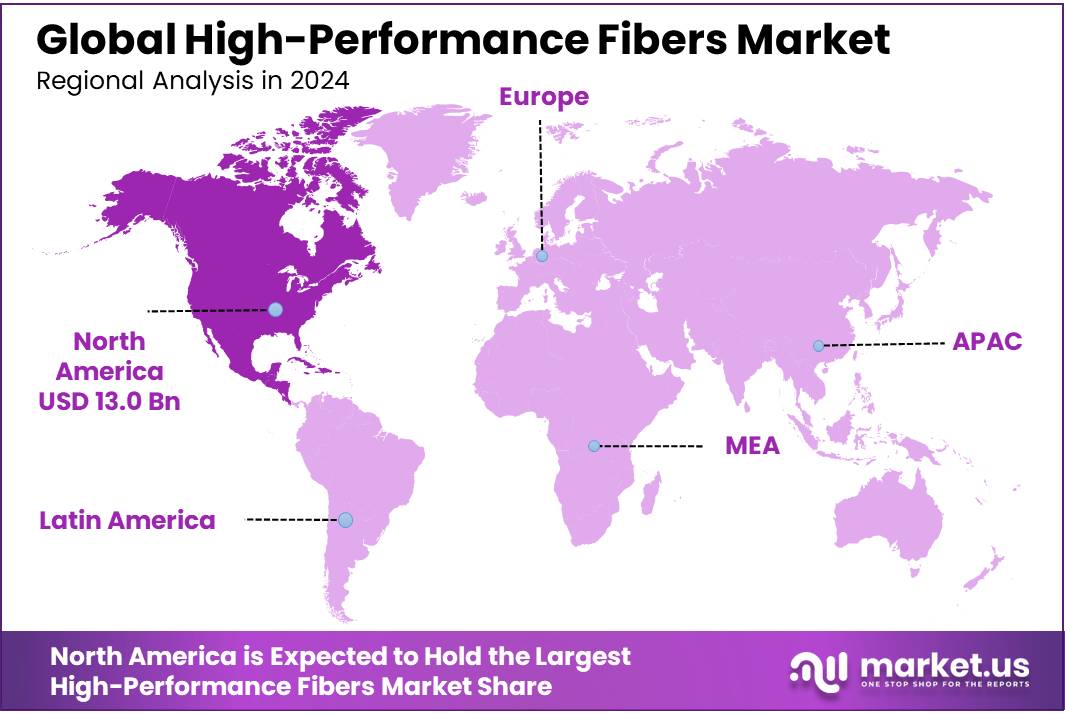

Regional Analysis

Asia Pacific Held the Largest Share of the Global High-Performance Fibers Market

In 2024, Asia Pacific dominated the global high-performance fibers market, accounting for 46.2% of the total market share, driven by countries such as China, India, and Southeast Asian nations due to growing economic expansion. This has led to rapid urbanization and infrastructural development, creating significant demand for construction materials such as carbon fibers, glass fibers, aramid fibers (like Kevlar), and synthetic fibers such as Polypropylene (PP) and Polyethylene (PE).

As cities expand and modernize, the need for high-quality building materials increases, further fueling the demand for high-performance fibers. Further technological advancements and variety of material products, and government stringent regulation control for the use of sustainable materials also fuel the demand for high-performance fibers.

Moreover, the growing construction industry is one of the fastest-growing sectors in the Asia Pacific region. This growth is driven by a multitude of factors, including population growth, rising disposable incomes, and government initiatives aimed at infrastructure development. Aluminum composite panels are widely used in commercial, residential, and industrial construction projects due to their durability, lightweight nature, and aesthetic appeal.

Additionally, the growing construction sector in Asia Pacific acts as a major catalyst for the demand for high-performance fiber material. Governments across the Asia Pacific region have implemented stringent regulations and sustainability initiatives to promote the use of environmentally friendly sustainable materials in high-tech industries.

High-performance fibers are known for their lightweight, energy efficiency, and low carbon footprint compared to other traditional materials like iron and steel. Additionally, these government mandates and incentives drive the adoption of high-performance fiber in construction as well as aerospace projects, further boosting their demand and market dominance in the region.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Key Players in the High-Performance Fibers Market Dominate The Market Through Innovation And Investment In Product Lines.

The global high-performance fiber market is dominated by key players such as Toray Industries, Teijin Limited, DuPont de Nemours, and Honeywell International. These companies lead in innovation and production of advanced fibers such as carbon fiber, aramid, and UHMWPE serving critical sectors including aerospace, defense, automotive, and sporting goods. Their investments in R&D and sustainable technologies continue to drive product development, meet evolving industrial demands, and strengthen market competitiveness. Strategic partnerships, capacity expansions, and acquisitions further support their global presence and influence.

Top Key Players in the Market

- Toray Industries, Inc.

- Dupont

- Teijin Limited

- TOYOBO MC Corporation

- Kolon Industries, Inc.

- Huvis Corp.

- AGY

- Zoltek

- Owens Corning

- Hexcel Corporation

- KUREHA CORPORATION

- Yantai Tayho Advanced Materials Co.,Ltd

- Mitsubishi Chemical Corporation

- Avient Corporation

- Bally Ribbon Mills

- Honeywell International Inc.

- China Jushi Co., Ltd.

- Solvay S.A.

- Sarla Performance Fibers Limited

- Other Key Players

Recent Developments

- In May 2025 – Teijin Frontier developed a high-performance polyester fabric that mimics the texture and appearance of natural fibers while offering advanced features like cool touch, quick-drying, UV protection, and anti-stickiness—made entirely from recycled polyester for circularity.

- In October 2023 – Toray Industries developed TORAYCA™ T1200, the world’s highest-strength carbon fiber with a tensile strength of 1,160 Ksi, aimed at advancing lightweight, high-performance applications in aerospace, defense, and sustainable technologies.

Report Scope

Report Features Description Market Value (2024) USD 17.9 Bn Forecast Revenue (2034) USD 38.6 Bn CAGR (2025-2034) 8.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Carbon Fiber, Aramid Fiber, Glass Fiber, Polybenzimidazole (PBI), Polybenzoxazole (PBO), High Strength Polyethylene, Others), By Category (Virgin, Recycled), By End-use (Aerospace and Defense, Automotive and Transportation, Sporting Goods, Building and Construction, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Toray Industries, Inc., Dupont, Teijin Limited, TOYOBO MC Corporation, Kolon Industries, Inc., Huvis Corp., AGY, Zoltek, Owens Corning, Hexcel Corporation, KUREHA CORPORATION, Yantai Tayho Advanced Materials Co.,Ltd, Mitsubishi Chemical Corporation, Avient Corporation, Bally Ribbon Mills, Honeywell International Inc., China Jushi Co., Ltd., Solvay S.A., Sarla Performance Fibers Limited, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  High-Performance Fibers MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

High-Performance Fibers MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Toray Industries, Inc.

- Dupont

- Teijin Limited

- TOYOBO MC Corporation

- Kolon Industries, Inc.

- Huvis Corp.

- AGY

- Zoltek

- Owens Corning

- Hexcel Corporation

- KUREHA CORPORATION

- Yantai Tayho Advanced Materials Co.,Ltd

- Mitsubishi Chemical Corporation

- Avient Corporation

- Bally Ribbon Mills

- Honeywell International Inc.

- China Jushi Co., Ltd.

- Solvay S.A.

- Sarla Performance Fibers Limited

- Other Key Players