Global Ethyl Polysilicate Market Report By Type (Ethyl Polysilicate 28, Ethyl Polysilicate 32, Ethyl Polysilicate 40), By Application (Adhesive Agent, Cross-linking Agent, Residential Binding Agent, Synthesis of Silica), By End-Use Industry (Chemicals, Metals, Paints and Coatings, Textiles, Pharmaceuticals, Optical, Ceramics), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: June 2024

- Report ID: 121378

- Number of Pages: 270

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

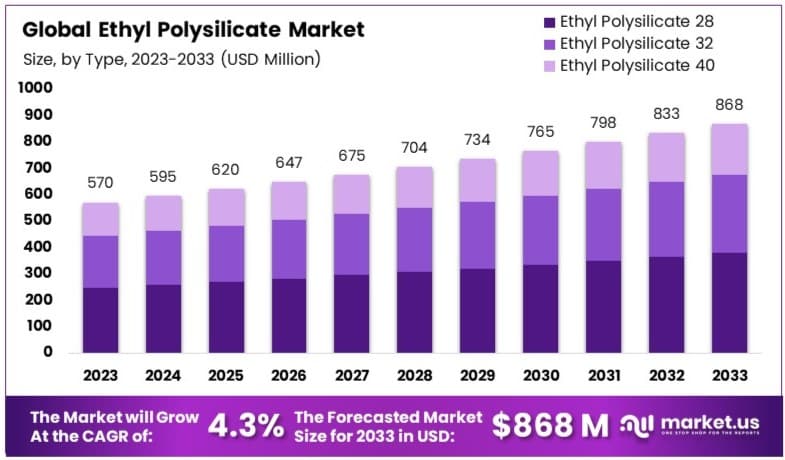

The Global Ethyl Polysilicate Market size is expected to be worth around USD 868 Million by 2033, from USD 570 Million in 2023, growing at a CAGR of 4.3% during the forecast period from 2024 to 2033.

The Ethyl Polysilicate Market serves a niche segment in the field of cross-linking agents used in the production of silicone polymers, paints, and coatings. This chemical compound is valued for its ability to form durable, weather-resistant, and chemical-resistant finishes. Its applications span across the construction, automotive, and electronics industries, where performance and longevity of materials are critical.

The market benefits from rising demands for protective coatings in harsh environmental conditions and the global push for infrastructure improvements. The growth trajectory of this market is supported by innovations that enhance the efficiency and environmental compliance of the products. Ethyl Polysilicate manufacturers are focusing on sustainable practices and advanced formulations to meet global standards and client expectations.

The Ethyl Polysilicate Market is currently experiencing significant growth, driven by its diverse applications across various industries such as paints and coatings, electronics, and healthcare. Ethyl polysilicate is highly valued for its properties as a cross-linking agent, contributing to improved durability and resistance in materials.

This market’s expansion is propelled by the rising demand in the construction and automotive sectors, where ethyl polysilicate’s use in paints and coatings enhances structural integrity and longevity of the surfaces. Additionally, the electronics industry utilizes this chemical for its adhesive qualities and its role in protecting delicate components from moisture and environmental stresses.

A key factor supporting the market’s robust growth is the ongoing innovation within the chemical industry, leading to enhanced product formulations that provide superior performance characteristics. This innovation not only helps in meeting stringent industry standards but also addresses the evolving needs of end-users seeking more efficient and sustainable solutions.

Moreover, the global push towards environmentally friendly materials has positioned ethyl polysilicate as a preferable choice due to its less toxic profile compared to alternative chemicals. This alignment with environmental regulations and sustainability goals is likely to bolster market growth further, attracting investment and fostering new development within the sector.

In conclusion, the Ethyl Polysilicate Market is set for continued expansion, underpinned by its critical role in key industrial applications, ongoing product innovation, and alignment with global sustainability trends. This positions the market well for sustained demand and potential investment opportunities in the coming years.

Key Takeaways

- Market Value: Projected to increase from USD 570 Million in 2023 to USD 868 Million by 2033, at a CAGR of 4.3%.

- Type Analysis: Ethyl Polysilicate 28 dominates with 43.6%; its balance of reactivity and stability makes it ideal for numerous industrial applications.

- Application Analysis: Cross-linking agents hold the lead at 37.8%; crucial for enhancing mechanical properties across various sectors including automotive and construction.

