Skin Repair Dressing Market By Product Type (Alginate Dressings, Collagen-based Dressings, Transparent Dressings, and Foam Dressings), By Application (Wound Healing and Wound Protection), By End-user (Hospitals, Clinics, Nursing Homes, and Home Healthcare Distributors), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 135582

- Number of Pages: 252

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

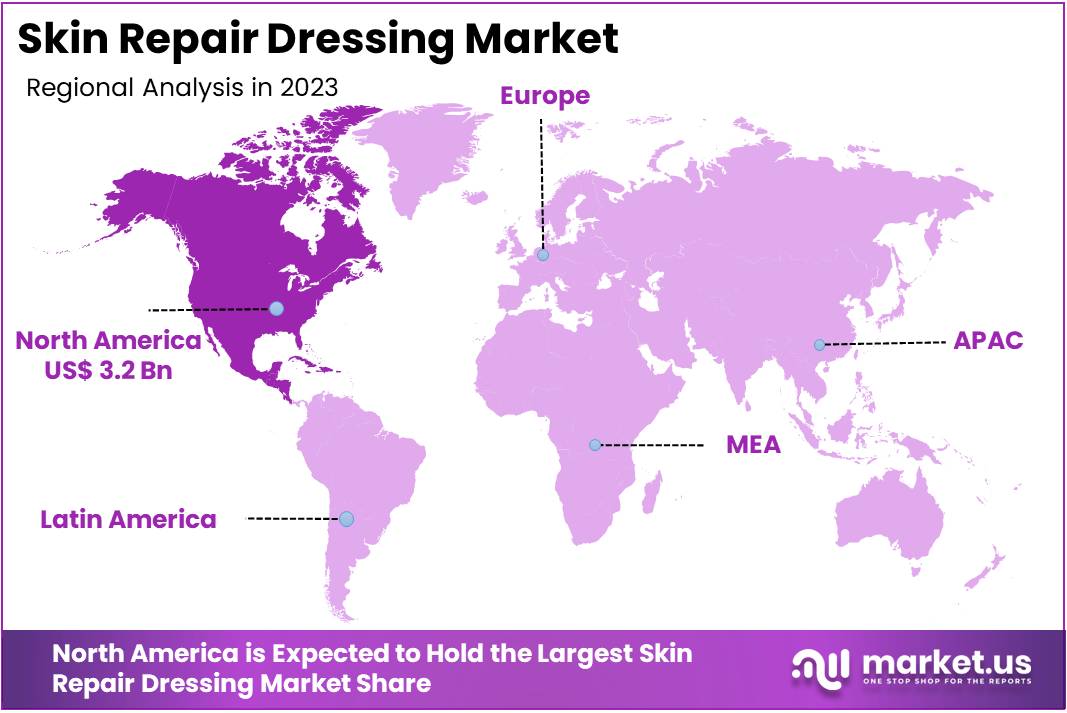

The Global Skin Repair Dressing Market size is expected to be worth around US$ 15.3 Billion by 2033, from US$ 8.1 Billion in 2023, growing at a CAGR of 6.6% during the forecast period from 2024 to 2033. North America held a dominant market position, capturing more than a 39.2% share and holds US$ 3.2 Billion market value for the year.

Growing awareness of advanced wound care and the increasing incidence of chronic wounds and burn injuries are driving the expansion of the skin repair dressing market. These dressings, designed to promote faster healing, reduce infection risk, and improve patient comfort, find applications in treating a wide range of skin conditions, including diabetic ulcers, surgical wounds, burns, and abrasions.

Rising demand for non-invasive, easy-to-use products is pushing innovation in skin repair dressings, leading to the development of more sophisticated materials such as hydrocolloids, alginates, and antimicrobial dressings. Additionally, the increasing focus on aesthetic and cosmetic treatments further drives market growth, as patients seek products that support skin regeneration and minimize scarring.

Opportunities also exist in the development of personalized skin repair solutions tailored to specific patient needs, such as those with sensitive skin or underlying health conditions. In March 2024, HealthQuad, a venture capital firm specializing in healthcare, led a US$20 million series B fundraising round for Cureskin, a platform that connects customers with skincare professionals.

