Global Expectorant Drugs Market Analysis By Drug Type (Guaifenesin, Bromhexine, Ambroxol, Potassium Iodide), By Formulation (Tablets, Syrups, Oral Solutions, Granules), By Route of Administration (Oral, Injectable, Inhalation), By Indication (Chronic Obstructive Pulmonary Disease, Asthma, Bronchitis) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2025

- Report ID: 136870

- Number of Pages: 309

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

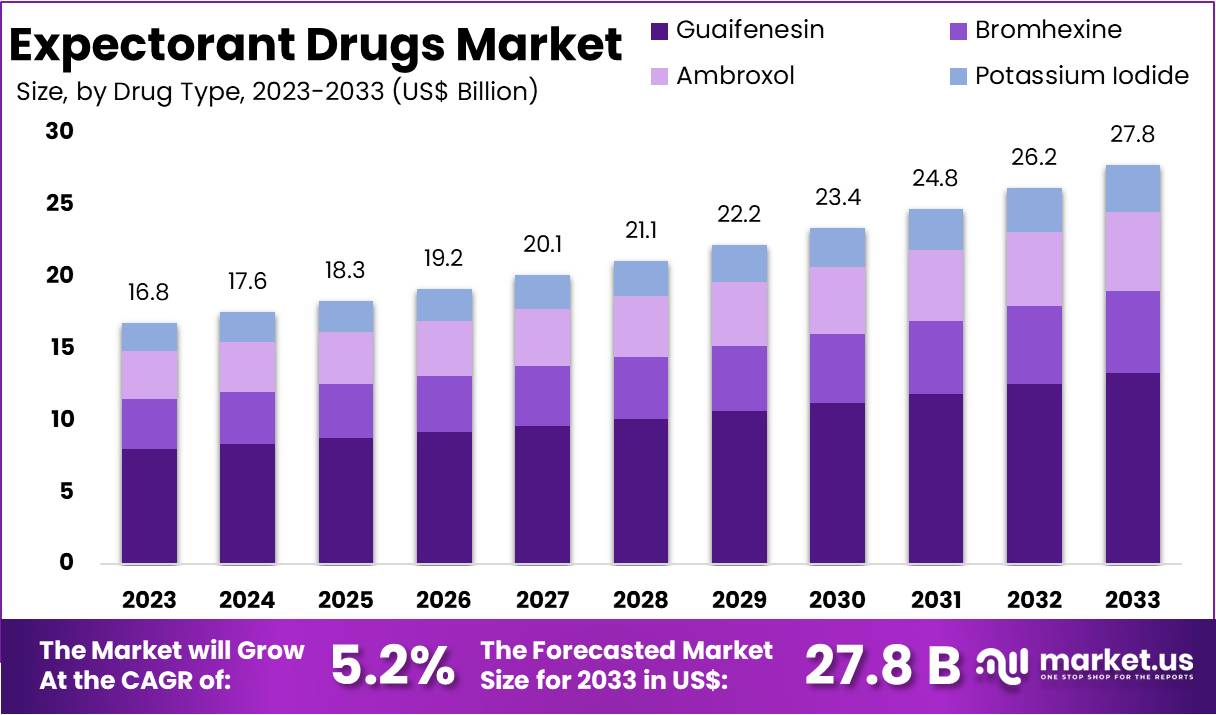

The Global Expectorant Drugs Market Size is expected to be worth around US$ 27.8 Billion by 2033, from US$ 16.8 Billion in 2023, growing at a CAGR of 5.2% during the forecast period from 2024 to 2033.

Expectorant drugs are medications designed to increase bronchial secretion or reduce its viscosity, easing the process of coughing up mucus from the respiratory tract. These drugs are commonly used in the treatment of respiratory conditions such as bronchitis, common cold, and other disorders that involve congestion and coughing. Active ingredients like guaifenesin are often found in expectorants, which work by thinning the mucus, making it easier to clear from airways.

