Global Plastisols Market Size, Share, And Business Benefits By Type (Phthalate-free, Phthalate-containing), By Application (Screen Printing, Molding, Coating, Dipping, Spraying, Adhesives and Sealants, Others), By End-use (Automotive and Transportation (Interior, Exterior), Building and Construction (Flooring, Roofing, Others), Consumer Goods (Appliances, Footwear, Furniture), Others (Toys, Sporting Goods),(Textile, Healthcare, Aerospace and Defense, Others)), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 147111

- Number of Pages: 334

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

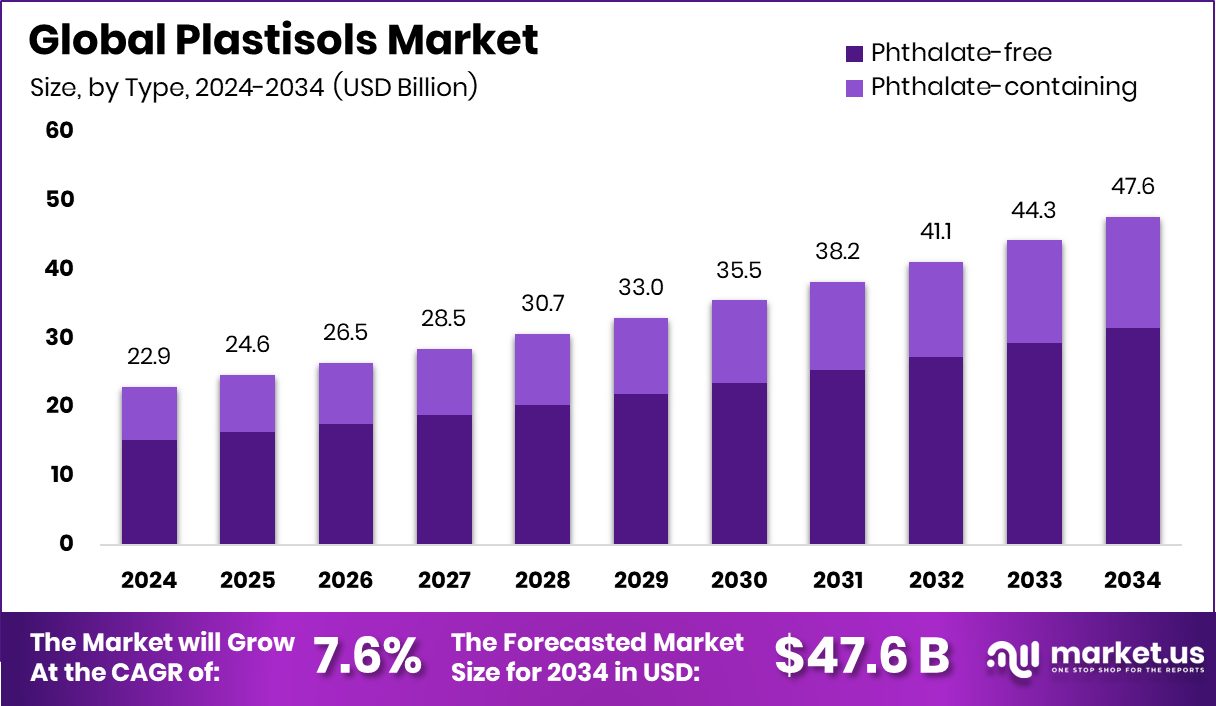

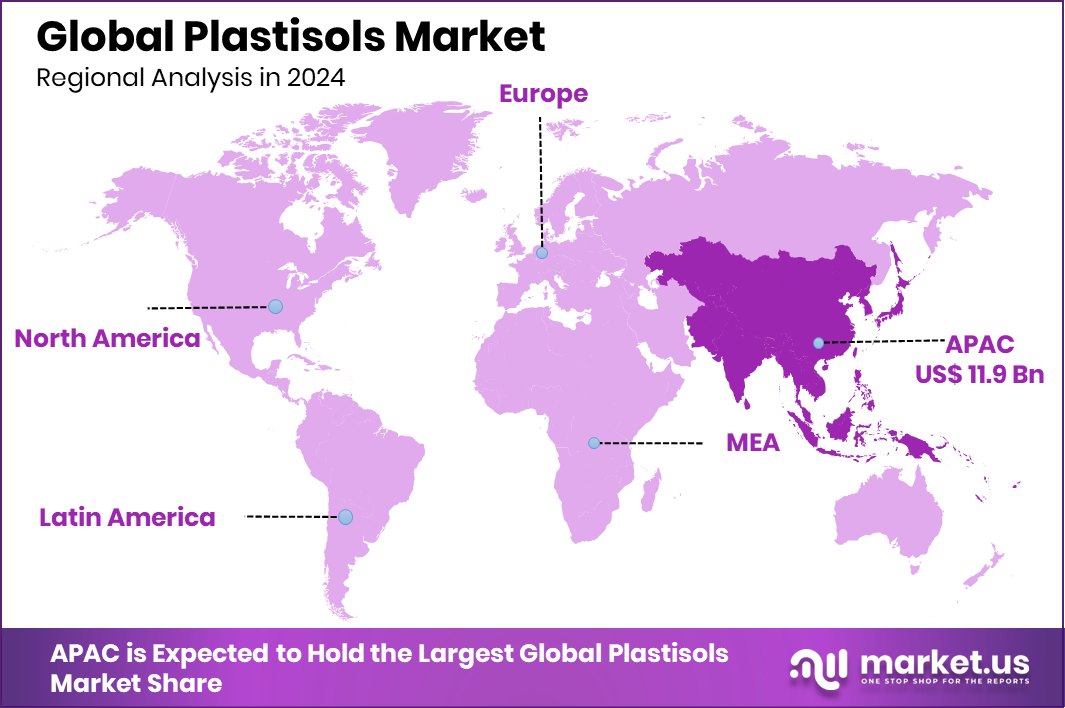

Global Plastisols Market is expected to be worth around USD 47.6 billion by 2034, up from USD 22.9 billion in 2024, and grow at a CAGR of 7.6% from 2025 to 2034. Strong industrialization and automotive growth boosted Asia-Pacific’s 52.4% Plastisols Market dominance sharply.

Plastisols are liquid suspensions made of PVC (polyvinyl chloride) particles dispersed in a plasticizer. When heated, plastisols undergo a chemical change, transforming from a liquid to a flexible solid without releasing any volatile materials. Due to their excellent flexibility, durability, and resistance to chemicals and wear, plastisols are widely used in applications like coatings, moldings, adhesives, textile inks, and automotive parts.

The plastisols market is expanding steadily, driven by increasing demand in the automotive, construction, and textile industries. The market benefits from the rising use of plastisols in underbody coatings, seat coverings, and protective layers. With manufacturers seeking durable and cost-effective alternatives to traditional materials, plastisols continue to gain traction.

A major growth factor fueling the plastisols market is the surging use in automotive applications. As vehicle manufacturers aim for better corrosion resistance and aesthetic finishes, plastisols are widely preferred for coating and sealing purposes. The material’s excellent adhesion properties and ability to protect against environmental damage create solid long-term growth potential in this segment.

Demand for plastisols is also increasing from the construction sector, especially for wall coverings, flooring, and roofing materials. Rising urbanization and infrastructure development projects across Asia-Pacific, North America, and parts of Europe drive this trend. The ease of application, longevity, and low maintenance of plastisols make them highly desirable for modern architectural needs.

Key Takeaways

- Global Plastisols Market is expected to be worth around USD 47.6 billion by 2034, up from USD 22.9 billion in 2024, and grow at a CAGR of 7.6% from 2025 to 2034.

- In 2024, Phthalate-free plastisols dominated the market, capturing a strong 66.3% share globally.

- Screen printing applications led the plastisols market, accounting for a significant 29.3% market share worldwide.

