Global Petroleum Coke Market By Type (Calcined Coke, Fuel-grade Coke, Shot Coke, Sponge Coke), By Coking Process (Delayed Coking, Fluid Coking), By Application (Cement, Ceramic, Power Generation, Industrial Boilers, Aluminum and Other Metals, Carbon Products, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 147096

- Number of Pages: 351

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

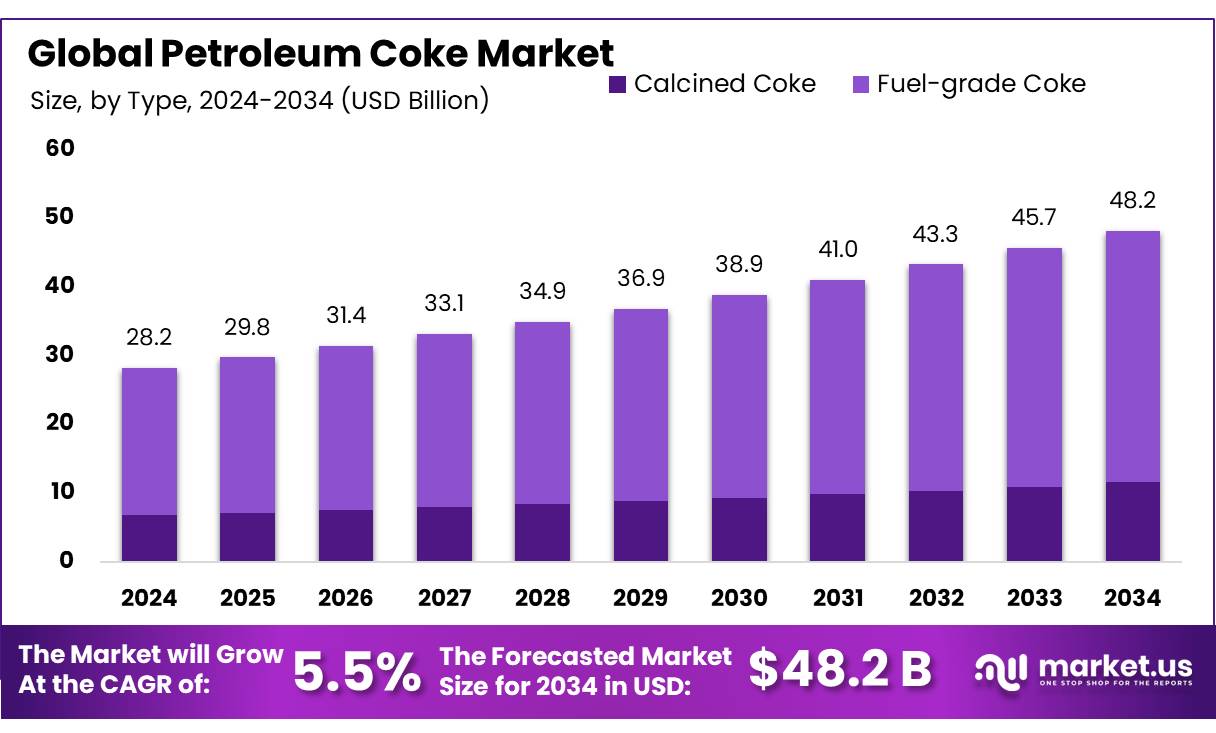

The Global Petroleum Coke Market size is expected to be worth around USD 48.2 Bn by 2034, from USD 28.2 Bn in 2024, growing at a CAGR of 5.5% during the forecast period from 2025 to 2034.

Petroleum coke, commonly referred to as petcoke, is a solid carbon material derived from oil refinery coker units or other cracking processes. It is primarily used as a fuel in cement kilns and power plants, and as a feedstock in the production of electrodes for the aluminum and steel industries. Petcoke’s high calorific value and relatively low cost compared to coal have made it an attractive energy source, especially in energy-intensive industries. According to the U.S. Energy Information Administration (EIA), U.S. refineries produced approximately 60.5 million metric tons of petroleum coke in 2023, highlighting its significant industrial role.

