Global Dioctyl Adipate Market Report By Grade (Food Grade, Technical Grade), By Application (Plasticizers, Adhesives and Sealants, Sheets, Other Applications), By End-Use Industry (Packaging, Construction, Consumer Goods, Other End-Use Industries), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 121376

- Number of Pages: 350

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

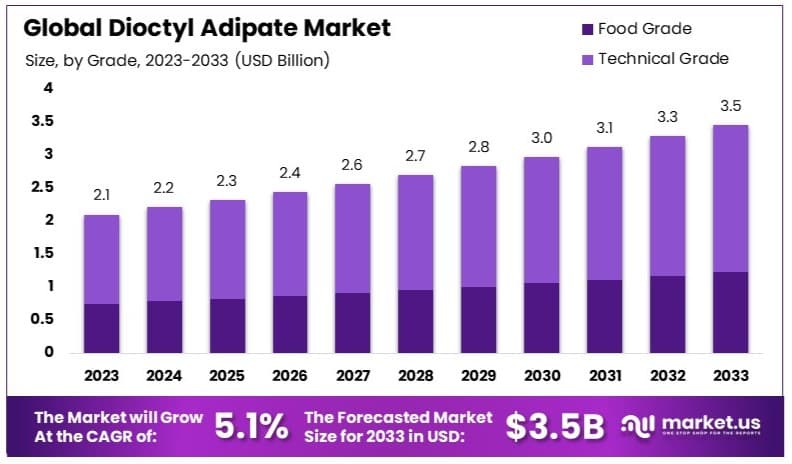

The Global Dioctyl Adipate Market size is expected to be worth around USD 3.5 Billion by 2033, from USD 2.1 Billion in 2023, growing at a CAGR of 5.1% during the forecast period from 2024 to 2033.

The Dioctyl Adipate Market focuses on a key plasticizer known for its use in producing soft, flexible plastics found in a variety of consumer goods. Dioctyl Adipate (DOA) is primarily utilized in applications where low temperature resistance and low viscosity are crucial. It enhances the durability and performance of products such as garden hoses, wires, and cables, and is also employed in food contact films and flooring.

The market is driven by demands from industries like automotive, construction, and food packaging. The growth in eco-friendly plasticizers due to stringent environmental regulations supports the expansion of this market. Key players in the market are innovating to produce non-toxic, high-efficiency alternatives to meet evolving consumer and regulatory demands.

The Dioctyl Adipate (DOA) market is poised for significant growth, driven by the escalating demand for flexible PVC products and the shift towards eco-friendly plasticizers. DOA, a key plasticizer, is primarily used to enhance the flexibility and durability of PVC, making it indispensable in various industries such as automotive, construction, and consumer goods. The world produces approximately 380 million tons of plastic annually, with up to 50% designated for single-use purposes. This substantial production volume underscores the critical need for efficient and sustainable plasticizer solutions.

As global awareness of environmental issues intensifies, the demand for non-phthalate plasticizers like DOA is expected to rise. This trend is further reinforced by stringent regulations aimed at reducing the environmental impact of plastics, prompting manufacturers to seek safer and more sustainable alternatives. The market’s growth trajectory is also supported by the burgeoning construction and automotive sectors, where flexible PVC applications are pivotal.

Moreover, the global production of plastic is projected to reach 1.1 billion tons annually by 2060. This projection highlights the immense potential for DOA as industries continue to expand their use of flexible and durable materials. The shift towards renewable and biodegradable plasticizers offers lucrative opportunities for innovation and market expansion.

In conclusion, the DOA market is set to experience robust growth, driven by regulatory pressures, increasing environmental consciousness, and the expanding applications of flexible PVC. Companies investing in research and development to produce high-performance, bio plasticizers are likely to gain a competitive edge in this evolving market landscape.

Key Takeaways

- Market Value: The Dioctyl Adipate Market is expected to grow from USD 2.1 Billion in 2023 to USD 3.5 Billion by 2033, at a CAGR of 5.1%.

- Grade Analysis: Technical Grade dominates with 64.5%; pivotal in various industrial applications due to its cost-effectiveness and compatibility with large-scale processes.

- Application Analysis: Plasticizers lead with 38.9%; essential for enhancing properties of materials like PVC, vital in construction and automotive sectors.