The expectorant drugs market is a significant segment within the pharmaceutical industry. It focuses on medications designed to help clear mucus from the respiratory tract. Expectorants, such as guaifenesin, are commonly used to alleviate symptoms of respiratory conditions like coughs, colds, and congestion. The market is primarily driven by the growing prevalence of respiratory diseases and seasonal illnesses, as well as advancements in drug formulations. Increased patient awareness of treatment options further fuels market growth.

According to industry reports, expectorant drugs help thin and loosen mucus, making it easier to expel from the lungs. This process facilitates better breathing and alleviates discomfort caused by congestion. The high occurrence of respiratory infections, such as colds and flu, continues to drive demand for these medications. Additionally, chronic respiratory conditions like asthma and COPD contribute to the sustained need for expectorants.

For example, guaifenesin is one of the most widely used expectorant drugs. In 2022, it ranked as the 295th most prescribed drug in the U.S., with over 400,000 prescriptions. Guaifenesin is available in various over-the-counter formulations, making it accessible to a broad patient base. Its widespread use, combined with its effectiveness in treating common respiratory issues, has significantly contributed to the market’s growth.

The veterinary sector also utilizes expectorant drugs to treat respiratory issues in animals. These medications help enhance bronchial secretions, promoting the clearance of mucus from the respiratory system. According to the Merck Veterinary Manual, common expectorants used in animals include saline expectorants, volatile oils like eucalyptus oil, and guaifenesin. Although studies on their efficacy in animals are limited, these agents are believed to aid in clearing mucus and improving lung function.

In Europe, the veterinary medicine market has seen notable growth. A study by the European Medicines Agency revealed that in 2023, the agency recommended 14 veterinary medicines for marketing authorization. Notably, nine of these medicines contained new active substances. This indicates a strong focus on innovation, including the development of new treatments for respiratory issues in animals. While data on expectorant use specifically is scarce, the trend toward novel treatments remains clear.

The global market for veterinary medicinal products, including expectorants, continues to grow. In Estonia, the veterinary medicinal products market reached €18.6 million in 2023, marking a 6.9% increase compared to the previous year. According to Ravi Miamet, 92% of this market’s sales were directed toward veterinarians or agricultural companies, with antiparasitic products making up 25% of the total turnover. This growing market reflects increasing investments in veterinary treatments, including respiratory care.

In the U.S., the Food and Drug Administration reported a decrease in the use of antimicrobial drugs for food-producing animals. Specifically, sales and distribution of medically important antimicrobial drugs dropped by 2% between 2022 and 2023. This decline is part of a broader trend, as such sales have decreased by 37% since 2015. This shift in antimicrobial use is likely to influence the development and sale of alternative treatments, including expectorants, in both human and veterinary markets.

Key Takeaways

- The Global Expectorant Drugs Market is projected to reach US$ 27.8 billion by 2033, growing at a CAGR of 5.2% from 2024 to 2033.

- Guaifenesin led the Drug Type Segment in 2023, holding over 47.9% of the Expectorant Drugs Market share.

