Global Super Abrasive Market Size, Share, And Business Benefits By Type (Diamond, (Natural, Synthetic), Cubic Boron Nitride (CBN), Others), By Bonding Agent (Resin Bond, Metal Bond, Electroplated, Vitrified, Others), By Application (Grinding, Cutting, Drilling, Polishing, Others), By End-use (Automotive, Oil and Gas, Aerospace, Electrical and Electronics, Medical, Composites, Machinery, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 146644

- Number of Pages: 395

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

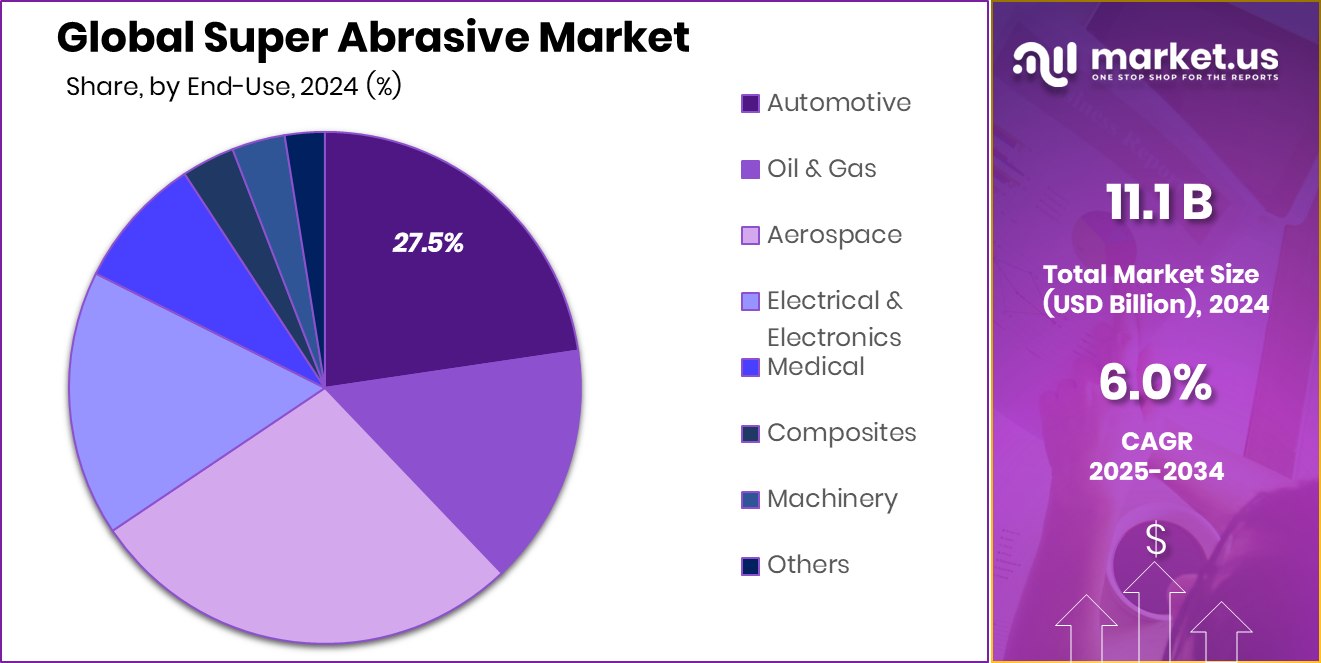

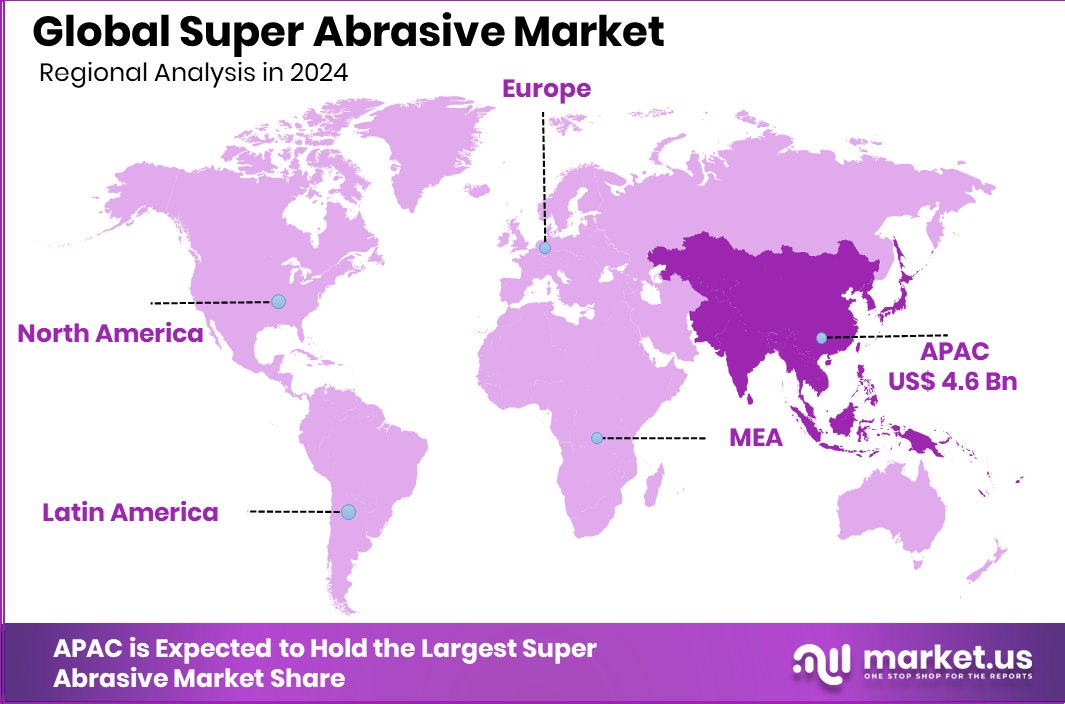

Global Super Abrasive Market is expected to be worth around USD 19.9 billion by 2034, up from USD 11.1 billion in 2024, and grow at a CAGR of 6.0% from 2025 to 2034. Super Abrasive usage rises in Asia-Pacific, capturing 42.3%, touching USD 4.6 Bn.

Super abrasives are high-performance cutting tools made from ultra-hard materials like diamond or cubic boron nitride (CBN). These materials offer extreme hardness, thermal resistance, and durability, making them ideal for precision grinding and machining applications. Unlike traditional abrasives, super abrasives maintain their sharpness and cutting ability over long production cycles.

The super abrasive market involves producing and supplying tools and materials used in high-precision cutting, drilling, grinding, and polishing. This market caters to demanding sectors that need efficient, long-lasting solutions for shaping hard metals and composite materials. With growing demand for tight-tolerance components and automated manufacturing, the market is evolving towards more specialized, high-performance abrasive solutions, including bonded wheels, coated abrasives, and superabrasive grits.