- End-Use Industry Analysis: Paints and coatings dominate with 39.5%; high demand for durable, performance coatings in construction and automotive boosts this segment.

- Dominant Region: APAC leads with 38.5% market share; significant growth driven by expanding industrial sectors in emerging economies.

- High Growth Region: North America maintains approximately 25% market share; steady growth due to technological advancements and high industrial standards.

- Analyst Viewpoint: The Ethyl Polysilicate market is competitive, with potential for growth as industries seek more efficient and durable materials.

- Growth Opportunities: Innovations in silicate chemistry that enhance performance and environmental compliance could distinguish leaders in this market.

Driving Factors

Rising Demand from Construction Industry Drives Market Growth

The construction industry significantly drives the demand for ethyl polysilicate due to its use as an adhesive and sealant. Urbanization, infrastructure development, and residential and commercial construction projects worldwide are key factors. For example, high-rise buildings’ increasing numbers necessitate efficient bonding and sealing solutions, boosting ethyl polysilicate products’ adoption. Statistics show that global urbanization is expected to increase to 68% by 2050, significantly contributing to the construction industry’s expansion. This growth directly correlates with the rising demand for ethyl polysilicate, as these materials are essential for constructing durable and reliable structures.

Additionally, the need for eco-friendly and sustainable construction materials has driven innovations in ethyl polysilicate applications. Combining this demand with advancements in construction technology, such as 3D printing and modular construction, has further propelled the market. These technologies often rely on high-performance adhesives and sealants, underscoring the importance of ethyl polysilicate. Thus, the construction industry’s expansion, driven by urbanization and technological advancements, significantly contributes to the ethyl polysilicate market’s growth.

Expanding Automotive Industry Drives Market Growth

The automotive industry’s expansion is another crucial factor driving the ethyl polysilicate market. This material is used in automotive coatings, adhesives, and sealants, essential for vehicle assembly and maintenance. The growing demand for automobiles, especially in emerging economies like China, India, and Brazil, is a significant market driver. In 2021, China alone produced over 26 million vehicles, underscoring the substantial demand for automotive-related materials.

Furthermore, the increasing focus on vehicle safety and performance has necessitated high-performance adhesives and sealants, further boosting ethyl polysilicate usage. The automotive industry’s push towards lightweight and fuel-efficient vehicles also plays a role, as ethyl polysilicate provides strong bonding and coating solutions. This factor, combined with advancements in electric vehicle production, which requires specialized materials for battery and component assembly, has amplified the market growth. The interaction between the expanding automotive sector and the technological innovations in vehicle manufacturing creates a robust demand for ethyl polysilicate, driving market growth.

Advancements in Packaging Industry Drives Market Growth

The packaging industry has seen a surge in demand for ethyl polysilicate-based coatings and adhesives due to their excellent barrier properties and resistance to moisture and oxygen. The growing demand for sustainable and eco-friendly packaging solutions, along with the rise of e-commerce and food delivery industries, has driven the adoption of ethyl polysilicate in packaging applications. The global packaging market was valued at approximately $900 billion in 2020 and is expected to reach over $1 trillion by 2025, indicating a substantial growth trajectory.

Sustainable packaging solutions, particularly those that enhance product shelf life and reduce waste, are in high demand. Ethyl polysilicate’s properties align well with these requirements, making it a preferred choice for various packaging applications. Additionally, the e-commerce boom has increased the need for robust and durable packaging materials, further driving the market. The interplay between the demand for sustainable packaging and the growth of e-commerce and food delivery services underscores the critical role of ethyl polysilicate in the packaging industry’s expansion, contributing significantly to market growth.

Restraining Factors

Stringent Environmental Regulations Restrain Market Growth

Stringent environmental regulations significantly restrain the ethyl polysilicate market. These regulations, implemented in various regions, aim to control emissions of hazardous substances and ensure safe handling and disposal. Compliance with these regulations increases production costs, posing challenges for manufacturers.

For instance, the European Union’s REACH regulation requires rigorous testing and documentation, adding to the operational burden. This can limit smaller companies’ ability to compete, slowing overall market growth. Additionally, regulatory changes can disrupt supply chains and delay product launches, further impacting market expansion. Despite ethyl polysilicate being relatively green, these regulatory hurdles can deter investment and innovation in the industry, ultimately restraining its growth.