The industrial scenario for petroleum coke has been shaped by both environmental regulations and global demand patterns. While fuel-grade petcoke continues to be widely consumed, especially in developing economies like India and China, concerns over its high sulfur and heavy metal content have led to tighter environmental controls.

The Indian Ministry of Environment, Forest and Climate Change, for instance, has placed restrictions on petcoke imports for use as fuel while allowing it for industries like cement and steel that have emission control technologies. Despite these regulations, global demand remains strong. India’s petcoke imports were recorded at 14.2 million metric tons in 2023, according to the Ministry of Commerce & Industry.

Driving factors supporting the growth of the petroleum coke industry include the increasing global demand for aluminum and steel production. Green petroleum coke (GPC) is a critical raw material in the production of anodes used in aluminum smelting. With global aluminum consumption expected to grow at 3% annually until 2030, as per the International Aluminium Institute, the demand for high-quality GPC remains robust. Furthermore, the cement industry’s steady expansion, particularly in Asia-Pacific regions, where urbanization and infrastructure investments are on the rise, continues to fuel the demand for fuel-grade petcoke.

Key Takeaways

- Petroleum Coke Market size is expected to be worth around USD 48.2 Bn by 2034, from USD 28.2 Bn in 2024, growing at a CAGR of 5.5%.

- Fuel-grade Coke held a dominant market position, capturing more than a 76.50% share.

- Delayed Coking held a dominant market position, capturing more than an 87.40% share in the Petroleum Coke Market by Coking Process.

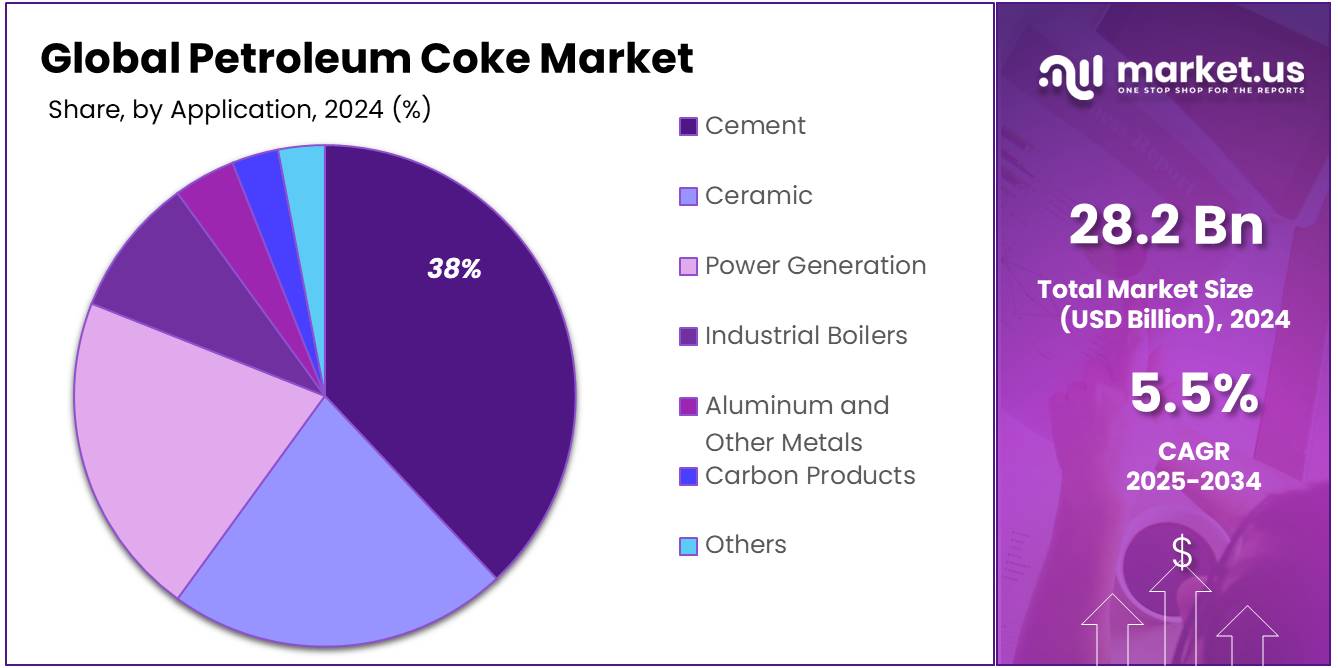

- Cement held a dominant market position, capturing more than a 38.40% share in the Petroleum Coke Market by Application.

