Global Handloom Product Market By Product Type (Sarees, Apparel, Home Furnishings, Accessories, Other Textiles), By Material Type (Cotton, Silk, Wool, Others), By End-Use (Residential, Commercial, Institutional), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 133632

- Number of Pages: 309

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

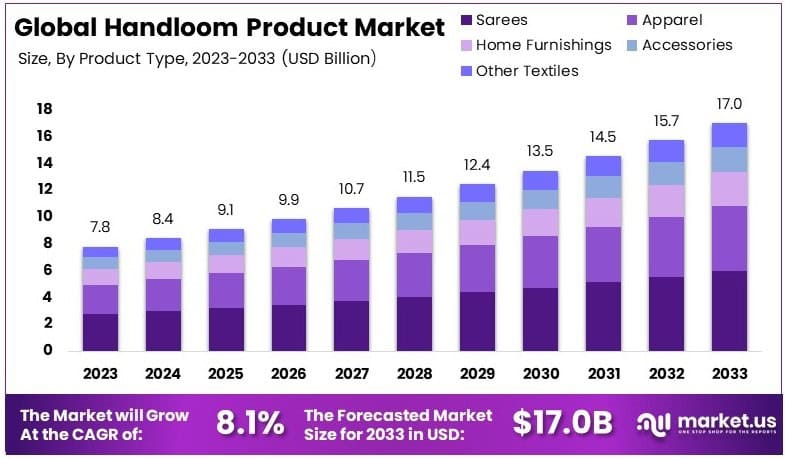

The Global Handloom Product Market size is expected to be worth around USD 17.0 Billion by 2033, from USD 7.8 Billion in 2023, growing at a CAGR of 8.1% during the forecast period from 2024 to 2033.

Handloom products are textiles woven manually on traditional looms, showcasing skilled craftsmanship and cultural heritage. These products often include sarees, shawls, carpets, and home furnishings. They are valued for their intricate designs, eco-friendly processes, and unique regional patterns. Handloom items represent sustainable and artisanal production methods, emphasizing creativity and tradition.

The handloom product market encompasses the trade and distribution of handmade textiles crafted using traditional looms. It includes diverse product categories such as apparel, home decor, and accessories. This market supports artisans globally, catering to consumers seeking authentic, sustainable, and culturally rich textile options. It highlights both domestic and export demand.

Handloom products are handmade textiles woven using traditional methods, reflecting cultural heritage and sustainable practices. According to Invest India, this sector employs 35.23 lakh weavers and allied workers, contributing 15% to India’s cloth production. These products are valued for their eco-friendly nature and intricate craftsmanship, resonating with global sustainability trends.

The handloom product market encompasses production, trade, and distribution of artisanal textiles. With exports to over 100 countries, including the United States, this market earned $1,802.36 million from handicrafts in 2023-2024 in India. Growing demand for sustainable goods and premium eco-friendly products drives this market, reflecting shifting consumer preferences globally.

Increasing global awareness of sustainability creates a strong demand for handloom products. Reports show that 89% of consumers favor eco-friendly products, with 80% willing to pay extra. Additionally, India’s government initiatives, such as financial aid for weavers, strengthen production capacity, offering opportunities for growth and export expansion.

The market is moderately competitive due to the dominance of unorganized players alongside emerging organized brands. While local markets thrive on authenticity, global exports face challenges from machine-made textiles. However, rising consumer preference for decorated apparel handmade and sustainable products offers Indian handloom products a unique competitive edge in the global market.

Locally, the handloom industry supports millions of livelihoods and preserves traditional skills. On a broader scale, it contributes significantly to India’s economy, earning valuable foreign exchange and promoting sustainable trade. These impacts underscore the sector’s dual role as a cultural preserver and an economic contributor.

Key Takeaways

- The Handloom Product Market was valued at USD 7.8 billion in 2023 and is expected to reach USD 17.0 billion by 2033, with a CAGR of 8.1%.

- In 2023, Sarees dominated the product type segment with 42.4%, driven by cultural significance and increasing consumer demand for traditional apparel.

- In 2023, Cotton led the material type segment with 61.2%, owing to its versatility, comfort, and widespread consumer preference.