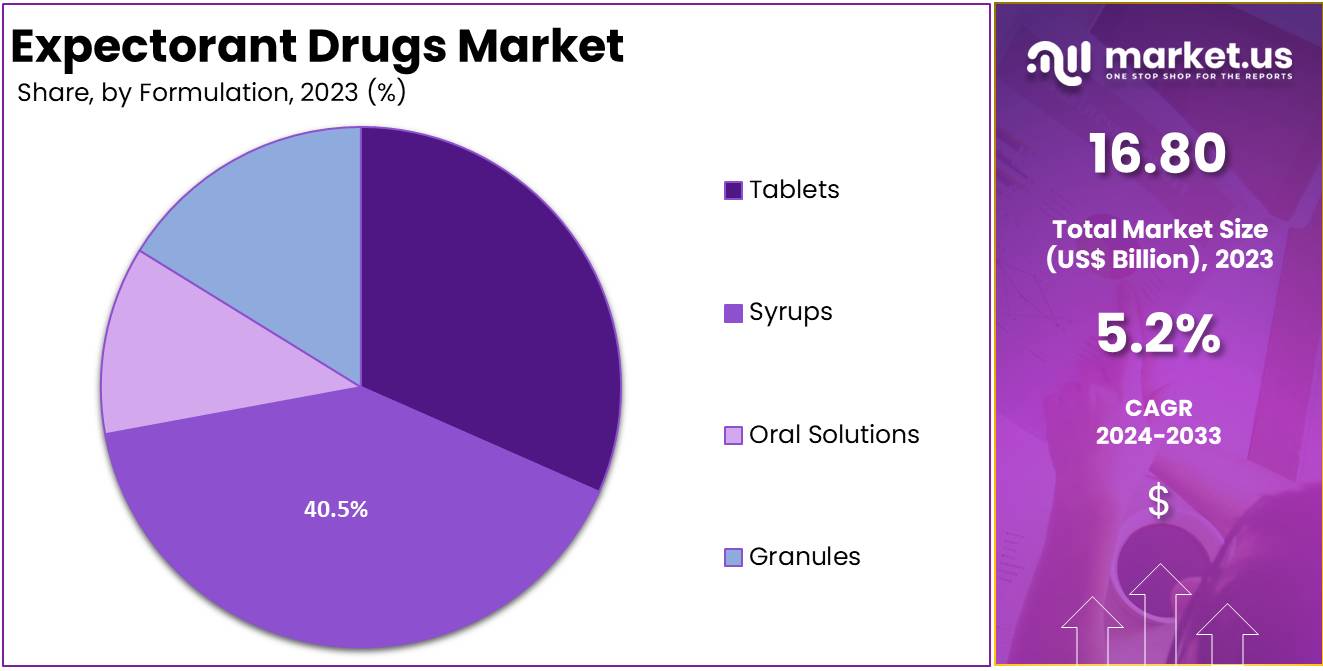

- Tablets dominated the Formulation Segment in 2023, capturing more than 40.5% of the market share for Expectorant Drugs.

- Oral administration led the Route of Administration Segment in 2023, accounting for over 68.5% of the market share.

- Chronic Obstructive Pulmonary Disease (COPD) was the leading indication for Expectorant Drugs in 2023, with a 35.4% market share.