According to the Ministry of Chemicals and Fertilizers, the chemical sector, which includes abrasives, has shown consistent growth in production and exports. For instance, the export value of inorganic chemicals, a category that encompasses certain abrasive materials, increased significantly from FY 2018-19 to FY 2022-23.

Additionally, the Ministry of Commerce and Industry reported that India’s overall trade deficit declined from US$ 121.62 billion in 2022-23 to US$ 75.56 billion in 2023-24, indicating a positive trend in the trade of industrial goods, including abrasives.

In India, the abrasives industry has witnessed substantial growth, driven by the country’s rapid industrialization and infrastructure development. According to the Department of Scientific and Industrial Research (DSIR), the bonded abrasives sector operates with an estimated capacity utilization of 85%, reflecting robust demand. The market size for bonded abrasives was valued at approximately ₹190 crore, while coated abrasives stood at ₹110 crore, indicating a significant market presence.

Key Takeaways

- Global Super Abrasive Market is expected to be worth around USD 19.9 billion by 2034, up from USD 11.1 billion in 2024, and grow at a CAGR of 6.0% from 2025 to 2034.

- In 2024, Diamond held 67.1% market share due to superior hardness and durability features.

- Resin Bond dominated with a 44.3% share, thanks to its versatility and smooth surface finishing.