- End-Use Industry Analysis: Packaging sector prevails at 37.5%; driven by increasing demand for flexible packaging solutions

- Dominant Region: APAC dominates with 36.8% market share; a key player due to substantial industrial and manufacturing activities.

- High Growth Region: North America follows with a 25.5% share; significant due to advanced industrial infrastructure and regulatory standards.

- escalating demand for flexible packaging solutions across various industries.

- Analyst Viewpoint: The Dioctyl Adipate market exhibits moderate competition and growth potential, with innovations and industrial demand driving expansion.

- Growth Opportunities: Emphasizing sustainable and advanced plasticizer formulations could provide competitive advantages and market expansion opportunities.

Driving Factors

Increasing Demand from the Plastics and Polymer Industry Drives Market Growth

The plastics and polymer industry significantly boosts the dioctyl adipate market. As a plasticizer, dioctyl adipate improves flexibility and workability in various polymeric materials. This is crucial for products in packaging, construction, automotive, and consumer goods sectors. The rising demand for plastic products in these sectors fuels the market’s growth. For example, dioctyl adipate is extensively used in PVC products, such as pipes, cables, and flooring, contributing to market expansion.

The synergy between the plastic industry’s expansion and the need for effective plasticizers like dioctyl adipate illustrates the market’s potential. As industries continue to innovate and demand more durable and flexible materials, the reliance on dioctyl adipate is likely to grow. Additionally, ongoing advancements in polymer technology may further enhance the use of dioctyl adipate, solidifying its position in the market. Thus, the interplay of rising demand and technological progress in the plastics sector plays a pivotal role in driving the dioctyl adipate market’s growth.

Growing Applications in Adhesives and Sealants Drive Market Growth

Dioctyl adipate’s role as a solvent and plasticizer in adhesives and sealants is crucial for the construction and automotive industries. The expanding infrastructure development and urbanization initiatives globally boost the demand for these products, and consequently, for dioctyl adipate. For instance, the global adhesives and sealants market is anticipated to be USD 119 billion by 2033. It is estimated to record a steady CAGR of 4.5% in the Forecast period 2023 to 2033. It is likely to total USD 77 billion in 2023. This growth indicates a substantial increase in dioctyl adipate consumption.

The growing need for durable and reliable bonding materials in construction and automotive applications highlights dioctyl adipate’s importance. Its properties enhance the performance of adhesives and sealants, making them more effective in various conditions. This interaction between the construction boom, automotive industry demands, and the adhesive sector’s growth drives the market for dioctyl adipate. As infrastructure projects and urbanization efforts intensify, the demand for high-performance adhesives and sealants will continue to rise, reinforcing the market for dioctyl adipate.

Expanding Use in Personal Care and Cosmetic Products Drives Market Growth

The personal care and cosmetics industry significantly influences the dioctyl adipate market. Used as an emollient and skin conditioning agent, dioctyl adipate is a key ingredient in lotions, creams, and hair care products. Increasing consumer awareness and demand for personal care products, coupled with the growing cosmetics industry, particularly in emerging economies, drive the market’s growth.

The interaction between consumer trends and product innovation in the personal care sector underscores dioctyl adipate’s market potential. As consumers seek high-quality, effective skincare and cosmetic products, the demand for dioctyl adipate rises. Additionally, the expanding middle-class population in emerging markets further fuels this growth, as disposable incomes increase and more people can afford personal care products. Thus, the convergence of consumer preferences, economic growth, and product development drives the dioctyl adipate market forward.

Restraining Factors

Stringent Environmental Regulations Restrain Market Growth

Strict environmental regulations classify dioctyl adipate as a hazardous substance, impacting its market growth. These regulations aim to protect human health and the environment from potential harm. Compliance with such rules can be costly and time-consuming for manufacturers, leading to reduced adoption of dioctyl adipate in certain regions.

For instance, the European Union’s REACH regulation imposes strict controls on the use and disposal of hazardous chemicals, including dioctyl adipate. This limits its application in the European market, hindering overall market expansion. As governments worldwide continue to tighten environmental laws, the dioctyl adipate market faces significant challenges in maintaining its growth trajectory.

Availability of Substitutes Restrains Market Growth

The dioctyl adipate market faces competition from alternative plasticizers and additives. Substitutes like dibutyl phthalate, diethyl phthalate, and trimellitic acid esters offer similar properties and are often preferred due to cost-effectiveness, availability, or perceived environmental benefits.

