Global Liquid Handling Technology Market By Product Type (Automated Workstations (Standalone Workstations and Integrated Workstations), Small Devices (Pipettes {Pipette Controllers, Manual Pipettes, and Electronic Pipettes}, Burettes, Dispensers, and Others), and Consumables (Disposable Tips, Regents, Tubes & Plates, and Others)), By Technology (Automated, Manual, and Semi-automated), By Application (Bioprocessing/Biotechnology, Cancer & Genomic Research, Drug Discovery & ADME-Tox Research, and Others), By End-use (Academic & Research Institutes, Contract Research Organizations, and Pharmaceutical & Biotechnology Companies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2024

- Report ID: 136523

- Number of Pages: 387

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

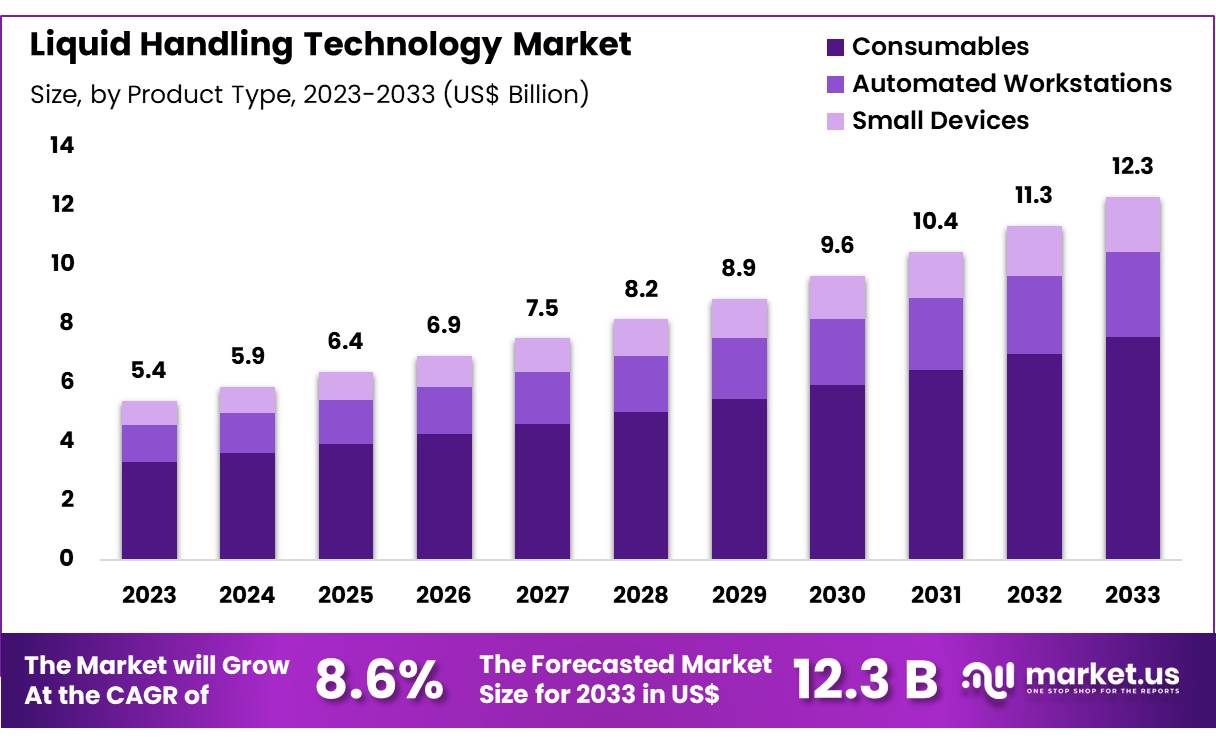

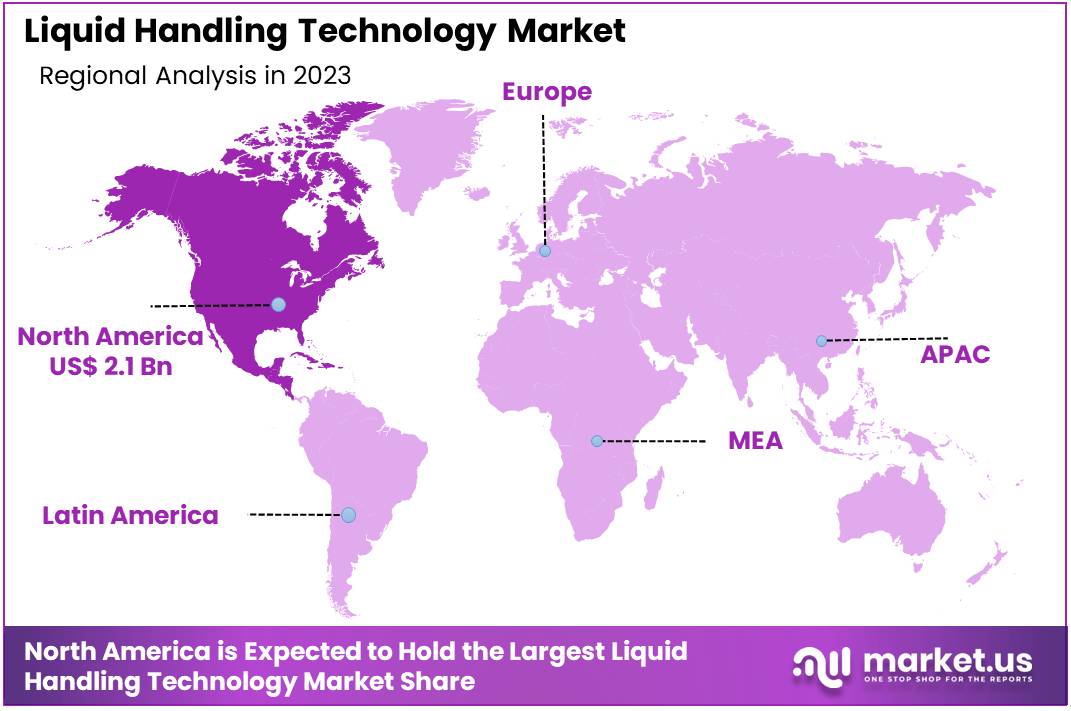

Global Liquid Handling Technology Market size is expected to be worth around US$ 12.3 billion by 2033 from US$ 5.4 billion in 2023, growing at a CAGR of 8.6% during the forecast period 2024 to 2033. In 2023, North America led the market, achieving over 39.7% share with a revenue of US$ 2.1 Million.

Increasing demand for precision and automation in laboratory workflows is driving the growth of the liquid handling technology market. These technologies are critical in various applications, including drug discovery, genomics, diagnostics, and life sciences research, where accurate liquid measurements and transfers are essential.

Liquid handling systems play a key role in accelerating research processes, improving throughput, and minimizing human error. The rising trend of personalized medicine and the need for more accurate diagnostics further fuel demand for advanced liquid handling solutions, as they enable high-quality sample preparation for molecular testing and assays.