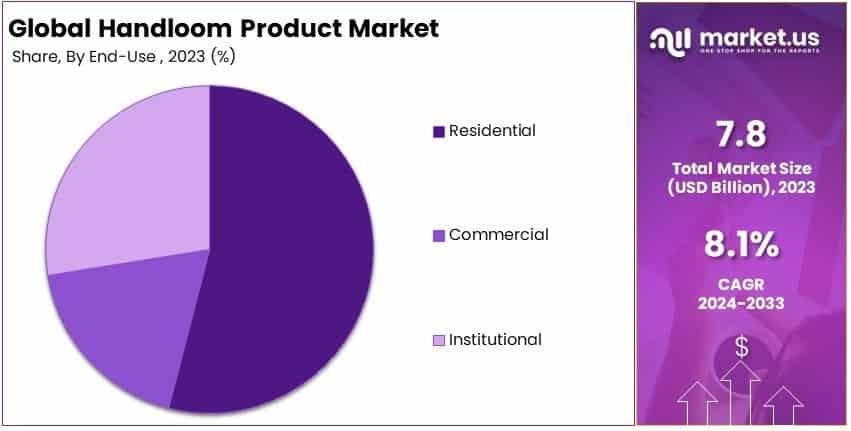

- In 2023, Residential use dominated the end-use segment, highlighting the growing demand for handloom products in households.

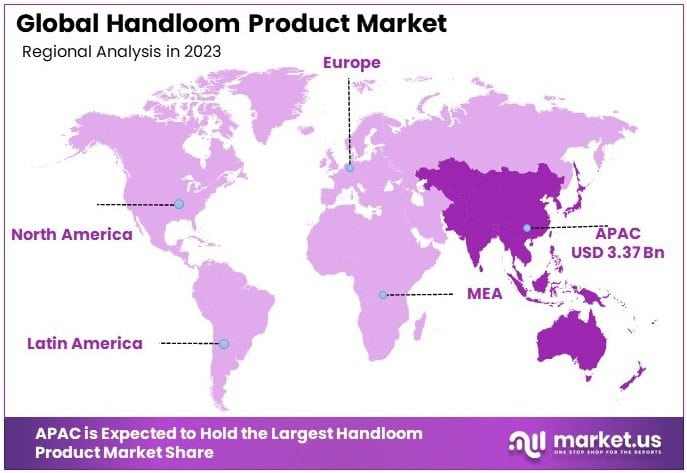

- In 2023, Asia Pacific held the largest market share of 43.2% and contributed USD 3.37 billion, attributed to strong production bases and export potential.

Type Analysis

Sarees dominate with 42.4% due to their traditional appeal and high demand in both domestic and international markets.

The Handloom Product Market is segmented into various product types including Sarees, Apparel, Home Furnishings, Accessories, and Other Textiles. Sarees, as the dominant sub-segment, hold a significant market share of 42.4%.

This dominance can be attributed to the rich cultural heritage associated with sarees, and their increasing popularity as a fashion statement globally. Manufacturers have capitalized on this trend by incorporating modern designs while retaining traditional weaving techniques, thus broadening their appeal across different consumer segments.

Apparel, which includes Men’s, Women’s, and Baby apparel, also plays a crucial role in the handloom industry. This sub-segment benefits from the growing consumer preference for sustainable and ethically produced garments. Men’s and Women’s Wear, particularly, have seen an uptick in sales due to the rising awareness of artisanal crafts among urban populations.

Home Furnishings, encompassing products like Curtains, Cushion Covers, and Rugs, contribute to the market by offering unique, handcrafted items that appeal to the environmentally conscious consumer. This segment is witnessing growth driven by the trend towards interior personalization and the desire for eco-friendly home decor.

Accessories such as Bags and Scarves are significant for their ability to incorporate handloom techniques into everyday fashion. This sub-segment benefits from the high margin on small goods which can be frequently changed and updated with new designs, attracting a younger demographic.

Lastly, Other Textiles cover a range of products that include handloom materials used in various applications, reflecting the versatility and innovation within the industry. This segment is crucial for testing new market trends and expanding the scope of handloom products.