For example, dibutyl phthalate and diethyl phthalate are widely used in various applications due to their lower costs and ease of access. This availability of alternatives limits the market potential for dioctyl adipate, as manufacturers and consumers may opt for these substitutes. The presence of these alternatives poses a significant challenge to the growth of the dioctyl adipate market, making it harder to capture a larger market share.

Grade Analysis

Technical Grade dominates with 64.5% due to widespread industrial use

The dioctyl adipate market is segmented by grade into food grade and technical grade. The technical grade dominates this market, accounting for 64.5% of the overall market share. This dominance is primarily due to its extensive use in various industrial applications. Technical grade dioctyl adipate is favored for its cost-effectiveness and suitability for large-scale industrial processes. It is commonly used in the manufacturing of flexible PVC, which is essential for products like cables, flooring, and hoses. The high demand for flexible PVC in construction, automotive, and consumer goods industries propels the technical grade segment’s growth.

The technical grade’s versatility and efficiency in enhancing the flexibility and durability of PVC products make it a preferred choice for manufacturers. Furthermore, ongoing industrialization and infrastructure development, especially in emerging economies, boost the demand for technical grade dioctyl adipate. As these sectors expand, the need for high-performance plasticizers like technical grade dioctyl adipate is expected to increase, maintaining its dominant market position.

On the other hand, the food grade segment, although smaller, plays a crucial role in specific applications. Food grade dioctyl adipate is used in food packaging and food contact materials, where safety and compliance with regulations are paramount. The increasing demand for safe and reliable food packaging solutions drives the growth of the food grade segment. However, its market share remains lower compared to technical grade due to the limited scope of applications and higher production costs.

Application Analysis

Plasticizers dominate with 38.9% due to their critical role in enhancing material properties

In the dioctyl adipate market, plasticizers represent the largest application segment, accounting for 38.9% of the market share. Plasticizers are essential additives that enhance the flexibility, workability, and durability of various polymeric materials, particularly PVC. The extensive use of dioctyl adipate as a plasticizer in the production of flexible PVC products such as cables, films, and sheets drives this segment’s growth. The global demand for flexible PVC, especially in the construction, automotive, and packaging industries, significantly contributes to the plasticizers segment’s dominance.

The critical role of plasticizers in improving the physical properties of polymers, making them suitable for diverse applications, underscores their importance. Additionally, advancements in polymer technology and the increasing need for high-performance materials in various industries boost the demand for dioctyl adipate-based plasticizers. The plasticizers segment’s robust growth is further supported by the ongoing trend towards lightweight and durable materials in automotive and construction sectors.

Other applications of dioctyl adipate include adhesives and sealants, sheets, and miscellaneous uses. Adhesives and sealants benefit from dioctyl adipate’s properties, enhancing their performance in demanding conditions. The sheets segment, though smaller, also sees steady growth due to its applications in packaging and industrial products. These secondary applications collectively support the overall market growth, although they do not match the scale and impact of the plasticizers segment.

End-Use Industry Analysis

Packaging dominates with 37.5% due to increasing demand for flexible packaging solutions

The packaging industry is the largest end-use segment for the dioctyl adipate market, holding 37.5% of the market share. This dominance is attributed to the rising demand for flexible and durable packaging solutions across various sectors. Dioctyl adipate is extensively used in the production of flexible PVC films and sheets, which are essential components of packaging materials. The global packaging industry’s growth, driven by increasing consumer goods demand, e-commerce expansion, and the need for sustainable packaging, significantly contributes to this segment’s prominence.

The critical role of packaging in preserving product quality, extending shelf life, and providing convenience to consumers underscores the demand for high-performance materials like dioctyl adipate. Additionally, innovations in packaging technology and the shift towards eco-friendly packaging solutions boost the market for dioctyl adipate-based products. The packaging industry’s robust growth trajectory is expected to continue, maintaining its dominant position in the dioctyl adipate market.

Other end-use industries include construction, consumer goods, and various miscellaneous applications. The construction sector utilizes dioctyl adipate in PVC products for pipes, cables, and flooring, driven by infrastructure development and urbanization. The consumer goods industry benefits from dioctyl adipate’s use in products requiring flexibility and durability. Although these segments contribute to the market, their impact is less pronounced compared to the packaging industry.