In June 2022, Beckman Coulter Life Sciences launched the Biomek NGeniuS liquid handling system, designed to enhance efficiency and streamline workflows in Next Generation Sequencing (NGS), highlighting the growing adoption of automation in genomic research. The trend toward miniaturization in laboratory equipment also opens up new opportunities for compact, high-performance liquid handling systems suitable for smaller laboratories and point-of-care settings.

Additionally, increasing investments in life sciences and the growing emphasis on precision medicine create a strong market for liquid handling technologies that can handle complex workflows in drug development, clinical diagnostics, and biotechnology. Furthermore, innovations such as integrated robotic systems and data-driven liquid handling solutions continue to drive market trends, improving efficiency and reproducibility in laboratory settings.

Additionally, increasing investments in life sciences and the growing emphasis on precision medicine create a strong market for liquid handling technologies that can handle complex workflows in drug development, clinical diagnostics, and biotechnology. Furthermore, innovations such as integrated robotic systems and data-driven liquid handling solutions continue to drive market trends, improving efficiency and reproducibility in laboratory settings.Key Takeaways

- In 2023, the market for Liquid Handling Technology generated a revenue of US$ 4 billion, with a CAGR of 8.6%, and is expected to reach US$ 12.3 billion by the year 2033.

- The product type segment is divided into automated workstations, small devices, and consumables, with consumables taking the lead in 2023 with a market share of 61.5%.