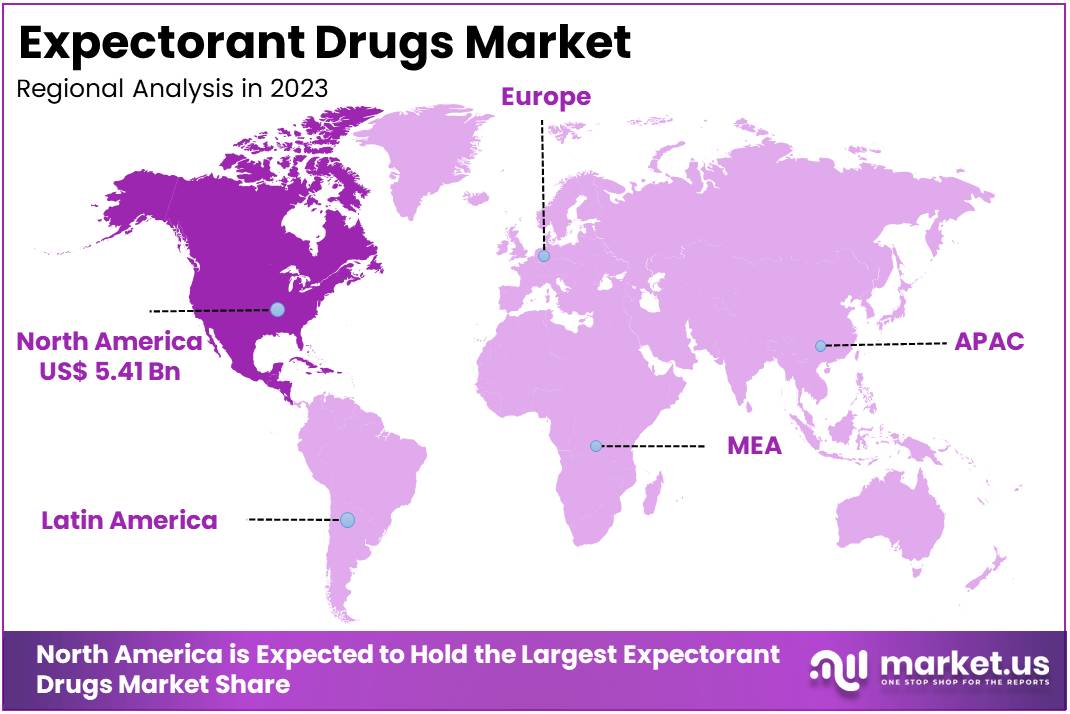

- North America held the largest market share in 2023, representing 32.2% of the global Expectorant Drugs Market, valued at US$ 5.41 billion.

Drug Type Analysis

In 2023, Guaifenesin held a dominant market position in the Drug Type Segment of the Expectorant Drugs Market, capturing more than a 47.9% share. This drug is known for its effectiveness in treating respiratory conditions. It works by loosening mucus in the airways, making it easier to expel. Guaifenesin is found in many over-the-counter products, which contributes to its significant market share.

Bromhexine is another key player in the expectorant drugs market. It has mucolytic properties that help break down mucus in the lungs. This allows the mucus to be cleared more easily. Bromhexine is commonly used for treating bronchitis and COPD. Its ability to improve airflow and ease breathing makes it a popular choice among healthcare providers.

Ambroxol, a derivative of Bromhexine, is gaining popularity in the market. It is effective in reducing mucus viscosity, which helps with easier breathing. Ambroxol is used in both adult and pediatric treatments. Potassium Iodide, though less common, also plays a role in the expectorant segment. It helps thin mucus and promotes its removal from the respiratory tract, particularly for conditions with excessive mucus production.

Formulation Analysis

In 2023, Tablets held a dominant market position in the Formulation Segment of the Expectorant Drugs Market, capturing more than a 40.5% share. This strong performance is mainly due to their convenience and ease of use. Tablets are easy to store and offer precise dosage. Patients prefer them because they are straightforward and cost-effective. The long shelf life of tablets further contributes to their popularity across various regions.

Syrups are another popular form in the market, holding a substantial share. They are especially favored by children and elderly patients who may have difficulty swallowing tablets. Syrups are easy to administer, and their liquid form allows for quicker absorption into the body. This makes them an attractive option for individuals seeking faster relief from respiratory issues. The growing preference for syrups is evident in multiple regions.

Oral solutions and granules are also part of the formulation segment, though they hold smaller shares. Oral solutions are gaining popularity due to their flexibility in dosing. They are ideal for patients who need customized doses. Granules, on the other hand, are used for specific conditions and are mixed with water for easier consumption. Though less common, both oral solutions and granules offer practical alternatives for patients who need non-tablet options.

Route of Administration Analysis

In 2023, Oral held a dominant market position in the Route of Administration Segment of the Expectorant Drugs Market, capturing more than 68.5% share. The oral route is the most popular choice for expectorants. It’s simple and convenient for patients to take. Oral expectorants, like syrups and tablets, help loosen mucus. This makes it easier to expel. It’s especially useful for treating conditions like cough, bronchitis, and asthma.

Injectable expectorants are another option but are less commonly used. These are typically administered in medical settings. They provide faster relief than oral medications. However, their higher cost and the need for professional administration limit their use. They are often reserved for more severe cases. Injectable expectorants are primarily used in hospitals or clinics where quick action is required for respiratory distress.

