Global Hair Supplements Market By Type (Single Ingredient and Multi-Ingredient), By Form (Powder, Gummies & Softgels, Capsules and Others), By Distribution Channel (Drug & Pharma Stores, Hypermarkets/Supermarkets, Online Pharmacies and Specialty Stores), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 176292

- Number of Pages: 215

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

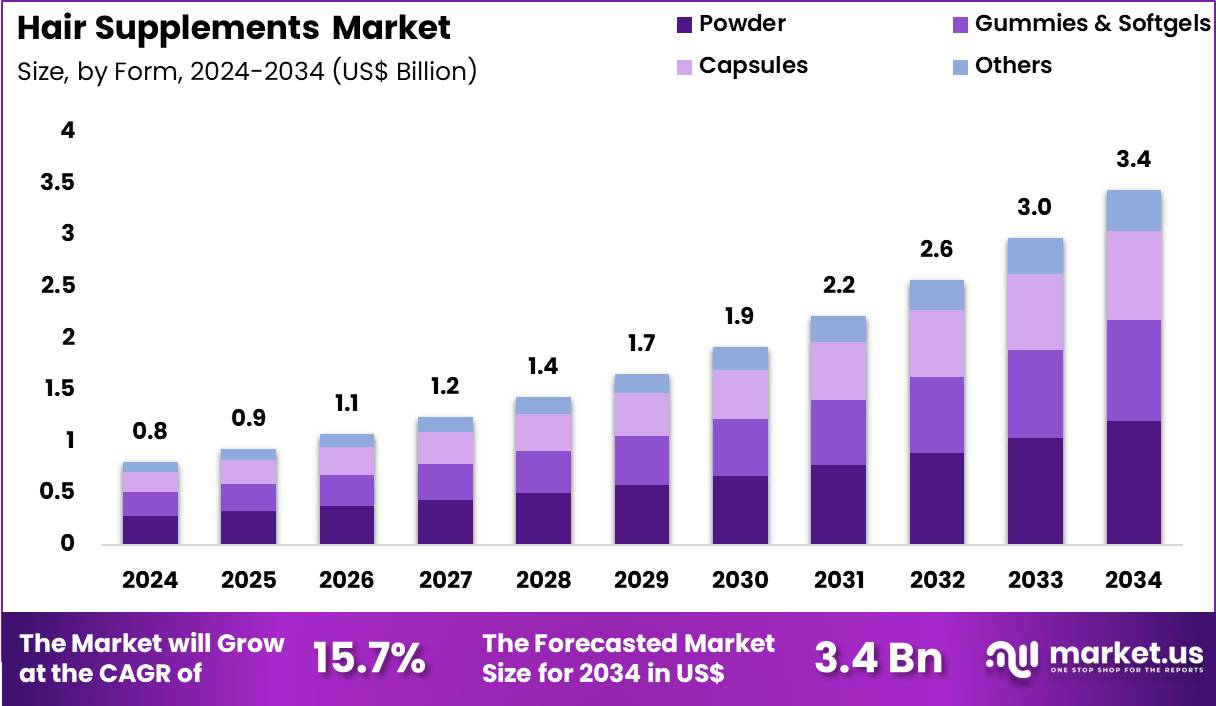

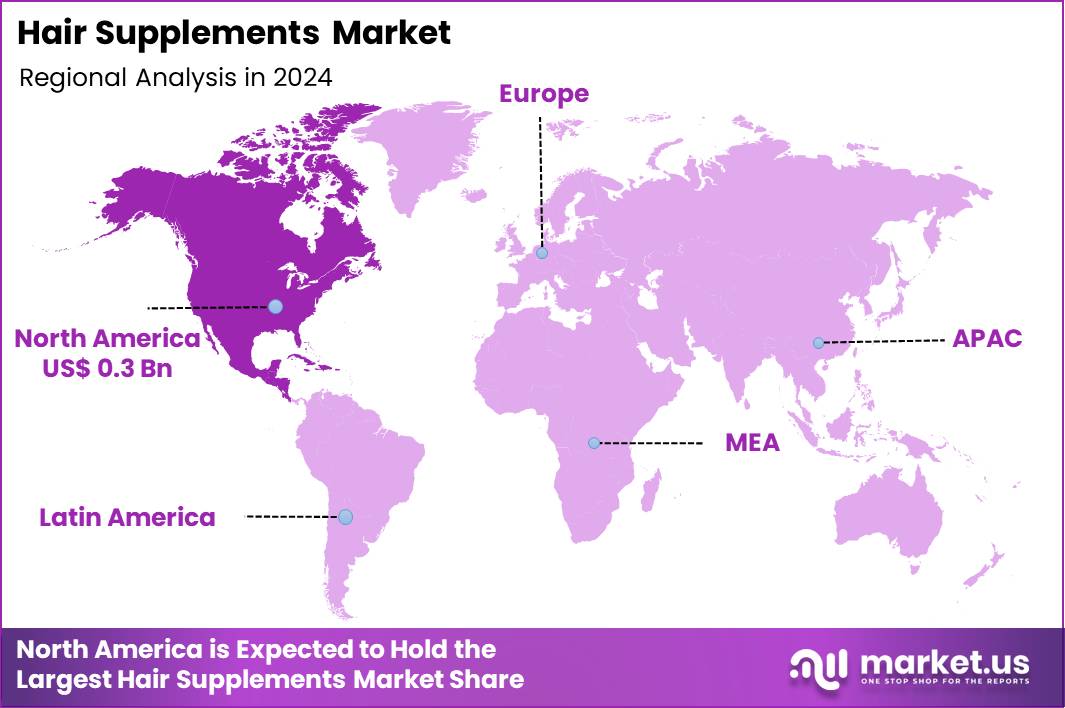

Global Hair Supplements Market size is expected to be worth around US$ 3.4 Billion by 2034 from US$ 0.8 Billion in 2024, growing at a CAGR of 15.7% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 43.3% share with a revenue of US$ 0.3 Billion.

Growing consumer awareness of hair health and appearance fuels the hair supplements market as individuals seek non-invasive solutions to combat thinning, breakage, and loss associated with aging, stress, nutritional deficiencies, and hormonal changes. Consumers increasingly incorporate biotin-rich supplements to strengthen hair shafts and promote thickness in cases of brittle or damaged strands caused by chemical treatments or environmental exposure.

These formulations support collagen-based products that enhance hair elasticity and reduce shedding in postpartum women and those experiencing telogen effluvium. Men and women utilize marine collagen and keratin supplements to improve hair density and shine, addressing androgenetic alopecia and age-related thinning through improved follicle nourishment.

Multivitamin blends with zinc, iron, and vitamin D target nutrient-related hair loss, restoring growth cycles in individuals with dietary imbalances or malabsorption issues. Saw palmetto and pumpkin seed oil supplements gain traction among men for reducing dihydrotestosterone effects, slowing progression of male pattern baldness when used consistently.

Manufacturers pursue opportunities to develop targeted formulations that combine adaptogens and antioxidants, expanding applications in stress-induced hair loss and premature graying prevention. Developers advance time-released capsules that optimize nutrient absorption, enhancing efficacy for long-term use in chronic conditions like alopecia areata and traction alopecia.

These innovations facilitate personalized regimens through subscription models that adjust ingredients based on hair type, age, and lifestyle factors. Opportunities emerge in plant-based and vegan options featuring millet extract and horsetail silica, appealing to health-conscious consumers avoiding animal-derived ingredients.

Companies invest in clinical validation of proprietary blends, building consumer trust for supplements addressing scalp health and follicle strength. Recent trends emphasize clean-label products free from artificial additives, aligning with demand for holistic wellness solutions that support hair vitality alongside skin and nail benefits.