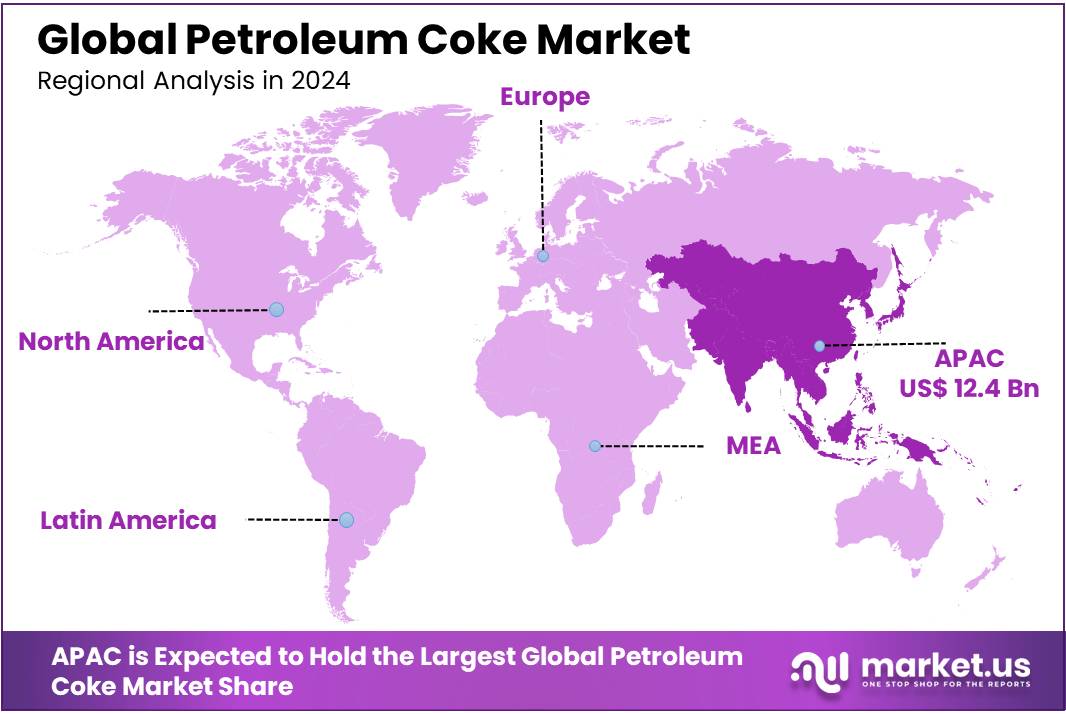

- Asia-Pacific (APAC) region stands as the dominant force in the global petroleum coke market, holding a substantial market share of approximately 44.30%, which translates to a market value of USD 12.4 billion.

By Type

Fuel-grade Coke dominates with 76.50% share due to its strong industrial fuel demand.

In 2024, Fuel-grade Coke held a dominant market position, capturing more than a 76.50% share in the Petroleum Coke Market. This type of coke is highly valued for its affordability and high-energy output, making it the preferred choice across industries like cement, power generation, and steel manufacturing. The rising global need for low-cost, high-calorific value fuels is one of the main reasons for its strong dominance. With many emerging economies continuing to depend heavily on thermal fuels, Fuel-grade Coke remains a critical industrial input.