This investment highlights the growing intersection between technology and skincare, where digital platforms and advanced treatments are reshaping how consumers approach skin health. As the market evolves, advancements in biomaterials and smart dressings, which monitor and adjust to the healing process, are expected to enhance the effectiveness and ease of skin repair treatments.

Key Takeaways

- In 2023, the market for skin repair dressing generated a revenue of US$ 8.1 billion, with a CAGR of 6.6%, and is expected to reach US$ 15.3 billion by the year 2033.

- The product type segment is divided into alginate dressings, collagen-based dressings, transparent dressings, and foam dressings, with collagen-based dressings taking the lead in 2023 with a market share of 35.2%.

- Considering application, the market is divided into wound healing and wound protection. Among these, wound healing held a significant share of 72.3%.

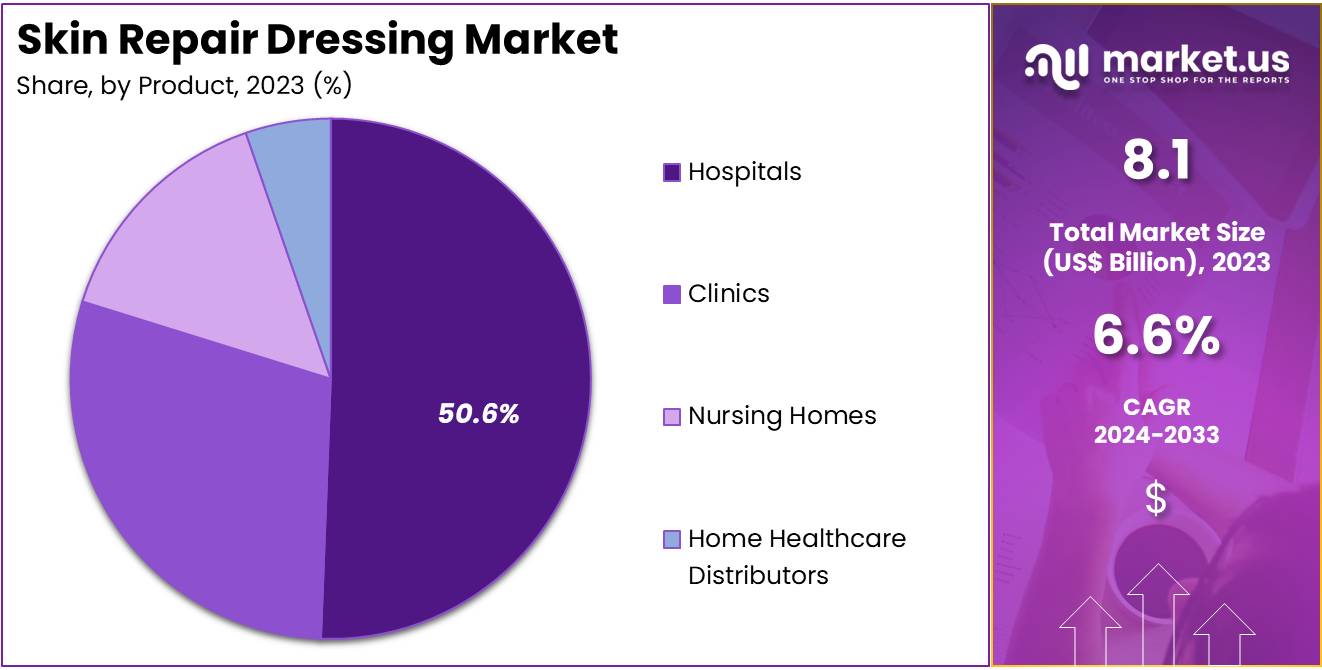

- Furthermore, concerning the end-user segment, the market is segregated into hospitals, clinics, nursing homes, and home healthcare distributors. The hospitals sector stands out as the dominant player, holding the largest revenue share of 50.6% in the skin repair dressing market.

- North America led the market by securing a market share of 39.2% in 2023.