Key Takeaways

- In 2024, the market generated a revenue of US$ 0.8 Billion, with a CAGR of 15.7%, and is expected to reach US$ 3.4 Billion by the year 2034.

- The type segment is divided into single ingredient and multi-ingredient, with single ingredient taking the lead with a market share of 57.6%.

- Considering form, the market is divided into powder, gummies & softgels, capsules and others. Among these, powder held a significant share of 34.8%.

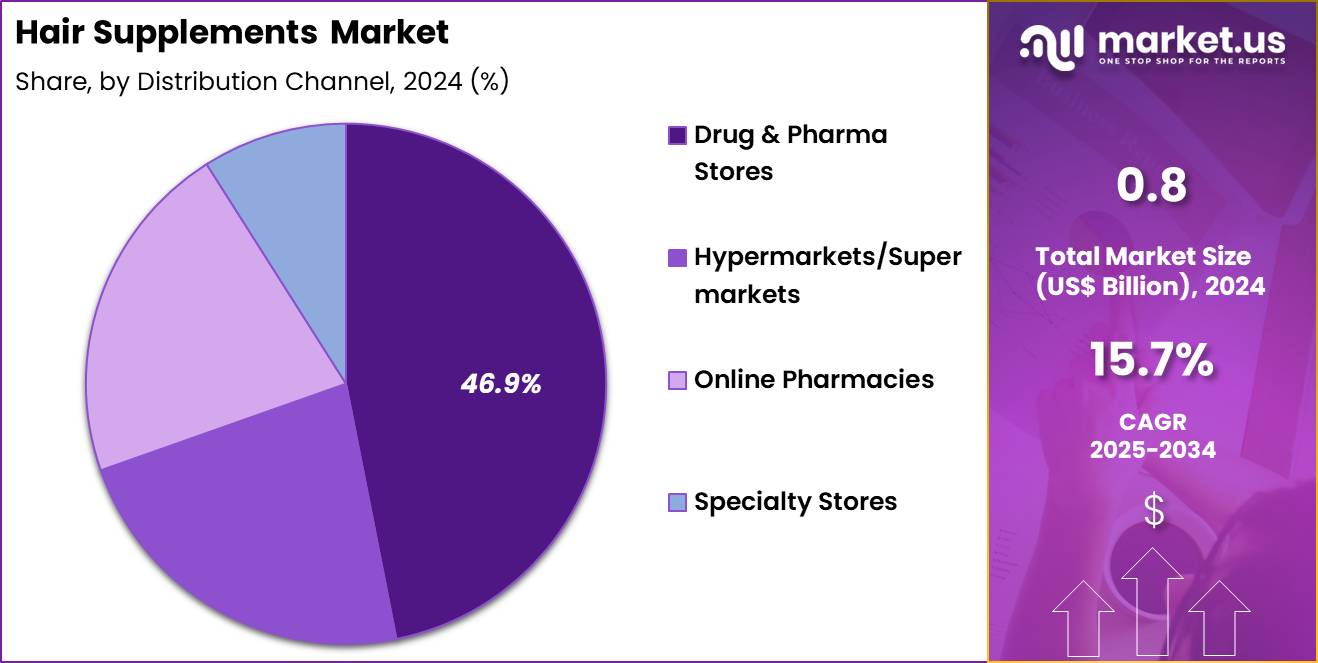

- Furthermore, concerning the distribution channel segment, the market is segregated into drug & pharma stores, hypermarkets/supermarkets, online pharmacies and specialty stores. The drug & pharma stores sector stands out as the dominant player, holding the largest revenue share of 46.9% in the market.

- North America led the market by securing a market share of 43.3%.

Type Analysis

Single ingredient products contributed 57.6% of growth within type and led the hair supplements market due to rising consumer preference for targeted nutrition and ingredient transparency. Consumers increasingly select standalone biotin, iron, zinc, or collagen supplements to address specific deficiencies linked to hair thinning and breakage. Healthcare professionals often recommend single ingredient options because they simplify dosing and reduce interaction concerns. This clarity supports higher trust among first-time users and individuals managing underlying nutritional gaps.