Availability of Substitutes Restrains Market Growth

The availability of alternative adhesives, sealants, and coatings poses a significant challenge to the ethyl polysilicate market. Products like epoxy resins, silicones, and acrylics offer similar or better performance characteristics. Their widespread availability and competitive pricing can influence the demand for ethyl polysilicate.

For example, epoxy resins are known for their strong adhesive properties and durability, often preferred in construction and automotive applications. This competition can reduce ethyl polysilicate’s market share and hinder its growth. Furthermore, innovations in substitute materials continuously improve their performance and cost-effectiveness, making it harder for ethyl polysilicate to maintain its market position.

Type Analysis

Ethyl Polysilicate 28 dominates with 43.6% due to its extensive industrial applications and optimal balance between reactivity and stability.

Ethyl polysilicate is categorized by types, with Ethyl Polysilicate 28, 32, and 40 being the primary sub-segments. Among these, Ethyl Polysilicate 28 dominates with a market share of 43.6%. Ethyl Polysilicate 28’s dominance is driven by its extensive use in industrial applications, particularly in the synthesis of silica and as a cross-linking agent. This type offers an optimal balance between reactivity and stability, making it suitable for a wide range of industrial processes. The growing demand for high-performance materials in construction, automotive, and electronics industries further propels its market share. Ethyl Polysilicate 28 is also favored for its role in enhancing the durability and performance of coatings and adhesives, which are critical in these sectors.

Ethyl Polysilicate 32 and 40, while significant, play secondary roles in the market. Ethyl Polysilicate 32 is used in applications requiring higher reactivity, such as specialized coatings and adhesives. Its ability to form strong bonds quickly makes it suitable for fast-paced manufacturing environments. Ethyl Polysilicate 40, on the other hand, is preferred for its superior stability and lower volatility. It finds applications in high-temperature settings and where long-term performance is crucial. Despite their valuable properties, the specific and niche applications of Ethyl Polysilicate 32 and 40 limit their market share compared to Ethyl Polysilicate 28.

Application Analysis

Cross-linking agent dominates with 37.8% due to its critical role in enhancing mechanical properties in various industries.

In terms of application, Ethyl Polysilicate is used as an adhesive agent, cross-linking agent, residential binding agent, and in the synthesis of silica. Among these, the cross-linking agent segment holds the dominant market share at 37.8%. The cross-linking property of ethyl polysilicate is crucial in various industries such as paints and coatings, construction, and automotive. It enhances the mechanical properties of materials, improving their durability and resistance to environmental factors. The increasing demand for high-performance coatings and adhesives, driven by the growth in the construction and automotive sectors, significantly contributes to the dominance of the cross-linking agent application.

The adhesive agent application is also notable but holds a smaller share compared to cross-linking. Adhesive agents made from ethyl polysilicate are valued for their strong bonding capabilities and resistance to moisture and chemicals. These properties make them ideal for use in construction, electronics, and packaging industries. The residential binding agent application, while important, caters more to niche markets where specialized binding solutions are required. The synthesis of silica, although critical in the production of high-purity silica for electronics and other advanced applications, represents a smaller segment due to its specific and limited use cases.

End-Use Industry Analysis

Paints and coatings dominate with 39.5% due to the high demand for durable and high-performance coatings in construction and automotive industries.

Ethyl Polysilicate finds its application across multiple end-use industries including chemicals, metals, paints and coatings, textiles, pharmaceuticals, optical, and ceramics. The paints and coatings industry is the dominant segment, holding a market share of 39.5%. This dominance is driven by the high demand for durable and high-performance coatings in the construction and automotive industries. Ethyl polysilicate is a key component in the formulation of coatings that provide excellent adhesion, resistance to corrosion, and protection against harsh environmental conditions. The growth of the construction and automotive sectors, especially in emerging economies, further boosts the demand for ethyl polysilicate in this segment.

The chemicals and metals industries also represent significant markets for ethyl polysilicate. In the chemicals industry, it is used in the production of silica-based chemicals and materials. In the metals industry, ethyl polysilicate is used as a binding and cross-linking agent in metal surface treatments and coatings. The textiles and pharmaceuticals industries, while important, represent smaller segments due to the specialized and limited use of ethyl polysilicate in these applications. The optical and ceramics industries also utilize ethyl polysilicate, but their market share is comparatively lower due to the specific nature of their applications.