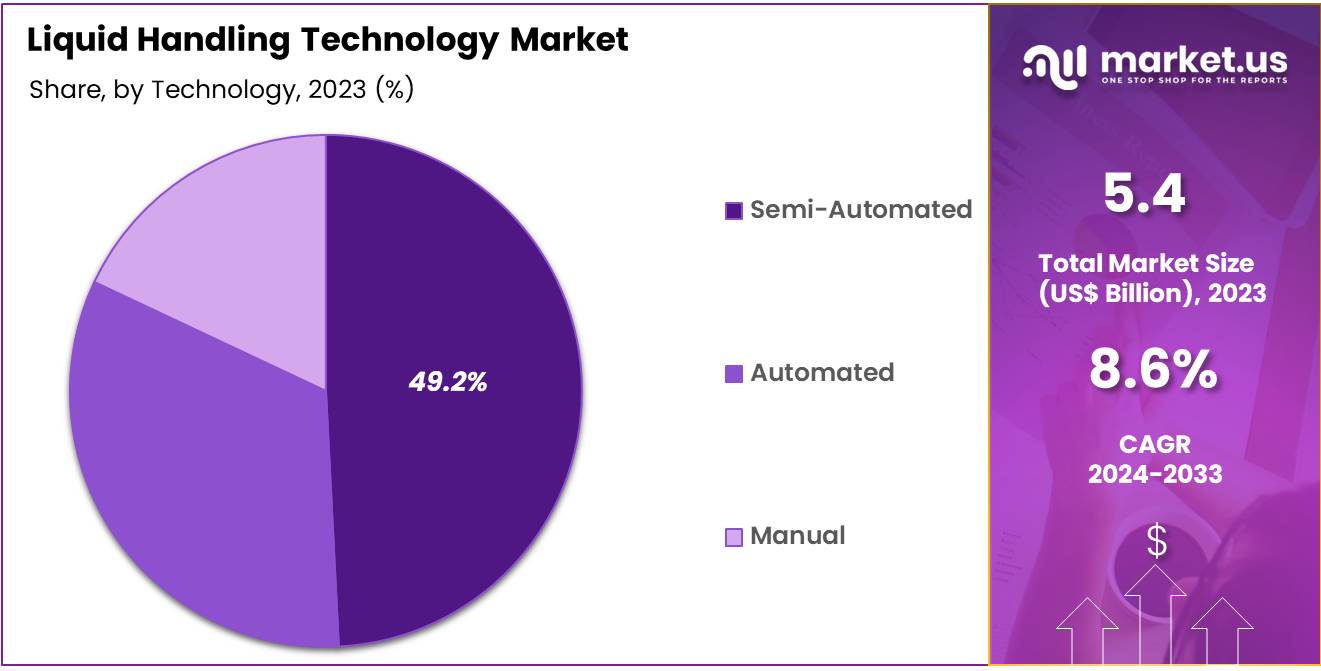

- Considering technology, the market is divided into automated, manual, and semi-automated. Among these, semi-automated held a significant share of 49.2%.

- Furthermore, concerning the application segment, the market is segregated into bioprocessing/biotechnology, cancer & genomic research, drug discovery & ADME-tox research, and others. The drug discovery & adme-tox research sector stands out as the dominant player, holding the largest revenue share of 45.9% in the Liquid Handling Technology market.

- The end-use segment is segregated into academic & research institutes, contract research organizations, and pharmaceutical & biotechnology companies, with the academic & research institutes segment leading the market, holding a revenue share of 48.2%.

- North America led the market by securing a market share of 39.7% in 2023.

Product Type Analysis

The consumables segment led in 2023, claiming a market share of 61.5% owing to the increasing need for high-quality, reliable, and cost-effective products in laboratory settings. Consumables, including pipette tips, reagents, and plates, are anticipated to see growing demand as laboratories strive for more efficient and accurate liquid handling processes.

The rise in high-throughput screening, personalized medicine, and advanced research applications is likely to further drive the growth of this segment. Researchers and pharmaceutical companies are expected to increasingly rely on consumables for repetitive tasks, as these products ensure consistent performance and reduce contamination risks.

Additionally, the continuous development of disposable consumables with specialized features, such as increased precision and compatibility with automated systems, is projected to support the expansion of this segment. As more laboratories adopt automated liquid handling systems, the need for consumables that complement these technologies is likely to grow, thus driving overall market growth.

Technology Analysis

The semi-automated held a significant share of 49.2% due to its ability to offer a balance between manual and fully automated systems, providing enhanced flexibility for research and clinical applications. Semi-automated systems are likely to attract growing demand from laboratories that require efficiency but are not yet ready to adopt fully automated solutions. These systems offer the advantage of reducing manual errors while still allowing for human intervention when necessary.