Growth strengthens as consumers adopt self-directed wellness routines and track outcomes more closely. Regulatory scrutiny and clean-label trends reinforce demand for simple formulations with recognizable ingredients. Price accessibility compared to complex blends also supports wider adoption across income groups.

Retail pharmacists frequently guide consumers toward single ingredient choices for symptom-specific needs. The segment is expected to remain dominant as personalization and ingredient-focused decision-making continue to shape supplement purchasing behavior.

Form Analysis

Powder formats generated 34.8% of growth within form and emerged as the leading segment due to dosage flexibility and rapid absorption preferences. Users favor powders because they allow easy adjustment of intake based on individual needs and lifestyle routines. The format integrates smoothly into beverages and meals, which supports daily compliance. Fitness-oriented consumers and wellness-focused individuals often prefer powders as part of broader nutrition regimens.

Manufacturers expand flavored and plant-based powder options to improve palatability and appeal. Bulk packaging and cost efficiency strengthen repeat purchases among long-term users. Powders also support higher active ingredient loads without capsule size constraints. Influencer-led nutrition trends further popularize drinkable supplements. The segment is projected to sustain leadership as consumers prioritize customizable and convenient supplementation formats.

Distribution Channel Analysis

Drug and pharma stores accounted for 46.9% of growth within distribution channel and dominated the hair supplements market due to strong consumer trust and professional guidance availability. Shoppers rely on pharmacists for advice on supplement selection, especially for hair loss concerns linked to health conditions or medications. These stores provide assured product authenticity, which reduces hesitation around quality and safety. Proximity and established purchasing habits further reinforce channel preference.

Growth accelerates as pharmacies expand wellness and nutraceutical sections to capture preventive care demand. In-store promotions and physician referrals increase foot traffic for hair supplements. Prescription-to-OTC crossover purchasing also supports add-on sales. Consistent inventory availability encourages brand loyalty. The segment is anticipated to remain the primary growth driver as credibility and accessibility continue to influence consumer buying decisions.

Key Market Segments

By Type

- Single Ingredient

- Multi-Ingredient

By Form

- Powder

- Gummies & Softgels

- Capsules

- Others

By Distribution Channel

- Drug & Pharma Stores

- Hypermarkets/Supermarkets

- Online Pharmacies

- Specialty Stores

Drivers

Increasing prevalence of alopecia is driving the market.

The escalating incidence of alopecia across various demographics has heightened the demand for hair supplements as a non-invasive approach to mitigate hair thinning and loss. Improved medical reporting and diagnostic tools have contributed to the recognition of this condition as a significant health concern.

According to the U.S. Department of Defense’s Armed Forces Health Surveillance Division, the incidence rate for alopecia among female active component service members more than doubled from 564.3 per 100,000 person-years in 2010 to 1,228 per 100,000 person-years in 2022. This upward trend reflects broader societal factors, including stress and nutritional deficiencies, prompting consumers to seek supplemental interventions.

Hair supplements containing vitamins and minerals are positioned as supportive therapies to address underlying causes of alopecia. Clinical communities are increasingly endorsing these products for their potential to enhance follicular health. Government health surveillance data emphasize the need for accessible solutions to manage rising cases.

Major companies are responding by formulating products targeted at alopecia-prone populations. This driver aligns with global efforts to promote preventive healthcare measures. Overall, the prevalence surge sustains market momentum in nutritional support for hair restoration.

Restraints

High cost of premium hair supplements is restraining the market.

The elevated pricing of high-quality hair supplements formulated with specialized ingredients restricts their adoption among budget-conscious consumers. Production complexities involving clinically tested components contribute to increased manufacturing expenses. In healthcare settings with limited funding, prioritization shifts toward essential medications over elective supplements.