Inhalation is a growing segment in the expectorant drugs market. This method delivers the medication directly to the lungs. Inhalers and nebulizers are commonly used for this. They offer rapid relief and are ideal for chronic conditions like COPD. Inhalation provides targeted action, which is why it’s becoming more popular. While the oral route remains dominant, inhalation and injectable options continue to support effective treatment for respiratory issues.

Indication Analysis

In 2023, Chronic Obstructive Pulmonary Disease (COPD) held a dominant market position in the Indication Segment of the Expectorant Drugs Market, capturing more than 35.4% share. COPD is a chronic lung condition that leads to difficulty breathing. It includes diseases such as emphysema and chronic bronchitis. With the rising global prevalence of COPD, the demand for effective expectorant drugs to manage symptoms like coughing and mucus production has significantly increased.

Asthma is another important indication in the expectorant drugs market. This condition causes inflammation and narrowing of the airways, making it harder to breathe. With a high number of asthma cases worldwide, treatments that help clear mucus from the airways are in high demand. Expectorant drugs play a crucial role in providing relief to asthma patients by easing their symptoms and improving breathing capacity.

Bronchitis, both acute and chronic, also contributes significantly to the market. This condition causes inflammation in the bronchial tubes, leading to persistent coughing and mucus buildup. Expectorants help clear the airways, offering much-needed relief. As more people are diagnosed with bronchitis, the market for expectorant drugs continues to grow, driven by the need for effective treatments to manage airway congestion and improve respiratory health.

Key Market Segments

By Drug Type

- Guaifenesin

- Bromhexine

- Ambroxol

- Potassium Iodide

By Formulation

- Tablets

- Syrups

- Oral Solutions

- Granules

By Route of Administration

- Oral

- Injectable

- Inhalation

By Indication

- Chronic Obstructive Pulmonary Disease

- Asthma

- Bronchitis

Drivers

Increasing Respiratory Disorders

The increasing prevalence of respiratory diseases is a key driver for the expectorant drugs market. Conditions like chronic obstructive pulmonary disease (COPD), asthma, and bronchitis are becoming more common worldwide. These conditions affect millions of people, leading to a growing demand for treatments that can improve breathing. As these diseases progress, patients often struggle with mucus build-up, which requires effective management. Expectorant drugs are designed to help loosen mucus, making it easier for patients to breathe.

With the rise in respiratory disorders, expectorants play a crucial role in treatment. COPD, asthma, and bronchitis can cause inflammation and excessive mucus production in the airways. This leads to difficulty breathing and potential lung infections. Expectorant drugs help thin and loosen the mucus, making it easier to expel. As more people are diagnosed with these diseases, the need for expectorants continues to grow, driving market expansion. This trend is expected to continue as respiratory diseases remain a global health concern.

As the global population ages and environmental factors worsen, respiratory diseases are becoming more prevalent. Air pollution, smoking, and genetic factors contribute to the rise in COPD and asthma. This trend increases the demand for expectorant drugs, which are essential for alleviating symptoms of these chronic conditions. The growing awareness of respiratory health is also pushing more patients to seek treatments. Consequently, the expectorant drugs market is expanding, driven by the increasing need for effective treatments for respiratory disorders.

Restraints

Side Effects and Safety Concerns

Expectorants are commonly used to relieve chest congestion, but they can cause side effects. Some users report experiencing nausea, dizziness, and gastrointestinal discomfort. These effects can be mild to moderate and may vary depending on individual tolerance. While expectorants help to thin mucus, their side effects must be considered when recommending them. These reactions could discourage some users, especially those sensitive to such adverse effects. Understanding the risk profile of expectorants is crucial when weighing their benefits against potential discomfort.