The rise of research and drug discovery activities, particularly in smaller-scale laboratories, is expected to contribute to the growth of this segment. Semi-automated systems also offer scalability and cost-effectiveness, which is anticipated to make them a more accessible option for a wide range of end-users, from academic institutions to contract research organizations.

As the need for faster, more accurate liquid handling processes continues to increase, semi-automated solutions are expected to become a preferred choice in the market.

Application Analysis

The drug discovery & adme-tox research segment had a tremendous growth rate, with a revenue share of 45.9% owing to the increasing demand for advanced tools to support drug development and toxicity testing. Automated liquid handling systems are likely to play a crucial role in drug discovery, helping to streamline the process of compound screening, hit identification, and lead optimization.

In ADME-tox (Absorption, Distribution, Metabolism, Excretion, and Toxicity) research, accurate liquid handling is essential for generating reliable data in preclinical testing. The growing focus on precision medicine and personalized drug development is projected to further drive the demand for high-throughput liquid handling systems, as they enable researchers to perform complex assays more efficiently.

Additionally, the increasing adoption of automation in drug discovery processes is likely to contribute to the expansion of this segment, as it enhances the speed and accuracy of tests while reducing human error.

End-use Analysis

The academic & research institutes segment grew at a substantial rate, generating a revenue portion of 48.2% due to the increasing reliance on liquid handling systems in research and experimentation. These institutions are expected to invest in automated and semi-automated liquid handling systems to improve the accuracy and throughput of their research.

As academic research becomes more complex and data-driven, the demand for efficient liquid handling systems is projected to rise, particularly in molecular biology, genomics, and biotechnology fields. The growing number of research projects focused on areas such as drug discovery, genetic research, and disease modeling is expected to fuel the adoption of advanced liquid handling solutions.

Additionally, academic institutions are likely to benefit from the scalability and flexibility offered by liquid handling technologies, making them suitable for both small and large-scale experiments. This increased reliance on automation is anticipated to drive the continued growth of the academic and research institutes segment.

Key Market Segments

Product Type

-

- Automated Workstations

-

-

- Standalone Workstations

- Integrated Workstations

- Small Devices

- Pipettes

-

-

-

-

- Pipette Controllers

- Manual Pipettes

- Electronic Pipettes

-

-

-

-

- Burettes

- Dispensers

- Others

- Consumables

- Disposable Tips

- Regents

- Tubes & Plates

- Others

-

Technology

-

- Automated

- Manual

- Semi-automated

Application

-

- Bioprocessing/Biotechnology

- Cancer & Genomic Research

- Drug Discovery & ADME-Tox Research

- Others

End-use

-

- Academic & Research Institutes

- Contract Research Organizations

- Pharmaceutical & Biotechnology Companies

Drivers

High demand for precision and accuracy is driving the market

High demand for precision and accuracy significantly drives the liquid handling technology market by ensuring reliable and reproducible results in various laboratory applications. In March 2023, Eppendorf SE presented an upgraded version of its epMotion series, an automated liquid handling system designed to improve precision, accuracy, and ease of use for laboratory workflows.

This advancement meets the increasing need for meticulous liquid handling in research, clinical diagnostics, and pharmaceutical development. Laboratories seek solutions that minimize human error and enhance throughput, making automated systems essential for high-stakes experiments and large-scale studies. The enhanced epMotion series offers advanced features such as improved pipetting accuracy, user-friendly interfaces, and seamless integration with existing laboratory information systems. These improvements enable researchers to conduct complex assays with greater confidence and efficiency.

Additionally, the rise in personalized medicine and high-throughput screening projects necessitates sophisticated liquid handling technologies that can handle diverse and intricate protocols. As scientific research becomes more data-driven and reliant on precise measurements, the adoption of advanced liquid handling systems is projected to accelerate.

Manufacturers are expected to continue innovating, introducing more refined and versatile instruments to cater to the evolving demands of the market. This trend not only boosts the performance and capabilities of liquid handling technologies but also drives overall market growth by expanding their application scope across various scientific disciplines.

The consistent focus on enhancing accuracy and reliability positions liquid handling technology as a critical component in modern laboratories, fostering advancements and ensuring the integrity of experimental outcomes.

Restraints

Growing complexity of technology is restraining the market

Growing complexity of technology poses a significant restraint to the liquid handling technology market by increasing the barriers to adoption and operational efficiency. Advanced liquid handling systems often require specialized training for laboratory personnel, which can lead to higher operational costs and longer implementation times.