Material Type Analysis

Cotton dominates with 61.2% due to its versatility, comfort, and wide acceptance in global markets.

In the Material Type segment, Cotton, Silk, Wool, and Others such as Jute and Linen are considered. Cotton leads with a substantial share of 61.2%, favored for its breathability, ease of dyeing, and softness, making it highly popular across various handloom products.

The widespread cultivation of cotton in major handloom producing countries significantly supports its availability and continuous innovation in cotton-based handloom products.

Silk is revered in the handloom sector for its luxurious texture and vibrant colors, often used in high-end sarees and apparel. Although more expensive, silk products hold a niche market that appreciates traditional weaving techniques combined with the aesthetic and tactile qualities of silk.

Wool in the handloom sector is primarily utilized for warm clothing and home furnishings. Its natural insulation properties make it ideal for products aimed at colder climates, contributing to its steady demand in the market.

Other materials like Jute and Linen are gaining traction due to their sustainability and eco-friendly properties. These materials are increasingly preferred for their rustic aesthetic and durability, making them suitable for both apparel and home furnishings.

End-Use Analysis

Residential use leads the market, driven by increasing consumer interest in sustainable and culturally rich home decor.

The End-Use segment of the Handloom Product Market is categorized into Residential, Commercial, and Institutional uses. The Residential segment is the most prominent, propelled by consumers’ growing interest in incorporating sustainable and artisan-crafted products into their homes. This trend is supported by the global shift towards more ethical consumption patterns.

Commercial usage includes handloom products used in hospitality settings such as hotels and restaurants, where there is a demand for unique and high-quality textiles that can create a distinctive ambiance.

Institutional use involves handloom products being utilized in settings such as corporate offices and public buildings, driven by corporate social responsibility initiatives and the desire to promote traditional arts.

Key Market Segments

By Product Type

- Sarees

- Apparel

- Home Furnishings

- Accessories

- Other Textiles

By Material Type

- Cotton

- Silk

- Wool

- Others

By End-Use

- Residential

- Commercial

- Institutional

Drivers

Increased Consumer Demand Drives Market Growth

The Handloom Product Market is expanding significantly, driven by growing consumer preference for sustainable and eco-friendly products. Consumers increasingly seek items produced with minimal environmental impact, encouraging manufacturers to use organic and biodegradable materials in handloom products.

Additionally, the rising appreciation for cultural heritage and traditional craftsmanship is boosting demand. Handloom products represent authenticity and uniqueness, appealing to consumers who value artistry over mass-produced alternatives.

Government support is another driving factor propelling market growth. Subsidies, export incentives, and financial aid for the handloom sector help enhance global competitiveness while preserving traditional weaving practices. Furthermore, e-commerce platforms have revolutionized the market by providing artisans with global reach.

Restraints

High Costs and Competition Restrict Market Growth

The high production costs of handloom products are a critical challenge restraining market growth. Handcrafted items are labor-intensive and time-consuming to produce, making them more expensive than machine-made alternatives. This price disparity often discourages cost-conscious consumers from purchasing handloom goods, especially in competitive markets.

Quality inconsistencies further hinder the market. Without standardized quality benchmarks, customers hesitate to buy products online, affecting overall trust and sales.

Additionally, intense competition from machine-made textiles and synthetic fabrics poses a threat. These alternatives, often cheaper and widely available, capture market share, leaving handloom products at a disadvantage. Limited access to advanced tools and modern weaving technologies also restricts scalability for traditional artisans.

Opportunity

Customized Offerings Create Market Opportunities

The rising demand for personalized and customizable products provides a significant opportunity for the Handloom Product Market. Consumers increasingly seek unique designs that reflect their preferences, and handloom products cater perfectly to this trend.

Similarly, the surge in sustainable fashion has created a lucrative avenue for market growth. Eco-conscious brands can expand their product range by incorporating handloom products, attracting environmentally mindful customers.

Global partnerships and export opportunities are also unlocking growth potential. Collaborations with international retailers enable artisans to penetrate untapped markets. Additionally, the growing popularity of experiential tourism, where travelers engage with local artisans and purchase authentic handcrafted items, is boosting demand. These factors collectively provide promising opportunities for market expansion.