The safety of expectorants is particularly important for vulnerable populations. Pregnant women, for example, may experience complications from the use of certain medications. Additionally, individuals with preexisting conditions such as asthma or gastrointestinal issues may face heightened risks. For these groups, it is essential to consult healthcare providers before using expectorants. The potential for side effects makes it necessary to consider alternative treatments for those who may be at higher risk.

Despite the concerns, expectorants remain a popular choice for treating congestion. Their effectiveness in loosening mucus is well-documented. However, the side effects and safety issues may limit their widespread use, especially among certain demographics. Market research shows that users are increasingly seeking products with fewer adverse reactions. This has led to the development of alternatives that promise fewer side effects, offering a safer option for people with specific health concerns.

Opportunities

Natural and Herbal Expectorants

The demand for natural and herbal expectorants is on the rise. Consumers are increasingly seeking alternative and plant-based remedies for respiratory issues. This shift is driven by a growing awareness of the potential side effects of synthetic medications. As people prioritize wellness and natural health solutions, herbal expectorants are gaining popularity. These products are perceived as safer, with fewer chemicals, and are often seen as more effective in supporting the body’s natural healing processes.

Companies in the health and wellness sector have a unique opportunity to capitalize on this trend. By innovating and offering natural expectorants, businesses can meet the growing consumer demand for plant-based solutions. Consumers are particularly interested in products made from herbs such as thyme, eucalyptus, and licorice root. These ingredients are known for their ability to clear mucus and support respiratory health. Companies that create high-quality, transparent products can build brand loyalty and tap into a lucrative market.

The market for natural and herbal expectorants is expected to continue growing. As more people turn to herbal remedies, there is room for businesses to expand their product lines. However, companies must ensure that their products are backed by solid research and effective formulations. Clear labeling, transparency in sourcing, and consumer education will play a key role in success. Companies that align with these consumer preferences will likely see a boost in market share as demand for natural expectorants grows.

Trends

Rising Popularity of Over-the-Counter (OTC) Expectorants

The rising popularity of over-the-counter (OTC) expectorants reflects a growing consumer preference for self-medication. This trend is largely driven by the convenience of purchasing these medications without a prescription. Consumers are seeking quick and effective solutions for respiratory issues like coughs and congestion. With OTC expectorants readily available in pharmacies and health stores, individuals can easily manage their symptoms at home. This shift highlights the increasing reliance on accessible healthcare products that do not require a doctor’s visit.

In regions with widespread access to pharmacies and health stores, the demand for OTC expectorants has surged. Consumers in these areas value the ease of purchasing such products without the need for medical appointments. The availability of OTC drugs empowers individuals to take control of their health and make informed decisions about their treatment. As a result, expectorants are becoming a go-to option for managing respiratory discomfort, especially for those seeking immediate relief.

This trend is also fueled by rising awareness of common cold and flu symptoms. With more people experiencing minor respiratory issues, the preference for OTC expectorants continues to grow. These medications are seen as both effective and affordable for managing mild conditions. As consumers become more health-conscious, they prioritize products that offer convenience, affordability, and accessibility. OTC expectorants provide a practical solution for managing respiratory health while avoiding long waits at medical facilities.

Regional Analysis

In 2023, North America held a dominant market position in the Expectorant Drugs Market, capturing more than a 32.20% share and achieving a market value of US$ 5.41 billion for the year. This lead is largely due to the high occurrence of respiratory conditions like chronic bronchitis and asthma. The increase in air pollution and an aging population have led to a rise in these diseases, which in turn boosts demand for expectorant medications.

The region’s superior healthcare infrastructure and significant healthcare expenditures also play vital roles. North America’s strong regulatory framework supports quick market entry for new treatments, enhancing consumer access to effective expectorant drugs. Additionally, the presence of leading pharmaceutical companies, heavily invested in research and development, drives innovation and expands the available range of treatments.