Consumer hesitation arises from the ongoing financial commitment required for long-term use. Regulatory standards for quality control further amplify costs passed to end-users. Smaller retailers face challenges in stocking expensive variants, limiting market availability. This restraint disproportionately impacts access in lower-income demographics.

Industry attempts to introduce value packs aim to counteract pricing barriers. Despite perceived benefits, economic considerations delay widespread integration. Consequently, affordability enhancements are necessary to alleviate this market constraint.

Opportunities

Growth in vitamins, minerals, and supplements business is creating growth opportunities.

The expanding vitamins, minerals, and supplements sector offers avenues for hair-specific products to integrate into broader wellness portfolios. Investments in nutritional science support the development of formulations addressing hair health needs.

Nestlé Health Science, encompassing brands like Nature’s Bounty, reported sales of CHF 6.7 billion in 2024, with organic growth of 6.2%. This performance indicates robust consumer interest in supplemental solutions for overall vitality, including hair maintenance. Strategic alliances with wellness platforms enable cross-promotion of hair supplements. Government endorsements for dietary aids bolster confidence in these categories.

The large consumer base seeking immune and beauty enhancements amplifies potential for specialized offerings. Key enterprises are establishing dedicated lines to exploit synergies with VMS growth. This opportunity facilitates innovation in multi-benefit products. Targeted expansions can secure positions in evolving nutritional landscapes.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic conditions influence the hair supplements market through consumer disposable income, retail pricing dynamics, and marketing spend decisions that leaders evaluate carefully. Inflation and higher interest rates reduce discretionary wellness purchases, which slows volume growth in premium supplement lines.

Geopolitical tensions disrupt supplies of vitamins, botanicals, and specialty packaging, increasing input volatility and freight costs. Current US tariffs on imported ingredients and finished products raise landed costs for brands and contract manufacturers, which pressures margins and prompts price rationalization. These factors challenge smaller labels and intensify competition on value.

On the positive side, trade friction accelerates domestic sourcing, ingredient traceability, and local contract manufacturing. Growing awareness of hair health, stress related hair loss, and preventive nutrition sustains baseline demand. With clearer claims, science backed formulations, and omnichannel reach, the market remains positioned for steady growth.

Latest Trends

Expansion of gummy formulations is a recent trend in the market.

In 2024, the proliferation of gummy-based hair supplements has transformed delivery methods to improve consumer compliance and appeal. These formats combine efficacy with enjoyable consumption, targeting diverse age groups effectively.

Nature’s Bounty expanded its women’s wellness line with Hair Growth Gummies in October 2024, incorporating essential nutrients for follicular support. This innovation caters to preferences for convenient, taste-enhanced alternatives to traditional capsules. Manufacturers are leveraging natural flavors to minimize synthetic additives in gummy products.

Clinical validations focus on bioavailability to ensure equivalent outcomes to pill forms. The trend responds to demands for lifestyle-compatible supplementation options. Regulatory adaptations facilitate approvals for novel textures in nutritional aids. Sector synergies emphasize child-friendly and adult variants for family use. These advancements aim to elevate adherence in routine hair care regimens.

Regional Analysis

North America is leading the Hair Supplements Market

North America holds a 43.3% share of the global Hair Supplements market, exhibiting considerable growth in 2024 attributable to escalating consumer prioritization of preventive health measures against alopecia triggered by modern stressors and nutritional gaps. Prominent brands including Viviscal and Nature’s Bounty have innovated with biotin-enriched gummies and collagen blends that promise thicker strands, appealing to millennials facing early onset balding from sedentary routines.

The area’s vibrant digital marketing landscape has amplified endorsements from influencers, educating audiences on supplement efficacy for scalp vitality and follicle strength. Public health discussions around vitamin deficiencies have prompted integrations of omega-3s and antioxidants in daily regimens, particularly for urban dwellers exposed to pollution.