In 2025, the segment is expected to maintain its leadership, supported by expanding infrastructure projects, especially in Asia-Pacific and Latin America. Industries are also adopting advanced combustion technologies to control emissions, which will help in the continued use of fuel-grade coke despite rising environmental concerns. The combination of cost-effectiveness, energy efficiency, and wide industrial application ensures that Fuel-grade Coke will stay the market leader through the upcoming year.

By Coking Process

Delayed Coking dominates with 87.40% share due to its high efficiency and wide adoption.

In 2024, Delayed Coking held a dominant market position, capturing more than an 87.40% share in the Petroleum Coke Market by Coking Process. This process is highly preferred because it allows refineries to convert heavy residual oils into high-value lighter products and solid petroleum coke efficiently. Delayed Coking technology is especially favored for its flexibility, high output of valuable by-products, and ability to handle a wide range of feedstocks. Industries rely on it to meet growing demand for both fuel-grade and calcined petroleum coke.

In 2025, the Delayed Coking segment is expected to retain its strong market lead, backed by rising heavy crude processing and refinery capacity expansions across Asia-Pacific and the Middle East. The process’s proven reliability, economic benefits, and adaptability to stricter environmental regulations are key factors ensuring its continued dominance in the petroleum coke production landscape.

By Application

Cement dominates with 38.40% share due to strong demand in construction and infrastructure sectors.

In 2024, Cement held a dominant market position, capturing more than a 38.40% share in the Petroleum Coke Market by Application. Cement manufacturers widely use petroleum coke as a primary fuel due to its high calorific value and cost-effectiveness compared to traditional fuels like coal. As infrastructure development and urban construction projects grow rapidly across Asia-Pacific and the Middle East, the demand for petroleum coke in the cement sector has surged.

In 2025, the Cement segment is expected to maintain its leading position, driven by large-scale housing projects, roadworks, and industrial developments worldwide. Moreover, many cement plants are upgrading their facilities to use petcoke more efficiently while managing emissions, ensuring steady consumption. The consistent need for affordable, high-energy fuels in cement production guarantees that petroleum coke will continue to play a crucial role in this sector in the coming years.

Key Market Segments

By Type

- Calcined Coke

- Fuel-grade Coke

- Shot Coke

- Sponge Coke

By Coking Process

- Delayed Coking

- Fluid Coking

By Application

- Cement

- Ceramic

- Power Generation

- Industrial Boilers

- Aluminum and Other Metals

- Carbon Products

- Others

Drivers

Growing Energy Demand in Emerging Economies Driving the Petroleum Coke Market

One of the major driving factors for the petroleum coke (petcoke) market is the increasing energy demand in emerging economies like India, China, and Southeast Asia. As these countries continue to industrialize rapidly, their need for affordable and high-energy fuel sources is rising. Petroleum coke, being a high-carbon content fuel, is becoming an attractive alternative, especially for industries like cement, power generation, and steel.

According to the International Energy Agency (IEA), global energy demand grew by 2.2% in 2023, with Asia accounting for over half of the global growth. This surge is largely fueled by industrial expansion and urban development in emerging markets. India alone is expected to see its energy demand double by 2040 under current policy settings, making it one of the largest future consumers of energy-intensive materials.

Moreover, government initiatives in countries like India are encouraging the use of alternative fuels to coal, and petroleum coke fits well due to its lower cost and higher energy content. The Indian government’s “Make in India” program is pushing for heavy industrialization, and sectors like cement and aluminum—major users of petcoke—are receiving strong policy support.

In China, despite a move towards renewable energy, many industries still depend on traditional fuels to meet their baseline power and material needs. The Chinese government’s plan for “New Infrastructure” also includes projects that will temporarily boost the need for conventional fuels, including petcoke, in construction materials like cement and steel.

Additionally, as the world moves towards lower-sulfur fuels due to new environmental regulations (such as the IMO 2020 rule for shipping), refineries are producing more petroleum coke as a byproduct. This increased supply, coupled with growing demand, continues to push the petcoke market forward.