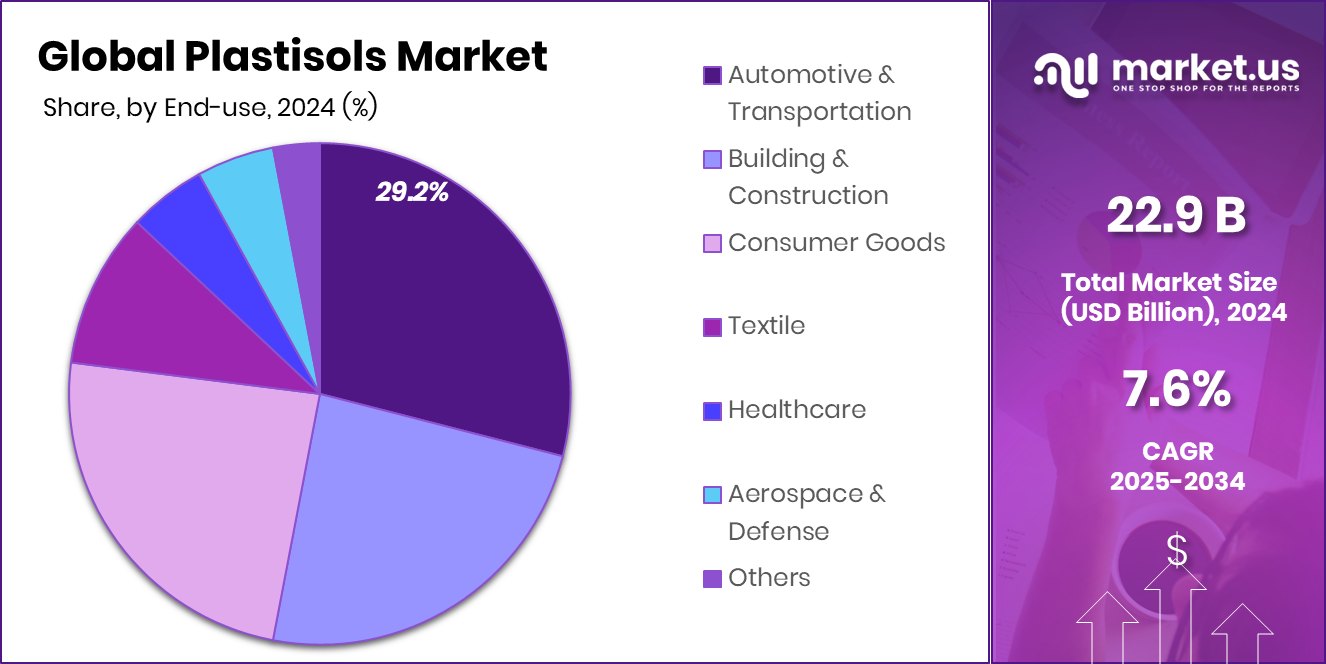

- Automotive and transportation industries captured around 29.2% share, highlighting strong adoption of plastisols coatings.

- Asia-Pacific Plastisols Market reached a value of USD 11.9 billion in 2024.

By Type Analysis

Phthalate-free plastisols dominated with a 66.3% share, driven by eco-friendly regulations.

In 2024, Phthalate-free held a dominant market position in the By Type segment of the Plastisols Market, with a 66.3% share. The strong shift toward safer and environmentally friendly alternatives played a major role in boosting the adoption of phthalate-free plastisols. Growing health concerns around traditional phthalate plasticizers and increasingly stringent global regulations have compelled manufacturers and end-users to prefer non-phthalate options.

Phthalate-free plastisols have gained immense popularity in industries like automotive, textiles, and construction, where product safety and compliance are critical. In automotive manufacturing, these formulations are now widely used for underbody coatings, interior parts, and sealing applications, aligning with green vehicle initiatives. The textile industry has also witnessed a significant transition, as phthalate-free inks are now preferred for screen printing to meet eco-label certifications.

Furthermore, many countries have introduced regulations limiting or banning phthalates in consumer goods, encouraging a faster market migration toward safer alternatives. This regulatory push, combined with rising consumer awareness about non-toxic materials, has solidified the leadership of phthalate-free plastisols within the market.

By Application Analysis

Screen printing applications accounted for a 29.3% share, fueled by textile industry growth.

In 2024, Screen Printing held a dominant market position in the By Application segment of the plastisols market, with a 29.3% share. The popularity of plastisols in screen printing applications is largely driven by their superior durability, vibrant color retention, and ease of use. Plastisols provide a thick, flexible finish that adheres excellently to fabrics, making them the top choice for printing on garments such as T-shirts, hoodies, and activewear.

The rise of customized apparel, promotional clothing, and sportswear continues to support strong demand for plastisol-based screen printing inks. Additionally, the material’s long shelf life and ease of curing under heat have made it ideal for both small and large-volume printing operations. Industries increasingly favor plastisol screen printing for its cost-effectiveness in producing large batches without compromising on design quality or finish.

Another critical factor contributing to its dominance is the adaptability of plastisol inks to various fabric types, including cotton, polyester, and blends. As the textile industry evolves toward faster production cycles and high-quality output, screen printing with plastisols remains a reliable and scalable solution.

By End-use Analysis

Automotive and transportation sectors captured a 29.2% share, due to durable coating needs.