Pharmaceutical collaborations have validated claims through clinical trials, building trust in over-the-counter options for androgenetic alopecia management. Retail expansions in pharmacies and online platforms have simplified access, aligning with busy lifestyles demanding convenient ingestion formats.

Moreover, demographic shifts toward older populations have intensified focus on anti-aging supplements that support keratin production. The American Hair Loss Association states that by age 35, two-thirds of American men experience some degree of appreciable hair loss, underscoring the urgency propelling supplement uptake.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Analysts foresee dynamic evolution in the hair nutrition segment throughout Asia Pacific over the forecast period, since urbanites confront escalating baldness from rapid industrialization and dietary shifts. Companies in South Korea and Japan formulate herbal capsules with ginseng extracts that combat follicular damage, while professionals in Singapore promote zinc-infused variants for enhanced resilience.

Healthcare entities in Malaysia organize seminars highlighting multivitamin benefits for strand density, motivating widespread integration into wellness routines. Investors in the Philippines channel funds toward seaweed-based innovations that nourish roots, catering to coastal communities prone to mineral shortages. Authorities in Indonesia subsidize campaigns advocating iron-rich options to counter anemia-linked thinning, expanding reach to provincial areas.

Dermatologists in Vietnam prescribe tailored blends addressing hormonal imbalances, optimizing results for young professionals. Manufacturers in Australia refine marine collagen products that fortify against UV exposure, gaining traction in sunny climates. Apollo Cosmetic Clinics reports that stress and pollution account for hair loss in 60% of men and 10% of women in India, catalyzing regional advancements.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key competitors in the hair supplements market pursue growth by refining formulations with clinically backed vitamins, minerals, and botanicals that align with rising consumer expectations for internal wellness and visible hair-health benefits. They expand digital and retail distribution channels, tapping e-commerce platforms and pharmacy chains to broaden reach while meeting demand in North America, Europe, and fast-growing Asia Pacific regions.

Firms also tailor offerings to consumer segments, from premium clean-label products to accessible chewables and gummies, strengthening loyalty and recurring purchases. Strategic collaborations with healthcare professionals and wellness influencers amplify credibility and drive trial among health-conscious buyers.

OZiva Hair Supplement represents a contemporary wellness-oriented brand that combines plant-based nutrients with targeted delivery formats, leverages online engagement, and builds brand trust through transparent ingredient lists and user education. The company sustains momentum by investing in product innovation, responsive marketing, and partnerships that translate broader beauty-from-within trends into sustained commercial performance.

Top Key Players

- Nestlé

- Amway

- HUM Nutrition

- Church and Dwight

- The Nature’s Bounty Co.

- Unilever

- Bayer AG

- Vitabiotics

- Perrigo Company

- GNC Holdings

Recent Developments

- In November 2024, Hum Nutrition expanded its product lineup with the launch of Hair Strong Capsule. The clinically evaluated supplement is formulated to support hair growth and improve strand strength, positioning it as a targeted solution for overall hair resilience and health.

- In November 2024, Lemme introduced a new dietary supplement focused on promoting hair growth. The formulation combines keratin with a blend of amino acids, essential vitamins, and minerals, designed to nourish hair structure and support healthier hair development.

Report Scope

Report Features Description Market Value (2024) US$ 0.8 Billion Forecast Revenue (2034) US$ 3.4 Billion CAGR (2025-2034) 15.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Single Ingredient and Multi-Ingredient), By Form (Powder, Gummies & Softgels, Capsules and Others), By Distribution Channel (Drug & Pharma Stores, Hypermarkets/Supermarkets, Online Pharmacies and Specialty Stores) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Nestlé, Amway, HUM Nutrition, Church and Dwight, The Nature’s Bounty Co., Unilever, Bayer AG, Vitabiotics, Perrigo Company, GNC Holdings Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Nestlé

- Amway

- HUM Nutrition

- Church and Dwight

- The Nature’s Bounty Co.

- Unilever

- Bayer AG

- Vitabiotics

- Perrigo Company

- GNC Holdings