Restraints

Environmental Regulations: A Major Challenge for the Petroleum Coke Market

One of the significant challenges facing the petroleum coke (petcoke) market is the increasing stringency of environmental regulations. Petcoke, a byproduct of oil refining, is known for its high carbon and sulfur content, making it a substantial contributor to air pollution and greenhouse gas emissions.

For instance, the U.S. Environmental Protection Agency (EPA) has established National Ambient Air Quality Standards (NAAQS) for particulate matter, which includes emissions from petcoke storage and handling. These standards aim to reduce the health risks associated with fine particulate matter, which can penetrate deep into the lungs and bloodstream, causing various health issues.

In India, the government has taken steps to curb the environmental impact of petcoke. In 2018, India banned the import of petcoke for use as fuel, citing its high sulfur content and the resulting air pollution. However, imports for use as feedstock in certain industries were still permitted.

Moreover, the production and use of petcoke have been linked to significant greenhouse gas emissions. According to the U.S. Energy Information Administration (EIA), most U.S. petcoke is exported due to its high carbon and sulfur content, which makes it subject to environmental regulations in some markets.

These regulatory measures reflect a growing global emphasis on environmental protection and public health. As countries strive to meet their climate goals and reduce pollution, industries reliant on petcoke face increasing pressure to find cleaner alternatives or invest in technologies that mitigate its environmental impact.

Opportunity

Expanding Use in Aluminum Production: A Key Growth Driver for the Petroleum Coke Market

One of the major growth opportunities in the petroleum coke market stems from its increasing demand in the aluminum industry. Petroleum coke, especially high-quality calcined coke, is widely used as an anode in aluminum smelting. This application leverages the high carbon purity and low ash content of petroleum coke, making it an ideal component in the production of aluminum.

The global aluminum industry has seen a steady rise in demand, attributed primarily to its use in automotive, construction, and packaging sectors. This is driven by the metal’s properties such as light weight and recyclability, aligning with global sustainability goals. The International Aluminum Institute notes a projected growth in global aluminum demand, emphasizing the critical role of raw materials like petroleum coke in meeting these requirements.

Government initiatives also support the petroleum coke industry. For instance, policies promoting lightweight materials in automotive manufacturing to enhance fuel efficiency and reduce emissions indirectly boost the demand for aluminum, and consequently, for petroleum coke. This is evident in regions like North America and Europe, where stringent environmental regulations are pushing industries towards more sustainable manufacturing practices.

Moreover, the shift towards renewable energy sources demands more efficient energy storage systems, where aluminum plays a crucial role in battery technologies. This further solidifies the position of petroleum coke in the supply chain for energy solutions.

Trends

Surge in Demand for Cleaner Energy Sources: Shaping the Petroleum Coke Market

A significant trend reshaping the petroleum coke market is the escalating demand for cleaner energy sources, which influences the use of petroleum coke in energy production. Petroleum coke, known for its high carbon content, is increasingly utilized in electricity generation plants as a cost-effective and high-energy alternative to traditional coals.

This trend is largely driven by the need for more efficient and cleaner fuel options in emerging economies where energy demand is skyrocketing due to rapid industrialization and urbanization. Countries like India and China are leading consumers of petroleum coke, using it extensively in their energy sectors to fuel their growing economies. According to government reports, these regions are focusing on balancing their energy mix and reducing environmental footprints by implementing more stringent emission standards.

Moreover, advancements in technology are enabling the more efficient use of petroleum coke in energy production, with innovations aimed at reducing the sulfur content when burnt, thus mitigating environmental impact. These technological improvements are crucial in aligning with global efforts towards sustainability, as outlined in international environmental agreements.

In addition to its use in energy, petroleum coke is also finding applications in other industries such as steel and cement manufacturing, where it serves as a reliable and cost-efficient fuel alternative. The push from these industries for more sustainable and economically feasible fuel options continues to drive the demand for petroleum coke.

Regional Analysis

The Asia-Pacific (APAC) region stands as the dominant force in the global petroleum coke market, holding a substantial market share of approximately 44.30%, which translates to a market value of USD 12.4 billion. This leading position is fueled by the extensive industrial activities across major economies such as China and India, where petroleum coke is primarily utilized in energy production and as a critical raw material in the manufacturing of aluminum and steel.