Challenges

Limited Resources and Workforce Pose Challenges

Several challenges impact the Handloom Product Market’s growth trajectory. Limited access to affordable raw materials, such as cotton and silk, significantly increases production costs. This pricing challenge reduces the competitiveness of handloom products in the market.

Furthermore, the lack of modern skill development programs limits artisans’ ability to adapt to evolving consumer demands and innovate their craft.

A declining interest among younger generations in traditional weaving presents another obstacle. Many potential artisans seek more lucrative career options due to the limited financial security in the industry.

Additionally, logistical inefficiencies, including weak supply chains and insufficient marketing infrastructure, further constrain market scalability. These challenges highlight the need for industry reforms to sustain growth.

Growth Factors

Economic Growth and Local Support Propel Market Growth

Economic factors are significantly fueling the Handloom Product Market. Rising disposable incomes, particularly in developing regions, allow consumers to spend more on artisanal goods. This trend enables the industry to cater to a broader demographic with higher purchasing power.

Simultaneously, women empowerment initiatives in rural areas are expanding the workforce, enhancing production capacity, and increasing the market’s reach.

Support from non-governmental organizations (NGOs) and international bodies has also strengthened the market. These organizations provide funding, training, and marketing assistance, enabling artisans to scale their businesses effectively. Moreover, the global movement to support small businesses and local economies has amplified demand for handloom products, creating a sustainable growth pathway for the industry.

Emerging Trends

Modern Trends Reshape Market Dynamics

Emerging trends are reshaping the Handloom Product Market. The integration of technology into traditional weaving practices is a notable shift. Smart textiles with advanced functionalities, such as temperature regulation, are gaining popularity among tech-savvy consumers.

Additionally, direct-to-consumer (DTC) models are enabling artisans to bypass intermediaries, boosting profits and establishing stronger customer relationships.

Social media is another transformative force. Platforms like Instagram and Pinterest showcase unique handloom creations, amplifying global visibility and inspiring demand. Collaborations between luxury brands and artisans further elevate the perceived value of handloom products, positioning them as premium offerings.

Regional Analysis

Asia Pacific Dominates with 43.2% Market Share

Asia Pacific leads the Handloom Product Market, accounting for a 43.2% of the global share. This prominence is driven by the region’s rich tradition of handloom craftsmanship, high demand for culturally rooted products, and the presence of a vast artisan community.

The market value is bolstered by strong government support in countries like India and China, where subsidies, training programs, and export incentives empower artisans and enhance market competitiveness.

The region benefits from a robust supply chain, abundant raw materials, and cost-effective labor, making it the largest hub for handloom production. Increasing global appreciation for sustainable and handcrafted goods amplifies demand for exports from this region. Rapid urbanization and rising disposable incomes in countries like India, China, and Indonesia also contribute to growing domestic consumption.

Asia Pacific’s influence on the global Handloom Product Market is expected to strengthen further. As sustainable and eco-friendly consumer trends continue to grow, the demand for handloom products will increase. Additionally, enhanced digital penetration and the use of e-commerce platforms are making it easier for artisans to reach global markets, ensuring long-term dominance for the region.

Regional Mentions:

- North America: North America showcases steady growth in the Handloom Product Market, driven by rising consumer interest in sustainable and culturally unique products. The region also benefits from robust online retail channels and growing awareness of artisanal craftsmanship, especially in urban areas.

- Europe: Europe holds a significant share in the Handloom Product Market, driven by its focus on sustainable fashion and ethical sourcing. The region’s preference for handcrafted and eco-friendly goods aligns with its environmentally conscious consumer base, sustaining its market relevance.

- Middle East & Africa: The Middle East and Africa are emerging markets for handloom products. Increasing tourism and a growing demand for cultural goods have enhanced the market. Initiatives to promote local craftsmanship and sustainable trade practices are further contributing to growth.

- Latin America: Latin America is gradually adopting handloom products, supported by a rich tradition of weaving and craftwork in countries like Mexico and Peru. Efforts to modernize the artisanal sector and expand into international markets are fostering steady growth in the region.