- Grinding captured 48.7% of the application segment due to rising precision engineering needs globally.

- Automotive held a 27.5% share, driven by demand for high-efficiency machining and component finishing.

- Strong industrial growth in Asia-Pacific boosts demand, holding 42.3%, worth USD 4.6 Bn.

By Type Analysis

In 2024, Diamond led with 67.1% due to unmatched cutting efficiency.

In 2024, Diamond held a dominant market position in the By Type segment of the Super Abrasive Market, with a 67.1% share. This strong foothold was primarily driven by diamond’s unmatched hardness, thermal conductivity, and ability to deliver precision cutting in critical applications.

Its widespread use in industrial grinding and cutting tools across sectors such as automotive, aerospace, and electronics contributed significantly to this market dominance. Diamond abrasives are particularly valued in machining hard metals and high-performance ceramics, offering extended tool life and reduced processing time, which enhances manufacturing efficiency.

Additionally, increasing demand for ultra-precision machining, especially in electronics and medical devices, continues to elevate the preference for diamond-based solutions. The synthetic diamond segment is also gaining traction due to cost efficiency and improved technological performance, further strengthening the overall demand. Given its performance benefits and adaptability across various substrates, diamond remains the top choice among super-abrasive types.

By Bonding Agent Analysis

Resin bond held 44.3% share, thanks to flexible grinding capabilities.

In 2024, Resin Bond held a dominant market position in the By Bonding Agent segment of the Super Abrasive Market, with a 44.3% share. This leading position was largely due to the flexibility and cost-effectiveness of resin bonds in diverse grinding applications.

Resin bonds offer excellent cutting efficiency and smooth surface finishes, making them ideal for precision machining across automotive, electronics, and aerospace sectors. Their ability to hold super abrasive grains like diamond and CBN firmly, while allowing controlled wear, results in longer tool life and improved grinding performance.

The popularity of resin bonds is further supported by their adaptability in both wet and dry grinding conditions, which makes them a versatile choice for end users. They are widely used in applications involving tool sharpening, surface finishing, and internal grinding, where consistent results and reduced heat generation are critical.

By Application Analysis

Grinding dominated applications with 48.7% due to rapid surface finishing needs.

In 2024, Grinding held a dominant market position in the By Application segment of the Super Abrasive Market, with a 48.7% share. This dominance is linked to the increasing demand for precision machining and high-performance material processing across manufacturing industries. Super abrasives are widely used in grinding applications due to their superior hardness, wear resistance, and ability to maintain tight tolerances.

The 48.7% share signifies the essential role of grinding in ensuring surface accuracy, part geometry, and reduced machining cycles. Super abrasive grinding tools are especially important for processing hard-to-machine materials such as hardened steel, ceramics, and composites. With industries prioritizing productivity and surface quality, super abrasive grinding tools offer the necessary performance to meet rising production demands.

Moreover, advancements in CNC and automated grinding machines have made the process more efficient and repeatable, encouraging wider adoption. The strong market share held by grinding applications reflects its central importance in industrial operations that require consistent precision and reduced operational downtime.

By End-use Analysis

The automotive segment led end-use with 27.5% due to engine component manufacturing.

In 2024, Automotive held a dominant market position in the By End-use segment of the Super Abrasive Market, with a 27.5% share. This leadership is primarily driven by the high precision and durability requirements in automotive component manufacturing. Super abrasives are extensively used in grinding engine parts, transmission systems, brake components, and other critical assemblies where dimensional accuracy and surface finish are crucial.

The 27.5% market share reflects the industry’s reliance on advanced materials and high-speed machining to meet rising performance and emission standards. Super abrasive tools, especially those based on diamond and CBN, support efficient machining of hardened steel and composite materials used in modern vehicles. Moreover, the automotive sector’s ongoing shift toward electric vehicles has further boosted the demand for precision grinding tools, as EV components require tighter tolerances and smoother finishes.

Automotive production continues to scale globally, particularly in emerging markets, adding to the demand for high-quality machining tools. This consistent demand has positioned the automotive industry as a core consumer of superabrasive solutions.