Key Market Segments

By Grade

- Food Grade

- Technical Grade

By Application

- Plasticizers

- Adhesives and Sealants

- Sheets

- Other Applications

By End-Use Industry

- Packaging

- Construction

- Consumer Goods

- Other End-Use Industries

Growth Opportunities

Increasing Focus on Sustainable and Bio-based Plasticizers Offers Growth Opportunity

With growing environmental concerns, there is an increasing demand for bio-based and eco-friendly plasticizers. Dioctyl adipate, being a non-phthalate plasticizer, provides an excellent opportunity for manufacturers to explore and develop sustainable and renewable sources.

This shift aligns with the global push towards sustainability and caters to the rising demand for environmentally friendly products. According to recent reports, the global market for bio-based plasticizers is projected to grow at a CAGR of 8.2% from 2023 to 2033. This trend indicates a significant potential for dioctyl adipate to capture a larger market share as industries move towards greener alternatives.

Emerging Applications in the Food and Beverage Industry Offer Growth Opportunity

Dioctyl adipate has gained approval for use as a food additive and a component in food packaging in certain regions, presenting new market opportunities. The food and beverage industry is continuously seeking safe and effective additives and packaging solutions.

This growth opens up significant opportunities for dioctyl adipate, especially as it meets the stringent safety and regulatory standards required in the food sector. By tapping into this expanding market, manufacturers can diversify their applications and drive growth.

Trending Factors

Shifting Focus towards Environmentally Friendly and Sustainable Production Are Trending Factors

The chemical industry is increasingly focusing on environmentally friendly and sustainable production practices. Manufacturers of dioctyl adipate are exploring greener and more efficient methods, such as using renewable feedstocks and implementing energy-efficient processes.

This shift aims to reduce the environmental footprint and meet regulatory requirements. The global green chemicals market is expected to grow at a high growth rate, reflecting the industry’s move towards sustainability. By adopting these practices, dioctyl adipate producers can align with market trends and enhance their competitive edge.

Increasing Demand for High-Performance Plasticizers Are Trending Factors

Industries are continuously striving for improved product performance and durability, leading to a growing demand for high-performance plasticizers. Dioctyl adipate, with its unique characteristics and compatibility with various polymers, caters to this demand.

The global plasticizers market is projected to grow at a CAGR of 5.8% from 2021 to 2028, driven by the need for high-quality, durable materials in construction, automotive, and consumer goods sectors. By offering superior performance, dioctyl adipate can secure a significant position in the market, meeting the evolving needs of these industries.

Regional Analysis

APAC Dominates with 36.8% Market Share

The Asia-Pacific (APAC) region leads the dioctyl adipate market, accounting for a 36.8% market share, valued at USD 0.77 billion. This dominance is driven by rapid industrialization, urbanization, and the booming construction and automotive sectors in countries like China, India, and Japan. Additionally, the increasing demand for flexible PVC products in various applications, such as packaging and consumer goods, boosts the market. The region’s large population base and growing disposable incomes also contribute to higher consumption of dioctyl adipate in personal care and cosmetic products.

APAC’s market performance is influenced by its robust manufacturing base and favorable economic conditions. The region’s significant investments in infrastructure and industrial development create a high demand for dioctyl adipate. Moreover, APAC’s cost-effective labor and raw material availability provide a competitive advantage, enhancing production efficiency and reducing costs. The regulatory landscape, which is relatively less stringent compared to Western regions, further facilitates market growth.

North America Market Share: 25.5%

North America holds a 25.5% share of the dioctyl adipate market. The region’s advanced industrial infrastructure and strong presence in the automotive and packaging industries drive this share. Stringent environmental regulations and a shift towards sustainable products are also key factors. The market in North America is expected to grow at a CAGR of 4.5%, with increasing adoption of bio-based plasticizers.

Europe Market Share: 20.3%

Europe accounts for 20.3% of the dioctyl adipate market. The region’s focus on sustainability and stringent environmental regulations promote the use of non-phthalate plasticizers like dioctyl adipate. Major automotive and construction sectors also contribute to market growth. The market in Europe is projected to grow at a CAGR of 3.8%, with rising demand for eco-friendly products.