Key Regions and Countries covered in the report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Handloom Product Market is dominated by key players that emphasize tradition, sustainability, and innovation. Among the top contributors are Fabindia, Khadi Gramodyog, Dastkar, and Barefoot College, each playing a significant role in shaping the market dynamics.

Fabindia leads the market with its extensive network and focus on preserving traditional craftsmanship. The company is known for integrating modern designs with authentic handloom techniques, catering to both domestic and international markets. Its emphasis on sustainable practices and fair trade partnerships with artisans has set a benchmark in the industry.

Khadi Gramodyog plays a pivotal role as a government-backed initiative promoting the use of khadi and handwoven fabrics. Its nationwide network and strong association with India’s independence movement have given it a cultural edge. Khadi Gramodyog’s focus on empowering rural weavers and generating employment has significantly contributed to the market’s growth.

Dastkar, a non-profit organization, strengthens the market by creating a direct platform for artisans to showcase and sell their products. With its focus on reviving traditional crafts and building sustainable livelihoods, Dastkar has been instrumental in connecting rural artisans to urban markets. Its annual exhibitions attract a large consumer base, boosting the visibility of handloom products.

Barefoot College takes an innovative approach by blending handloom production with education and community empowerment. Its initiatives to train women in rural areas and produce eco-friendly products cater to a growing global demand for sustainable goods. This unique model ensures social impact alongside market relevance.

These companies collectively drive the Handloom Product Market by promoting sustainability, supporting artisans, and creating global awareness for traditional crafts. Their combined efforts ensure a steady growth trajectory for the industry, while fostering a deeper connection between consumers and heritage products.

Top Key Players in the Market

- Fabindia

- Dastkar

- Khadi Gramodyog

- Barefoot College

- Bharat Handloom

- Varanasi Weaves

- Jaypore

- Nandini Handlooms

- Assam Handloom

- Dastkari Haat Samiti

- The India Handloom Brand

- Ranganayaki Handlooms

- Anokhi

- Looms & Weaves

- Sanganeri Textiles

Recent Developments

- Indian Government and the India Handloom Brand: In August 2024, the Indian government announced that approximately 2,000 registrations had been issued under the ‘India Handloom’ Brand, covering 184 product categories. Launched in August 2015, this initiative aims to promote high-quality handloom products that are environmentally friendly and defect-free.

- Integrated Handloom Village Project: In August 2024, it was reported that the first phase of the Integrated Handloom Village project at Chendamangalam was nearing completion, with about 90% of the main buildings finished. The project aims to showcase indigenous weaving traditions and is expected to attract tourists, thereby boosting the local handloom industry.

- KIIT Deemed to be University: In August 2024, KIIT Deemed to be University announced plans to create an encyclopedia dedicated to the crafts of Odisha and to establish a Craft Museum. This initiative aligns with the university’s ongoing efforts to promote artisans and handloom products from Odisha on both national and international platforms.

Report Scope

Report Features Description Market Value (2023) USD 7.8 Billion Forecast Revenue (2033) USD 17.0 Billion CAGR (2024-2033) 8.1% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Sarees, Apparel, Home Furnishings, Accessories, Other Textiles), By Material Type (Cotton, Silk, Wool, Others (Jute, Linen, etc.)), By End-Use (Residential, Commercial, Institutional) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Fabindia, Dastkar, Khadi Gramodyog, Barefoot College, Bharat Handloom, Varanasi Weaves, Jaypore, Nandini Handlooms, Assam Handloom, Dastkari Haat Samiti, The India Handloom Brand, Ranganayaki Handlooms, Anokhi, Looms & Weaves, Sanganeri Textiles Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Fabindia

- Dastkar

- Khadi Gramodyog

- Barefoot College

- Bharat Handloom

- Varanasi Weaves

- Jaypore

- Nandini Handlooms

- Assam Handloom

- Dastkari Haat Samiti

- The India Handloom Brand

- Ranganayaki Handlooms

- Anokhi

- Looms & Weaves

- Sanganeri Textiles