Key Market Segments

By Type

- Ethyl Polysilicate 28

- Ethyl Polysilicate 32

- Ethyl Polysilicate 40

By Application

- Adhesive Agent

- Cross-linking Agent

- Residential Binding Agent

- Synthesis of Silica

By End-Use Industry

- Chemicals

- Metals

- Paints and Coatings

- Textiles

- Pharmaceuticals

- Optical

- Ceramics

Growth Opportunities

Emerging Applications in Electronics and Semiconductors Offer Growth Opportunity

The electronics and semiconductor industries present significant growth opportunities for the ethyl polysilicate market. Ethyl polysilicate is increasingly used in manufacturing electronic components, application specific integrated circuits, and semiconductor devices due to its excellent insulating and dielectric properties.

The growing demand for advanced electronics and the continuous miniaturization of electronic components are driving its adoption in these sectors. The global electronics market is expected to reach $1.7 trillion by 2025, with a significant portion attributed to semiconductors. This demand for smaller, more efficient electronic devices enhances the need for high-performance materials like ethyl polysilicate, thus creating substantial market growth opportunities.

Expansion in Developing Economies Offers Growth Opportunity

Developing economies in Asia-Pacific, Latin America, and Africa offer substantial growth opportunities for the ethyl polysilicate market. These regions are witnessing rapid industrialization, urbanization, and infrastructural development, leading to increased demand for construction materials, automotive products, and consumer goods.

For instance, the construction industry in Asia-Pacific is projected to grow at a CAGR of 6.2% from 2023 to 2033, fueling the demand for ethyl polysilicate-based products. As these economies continue to grow, the demand for high-quality adhesives, sealants, and coatings is expected to rise, thereby driving market expansion.

Trending Factors

Sustainable and Eco-friendly Practices Are Trending Factors

The increasing focus on sustainability and environmental consciousness is a major trend across various industries. Consumers and businesses are actively seeking eco-friendly and sustainable products, driving the demand for ethyl polysilicate as a relatively green alternative to traditional adhesives and sealants.

The global green building materials market is expected to reach a significant valuation by 2024, indicating a significant shift towards sustainable practices. Ethyl polysilicate’s low environmental impact and superior performance make it an attractive choice for companies aiming to reduce their carbon footprint, thereby promoting its market adoption and growth.

Advancements in Nanotechnology Are Trending Factors

The integration of nanotechnology with ethyl polysilicate has emerged as a trending factor in the market. Nanosilica-based ethyl polysilicate formulations offer superior properties, such as enhanced mechanical strength, thermal stability, and barrier properties.

These advancements have opened up new applications in fields like advanced coatings, composites, and energy storage devices. The global nanotechnology market is projected to reach $125 billion by 2024, highlighting the growing importance of nanomaterials. This trend is expected to drive the demand for ethyl polysilicate, especially in high-tech applications, contributing to its market growth.

Regional Analysis

APAC Dominates with 38.5% Market Share

The Asia-Pacific (APAC) region holds a dominant market share of 38.5% in the ethyl polysilicate market, valued at USD 219.45 million.

The rapid industrialization and urbanization in countries like China, India, and Japan drive the demand for ethyl polysilicate. The booming construction industry, particularly in China, contributes significantly. The automotive and electronics industries’ growth in this region also plays a crucial role, increasing the need for high-performance adhesives and coatings.

The APAC region benefits from a large manufacturing base, lower production costs, and supportive government policies promoting industrial growth. The high demand for infrastructure development and the increasing consumer base fuel market expansion.

North America Market Share and Growth

North America holds a market share of approximately 25%. The region’s demand is driven by the advanced automotive and construction industries. Technological innovations and a focus on sustainable practices are key growth drivers. The market value in this region is expected to grow at a moderate rate due to established industrial bases and steady demand.

Europe Market Share and Growth

Europe accounts for around 20% of the market share. The region’s growth is fueled by the strong presence of automotive and construction sectors, along with stringent environmental regulations promoting the use of eco-friendly materials. The market in Europe is anticipated to grow steadily, supported by ongoing technological advancements and sustainability initiatives.

Middle East & Africa Market Share and Growth

The Middle East & Africa region holds about 10% of the market share. The growth is driven by infrastructural development and increasing industrialization. Despite political and economic challenges, the demand for ethyl polysilicate is expected to rise moderately, particularly in the construction and oil & gas industries.