Key Market Segments

By Type

- Diamond

- Natural

- Synthetic

- Cubic Boron Nitride (CBN)

- Others

By Bonding Agent

- Resin Bond

- Metal Bond

- Electroplated

- Vitrified

- Others

By Application

- Grinding

- Cutting

- Drilling

- Polishing

- Others

By End-use

- Automotive

- Oil and Gas

- Aerospace

- Electrical and Electronics

- Medical

- Composites

- Machinery

- Others

Driving Factors

High Precision Demand Boosting Super Abrasive Usage Worldwide

One of the biggest driving factors for the super abrasive market is the rising need for high-precision tools in industries like automotive, aerospace, and electronics. As these industries shift toward complex parts and tighter tolerances, traditional abrasives often fall short.

Super abrasives—like diamond and CBN—offer unmatched hardness and durability, which helps in delivering cleaner finishes and longer tool life. This precision is especially crucial in grinding engines, gears, and semiconductor components.

With the global shift toward electric vehicles and miniaturized electronics, the demand for ultra-precise machining continues to grow. As a result, industries are increasingly adopting super abrasives to improve product quality, reduce waste, and enhance efficiency in manufacturing processes.

Restraining Factors

High Production Costs Limit Super Abrasive Adoption

One major restraining factor for the super abrasive market is the high production cost involved. Super abrasives like synthetic diamond and cubic boron nitride (CBN) require advanced technology, specialized equipment, and expensive raw materials.

These materials are costlier than traditional abrasives, making them less affordable for small and medium manufacturers. Also, the initial investment in tools and machines compatible with super abrasives is quite high.

Many companies, especially in developing regions, hesitate to switch due to budget limitations. Although super abrasives last longer and perform better, the upfront cost becomes a challenge. This cost barrier slows down widespread adoption, especially in price-sensitive markets, limiting the growth potential of the industry in certain regions.

Growth Opportunity

Expanding Electronics Industry Fuels Super Abrasive Demand

The rapid growth of the electronics industry presents a significant opportunity for the super abrasive market. Super abrasives, such as diamond and cubic boron nitride (CBN), are essential in manufacturing electronic components like printed circuit boards (PCBs), semiconductors, and microchips.

These materials require precise grinding and polishing to achieve the necessary specifications. As the demand for smaller, more efficient electronic devices increases, so does the need for high-precision manufacturing tools.

Super abrasives offer the durability and accuracy required for these applications, making them indispensable in the production process. Furthermore, the expansion of the electronics sector in regions like Asia-Pacific, particularly in countries such as China and India, amplifies this demand.

Latest Trends

Nano-Diamond Coatings Enhance Super Abrasive Performance

These ultra-thin coatings, composed of nano-sized diamond particles, provide exceptional hardness and thermal conductivity, leading to tools that are more durable and efficient. Industries such as aerospace, automotive, and electronics benefit from these advancements, as nano-diamond-coated tools offer improved wear resistance and longer service life.

This innovation reduces the frequency of tool replacements, thereby decreasing downtime and operational costs. Moreover, the enhanced precision and consistency achieved with these coatings contribute to higher-quality end products.

As manufacturers seek to optimize production processes and meet stringent quality standards, the adoption of nano-diamond coatings in super abrasives is expected to grow, driving the market forward.

Regional Analysis

Asia-Pacific leads the Super Abrasive Market with 42.3% share, valued at USD 4.6 Bn.

The Asia-Pacific region dominates the global super abrasive market, accounting for a commanding 42.3% share, equivalent to USD 4.6 billion. This leadership is driven by robust industrial growth, particularly in countries like China, India, and Japan, where the demand for precision tools in electronics and automotive manufacturing is escalating. The region’s rapid urbanization and infrastructure development further bolsters the market, making Asia-Pacific the epicenter of super abrasive consumption.

North America follows, propelled by technological advancements and a strong presence in the aerospace and automotive sectors. The United States, in particular, is witnessing increased adoption of super abrasives due to the rise in electric vehicle production and the need for high-precision components. The region’s focus on innovation and quality manufacturing processes contributes to its significant market share.

Europe maintains a steady position in the market, supported by its well-established automotive industry and stringent manufacturing standards. Countries like Germany and France are key contributors, emphasizing high-quality production and technological integration. The region’s commitment to sustainable manufacturing practices also influences the adoption of advanced super abrasive materials.