The sophisticated nature of these instruments necessitates regular maintenance and calibration to ensure optimal performance, adding to the overall expenses for research facilities. Additionally, the integration of automated liquid handling systems with existing laboratory infrastructure can be challenging, requiring compatibility with various software and hardware components. This complexity can deter smaller laboratories with limited resources from investing in high-end liquid handling technologies.

Moreover, the rapid pace of technological advancements means that equipment can quickly become outdated, necessitating frequent upgrades or replacements to stay current with the latest innovations. This constant need for updates not only strains budgets but also disrupts ongoing research projects, potentially delaying critical experiments and studies.

Furthermore, the high initial investment required for advanced liquid handling systems can be prohibitive, especially for institutions operating under tight financial constraints. The complexity of customizing these systems to meet specific research needs also limits their flexibility and ease of use. As a result, the growing complexity of liquid handling technology acts as a barrier to widespread adoption, restraining the market by limiting accessibility and increasing the financial and operational burdens on potential users.

Opportunities

Increase in launch of new and effective liquid-handling solutions is creating opportunities for the market

Increasing launch of new and effective liquid-handling solutions creates substantial opportunities for the liquid handling technology market by expanding the range of applications and enhancing user capabilities. In May 2023, Opentrons introduced the Opentrons Flex robot, a cost-effective liquid-handling solution developed to simplify lab automation. This innovative system is tailored to meet the needs of laboratories of various sizes, expanding access to advanced automation tools for a diverse range of researchers.

The Opentrons Flex robot offers flexibility and scalability, allowing labs to customize workflows and adapt to changing research demands without significant additional investments. By providing user-friendly interfaces and modular designs, Opentrons enables researchers to integrate liquid handling seamlessly into their existing processes, improving efficiency and reducing turnaround times. The introduction of such versatile and affordable solutions attracts a broader customer base, including academic institutions, biotechnology firms, and clinical laboratories.

Furthermore, the continuous innovation in liquid handling technologies drives competition, leading to the development of more advanced, reliable, and feature-rich instruments. These new solutions often incorporate the latest advancements in automation, software integration, and data analytics, providing users with enhanced control and precision in their experiments.

The ability to handle complex protocols and diverse sample types with ease makes these new liquid-handling systems highly desirable in various scientific fields. As companies continue to launch effective liquid-handling solutions, the market is likely to experience accelerated growth, driven by the increasing adoption of automation in laboratories worldwide.

This trend not only boosts the performance and versatility of liquid handling technologies but also fosters greater collaboration and innovation in scientific research, further propelling the market forward.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the liquid handling technology market. On the positive side, the rapid growth of industries like pharmaceuticals, biotechnology, and healthcare drives the demand for precision and efficiency in laboratory processes.

Expanding research and development investments in diagnostics, personalized medicine, and drug discovery fuel the adoption of automated systems. However, economic downturns can lead to budget constraints in both private and public sectors, slowing the pace of technological advancements and purchases.

Geopolitical tensions, such as trade wars or political instability in key manufacturing regions, could disrupt the supply chain for components used in liquid handling systems, raising costs. Additionally, varying regulatory standards across countries complicate product standardization and market entry. Despite these challenges, the increasing need for higher productivity, accuracy, and efficiency in laboratory environments ensures continued growth in the sector, driven by technological innovation and automation.

Latest Trends

Surge in Mergers and Acquisitions Driving the Liquid Handling Technology Market:

Increasing mergers and acquisitions are playing a pivotal role in advancing the liquid handling technology market. High levels of consolidation are expected to lead to more innovative solutions and an expanded product portfolio, making the technology more accessible and efficient. Companies are likely to pursue acquisitions to integrate new capabilities and broaden their market presence.

In December 2023, Hudson Robotics and Art Robbins Instruments, part of Argosy Healthcare Partners, acquired Tomtec Inc., a company specializing in automated liquid handling systems widely used for mass spectrometry sample preparation.

This acquisition is anticipated to enhance the technological offerings and market reach of the acquiring companies. As the demand for automation and high-throughput testing rises, the trend of mergers and acquisitions is projected to continue, driving market growth and fostering innovation.

Regional Analysis

North America is leading the Liquid Handling Technology Market

North America dominated the market with the highest revenue share of 39.7% owing to advancements in biotechnology, pharmaceutical research, and diagnostics. The increasing complexity of laboratory workflows, especially in genomics, drug discovery, and clinical diagnostics, has heightened the demand for efficient and accurate liquid handling systems.