Latin America Market Share and Growth

Latin America represents approximately 6.5% of the market share. The region’s market growth is influenced by urbanization and industrial activities in countries like Brazil and Mexico. The construction and automotive sectors are primary contributors to the demand for ethyl polysilicate. The market is expected to grow at a moderate pace, driven by regional economic improvements and industrial investments.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The ethyl polysilicate market features several prominent companies, each contributing significantly to the market’s growth and dynamics. Wacker Chemie AG and Evonik are leading players, leveraging their extensive R&D capabilities and strong global presence. Their strategic focus on innovation and sustainable practices has positioned them at the forefront of the market.

COLCOAT and Momentive also play crucial roles, emphasizing product development and catering to diverse industrial applications. Their robust supply chains and customer-centric approaches enhance their market influence.

In China, companies like Zhejiang Xinan Chemical, Nantong Chengua Chemical, Zhangjiagang Longtai, and YAJIE Chemical dominate the regional market. Their competitive pricing, large-scale production capacities, and local market expertise drive significant market share.

Zhangjiagang Xinya and Zhejiang Zhengbang Organosilicon are notable for their specialized products and strategic partnerships, further strengthening their market positions.

Changzhou Wujin Hengye Chemical and other key players contribute to market diversity through innovation and expanding product portfolios, addressing various industrial needs.

Overall, these key players shape the ethyl polysilicate market through strategic positioning, innovation, and a strong focus on sustainability and customer satisfaction.

Market Key Players

- Wacker Chemie AG

- Evonik

- COLCOAT

- Momentive

- Zhejiang Xinan Chemical

- Nangtong Chengua Chemical

- Zhangjiagang Longtai

- YAJIE Chemical

- Zhangjiagang Xinya

- Zhejiang Zhengbang Organosilicon

- Changzhou Wujin Hengye Chemical

- Other Key Players

Recent Developments

- Dynasylan 40 is a low-viscosity ethyl polysilicate grade that acts as an adhesion promoter. It contains 40% silicon dioxide and is used to enhance the adhesion properties of adhesives and sealants.

- SiSiB PC5424 is a hydrolyzed and oligomerized form of ethyl silicate. It is a transparent liquid containing 40% silica and is used to deposit silicic acid, which bonds well to various substrates.

Report Scope

Report Features Description Market Value (2023) USD 570 Million Forecast Revenue (2033) USD 868 Million CAGR (2024-2033) 4.3% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Ethyl Polysilicate 28, Ethyl Polysilicate 32, Ethyl Polysilicate 40), By Application (Adhesive Agent, Cross-linking Agent, Residential Binding Agent, Synthesis of Silica), By End-Use Industry (Chemicals, Metals, Paints and Coatings, Textiles, Pharmaceuticals, Optical, Ceramics) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Wacker Chemie AG, Evonik, COLCOAT, Momentive, Zhejiang Xinan Chemical, Nangtong Chengua Chemical, Zhangjiagang Longtai, YAJIE Chemical, Zhangjiagang Xinya, Zhejiang Zhengbang Organosilicon, Changzhou Wujin Hengye Chemical, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the projected market size of the Global Ethyl Polysilicate Market by 2033?The Global Ethyl Polysilicate Market is projected to reach USD 868 Million by 2033, growing from USD 570 Million in 2023.

Which industries are the primary consumers of Ethyl Polysilicate?Key industries include construction, automotive, electronics, and paints and coatings, where it is used for its durability and resistance properties.

Are there substitutes for Ethyl Polysilicate in the market, and how do they affect its growth?Yes, alternatives like epoxy resins and silicones offer competitive performance and pricing, which can limit the market share of Ethyl Polysilicate.

Which region is the dominant market for Ethyl Polysilicate?The Asia-Pacific (APAC) region leads with 38.5% of the market share, driven by rapid industrialization and urbanization.

Who are the key players in the Ethyl Polysilicate Market?Prominent companies include Wacker Chemie AG, Evonik, COLCOAT, Momentive, and several leading Chinese manufacturers like Zhejiang Xinan Chemical and Nantong Chengua Chemical.

-

-

- Wacker Chemie AG

- Evonik

- COLCOAT

- Momentive

- Zhejiang Xinan Chemical

- Nangtong Chengua Chemical

- Zhangjiagang Longtai

- YAJIE Chemical

- Zhangjiagang Xinya

- Zhejiang Zhengbang Organosilicon

- Changzhou Wujin Hengye Chemical

- Other Key Players