Middle East & Africa Market Share: 10.4%

The Middle East & Africa region holds a 10.4% market share. The growing construction industry and increasing infrastructure projects drive the demand for dioctyl adipate. Economic development and urbanization in countries like the UAE and Saudi Arabia also contribute to market growth. The region’s market is expected to grow at a CAGR of 5.2%, supported by ongoing industrialization efforts.

Latin America Market Share: 7.0%

Latin America accounts for 7.0% of the dioctyl adipate market. The region’s market is driven by the expanding automotive and construction industries. Brazil and Mexico are key contributors, with increasing demand for flexible PVC products. The market in Latin America is projected to grow at a CAGR of 4.0%, with rising industrial activities and infrastructure development initiatives.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The dioctyl adipate market features several key players, each contributing significantly to market dynamics through strategic positioning and influence. BASF SE and ExxonMobil Corporation are prominent leaders, leveraging their extensive R&D capabilities and global distribution networks to dominate the market. Their strong emphasis on innovation and sustainable practices enhances their competitive edge.

The HallStar Company and Eastman Chemical Company are pivotal in driving technological advancements and offering high-performance plasticizers. Their focus on expanding product portfolios and maintaining high-quality standards solidifies their market presence. Aarti Industries and Hanwha Solutions Corporation have made significant strides through strategic partnerships and expanding production capacities, catering to the increasing demand in emerging economies.

GJ Chemical, New Japan Chemical Co., Ltd., and Penta Manufacturing Company contribute to the market by offering diverse product ranges and focusing on niche applications. These companies emphasize flexibility and customer-centric approaches, enabling them to effectively meet specific market needs.

Other key players, through continuous innovation and strategic market maneuvers, also play crucial roles in shaping the dioctyl adipate market. Their collective efforts in improving product efficiency, adhering to environmental regulations, and exploring bio-based alternatives contribute to the market’s growth and resilience.

Market Key Players

- BASF SE

- ExxonMobil Corporation

- The HallStar Company

- Aarti Industries

- Hanwha Solutions Corporation

- Eastman Chemical Company

- GJ Chemical

- New Japan Chemical Co., Ltd.

- Penta Manufacturing Company

- Other Key Players

Recent Developments

- July 2023: An agreement between Sohar Freezone and Nasir Chemicals to establish a Dioctyl Phthalate and Dioctyl Terephthalate plant is expected to boost port cargo volumes. The plant will cover 5,000 m², have a production capacity of 30,000 tons a year, and increase container throughput by 2000 TEU annually.

- December 2021: Hanwha Solutions quadrupled production of phthalate-free plasticizer Eco-DEHCH, addressing growing demand for eco-friendly alternatives to hazardous phthalates. This move aligns with the company’s ESG mandate, focusing on sustainable solutions for the planet.

Report Scope

Report Features Description Market Value (2023) USD 2.1 Billion Forecast Revenue (2033) USD 3.5 Billion CAGR (2024-2033) 5.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Grade (Food Grade, Technical Grade), By Application (Plasticizers, Adhesives and Sealants, Sheets, Other Applications), By End-Use Industry (Packaging, Construction, Consumer Goods, Other End-Use Industries) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape BASF SE, ExxonMobil Corporation, The HallStar Company, Aarti Industries, Hanwha Solutions Corporation, Eastman Chemical Company, GJ Chemical, New Japan Chemical Co., Ltd., Penta Manufacturing Company, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the market size of the Global Dioctyl Adipate Market?The market is expected to grow from USD 2.1 billion in 2023 to USD 3.5 billion by 2033. The market is projected to grow at a CAGR of 5.1% from 2024 to 2033.

What factors are driving the growth of the Dioctyl Adipate Market?Growth is driven by demand from automotive, construction, and food packaging industries, alongside increasing environmental regulations and the shift towards eco-friendly plasticizers.

Which region holds the largest market share for Dioctyl Adipate?The Asia-Pacific (APAC) region holds the largest market share at 36.8%, driven by substantial industrial and manufacturing activities.

Which companies are key players in the Dioctyl Adipate Market?Key players include BASF SE, ExxonMobil Corporation, The HallStar Company, Aarti Industries, and Hanwha Solutions Corporation.

-

-

- BASF SE

- ExxonMobil Corporation

- The HallStar Company

- Aarti Industries

- Hanwha Solutions Corporation

- Eastman Chemical Company

- GJ Chemical

- New Japan Chemical Co., Ltd.

- Penta Manufacturing Company

- Other Key Players