In 2024, Automotive and Transportation held a dominant market position in the By End-use segment of the Plastisols Market, with a 29.2% share. The automotive sector’s consistent need for durable, flexible, and protective coatings significantly contributed to this leadership. Plastisols are extensively used for underbody coatings, body seals, and sound-dampening layers, where their resistance to corrosion, abrasion, and chemicals is critical.

Additionally, automotive manufacturers increasingly prefer plastisols for interior components such as seat coverings, dashboards, and door panels. Their ability to offer superior aesthetic finishes, combined with functional benefits like scratch resistance and easy maintenance, makes them a preferred material across both passenger and commercial vehicle categories.

Regulatory pressure for improved environmental performance has also led to innovations in phthalate-free and low-VOC plastisol formulations, supporting their continued use in transportation applications. The versatility and performance reliability of plastisols ensure that the automotive and transportation segment will maintain a strong foothold, with further opportunities emerging from electric vehicle manufacturing and lightweight material advancements.

Key Market Segments

By Type

- Phthalate-free

- Phthalate-containing

By Application

- Screen Printing

- Molding

- Coating

- Dipping

- Spraying

- Adhesives and Sealants

- Others

By End-use

- Automotive and Transportation

- Interior

- Exterior

- Building and Construction

- Flooring

- Roofing

- Others

- Consumer Goods

- Appliances

- Footwear

- Furniture

- Others (Toys, Sporting Goods)

- Textile

- Healthcare

- Aerospace and Defense

- Others

Driving Factors

Growing Automotive Demand Boosting Plastisols Market Growth

One of the main driving factors for the plastisols market is the growing demand from the automotive industry. Plastisols are used for underbody coatings, seat covers, door panels, and soundproofing parts in vehicles.

As automotive companies focus more on making durable, lightweight, and long-lasting vehicles, the need for strong coating materials like plastisols is rising. Their excellent chemical resistance, flexibility, and ability to protect against corrosion make them perfect for automotive use.

With global vehicle production steadily increasing, especially in countries like China, India, and Mexico, the demand for plastisols is also going up. Moreover, the trend toward electric vehicles is pushing manufacturers to use innovative materials, opening even more opportunities for plastisols in modern car designs and components.

Restraining Factors

Environmental Concerns Restraining Plastisols Market Expansion

One of the major restraining factors for the plastisols market is growing environmental concerns. Traditional plastisols are based on PVC and phthalate plasticizers, which are under strict regulation in many countries due to their harmful effects on health and the environment.

Many governments have introduced rules limiting the use of phthalates, especially in consumer products. Consumers are also becoming more aware of the environmental impact of plastic-based products, which has led to a shift toward eco-friendly alternatives.

These changes are forcing manufacturers to develop phthalate-free and sustainable plastisols, which can be more expensive and challenging to produce. Until the industry fully adapts to greener options, environmental regulations will continue to slow down the overall growth of the plastisols market.

Growth Opportunity

Rising Demand For Eco-friendly Plastisols Solutions

A big growth opportunity for the plastisols market is the rising demand for eco-friendly solutions. As more industries and consumers prefer sustainable products, companies are focusing on developing phthalate-free and bio-based plastisols.

These eco-friendly alternatives meet strict environmental regulations while still offering the same durability, flexibility, and performance benefits as traditional plastisols. The textile and automotive sectors, in particular, are pushing hard for greener materials to maintain certifications and improve brand image.

Governments worldwide are also supporting the use of safer materials through incentives and new policies. This shift toward sustainability is opening new business avenues for manufacturers ready to innovate, helping them tap into expanding markets while building a strong reputation for environmental responsibility.

Latest Trends

Shift Towards Water-Based Plastisols Gaining Momentum

A significant trend in the plastisols market is the increasing shift towards water-based plastisols formulations. Traditional plastisols, primarily composed of PVC and phthalate plasticizers, have raised environmental and health concerns due to their potential toxicity and the release of volatile organic compounds (VOCs).

In response, manufacturers are developing water-based alternatives that offer similar performance characteristics while minimizing environmental impact. These eco-friendly plastisols are gaining traction across various industries, including textiles, automotive, and construction.

Their advantages include lower VOC emissions, improved worker safety, and compliance with stringent environmental regulations. As consumer demand for sustainable products grows, the adoption of water-based plastisols is expected to rise, driving innovation and opening new opportunities in the market.

Regional Analysis

In 2024, Asia-Pacific led the Plastisols Market, holding 52.4% market share.