Product Type Analysis

The collagen-based dressings segment led in 2023, claiming a market share of 35.2% owing to their effectiveness in wound management and their ability to accelerate the healing process. Collagen-based dressings, which provide a scaffold for new tissue formation, are anticipated to become increasingly popular, particularly for chronic wounds such as diabetic ulcers, pressure sores, and venous leg ulcers.

These dressings are projected to promote faster healing by stimulating collagen production, enhancing the body’s natural healing process. The growth of this segment is also driven by the rising prevalence of chronic wounds, a growing aging population, and an increase in the number of surgical procedures.

As healthcare providers increasingly focus on advanced wound care solutions, collagen-based dressings are likely to be favored for their ability to maintain a moist wound environment, reduce infection risk, and improve patient comfort.

Additionally, advancements in collagen technology, such as the development of synthetic and bioengineered collagen dressings, are expected to further boost the segment’s growth.

Application Analysis

The wound healing held a significant share of 72.3% as healthcare providers continue to prioritize effective wound management solutions. Wound healing dressings are expected to be in high demand, especially in the treatment of chronic, surgical, and traumatic wounds. These dressings support the healing process by promoting a moist environment, reducing scarring, and preventing infection.

The growth of the segment is likely to be driven by an increase in conditions such as diabetes, which are associated with slow-healing wounds, as well as a rise in the number of surgeries, burn injuries, and trauma cases.

Advances in technology, such as the incorporation of antimicrobial agents in wound healing dressings, are anticipated to boost the demand for these products. Additionally, as healthcare providers focus on reducing hospital stays and improving patient outcomes, the use of advanced wound healing dressings is expected to increase.

End-user Analysis

The hospitals segment had a tremendous growth rate, with a revenue share of 50.6% as hospitals remain a key end-user for advanced wound care products. With an increasing number of surgical procedures and trauma cases, hospitals are expected to account for a large share of the market, as they require a wide range of skin repair dressings to treat postoperative wounds, burns, and chronic conditions.

As hospitals continue to focus on improving patient outcomes, they are likely to prioritize products that speed up recovery and reduce the risk of infection. The segment’s growth is also anticipated to be fueled by the growing aging population, which is more prone to chronic wounds and skin-related health issues. Moreover, hospitals are expected to adopt more advanced dressing technologies, such as collagen-based and antimicrobial dressings, to optimize wound healing and reduce complications associated with long-term hospitalizations.

Key Market Segments

By Product Type

- Alginate Dressings

- Collagen-based Dressings

- Transparent Dressings

- Foam Dressings

By Application

- Wound Healing

- Wound Protection

By End-user

- Hospitals

- Clinics

- Nursing Homes

- Home Healthcare Distributors

Drivers

Growing Number of Diabetic Patients

The growing number of diabetic patients is significantly driving the demand for skin repair dressings. As per a recent survey, it is estimated that the number of diabetic patients will rise from 74.9 million in 2021 to 124.9 million by 2045. Diabetes often leads to chronic wounds and skin ulcers, especially on the feet and legs, which require specialized care and dressing solutions.

The increase in the diabetic population is expected to accelerate the demand for advanced skin repair dressings that promote faster healing and reduce the risk of infections. As diabetic patients are more prone to wounds due to poor circulation and nerve damage, the need for effective wound care products is anticipated to grow substantially.

Skin repair dressings that help manage such conditions are likely to see increased adoption, particularly those offering features such as enhanced absorption, antimicrobial properties, and improved comfort. The market is projected to expand as both healthcare providers and patients seek reliable solutions for managing diabetic wounds.

Restraints

Limited Awareness and Adoption in Developing Regions

Rising awareness about skin care and wound management has not been uniform across all regions, especially in developing countries, which could impede the growth of the skin repair dressing market. Limited access to advanced healthcare products in these regions hampers the widespread adoption of specialized skin repair solutions.

The high cost of some premium dressings, along with a lack of proper education and training for healthcare professionals in these areas, is expected to slow market expansion. In addition, cultural factors and the preference for traditional remedies may also contribute to the slow uptake of modern skin repair dressings.