Automation in laboratories has become crucial for improving throughput and reducing human error, fueling the adoption of automated liquid handling solutions. A notable development in the market was the launch of two advanced liquid handling platforms by SPT Labtech in February 2022 during the SLAS International Conference. These included the Firefly platform for next-generation sequencing library preparation and the Apricot DC1, a multifunctional 4-in-1 automated system.

These innovations demonstrate the growing trend toward automation in laboratory environments, which has greatly contributed to the market’s growth in North America. Furthermore, the region’s emphasis on personalized medicine and precision therapies has increased the need for high-throughput technologies, further driving the demand for sophisticated liquid handling systems. The strong presence of research institutions and pharmaceutical companies has also played a key role in expanding the market.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to rapid advancements in life sciences, healthcare infrastructure, and pharmaceutical research. Countries such as China, India, and Japan are expected to see rising demand for automated liquid handling systems as they invest in expanding research capabilities in fields like genomics, diagnostics, and drug development.

The increasing focus on precision medicine and the growing need for high-throughput screening systems are likely to drive market adoption. A significant development in this regard was the launch of Tianlong’s automated pipetting workstation in November 2021, designed specifically for PCR workflows, which has provided enhanced performance and reliability for laboratory procedures.

As the region continues to prioritize healthcare innovation, the demand for advanced laboratory automation technologies, including liquid handling systems, is anticipated to increase. Additionally, growing government support for research and biotechnology in Asia Pacific is expected to propel the market, as pharmaceutical companies seek reliable and efficient systems to streamline laboratory processes and accelerate drug discovery.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the liquid handling technology market focus on strategies such as developing automated and precision-based solutions to enhance laboratory efficiency and accuracy. Companies expand their product portfolios with user-friendly systems that cater to diverse applications, including genomics, drug discovery, and clinical diagnostics.

Strategic collaborations with research institutions and biotechnology firms help accelerate innovation and improve market penetration. Many players also prioritize digital integration, offering cloud-based systems and software that streamline data management. Expanding into emerging markets with growing research activities and investments in healthcare infrastructure drives further growth.

Tecan Group Ltd is a leading company in this market, known for its advanced liquid handling systems and laboratory automation solutions. The company emphasizes innovation, offering customizable products like the Freedom EVO and Fluent platforms that cater to various scientific and clinical needs. Tecan’s global presence and focus on customer-centric solutions strengthen its position as a trusted provider in the liquid handling industry.

Top Key Players

- Thermo Fisher Scientific

- SPT Labtech

- Hamilton Company

- Gilson

- Eppendorf SE

- Danaher Corporation

- Tecan Group Ltd

- Agilent Technologies

Recent Developments

- In June 2024, ChargePoint Technologies unveiled a robotic material handling system aimed at improving productivity and ensuring safety in solid-dose medication manufacturing. The system reflects the company’s expertise in powder and liquid transfer solutions.

- In 2022, SPT Labtech launched the Apricot DC1, a multifunctional 4-in-1 liquid handling device designed to automate processes such as mixing, aliquoting, pooling, and serial dilution preparation, enhancing laboratory efficiency.

Report Scope

Report Features Description Market Value (2023) US$ 5.4 billion Forecast Revenue (2033) US$ 12.3 billion CAGR (2024-2033) 8.6% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Automated Workstations (Standalone Workstations and Integrated Workstations), Small Devices (Pipettes {Pipette Controllers, Manual Pipettes, and Electronic Pipettes}, Burettes, Dispensers, and Others), and Consumables (Disposable Tips, Regents, Tubes & Plates, and Others)), By Technology (Automated, Manual, and Semi-automated), By Application (Bioprocessing/Biotechnology, Cancer & Genomic Research, Drug Discovery & ADME-Tox Research, and Others), By End-use (Academic & Research Institutes, Contract Research Organizations, and Pharmaceutical & Biotechnology Companies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific, SPT Labtech, Hamilton Company, Gilson, Eppendorf SE, Danaher Corporation, Tecan Group Ltd, and Agilent Technologies. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Liquid Handling Technology MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample

Liquid Handling Technology MarketPublished date: Dec 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fisher Scientific

- SPT Labtech

- Hamilton Company

- Gilson

- Eppendorf SE

- Danaher Corporation

- Tecan Group Ltd

- Agilent Technologies