In 2024, the Asia-Pacific region dominated the global plastisols market, capturing a substantial 52.4% share, equivalent to USD 11.9 billion. This dominance is attributed to rapid industrialization, urbanization, and the expansion of automotive and construction sectors in countries like China and India. The region’s demand is further bolstered by the growing textile industry and increasing adoption of eco-friendly plastisol alternatives.

North America held a significant position in the market, driven by advancements in automotive manufacturing and a strong emphasis on sustainable materials. The region’s mature industrial base and stringent environmental regulations have propelled the adoption of phthalate-free plastisols.

Europe also contributed notably to the market, with a focus on high-quality coatings and automotive applications. The region’s commitment to environmental sustainability has led to increased research and development in bio-based plastisols.

The Middle East & Africa and Latin America regions, while currently holding smaller market shares, are experiencing growth due to infrastructural developments and rising industrial activities. These regions present emerging opportunities for plastisol applications in the construction and automotive sectors.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Avient Corporation, Follmann GmbH & Co. KG, and Campbell Plastics emerged as prominent players in the global plastisols market, each contributing uniquely to the industry’s growth trajectory.

Avient Corporation demonstrated robust financial performance in 2024, with full-year sales reaching $3.24 billion, marking a 4% organic growth compared to the previous year. The company’s commitment to sustainability was evident through its Wilflex™ Revive™ Bio Plastisol Inks, which contain 50–59% bio-derived content, catering to the increasing demand for eco-friendly solutions in screen printing applications.

Follmann GmbH & Co. KG showcased its innovative capabilities at FILTECH 2024 by presenting customized adhesive solutions tailored for the filtration industry. Their FOLCO SOL plastisols are optimized for efficient manufacturing processes and maximum functionality of filter media, highlighting Follmann’s expertise in developing specialized plastisol applications.

Campbell Plastics continued to strengthen its position in the plastisols market by offering a diverse range of products, including plastisols for various applications. Their commitment to quality and customer satisfaction has solidified their reputation as a reliable supplier in the industry.

Top Key Players in the Market

- Avient Corporation

- Follmann GmbH & Co. KG

- Campbell Plastics

- Fujifilm Holdings Corporation

- Chemionics Corporation

- International Coatings

- Lancer Group International

- Monarch Color Corp

- Patcham FZC

- Protech Group

- Polyblend

- PolySol LLC

- Lakeside Plastics, Inc.

- BSL Industrie a.s.

- Total Ink Solutions

- Other Key Players

Recent Developments

- In April 2022, Longacre Group invested in Polyblend UK Limited, a market-leading producer of liquid plastisols and dispersion systems. This investment provided Polyblend with the resources of a larger group, enhancing its capabilities in formulation development, blending, and quality control.

- In November 2021, Lakeside Plastics was acquired by KB Components, a Swedish industrial group. The acquisition was structured as an asset deal, with operations in Windsor, Ontario, becoming part of KB Components Canada Inc. This move aimed to strengthen KB Components’ position in the North American market, particularly in the electric vehicle sector.

Report Scope

Report Features Description Market Value (2024) USD 22.9 Billion Forecast Revenue (2034) USD 47.6 Billion CAGR (2025-2034) 7.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Phthalate-free, Phthalate-containing), By Application (Screen Printing, Molding, Coating, Dipping, Spraying, Adhesives and Sealants, Others), By End-use (Automotive and Transportation (Interior, Exterior), Building and Construction (Flooring, Roofing, Others), Consumer Goods (Appliances, Footwear, Furniture), Others (Toys, Sporting Goods),(Textile, Healthcare, Aerospace and Defense, Others)) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Avient Corporation, Follmann GmbH & Co. KG, Campbell Plastics, Fujifilm Holdings Corporation, Chemionics Corporation, International Coatings, Lancer Group International, Monarch Color Corp, Patcham FZC, Protech Group, Polyblend, PolySol LLC, Lakeside Plastics, Inc., BSL Industrie a.s., Total Ink Solutions, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Avient Corporation

- Follmann GmbH & Co. KG

- Campbell Plastics

- Fujifilm Holdings Corporation

- Chemionics Corporation

- International Coatings

- Lancer Group International

- Monarch Color Corp

- Patcham FZC

- Protech Group

- Polyblend

- PolySol LLC

- Lakeside Plastics, Inc.

- BSL Industrie a.s.

- Total Ink Solutions

- Other Key Players