As a result, the growth of the market in low- and middle-income countries is likely to face significant restraints, despite the growing demand for wound care products in these regions. The lack of infrastructure and government support for wound care initiatives in developing regions could further limit the market potential.

Opportunities

Rising Innovation Driving the Skin Repair Dressing Market

Rising innovation in wound care products is creating significant opportunities in the skin repair dressing market. New technological advancements are poised to enhance the performance and efficiency of skin repair solutions. For example, in January 2024, Medline introduced the OptiView Transparent Dressing, featuring innovative HydroCore Technology. This advanced wound care product offers a transparent design that allows caregivers to monitor wounds without removing the dressing.

The transparent design of Medline’s OptiView enables continuous assessment of the wound site and skin health, promoting better care management. The ability to check wounds without disrupting them is crucial for healing. Such innovative products are expected to increase the adoption of skin repair solutions that are easy to use and offer effective healing outcomes.

As research and development in the sector persist, the market is likely to see more advanced products. Future innovations may include features like enhanced moisture management, antimicrobial properties, and faster healing capabilities. These advancements are set to meet the increasing demand for efficient and user-friendly skin care solutions, especially beneficial for patients with chronic wounds or skin conditions.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors play a pivotal role in shaping the skin repair dressing market. Economic slowdowns or recessions can reduce healthcare budgets, affecting spending on wound care products and medical devices. Additionally, fluctuations in currency exchange rates and international trade barriers may impact the cost and availability of raw materials used in manufacturing.

On the positive side, the rising prevalence of chronic diseases, an aging population, and increased awareness about wound care are contributing to market growth. Geopolitical stability and improving healthcare infrastructure in emerging markets are likely to create new growth opportunities. As healthcare systems adapt to increasing demands, the skin repair dressing sector remains poised for further expansion in response to evolving patient care needs.

Trends

Surge in Mergers and Acquisitions Driving the Skin Repair Dressing Market

Rising mergers and acquisitions have become a key trend in the skin repair dressing market. Increasing interest in expanding product portfolios and enhancing research and development capabilities is driving consolidation. In July 2023, Coloplast, a Danish medical device manufacturer, agreed to acquire Kerecis, an Icelandic firm specializing in wound care, for US$1.2 billion.

This acquisition will likely strengthen Coloplast’s position in the skin repair dressing market by adding innovative wound care solutions to its portfolio. The growing number of mergers and acquisitions in the sector is expected to accelerate advancements in wound care technology and expand market reach.

Regional Analysis

North America is leading the Skin Repair Dressing Market

North America dominated the market with the highest revenue share of 39.2% owing to the increasing prevalence of chronic conditions such as diabetes, which affects approximately 38.4 million people in the US alone, according to the CDC. Diabetes-related complications, particularly diabetic foot ulcers and wounds that are slow to heal, have led to a rising demand for advanced skin repair dressings designed to promote healing and prevent infection.

The growing awareness of the benefits of specialized wound care products, along with an aging population prone to skin injuries, has contributed to the market’s expansion. Furthermore, advancements in materials used in skin repair dressings, such as hydrocolloids, alginates, and silicone-based dressings, have improved patient outcomes, driving the adoption of these products. The availability of insurance coverage for wound care products in North America has also supported market growth, making these treatments more accessible to a broader population.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is anticipated to experience the fastest compound annual growth rate (CAGR) in the wound care market. This growth is driven by increasing healthcare awareness, a higher prevalence of chronic diseases, and significant advancements in wound care technologies. Countries like India and China are poised to play crucial roles due to their substantial diabetic populations and escalating investments in healthcare infrastructure.

In a significant development in February 2024, Indian scientists innovated a sustainable wound healing material using banana pseudo stems, typically regarded as agricultural waste. This breakthrough represents a pivotal advancement in utilizing eco-friendly resources for medical applications, aligning with global sustainability trends.