Moreover, there’s a high level of public awareness regarding respiratory health issues in North America. Educational initiatives and preventive measures increase the use of over-the-counter expectorant products. The strategic collaborations and acquisitions among major pharmaceutical firms further strengthen the regional market by extending their reach and enhancing their product offerings, solidifying North America’s market dominance.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global expectorant drugs market is marked by intense competition, with major pharmaceutical players driving growth through innovation and global outreach. Pfizer Inc. holds a strong position with a broad respiratory drug portfolio, supported by extensive R&D and a global supply network. F. Hoffmann-La Roche Ltd. focuses on mucolytic therapies and precision medicine, investing in clinical research to enhance its pipeline. Mylan, now under Viatris, plays a critical role in the generics segment. It offers cost-effective solutions and has strong market penetration in emerging economies through its wide manufacturing base.

Bristol Myers Squibb remains a smaller player in this segment but has potential due to its focus on biologics and pipeline diversification. While its primary focus is oncology, selected respiratory initiatives may influence future market trends. Johnson & Johnson, through its consumer health division, maintains a solid OTC expectorant product range. Its strength lies in brand loyalty and global consumer access. Strategic marketing and presence in underserved regions contribute to its stable growth in the expectorant drugs market segment.

GlaxoSmithKline plc (GSK) is one of the top names in respiratory care. The company’s legacy in asthma and COPD therapy translates well into its expectorant offerings. GSK benefits from a strong OTC product line and established brand equity. Continuous investment in respiratory research and a digital-first approach improve its competitiveness. In addition to these key players, several regional and emerging pharmaceutical companies are actively shaping the market by launching generic formulations and forming strategic distribution partnerships, thereby increasing accessibility across different geographies.

Market Key Players

- Pfizer

- Roche

- Mylan

- BristolMyers Squibb

- Johnson and Johnson

- GlaxoSmithKline

- AstraZeneca

- AbbVie

- Takeda Pharmaceutical

- Merck and Co

- Novartis

- Teva Pharmaceutical Industries

- Boehringer Ingelheim

- Sanofi

Recent Developments

- In March 2022: Pfizer finalized its acquisition of Arena Pharmaceuticals for approximately $6.7 billion. This acquisition enhances Pfizer’s portfolio in immuno-inflammatory diseases with several potential therapies in various stages of development, including treatments for ulcerative colitis, Crohn’s Disease, and atopic dermatitis. The key drug, etrasimod, was undergoing a critical Phase 3 trial with expected results at the time of the acquisition.

- In September 2024: Bristol-Myers Squibb launched a new drug, COBENFY™ (xanomeline and trospium chloride), for treating schizophrenia in adults. This first-in-class muscarinic agonist received approval from the U.S. Food and Drug Administration. Although primarily targeted at schizophrenia, the ingredients involve complex interactions with body systems that could have broader applications in treating other conditions.

Report Scope

Report Features Description Market Value (2023) US$ 16.8 Billion Forecast Revenue (2033) US$ 27.8 Billion CAGR (2024-2033) 5.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Drug Type (Guaifenesin, Bromhexine, Ambroxol, Potassium Iodide), By Formulation (Tablets, Syrups, Oral Solutions, Granules), By Route of Administration (Oral, Injectable, Inhalation), By Indication (Chronic Obstructive Pulmonary Disease, Asthma, Bronchitis) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Pfizer, Roche, Mylan, BristolMyers Squibb, Johnson and Johnson, GlaxoSmithKline, AstraZeneca, AbbVie, Takeda Pharmaceutical, Merck and Co, Novartis, Teva Pharmaceutical Industries, Boehringer Ingelheim, Sanofi Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Pfizer

- Roche

- Mylan

- BristolMyers Squibb

- Johnson and Johnson

- GlaxoSmithKline

- AstraZeneca

- AbbVie

- Takeda Pharmaceutical

- Merck and Co

- Novartis

- Teva Pharmaceutical Industries

- Boehringer Ingelheim

- Sanofi