China, as the largest consumer of petroleum coke in APAC, drives regional demand due to its massive aluminum and steel manufacturing sectors. The country’s ongoing urbanization and industrialization initiatives require substantial amounts of aluminum for construction and infrastructure, and steel for manufacturing and automotive industries, thereby boosting the consumption of petroleum coke. Furthermore, India follows closely, leveraging petroleum coke to meet its burgeoning energy needs amidst rapid economic growth and escalating power requirements.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

BP is a major player in the global petroleum coke market, leveraging its vast refining capabilities to produce high-grade petroleum coke essential for industrial applications, particularly in aluminum and steel manufacturing. The company integrates cutting-edge technology to enhance the quality and environmental compatibility of its products, focusing on reducing the sulfur content to meet stringent global standards.

Chevron Corporation stands out in the petroleum coke industry by capitalizing on its extensive oil refining operations. The company produces a significant amount of petroleum coke as a byproduct, primarily used in energy production and metal manufacturing. Chevron is committed to innovation and sustainability, aiming to improve the efficiency and environmental footprint of its petroleum coke products.

Oxbow Corporation specializes in the marketing and distribution of petroleum coke globally. With a robust supply chain and distribution network, Oxbow ensures the reliable delivery of petroleum coke to major industrial consumers worldwide. The company focuses on customizing product specifications to meet diverse client needs, enhancing customer satisfaction and market reach.

Top Key Players in the Market

- BP p.l.c.

- Chevron Corporation

- Oxbow Corporation

- The Phillips 66 Company

- Aminco Resources LLC

- Reliance Industries Ltd

- HPCL-Mittal Energy Limited

- Indian Oil Corporation Ltd

- Marathon Petroleum Corporation

- China Petrochemical Corporation

- Bharat Petroleum Corporation Limited

- Rain Carbon Inc

- Repsol S.A.

- Valero Energy Corporation

- Other Key Players

Recent Developments

In 2024, Oxbow has strategically enhanced its operations to meet the growing demand for petroleum coke, especially from aluminum and steel manufacturers. The company specializes in the procurement, marketing, and distribution of this essential industrial component, ensuring a steady supply to major consumers worldwide.

In 2024, Phillips 66 continued to optimize its production processes to enhance the efficiency and environmental sustainability of its petroleum coke, making it a preferred choice for heavy industries like aluminum and steel manufacturing. The company’s commitment to environmental standards and technological advancement has positioned it as a leader in the supply of cleaner, more sustainable petroleum coke.

Report Scope

Report Features Description Market Value (2024) USD 28.2 Bn Forecast Revenue (2034) USD 48.2 Bn CAGR (2025-2034) 5.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Calcined Coke, Fuel-grade Coke, Shot Coke, Sponge Coke), By Coking Process (Delayed Coking, Fluid Coking), By Application (Cement, Ceramic, Power Generation, Industrial Boilers, Aluminum and Other Metals, Carbon Products, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BP p.l.c., Chevron Corporation, Oxbow Corporation, The Phillips 66 Company, Aminco Resources LLC, Reliance Industries Ltd, HPCL-Mittal Energy Limited, Indian Oil Corporation Ltd, Marathon Petroleum Corporation, China Petrochemical Corporation, Bharat Petroleum Corporation Limited, Rain Carbon Inc, Repsol S.A., Valero Energy Corporation, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- BP p.l.c.

- Chevron Corporation

- Oxbow Corporation

- The Phillips 66 Company

- Aminco Resources LLC

- Reliance Industries Ltd

- HPCL-Mittal Energy Limited

- Indian Oil Corporation Ltd

- Marathon Petroleum Corporation

- China Petrochemical Corporation

- Bharat Petroleum Corporation Limited

- Rain Carbon Inc

- Repsol S.A.

- Valero Energy Corporation

- Other Key Players