The Middle East & Africa and Latin America regions are emerging markets with growing potential. In the Middle East & Africa, industrialization and infrastructure projects are creating new opportunities for super abrasive applications. Latin America’s market is gradually expanding, driven by developments in the automotive and construction sectors, indicating a positive outlook for future growth.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

3M continues to lead the super abrasive market with its innovative product lines, notably the 3M™ Cubitron™ 3 Performance Abrasives. These abrasives utilize precision-shaped grain technology, offering up to three times the performance in lifespan and cut rate compared to previous iterations. Such advancements cater to industries demanding high efficiency and durability, including aerospace and automotive sectors.

With over a century of experience, Tyrolit Group stands as a prominent manufacturer of grinding and dressing tools. The company’s focus on product stability and secured delivery, as highlighted in their recent communications, underscores their dedication to quality and customer satisfaction. Tyrolit’s extensive product range and global presence enable it to serve diverse industries effectively, maintaining its status as a key player in the super abrasive market.

Asahi Diamond Industrial Co., Ltd. is recognized for its comprehensive range of super-abrasive products, including diamond and cubic boron nitride tools. The company’s emphasis on research and development facilitates the creation of high-precision tools tailored for various applications, from automotive to electronics. Asahi’s global operations and commitment to innovation contribute significantly to its strong market position.

Top Key Players in the Market

- 3M Company

- Tyrolit Group

- Asahi Diamond Industrial Co.,Ltd.

- Noritake Co., Limited

- Saint-Gobain

- VSM AG

- CUMI

- Gunter Effgen GmbH

- Heger GmbH Excellent Diamond Tools

- Super Abrasives

- Continental Diamond Tool Corporation

- Hyperion Materials & Technologies

- White Dove Abrasives Co., Ltd

- Luoyang Runbao Super Abrasives Co. Ltd.

- Zhuhai Elephant Abrasives Co., Ltd

- Norton Abrasives

- Other Key Players

Recent Developments

- In March 2025, 3M announced a $3.5 billion investment in R&D over the next three years, aiming to launch 1,000 new products. This initiative includes leveraging AI to enhance product development, such as optimizing abrasive shapes for better performance.

- In January 2024, Tyrolit acquired a majority share in ATS, an Australian wholesaler and converter of abrasive tools. This move strengthens Tyrolit’s presence in the Australian market and expands its customer base.

Report Scope

Report Features Description Market Value (2024) USD 11.1 Billion Forecast Revenue (2034) USD 19.9 Billion CAGR (2025-2034) 6.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Diamond, (Natural, Synthetic), Cubic Boron Nitride (CBN), Others), By Bonding Agent (Resin Bond, Metal Bond, Electroplated, Vitrified, Others), By Application (Grinding, Cutting, Drilling, Polishing, Others), By End-use (Automotive, Oil and Gas, Aerospace, Electrical and Electronics, Medical, Composites, Machinery, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape 3M Company, Tyrolit Group, Asahi Diamond Industrial Co.,Ltd., Noritake Co., Limited, Saint-Gobain, VSM AG, CUMI, Gunter Effgen GmbH, Heger GmbH Excellent Diamond Tools, Super Abrasives, Continental Diamond Tool Corporation, Hyperion Materials & Technologies, White Dove Abrasives Co., Ltd, Luoyang Runbao Super Abrasives Co. Ltd., Zhuhai Elephant Abrasives Co., Ltd, Norton Abrasives, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- 3M Company

- Tyrolit Group

- Asahi Diamond Industrial Co.,Ltd.

- Noritake Co., Limited

- Saint-Gobain

- VSM AG

- CUMI

- Gunter Effgen GmbH

- Heger GmbH Excellent Diamond Tools

- Super Abrasives

- Continental Diamond Tool Corporation

- Hyperion Materials & Technologies

- White Dove Abrasives Co., Ltd

- Luoyang Runbao Super Abrasives Co. Ltd.

- Zhuhai Elephant Abrasives Co., Ltd

- Norton Abrasives

- Other Key Players