The demand for advanced wound care products, including skin repair dressings, is expected to surge in Asia Pacific. This growth is supported by enhanced healthcare access and government initiatives promoting affordable healthcare solutions. These factors collectively contribute to a robust expansion of the wound care market in the region, promising improved health outcomes and innovative treatment options.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the skin repair dressing market focus on enhancing product efficacy, expanding their product portfolios, and fostering strategic partnerships to drive growth. Companies invest in developing advanced wound care solutions, incorporating antimicrobial properties, hydrogels, and biosynthetic materials to improve healing times and reduce infection risks.

They also prioritize the development of customized dressings tailored to specific wound types, such as burns, diabetic ulcers, and surgical wounds, to address diverse healthcare needs. Strategic collaborations with hospitals, healthcare providers, and research organizations help players reach a broader patient base and accelerate product adoption.

Additionally, players focus on expanding into emerging markets by offering cost-effective and innovative solutions to meet local healthcare demands. One key player in the skin repair dressing market is ConvaTec Group. ConvaTec specializes in wound care, offering a broad range of products, including advanced skin repair dressings for chronic and acute wounds.

The company’s growth strategy includes expanding its product range and incorporating innovative technologies, such as hydrocolloid and foam-based dressings, to enhance wound healing and patient comfort. ConvaTec also focuses on expanding its global footprint, particularly in emerging markets, through strategic partnerships and targeted acquisitions. By prioritizing research and development and delivering high-quality products, ConvaTec continues to strengthen its position as a market leader.

Top Key Players in the Skin Repair Dressing Market

- Solventum

- MiMedx Group

- Medtronic

- Johnson Johnson

- ConvaTec Group

- DuPont

- Derma Sciences

- Acelity

- 3M

Industrial Advantages and Opportunities For Market Players

The market for skin repair dressings presents substantial business benefits for key players. These benefits include stable revenue growth driven by consistent demand in medical treatments and opportunities for brand differentiation through innovative products. Additionally, the potential for expansion into emerging markets with developing healthcare infrastructures can significantly boost market presence and profitability.

Technological advancements in materials science provide a distinct industrial advantage, enhancing the effectiveness and healing capabilities of skin repair products. Furthermore, regulatory bodies may expedite approval for innovative products that demonstrate substantial clinical benefits, giving companies a competitive edge. Collaborations with healthcare providers for clinical trials also play a crucial role in product development and market penetration.

There are significant opportunities linked to the global increase in the aging population, which is prone to chronic wounds like diabetic ulcers. This demographic shift is expanding the market for skin repair dressings. Moreover, there is a continuous demand for products that not only expedite healing but also integrate better with the skin and minimize scarring, opening doors for innovative solutions in wound care.

The shift towards sustainability is prompting the development of eco-friendly, biodegradable wound care products. Additionally, integrating smart technologies into skin repair dressings to monitor healing and gather data offers a promising opportunity. Such advancements can lead to superior patient outcomes and operational efficiencies, positioning companies at the forefront of the wound care industry and fostering long-term growth.

Recent Developments

- In September 2024: Solventum announced the introduction of the V.A.C. Peel and Place Dressing, an integrated dressing and drape that patients may wear for up to seven days and apply in less than two minutes.

- In October 2023: the newly released DuPont Liveo MG 7-9960 silicone soft skin adhesive (SSA) is a low-cyclic, higher-adhesion product from the technology-based materials and solutions provider DuPont. The unique adhesive is meant to be used in advanced wound care dressings, to affix medical devices to the skin for extended lengths of time, and to remove them with gentleness.

Report Scope

Report Features Description Market Value (2023) US$ 8.1 billion Forecast Revenue (2033) US$ 15.3 billion CAGR (2024-2033) 6.6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Alginate Dressings, Collagen-based Dressings, Transparent Dressings, and Foam Dressings), By Application (Wound Healing and Wound Protection), By End-user (Hospitals, Clinics, Nursing Homes, and Home Healthcare Distributors) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Solventum , MiMedx Group, Medtronic, Johnson Johnson, Hollister Incorporated, DuPont, Derma Sciences, Acelity, and 3M. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Skin Repair Dressing MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Skin Repair Dressing MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Solventum

- MiMedx Group

- Medtronic

- Johnson Johnson

- ConvaTec Group

- DuPont

- Derma Sciences

- Acelity

- 3M